Guide: What is a Mortgage Loan Originator License? How to Get?

Whether you are just curious about what a mortgage loan originator license is, or plan to get one. This ultimate guide has you covered. Better yet, you'll learn more information about this license, like who needs it, what the benefits are, how much it would cost, and how to maintain it. To grasp more ideas, you'd better walk through with me and start reading now!

** People Also Read**

- What is Loan Origination? Meaning, Steps, Example, Requirements

- Mortgage Loan Originator vs Loan Officer: Differences and Similarities

- Ultimate Guide: How to Become a Loan Officer with No Experience?

- [Ultimate Guide] Where to Find a Loan Officer Near Me?

- Mortgage Origination Fee: What Is It? Everything You Should Know

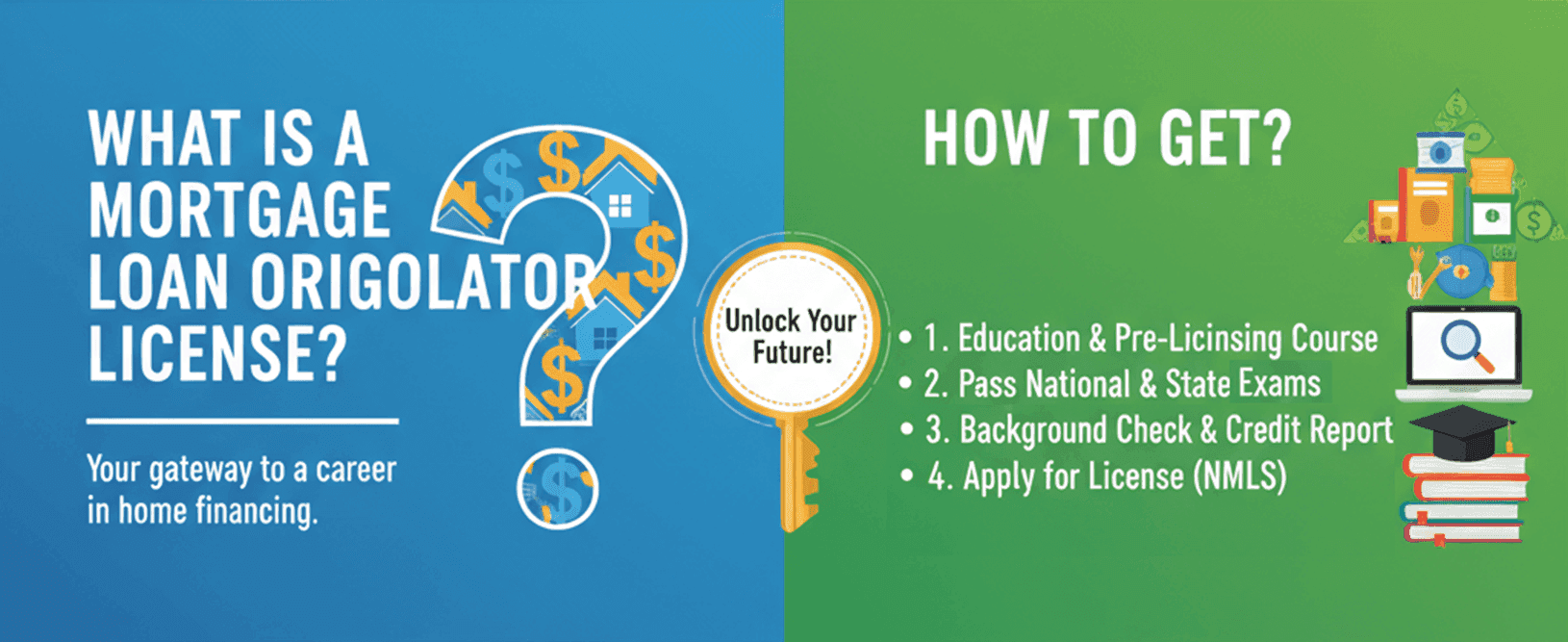

What is a Mortgage Loan Originator License?

