![[Solved] When to Refinance Mortgage? Best Time You Cannot Miss](/_next/image?url=https%3A%2F%2Fdynamic-light-ab6e2536d6.media.strapiapp.com%2Fwhen_to_refinance_banner_c0f32803ca.png&w=3840&q=75)

[Solved] When to Refinance Mortgage? Best Time You Cannot Miss

I was browsing through forums the other night, deep in a thread where homeowners were debating their biggest financial regrets. The most common theme? "I missed the boat on 3% rates." But what struck me wasn't just the regret, it was the confusion. Many people admitted they didn't refinance because they were intimidated by the math or waiting for a "perfect" bottom that never came.

If you are feeling that same anxiety today, wondering if you should move on to current rates or wait it out, you aren't alone. The truth is, there isn't one universal "right" day to refinance, but there is a right calculation for your specific situation. To make this decision, you need real numbers, not just gut feelings. I highly recommend you check real rates at Bluerate to compare lenders, as having accurate data is the only way to see if the math actually works for you.

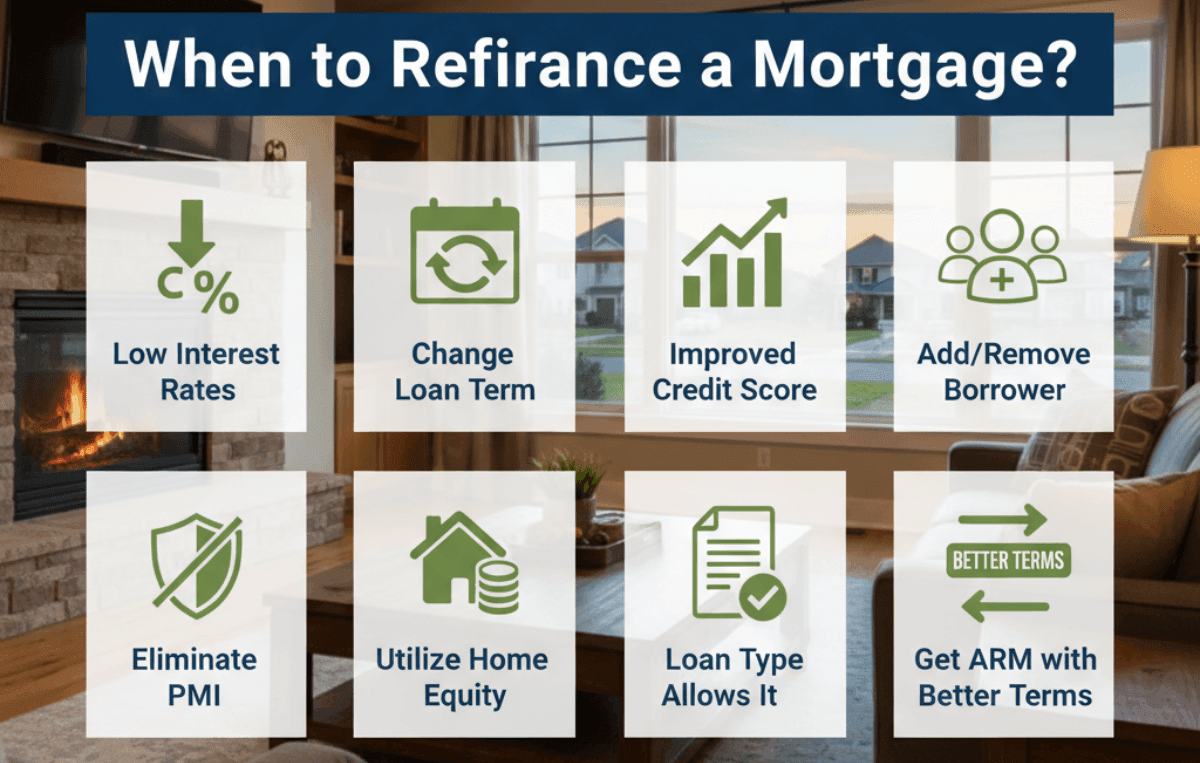

When to Refinance a Mortgage?

For years, the old school "rule of thumb" was that you shouldn't refinance unless you could drop your interest rate by at least 2%. While that's safe advice, it's also outdated. In today's market, a 2% drop is massive and might not happen for years.

