Must Read: Minimum Down Payment for House First-Time Buyer

I remember the exact moment I almost gave up on buying a home. I was staring at a calculator, convinced I needed to save 20% of the purchase price. For a $400,000 home, that's $80,000 in cash, it felt impossible.

Here is the truth that changed everything for me: You likely do not need 20% down.

Most first-time buyers put down significantly less, often between 3% and 7%. While saving is hard, you might already have enough to buy today. In this guide, I'll break down the real numbers. Want to skip the math? Enter your available savings into Bluerate now to instantly see your personalized buying power based on your specific down payment.

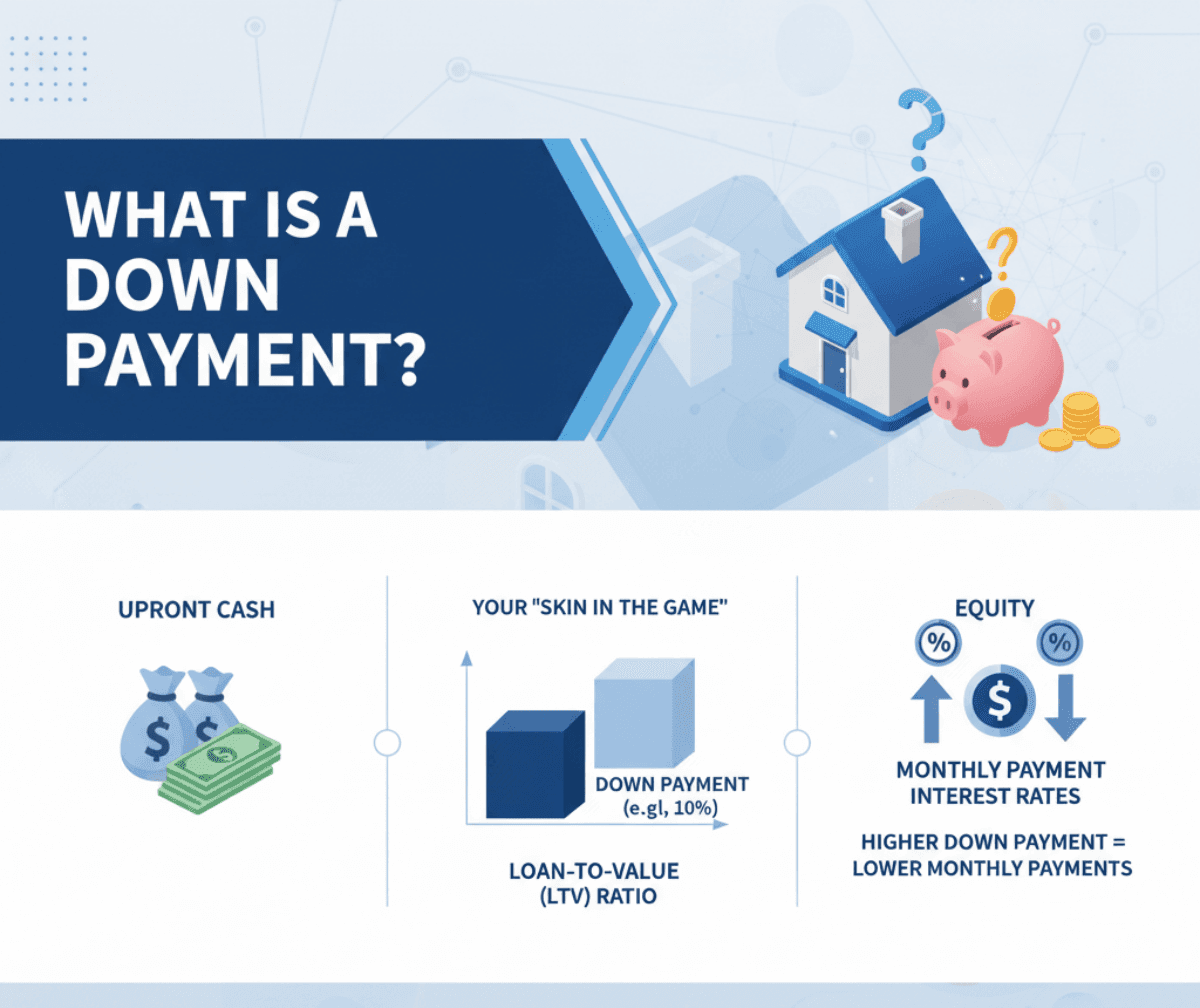

What is a Down Payment?

