What is a non-QM Loan? Requirements, Pros, Cons, FAQs

Have you ever felt like the financial system just wasn't built for you? I've seen it happen time and again: a successful business owner or a savvy real estate investor walks into a big bank, only to be turned away because their tax returns don't tell the full story.

If you are looking for answers or wondering if you fit the mold, you are in the right place. In this guide, I will break down exactly what a non-QM loan is, its requirements, and the pros and cons you need to weigh. If you want to skip the research and speak to an expert directly, I recommend contacting a non-QM loan officer at Bluerate for a free consultation.

What is non-QM Loan?

To understand a non-QM loan (Non-Qualified Mortgage), you first need to understand what the government considers a "standard" loan. Most mortgages you hear about, like those from Fannie Mae or Freddie Mac, are "Qualified Mortgages" (QM). They follow strict rules set by the Consumer Financial Protection Bureau (CFPB) to ensure you have the "ability to repay."

But here is the problem: those rules are rigid. They rely heavily on W-2 forms and standard tax returns.

A non-QM loan is simply a mortgage that doesn't fit inside that specific government box. It's not necessarily a "bad credit" loan. It is an alternative documentation loan. It allows lenders to use different methods to verify your income.

Imagine you are a freelance graphic designer. You make $150,000 a year, but you write off a lot of expenses (home office, equipment, travel) to save on taxes. Your tax return might show a net income of only $40,000. A traditional bank looks at that $40,000 and says, "Sorry, you can't afford this house." A non-QM lender, however, looks at your bank statements to see the actual cash flow of $150,000 moving through your account and says, "Approved."

