10 Tips: First-Time Home Buyer Tips and Advice for You

Takeaway:

- Learn before you shop — understand the homebuying and mortgage process first.

- Look for help — explore first-time buyer programs, grants, and down payment assistance.

- Know your true budget — factor in taxes, insurance, HOA fees, and maintenance.

- Check your credit early — fix errors and reduce debt to qualify for better rates.

- Separate your cash — plan for both the down payment and closing costs.

- Choose the right agent — work with someone local, experienced, and on your side.

- Compare lenders — shop multiple loan estimates, not just interest rates.

- Never skip the inspection — it protects you and gives room to negotiate.

- Think long term — consider future needs, resale value, and lifestyle changes.

- Keep an emergency fund — unexpected repairs are part of homeownership.

Buying a home is one of the biggest financial milestones in life, but let's be honest—it is also incredibly stressful. I remember standing in the kitchen of the first house I toured, feeling a mix of excitement and absolute confusion. I didn't know the difference between a pre-qualification and a pre-approval, and the term "closing costs" sounded like a foreign language.

As a first-time home buyer, you are often vulnerable because you don't know what you don't know. That is why you need solid first-time home buyer tips to navigate this complex market. From understanding your credit score to knowing which inspections are non-negotiable, the learning curve is steep. I am writing this guide to share what to know as a first-time home buyer based on my own experience and industry standards. My goal is to help you make confident decisions, avoid the expensive pitfalls I almost fell into, and finally get those keys in your hand.

Read Also: First-Time Home Buyer Requirements: Everything You Need to Know

Tip 1. Start with a Free and Educational Class on Fannie Mae

Before you even start browsing listings on Zillow or Redfin, I strongly suggest you go back to school—briefly. One of the most underrated resources I found was Fannie Mae's education center. They offer a free course called "HomeView," and honestly, it was a game-changer for me.

When looking for tips on first time home buying, many people skip the educational part, thinking they can learn as they go. That is a mistake. The Fannie Mae course breaks down the entire process into bite-sized modules. You will learn exactly how mortgages work, what lenders look for, and the responsibilities of homeownership.

What I loved about it was that it wasn't just dry theory. It taught me how to calculate what I could afford and explained difficult concepts like debt-to-income ratios in simple English. Plus, completing this course is actually a requirement for certain first-time home buyer loan programs and closing cost assistance grants. So, not only do you get smarter, but you might also qualify for financial help just by finishing it. It is the perfect starting block to build your confidence.

Tip 2. Explore First-time Home Buyer Programs

When I started, I thought I needed a 20% down payment to buy a house. I was wrong. One of the most valuable first time home buying tips I can give you is to aggressively research First-Time Home Buyer Programs. These are federal, state, and sometimes even local initiatives designed specifically to help people like us get into the market.

You should know that "First-Time Buyer" often includes anyone who hasn't owned a home in the last three years. These programs can offer lower interest rates, down payment assistance (DPA), or tax credits. For example, FHA loans are huge in the US because they allow down payments as low as 3.5% and are more lenient with credit scores. If you are a veteran, VA loans offer 0% down options.

I also looked into my state's Housing Finance Agency. They offered a grant to help cover closing costs that I didn't have to pay back. It took a little extra paperwork, but it saved me thousands of dollars upfront. Don't assume you have to pay full price for everything; there is help out there if you look for it.

Tip 3. Comfortable with and Stick to Your Budget

It is very easy to fall in love with a house that stretches your wallet too thin. I've seen friends get approved for a $400,000 loan, buy a $400,000 house, and then struggle to eat anything but instant noodles. You must get comfortable with a budget and stick to it.

Crucially, do not just look at the mortgage principal and interest. Real estate forums and experienced buyers often discuss "PITI"—Principal, Interest, Taxes, and Insurance. But even that isn't the whole picture. You have to factor in Private Mortgage Insurance (PMI) if you put down less than 20%, plus potential HOA (Homeowners Association) fees.

