What is the Lowest Mortgage Rate Today? Get Best Quote Today!

If you are reading this, you are probably feeling the same frustration I hear from homebuyers every day. You're constantly refreshing your browser, wondering, "Is today the day rates finally drop?" or "Am I actually seeing the real number, or just a teaser rate?" Whether you are a first-time homebuyer trying to break into the market or a homeowner looking to refinance, finding the absolute lowest mortgage rate today can feel like finding a needle in a haystack.

In this guide, I will cut through the noise. I'll show you exactly where to look for accurate numbers, what is driving the market right now, and how you can secure a rate that saves you thousands.

What is the Lowest Mortgage Rates Today?

Finding the "true" market rate can be tricky because different websites track data differently. Some rely on surveys, while others look at marketplace offers. To get a complete picture, I always recommend cross-referencing these three major platforms: Freddie Mac, Bankrate, and NerdWallet.

Each serves a different purpose.

- If you want a reliable industry benchmark, check Freddie Mac.

- If you want to see how much you can save by comparing offers, look at Bankrate.

- If you need a deep dive into APR versus interest rates, NerdWallet is your go-to.

Here, I've broken down exactly what you'll find on each right now.

FreddieMac

Freddie Mac is arguably the gold standard for mortgage rate trends. When the news talks about "average mortgage rates," they are usually citing the Primary Mortgage Market Survey (PMMS). I check this weekly because it gives me a solid baseline of where the market stands without the marketing fluff.

As of late November 2025, Freddie Mac reports that the 30-year Fixed-Rate Mortgage is averaging around 6.26%. If you are looking for a shorter term to pay off your home faster, the 15-year Fixed-Rate Mortgage is sitting lower, averaging about 5.54%.

Keep in mind, these are averages for borrowers with excellent credit putting 20% down. If your profile looks different, your rate might vary. However, Freddie Mac's data is crucial because it helps you spot the trend—right now, we are seeing rates stabilize in a narrow range, which is a positive sign of market certainty compared to the volatility we saw a year ago.

Bankrate

Bankrate is fantastic because it doesn't just show you an average; it shows you the "spread." On their mortgage rates page, you can see a clear comparison between the National Average and the Top Offers available on their network.

For example, right now, the national average for a 30-year fixed loan is hovering around 6.28%, but the top offers on Bankrate are often coming in significantly lower—sometimes by nearly 0.68%. On a typical loan, that gap translates to almost $1,800 in annual savings!

I also use Bankrate to track trends over specific timeframes—6 months, 1 year, or even 5 years. They cover a massive range of loan types, including Purchase and Refinance loans for 30-Year Fixed (Standard, VA, FHA, Jumbo), 20-Year, 15-Year, and various Adjustable Rate Mortgages (ARMs) like the 5/1 ARM. It's a powerful tool to see if your lender's quote is competitive or if you are leaving money on the table.

NerdWallet

NerdWallet is where I send people who get confused by the "hidden costs" of a mortgage. Their interface is excellent for distinguishing between the Interest Rate (the cost of borrowing) and the APR (Annual Percentage Rate, which includes fees).

Currently, NerdWallet is displaying real-time data from multiple lenders. You might see a 30-year fixed rate advertised at 5.99%, but with an APR of 6.15%. That difference reveals the lender fees, and seeing it upfront is vital.

Beyond just the numbers, NerdWallet allows you to explore historical trends and filter by specific loan types like 30-year Fixed FHA, VA, and Jumbo, as well as ARM products like the 3/1, 5/1, 7/1, and 10/1 ARM. They also calculate your Est. mo. payment and break down total fees and lender credits. If you want to know exactly what you will pay at the closing table alongside your rate, this is the place to check.

What Are Factors that Determine Your Mortgage Rate?

You might look at the averages above and wonder, "Why is my quote higher?" The truth is, the rate you see online is just a starting point. Your final number is determined by a unique mix of your personal financial "resume" and broader economic forces.

Personal and Property-Specific Factors

Lenders use a risk-based pricing model, meaning every detail of your application shifts your rate up or down. Here are the six biggest personal drivers:

- Credit Score: This is the heavyweight champion. A score of 760+ usually unlocks the lowest rates. If you are below 620, you might face significantly higher costs.

