8 Best Non-QM Mortgage Lenders 2026: Get Your Best Pick Here

I was browsing through a Reddit thread on r/loanoriginators recently, and it highlighted a massive pain point in our industry right now. Both loan officers and first-time homebuyers are constantly asking: who are actually the best non-PMI mortgage lenders when the deal gets tough? There is so much noise out there. A lender might be great for a foreign national but terrible for a self-employed borrower with declining income.

You can't just pick a name out of a hat. You need a partner who understands the specific "story" behind the file. I decided to dig into the data and compile this guide for 2026 to cut through the confusion.

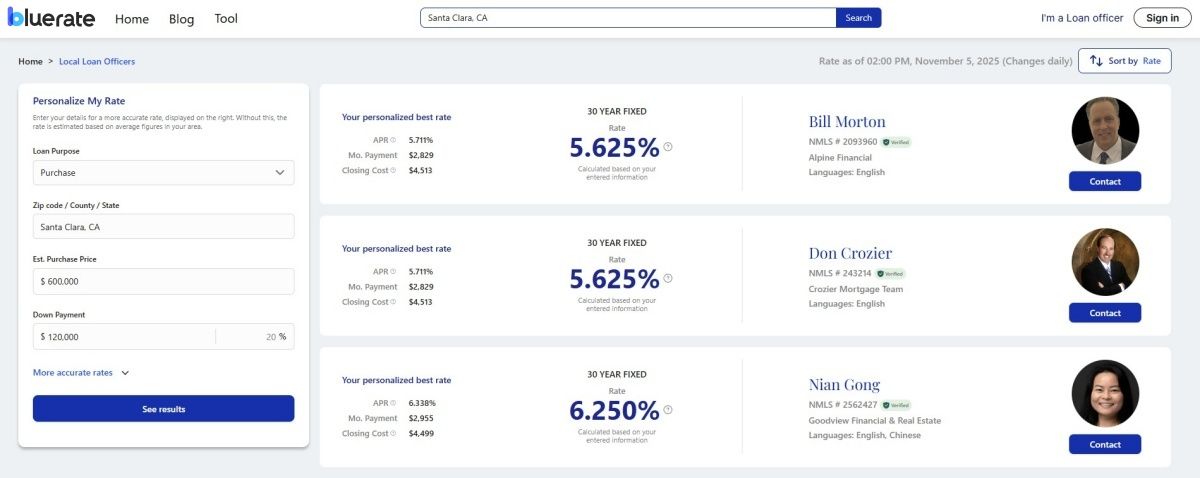

However, if you are a borrower reading this and feeling overwhelmed by wholesale jargon, you don't need to hunt down these lenders yourself. You can head over to Bluerate to directly find and compare local Non-QM loan officers who work with these exact lenders. You get a free consultation, and it saves you the headache of calling banks that might not even offer the program you need.

#1. Angel Oak Mortgage Solutions - Best for self-employed borrowers and real estate investors

If you ask anyone in the industry who the "OG" of the Non-QM space is, Angel Oak usually comes to mind first. From what I've seen, they aren't just dipping their toes in the water. They practically built the pool. Angel Oak Mortgage Solutions is a full-service mortgage lender that specializes in alternative lending products, specifically designed for borrowers who don't fit the tight box of agency guidelines.

They are hands down the best non qm lenders when it comes to self-employed borrowers and real estate investors. I've noticed they have a very robust Bank Statement program that allows business owners to use 12 or 24 months of personal or business bank statements to prove income, rather than tax returns. For investors, their DSCR (Debt Service Coverage Ratio) product is solid, focusing on the property's cash flow rather than the individual's personal income.

Why Choose Angel Oak Mortgage Solutions?

- Vertical Integration: They have an affiliated asset management arm, meaning they have more control over their credit guidelines.

- Bank Statement Expertise: They handle complex self-employed income analysis better than most.

- Loan Amounts: They offer loans up to $3.5 million, which is great for high-cost areas.

- Foreclosure Forgiveness: They have options for borrowers just two years out of a foreclosure or bankruptcy.

- Experience: Being a pioneer in Non-QM means their underwriters have seen it all.