The modern rule is much more practical: Refinance if your break-even point is less than the time you plan to stay in the home. The break-even point is simply the moment your monthly savings outweigh the upfront closing costs. However, lowering your rate isn't the only reason to refinance. Let's look at the specific scenarios where pulling the trigger makes financial sense.

When Interest Rates are Low

This is the most obvious reason, but it requires the most careful analysis. When market rates drop significantly below your current mortgage rate, the potential for long-term savings is huge. However, "low" is relative. If you have a 7.5% rate and the market drops to 6.25%, that 1.25% difference can save you hundreds of dollars a month on a typical loan.

But here is the catch I always tell people: do not just look at the advertised headline rate. You must look at the APR, which includes the fees. Refinancing isn't free. Refinance closing costs typically run between 2% and 6% of your loan amount. If you refinance to save $200 a month, but it costs you $10,000 to close, it will take you 50 months (over 4 years) just to break even. If you plan to move in three years, a lower interest rate will actually cost you money.

When You Want to Change the Loan Term

Changing your loan term, usually from a 30-year to a 15-year mortgage, is a powerful move for building wealth, but it drastically changes your monthly budget. I've seen homeowners do this when their income increases and they want to be debt-free before retirement.

When you switch to a 15-year term, you usually get a lower interest rate than the 30-year counterpart. The real magic, however, is in the amortization schedule. On a 30-year loan, your early payments are almost entirely interest. On a 15-year loan, you attack the principal balance immediately. Yes, your monthly payment will likely go up (even with a lower rate), but the total interest you save over the life of the loan can be astronomical, often saving over $100,000 on a standard mortgage. You have to ensure your monthly cash flow is stable enough to handle the higher commitment, as you lose the flexibility of the lower 30-year payment.

When Your Credit Score Increases

Your credit score is the single biggest factor lenders use to determine your "risk," and therefore, your interest rate. If your credit score was mediocre when you bought your house, perhaps in the 620-680 range, you were likely slapped with a higher rate.

If you have spent the last few years paying down debt and your FICO score has jumped into the "Excellent" tier (usually 760+), you are now a different borrower in the eyes of the bank. Lenders reserve their most aggressive rates for these top-tier borrowers. Even if market rates haven't moved much, your available rate might have dropped significantly simply because you are less risky. I recommend checking your score; if you've crossed a major threshold like moving from the 600s to the 700s), simply refinancing to reflect your new creditworthiness could save you a significant amount of money without the market needing to change at all.

When You Need to Add or Remove a Borrower

Life changes, marriage, divorce, or perhaps you bought a home with a parent or sibling and now want to take over the loan yourself. In the mortgage world, you generally cannot just "edit" a name on the contract like you would a Netflix subscription. To remove someone from the legal obligation of the debt, you almost always have to refinance.

This is critical in divorce situations where one spouse keeps the house. The leaving spouse needs their name off the mortgage to clear their debt-to-income ratio, allowing them to buy a new place. Conversely, if you are adding a spouse with a strong income and credit history, refinancing together might help you qualify for better terms. Just remember, when you refinance to remove a borrower, the remaining borrower must be able to qualify for the loan entirely on their own income.

When You Can Get Rid of PMI

Private Mortgage Insurance (PMI) is that annoying monthly fee you pay if you put less than 20% down on a conventional loan. It protects the lender, not you. Once you have built up 20% equity in your home, you shouldn't have to pay it anymore.

While PMI sometimes falls off automatically at 78% loan-to-value (LTV), you can often remove it sooner by refinancing if your home's value has skyrocketed. For example, if you bought a home for $300,000 and it's now worth $400,000, your equity position has changed drastically. By refinancing, the new loan is based on the current appraisal value. If that new appraisal shows you have over 20% equity, the new loan won't have PMI. I have seen people save 150-300 a month just by eliminating this fee, even if their interest rate stayed roughly the same. It is instant cash flow back in your pocket.

When You Want to Use Equity

A "Cash-Out Refinance" allows you to tap into the wealth you have built in your home. This involves taking out a new mortgage for more than you currently owe and pocketing the difference in cash. This is often the cheapest money you can borrow compared to personal loans or credit cards.

Homeowners often use this to fund major renovations (which hopefully add more value to the house) or to consolidate high-interest debt. For instance, if you have $30,000 in credit card debt at 22% interest, rolling that into a mortgage at 6% or 7% can save you a fortune in interest and lower your total monthly payments. However, you must be disciplined. I always warn people: do not use your home equity to pay for vacations or luxury cars. You are securing that debt with your house. If you fail to pay, you risk foreclosure, so use this tool strictly for investments or necessary debt restructuring.