- Down Payment: The more skin you have in the game, the less risky you are. Putting 20% down avoids Private Mortgage Insurance (PMI) and often lowers your rate compared to a 3% down payment.

- Debt-to-Income Ratio (DTI): Lenders want to know you aren't overextended. A DTI below 36% is ideal; anything above 43% might trigger higher rates or loan denial.

- Loan Amount and Type: "Conforming" loans (backed by Fannie/Freddie) usually have better rates than "Jumbo" loans (for expensive properties), though this gap varies.

- Property Type and Location: A primary residence gets the best rate. Buying a vacation home, investment property, or a condo? Expect an "add-on" to your rate.

- Mortgage Points: This is the most common reason for rate confusion. You can pay "points" (upfront fees) to buy down your rate. Always ask if a low quoted rate includes points.

Economic and Market Factors

Even if you have perfect credit, you are swimming in a larger economic ocean. Four main currents move the tide for everyone:

- Inflation: Mortgage rates hate inflation. When prices for goods rise, lenders demand higher interest rates to maintain their profit margin over time.

- Federal Reserve: The Fed doesn't set mortgage rates directly, but its decisions on the "Federal Funds Rate" influence the bond market, which mortgages follow.

- Economic Conditions: In a strong economy with low unemployment, rates tend to rise. In a recession, rates often fall to encourage borrowing.

- Market Dynamics: Mortgage rates are tied closely to the 10-Year Treasury Yield. If investors sell off bonds, yields go up, and mortgage rates follow suit.