Think of a down payment as your "skin in the game." It is the portion of the home's purchase price you pay upfront in cash, while the rest is covered by your mortgage loan.

From a lender's perspective, this money represents immediate equity in the property and lowers their risk. The relationship between your down payment and the loan amount is called the Loan-to-Value (LTV) ratio. For example, if you put 10% down, your LTV is 90%.

Why does this matter? Generally, a higher down payment means a lower monthly mortgage payment and better interest rates, but as we will see, a lower down payment is often the key to entering the market sooner.

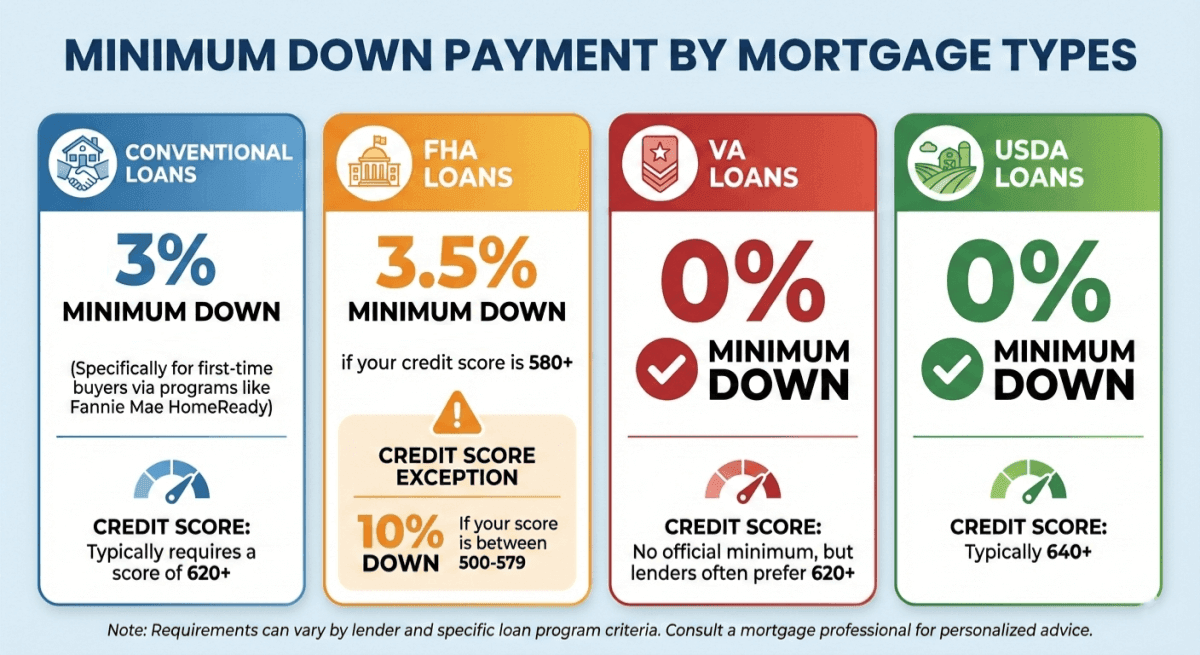

Minimum Down Payment By Mortgage Types

When I started shopping for loans, I realized that "minimum requirements" vary wildly depending on the program. Choosing the right loan type was the single biggest factor in what I could afford. Here is the breakdown of the most common loan types for 2026:

Conventional Loans

The standard for most buyers.

- Minimum Down: 3% (specifically for first-time buyers via programs like Fannie Mae HomeReady).