Before going any further, let's learn what a Mortgage Loan Originator (MLO) license is at first. The license authorizes a person to originate residential mortgage loans and to interact directly with borrowers about loan products, rates, disclosures, and applications.

The SAFE Act created national minimum standards for state-licensed originators and established the Nationwide Multistate Licensing System (NMLS) as the central registry for MLO records, background checks, and test results. Licensed MLOs collect borrower documentation, evaluate qualifications, prepare loan files for underwriting, and must follow federal and state disclosure and anti-fraud rules.

The licensing framework exists to protect consumers: it ensures originators meet minimum education, testing, and character standards and that their credentials are publicly verifiable in the NMLS Consumer Access database. For candidates, the license is a legal requirement to perform origination duties in most settings and enables portability across participating states.

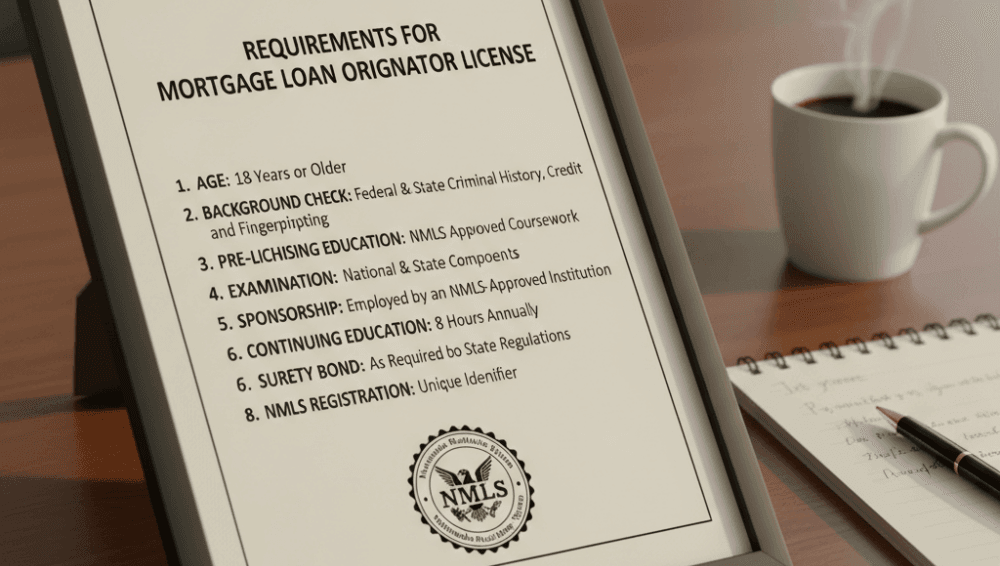

Requirements of a Mortgage Loan Originator License

Actually, there are requirements to get a mortgage loan originator license, because states and the SAFE Act require multiple pillars of qualification to grant an MLO license. To learn more, let's read on.

Education

Applicants must finish the 20-hour NMLS-approved pre-licensing curriculum as a baseline. That national 20-hour course covers federal law, ethics, nontraditional mortgage products, and general mortgage knowledge. States may add hours or state-specific modules on top of the federal minimum. Approved providers include national vendors, and course completions are reported directly to NMLS. Completing the required education not only fulfills regulatory steps but also builds the practical knowledge needed to advise borrowers, calculate closing costs, and follow disclosure rules.

Testing

Candidates must pass the SAFE MLO National Examination. The test uses 120 multiple-choice questions which include typically 115 scored plus ~5 pretest items in 190 minutes. The passing score is 75% or higher. The exam covers federal mortgage laws, ethics, origination activities, general mortgage knowledge, and the Uniform State Content section. Many states also require a state-specific test or state module. Test scheduling and proctoring are managed through authorized testing vendors. Exam fees are commonly noted on NMLS and testing vendor pages.

