![[Must-Read Tips] How Do I Get the Lowest Mortgage Rates?](/_next/image?url=https%3A%2F%2Fdynamic-light-ab6e2536d6.media.strapiapp.com%2Fget_the_lowest_mortgage_rates_banner_811e5da6b9.png&w=3840&q=75)

[Must-Read Tips] How Do I Get the Lowest Mortgage Rates?

I was scrolling through Reddit the other day and stumbled upon a post in r/Mortgages that really resonated with me. A user asked, "What's the best way to get my mortgage lower?" They felt stuck, looking at high monthly payments and wondering if they were missing a secret trick to make homeownership affordable. Reading that thread, I realized how many of us feel overwhelmed by the complexity of interest rates. It's not just about luck. It's about strategy.

When I bought my first home, I felt the exact same anxiety. I knew that even a fraction of a percentage point could mean the difference between a comfortable budget and living paycheck to paycheck. In this guide, I want to share the concrete steps and industry insights I've learned. I will walk you through exactly what drives these rates and provide ten actionable tips to help you secure the lowest possible rate for your situation. Let's take control of your financial future.

Why Is It Important to Get the Lowest Mortgage Rate?

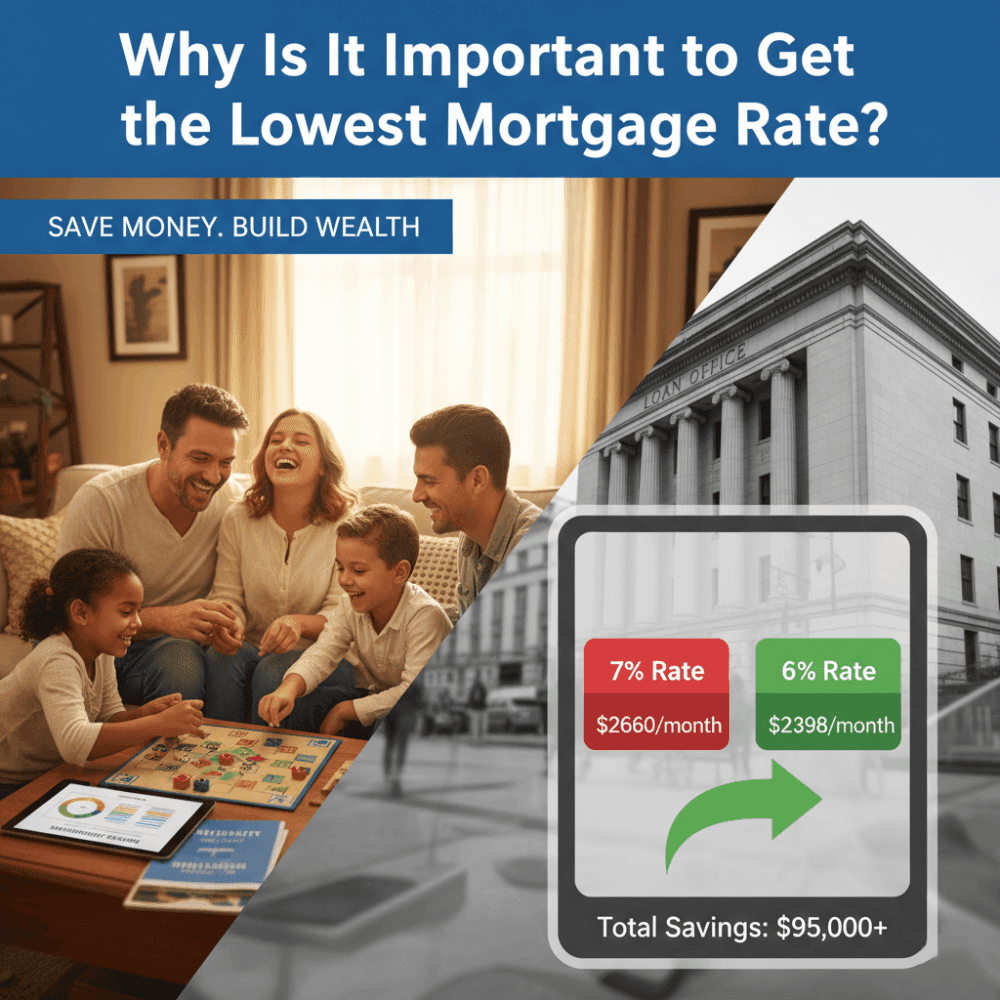

Getting the lowest mortgage rate isn't just about bragging rights at a dinner party. It is strictly about the long-term health of your finances. When I crunched the numbers for my own loan, the results were shocking. The interest rate directly dictates how much "rent" you pay to the bank for the privilege of using their money. Indeed, mortgage rates impact affordability.