#2. CrossCountry Mortgage - Best for flexible credit and income scenarios

CrossCountry Mortgage is a massive name in the industry, but many people don't realize how deep their Non-QM bench is. They are a nationwide lender known for combining the speed of a large retail operation with the flexibility usually reserved for niche shops. They excel at catching the "fallout" from conventional loans like deals that almost work for Fannie Mae or Freddie Mac but get denied at the last minute due to a minor credit blip or DTI (Debt-to-Income) issue.

I rank them as one of the top non-QM mortgage lenders for flexible credit and income scenarios because they offer a wide menu of solutions that bridge the gap. Whether it is an Asset Depletion loan for a retiree with high net worth but low monthly income, or a bridge loan for someone buying before they sell, CrossCountry seems to find a way to make the math work.

See More: CrossCountry Mortgage Reviews 2026: Benefits, Drawbacks, and FAQs

Why Choose CrossCountry Mortgage?

- National Footprint: They are licensed in all 50 states, making them a reliable go-to regardless of location.

- Tech Stack: Their digital application process is smoother than many smaller Non-QM shops.

- Diverse Income Qualifiers: They accept RSUs (Restricted Stock Units) and asset depletion as income.

- Speed: They are known for faster turn times on underwriting compared to traditional banks.

- Wide Credit Box: They have programs for credit scores that dip below the standard 620 threshold.

#3. First National Bank of America - Best for ITIN borrowers and alternative documentation

First National Bank of America (FNBA) is a unique player on this list because they are an actual bank, not just a mortgage company. This gives them a distinct advantage: they hold their loans in their own portfolio. Because they don't have to sell the loans to investors on the secondary market, they can make "common sense" decisions that other lenders simply can't.

In my experience, FNBA is the standout choice for ITIN borrowers and those needing alternative documentation. An ITIN loan is essential for borrowers who work in the U.S. but don't have a Social Security Number. While many lenders cap these loans at high down payments, FNBA is known for being more aggressive and understanding the stability of these borrowers. They look at the "story" behind the paperwork. If a borrower has a history of paying bills on time, even if the documentation is unconventional, FNBA often steps up.

Why Choose First National Bank of America?

- Portfolio Lender: They make their own rules and keep the loans, offering unmatched flexibility.

- ITIN Specialists: They are arguably the market leader for borrowers without SSNs.

- Unique Property Types: They will lend on properties others won't, like non-warrantable condos or large acreage.

- Recent Credit Events: They are more forgiving of recent credit dings if the rest of the file makes sense.

- Personalized Underwriting: You aren't just a number. A human actually reviews the story.

#4. Carrington Mortgage Services - Best for complex non-QM processing and investors

Carrington Mortgage Services has deep roots in the subprime and tough-credit world, and that heritage shines through in its Non-QM offerings. They aren't the lender you go to for a vanilla file. They are the ones you call when the file is "hair on it", meaning it's complex, messy, or requires manual underwriting.

They are positioned as one of the top non-QM lenders for complex processing and investors who need flexibility. Carrington is particularly strong in manual underwriting for borrowers who have low credit scores (sometimes down to the 500s) or past financial hardships like bankruptcy. For real estate investors, Carrington offers competitive pricing on their investor products, understanding that a landlord's primary goal is ROI. They don't shy away from the hard work required to document income for borrowers with multiple businesses or layered income streams.

See More: True Carrington Mortgage Reviews in 2026: Lifesaver or Nightmare?

Why Choose Carrington Mortgage Services?

- Manual Underwriting Experts: They excel at files that automated underwriting systems (AUS) reject.

- Low FICO Tolerance: They have programs accommodating credit scores as low as 500-550.

- Process Efficiency: Despite the complexity, they have streamlined their Non-QM processing flow.

- Investor Focus: Strong DSCR programs that help investors scale their portfolios.

- Stability: They have been navigating difficult markets for years and offer reliable capital.

#5. A&D Mortgage LLC - Best for jumbo non-QM and investment properties

A&D Mortgage has rapidly gained traction by combining aggressive pricing with cutting-edge technology. Based in Florida but operating nationally, they have built a reputation for handling large loan amounts and sophisticated investment deals. If you are looking for high-leverage lending, this is a name you need to know.

