Non-QM Loan Requirements: Everything to Know At First

If you've ever had a bank turn you down because you couldn't produce a standard W-2, even though you make good money, you know how frustrating the mortgage world can be. That's exactly who Non-QM (Non-Qualified Mortgage) loans are for—self-employed entrepreneurs, real estate investors, or anyone with a complex financial life. Unlike traditional loans, these don't fit the strict government mold.

However, "flexible" doesn't mean "no rules." You still need to meet specific criteria regarding assets and credit. Because every lender has a different "appetite" for risk, the requirements vary wildly. In my experience, the fastest way to stop guessing and get real answers is to contact a Bluerate non-qm loan officer directly. They can scan the whole market for you instantly.

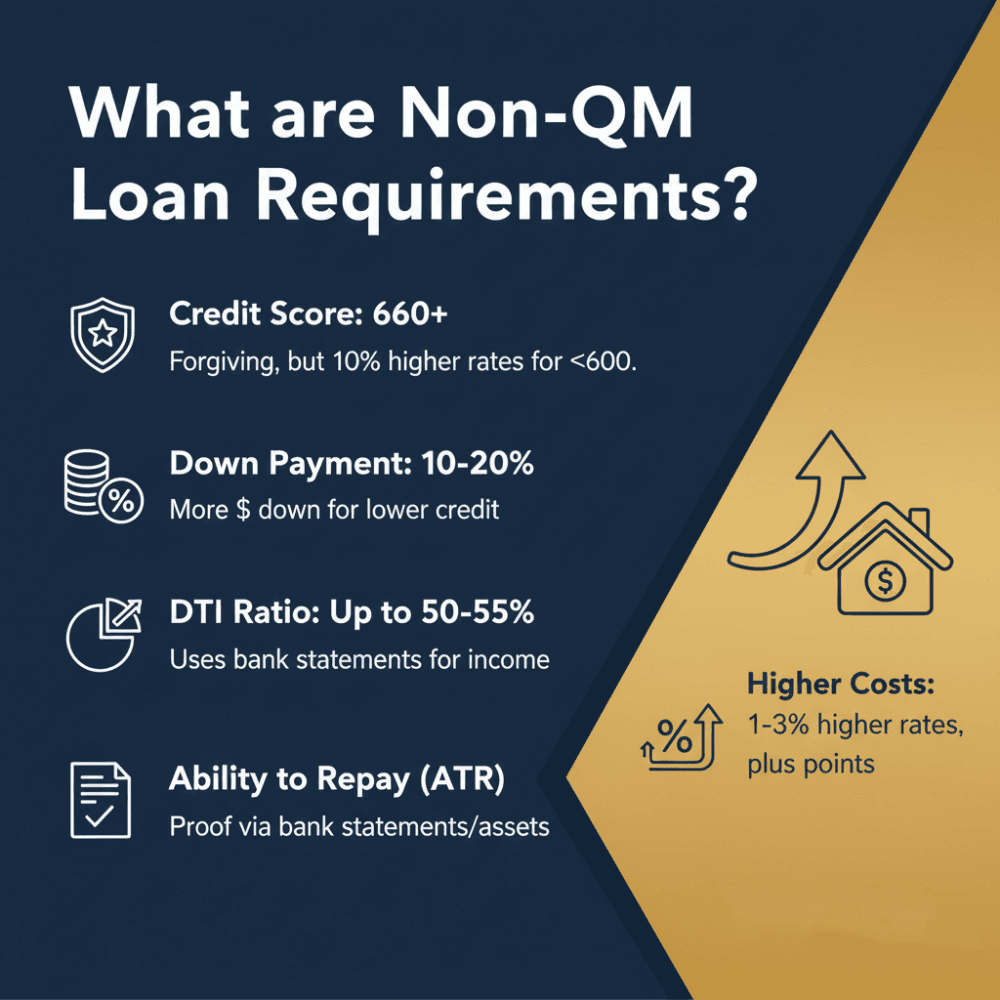

What are Non-QM Loan Requirements?