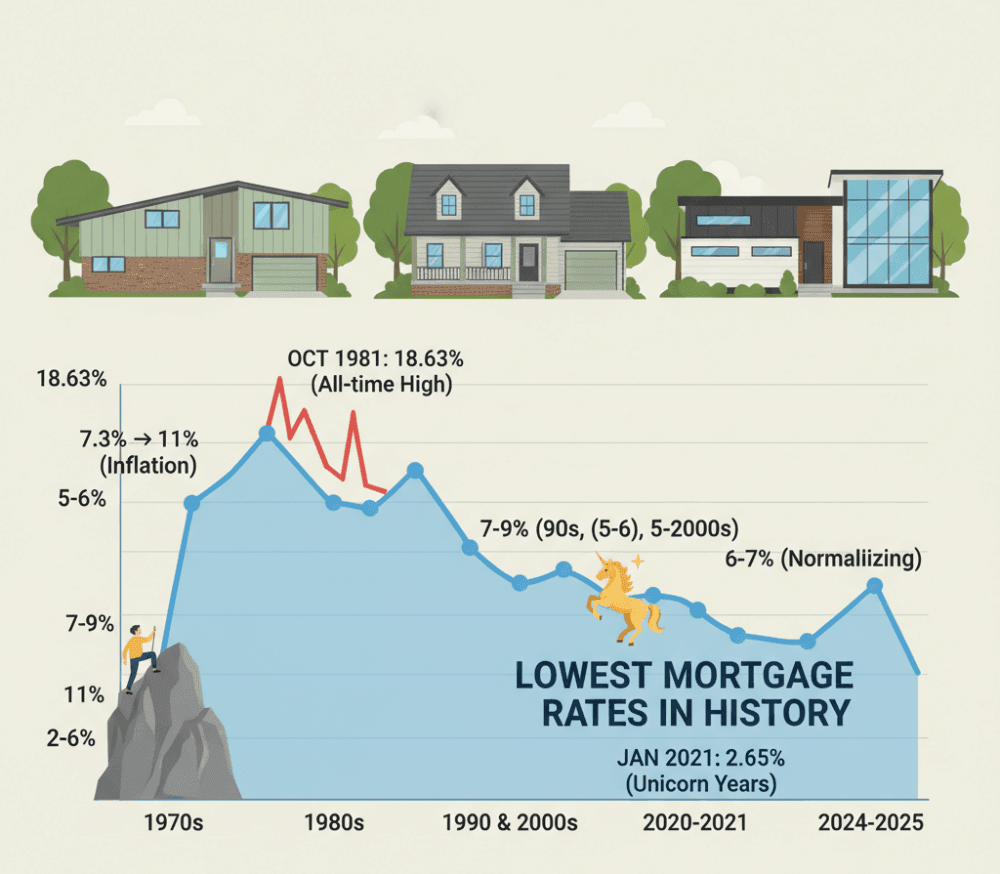

Lowest Mortgage Rates in History

To understand where we are today, we have to look at where we've been. It's easy to feel bad about a 6% rate until you look at the 1980s! Meanwhile, mortgage rates really impact the affordability.

- 1970s: Rates started the decade around 7.3% but climbed steadily to over 11% by 1979 as inflation took hold.

- 1980s: The peak of pain. In October 1981, 30-year rates hit an all-time high of 18.63%.

- 1990s & 2000s: A period of normalization. Rates hovered between 7% and 9% in the 90s and dropped to the 5-6% range in the 2000s.

- 2020-2021: The "Unicorn" years. Due to the pandemic, rates hit historical lows, bottoming out at 2.65% in January 2021.

- 2024-2025: After spiking in 2023, rates have been normalizing, settling into the 6% to 7% range.

How Do I Get the Lowest Mortgage Rate?

Getting the best rate isn't just about luck; it's about strategy. Here are nine actionable steps I recommend to every borrower:

- Improve Your Credit Score: Before you apply, pay down high-interest credit card balances and avoid opening new lines of credit. Even a 20-point boost can save you 0.25% on your rate.

- Lower Your Debt-to-Income Ratio: If possible, pay off a car loan or student loan before applying. This frees up monthly income, making you a safer bet for lenders.

- Save for a Larger Down Payment: Moving from 5% down to 20% down changes the loan dramatically. It removes mortgage insurance and lowers the lender's risk, often resulting in a better rate.

- Pay for Discount Points: If you plan to stay in the home for a long time (10+ years), paying upfront points to lower the interest rate can save you money in the long run.

- Consider a Shorter Loan Term: 15-year mortgages almost always have lower rates than 30-year mortgages. The monthly payment is higher, but the interest savings are massive.

- Shop Around with Multiple Lenders: This is non-negotiable. Get Loan Estimates from a bank, a credit union, and an online lender. The variance can be surprisingly large.

- Negotiate with Lenders: Yes, you can negotiate! If Lender A offers 6.5% and Lender B offers 6.3%, show Lender A the quote. They will often match or beat it to win your business.

- Consider an Adjustable-Rate Mortgage (ARM): If you only plan to own the home for 5-7 years, a 5/1 ARM might offer a significantly lower starting rate than a fixed loan.

- Explore Government-Backed Loans: If you qualify for a VA loan (veterans) or USDA loan (rural areas), these often come with lower interest rates than conventional loans.

How to Find the Lowest Mortgage Rate?