When Your Loan Type Allows It

Sometimes the specific type of loan you have is the problem. A common scenario is moving from an FHA loan to a Conventional loan. FHA loans are great for getting into a home with a low down payment and lower credit score, but they come with a heavy cost: the Mortgage Insurance Premium (MIP) usually lasts for the life of the loan, regardless of how much equity you build.

The only way to get rid of FHA mortgage insurance (if you put less than 10% down originally) is to refinance into a Conventional loan once you have improved your credit score and built up 20% equity. This switch does two things: it eliminates the permanent insurance cost and usually offers better long-term borrowing terms. Similarly, veterans might refinance from a Conventional loan into a VA loan to take advantage of the specific benefits VA loans offer, such as zero monthly mortgage insurance.

When Changing from an Adjustable-Rate Mortgage to a Fixed-Rate Mortgage

An Adjustable-Rate Mortgage (ARM) can be terrifying when the fixed period ends. You might have enjoyed a low 5-year introductory rate, but once that period is over, your rate floats with the market. In a rising interest rate environment, your payment could suddenly jump hundreds of dollars overnight.

Refinancing into a Fixed-Rate Mortgage provides stability. You are essentially buying peace of mind. Even if the fixed rate is slightly higher than your current ARM rate, locking it in protects you from future volatility. I consider this a defensive financial move. If you plan to stay in your home for the long haul, knowing exactly what your principal and interest payment will be for the next 20 or 30 years is incredibly valuable. It makes budgeting predictable and insulates you from economic inflation or Federal Reserve rate hikes that you cannot control.

When Getting an ARM with Better Terms

Conversely, there are rare times when switching into an ARM makes sense. If you know for a fact that you are moving in a few years, say, you are in the military or completing a medical residency, you don't need a 30-year fix. You only need a low rate for the 3 to 5 years you will actually live there.

ARMs typically offer lower initial interest rates than 30-year fixed mortgages because the borrower is taking on the long-term risk. If you can refinance into a 5/1 ARM (fixed for 5 years) at a rate that is 1% lower than the fixed market rate, and you plan to sell the house in year 4, you win. You get the lower payments and sell the house before the rate ever adjusts. It is a calculated risk, but for the short-term homeowner, the savings can be substantial.

