What is a Cash Out Refinance Loan? Everything to Know

People were completely spiraling over the concept of "cash out refinancing" on Reddit. They just couldn't wrap their head around the math, how you can "take money out" of a house you're still paying for. Honestly, I get it. It sounds like magic, but it's really just finance.

If the breakdown below still feels a bit heavy or you want someone to run the specific numbers for your zip code, I always suggest chatting with a local loan officer. You can find a vetted pro on Bluerate for a free consultation to clear up the confusion.

What is a Cash Out Refinance Loan?

To put it simply, a Cash Out Refinance Loan is a financial move where I replace my current mortgage with a new, larger mortgage. The difference between the two loans is given to me in tax-free cash. It's different from a standard "Rate-and-Term" home refinance, where the only goal is to lower the interest rate or change the repayment timeline (like going from a 30-year to a 15-year term) without touching the equity.

However, they do share some common ground. Both require me to go through the underwriting process again, meaning credit checks, appraisals, and closing costs are part of the deal.

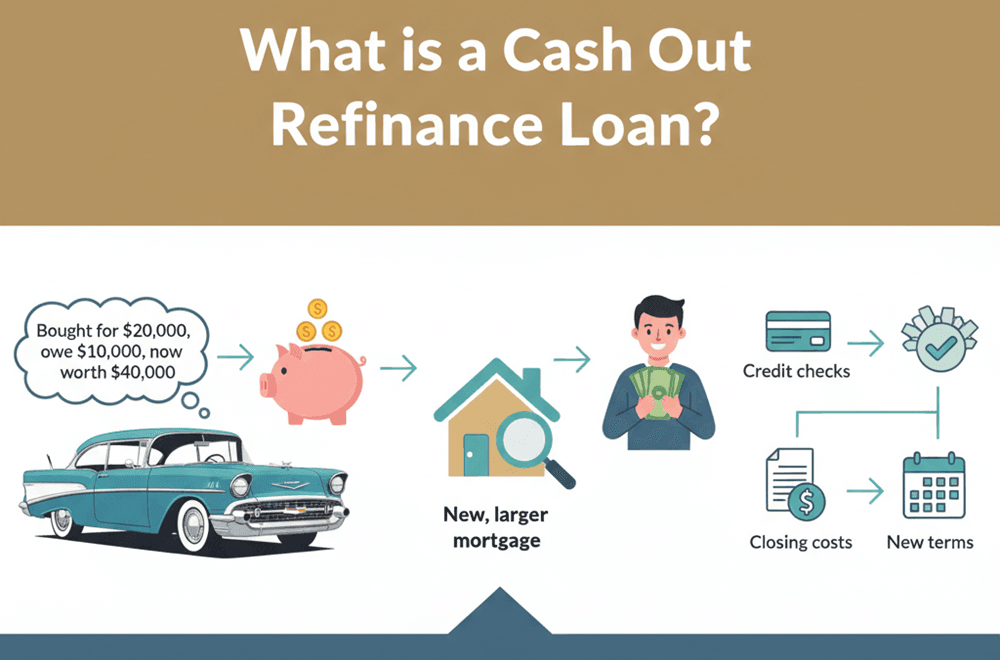

Think of it like this: Imagine I bought a car for $20,000, paid off half, so I owe $10,000. But now, that car is a classic and worth $40,000. If I went back to the bank and said, "refinance this car for $30,000," I would pay off the old $10,000 debt and pocket the remaining $20,000. That is exactly what happens with your house. You aren't getting free money. you are just liquidating the ownership stake (equity) you've built up over time and restarting your loan with a higher balance.

Types of Cash Out Refinance Mortgage

There isn't just one "flavor" of this loan. Depending on your background, one of these might save you thousands:

-

Conventional cash-out refinance: The standard option. Typically, lenders let you borrow up to 80% of your home's value. It follows Fannie Mae/Freddie Mac guidelines.

-

Conventional student loan cash-out refinance: A hidden gem. This allows you to pay off student debt directly. Often, Fannie Mae waives certain price adjustments, giving you a better rate than a standard cash-out.

-

VA cash-out refinance: Exclusively for veterans. This is powerful because it allows qualifying vets to refinance up to 100% of the home's value, giving you access to way more cash than other loans.

