Comprehensive 21st Mortgage Reviews: What, Pros & Cons, FAQs

21st Mortgage Corporation is one of the largest specialized lenders in the United States for manufactured and mobile home financing. This review explains who 21st Mortgage is, what loan products it actually offers, plus common borrower experiences and the practical tradeoffs, especially the higher rates and servicing patterns that often appear in public reviews.

If you're a first-time buyer, you might as well check out this guide to decide whether 21st is a good match for your borrower profile or a partner for your retail/wholesale origination pipeline.

People Also Read

- Better Mortgage Reviews: Pros, Cons, and Everything to Know

- AmeriSave Mortgage Reviews 2025: Pros & Cons, Loan Options, Rating

- CrossCountry Mortgage Reviews 2026: Benefits, Drawbacks, and FAQs

- [Solved] How to Calculate HELOC Payment? Easy-to-Understand

What is 21st Mortgage?

21st Mortgage Corporation launched in the mid-1990s and is headquartered in Tennessee. The company specializes in financing for manufactured and mobile homes, including homes sited on leased land (park models), homes on permanent foundations, and chattel (mobile) loans. Over the years, 21st has focused its business model and product set around factory-built housing, building underwriting expertise, servicing operations, and dealer relationships specific to that market.

21st's public materials and industry reports show it is a major originator/servicer in the manufactured-home niche with large loan counts and servicing balances compared with other specialty lenders. Because 21st concentrates on factory-built housing, it does not offer broad conventional retail mortgage products like typical conforming, FHA, or VA programs available at most banks, in the same way mainstream retail lenders do.

Benefits of 21st Mortgage

There are some pros and cons based on the overall experience. You can take a look at it here.

Helpful Staff

Many borrowers report positive interactions with 21st loan officers and originators who are experienced in manufactured-home underwriting and dealer workflows. For first-time manufactured-home buyers, this expertise can speed approvals because staff understand special documentation needs like title/placement issues, park lease documentation, and HUD certs.

Accessible Financing

21st's core strength is accessibility. The company routinely serves borrowers who cannot obtain traditional bank mortgages because of credit history, home type, or property placement. In many cases, 21st will consider alternative credit data, allow higher LTVs for qualified buyers, and structure loans for homes that do not meet a conventional lender's requirements, for example, older factory homes, homes on leased land, or homes without permanent foundations.

Efficient Process

21st has invested in a digital application and servicing platform optimized for manufactured home flows. Many borrowers report a relatively quick initial underwriting decision compared with smaller local lenders unfamiliar with chattel paperwork. For straightforward transactions with complete seller/dealer documentation, 21st's process can be more efficient than less-specialized lenders.

Drawbacks of 21st Mortgage

Aggressive Collections

A recurring theme in borrower reviews is aggressive or persistent servicing/collection communications when payments are late. Multiple review platforms include complaints about frequent calls and difficulty negotiating hardship arrangements. For borrowers who experience temporary hardship, the perceived collection tone has been a frequent point of friction.

High Interest Rates and Fees

Because manufactured and mobile home lending carries higher credit and collateral risk, 21st's rate range is generally higher than conventional conforming mortgage rates. Public summaries and the company's product disclosures indicate rates for many manufactured/mobile loans commonly fall in a higher band than traditional mortgages, which are usually at 7%-14%. Higher APRs and additional chattel-loan fees are expected in this sector compared with conforming mortgages.

Poor Communication

Alongside servicing complaints, several reviewers describe inconsistent communications across departments from origination → closing → servicing. That can result in duplicate document requests or delays in resolving underwriting questions. Borrowers with straightforward documentation report smooth experiences. Those with complex title/placement situations more often note friction.

Limited Loan Types

21st is a specialist, it focuses on manufactured and mobile home loans with fixed-rate products and chattel options and does not offer the full suite of conventional bank products, for example, standard conforming/HFA FHA/VA/USDA in the same way retail banks do. Adjustable-rate programs are not generally part of the company's core product mix for mobile/manufactured loans. If a borrower needs USDA, construction financing, or certain rehab products, they will need a different lender.

What Customers Say About?

Public review platforms show a wide difference in borrower experiences, from very satisfied to very dissatisfied. Because 21st handles both originations and a large servicing portfolio, originations reviews often praise knowledgeable originators, while servicing reviews are more mixed.

Birdeye 4.6/5.0

Birdeye and other review aggregators often show strong scores from customers who had good origination experiences with specific loan officers. Example sentiments include praise for responsiveness and problem solving during purchase.

-

Kaden was a huge help to me. He was able to answer all my questions to the T and help me get the answers I needed about my policy!

-

I contacted 21st Mortgage and spoke with Peyton in Customer Service. She was so nice and helpful. This type of service is so appreciated.

