![[Solved] Can First-Time Home Buyer Buy Land? More Details Here](/_next/image?url=https%3A%2F%2Fdynamic-light-ab6e2536d6.media.strapiapp.com%2Fcan_first_time_home_buyer_buy_land_banner_7d816c5afb.png&w=3840&q=75)

[Solved] Can First-Time Home Buyer Buy Land? More Details Here

I was checking funs the other day, and I saw a Reddit post that perfectly captured the frustration many of you feel. A user asked, "Can I buy land as a first-time homebuyer?" They were tired of bidding wars on overpriced houses and just wanted a slice of dirt to call their own. I get it, the dream of building from scratch is powerful.

So, here is the short answer: Yes, you can absolutely buy land as a first-time buyer. However, it is not as simple as getting a standard 30-year mortgage. Lenders view empty land as "high risk," meaning the rules are different. If you aren't careful, you might end up with a plot you can't build on. In this guide, I'll walk you through exactly how to finance raw land versus land for immediate construction.

Can First-Time Home Buyer Buy Land?

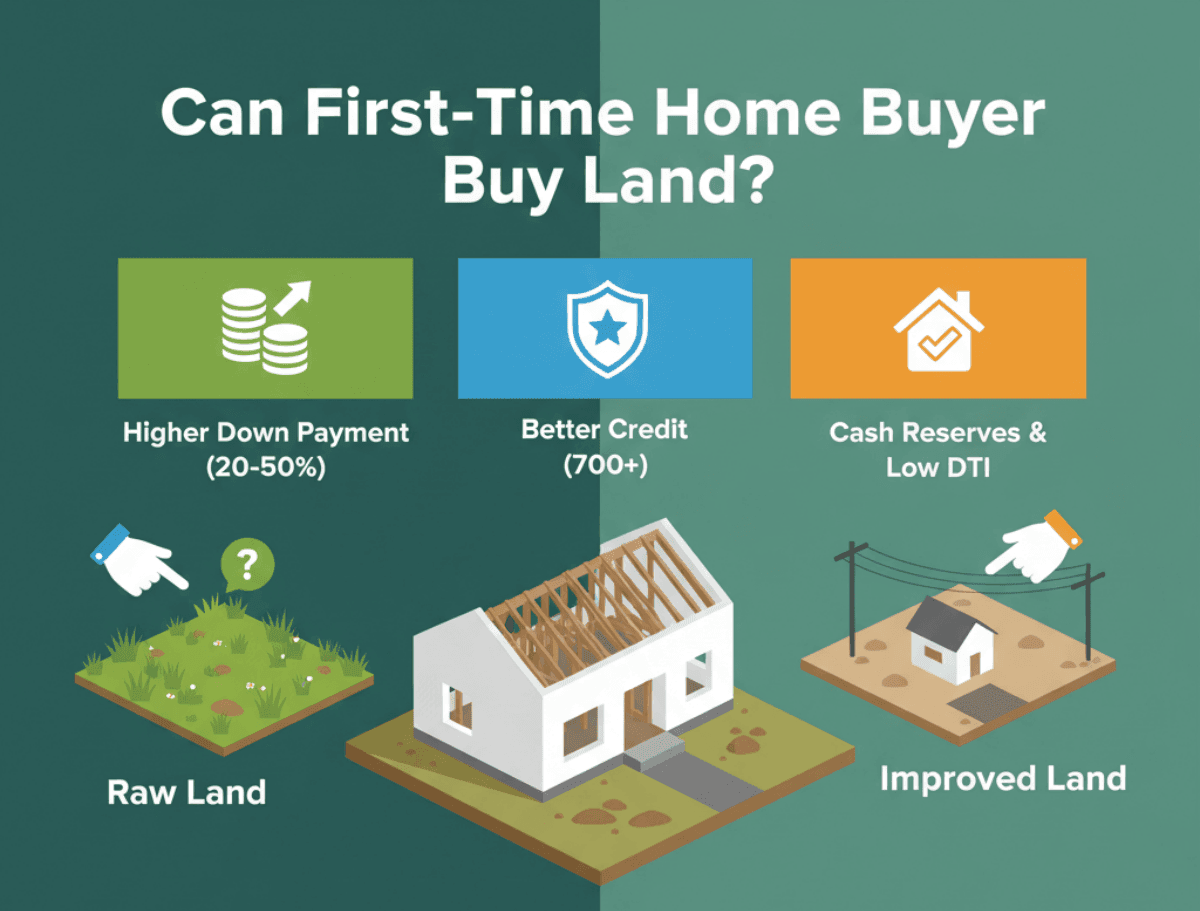

The direct answer is yes, but let's be real, buying land is fundamentally different from buying a standing house. When I talk to clients, I always emphasize one critical distinction: Raw Land vs. Improved Land.