I consider them the best choice for Jumbo Non-QM and investment properties. Traditional Jumbo loans usually require pristine credit and low DTI. A&D Mortgage, however, offers "Super Prime" and Jumbo Non-QM options that allow for higher DTIs and flexible income verification, such as P&L (Profit and Loss) statements only. For investors, their DSCR program is a favorite because it allows for some of the highest Loan-to-Value (LTV) ratios in the market, meaning you can buy more property with less cash down.

Why Choose A&D Mortgage LLC?

- High Loan Limits: They offer loan amounts that exceed typical Non-QM caps, often up to $3M+.

- Foreign National Programs: Excellent options for non-US citizens buying investment property here.

- Fast Pricing Engine: Their Quick Pricer tool is accurate and helps LOs quote deals instantly.

- Flexible Reserves: They often require fewer months of cash reserves compared to competitors.

- Crypto Acceptance: They are forward-thinking and can sometimes use cryptocurrency for reserves.

#6. Deephaven Mortgage - Best for credit-recovered and investor cash flow loans

Deephaven Mortgage was formed specifically to address the Non-QM market, helping millions of Americans who are creditworthy but locked out of the agency market. They view themselves as a bridge for borrowers to return to homeownership.

They are the go-to lender for credit-recovered borrowers and investor cash flow loans. "Credit-recovered" refers to people who had a major financial event like a foreclosure, short sale, or bankruptcy and have since re-established good payment habits, but haven't waited the standard 4-7 years required by Fannie Mae. Deephaven shortens that waiting period significantly. Additionally, their investor cash flow (DSCR) loans are streamlined, focusing purely on whether the rental income covers the mortgage payment, ignoring the borrower's personal debt-to-income ratio entirely.

Why Choose Deephaven Mortgage?

- Second Chance Lending: They lend to borrowers just one day out of foreclosure or bankruptcy in some programs.

- Aggressive DSCR: No income or employment verification is needed for investment properties.

- Interest-Only Options: They offer interest-only payments to help lower monthly cash flow requirements.

- First-Time Investors: Unlike some lenders, they allow first-time homebuyers to use DSCR loans.

- Reliability: They have a long track record of consistent liquidity in the Non-QM space.

#7. Open Wholesale Mortgage - Best for low FICO, ITIN, and high LTV non-QM

Open Wholesale (the wholesale division of Open Mortgage) is all about empowering loan officers with products that open doors—pun intended. They position themselves as a partner that helps originators capture the business that others leave on the table. They focus heavily on underserved niches that require a tailored approach.

They stand out as the best option for Low FICO, ITIN, and high LTV Non-QM loans. While many lenders are tightening their belts, Open Wholesale continues to offer programs with higher Loan-to-Value ratios, meaning borrowers can bring less money to the closing table. Their ITIN program is robust, catering to the growing demographic of tax-paying non-citizens. Furthermore, they are willing to work with lower credit scores, where other lenders might require a 680 or 700 to even look at the file.

Why Choose Open Wholesale Mortgage?

- High LTV Options: Great for borrowers who have income but limited down payment funds.

- Niche Support: Dedicated account executives who understand ITIN and low FICO nuances.

- Marketing Support: They provide white-label marketing materials to help LOs find these borrowers.

- Flexible Terms: They offer a variety of amortization terms to fit different budget needs.

- Common Sense Approach: They look for compensating factors to approve loans with lower credit scores.

#8. Champions Funding - Best for non-traditional credit profiles and underserved communities

Champions Funding is a mission-driven lender. They are a Community Development Financial Institution (CDFI), a certification given by the U.S. Treasury to financial institutions that provide credit to underserved markets. This status is a game-changer because it exempts them from certain strict regulatory rules (like the Ability-to-Repay rule constraints), allowing them to be incredibly flexible.

They are the top pick for non-traditional credit profiles and underserved communities. Because of their CDFI status, they can offer their flagship "HERO" program, which often requires no ratio (no DTI calculation) and no income documentation for owner-occupied homes. Something almost unheard of elsewhere. They are dedicated to closing the racial wealth gap and helping community members who don't have standard credit histories get into homes.

Why Choose Champions Funding?

- CDFI Certification: Allows for unique "No Ratio" programs for primary residences.