When I bought my place, I also budgeted for the unsexy stuff: higher utility bills, lawn maintenance, and garbage collection fees. A $2,000 monthly mortgage payment can easily turn into a $2,600 monthly obligation once you add everything up. Be honest about your lifestyle. If you love traveling or dining out, don't buy a house that requires 50% of your take-home pay. Your budget should empower you, not suffocate you. Also, you can consider calculating your home affordability.

Tip 4. Review Your Credit and Improve It

Your credit score is the gatekeeper to your new home. In the US mortgage industry, your FICO score determines not just if you get a loan, but how much that loan costs you. A higher score usually secures a lower interest rate, which can save you tens of thousands of dollars over a 30-year term.

I made it a priority to pull my credit reports from the three major bureaus (Equifax, Experian, and TransUnion) months before I applied. I checked for errors—like an old medical bill I had already paid—and got them disputed.

To improve my score, I paid down my credit card balances to lower my credit utilization ratio. A good rule of thumb is to keep your balance below 30% of your limit. Also, here is a critical piece of advice: do not open new credit lines during this time. I almost bought a new car right before house hunting, but my loan officer warned me it would tank my score and debt-to-income ratio. Keep your financial profile boring and stable until you close on the house.

Tip 5. Save for a Down Payment and Closing Costs

Saving money is obvious, but many tips for buying a home for the first time fail to distinguish between the Down Payment and Closing Costs. You need separate piles of cash for both.

The minimum down payment is your equity in the home. While 20% is great to avoid PMI, many first-time buyers put down between 3% and 5%. However, the shocker for me was the closing costs. These are the fees paid to third parties to finalize the deal—appraisal fees, title insurance, attorney fees, and recording fees. In the US, this typically runs between 2% and 5% of the loan amount.

On a $300,000 home, closing costs alone could be $6,000 to $15,000! I had to scramble a bit because I hadn't calculated this accurately. Make sure you have "cash to close" ready in a liquid account (like a savings account), not tied up in stocks that might drop in value right when you need to withdraw. Being cash-prepared prevents last-minute panic.

Tip 6. Find a Trusted Real Estate Agent

You might think you can handle everything yourself to save money, but as a buyer, having a Real Estate Agent is usually free for you (since the seller pays the commission). A good agent is your advocate, negotiator, and guide.

I interviewed three different agents before picking one. I wanted someone who knew the local neighborhoods intimately—not just the prices, but the traffic patterns and school districts. A good agent will also spot red flags in a house that you might miss, like signs of water damage or an aging roof.

Don't just go with your cousin's friend. Treat this like a job interview. Ask them about their experience with first-time buyers. When we finally made an offer, my agent's advice on how to structure the deal (offering a quick closing date) helped me beat out another buyer without raising my price. They are your quarterback in this process; make sure you pick a good one.

Tip 7. Compare Mortgage Lenders

Just like you shop around for a car or a TV, you need to shop around for money. A "Mortgage Lender" is the bank or company giving you the loan. Many people just go to their primary bank, but that loyalty can cost you.

I applied with a big national bank, an online lender, and a local credit union. I was surprised to see the interest rates varied by about 0.3% to 0.5%. That sounds small, but on a large loan, it's massive. Additionally, compare their fees, like Loan Origination Fees.

Getting a "Loan Estimate" from each lender allows you to compare apples to apples. I actually used a quote from an online lender to get my local bank to lower its rate to match it. Competition is good for the consumer. Also, pay attention to their responsiveness. You want a lender who answers the phone on a Friday afternoon when things get stressful, not one who ghosts you until Monday. Or, you can find a professional loan officer around you on Bluerate to get a quick comparison.

Tip 8. Thoroughly Inspect and Appraise the Property

Never, ever skip the home inspection. In a competitive market, some buyers waive inspections to make their offer look better. This is a huge gamble that I do not recommend.