- Credit Score: Typically requires a score of 620+.

- Best For: Buyers with good credit who want to minimize upfront costs.

FHA Loans

Backed by the government, these are more forgiving.

- Minimum Down: 3.5% if your credit score is 580+.

- Credit Score Exception: If your score is between 500-579, you will need 10% down.

- Best For: Buyers with lower credit scores or higher debt-to-income ratios.

VA Loans

Exclusively for veterans and active-duty military.

- Minimum Down: 0%.

- Credit Score: No official minimum, but lenders often prefer 620+.

- Best For: Eligible service members (this is arguably the best loan product available).

USDA Loans

For homes in designated rural or suburban areas.

- Minimum Down: 0%.

- Credit Score: Typically 640+.

- Best For: Buyers willing to live outside major city centers.

Pros and Cons of Lower Down Payment

Deciding to put down only 3% or 3.5% was a strategic choice for me, but it wasn't without trade-offs. If you are leaning toward a low down payment, here is what you need to weigh:

Pros

- Buy Sooner: This is the biggest advantage. Instead of renting for another five years to save 20%, you can lock in a home price now and start building equity immediately.

- Reserve Cash: By not draining your bank account for the down payment, you keep liquid cash for an emergency fund, moving costs, or immediate renovations. House-poor is a real and dangerous feeling. keeping cash reserves prevents that.

- Inflation Hedge: Real estate generally appreciates. Buying now with less money down allows you to benefit from that appreciation sooner.

Cons

- Private Mortgage Insurance (PMI): This was the stinging part for me. Because I put down less than 20%, I had to pay PMI, a monthly insurance fee that protects the lender, not me. It can add 50-200+ to your monthly bill.

- Higher Monthly Payments: Since you are borrowing a larger percentage of the home's value, your principal and interest payments will naturally be higher.

- Strict Inspection Requirements: Government-backed low-down-payment loans (like FHA) often have stricter appraisal requirements regarding the home's condition.

Pros and Cons of Higher Down Payment

On the flip side, I have friends who waited until they had a massive pile of cash before buying. While I envied their lower monthly bills, their path had its own hurdles. Here is the reality of a high down payment (20% or more):

Pros

- No PMI: This is the "gold standard" benefit. Hitting 20% equity immediately eliminates that wasted monthly insurance cost.

- Lower Interest Rates: Lenders see you as a lower risk. Consequently, they often offer a lower interest rate, which saves you thousands over the life of the loan. You can verify this by checking Bluerate to see how different down payment amounts shift your rate.

- Instant Equity: You own a significant chunk of your home from day one, giving you a cushion if housing market values dip slightly.

- Competitive Offer: In a bidding war, sellers often prefer buyers with higher down payments because the financing is less likely to fall through.

Cons

- Opportunity Cost: That $80,000 you locked into the house? It is now illiquid. It cannot earn high returns in the stock market, and you cannot easily access it without selling or refinancing.

- Time Lost: The years spent saving that large sum are years you were paying rent (which has 0% return) instead of paying down your own mortgage. In rising markets, home prices might rise faster than you can save.

