True Carrington Mortgage Reviews in 2026: Lifesaver or Nightmare?

Carrington Mortgage Reviews 2025

Carrington Mortgage Services is a large, national player that offers flexible underwriting for borrowers who may struggle to qualify elsewhere, but its size and product mix come with mixed customer feedback. This review will show you Carrington's history, benefits, drawbacks, loan products, common complaints, representative real reviews from public platforms, so you can decide whether Carrington fits your needs.

People Also Read

- Better Mortgage Reviews: Pros, Cons, and Everything to Know

- AmeriSave Mortgage Reviews 2025: Pros & Cons, Loan Options, Rating

- CrossCountry Mortgage Reviews 2026: Benefits, Drawbacks, and FAQs

- Comprehensive 21st Mortgage Reviews: What, Pros & Cons, FAQs

- Freedom Mortgage Reviews 2026: Complaints, Pros, Cons, and More

- Guide: What is a Mortgage Loan Originator License? How to Get?

What is Carrington Mortgage Services?

Established as part of the Carrington Family of Companies, Carrington Mortgage Services (CMS) is a vertically integrated mortgage lender and servicer that operates across the U.S. market. Carrington Holding Company was founded in 2003. Its mortgage arm (Carrington Mortgage Services) grew into a full lending and servicing platform in the 2000s (CMS traces major origination/servicing activity to about 2007).

The company offers retail, wholesale, and correspondent lending plus loan servicing and related real-estate services through affiliated brands (Vylla Home, Vylla Title, etc.). Headquartered in California, Carrington says it services loans in all 50 states and Puerto Rico, and, depending on the business line and branch, is licensed to lend in 49 states.

In late 2022, Carrington disclosed a major MSR (mortgage servicing rights) purchase cycle: it boarded roughly $62.3 billion in loans in 2022 (an acquisition of many servicing portfolios) and reported a servicing platform of about $122.1 billion, representing roughly 682,000 borrowers after those purchases. That scale explains why Carrington appears frequently in consumer servicing complaints and industry scorecards.

The company frames its mission around helping consumers reach homeownership (including programs for veterans, first-time buyers, and nontraditional income borrowers) and offering end-to-end services across origination, servicing, and real estate. For product details and company mission text, see Carrington's official pages.

Pros & Cons to Know in Advance

Understanding Carrington's strengths and weaknesses up front helps borrowers choose wisely.

Pros

-

Flexible qualification paths/non-QM offerings: Carrington is known for non-QM product lines (Flexible Advantage, Flexible Advantage Plus, Prime Advantage) and accepts alternative income documentation, useful for self-employed borrowers and people with recent credit events.

-

Low nominal credit thresholds on certain programs: Carrington's public product documentation notes lower minimum-score allowances on some FHA/VA/non-QM paths, for example, FHA programs referenced with lower minimums. These products expand access for borrowers who might be declined elsewhere.

-

Large servicing scale and integrated services: Owning originations, servicing, and related real-estate operations (Vylla) gives Carrington reach and cross-sell capability. For some borrowers, this is convenient.

Cons

-

Customer satisfaction and service issues: Independent studies and customer reviews show Carrington scores below the industry average on service satisfaction. J.D. Power's 2024 U.S. Mortgage Servicer Satisfaction Study places several large servicers ahead of Carrington and reports an industry average of 606 (1,000-point scale). Carrington's position in that 2024 ranking falls below the average (the 2024 study's ranking data show a low-500s score for Carrington). These objective indices matter because servicing quality (responsiveness, escrow accuracy, problem resolution) drives the homeowner experience.

-

Regulatory enforcement history (CFPB consent order): In November 2022, the Consumer Financial Protection Bureau (CFPB) issued a consent order against Carrington, citing failures related to CARES Act forbearance administration and other servicing practices. The order included a required consumer remediation program and a civil money penalty of $5.25 million. (The company later worked through the remediation steps, and the CFPB terminated the order after Carrington met its obligations.) That enforcement history is an important signal to borrowers about prior systemic problems and the company's subsequent remediation efforts.

-

Consumer complaints volume and mixed third-party ratings: The Better Business Bureau (BBB) profile shows hundreds of complaints in recent reporting windows and notes that Carrington is not BBB-accredited (B- rating on its profile). Online review sites (ConsumerAffairs, WalletHub, Trustpilot, Yelp) show a wide spread of experiences, from satisfied customers to strongly negative reports, making it essential to read recent reviews in your state and on your loan type.