For example, let's look at a standard $400,000 loan over 30 years. If you secure a 7% interest rate, your monthly principal and interest payment is roughly $2,660. However, if you manage to negotiate that down to 6%, the payment drops to about $2,398. That saves you over $260 every single month.

While that sounds nice on a monthly basis, the real impact is over the life of the loan. That 1% difference saves you nearly $95,000 in total interest payments over 30 years. That is money that could fund your retirement, your child's education, or future investments, rather than lining the lender's pockets.

Learn Factors that Influence Mortgage Rates

Before we dive into the tips, we need to understand the playing field. Mortgage rates don't just appear out of thin air. They are the result of a complex interplay between your personal financial profile and the broader global economy. Understanding these eight key factors gave me the clarity I needed to know what I could control and what I had to accept.

Federal Reserve policies and inflation

The Federal Reserve doesn't set mortgage rates directly, but its decisions influence them heavily. When the Fed raises the federal funds rate to fight inflation, it becomes more expensive for banks to borrow money. Consequently, lenders raise mortgage rates to maintain their profit margins. If inflation is high, expect mortgage rates to climb as lenders demand higher returns to offset the devaluing dollar.

Housing market conditions

Supply and demand play a massive role here. When home sales are booming and demand for mortgages is high, lenders have no incentive to lower rates. Conversely, when the housing market cools down and fewer people are applying for loans, lenders might lower rates slightly to attract business. I learned to keep an eye on housing reports to gauge the market temperature.

Current economic trends

Mortgage rates generally track the yield on the 10-year Treasury note. When the economy is strong, investors feel safe putting money into the stock market, causing bond prices to fall and yields (and mortgage rates) to rise. Bad economic news often sends investors flocking to safe bonds, which can actually drive mortgage rates down.

Credit score and history

This is the most significant personal factor you can control. Lenders use your credit score to predict the likelihood of you repaying the loan. A higher score tells them you are a low-risk borrower. In my experience, the difference in rates offered to someone with a 760 score versus a 660 score can be substantial, often differing by 0.5% or more.

Debt-to-income ratio

Your Debt-to-Income (DTI) ratio compares your total monthly debt payments to your gross monthly income. Lenders want to ensure you aren't overextended. If a large chunk of your income already goes to car loans or credit cards, you are seen as a higher risk, which often results in a higher interest rate quote.

Employment history and income

Stability is key for lenders. They typically look for a steady employment history, usually at least two years in the same field. If your income fluctuates wildly or you have gaps in employment, lenders might view you as risky. A consistent salary history assures them you can maintain the mortgage payments over the long haul.

Down payment amount

The more money you put down upfront, the less risk the lender takes on. If you default, they have a larger equity buffer. Because of this reduced risk, lenders often reward borrowers who make larger down payments (like 20% or more) with lower interest rates compared to those putting down only 3% or 5%.

Length of the loan

Generally, shorter-term loans, like a 15-year mortgage, carry lower interest rates than the standard 30-year mortgage. The lender gets their money back faster, so there is less risk of inflation eating into their returns. However, the trade-off is a significantly higher monthly payment.

10 Tips: How to Get the Lowest Mortgage Rate?

Now that we understand the economic machinery behind the rates, let's shift gears to strategy. I have compiled ten practical, proven methods to help you secure the most competitive deal possible. Here is how you can actively lower your costs.

1. Elevate Your Credit Score

Your credit score is essentially your financial report card, and it is the first thing a lender looks at. When I decided to buy a house, I pulled my credit report from AnnualCreditReport.com months in advance. I found that even a small error could drag my score down. I made sure to pay down my credit card balances to below 30% of my limit, which gave my score a quick boost.

To get the best rates, you generally need a score of 760 or higher. If you are sitting at 700, it is worth delaying your application for a few months to improve it. Do not open any new credit lines during this time, as hard inquiries can temporarily dip your score. I treated my credit score like a fragile asset. protecting it meant saving thousands in interest. By paying all bills on time and reducing revolving debt, you prove to the lender that you are a safe bet, rewarding you with their lowest advertised rates.