An appraisal is for the bank (to ensure the house is worth the loan amount), but the inspection is for you. When I had my inspection, I followed the inspector around. We checked the HVAC system, the electrical panel, the plumbing, and the foundation.

I recommend making a checklist or asking your inspector to explain every major system. In my case, the inspection revealed that the water heater was on its last legs. Because we found this before closing, I was able to negotiate a credit from the seller to replace it. Without that inspection, I would have moved in and been hit with a $1,500 bill a month later. Thorough diligence protects your future wallet.

Tip 9. Consider Long-Term Financial Implications

Buying a home isn't just a transaction for today; it's a commitment for the next 5, 10, or 30 years. You need to think about the long-term financial implications of your purchase.

Ask yourself: Will this home suit my needs in five years? If you plan to have kids or get a dog, is there room? Buying and selling homes is expensive due to transaction costs. If you move again in two years, you might actually lose money compared to renting.

I also considered the resale value. Even if you love a quirky house, will it be hard to sell later? Furthermore, look at the tax history of the property. In many US states, property taxes increase significantly over time. I made sure to calculate if I could still afford the monthly payment if taxes and insurance went up by 10% or 20% over the next few years. Thinking long-term prevents "buyer's remorse."

Tip 10. Maintain an Emergency Fund

The day you sign the deed, the landlord is you. When the toilet breaks or the roof leaks, there is no one else to call. This is why maintaining an emergency fund is one of the most vital pieces of first-time home buyer tips and advice.

Many lenders require you to have "reserves"—cash left over after the down payment—before they approve the loan. But even if they don't, you should do it for your own peace of mind. I aimed to keep at least 3 to 6 months of living expenses in a separate account.

Sure enough, during my first winter, the furnace acted up. Because I hadn't drained my bank account to zero for the down payment, I could pay for the repairs without putting it on a credit card. Do not become "house poor" where you have a nice house but zero cash for emergencies. It turns a minor inconvenience into a financial crisis.