-

FHA cash-out refinance: Backed by the government, this is great if my credit score is lower (usually down to 500-580), though it's capped at 80% Loan-to-Value.

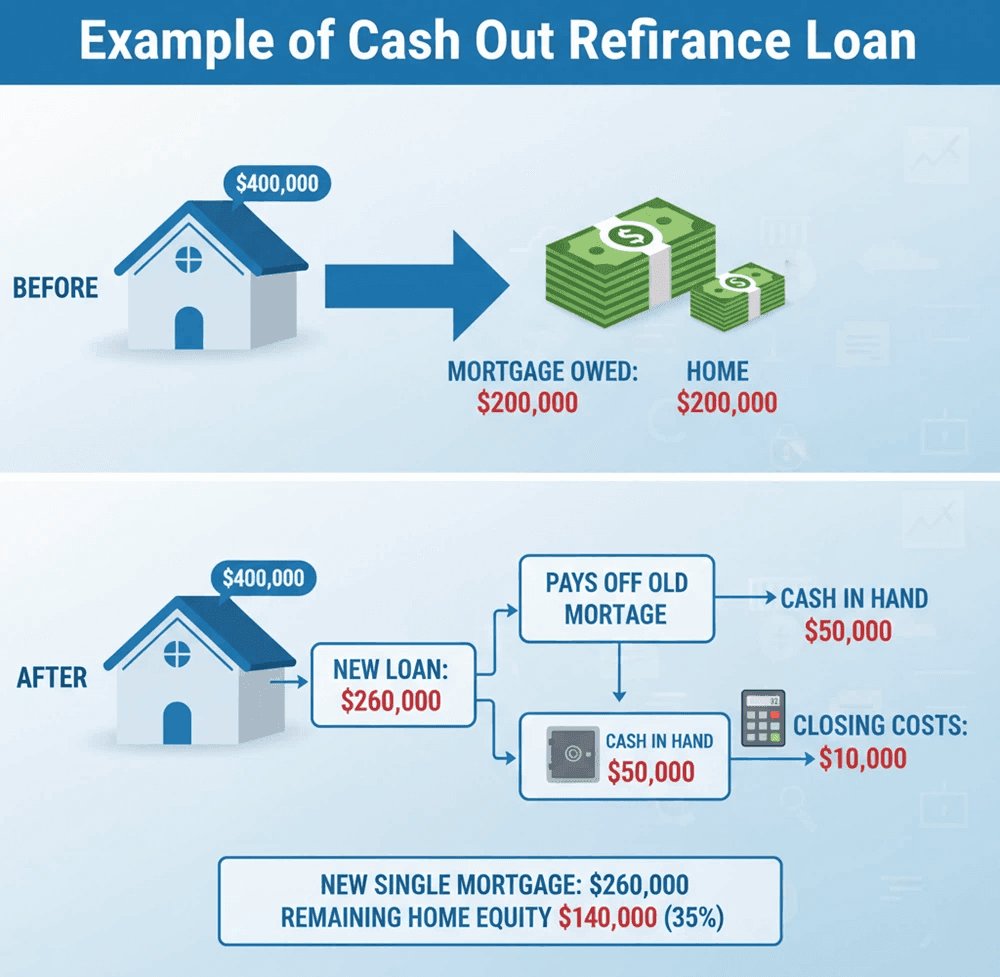

Example of a Cash Out Refinance Loan

Let's look at the real numbers. Say my home is currently valued at $400,000. I still owe $200,000 on my original mortgage. I want $50,000 in cash for renovations.

I apply for a new loan totaling $260,000. Here is where that money goes:

-

$200,000 pays off the old lender (goodbye old loan).

-

$50,000 is deposited into my bank account.

-

$10,000 covers the closing costs (roughly).

Now, I have a single mortgage of $260,000. I still have $140,000 in equity left in the house (35%), which keeps me safely under the typical 80% borrowing limit. It's recommended to estimate your refinance before you kick off.

How Does a Cash Out Refinance Work?