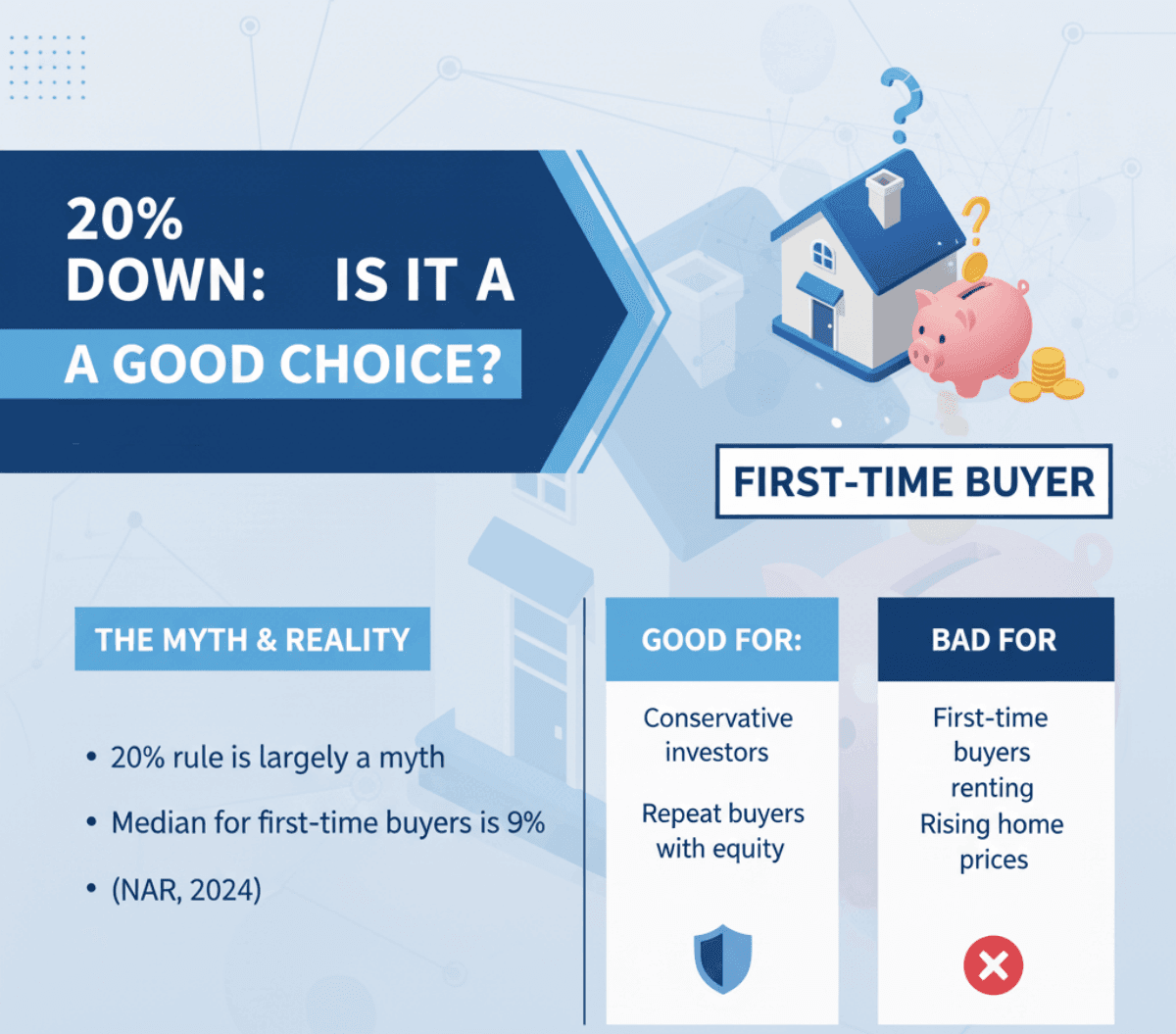

20% Down: Is It a Good Choice?

Is 20% down still necessary? For most first-time buyers, the answer is no.

The "20% rule" is largely a myth from a different financial era. While it is undeniably a good choice if you have the funds readily available, mainly to avoid PMI and secure a lower monthly payment, it is not a required choice.

In fact, according to the National Association of Realtors (NAR), the median down payment for first-time buyers in 2024 was only 9%. If you live in a high-cost area, waiting to save 20% might mean you get priced out of the market entirely as home values rise.

Ideally, 20% is perfect for:

- Conservative investors who want the lowest possible monthly obligation.

- Repeat buyers rolling over equity from a previous home.

It is bad for:

- First-time buyers who are currently renting and watching home prices escalate.

How to Lower Your Down Payment as a First-Time Buyer?

If the idea of saving 20% feels paralyzing, take a deep breath. You don't have to climb that mountain. There are strategic, proven ways to lower your upfront costs without jeopardizing your financial future. Here is exactly how you can enter the market with less cash in hand.