Background and Credit Checks

Applicants must submit fingerprints for an FBI criminal background check and authorize an independent credit report. NMLS coordinates electronic fingerprint submissions and credit report orders to support state review of criminal history and financial responsibility. Background checks help states identify disqualifying convictions and credit reviews show debt management patterns. Both influence licensing decisions. Fees for these checks are small but mandatory and are charged during the NMLS application process. Some states add separate state-level background checks or state processing charges.

Character

Licensing authorities evaluate applicants' character, fitness, and reputation. This assessment reviews prior licensing or disciplinary actions, allegations of misconduct, employment references, and the applicant's willingness to comply with laws and consumer-protection principles. Regulators use both objective records, like background checks, and public enforcement actions, as well as subjective measures, like references, and employment history, to decide whether an applicant will "operate honestly, fairly, and efficiently." Demonstrating integrity and stable, lawful conduct increases approval likelihood.

Specific Felonies

The SAFE Act and state regulations disqualify applicants with certain felony convictions—especially offenses involving fraud, dishonesty, breach of fiduciary duty, or money laundering. The law includes a seven-year lookback for most felonies and a permanent bar for felonies related to fraud or dishonesty in many jurisdictions. Expungements or pardons do not automatically guarantee approval. States retain discretion to evaluate each case. Applicants with prior convictions should consult counsel and disclose full details to avoid later disciplinary action.

Who Needs a Mortgage Loan Originator License?

Anyone who takes a residential mortgage application, offers or negotiates terms, or counsels borrowers about mortgage products generally must be licensed as an MLO in their operating state.

That includes retail loan officers employed by banks and mortgage companies, wholesale originators who submit loans to wholesale lenders, company principals who originate loans, and brokers or agents who go beyond referral activity.

Employees of federally regulated institutions sometimes register rather than obtain state licenses under limited federal registration rules, but most originators working with consumers will need state licensure and NMLS registration.

Operating without required licensure exposes both the individual and their employer to enforcement, civil penalties, and business interruption.

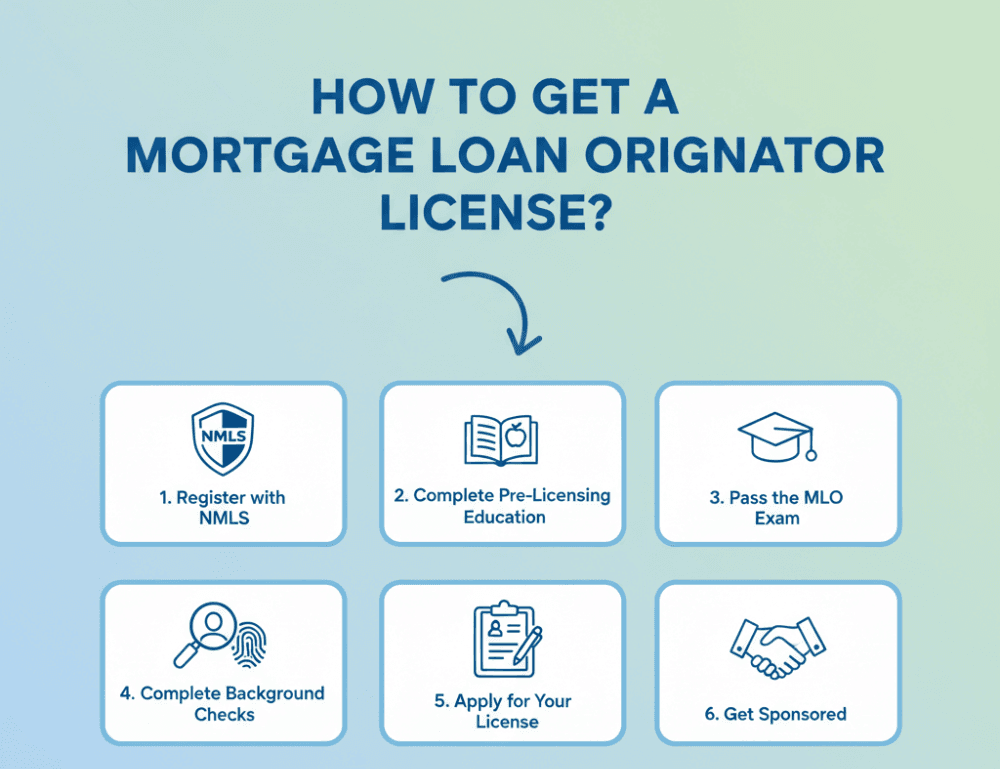

How to Get a Mortgage Loan Originator License?