When we talk about requirements for these loans, we aren't looking at a single rulebook like Fannie Mae uses. Instead, we are looking at a spectrum of "compensating factors." Essentially, if you are weak in one area, like credit, you need to be strong in another, like down payment. Here is a breakdown of what you typically need to bring to the table.

Credit Score

Credit scores are often the biggest source of anxiety for borrowers, but in the Non-QM world, I've found lenders to be much more forgiving. While a conventional loan might slam the door if you dip below 620, Non-QM lenders look at the bigger picture. Generally, the "sweet spot" for the best rates is a FICO score of 660 to 680 or higher.

However, if your score has taken a hit, don't panic. I have seen borrowers get approved with scores as low as 500 to 580, provided they had other strong financial pillars to stand on. The trade-off here is straightforward: the lower your score, the higher your interest rate and down payment will be. It's not about being perfect; it's about showing you aren't a current risk. If you have "bad credit" due to a past event but have re-established good habits recently, many lenders will work with you.

Down Payment

One thing I always tell clients upfront is to prepare their liquidity. Non-QM loans are rarely "low money down" products. Because the lender is taking on more risk by not selling your loan to the government, they want you to have "skin in the game."

Typically, you should expect a down payment requirement between 10% and 20%. This is a significant jump from the 3% or 3.5% you might see with conventional or FHA loans. If your credit score is on the lower end, say, under 600, or if you are a foreign national with no US credit history, that requirement could climb to 30% or more.

Also, unlike standard loans, where the down payment can sometimes be fully gifted, Non-QM lenders often want to see that at least part of that cash is your own hard-earned money. It reassures them that you are financially stable enough to handle the mortgage.

Debt-to-Income (DTI) Ratio

This is where Non-QM loans truly shine. If you've ever calculated your DTI for a standard loan, you know the dreaded "43% rule". If your monthly debts exceed 43% of your income, you're usually out of luck.

Non-QM guidelines are far more generous. I frequently see approvals for DTI ratios up to 50%, and in some cases with strong cash reserves, even 55%. This flexibility is a game-changer for people living in expensive cities where housing costs naturally eat up a larger chunk of income.

Furthermore, the way they calculate the "Income" part of that ratio is different. Instead of looking at the bottom line of your tax return, which might be low due to business write-offs, they might use the cash flow moving through your bank accounts. This naturally lowers your calculated DTI, making it much easier to qualify for the home you actually want, rather than the one a tax return says you can afford.

Ability to Repay (ATR)

There is a common misconception that Non-QM loans are "Wild West" lending like the subprime days of 2008. Trust me, they are not. The "Ability to Repay" (ATR) rule still applies, which means the lender must make a reasonable determination that you can pay the loan back.

The difference lies in how we prove it. For a standard Qualified Mortgage (QM), ATR is proved via W-2s and tax returns. For Non-QM, we prove ATR using alternative methods. This could be 12 months of bank statements showing regular deposits, 1099 forms, or for investors, the rental income of the property itself.

I've guided many freelancers through this. We sit down, look at their liquid assets, their current cash flow, and their employment history. As long as the math makes sense and proves you aren't overleveraging yourself, the ATR requirement is satisfied. It's about common-sense underwriting rather than checking a government box.

Higher Costs

We have to be realistic: convenience and flexibility come with a price tag. Because Non-QM loans are not government-backed, the lender is holding the bag if something goes wrong. To offset this risk, these loans almost always come with higher costs than a standard 30-year fixed mortgage.

In terms of interest rates, you can generally expect to pay 1% to 3% higher than the current prime market rate. Additionally, closing costs can be steeper. It is very common to see "points" (prepaid interest) involved. You might pay 1 or 2 points upfront to secure the loan.

However, I always remind borrowers that this isn't necessarily a "forever" loan. Many of my clients use a Non-QM loan to secure a property now, and then refinance into a conventional loan two or three years down the road once their tax returns or credit scores have improved. It's a strategic tool, not necessarily a lifelong commitment.