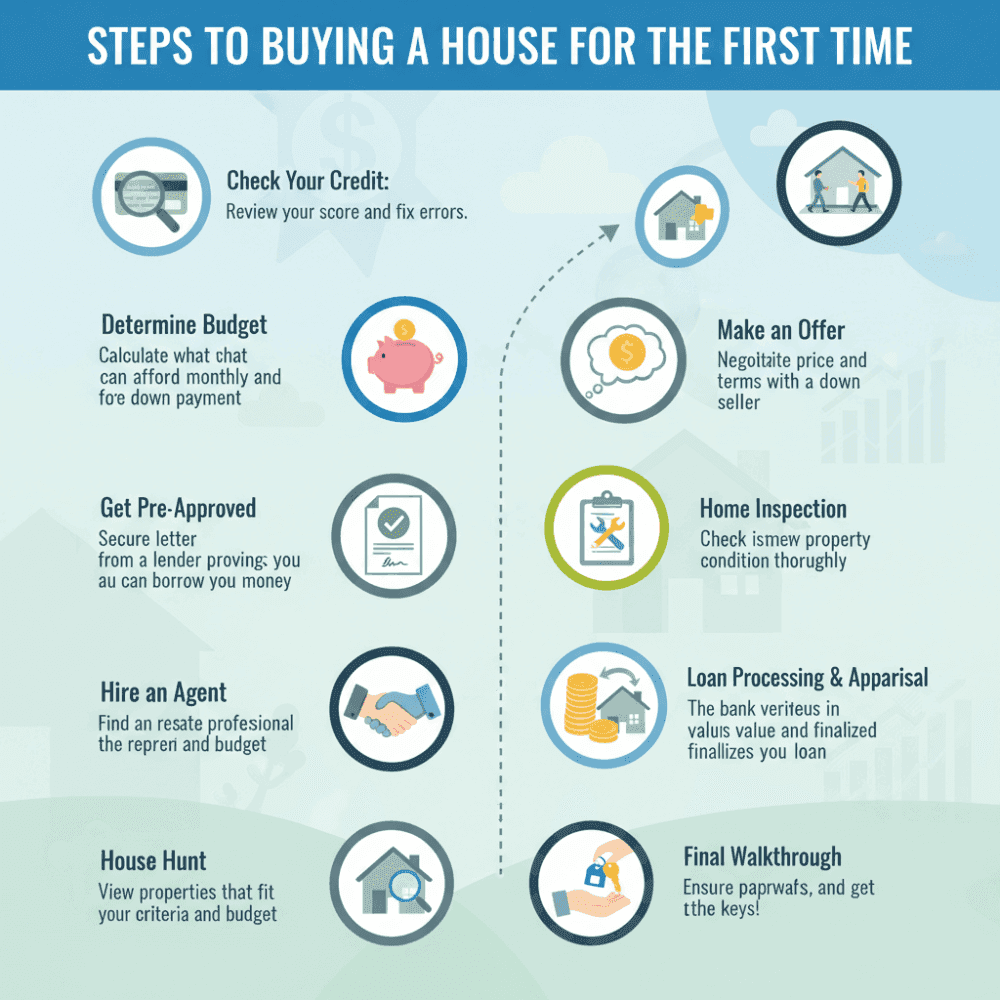

Steps to Buying a House for the First Time

Here is the general roadmap of how the process of buying a home works in the US:

- Check Your Credit: Review your score and fix errors.

- Determine Budget: Calculate what you can afford monthly and for a down payment.

- Get Pre-Approved: Secure a letter from a lender proving you can borrow the money.

- Hire an Agent: Find a real estate professional to represent you.

- House Hunt: View properties that fit your criteria and budget.

- Make an Offer: Negotiate price and terms with the seller.

- Home Inspection: Check the property condition thoroughly.

- Loan Processing & Appraisal: The bank verifies the value and finalizes the loan.

- Final Walkthrough: Ensure the house is in the agreed condition.

- Closing: Sign the paperwork, pay the costs, and get the keys!

FAQs for First-Time Homebuyers

Have any questions? You can go and check more FAQs in the following section.

Q1. What to do after buying first home?

First, change all the locks—you don't know who has old keys. Next, deep clean the house before moving your furniture in. Locate your main water shut-off valve and circuit breaker box so you are prepared for emergencies. Finally, update your address with the post office, banks, and your employer, and file your homestead exemption documents if your state offers tax breaks for primary residences.

Q2. What is the 30/30/3 rule for home buying?

The 30/30/3 rule is a conservative guideline to keep you financially safe. It suggests:

- Spend no more than 30% of your gross monthly income on mortgage payments.

- Have 30% of the home value saved in cash (20% for the down payment and 10% as a healthy buffer).

- The price of the home should be no more than 3x your annual gross income.

Q3. What is the 20 30 40 rule for buying a house?

This rule is often used to manage debt and savings. In the context of home buying, it usually implies:

- Put 20% down to avoid Private Mortgage Insurance (PMI).

- Keep housing costs under 30% of your gross income.

- Ensure your total debts (mortgage + cars + student loans) do not exceed 40% of your income (Debt-to-Income ratio). Sticking to this helps ensure you can actually afford your life, not just your house.

Conclusion: What Should I Do as a First-Time Buyer?

Buying a home is a journey that is equal parts exciting and terrifying. However, by following these tips for buying a home for the first time, you are already setting yourself up for success.

To recap: educate yourself using free resources like Fannie Mae, stick to a realistic budget that includes hidden costs, and protect your credit score at all costs. Build a team of professionals—a great agent and a trusted lender—who will fight for your best interests. And please, save that emergency fund!

I hope this guide has clarified the process for you. It might feel overwhelming now, but when you turn the key to your own front door for the first time, you will know it was worth the effort. Good luck! Also, you can directly contact loan officers nearby on Bluerate to shop around with efficiency.