CrossCountry Mortgage Reviews 2026: Benefits, Drawbacks, and FAQs

Do you want to buy a new home or refinance with CrossCountry Mortgage? You must take a quick look at this guide before you go any further. CCM has become a major player in the mortgage industry, ranking among the nation's largest retail lenders. However, customer feedback varies widely across platforms, from very high satisfaction at the loan-officer level to sharp criticism on some national review sites. This review will introduce you to what CrossCountry Mortgage is, the advantages and disadvantages, and what it offers. Better yet, some FAQs you may be curious. Let's go get the rope below.

People Also Read

- Better Mortgage Reviews: Pros, Cons, and Everything to Know

- AmeriSave Mortgage Reviews 2025: Pros & Cons, Loan Options, Rating

- How Much Mortgage Can I Afford? Know Your Affordability

- [Solved] How to Calculate HELOC Payment? Easy-to-Understand

What is CrossCountry Mortgage (CCM)?

CrossCountry Mortgage (CCM) is a large non-bank retail mortgage lender headquartered in Cleveland, Ohio. The company was founded in 2003 and has grown into a national retail platform with hundreds of branches and several thousand employees.

CCM markets itself as a full-service mortgage company that both originates and services loans and emphasizes speed, realtor relationships, and a large product menu. In company materials and press releases for 2024, CCM reported it funded more than 88,000 loans in 2024, a production level the company described as "about 1 in every 37 home purchases nationwide."

Pros and Cons of CrossCountry Mortgage

Now, let's take a look at the benefits and shortcomings of CrossCountry Mortgage. It does offer a broad product set and fast programs, but like any large lender, it also generates consumer complaints in some areas. Below is a concise transition and the key advantages and drawbacks. I pulled the competitive and consumer complaint points from industry reviews and CCM disclosures.

Pros:

-

Generous down-payment assistance and first-time buyer programs in select markets.

-

Fast-close programs. The company advertises 21-day averages and specific "FastTrack"/credit approval paths for qualified borrowers.

-

Very wide product menu, including conventional, FHA, VA, USDA, jumbo, HELOC, non-QM, and specialty programs.

-

Large local footprint and loan-officer network.

Cons:

-

Online reputation is mixed: some national review sites report below-average scores and a number of complaints about communication and closing surprises.

-

Origination fees and some closing costs have been reported above national averages in third-party reviews.

-

CCM does not publicly post retail rate tables on its website, and you'll need to contact a loan officer for personalized pricing.

Listen to Real Reviews

Ratings across platforms are quite different. That divergence means you should weigh real CrossCountry Mortgage reviews. High ratings on loan-officer directories reflect individual originators who deliver excellent service, while lower corporate ratings reflect backend or servicing issues reported by some borrowers. Below, I show the three platforms and sample review summaries.

Zillow: 4.97 out of 5.0 on 22,696 Ratings

Zillow's lender profile aggregates loan-officer and team reviews and often shows very high satisfaction for many individual CCM originators. This reflects strong local LO performance in many markets. Readers should look at the specific loan officer's profile and reviews (not just the corporate aggregate) when choosing a contact.

I'm truly grateful for everything Carlos Martinez and his team did for me throughout the process. They were extremely professional, responsive, and made everything smooth and stress-free from start to finish. I would definitely recommend Carlos and his team to anyone looking for a reliable and knowledgeable lender, they go above and beyond for their clients!

Working with Tyler Berg was a fantastic experience! He was incredibly responsive, always quick to answer questions and keep me updated throughout the process. His knowledge and professionalism made everything smooth and stress-free, and he went above and beyond to make sure I understood each step. I'd highly recommend Tyler to anyone looking for a reliable, helpful, and experienced mortgage lender.

Adam was incredible to work with. He made our entire transaction easy and guided us through every step with clear explanations and prompt updates. Professional, friendly, and truly attentive no matter the time of day! Highly recommend!

Bankrate: 2.3 out of 5.0 on 28 Ratings

Bankrate's review notes a number of consumer complaints (communication, fee surprises) that lowered CCM's score on their platform. Bankrate's analysis can be useful to spot patterns in complaints, particularly around customer service and disclosure.

Richard at cross country is amazing. This mortgage company offers many options for home owners to reach their real estate and financial goals. Great experience glad I chose to work with them

Alex and his team helped my husband and I close in less than 30 days! He remained patient when my husband and I had many questions as this process can be truly stressful, the team worked hard and efficiently even when it seemed impossible they truly worked their magic.