Raw land is just that, dirt. No sewers, no electricity, and maybe not even a road. Improved land usually has utilities accessible or a driveway cut in. Why does this matter? Because banks are terrified of raw land. If you default on a mortgage, they can sell the house. If you default on raw land, they are stuck with a patch of grass that's hard to sell.

Because of this risk, you won't be using a standard FHA loan to buy just the land unless you build immediately, more on that later. Instead, you'll likely need a Land Loan or a Lot Loan.

Here are the typical requirements you need to prepare for:

- Higher Down Payment: Unlike the 3% for a house, expect to put down 20% to 50%.

- Better Credit: Lenders generally want to see a score of 700+.

- Lower DTI: Your Debt-to-Income ratio needs to be solid, often under 43%.

- Cash Reserves: You need liquid cash to show you can handle payments without a rental income from the property.

First-Time Land Buyer Programs to Learn

This is where most advice online gets confusing. You might read "FHA covers land," but that's only half true. As a first-time buyer, you need to know which specific programs actually work for your situation. Here are the best options I've analyzed for 2026.

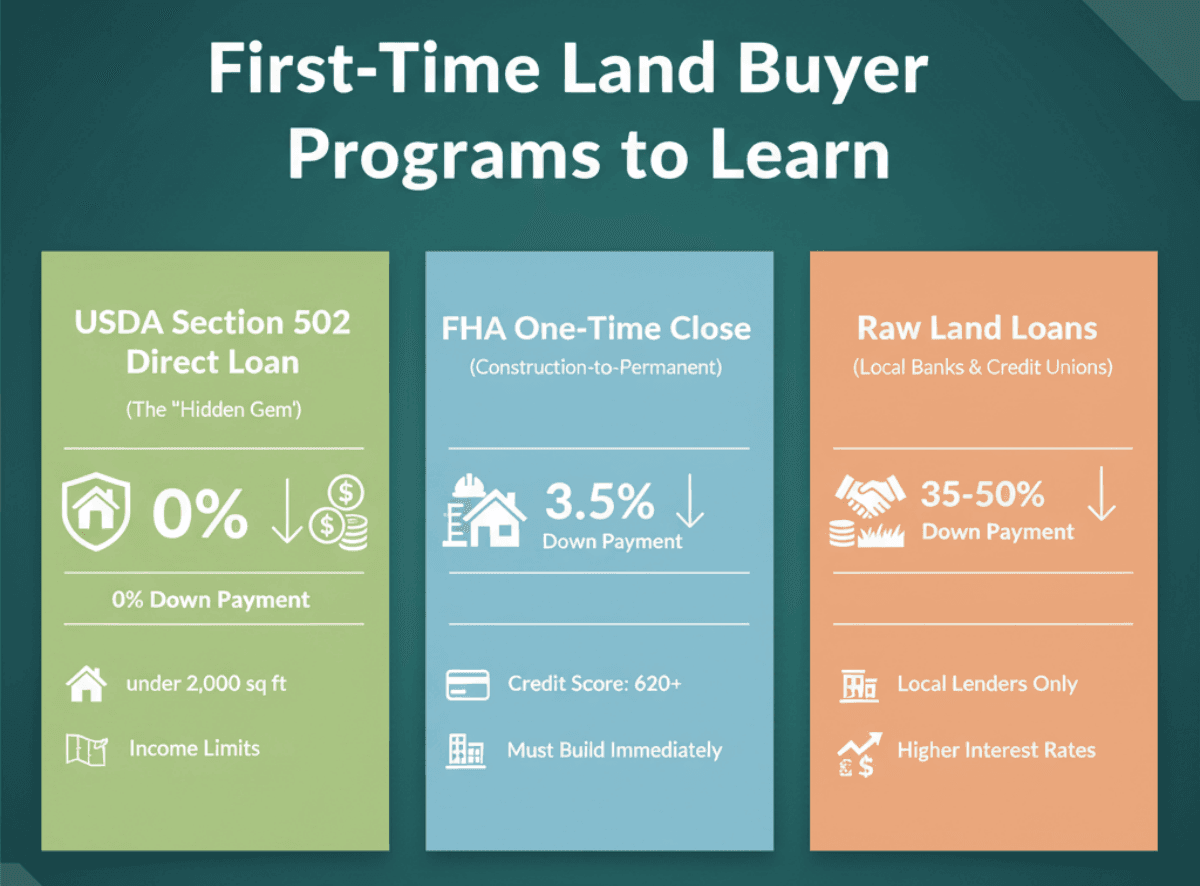

1. USDA Section 502 Direct Loan (The "Hidden Gem")

If you are looking in a rural area and have a low-to-moderate income, this is hands down the best program. The USDA Section 502 Direct Loan allows you to buy land and build a home with potentially 0% down payment.

- The Catch: You must build a "modest" home (usually under 2,000 sq. ft.), and the land cannot be worth more than the house itself.

- Income Limits: Eligibility is strictly based on your county's median income.

2. FHA One-Time Close (Construction-to-Permanent)

This is the closest thing to a "standard" first-time buyer loan for land. It combines the purchase of the land, the construction costs, and your final mortgage into a single loan with one closing cost.

- Down Payment: As low as 3.5% (a huge advantage over the 20% for private land loans).

- Credit Score: Officially 580, but most lenders I know require 620+.

- Requirement: You cannot just buy the land and wait. You must have a contractor and plans ready to go at closing.

3. Raw Land Loans (Local Banks & Credit Unions)

If you just want to buy land and wait 10 years to build, government programs won't help you. You need a private Raw Land Loan.

- Where to find them: Big national banks often don't do these. You need to visit a local Credit Union (CU) near the land.

- Reality Check: Expect higher interest rates (often 1-2% higher than mortgage rates) and a down payment of 35-50% for completely undeveloped land.