The licensing process follows a predictable sequence: create an NMLS account and obtain an NMLS ID, finish pre-licensing education, schedule and pass the SAFE MLO exam (plus any state module), submit fingerprints and credit authorization, file the state license application through NMLS and pay application and processing fees, and secure employer sponsorship to activate the license. Timing depends on testing availability and state processing. Many candidates complete all steps in 2–4 months if there are no complications. Keep digital copies of certificates and monitor your NMLS account for state requests to avoid delays.

Register with NMLS

Start by creating an NMLS account and receiving your unique NMLS identifier. This is your lifetime industry ID. Use the NMLS portal to populate your MU4 (individual) application, upload identification, and begin education and testing enrollment. The NMLS system centralizes test scores, education records, fingerprint results, and license applications so states can evaluate your complete file. Registration itself usually has no charge, but subsequent processing and state fees will apply. Keep your NMLS ID safe and consistent on employer forms and license applications.

Complete Pre-Licensing Education

Select an NMLS-approved course (20 hours national minimum) from an established provider and complete the modules required for your state. Providers submit completion records directly to NMLS, so you don't have to mail certificates. Choose a course that offers exam prep and practice tests if you're new to mortgage regulations—bundled packages can raise pass rates and speed time to test readiness. Keep receipts—some employers reimburse course fees.

Pass the MLO Exam

Schedule the SAFE MLO national exam and any state module through the NMLS testing vendor. Allow adequate study time and take practice tests. The exam expects applied case-style knowledge (disclosures, documentation, and rule application). If you fail, you can retake the test, but you must pay the exam fee again. Once you pass, the score posts to your NMLS account and is available for state applications.

Complete Background Checks

Order electronic fingerprinting via NMLS and authorize the required credit report. Fingerprint results and credit checks are submitted to your NMLS file for state review. Confirm whether your state requires additional state-level checks (some do) and schedule any supplementary steps promptly to avoid application delays. Keep contact info current in NMLS so state requests reach you.

Apply for Your License

When education, testing, and background checks are complete, file the state license application via NMLS (MU4). Pay state application and NMLS processing fees, answer disclosure questions fully, and upload any required supporting documents. Processing times vary. Monitor messages in NMLS in case the state requests clarifications or extra information. Once approved, your state will issue the license, and you'll proceed to sponsorship.

Get Sponsored

A licensed mortgage employer must sponsor you to move your license from inactive to active status. Sponsorship is submitted in NMLS by the employer. Some companies require pre-employment or a signed offer before sponsoring. Without sponsorship, you cannot originate loans even after you hold a license. If you change firms, your new employer must submit sponsorship to activate your origination privileges.