Complaints About Carrington Mortgage Services

BBB's complaint index lists hundreds of complaints. The BBB complaint page categorizes most issues into common buckets below and publishes many complaint threads and company responses. Current BBB summary figures show about 353 complaints in the last three years.

Primary categories found in BBB and consumer complaint summaries

-

Escrow account management: Escrow analyses, shortages, overpayments, and delayed or incorrect tax/insurance payments are a recurrent theme. Many borrowers report surprise escrow increases after a servicing transfer or analysis.

-

Payment processing & recordkeeping: Reports of payments being misapplied or "unapplied," late notices after timely bank debits, and difficulties getting proof of application corrected.

-

Communication breakdowns/long resolution times: Complaints about slow or no callbacks, conflicting information across departments, and delays on time-sensitive items such as payoff statements or modification paperwork.

Representative short complaint excerpts:

-

One BBB thread documents a borrower whose escrow analysis produced an unexpected shortage and an increased monthly payment after Carrington performed an analysis following a servicing transfer.

-

Another complaint describes repeated unsuccessful attempts to resolve a loss-mitigation decision, with mailed appeals unanswered for months.

-

Several complaints describe payments marked "unapplied" and the borrower being forced to resubmit proof of payment to avoid late reporting.

Listen to the True Carrington Mortgage Reviews

Below are representative review aggregations from employee and customer platforms. I selected sample reviews to illustrate typical themes, positive staff members who help customers, and negative reports about escrow, communications, or loan transfers.

Indeed: 3.0/5.0 on 559 Reviews

Indeed's employee reviews for Carrington are mixed. ratings vary by year and department. Positive comments often mention good pay in strong markets, helpful managers, and learning opportunities. Negative reviews highlight management communication, workload swings, and layoffs/market-sensitivity for some roles. Representative comments from Indeed show this split:

Great company to work for, great benefits, great pay. But it is a ton of work. To the point of becoming unmanageable. Opportunities to move up are more limited to customer service into high level management and anything outside of that just seems like pure favorability. If you want to stay in the same spot for 10 years and not be able to move up no matter how hard you work without leaving the company then I recommend it.

Calls are back to back every day. All managers are fake ash, even the higher ones. Don't promote you even if you do good. PTO is a joke, barely get any. No matter how short or long you work there and how good you do they will let you go with NO REASON! Go with another mortgage company because this one is a whole joke!

Working here has its perk, if you're able to take many mortgage payments from borrowers, you get incentivized. You'd have to try to get over 5-7 calls per hour to stay in "good graces" with the team lead. Incoming calls can be non stop on certain days, like the 1st of the month or before the month ends. Be ready to take calls back to back all day.

ConsumerAffairs: 2.1/5.0 on 955 Reviews

ConsumerAffairs customer reviews show the polar extremes: some borrowers praise individual loan officers who provided clear guidance and timely closings. Other reviewers describe escrow confusion, servicing transfer problems, or aggressive collection/foreclosure notices despite payments. Example excerpts illustrate why consumers advise reading recent, product-specific reviews before applying or accepting a transferred servicer:

I have a rough time in the beginning with Carrington Mortgage Services LLC company but the supervisor and the director at Carrington stepped in and gave me someone that could actually help me and get the job done and I am happy and grateful that it all got resolved

Horrible company! Not Veteran friendly and I would not recommend to anyone. My loan was recently transferred to this company and after 45 minutes and speaking with several customer service representatives no one could tell me how my monthly payment went from 1894$ to 3000$. Additionally, the unprofessionalism, lack of experience, and inability to answer my inquiries was extremely alarming.

I had such wonderful help with trying to secure a refinancing and I kept goofing up making mistakes and couldn't figure out what I was doing wrong; however Jennifer ** amazingly figured it all out and helped me complete the process.

WalletHub: 2.0/5.0 on 191 Reviews

WalletHub's customer profile contains many negative testimonials focused on loan transfers, misapplied payments and foreclosure threats despite claimed timely payments. WalletHub's user comments mirror the BBB/ConsumerAffairs themes and are worth scanning for state-specific patterns.

