First-Time Home Buyer Requirements: Everything You Need to Know

Let's be real for a second: buying your first home is terrifying.

I've sat across the desk from hundreds of people in your shoes. There's that specific mix of excitement, and "I'm finally getting a backyard!" and absolute dread, "What if I get rejected?". It doesn't help that the internet is flooded with conflicting advice. Your uncle tells you one thing, Google tells you another, and TikTok is... well, TikTok.

Here is the truth: Getting approved isn't magic. It's a checklist. But it's not just about having a pulse and a paycheck. Underwriters are like detectives. They are looking for specific clues that prove you can handle a mortgage.

If you are tired of the jargon and just want to know exactly what gets a deal across the finish line, you are in the right place. We are going to look at the "Big Three" (Credit, Income, Assets) and the hidden requirements most people miss until it's too late.

What is a First-Time Home Buyer?

This sounds like a stupid question, right? You either have bought a house before, or you haven't.

But in the mortgage world, definitions are a bit loose. You might actually be a "first-time buyer" and not even know it.

According to HUD (the U.S. Department of Housing and Urban Development), the rule is surprisingly generous: If you haven't owned a principal residence in the last three years, you are a first-time home buyer again.

I see this all the time. Maybe you owned a condo five years ago, sold it, and have been renting ever since. Guess what? In the eyes of a lender, you've hit the reset button. You are eligible for all the first-time perks again, like lower down payments and grants.

Also, life happens. There are exceptions for displaced homemakers or single parents who only owned a home with a former spouse. If that's you, don't assume you're disqualified.

Read Also: 10 Tips: First-Time Home Buyer Tips and Advice for You

Requirements for First-Time Home Buyer

Okay, let's cut through the noise. While different loan programs (FHA, Conventional, VA) have their own quirks, every lender is fundamentally looking at the same risk factors. Here is the breakdown of what you actually need.

First-Time Buyer Status

If you are aiming for a program specifically for first-timers, you'll have to prove it.

This usually isn't hard. Lenders will pull a "Fraud Report" or look at public records to see if your name has been on a property title recently. At closing, you'll likely sign a First-Time Home Buyer Affidavit. It's just a legal document where you swear, "Yes, I qualify." Just be honest. Mortgage fraud is a federal crime, and it's a terrible way to start homeownership.

Down Payment

Stop listening to anyone who tells you that you need 20% as the minimum down payment. That rule is ancient history.

In today's market, most first-time buyers are putting down between 3% and 7%. Here is the reality of what you need in the bank:

- Conventional Loans: You can get in with just 3% down with programs like HomeReady are great for this.

- FHA Loans: The magic number is 3.5%, assuming your credit isn't tanked.

- VA & USDA: These are the unicorns. 0% down if you qualify.

If you put down less than 20%, you will almost certainly pay PMI (Private Mortgage Insurance). It's an extra monthly fee to protect the lender, not you. But honestly? It's often worth paying PMI to get into a home now rather than waiting five years to save up 20%.

Debt-to-Income Ratio (DTI)

This is the number that kills more deals than anything else. I've seen people with 800 credit scores get denied because their DTI was out of whack.

DTI is simple: What's coming in vs. what's promised to others.

Lenders add up your future mortgage payment plus all your minimum monthly debts (student loans, car payments, credit cards). They divide that by your gross monthly income.

You want this number to be under 43%.

Can you go higher? Sometimes. With FHA loans or strong cash reserves, I've seen approvals up to 50% or even 55%. But that's pushing it. If you are borderline, paying off a $50/month credit card minimum might be the difference between "Approved" and "Denied."

Credit Score

Your score is the gatekeeper. It determines if you get in the door and how much you pay for the seat.

- 740+: You are the golden child. You get the best rates.

- 620 - 680: This is standard territory for Conventional loans.

- 580: This is usually the hard floor for FHA loans with 3.5% down.

If your score is 579, you might need to put 10% down on an FHA loan. The difference between a 579 and a 580 is massive. If you are close, don't apply yet. Work on boosting that score by a few points first.

Credit History

It's not just about the score number. It's about the story your report tells.

Lenders want to see "active trade lines." If you have zero credit cards and no loans, you have a "thin file," which can be tricky.

And if you have a Bankruptcy or Foreclosure in your past? You aren't banned forever, but you have to serve your time in the "penalty box."

- Chapter 7: Usually a 2-4 year wait.

- Foreclosure: Usually a 3-7 year wait.

Don't try to hide this. Lenders will find it.

Employment History

The "Two-Year Rule" is the standard, but it's misunderstood.