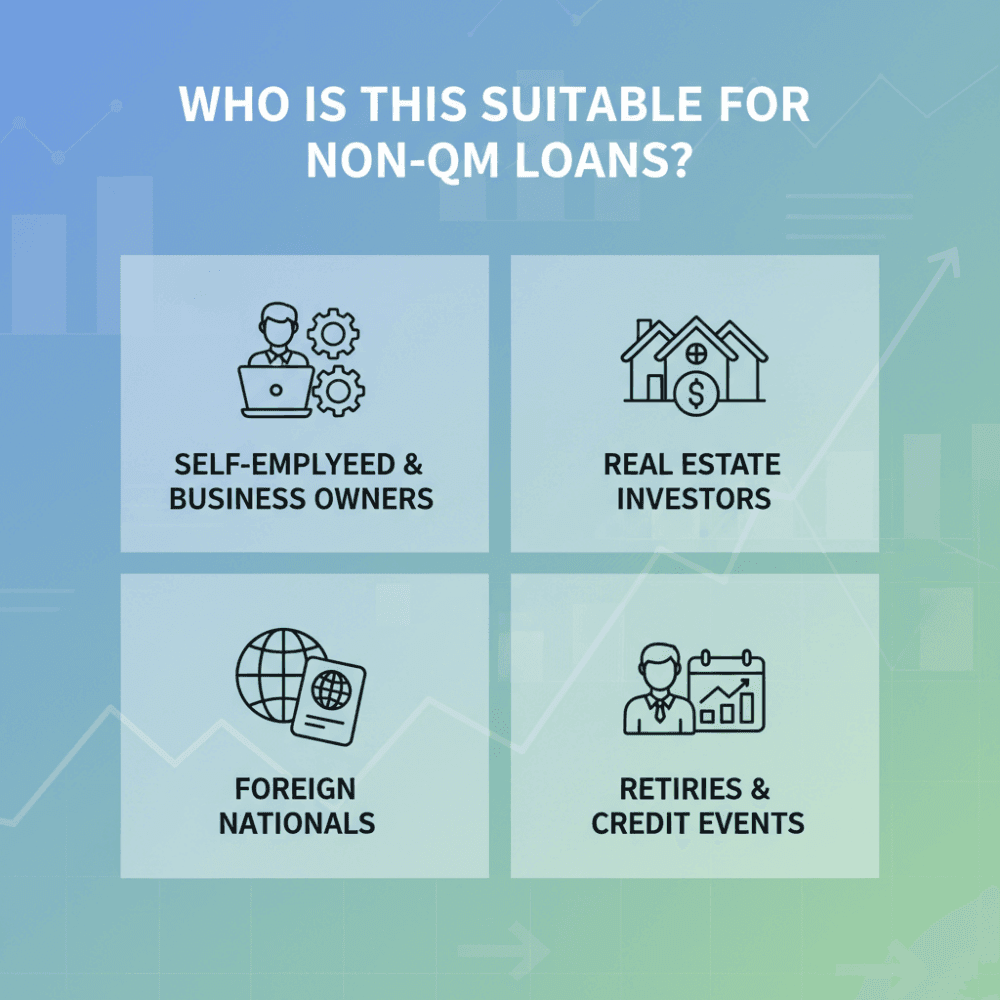

Based on current market data, non-QM loans are typically a perfect fit for:

- Self-employed individuals and business owners with complex tax returns.

- Real estate investors looking to expand their portfolios without using personal income.

- Foreign nationals who don't have a U.S. credit history or Social Security Number.

- Retirees with significant assets but a lower monthly income.

- Borrowers with credit events like a foreclosure or bankruptcy, in the last two years, who can't wait for the standard waiting period.

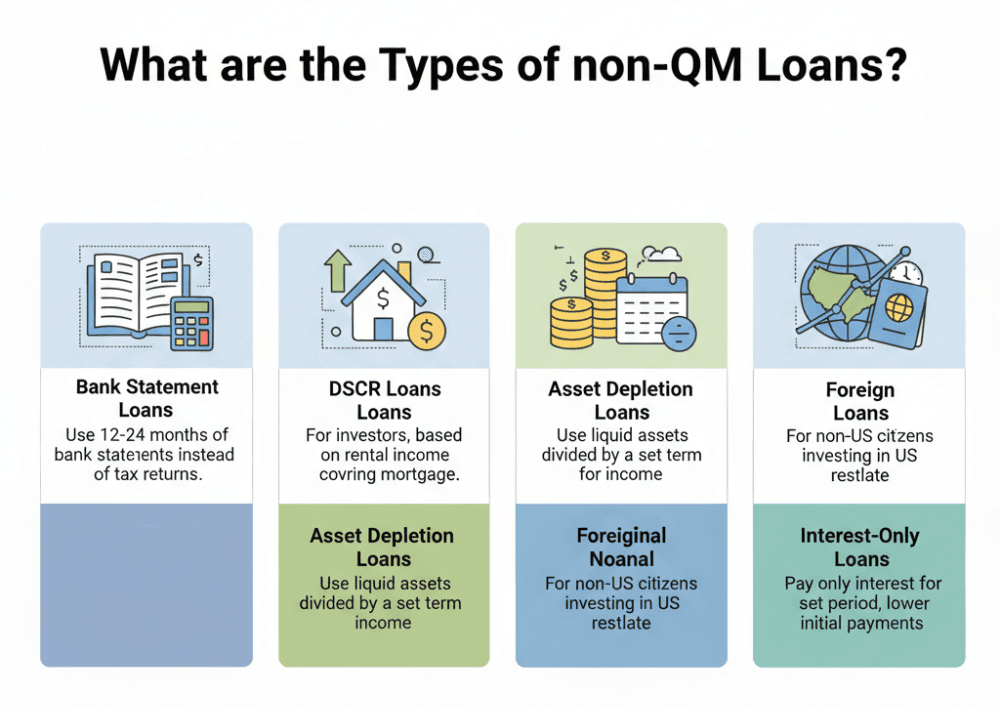

What are the Types of non-QM Loans?

The non-QM market is incredibly diverse because it is designed to solve specific problems. Here are the most common types I see in the market today:

- Bank Statement Loans: The lender analyzes 12 to 24 months of personal or business bank statements to calculate income, rather than looking at tax returns.

- DSCR Loans (Debt Service Coverage Ratio): Designed for investors. Qualification is based solely on whether the property's rental income covers the mortgage payment. No personal income is required.