Example of Refinancing a Mortgage

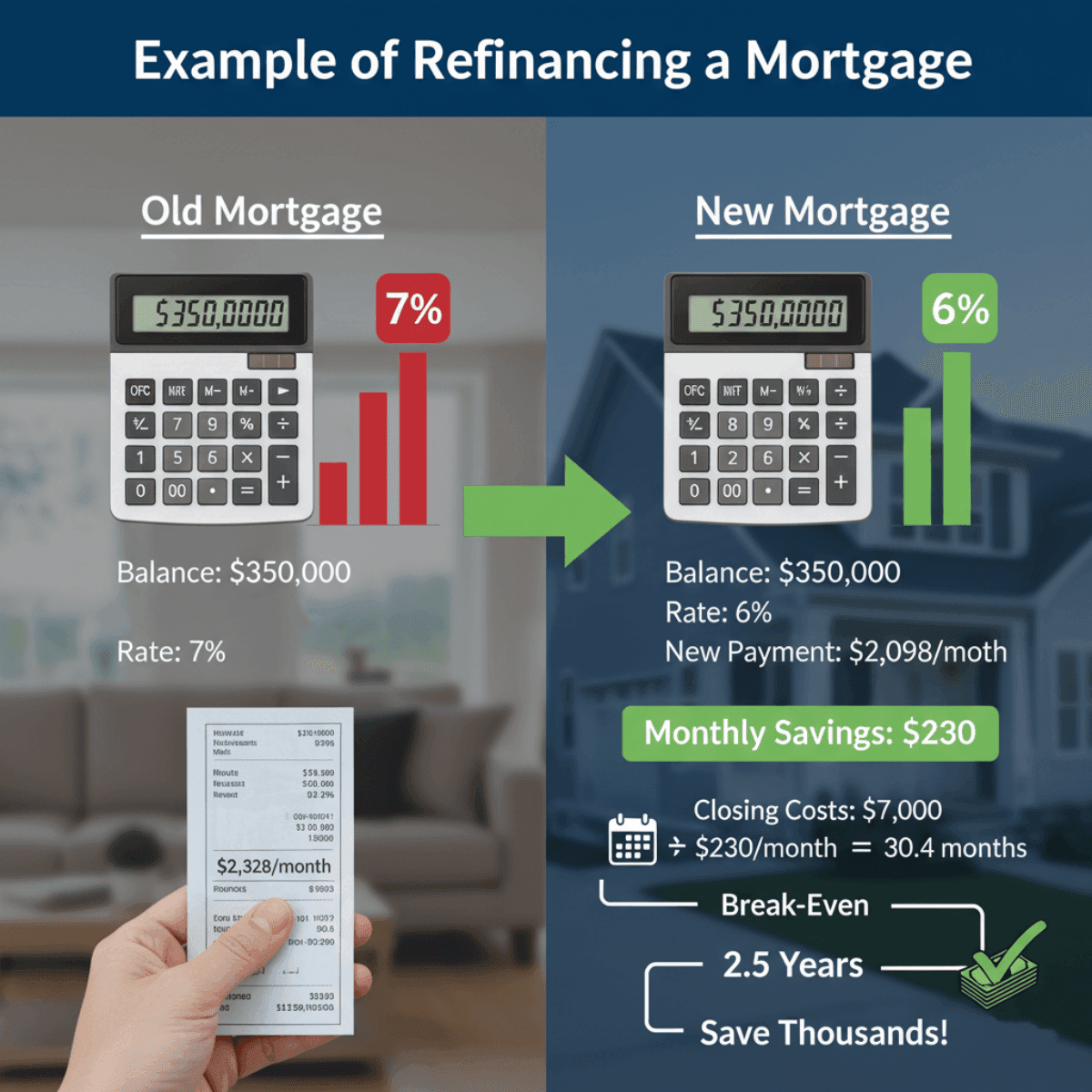

Let's look at the real math, because this is where the decision becomes clear. Imagine you have a 350,000 mortgage balance at $2,328 per month.

Now, let's say you can refinance that same balance to a 6% rate.

Your new payment would be roughly $2,098.

Monthly Savings: $230.

That sounds great, but we have to factor in closing costs. If your closing costs are roughly $7,000 (about 2% of the loan), we divide the cost by the savings:

$7,000 ÷ $230 = 30.4 months.

This means it will take you about two and a half years to break even. If you plan to live in the house for 5 or 10 years, this refinance is a slam dunk, you will save thousands of dollars after month 31. However, if you plan to move in two years, you would actually lose money by refinancing, even with the lower rate.