-

VERY RUDE!!!! I hit hard times financially and this company's managers make FUN OF ME and called me LAZY after I told them can't make the payment they called me a LIAR!! The place is so unprofessional!!!!!

WalletHub 2.4/5.0

WalletHub and similar aggregators collect many servicing complaints, comments typically reference collection practices, difficulty reaching servicing teams, or frustration when payments or payoff quotes are unclear.

-

This is by far the worst company I have ever had to deal with. The customer service is horrible, as are the workers, especially Matthew. He doesn't know me, yet he had the audacity to be rude to me. I work in customer service and I wouldn't recommend this company to anyone; their behavior is unacceptable. I wish I could go elsewhere. It's a shame how they treat their customers, so to anyone considering this company, please don't.

-

I was well pleased with Michael Rodriguez for being courteous and knowledgeable during his assistance during my escrow phone call.

-

They raised my monthly payment by $68 with no explanation. Today I received a notice from my home insurance that the premiums are not being paid. What is 21st Mortgage doing with the payment? This company needs to be investigated.

ConsumerAffairs 4.3/5.0

ConsumerAffairs includes a mixture of long-form reviews, many positive originations stories, plus detailed servicing complaints from customers who later experienced hardship or payoff disputes.

-

I called 21st and the process was real fast. They were very pleasant, every part of it. The rep who helped me, Grant, called me once a week to let me know what was going on and he gave me all the information I needed. It was the first time I ever bought a home so it was all new to me. He didn't get tired of me calling them.

-

The process went extremely well until the last week when we lost complete communication with our LO. We were left believing that the loan was not going to close either on time or at all, and neither us nor title could determine what was going on. No notices, no updates, nothing. And then, when the loan was supposed to fund after not hearing anything for several days, it funded. All it would have taken was a little bit of communication on the last few days for us to have received a positive human experience throughout the transaction. However, that window of going dark made the entire transaction nothing more than average.

-

My loan officer apparently quit in the middle of my loan processing. I was the one who had to constantly call and keep them on track to make my closing which ended up three days later than expected. They did not reassign my file and I was given very poor interest rates despite my very high credit score. This seems like a predatory lender and practices.

What Loan Does 21st Mortgage Offer?

21st Mortgage specializes in two primary product families focused on factory-built housing:

-

Manufactured home loans (real property), financing for HUD-standard manufactured homes that are treated as real property. This usually on permanent foundations and often when land and home are sold together.

-

Mobile home/chattel loans (personal property), loans secured by the home only, commonly called chattel loans, for homes on leased land or where the home is not permanently attached to real property.

21st predominantly offers fixed-rate products for these categories, ARMs are not generally part of the core manufactured/movable home offering. Rates and terms vary by credit profile, home age, collateral type (foundation vs. chattel), occupancy (primary vs. secondary), loan amount, and LTV. Minimum loan amounts and program details differ by scenario (dealer sale vs. private sale vs. refinance).

Manufactured Home Loan

These are structured for factory-built homes that can be titled and taxed as real estate, often with permanent foundations. Terms can mirror mortgage-style amortizations and are designed to finance the home and sometimes land, where offered, under real-property classification.

Mobile Home Loan

Chattel loans for mobile homes remain common in park settings or when buyers purchase a home without land. Chattel loans usually have shorter terms and higher rates vs. real estate loans because the home is classified as personal property, and the collateral typically depreciates.