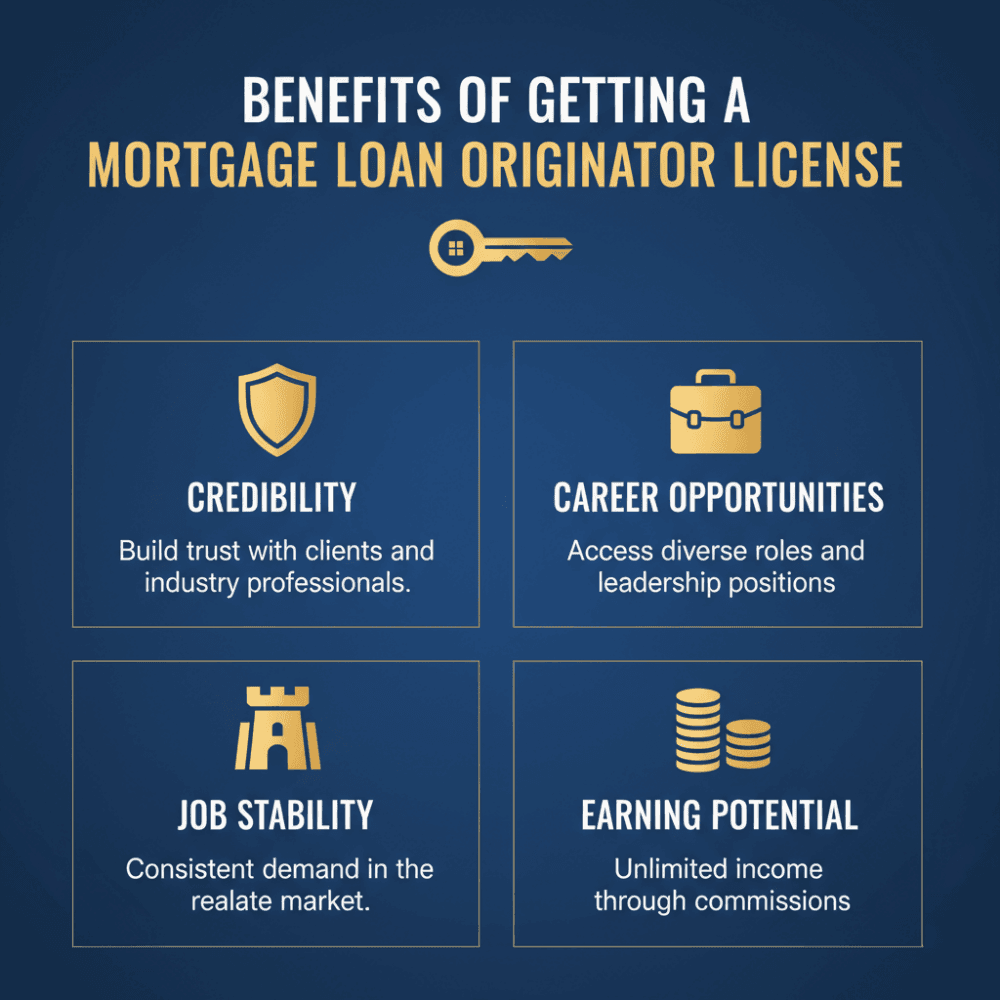

Benefits of Getting a Mortgage Loan Originator License

Licensure provides measurable career advantages: it builds verified professional credibility with borrowers and partners, unlocks a broader range of employer types, improves job stability through regulatory barriers to entry, and materially increases earning potential for productive originators. Holding a license also demonstrates ongoing regulatory compliance and makes it easier to expand into multiple states. Below are the practical aspects hiring managers and borrowers value most.

Credibility

An MLO license signals regulated competence. The public can look up credentials via NMLS Consumer Access, which lists disciplinary actions and license status. That transparency reassures borrowers and referral partners (real estate agents, financial planners), and demonstrates a candidate's commitment to regulated, compliant lending practices. In markets where trust matters, licensure is a baseline credibility filter that employers and consumers use.

Career Opportunities

Licensed originators are eligible for roles at banks, credit unions, national mortgage firms, regional lenders, and brokerages. The license also enables upward mobility into management, compliance, or broker/banker roles that require demonstrated regulated experience. Multistate licensing expands geography and market reach, which can materially increase hiring opportunities and career flexibility.

Job Stability

Although employment growth for loan officers is projected to be modest, the BLS estimates about 20,300 annual openings over the coming decade due mainly to replacement needs, implying steady hiring opportunities for qualified originators. Licensure creates a market advantage when firms screen for compliant, credentialed origination talent.