Very bad experience with this company with a financial loss due to bad guidance. I was told to get an inspection and also guided to the title company where I receive a closing date. We would then told by our realtor that the mortgage company made a huge error early on and we were out of time on this house. The loss was 1700.00 I have to now get another lender and try to trust them and that is going to be hard after this experience!

Trustpilot: 1.8 out of 5.0 on 89 Ratings

Trustpilot shows more negative experiences at the corporate level, typically focused on servicing or communication breakdowns. As with any large lender, unhappy customers often post publicly. Use this as one signal alongside local loan-officer feedback and regulatory filings.

My experience with Mr. Jonathan Williams was Top Tier... Over the top phenomenal. From start to finish line I had a smile on my face because Mr. J made sure he helped me every step of the way. My mind is blown how knowledgeable and supportive and patient he was. I can go on and on about how wonderful my experience was but we would be here all day. Thanks a bunch Mr. Jonathan I truly can't thank you enough....Yonnis S

CrossCountry Mortgage lured us away from a better loan from a competitor, failed to honor a $13K lender credit, overcharged us $9K in payoff discrepancies, and lied about applying biweekly payments that would've saved us thousands in interest. We've filed complaints with the CFPB, the DFPI, and the BBB. Their practices are deceptive, predatory, and in violation of TILA, RESPA, UCL, and CLRA. Avoid CrossCountry Crooks at all costs!

Actually They should get NO STARS. Had an issue with my taxes and no one can help. I ask to speak to someone in the tax department and they wouldn't connect me to anyone. Still having problems. There customer service is absolutely horrible. Stay away from Cross country mortagfe

What Types of Loan Offered?

Actually, CrossCountry provides a broad set of loan types to meet many borrower needs, including purchase loans, refinances, and home-equity products are all offered through national retail channels and local loan officers. The company's product pages list conventional, government, jumbo, refinance, and HELOC options.

-

Conventional Loans: Fixed and adjustable conventional options, including programs that support lower down payments on eligible loans.

-

Government Loans: CCM offers FHA, VA, and USDA programs and specialty agency products where eligible.

-

Jumbo Loans: Higher-balance mortgage programs for high-value properties. eligibility and maximums vary by county and investor guidelines.

-

Refinance Loans: Rate-and-term and cash-out refinance options, plus applicable streamline programs for government loans.

-

Home Equity Loans: HELOC and closed-end home equity options. CCM markets both variable and fixed structures.

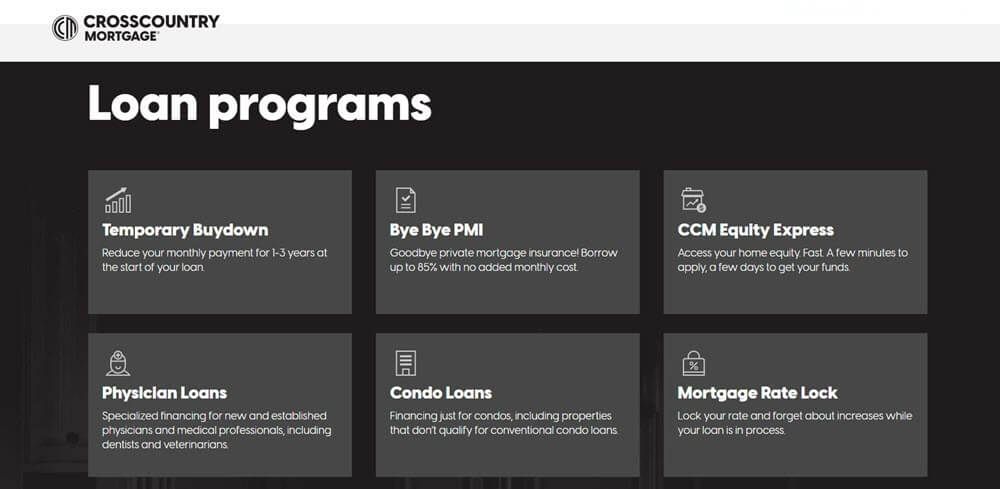

Special Loan Programs of CrossCountry Mortgage

CrossCountry Mortgage publishes multiple specialized programs on its site and marketing materials. You may check out its 12 special offers here.