- Asset Depletion Loans: If you have high liquid assets but low income, the lender divides your total assets by a set term to calculate a "monthly income."

- Foreign National Loans: For non-US citizens investing in US real estate, often using an ITIN number.

- Interest-Only Loans: You pay only the interest for a set period (e.g., 10 years), lowering monthly payments initially.

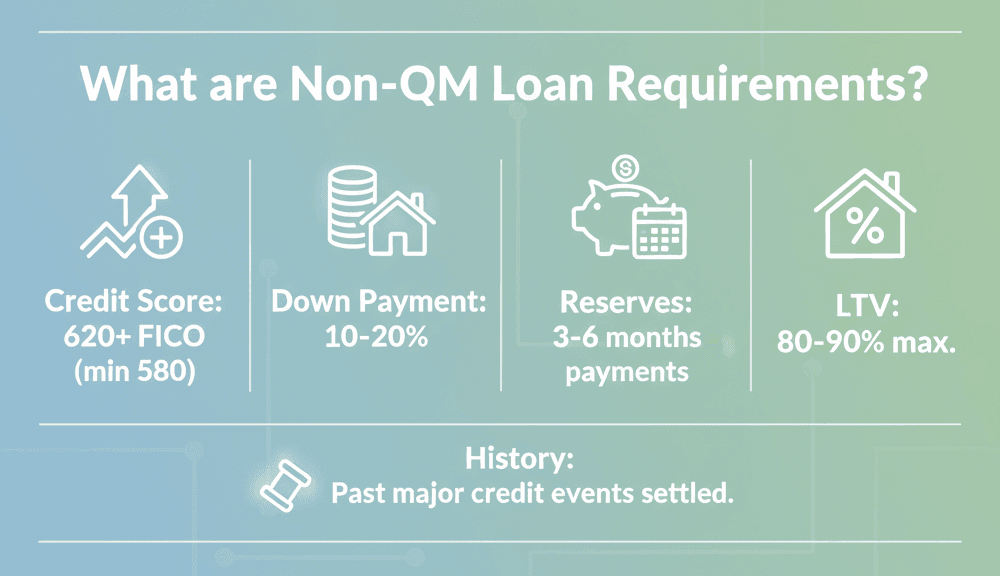

What are non-QM Loan Requirements?

While these loans are flexible, they aren't a free-for-all. Lenders still need to ensure you aren't a default risk. Requirements of non-QM loans vary by lender, but here is the standard baseline you should expect:

- Credit Score: Typically, you need a FICO score of 620 or higher. However, I've seen some programs for scores as low as 580, though they come with higher interest rates.

- Down Payment: Expect to put down at least 10% to 20%. Because the lender is taking on more risk, they want you to have "skin in the game."

- Reserves: This is crucial. Lenders often require you to have 3 to 6 months of mortgage payments saved in liquid cash after closing.

- LTV (Loan-to-Value): Usually capped at 80% to 90%, meaning you can't borrow the full value of the home.

- History: While more lenient, most lenders still want to see that any major credit event (like bankruptcy) is settled.

Pros and Cons of non-QM Loans

Before you sign on the dotted line, you need to weigh the trade-offs. Non-QM loans are tools, and they are effective when used correctly, but they come with costs.

Benefits

- Flexible Underwriting & Alternative Documentation: This is the biggest selling point. Being able to use bank statements or rental income instead of tax returns is a lifesaver for entrepreneurs.

- Wider Eligibility: They open the door for people with "credit events." You might qualify just one day after a foreclosure settlement, whereas a standard loan would make you wait up to seven years.

- Access to Credit: For foreign nationals or those with high assets but low taxable income, this is often the only way to access financing.

- Loan Feature Flexibility: Options like interest-only payments or 40-year terms can help manage cash flow, especially for investors.

- Property Investor Options: DSCR loans allow investors to scale essentially infinitely, as long as the properties are profitable.

Drawbacks

- Higher Costs: You are paying for flexibility. Interest rates are typically 0.50% to 3.00% higher than conventional loans, depending on your credit profile.