Things to Consider Before Buying a Land

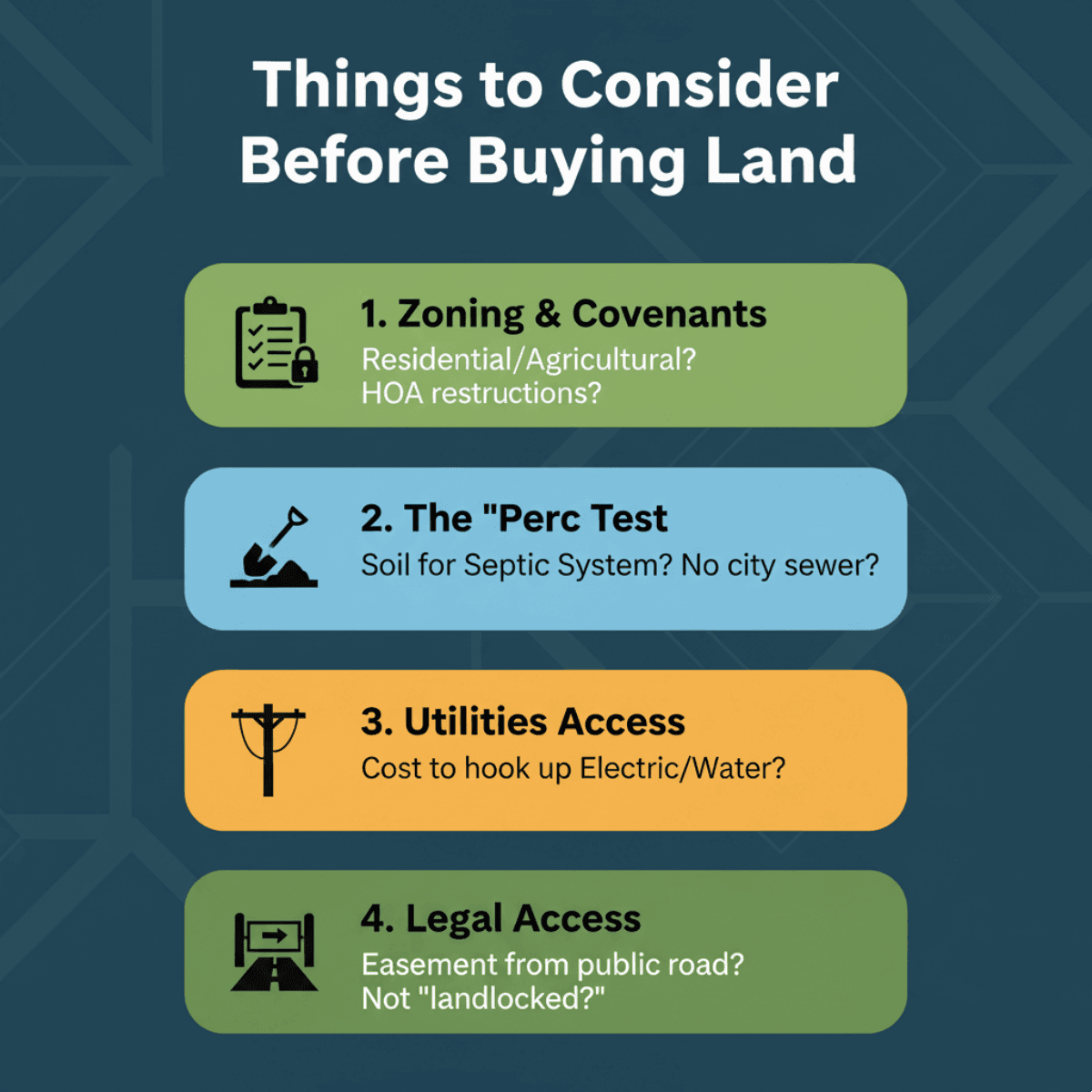

I've seen heartbreaks happen because a buyer fell in love with a view but didn't check the invisible problems. Before you sign anything, you must investigate these four factors.

- Zoning & Covenants: Never assume you can place a mobile home or build a barn. Check with the county zoning office. Is it zoned Residential or Agricultural? Are there HOA restrictions?

- The "Perc Test": This is non-negotiable. A percolation test determines if the soil can handle a septic system. If the land fails this test and there's no city sewer, you cannot build a house there.

- Utilities Access: Seeing a power line nearby isn't enough. I've known buyers who had to pay $10,000 just to get a pole installed on their property. Verify the cost to hook up electricity and water.

- Legal Access: Ensure the land isn't "landlocked." You must have a legal easement to drive from the public road to your property.

How to Buy Land as a First-Time Homebuyer?