2. Leverage First-Time Home Buyer Programs

If you are new to the housing market, you might have access to special programs that aren't available to investors or repeat buyers. I looked into FHA loans, which are backed by the government and often offer lower rates even if your credit isn't perfect. While FHA loans come with mortgage insurance, the base interest rate can be very competitive.

Additionally, there are state-specific bond programs and grants designed to encourage homeownership. These programs sometimes offer below-market interest rates or assistance with closing costs. I recommend visiting your local housing authority's website or checking HUD.gov. Veterans should absolutely explore VA loans, which typically have some of the lowest rates on the market and require no down payment. Even USDA loans for rural areas offer excellent terms. Utilizing these programs can bypass the higher rates found in conventional commercial lending, giving you a significant head start. If you're a newbie, check here to see 10 tips for first-time homebuyers.

3. Commit to a Larger Down Payment

There is a direct correlation between how much skin you have in the game and the rate a lender offers. When I was saving, I aimed for 20% down. While it was a difficult target to hit, it served two purposes: it eliminated the need for Private Mortgage Insurance (PMI), and it secured a lower interest rate. Lenders view a loan with a 80% Loan-to-Value (LTV) ratio as much safer than one with 95% LTV.

For instance, on a $300,000 home, putting down $60,000 (20%) instead of $10,000 (3.3%) drastically changes the lender's risk profile. In many cases, lenders have price adjustments based on LTV "buckets." Crossing from 5% down to 10%, or 15% to 20%, can trigger a rate reduction. If you are close to a threshold, say you have saved 18%, it might be worth waiting a little longer or finding that extra 2% to unlock the better rate tier.

4. Explore Alternative Mortgage Structures

Most people default to the 30-year fixed-rate mortgage, but that isn't always the cheapest option. I explored Adjustable-Rate Mortgages (ARMs) during my search. An ARM typically offers a lower introductory rate for the first 5, 7, or 10 years compared to a fixed loan. If you plan to move or sell the house within that timeframe, an ARM could save you a significant amount of money without the risk of the rate adjusting higher later.

Another powerful option is the 15-year fixed mortgage. Because you pay the loan off twice as fast, the lender offers a significantly lower interest rate—often 0.50% to 0.75% lower than the 30-year counterpart. The catch, of course, is the higher monthly payment. However, if your income supports it, this is one of the most effective ways to get the absolute lowest rate and build equity at a record pace.

5. Paying for Discount Points

"Points" are essentially a way to pay some interest upfront in exchange for a lower rate on the loan. One point usually costs 1% of the loan amount and typically lowers your interest rate by about 0.25%. When I looked at my loan estimate, I had to calculate the "breakeven point." This is the time it takes for the monthly savings to equal the upfront cost of the points.

For example, on a $400,000 loan, one point costs $4,000. If that point lowers your payment by $100 a month, it would take 40 months (about 3.5 years) to break even. If you plan to stay in your "forever home" for 10 or 20 years, buying points is a brilliant strategy to lock in a permanently lower rate. However, if you might move in two years, paying for points would be a waste of money.

6. Compare Lenders with Bluerate

My biggest piece of advice is to never accept the first offer you receive. You must shop around. This is where I highly recommend using Bluerate. It is a fantastic platform designed to help borrowers quickly and easily find professional, reliable, and NMLS-verified Loan Officers right in their local area.

What I love about Bluerate is the transparency. You aren't seeing "teaser rates" that disappear when you apply. You get real-time mortgage rates that you can actually lock in. On their Loan Officer Profile pages, you can input your specific data—credit score, estimated purchase price, down payment, gross monthly income, and monthly liabilities—to check rates for your exact scenario. This allows you to find different Loan Officers nearby and compare them side-by-side.

Bluerate supports all loan types, including Fannie Mae, Freddie Mac, FHA, USDA, VA, and Jumbo. They are particularly strong in specialized areas like Non-QM, DSCR, Hard Money, and Private Lending. If you are a self-employed borrower or an investor needing these complex products, Bluerate is the most matched platform for you. You can contact the LOs directly through the site, cutting out the middleman.

7. Optimize Your Debt-to-Income Ratio

Your Debt-to-Income (DTI) ratio is a major factor in the rate you get. It is calculated by dividing your monthly debt payments by your gross monthly income. Before applying, I made a conscious effort to lower my DTI. I paid off a car loan that had a high monthly payment and cleared my credit card balances.