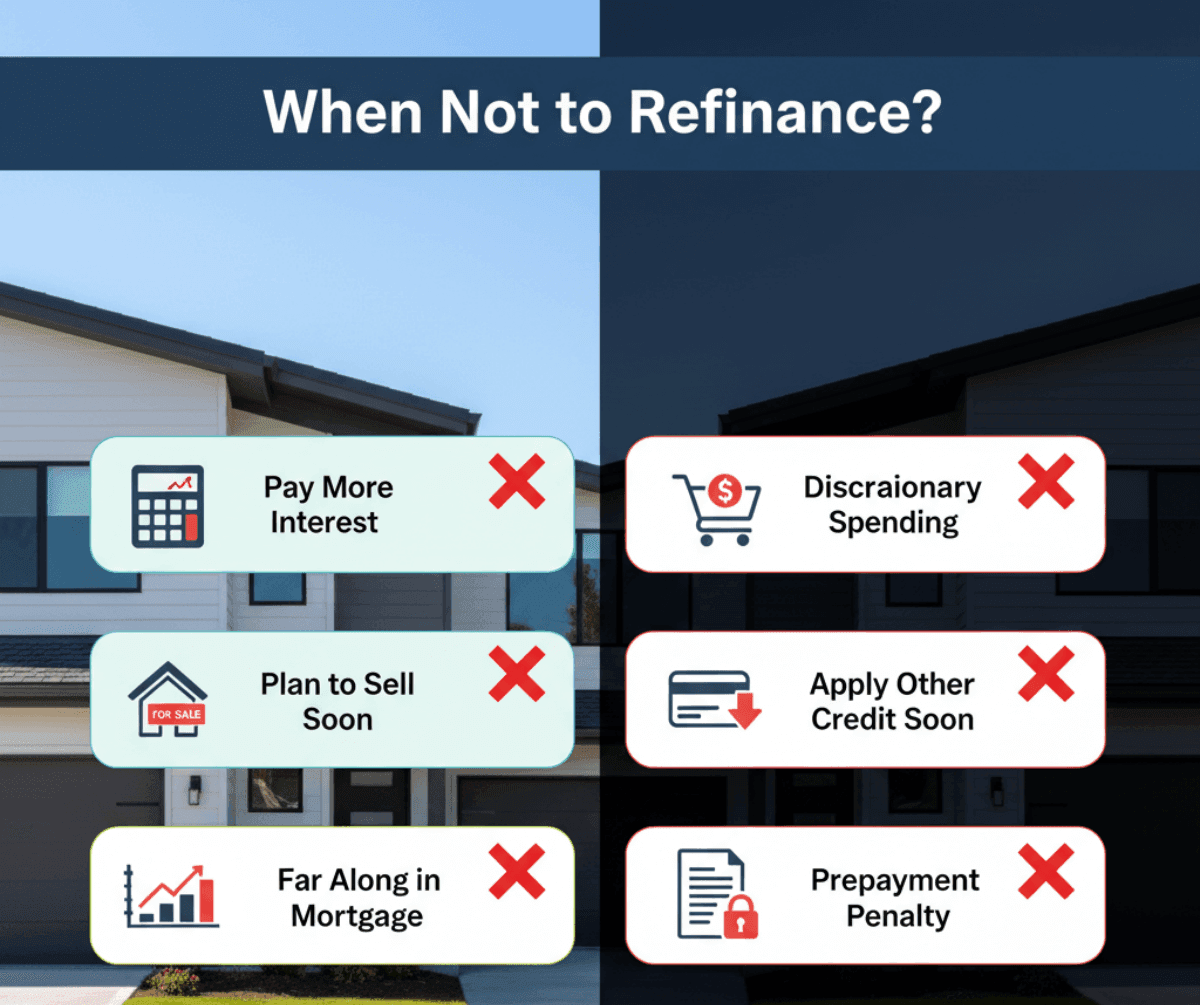

When Not to Refinance?

Refinancing is heavily marketed by banks because they make money on the fees, but it is not always in your best interest. Just because you can lower your rate or get cash out doesn't mean you should. If you fall into the following categories, you are likely better off keeping your current loan.

Pay a lot more in interest

If you reset the clock, you might pay more in the long run. Let's say you have been paying your 30-year mortgage for 10 years. You only have 20 years left. If you refinance into a new 30-year loan to get a lower monthly payment, you are extending your debt by another decade.

Even with a lower interest rate, adding 10 extra years of payments usually means the total interest you pay over the life of the loan increases drastically. You are trading short-term monthly cash flow for long-term wealth reduction. Unless you are in a financial crisis and desperate for lower payments, resetting the amortization clock is often a bad deal.

Plan to sell your home soon

This refers back to the "break-even" math we discussed earlier. Refinancing is a front-loaded cost strategy. You pay thousands of dollars upfront (closing costs, appraisal fees, title insurance) to save a small amount monthly.

If you are planning to list your home for sale in the next 12 to 24 months, the math simply rarely works. You will likely spend $5,000 to $10,000 on fees to save $100 or $200 a month. By the time you sell, you won't have recouped your initial investment. In this case, keep your higher rate; the cost of the refinance is higher than the extra interest you will pay over that short period.

Plan to use the savings for discretionary spending

This is a behavioral warning rather than a mathematical one. If you are doing a "Cash-Out Refinance" to buy a boat, a luxury car, or fund a lavish wedding, I strongly advise against it.

When you roll short-term consumption debt into a 30-year mortgage, you end up paying for that vacation for the next three decades. That $20,000 car might end up costing you $40,000 or $50,000 in interest over the life of the loan. Furthermore, you are putting your home at risk. If you lose your job and can't make the payments, the bank can take your house. Never risk your shelter for unnecessary discretionary purchases.

Far along in your mortgage

Mortgages are structured so that you pay the most interest in the beginning and the most principal at the end. If you have only 5 or 8 years left on your mortgage, the majority of your monthly payment is now going directly to paying off your home, not to the bank as interest.

Refinancing now would be tragic. You would be restarting the loan at a point where payments are interest-heavy again. Even if you refinance into a shorter 10-year term, the closing costs might outweigh the minimal interest savings you would gain on a small remaining balance. Once you see the light at the end of the tunnel, it is usually best to just sprint to the finish line.