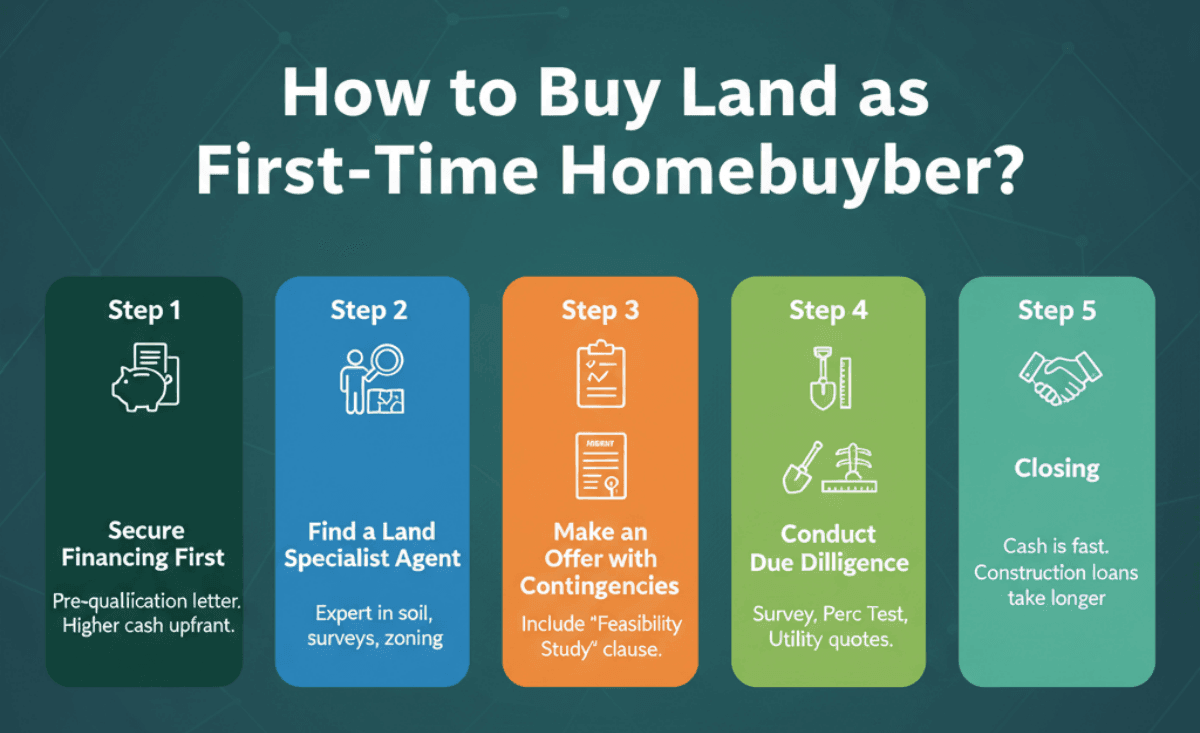

Buying land is less regulated than buying a house, which means you need to be your own advocate. Here is the step-by-step process I recommend to keep you safe.

Step 1: Secure Financing First

Don't shop yet. Go to a local credit union or find a lender specializing in "One-Time Close" loans. Get a pre-qualification letter so you know your budget. Remember, land requires more cash upfront.

Step 2: Find a Land Specialist Agent

Do not use a regular residential realtor. You need an agent who understands soil reports, surveys, and mineral rights. A "Land Specialist" will spot red flags that a house agent might miss.

Step 3: Make an Offer with Contingencies

This is the most important step. When you make an offer, include a "Feasibility Study" contingency. This gives you 30-90 days to "do your homework" (tests, zoning checks) with the right to back out and get your deposit back if the land is unbuildable.

Step 4: Conduct Due Diligence

During your feasibility period, spend the money to hire a surveyor to mark the boundaries. Order the Perc Test. Call the power company for quotes.

Step 5: Closing

Once the tests pass, you close. If you are using a cash loan, it's quick. If you are using an FHA Construction loan, it will take longer as the lender approves your builder's contract.

What Can You Do with the Land?

Once you own the dirt, what's next? The possibilities are why we love land, but local laws dictate the reality. Here are the most common uses I see in the US:

- Custom Home Building: Whether it's a stick-built traditional home or a modern Barndominium.

- Manufactured/Modular Homes: A faster, cheaper option. Just ensure the land is zoned for "Mobile" or "Manufactured" housing, as many areas restrict this.

- Homesteading: Growing your own food, raising chickens, or keeping livestock. (Check strictly for animal limits per acre).

- Recreation: Using the land for camping, hunting, or ATVs.

- Investment: Simply holding the land as a long-term asset, hoping the area develops and values rise.