You generally need a two-year work history, but you don't need to be at the same job for two years.

If you are a nurse and you moved from one hospital to another for a raise? Great. Lenders love that.

But if you were a W-2 salaried accountant and last month you quit to start a commission-only dog walking business? That's a problem.

Lenders crave stability. If your income fluctuates like commission, bonuses, or self-employment, they are going to average it over the last two years. If the trend is going down, that's a red flag.

Income Limits

Wait, can you make too much money?

For a standard loan, no. The more the merrier.

But for specific First-Time Buyer Grants or subsidized interest rate programs (like Home Possible), yes.

These programs often cap your income at 80% of the Area Median Income (AMI). If you make $150k a year, you probably won't qualify for down payment assistance, and that's okay. You likely don't need it. You'll just get a standard loan instead.

Homebuyer Education

I know, nobody wants to take a class. But if you are using a low-down-payment program, it's often mandatory.

Don't worry, you don't have to go sit in a classroom on a Saturday. It's almost always an online course now. It costs maybe $75 and takes a few hours.

Honestly? Pay attention to the sections on closing costs. It might save you from a nasty surprise later.

Occupancy

First-time buyer loans are for homes you actually plan to live in.

You cannot use these low rates to buy an investment property or a vacation cabin.

You usually have to sign a paper stating you will move in within 60 days and stay for at least a year. If you buy it as a "primary residence" and immediately list it on Airbnb? That's mortgage fraud. The FBI actually investigates this. Don't do it.

Learn What Loan Types Are for You

Loans aren't one-size-fits-all. Think of them like tools. You need the right one for the job.

- Conventional: The standard tool. Best if you have good credit (620+) and want to avoid high mortgage insurance costs eventually.

- FHA: The safety net. Perfect if your credit is bruised (580+) or your debt ratios are high. It's more forgiving but comes with fees.

- VA: The best deal on the planet. If you are a Vet, use this. 0% down, no mortgage insurance.

- USDA: The rural perk. 0% down, but you have to buy in a designated "rural" area (which sometimes includes suburbs).

The "Wild Card": Non-QM Loans

What if you are self-employed and your tax returns show you make $10,000 (because you have a great CPA), but you actually bring in $10,000 a month? A standard bank will deny you.

This is where Non-QM (Non-Qualified Mortgage) comes in. These lenders can look at your Bank Statements instead of tax returns to calculate income. The rate is a bit higher, but it gets the deal done.

If your situation is weird—self-employed, complex income, recent credit issues—don't waste time with a big box bank that runs on rigid algorithms. Bluerate is excellent for this. They offer free consultations and have access to those niche Non-QM programs that most regular banks don't even know exist.

How to Prepare for a First Home Purchase?