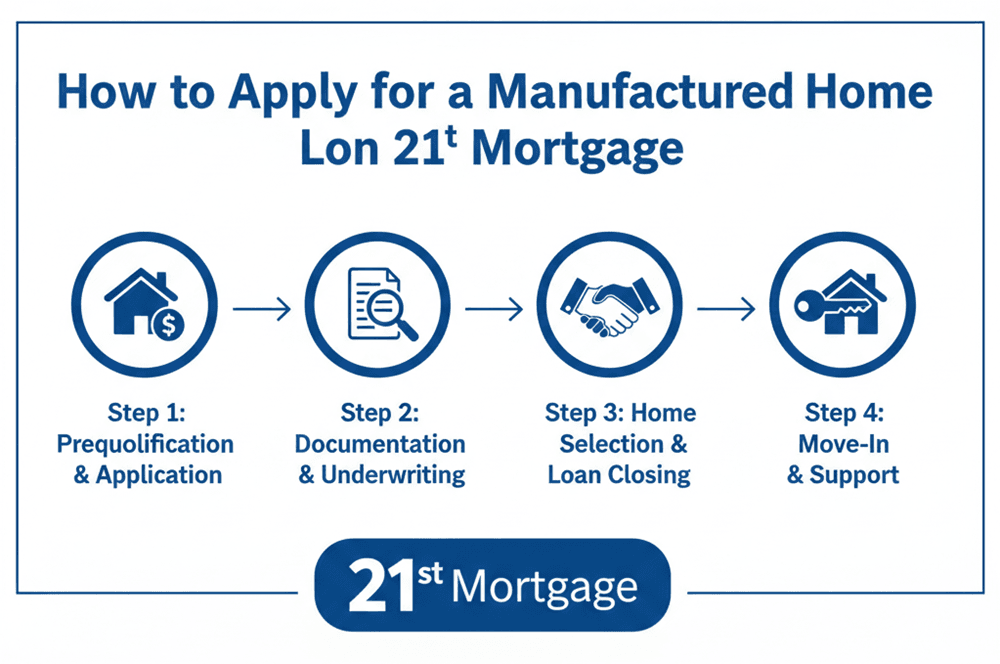

How to Apply for a Manufactured Home Loan on 21st Mortgage?

21st's online application is the usual entry point: borrowers complete a credit application and provide ID, income documentation, purchase information (dealer name, home details), and land/park paperwork if applicable. Because 21st's underwriting is tailored to manufactured housing, expect questions about:

-

Home age, HUD plate (if applicable), serial numbers;

-

Foundation type and installation/permanency;

-

Site/park lease terms (if not buying land);

-

Proof of income (pay stubs, tax returns) and other standard underwriting items.

21st Mortgage's Other Services

Moreover, 21st Mortgage has other services that you may be interested in.

Insurance

21st operates an affiliated insurance agency to help borrowers obtain policies specific to manufactured/mobile homes (property coverage, liability, etc.). Bundling insurance with the loan is a common convenience, and the agency often understands the unique coverage needs of factory-built housing.

Payment Estimator

21st provides an online payment estimator for purchase and refinance scenarios, so borrowers can preview monthly payment ranges given rate and term inputs. These tools are helpful for early budgeting, especially in a market segment where rates and terms vary materially by profile.

Calculators

The company publishes calculators for common borrower decisions, including Mortgage Calculator, Affordable Calculator, Amortization Calculator, Extra Principal Calculator, and Early Loan Payoff Calculator. These help borrowers model different payoff or refinance scenarios.

FAQs About 21st Mortgage Reviews

Q1. Is 21st Mortgage a legitimate company?

Yes, 21st Mortgage Corporation is an established and licensed specialty lender focused on manufactured and mobile housing. It is licensed to originate in numerous states and has long-standing dealer relationships in the manufactured housing channel.

Q2. What credit score do you need for a 21st Mortgage?

21st evaluates loans on a holistic basis. They commonly originate loans for borrowers with a wide range of credit profiles. Expect higher rates or different terms for lower credit scores, for some refinance programs or cash-out options, a 600+ score threshold is commonly referenced. You should always confirm the specific minimum for the product you plan to recommend or originate.

Q3. How does 21st Mortgage compare to other lenders?

Compared with conventional mortgage lenders, 21st focuses exclusively on manufactured/mobile housing and therefore offers expertise and product structures that many banks do not. That specialization increases accessibility for borrowers who would otherwise be declined, but typically at higher interest rates and with a potential for more active servicing/collection practices. If a borrower qualifies for a conventional loan (FHA/conforming/VA) at favorable terms, those options often deliver a lower lifetime cost than chattel financing.

Q4. Does 21st Mortgage offer pre-qualifications?

21st's process emphasizes completing a formal application rather than a soft-pull prequal. 21st Mortgage doesn't offer pre-qualifications.

Q5. What is the minimum home loan amount 21st Mortgage provides?

Minimums vary by purchase type, such as dealer sale vs. individual seller vs. refinance. There are different thresholds. Typical minimums reported in product guides are in the low-to-mid five-figure range, for example, $16k--$25k depending on scenario.

Q6. What is required for a home loan down payment on 21st Mortgage?

Home loan down payments as low as 0% are available for well qualified buyers. Typical down payment requirements range from 5% to 35% and are based on overall credit profile of the buyer, collateral type (home type, home placement, etc.), and occupancy type (i.e. primary residence, secondary home, etc.). Investment properties and "Buy-For" transactions require a minimum of 20% down payment. Home loan down payments may be in the form of cash, trade, or land equity.

Conclusion

21st Mortgage occupies a clear niche: it is one of the largest specialized lenders for manufactured and mobile homes. That specialization gives borrowers who can't access conventional financing a realistic route to homeownership.

The tradeoffs are higher rates, reflecting collateral and credit risk, and mixed servicing reviews, especially around collections. For loan officers and originators who serve manufactured housing markets, 21st is a key partner, but you should compare costs carefully for each borrower and document all promises in writing.