- Larger Down Payments: You rarely find "low down payment" options here. You usually need substantial cash upfront (20% is standard).

- Increased Borrower Risk: Features like interest-only payments or balloon payments can lead to "payment shock" later if you aren't prepared.

- Fewer Consumer Protections: Because these fall outside standard QM "Safe Harbor" rules, you have fewer federal protections if things go wrong.

- Limited Availability: You can't just walk into any local bank branch to get one. You usually need a specialized broker.

Who Offers non-QM Loans?

You generally won't find these loans at big traditional banks like Wells Fargo or Chase. Because non-QM loans are considered "non-conforming" (they can't be sold to Fannie Mae), big banks usually avoid them.

Instead, these are offered by:

- Specialized Mortgage Lenders: Companies that exist solely to serve this niche market.

- Mortgage Brokers: This is your best bet. A broker acts as a middleman and has relationships with dozens of wholesale non-QM lenders. They can shop your scenario around to find the best fit.

- Credit Unions: Some local credit unions keep these loans in their own "portfolio," meaning they don't sell them, so they can make their own rules.

- Marketplace: Bluerate enables you to directly get your best mortgage rate for a non-QM loan and contact a loan officer nearby for free.

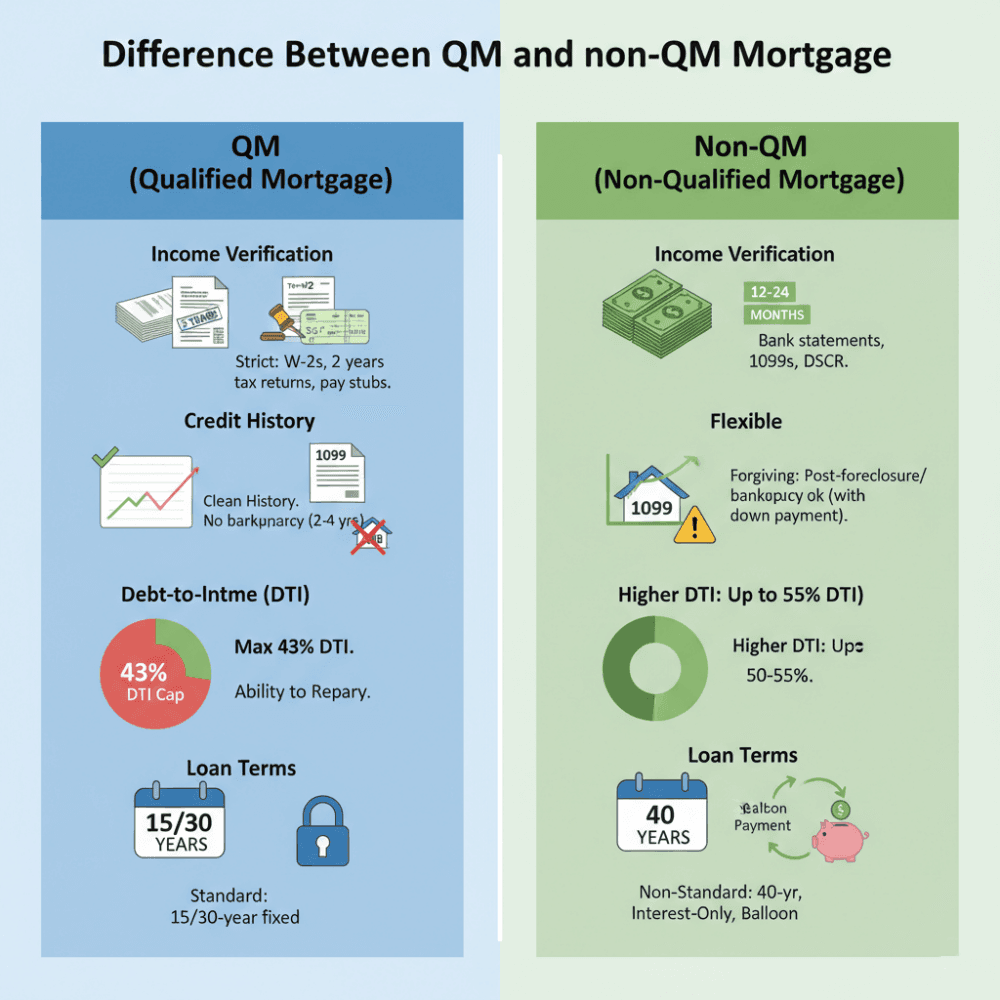

Difference Between QM and non-QM Mortgage

If you are trying to decide between the two, it helps to see the differences side-by-side. Here is how they compare on the four biggest factors:

1. Income Verification

QM: Strict. Requires W-2s, two years of tax returns, and pay stubs. If you write off expenses, that income doesn't count.

Non-QM: Flexible. Accepts 12-24 months of bank statements, 1099 forms, or even just the cash flow of the property itself (DSCR).

2. Credit History

QM: Usually requires a clean credit history. A bankruptcy within the last 2-4 years is often an automatic disqualification.

Non-QM: Much more forgiving. Some programs allow borrowers to apply immediately after a foreclosure or bankruptcy discharge, provided they have a strong down payment.

3. Debt-to-Income (DTI)

QM: The "Ability to Repay" rule typically caps your DTI at 43%. If your monthly debts eat up more than 43% of your gross income, you are denied.

Non-QM: Many lenders allow DTIs up to 50% or even 55%. This is huge for people with high income but high monthly leverage.

4. Loan Terms

QM: Standard 15 or 30-year fixed terms. No "risky" features allowed.

Non-QM: Offers 40-year terms, interest-only periods, and sometimes balloon payments.