Earning Potential

Earnings vary widely by market, employer, and experience. Industry salary aggregators show median and average figures that reflect commission structures and local market differences—zipper averages often center in the mid-five figures to low six figures for experienced producers, while national medians reported by the BLS (and market sites) provide benchmark context. High producers in strong markets can earn substantially above median figures.

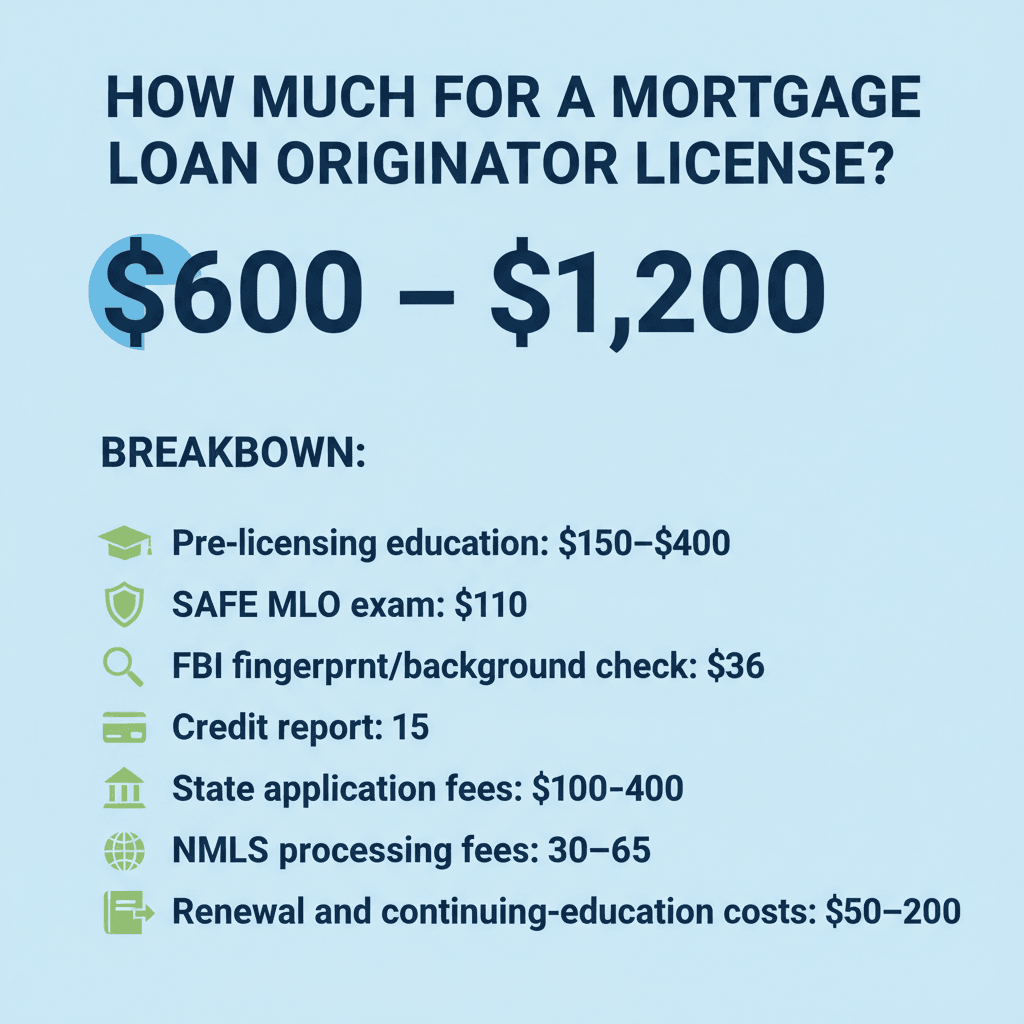

How Much Does it Cost to Get a Mortgage Loan Originator License?