FAQs About Buying Land for First-Time Home Buyers

Q1. Can I use a first-time home buyer loan to buy land?

Generally, no. Standard FHA or Conventional loans are for homes, not land. However, you can use an FHA One-Time Close loan to buy land if you plan to build a home on it immediately.

Q2. What is the lowest down payment for land?

If you qualify for a USDA loan, it can be 0%. For an FHA construction loan, it is 3.5%. For a pure raw land loan (no building planned), the lowest is typically 20-25%.

Q3. What credit score is needed to purchase land?

For private land loans, lenders prefer 700-720+. Government-backed construction loans (FHA/USDA) are more lenient, often accepting scores as low as 620 or 640, provided you have a clean recent history.

Q4. How hard is it to get approved to buy land?

It is harder than buying a house. Lenders scrutinize your cash reserves more heavily because land is illiquid. You need to prove you can pay the loan even if your financial situation changes.

Q5. How much is required to put down for a land loan?

For Raw Land, expect 35% to 50% down. For Improved Land (with utilities), you might find lenders accepting 20%.

Q6. Can you use first-time home buyer for manufactured homes?

Yes! FHA, VA, and USDA loans all allow you to buy a manufactured home and the land it sits on, provided the home is permanently affixed to a foundation and titled as real property.

Conclusion

Buying land as a first-time buyer is absolutely possible, but it requires more grit and cash than buying a suburban tract house. You aren't just buying a property. You are buying a project.

My final piece of advice? Don't go it alone. Build a team: a lender who knows land, an agent who knows dirt, and a builder you trust. If you are willing to navigate the zoning laws and perc tests, the reward, building your dream home exactly where you want it, is worth every headache. Start by checking your credit and talking to a local lender today.