Poor customer service; it seems they try extra hard to make things difficult. I've never been late and they failed to report three payments to bureaus. It's not a big deal, but if I were late, I'm sure those "non-payments" would be reported. The staff are poorly trained, and the answer to your questions seems to change depending on who you talk to. Thank you, United Wholesale, for selling my mortgage to these individuals.

Stay far away. Rude and incompetent customer service. If there's an issue, they only respond after you file complaints with consumer protection advocates.

Horrible communications, excessive hold times. Answers are inconsistent and followup is non-existent. So many spam calls once my loan was sold to this company. Nightmare to work with!

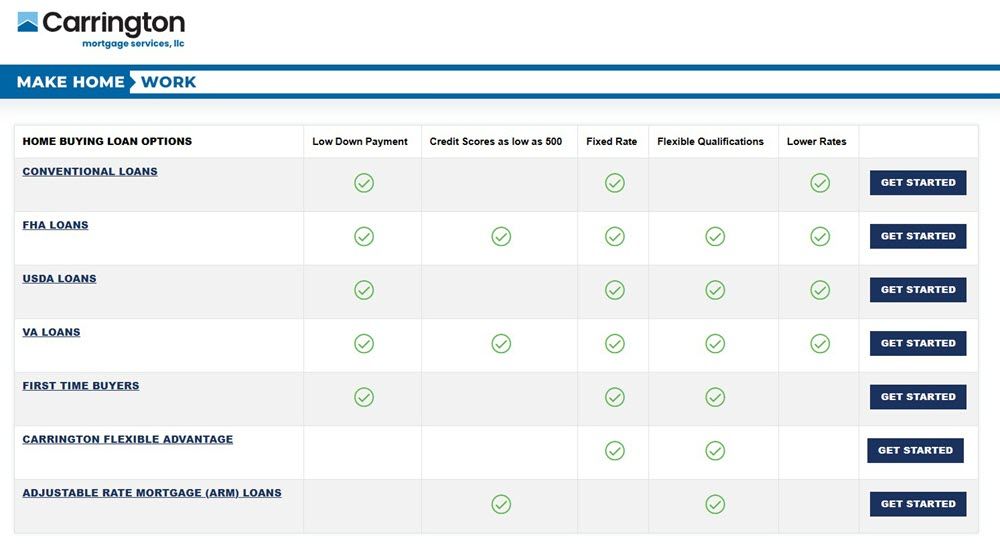

Home Buying Loan Options on Carrington Mortgage

Carrington's Buy a House page lists a broad menu of purchase programs: Conventional, FHA, VA, USDA, First-time buyer resources, Flexible Advantage (non-QM), and Adjustable-Rate Mortgage (ARM) options. The company positions these products to address both conventional borrowers and those with nontraditional income or credit events. Below, each section describes the Carrington product and the borrower profiles that typically fit.

Conventional Loans

Carrington's conventional purchase loans follow standard agency rules where applicable, and are best for borrowers with steady verifiable income, a credit score usually ≥620 for competitive pricing, and funds for a down payment (3--20%+ depending on program). Conventional loans are a good fit for credit-strong buyers who want predictable fixed-rate payments and lower long-term costs.

FHA Loans

Carrington offers FHA purchase programs designed to help buyers with limited down payment funds or lower credit scores. The FHA program on Carrington's pages references credit score thresholds consistent with FHA guidelines (e.g., the commonly noted 580 threshold for 3.5% down, though Carrington's guidance also references flexibility in some cases). FHA is commonly used by first-time buyers and borrowers rebuilding credit.

USDA Loans

Carrington lists USDA purchase options for eligible rural properties that may allow 100% financing with no down payment. USDA loans require the property to be in USDA-eligible territory and the borrower's income to meet program limits, ideal for low-to-moderate income buyers in rural areas.

VA Loans

Carrington offers VA purchase mortgages for veterans, active duty service members, and eligible spouses, typically featuring no down payment and no PMI. Carrington's VA materials also point to IRRRL/VA refinance options and guidance for Certificate of Eligibility (COE) issues. VA loans are best for eligible service members and veterans who want low upfront costs and favorable terms.

First Time Buyers

Carrington packages first-time buyer guidance, including FHA, down-payment assistance resources, and loan education, under dedicated resources. First-time buyers benefit from Carrington's mix of low-down options and on-platform homeownership concierge support. Evaluate which program best matches your down payment, credit, and long-term plan.