Initial licensing costs vary by state but generally include education, exam fees, fingerprinting, credit reports, and state/NMLS processing fees. There are common line items:

- Pre-licensing education: $150–$400

- SAFE MLO exam: $110

- FBI fingerprint/background check: $36

- Credit report: $15

- State application fees: $100–$400

- NMLS processing fees: $30–$65

- Renewal and continuing-education costs: $50–$200

Some states add additional state background checks or state education fees. Example totals reported by education providers and state guides typically range from about $600 to $1,200 for first-time licensing, depending on state specifics and course choices.

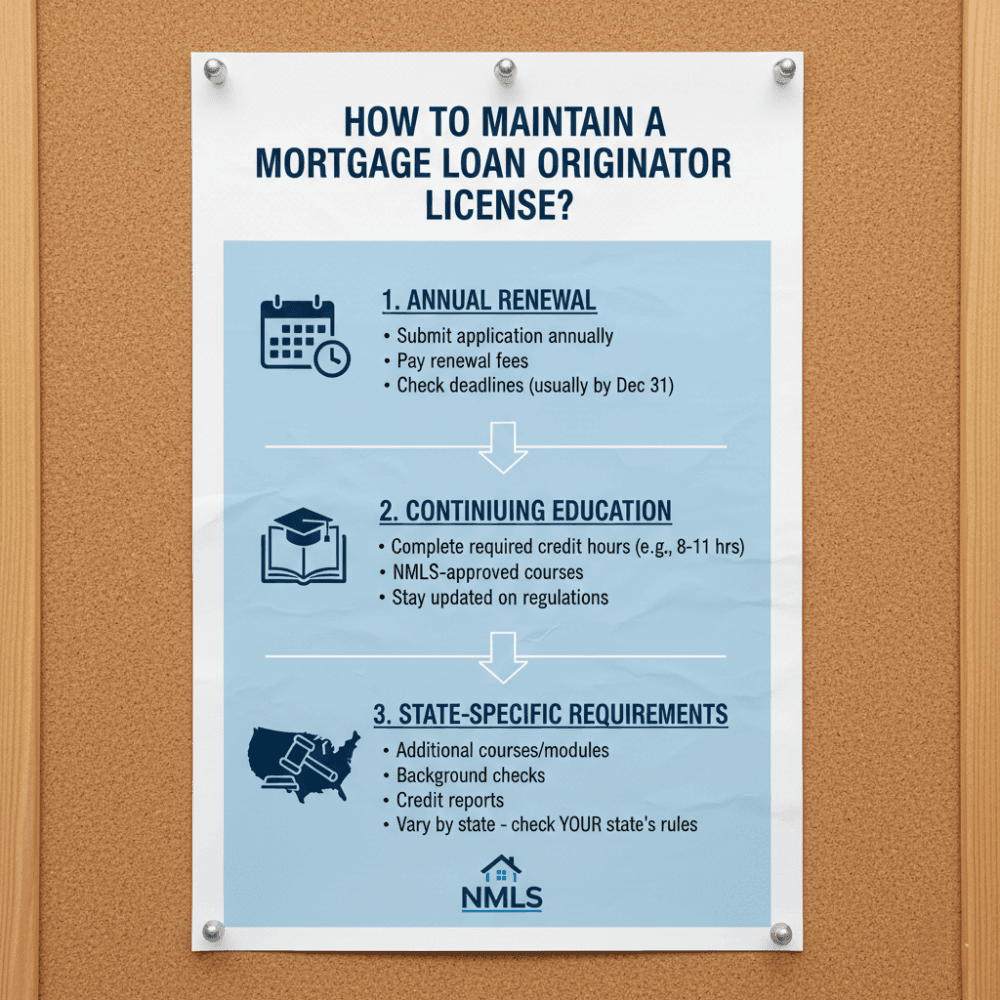

How to Maintain a Mortgage Loan Originator License?

After initial licensure, you must keep your license active through timely renewals, annual continuing education, and compliance with any state-specific monitoring or reporting. To maintain a mortgage loan originator license, you'll have to pay attention to the following.