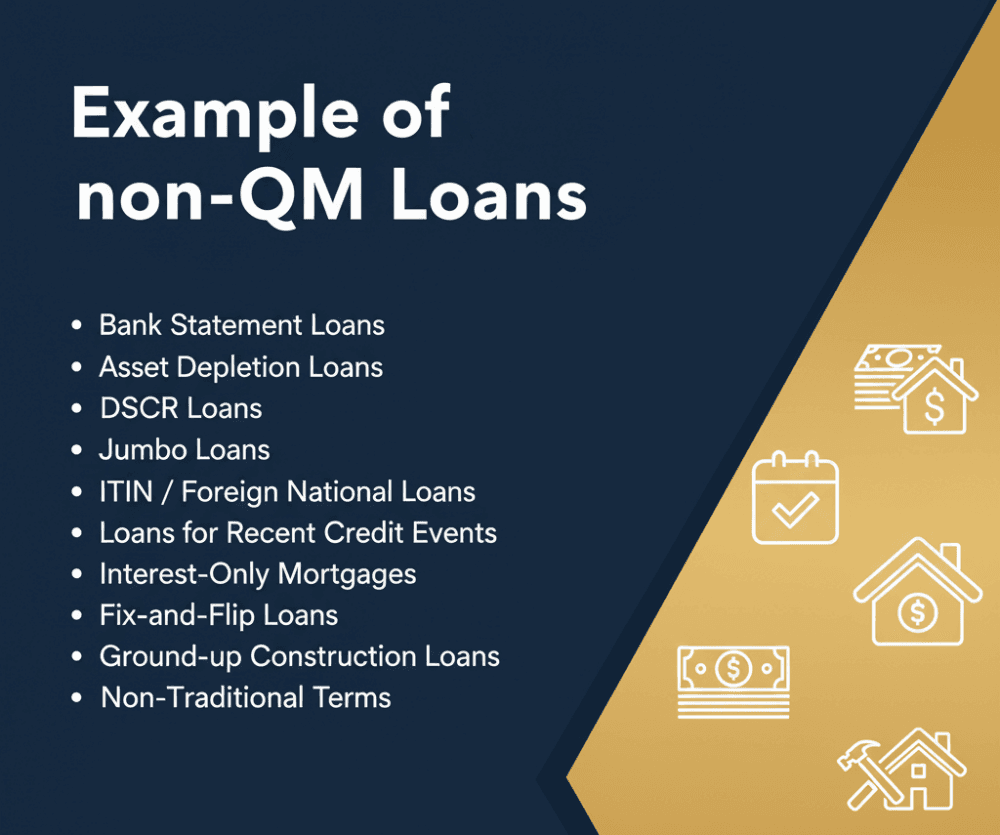

Example of Non-QM Loans and Documentation

One of the best things about this sector is the variety. There isn't just one "Non-QM loan"—there are specific tools for specific jobs. Depending on which one you pick, the paperwork stack changes completely. Here is a look at the most common types.

Bank Statement Loans

This is the bread and butter for business owners. If you write off a lot of expenses to save on taxes, your net income might look too low for a bank. Bank Statement loans solve this by ignoring your tax returns entirely.

Instead, the lender asks for 12 to 24 months of personal or business bank statements. They add up the deposits to calculate your "real" income. For business accounts, they might apply an expense factor (like assuming 50% is profit), but it's still usually much higher than what shows on your taxes.

Documentation needed:

- 12-24 months of bank statements with all pages.

- Business license or CPA letter verifying you've been in business for 2+ years.

- No tax returns required.

I often recommend this to self-employed contractors or doctors who have complex corporate structures but healthy cash flow.

Asset Depletion Loans

This is a favorite for retirees or High-Net-Worth Individuals (HNWI) who might not have a steady monthly salary but are sitting on a mountain of cash or stocks.