Carrington Flexible Advantage

Flexible Advantage is Carrington's non-QM product designed for borrowers with lower credit scores (documentation and allowable minimums vary), recent credit events, or self-employed borrowers needing bank-statement or alternative income qualification. This program is explicitly positioned for borrowers who do not fit traditional underwriting boxes.

Adjustable Rate Mortgage (ARM) Loans

Carrington offers ARMs with common structures (5/1, 7/1, 10/1) that provide lower intro rates for a fixed period before periodic adjustments. ARMs suit borrowers who plan to sell or refinance before the rate reset or who expect rising income. However, they carry interest-rate risk after the initial period.

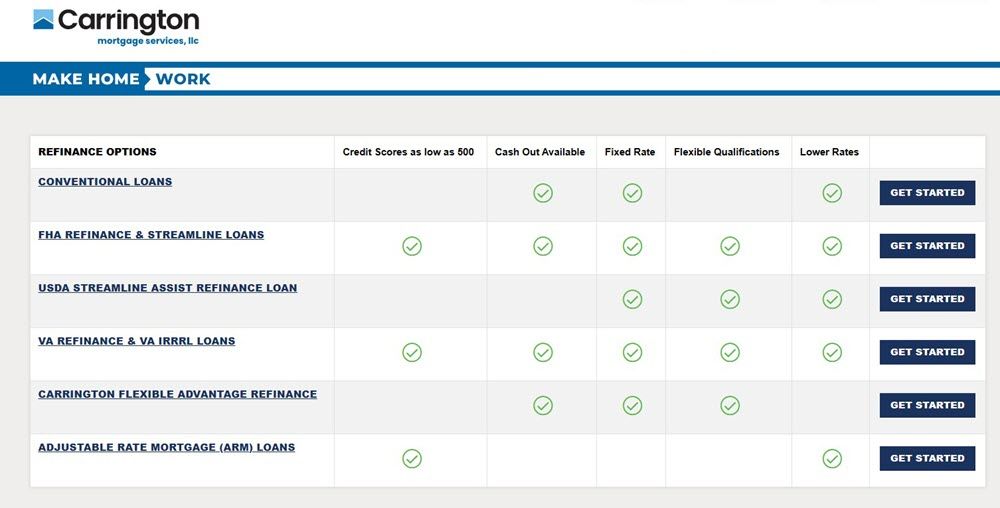

Refinance Options on Carrington Mortgage

Carrington's refinance page mirrors its purchase options: conventional rate-and-term and cash-out refinances, FHA streamline and full FHA refinance options, USDA streamline assist, VA IRRRL (streamline) and VA cash-out, non-QM Flexible Advantage refinances, and ARM refinance variants.

Conventional Loans

Rate-and-term or cash-out conventional refinances at Carrington are intended for borrowers who can document stable income and want to lower rates, shorten terms, or tap equity for large expenses. Typical minimum credit guidance is aligned with conventional program norms, for example, 620+ for best pricing.

FHA Refinance & Streamline Loans

Carrington supports FHA streamline refinances, which often require less documentation and sometimes no appraisal, for existing FHA borrowers who want lower rates or to move from an ARM to a fixed-rate. These are tailored for current FHA holders needing a quick path to savings.

USDA Streamline Assist Refinance Loan

For eligible USDA loan holders, Carrington's USDA Streamline Assist can allow a simplified refinance process, and sometimes without appraisal or DTI verification. This is useful if you already have a USDA loan in good standing.

VA Refinance & VA IRRRL Loans

Carrington offers VA IRRRL (Interest Rate Reduction Refinance Loan) options for streamlined refinancing with limited documentation for existing VA loan holders, plus VA cash-out for eligible veterans seeking cash from equity. IRRRLs often allow rolling fees into the loan.

Carrington Flexible Advantage Refinance

Flexible Advantage refinances allow borrowers with nontraditional income, previous bankruptcies/foreclosures, or imperfect credit histories to refinance when conventional channels aren't available. These programs accept alternative documentation and flexible seasoning requirements depending on the credit event.

Adjustable Rate Mortgage (ARM) Loans

ARM refinances follow the same logic as purchase ARMs, lower initial rates with potential long-term rate exposure. Borrowers should model scenarios where rates rise at the first adjustment and ensure a refinance or sale plan, or an adequate income buffer, exists.