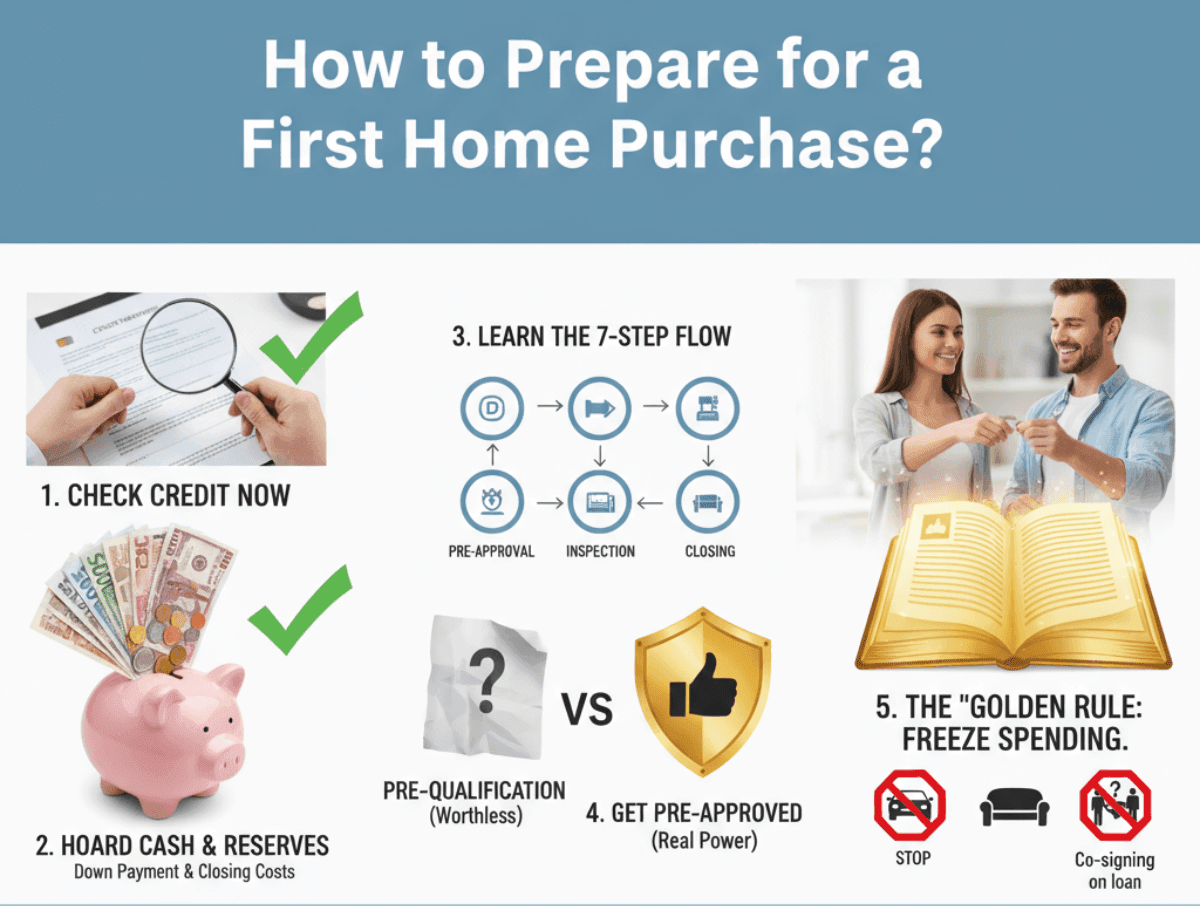

If you want to sleep better at night, here is your pre-game checklist:

-

Check Your Credit Now: Not next month. Now. I've seen deals delayed because of a $100 error on a credit report that took weeks to remove.

-

Hoard Cash: You need more than just the down payment. You need closing costs, which are 2-5% of the price, and "Reserves" as money left over, so you don't starve.

-

Learn the Flow: Understand the 7 steps to buying a home: Pre-approval -> Offer -> Inspection -> Appraisal -> Closing.

-

Get Pre-Approved: A "Pre-Qualification" is worthless. It just means you told a lender how much you make. A "Pre-Approval" means they checked your pay stubs. Sellers only care about the latter.

Read Also:

- Must-Read: How Long is a Mortgage Preapproval Good for?

- Mortgage Prequalification vs Preapproval: All Differences in 2026

- The "Golden Rule": Once you apply, freeze your spending. Do not buy a car. Do not finance furniture. Do not co-sign a loan for your cousin. Any new debt can ruin your DTI at the last minute.

FAQs About First-Time Home Buyer Requirements

Q1. What are the qualifications for first-time home buyer grant?

It varies by state, but generally: you must be a first-time buyer (3-year rule), earn under a certain income cap (needs-based), and plan to live there. Grants are free money, so the rules are strict.

Q2. When are you considered a first-time home buyer again?

Three years. If you haven't owned a main home in the last three years ending on the date you buy the new one, you are back in the club.

Q3. What are the income requirements for first-time home buyers?

There isn't a "minimum wage" for buying a house. It's all about the math. If you make $3,000 a month but have zero debt and buy a cheap house, you can qualify. It's about DTI, not total wealth.

Q4. What doesn't qualify for a first-time home buyer?

Investment properties (rentals), commercial buildings, or buying a house for someone else (unless you are a co-signer). It has to be your roof over your head.

Final Word

Look, I know this list looks long. Requirements, ratios, documents. It's a lot.

But here is the thing: Millions of people figure this out every year. They aren't financial geniuses. They just took it one step at a time. The perfect borrower doesn't exist. Lenders deal with messy situations every day.

The most important step you can take is simply asking for a professional opinion on where you stand today. Don't guess.

If you are ready to stop renting and start building your own equity, or if you just want to know if that bank statement loan could work for you, reach out to Bluerate for a free chat with local loan officers. It's free, it's low pressure, and it might just be the push you need to get the keys to your first front door. Here are recommended loan officers:

You've got this.

People Also Read

- [Must-Read Tips] How Do I Get the Lowest Mortgage Rates?

- [Ultimate Guide] Where to Find a Loan Officer Near Me?

- How to Pay off Mortgage Faster? Pros, Cons, and 7 Ways for You

- Mortgage Origination Fee: What Is It? Everything You Should Know

- [Solved] Can First-Time Home Buyer Buy Land? More Details Here