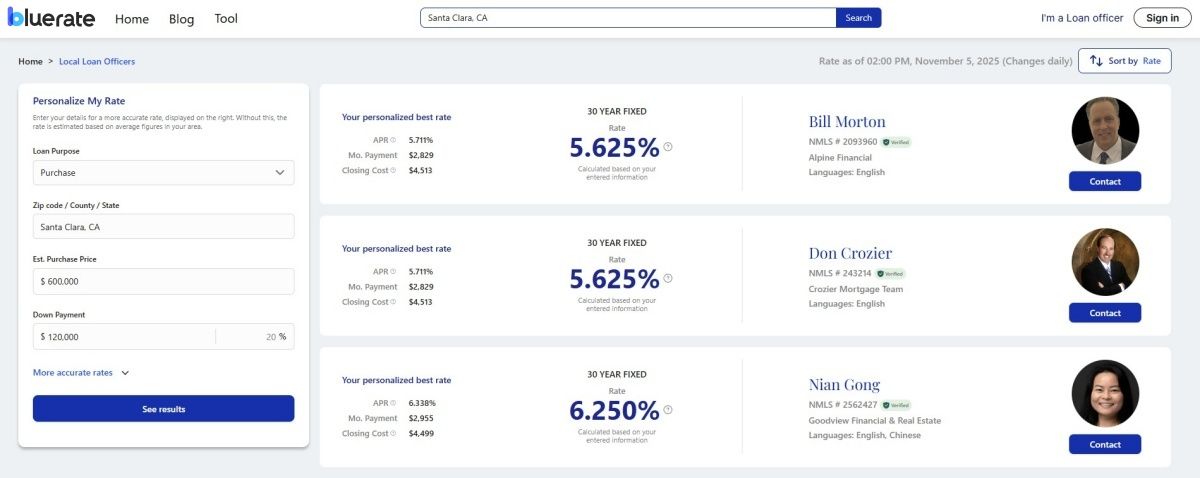

You can spend hours visiting the sites I mentioned above, or you can use a platform built to solve the biggest headaches in the mortgage industry: Bluerate. I'm recommending Bluerate because they operate differently from the typical "lead generator" sites like Bankrate.

Why Bluerate is Different?

First, many marketplaces show you "teaser rates" that vanish once you apply. Bluerate integrates directly with Loan Origination Systems (LOS). This means the rate you see on your screen is the actual rate you can get, based on live lender data. No bait and switch.

Second, privacy is a huge issue. Usually, when you fill out a form online, your phone blows up with spam calls because your info was sold to fifty lenders. Bluerate protects your personal information. They don't sell your data.

Precision Matching

Instead of tossing you to a random call center, Bluerate allows you to find and match with a Loan Officer (LO) in your specific area who specializes in your specific need. You enter your credit score, purchase price, down payment, and income, and the system matches you with a professional who can actually close your loan.

Technology Advantage

They use advanced AI tools like GuidelineGPT and Scenario AI. These tools automate the checking of thousands of loan guidelines (reducing manual work by 100%), which speeds up the entire process. This efficiency allows professionals to close loans 20% to 30% faster, meaning you get to the closing table quicker.

Specialized Loan Types

If you are a self-employed borrower or an investor, traditional banks often say "no." Bluerate excels here. They support all loan types like Fannie Mae, Freddie Mac, FHA, VA, and USDA, but they are particularly strong in Non-QM, DSCR, and Private Lending. If you have a unique income situation, Bluerate is arguably the best place to find a lender who understands your profile.

FAQs About Lowest Mortgage Rates

Q1. Who has the lowest mortgage rates?

There is no single lender who is always the cheapest. Credit unions often have lower rates than big banks, but online lenders can sometimes undercut both due to lower overhead. The "lowest" lender changes daily, which is why comparison shopping on a platform like Bluerate is essential.

Q2. When will mortgage rates go down?

Rates generally move down when inflation cools, or the economy weakens. Current forecasts for late 2025 suggest a gradual stabilizing or slight downward trend as the Federal Reserve normalizes policy, but huge drops (like back to 3%) are unlikely in the near term.

Q3. Will home loan rates drop below 4%?

It is highly unlikely we will see rates below 4% anytime soon unless there is a severe economic crisis. The sub-3% rates of 2021 were a historical anomaly driven by a global pandemic. A "healthy" market usually sees rates between 5% and 7%.

Q4. When have mortgage rates been 3%?

Mortgage rates dipped into the 3% range (and even high 2%) primarily during 2020 and 2021. Before that, you have to go back to brief dips in 2012 or 2016 to see anything close to 3.5%, but the sub-3% era was strictly a result of the COVID-19 economic response.

Conclusion

Navigating mortgage rates in late 2025 doesn't have to be a guessing game. While the days of 3% rates are behind us, there are still smart ways to secure a competitive deal. By monitoring benchmarks like Freddie Mac, improving your personal financial factors, and aggressively shopping around, you can save significant money.

If you want to skip the spam calls and get straight to accurate, real-time quotes, I highly recommend checking out Bluerate. Whether you need a standard conventional loan or a specialized Non-QM product, their AI-driven platform and ability to match you with local, expert Loan Officers make them a standout choice for finding the absolute best rate for your specific situation.

Get your real rate quote on Bluerate today and stop overpaying for your mortgage.