- Speed: Their proprietary technology, "Champ TPO," speeds up the submission-to-close timeline.

- Underserved Focus: They actively want to lend in areas other banks ignore.

- Pricing: CDFI status allows them to offer competitive rates despite the higher risk profile.

- Diverse Products: From DSCR to Bank Statements, they cover the full Non-QM spectrum.

Considerations: How to Choose the Top Non-QM Lenders?

Navigating the world of alternative lending can feel like the Wild West. With so many options, how do you actually pinpoint the top non-QM mortgage lenders for your specific situation? It's not just about who has the flashiest website. Here is a checklist I use to evaluate potential partners:

Loan Programs Offered

First, check the menu. Not all Non-QM lenders are the same. Some specialize strictly in DSCR loans for investors, while others are experts in Bank Statement loans for the self-employed. Make sure the lender actually supports the specific loan type you need. If you need a 1-year P&L program, don't waste time with a lender who requires 24 months of statements.

Minimum Requirements

Every lender has a "floor" for non-QM loan requirements. This usually applies to credit scores and down payments. One lender might require a 680 FICO for a 10% down payment, while another might accept a 620 FICO if you put 20% down. Know your numbers before you apply to avoid instant rejection.

Rates and Fees

Let's be real. Non-QM loans come with higher rates than standard conventional loans. However, the spread can vary wildly. Compare the APR, not just the interest rate, as this includes the fees. Some lenders charge higher "points" upfront to give you a lower rate, so do the math on the total cost.

State Availability

This is a basic but crucial step. Mortgage licensing is state-specific. You might find the perfect lender, only to realize they aren't licensed to lend in the state where the property is located. Always check their coverage map first.

Lender's Qualifications and Licenses

Trust is paramount. Ensure the lender is legitimate. You should verify their NMLS ID number. You can look them up on NMLS Consumer Access to see if they are in good standing and if they have any regulatory actions against them.

Real Customer Feedback

Marketing brochures promise the moon. User reviews tell you if they actually deliver. Don't just look at the star rating. Read the written reviews on Google, Trustpilot, or industry forums. Look for comments about communication, hidden fees, and whether they hit their closing dates.

Tip: Directly Connect to Non-QM Loan Officers on Bluerate

If you are a borrower, trying to find a wholesale lender directly can be frustrating because many don't work with the public. The smartest move is to find a loan officer who already has these relationships.

I recommend using Bluerate to match with a local, NMLS-licensed Non-QM loan officer. You can verify their credentials instantly. Whether you need a Bank Statement loan, a DSCR loan for a rental, or an ITIN loan, Bluerate connects you with the specialist who knows that product best.

Why Choose Bluerate?

- Secure & Private: They are SOC 2 Type II certified. Your data is safe, and unlike other sites, they won't sell your info to a dozen lenders. No spam calls.

- Real Personalized Rates: By inputting your credit score, estimated purchase price, gross monthly income, and monthly liabilities, you get calculated, personalized rates—not fake "teaser" rates.

- Streamlined Process: You can pre-qualify online and complete the 1003 form with ease.

- Transparency: The platform connects to the LOS (Loan Origination System), so you can track your loan status in real-time.

- Data Portability: You can even export your loan data in FNM 3.4 format if needed.

Conclusion

Finding the right non-QM mortgage financing in 2026 doesn't have to be a headache. Whether you need the flexibility of Angel Oak for self-employment, the "story" underwriting of FNBA for ITIN, or the community focus of Champions Funding, there is a partner out there for you. These top non-QM mortgage lenders are leading the charge in making homeownership accessible again.

However, the best lender is only as good as the loan officer structuring your deal. For a seamless experience, I highly suggest starting your journey at Bluerate. It's the most efficient way to compare real rates and connect with a non-QM pro who can navigate these options for you.

People Also Read

- [Must-Read Tips] How Do I Get the Lowest Mortgage Rates?

- What is the Lowest Mortgage Rate Today? Get Best Quote Today!

- 10 Tips: First-Time Home Buyer Tips and Advice for You

- What is Loan Origination? Meaning, Steps, Example, Requirements

- Mortgage Prequalification vs Preapproval: All Differences in 2026