Annual Renewal

Licenses typically require annual renewal through NMLS before the state's deadline. Many states set year-end deadlines. NMLS renewal windows generally open in the fall. Renewal fees and exact deadlines vary by state. Timely renewal with CE completion and current sponsorship information keeps licenses active. Late renewals may carry penalties or temporary deactivation until resolved. You should monitor NMLS notifications and employer communications year-round.

Continuing Education

Most state-licensed MLOs must complete 8 hours of NMLS-approved continuing education annually. The standard breakdown includes federal law, ethics, nontraditional mortgages, and electives. However, states can add hours or state-specific modules. Approved providers submit CE completions to NMLS automatically. Keep CE receipts and confirmations in your records, and schedule courses early in the renewal window to avoid year-end bottlenecks.

State-Specific Requirements

States sometimes impose additional or different obligations—extra CE hours, state law modules, re-examination, higher renewal fees, or special disclosures. If you plan to operate in multiple states, verify each jurisdiction's unique requirements via NMLS and the state regulator. Employer compliance teams commonly assist with multi-state maintenance. Proactive checks prevent surprise requirements during renewal.

Learn About Different Types of Mortgage Licenses

Across the industry, there are several distinct license types for companies and individuals. Understanding these helps you choose the right credential for your role and business model.

Mortgage Loan Originator License

This individual license allows a person to take mortgage applications, advise about loan terms, and submit loan files for funding. It focuses on borrower interaction, documentation, and disclosures. The MLO license is usually the first credential new originators pursue and is required to perform origination work in most states.

Mortgage Banker License

A mortgage banker is an entity that originates and funds loans using its own capital or credit facilities. Banker licenses often require financial strength (net worth), surety bonding, audited statements, and specific corporate registrations—requirements that reflect the institution's funding and servicing responsibilities.

Mortgage Broker License

Mortgage brokers act as intermediaries that connect borrowers with lenders. Brokers do not typically fund loans themselves. Broker licensing for firms often requires business registration, surety bonds, experience thresholds, and corporate disclosures in addition to individual MLO licensure for originators who work under the broker.

Mortgage Lender License

Lender licenses apply to institutions that directly originate and fund mortgages and often overlap with banker requirements. Lenders must meet capital, bond, and compliance program thresholds and typically employ licensed MLOs to perform origination tasks on their behalf. State rules define thresholds and the exact licensing path for lenders.

FAQs About Mortgage Loan Originator License

Q1. What's the difference between an MLO license and NMLS?

An MLO license is the professional credential issued under state law authorizing a person to originate residential mortgages in that state. NMLS is the web-based system that administers registration, testing records, background checks, and state applications—essentially the administrative platform and public registry used to manage and verify licenses. Think: the license is the credential. NMLS is the nationwide administrative system.

Q2. How hard is the MLO exam?

The SAFE MLO exam is intentionally rigorous enough to ensure practical competence. It tests applied knowledge of laws, documentation, and origination tasks. National pass rates vary by provider and year, but many test-prep programs report first-time pass rates in the 50–70% range, depending on preparation. Focused study, practice exams, and a structured prep course materially improve outcomes.

Q3. Will MLO be replaced by AI?

AI and automation are increasingly used to speed document handling, pre-underwriting checks, and borrower intake, but full replacement of licensed MLOs is unlikely in the near term. Origination still requires human judgment for complex cases, regulatory accountability, and consumer counseling. Expect hybrid workflows where AI handles routine tasks and licensed originators manage client relationships, complex underwriting exceptions, and compliance decisions.

Conclusion

A Mortgage Loan Originator license is a practical, verifiable credential that opens multiple pathways in the residential lending ecosystem. The process centers on NMLS registration, 20 hours of pre-licensing education, passing the SAFE MLO exam, fingerprinting and credit checks, and employer sponsorship.

Costs and timelines vary by state, but initial licensing is commonly achievable within a few months with organized preparation. Maintaining the license requires annual renewal, continuing education, and adherence to state rules. For employers and borrowers alike, licensure signals competence and regulatory oversight—making it a foundational step for anyone serious about a career in mortgage origination.