The concept is simple: the lender takes your total liquid assets including savings, stocks, bonds, retirement accounts, and divides them by a set term (often 60 or 84 months) to create a "monthly income" figure. You don't actually have to sell the assets. We just use the calculation to qualify you.

Documentation needed:

- Proof of ownership for all assets (investment account statements).

- Verification that assets are liquid (not tied up in real estate).

- Standard credit report.

It's a perfect solution if you are "asset rich but income poor" on paper and want to avoid touching your principal investments.

DSCR Loans

For real estate investors, the DSCR (Debt Service Coverage Ratio) loan is arguably the most powerful tool available. I love this product because it doesn't care about your personal income at all.

The lender looks strictly at the property's potential. If the monthly rent covers the monthly mortgage payment (plus taxes and insurance), you qualify. Usually, they want a ratio of 1.0 or higher (meaning income = expenses), though some will go lower with a higher down payment.

Documentation needed:

- Lease agreements if currently rented or a 1007 Rent Schedule from an appraiser.

- Good credit history, usually 660.

- 6 months of cash reserves to show you can handle vacancies.

- No personal income verification or employment history required.

Jumbo Loans

In many parts of the country, a "normal" family home now costs more than the government lending limit (the conforming limit). A Jumbo loan is simply any mortgage that exceeds this amount.

While some Jumbos are "Qualified Mortgages," many Non-QM lenders offer Jumbo products with more flexible terms. For example, a Non-QM Jumbo might allow for a lower credit score or a higher DTI than a traditional bank Jumbo, which are notoriously strict.

Documentation needed:

- Full tax returns and W-2s (usually).

- Higher credit scores (often 700+ for the best rates).

- Significant cash reserves (post-closing liquidity).

- Two appraisals are often required for very high loan amounts (e.g., over $2 million).

ITIN/Foreign National Loans

If you are a non-US citizen looking to buy property here, standard financing is almost impossible because you lack a Social Security Number.

ITIN loans allow you to use your Individual Taxpayer Identification Number instead. For Foreign Nationals who live abroad and want an investment property in the US, we can often lend without any US credit at all, basing the decision on the property's cash flow and a large down payment.

Documentation needed:

- Copy of ITIN letter or Passport/Visa.

- Proof of foreign assets.

- Letter from an accountant in your home country or international credit report.

- Usually requires a higher down payment (25-30%).

Loans for Recent Credit Events

Life happens. Bankruptcy, foreclosure, or a messy divorce can wreck your credit score. In the traditional world, you are in the "penalty box" for up to 7 years after a foreclosure.

Non-QM lenders shorten that penalty box significantly. I have access to programs that allow you to buy a home just one day out of foreclosure or bankruptcy discharge. The catch? You will need a significant down payment (often 20-30%) and rates will be higher, but it gets you back into homeownership immediately rather than waiting years.

Documentation needed:

- Proof of bankruptcy discharge or foreclosure completion.

- Letter of explanation (what happened and why it won't happen again).

- Re-established credit history since the event helps.

Interest-Only Mortgages

For borrowers who manage their cash flow tightly, an Interest-Only (IO) loan can be a strategic move. As the name suggests, you only pay the interest portion of the mortgage for the first 10 years.

This drastically lowers your monthly payment initially. This is popular with borrowers who receive large annual bonuses; they pay the minimum monthly and then make a large principal payment once a year. It increases your buying power by lowering your DTI calculation.

Documentation needed:

- Similar to Bank Statement or Full Doc loans.

- Proof of significant cash reserves is usually required to ensure you can handle payment shocks later.

Fix-and-Flip Loans

These are short-term loans designed for investors who buy distressed properties, renovate them, and sell them for a profit. They are basically bridge loans with a renovation budget included.

These loans are all about speed. We don't look at your personal income; we look at the "After Repair Value" (ARV) of the house. The loan usually lasts only 12 to 18 months.

Documentation needed:

- Detailed Scope of Work (budget for repairs).

- Track record of successful flips (preferred but not always required).

- Exit strategy (how you plan to sell or refinance).

- Liquidity for the down payment and initial construction costs.