Consider Your Loan Type

Your choice of loan is your most powerful lever. As mentioned earlier, shifting from a mindset of "I need a standard loan" to "I qualify for an FHA or Conventional 97 loan" instantly drops your requirement from 20% to 3–3.5%.

Furthermore, look into Fannie Mae HomeReady or Freddie Mac Home Possible. These are specific conventional loan programs designed for credit-worthy, low-to-moderate-income buyers that allow for 3% down payments and often offer reduced mortgage insurance rates. Don't assume you are stuck with one product. Shop around and compare the requirements.

Qualify for Down Payment Assistance Programs

This is the best-kept secret in real estate. Down Payment Assistance (DPA) programs are offered by state housing finance agencies, local cities, and nonprofits. They can provide funds in the form of:

- Grants: Money you do not have to pay back.

- Forgivable Loans: 0% interest loans that are forgiven after you live in the home for a set number of years (often 5–10 years).

I strongly suggest asking your lender specifically about "state bond programs" or local DPA availability. It could literally cover your entire down payment.

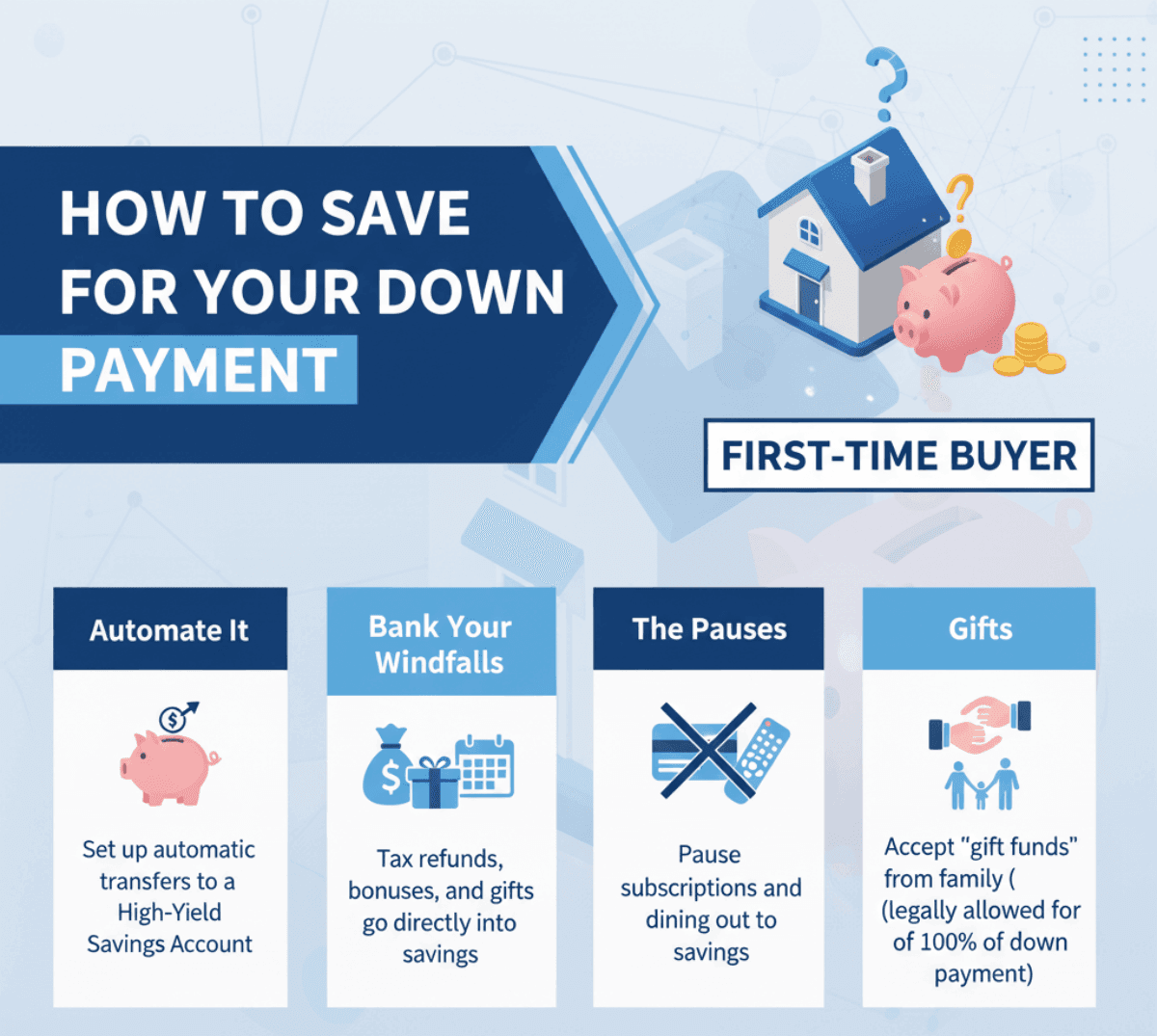

How to Save for Your Down Payment

Even if you are aiming for just 3.5%, saving thousands of dollars requires discipline. When I was saving, I had to treat my down payment fund like a monthly bill that had to be paid.

- Automate It: I opened a separate High-Yield Savings Account (HYSA). I set up an automatic transfer on payday so the money left my checking account before I could spend it.

- Bank Your Windfalls: Every time I got a tax refund, a work bonus, or even a birthday check, it went 100% into the house fund.

- The "Pauses": I didn't cancel everything, but I paused subscriptions and dining out for six months.

- Gifts: Don't be too proud to accept help. FHA and Conventional loans allow "gift funds" from family members to cover 100% of your down payment. If a relative offers to help, know that it is a legally acceptable source of funds.

FAQs About Minimum Down Payment

Q1. How much house can I afford with $10,000 down?