Lenders generally prefer a DTI below 36%, though they may accept higher. If your DTI is too high, lenders might still approve you, but they will charge a higher interest rate to offset the perceived risk. If you cannot pay off debts, consider ways to increase your documented income, such as a raise or a co-borrower. Lowering your recurring monthly obligations signals to the lender that you have plenty of cash flow to handle the mortgage, making you a "prime" borrower eligible for the best rates.

8. Temporary Mortgage Buy-Downs

In a market with high rates, a temporary buy-down can be a lifesaver. This is a financing structure where the interest rate is subsidized for the first few years of the loan. A common example is the "2-1 buydown." In this scenario, your rate is 2% lower than the note rate in the first year, and 1% lower in the second year, before settling at the full rate in year three.

Often, this is paid for by the seller as a concession to close the deal. I have seen buyers negotiate this instead of a price reduction. It keeps your monthly payments low during the expensive transition period of moving into a new home. While it doesn't change the 30-year fixed rate permanently, it effectively gives you the lowest possible rate for the initial years when your budget might be tightest.

9. Assume an Existing Mortgage

One of the most underutilized strategies is the "Assumable Mortgage." This allows you to take over the seller's existing mortgage loan, including their interest rate, current balance, and repayment period. If the seller bought their home in 2020 or 2021, they might have a rate around 3%. By assuming their mortgage, you get that 3% rate even if current market rates are 7%.

Not all loans are assumable. typically, FHA, VA, and USDA loans allow this. Conventional loans usually do not. The main challenge I found is that you must cover the "equity gap" in cash. If the home costs $400,000 and the assumable loan balance is $250,000, you need $150,000 cash (or a second loan) to cover the difference. However, for a rate that low, the effort to find these deals is often worth it.

10. The 'Buy Now, Refinance Later' Strategy

Sometimes, you cannot get the rate you want right now because the market is simply too high. In this case, the strategy is "Marry the House, Date the Rate." If you find your dream home and can afford the current payments, you buy the house now to secure the asset and start building equity.

Later, when market rates drop, you apply for a refinance. Refinancing involves taking out a new mortgage to pay off the old one. I keep a close watch on rates. a drop of 0.75% to 1% is usually enough to justify the closing costs associated with refinancing. This strategy requires patience and maintaining a good credit score so you are ready to strike when the market improves. It allows you to get the lowest rate eventually, without putting your life on hold today.

FAQs About Getting the Lowest Mortgage Rate

Q1. Is it possible to lower the mortgage rate?

Yes, absolutely. You can lower your rate before you buy by improving your credit score, making a larger down payment, or buying discount points. After you have the loan, you can lower your rate by refinancing when market conditions improve.

Q2. What is the 3-7-3 rule in mortgage?

The 3-7-3 rule refers to the waiting periods mandated by the Truth in Lending Act to protect borrowers. Lenders must give you a Loan Estimate within 3 business days of your application. You must wait at least 7 business days after receiving the estimate before you can close. Finally, if there are significant changes to the loan terms, you must receive a new Closing Disclosure at least 3 business days before closing.

Q3. Will mortgage rates ever be 3% again?

While nothing is impossible, it is highly unlikely we will see 3% rates in the near future. Those historically low rates were the result of a specific economic crisis (the pandemic) and aggressive Federal Reserve intervention. It is safer to budget for historical averages rather than waiting for an anomaly to return.

Q4. How can I pay off a 30-year mortgage in 10 years?

To payoff mortgage faster, you need to aggressively attack the principal. You can make bi-weekly payments (making 13 full payments a year), or simply add a significant amount of extra principal to every monthly check. Ensure your lender does not have prepayment penalties. This drastically reduces the total interest paid, effectively lowering your "effective" rate. Also, you can calculate the early payoff of mortgage to see whether it's worthy.

Conclusion

Securing the lowest mortgage rate is a combination of understanding the market and polishing your own financial profile. It takes a bit of effort—fixing your credit, saving that extra down payment, and negotiating terms—but the savings are life-changing. You don't have to navigate this complex landscape alone.

I strongly recommend using Bluerate to assist you in this journey. By connecting you with local, NMLS-verified Loan Officers and providing transparent, real-time rate comparisons, Bluerate empowers you to make the best decision. Whether you need a standard loan or specialized Non-QM and Private Lending options, their platform ensures you aren't just getting a loan, but the right loan at the right rate. Take control, shop around, and secure your financial future today.