Steps to Get a Home Loan on Carrington Mortgage

Carrington's online resources and Homeownership Concierge outline standard purchase and refinance flows. Both tracks require documentation, underwriting, appraisal (except when the streamline programs waive it), and a closing. The firm publishes a step-by-step loan process on its site.

How to Buy a Home on Carrington Mortgage

-

Check & improve credit: get free credit reports and correct errors.

-

Estimate affordability & down payment: use calculators and plan closing funds.

-

Get prequalified/preapproved: submit income, assets, and IDs for prequalification.

-

House hunt & offer: use an agent (Vylla Home can be a Carrington affiliate option).

-

Complete application & documents: provide pay stubs, tax returns, bank statements, and any additional documentation requested.

-

Underwriting & appraisal: underwriting verifies the file. An appraisal usually confirms property value.

-

Closing: sign documents and fund transaction.

How to Refinance My Home on Carrington Mortgage?

-

Define your goal: lower rate, shorter term, cash-out, or consolidate debt.

-

Check rates & run savings estimate: Carrington's online calculators can help estimate net benefit.

-

Choose product: conventional, FHA, VA, USDA, non-QM, or ARM based on your eligibility.

-

Submit application & documents: provide pay stubs, tax returns, bank statements, and lender-specific items.

-

Appraisal or streamline: some programs require appraisals. Others (FHA streamline, USDA streamline) may waive them.

-

Underwriting & closing: after underwriting and clear-to-close, sign paperwork and swap loans at closing.

FAQs About Carrington Mortgage

If you have any further questions, let's see whether the answers below can help you out.

Q1. What is Carrington Holding Company?

Carrington Holding Company, LLC is the parent organization that operates multiple affiliated businesses across asset management, mortgage origination, servicing, and real-estate services. The holding company was founded in 2003, and the Carrington family of companies now spans origination, servicing, and brokerage arms.

Q2. Who is Carrington Mortgage owned by?

Carrington Mortgage Services is a subsidiary of the privately held Carrington Holding Company, LLC family. The business is not publicly traded and operates as part of the holding company's integrated platform.

Q3. Who is the CEO of Carrington Mortgage?

Andrew Taffet --- Carrington's Chief Investment Officer --- was named Chief Executive Officer of The Carrington Companies in early March 2024. Bruce Rose moved to a chairman/executive-committee role.

Q4. Is Carrington Mortgage a good company to work for?

Employee experiences vary significantly by department and geography. Public employer sites (Indeed, Glassdoor) show mixed reviews: pros include competitive pay in certain roles and good benefits for some teams. Cons include workload swings, market sensitivity, and communication complaints from others. If you're recruiting or applying, read role-specific reviews and ask about turnover/metrics in interviews.

Q5. Is it hard to get approved for a Carrington mortgage?

Approval difficulty depends on program: Carrington publishes products with lower score thresholds and alternative documentation options like non-QM Flexible Advantage, and FHA/VA/USDA products. For borrowers with conventional, strong credit, a standard conventional lender may be more competitive on pricing. For those with nontraditional income or recent credit events, Carrington's flexible programs can increase approval chances. Always compare pricing, fees, and servicing reputation when choosing any lender.

Conclusion

Carrington Mortgage Services is a serviceable choice for borrowers who need flexible underwriting, self-employed applicants, those with recent credit events, or buyers seeking USDA/VA/FHA pathways. Carrington's menu and non-QM programs are helpful. The firm's growth through MSR purchases and platform scale (hundreds of thousands of borrowers and large servicing balances) shows it is a major player in non-bank servicing and lending.

However, consistent themes in third-party scorecards and consumer complaint forums warrant caution. Objective signals to weigh carefully:

-

J.D. Power and other industry studies place Carrington below the study average for servicer satisfaction (meaning you should expect to be more hands-on when servicing issues arise).

-

The CFPB consent order (Nov 2022), the remediation steps, and later termination of the order after Carrington met its obligations, are part of the company's regulatory history and should factor into risk assessments for borrowers considering a long-term relationship.

-

BBB and multiple consumer review sites show recurring themes like escrow errors, payment posting issues, and communication problems, even as many borrowers praise individual Carrington loan officers who performed well for them. Always read the most recent reviews for your state and loan type.