If you are using an FHA loan with a 3.5% down payment, 10,000 mathematically allows for a purchase price of roughly 285,000. If you qualify for a Conventional 97 loan (3% down), that same 10,000 could leverage a purchase price of up to 333,000. However, please remember: you also need cash for closing costs (typically another 2-5% of the loan), so you cannot use every single penny of your $10,000 just for the down payment.

Q2. What is the 3 7 3 rule in mortgage?

This is not a qualification rule, but a consumer protection timeline known as the TRID rule. It ensures you aren't rushed into a bad deal.

- 3 Days: The lender must give you a Loan Estimate within 3 days of your application.

- 7 Days: You must wait at least 7 days after receiving that estimate before you can close on the home.

- 3 Days: If the lender changes the APR significantly (more than 1/8%), they must issue a new Closing Disclosure and wait another 3 days before you can sign.

Q3. What is the lowest deposit for a first time buyer?

Technically, the lowest deposit is $0 (0%) if you qualify for a VA Loan (military) or a USDA Loan (rural areas). For the general public not qualifying for those niche programs, the lowest standard deposit is 3% via a Conventional loan (Fannie Mae/Freddie Mac) designed specifically for first-time buyers. You can check out more requirements to first-time homebuyers here.

Q4. Is $30,000 a good down payment on a house?

Yes, absolutely. For a $300,000 home, $30,000 is a 10% down payment. This is excellent, it is higher than the average first-time buyer (who puts down ~6-7%) and will significantly lower your monthly PMI costs compared to a minimum down payment. It gives you a strong equity position without draining your entire life savings.

Final Word

Buying your first home is an emotional rollercoaster. I've been there, worrying about credit scores, stress-testing budgets, and wondering if I'll ever save enough. But remember: the "perfect" down payment doesn't exist. There is only the down payment that gets you into a home you love at a monthly price you can afford.

Don't let the 20% myth keep you renting for another year. The market is more flexible than you think, and products exist specifically to help you bridge the gap.

Ready to see what you can actually afford? Stop guessing and doing mental math. Input your specific savings amount into Bluerate right now. You will get a personalized rate quote instantly that shows you exactly what your buying power looks like today. No impact on your credit score to check, just clarity.