Bridge Loans

A Bridge loan helps you span the gap between selling your old home and buying a new one. In a competitive market, you can't always make an offer "contingent on sale."

A Bridge loan uses the equity in your current home to fund the down payment on the new one. Once your old home sells, you pay off the Bridge loan. It's a short-term, convenience-focused product.

Documentation needed:

- Listing agreement for your current home.

- Purchase contract for the new home.

- Equity verification in the current property.

Ground-up Construction Loans

If you can't find the perfect house, sometimes you have to build it. Traditional construction loans are hard to get, especially for spec builders (investors building to sell).

Non-QM construction loans provide the funds to buy the land and pay the builders. These are "draw" loans—the bank releases money in stages as work is completed and inspected.

Documentation needed:

- Builder contract and resume.

- Architectural plans and permits.

- Land purchase agreement or deed.

- "As-completed" appraisal.

Non-Traditional Terms

Finally, there are loans that simply tweak the math to make payments affordable. One popular option recently is the 40-year mortgage.

By stretching the loan term from 30 years to 40 years, the monthly payment drops because the amortization is spread out longer. You pay more interest in the long run, but for many buyers, that lower monthly payment is the difference between qualifying and being denied.

Documentation needed:

- Standard income/asset documentation.

- Assessment of why the 40-year term is necessary (usually DTI management).

FAQs About Non-QM Loan Requirements

Q1. What credit score is needed for non-QM loans?

Typically, lenders look for a score of 620 to 660. However, exceptions exist. I have seen programs for scores as low as 500, provided you can put down 20-30% and have cash reserves.

Q2. What is the 3% qm rule?

This refers to a cap on "Qualified Mortgages." The rule says that for a loan to be "Qualified," the points and fees charged to the borrower cannot exceed 3% of the total loan amount. Non-QM loans are exempt from this cap, which is why they often have higher upfront fees.

Q3. How to get 800 credit score in 45 days?

Honestly? It is nearly impossible unless your report has errors. If you have high credit card utilization, paying those balances to zero can boost your score by 30-50 points quickly. But jumping to 800 usually takes years of consistent history.

Q4. Can I get a mortgage loan with a 500 credit score?

Yes, but it is expensive. You will likely need a Non-QM lender, a down payment of at least 20-30%, and you should expect an interest rate significantly higher than the market average.

Q5. What is a ghost mortgage?

This term is often used to describe a "Zombie Mortgage." It refers to an old second mortgage that you thought was forgiven or written off years ago (often during the 2008 crash), which suddenly reappears with a debt collector demanding payment. It can also refer to fraud where a loan is taken out on a property without the owner's knowledge.

Q6. What does qm loan mean?

QM stands for Qualified Mortgage. These are loans that meet the strict "safe" lending standards set by the federal government (CFPB), including the 43% DTI limit and prohibitions on risky features like interest-only payments.

Q7. Are non-QM loans subject to high cost?

Yes. Because they fall outside the government's "safe harbor" protections, they are often classified as "High-Priced Mortgage Loans" (HPML). This triggers extra appraisal requirements and disclosure rules to ensure you aren't being taken advantage of.

Q8. What is the rate for non-QM loans?

Rates are fluid, but generally, expect them to be 1% to 3% higher than standard conventional rates. If a standard 30-year fixed is 6.5%, a Non-QM loan might be anywhere from 7.5% to 9.5% depending on your credit and down payment.

Conclusion

Navigating the world of Non-QM loans can feel overwhelming because there is no single "standard" to follow. However, these loans are a vital lifeline for self-employed individuals, investors, and anyone who doesn't fit in a perfect box. The key is understanding that while the rates are higher, the flexibility they offer is unmatched.

Don't waste time calling random banks that will just say "no." My best advice is to reach out to a Bluerate non-qm loan officer directly. They specialize in this exact market. They can give you a real, real-time rate quote—not a fake "teaser" rate—completely for free. It's the smartest way to see exactly what you qualify for without the headache.