FAQs About non-QM Loans

Q1. What property types are eligible for non-QM lending?

Non-QM loans cover a wide range of properties. Beyond standard single-family homes, they are excellent for Non-Warrantable Condos (condos that don't meet government lists), multi-unit properties (duplex, triplex, fourplex), and even mixed-use buildings (storefront with apartments above).

Q2. What are examples of non-QM loans?

The most popular examples are Bank Statement Loans for self-employed, DSCR Loans for landlords, Asset Depletion Loans for high-net-worth retirees, and Foreign National Loans for non-citizens.

Q3. Is a non-QM loan a conventional loan?

No. A "conventional loan" typically refers to a loan that conforms to the guidelines of Fannie Mae or Freddie Mac. Non-QM loans are the opposite. They are "non-conforming" loans that do not adhere to those specific government guidelines.

Q4. Are jumbo loans non-QM?

Often, yes. A Jumbo loan is any loan that exceeds the conforming loan limit, which changes annually. While some Jumbo loans are "Prime Jumbo" and follow strict rules, many are considered non-QM because lenders hold them in their own portfolios and set their own underwriting standards.

Q5. Is a HELOC a non-QM loan?

It depends. Many HELOCs (Home Equity Lines of Credit) are considered non-QM because they are second liens and don't fit standard purchase guidelines. However, if a bank keeps the HELOC on its own books, the distinction matters less to you than the specific terms it offers.

Q6. Is a bank statement loan considered non-QM?

Yes, this is the classic example of a non-QM loan. Because you are using bank statements to prove income rather than the standard tax returns required by the CFPB's Qualified Mortgage definition, it falls squarely into the non-QM category.

Q7. What is non-qualified financing?

"Non-qualified financing" is just another term for non-QM lending. It refers to any financing agreement that does not meet the "Qualified Mortgage" standards set by the federal government under the Dodd-Frank Act.

Conclusion

Non-QM loans are not about "bad credit". They are about smart leverage for people with unique financial pictures. Whether you are an entrepreneur investing in your business or a real estate mogul building an empire, these loans provide the flexibility standard banks simply cannot offer.

However, the landscape is complex, and rates vary wildly between lenders. I highly recommend you don't navigate this alone. To find the best program for your specific situation, reach out to non-QM loan officers on Bluerate today. Their specialized loan officers can help you uncover options you didn't even know existed.