Apply for other credit soon

Refinancing requires a "Hard Pull" on your credit report and intense scrutiny of your finances. If you are also planning to buy a car, take out a student loan, or open a business line of credit in the immediate future, refinancing can complicate things.

The hard inquiry can temporarily dip your score. More importantly, taking on a new mortgage changes your "Debt-to-Income" (DTI) ratio calculations and creates a new trade line on your credit report. Lenders for other products might see this new, large obligation and get nervous, potentially denying your other applications. It is generally best to do one major financial move at a time and let the dust settle before starting another.

Your current mortgage has a prepayment penalty

While rare in standard conforming loans today, some older mortgages or non-qualified mortgages (Non-QM) still carry prepayment penalties. This is a fee the lender charges if you pay off the loan "too early", usually within the first 3 to 5 years.

You need to read the fine print of your current contract. If you have a penalty of, say, 2% of the outstanding balance (which could be $6,000 on a $300k loan), that fee gets added to your cost of refinancing. This effectively skyrockets your break-even point. If you face a penalty, it is often wise to wait until that penalty phase expires before attempting to refinance.

What to Learn Before Your Refinance

Your current interest rate

This sounds simple, but you need to know exactly what you are paying now. Check your latest statement. Also, check if your rate is fixed or variable. You can't compare potential savings if you don't have a firm baseline.

Estimate Your Refinance

Before talking to a lender, do some napkin math to estimate your refinance. How much equity do you have? (Current home value minus loan balance). If you have less than 20% equity, you might get stuck with PMI again, which could eat up your savings.

How long you plan to stay in the house

Be honest with yourself. Is this your "forever home" or a stepping stone? If there is a decent chance you will move for work or upgrade in 3 years, refinancing is likely a waste of money. The longer you stay, the more a refinance makes sense.

Check your credit

Pull your credit report before a lender does. Fix any errors you find. If your score is 719, paying down a small credit card balance to get it to 720 could bump you into a better pricing tier. Every point counts.

Compare scenario

Don't just look at one option. Compare a 30-year refinance vs. a 20-year. Compare "buying points" (paying more upfront for a lower rate) vs. a "no-closing-cost" refinance (higher rate, but no upfront fees). The "lowest rate" isn't always the best product.

FAQs About When to Refinance a Mortgage

Q1. What is the 2% rule for refinancing?

The 2% rule is an older guideline suggesting you should only refinance if you can lower your interest rate by 2 percentage points (e.g., from 8% to 6%). While it guarantees savings, it is too conservative for today's market. Many experts now say a 0.75% to 1% drop is enough to justify refinancing if you plan to stay in the home for several years.

Q2. What is the 80/20 rule in refinancing?

This refers to the Loan-to-Value (LTV) ratio. If you own at least 20% of your home's equity (meaning you owe 80% or less of its current value), you can refinance without paying for Private Mortgage Insurance (PMI). Crossing this 80/20 threshold is a major "green light" moment for refinancing.

Q3. What is the break-even point for refinancing?

The break-even point is the number of months it takes for your monthly savings to pay back the upfront closing costs. The formula is: Total Closing Costs ÷ Monthly Savings = Months to Break Even. If the result is 30 months, and you move in 24 months, you lose money.

Q4. Is it worth refinancing from 7% to 6%?

Yes, usually, if the closing costs are reasonable and you plan to stay. On a $400,000 loan, a 1% drop can save over $250 a month. Over 30 years, that is $90,000 in savings. However, calculate your break-even point first to ensure the upfront fees don't negate the benefit.

Q5. Does refinancing hurt your credit score?

Temporarily, yes. When you apply, the lender does a "hard inquiry," which might drop your score by 5 to 10 points. However, this is minor and typically recovers within a few months. The long-term benefit of lower debt payments usually outweighs this small, temporary dip.

Conclusion

Refinancing is not just about chasing the lowest number; it is about aligning your mortgage with your life goals. If you plan to stay in your home long-term and can lower your rate, remove PMI, or shorten your term, it is often a brilliant financial move. However, if you are moving soon or are nearly finished paying off your loan, stick with what you have.

The market changes daily, and rates can fluctuate wildly between different banks. I strongly encourage you to stop guessing and visit Bluerate to check real rates. You can compare lenders side-by-side to ensure you aren't leaving money on the table. Knowledge is leverage, and make sure you have the right numbers before you sign. Then, you can start to refinance your house.