-

Temporary Rate Buydowns: short-term payment reductions via 3-2-1 or similar buydowns.

-

Bye Bye PMI: programs to avoid private mortgage insurance in certain scenarios.

-

Physician Program: tailored documentation and qualifying rules for medical professionals.

-

Condo Loans: options for condos that don't meet standard agency eligibility.

-

Mortgage RateLock: rate-lock solutions, including extended locks in specific circumstances.

-

Buy Now Refinance Later: incentives to refinance with CCM after a defined seasoning period.

-

Bridge Loans: short-term bridge financing to help buy before selling an existing home.

-

Lock2Sell: programs that help sellers market homes by offering temporary rate buy-downs to buyers.

-

CCM EasyGreen: finance energy upgrades through the mortgage where eligible.

-

Low-Income Refinance: targeted closing cost assistance for qualified low/moderate income borrowers.

-

Line of Duty Death Benefits: Cancel up to $525,000 in debts for special groups.

-

CCM Equity Express: Quickly access home equity for application.

What Can CrossCountry Mortgage Do for You?

CrossCountry offers the standard retail mortgage services and local loan-officer network support, plus digital tools and calculators.

Buy a Home

CCM provides an online starting point for prequalification and coordinates with loan officers to convert leads into loan applications. The company promotes programs to speed approval and closing for qualified borrowers.

Refinance

Multiple refinance pathways are offered (rate-and-term, cash-out, and agency streamline programs). CCM markets some targeted assistance programs to make refinancing more accessible for lower-income borrowers.

Find a Loan Officer

CCM offers a tool to help you quickly find a loan officer near you. Loan officer reputation and responsiveness often determine the final consumer experience.

Mortgage Calculators

CCM provides a range of mortgage calculators to help homebuyers do math, including the Adjustable-Rate Mortgage Calculator, Debt-to-Income Ratio Calculator, Home Sale Calculator, Mortgage Comparison Calculator, Mortgage Payment Calculator, Mortgage Payoff Calculator, Refinance Calculator, and Rent vs. Buy Calculator.

FAQs About CrossCountry Mortgage

Q1. What is the minimum credit score for a CrossCountry Mortgage?

The minimums vary by program. Conventional typically starts around 620, FHA around 500–580 with higher down payments below 580, and jumbo/non-QM programs have higher thresholds, which are often 660+. You should confirm with your local loan officer because investor overlays and product rules change.

Q2. What is the Min. down payment for CrossCountry Mortgage?

This depends on the product. Some conventional options begin at 3%, FHA at 3.5% or higher for lower credit tiers, VA/USDA may be 0% where eligible, and jumbo/non-QM programs generally require larger down payments. Local assistance programs may also reduce upfront cash needs in some markets.

Q3. Is CrossCountry Mortgage a legitimate company?

Yes, CCM is an established national retail lender (NMLS #3029), licensed to do business in all 50 states and other U.S. jurisdictions. It is a seller/servicer with agency relationships, and routinely issues corporate press releases with production figures. You should always look up the LO NMLS numbers on NMLS Consumer Access when you pick a contact.

Q4. Is Cross Country a good lender?

That depends on what matters most to you. CCM is strong on product breadth, speed programs, and local LO access. However, aggregated consumer reviews show mixed experiences on service and disclosures. If you value speed and product variety but also want high-touch servicing, interview the local loan officer, ask for references, and request written confirmations of any credits or guarantees.

Q5. Is CrossCountry Mortgage a good option for first-timers?

CCM runs down-payment assistance and first-time buyer programs in some markets and offers agency products (FHA, VA) that help first-time buyers. For first-timers, compare quotes and LO reviews locally. CCM can be a good fit when paired with a responsive local loan officer.

Conclusion

CrossCountry Mortgage is a major national retail lender with broad product coverage, speed-focused programs, and a large LO network. That scale delivers benefits like product availability, speed programs, local officers) but also means consumer experiences vary by branch and servicing team.

For best results, you should verify local LO credentials (NMLS), pull multiple Loan Estimates, and document any promised credits or guarantees in writing. If you prefer ultra-fast digital closings and broad program choice, CCM is worth considering. If you need highly personalized servicing post-closing, compare several lenders and check local LO reviews carefully. Also, you can contact LOs near you on Bluerate to shop around.