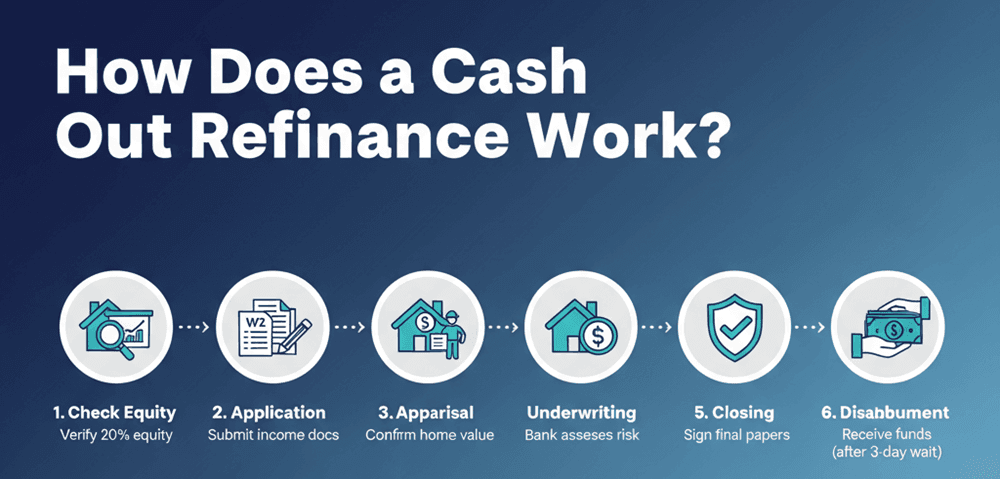

The process to refinance a mortgage is nearly identical to when I first bought my home, but with a few twists. Here is how cash out refinance usually goes down:

-

Check Equity: I verify I have at least 20% equity left over after taking the cash.

-

Application: I submit income docs (W2s, pay stubs) to the lender.

-

Appraisal: The lender sends an appraiser to confirm the home's current market value. This is the most critical step because it determines how much cash I can actually get.

-

Underwriting: The bank assesses my risk profile.

-

Closing: I sign the papers.

-

Disbursement: unlike a purchase, there is a 3-day Right of Rescission period (for primary homes). I won't get the check until the fourth business day after closing.

Pros and Cons of a Cash Out Refinance

Like any major financial tool, this strategy has sharp edges. It can save the day or sink your finances depending on how you use it. Let's weigh the good against the bad.

Benefits of a Cash Out Refinance

-

Access to a large sum of money: This is the cheapest way to access tens of thousands of dollars quickly. Whether for college tuition or a wedding, the liquidity is unmatched.

-

Potentially lower interest rates: Even if mortgage rates are high, they are almost always lower than credit cards (often 20%+) or unsecured personal loans (10-15%).

-

Debt consolidation: By rolling high-interest credit card debt into my mortgage, I can sometimes cut my total monthly payments in half, improving my monthly cash flow immediately.

-

Tax benefits: This is a big "Information Gain" point many miss. According to IRS rules, if I use the cash to buy, build, or substantially improve my home, the interest on that extra cash may be tax-deductible. (Always ask a CPA!).

-

Predictable payments: Unlike a HELOC which often has a variable rate that fluctuates with the Fed, a cash-out refinance usually locks in a fixed rate for 15 or 30 years.

Drawbacks of a Cash Out Refinance

-

Increased debt burden: I am restarting the clock. If I had 20 years left on my mortgage and I refinance to a new 30-year term, I am paying interest for a significantly longer time.

-

Home as collateral: This is the scary part. If I default on a credit card, my credit score drops. If I default on this loan, I lose my house. The stakes are higher.

-

Closing costs: It is expensive. I have to pay 2% to 6% of the entire loan amount, not just the cash I take out. On a $300k loan, that's $6,000 to $18,000 in fees.

-

Resets your mortgage term: I might lower my monthly payment, but I will likely pay much more in total interest over the life of the loan because of the extended timeline.

-

Interest rates may be higher: Lenders view cash-out loans as riskier than standard refinances. Therefore, the rate I get might be 0.125% to 0.5% higher than a regular rate-and-term refi.

-

Reduces home equity: I own less of my home instantly. If housing prices crash, I risk going "underwater" (owing more than the home is worth).

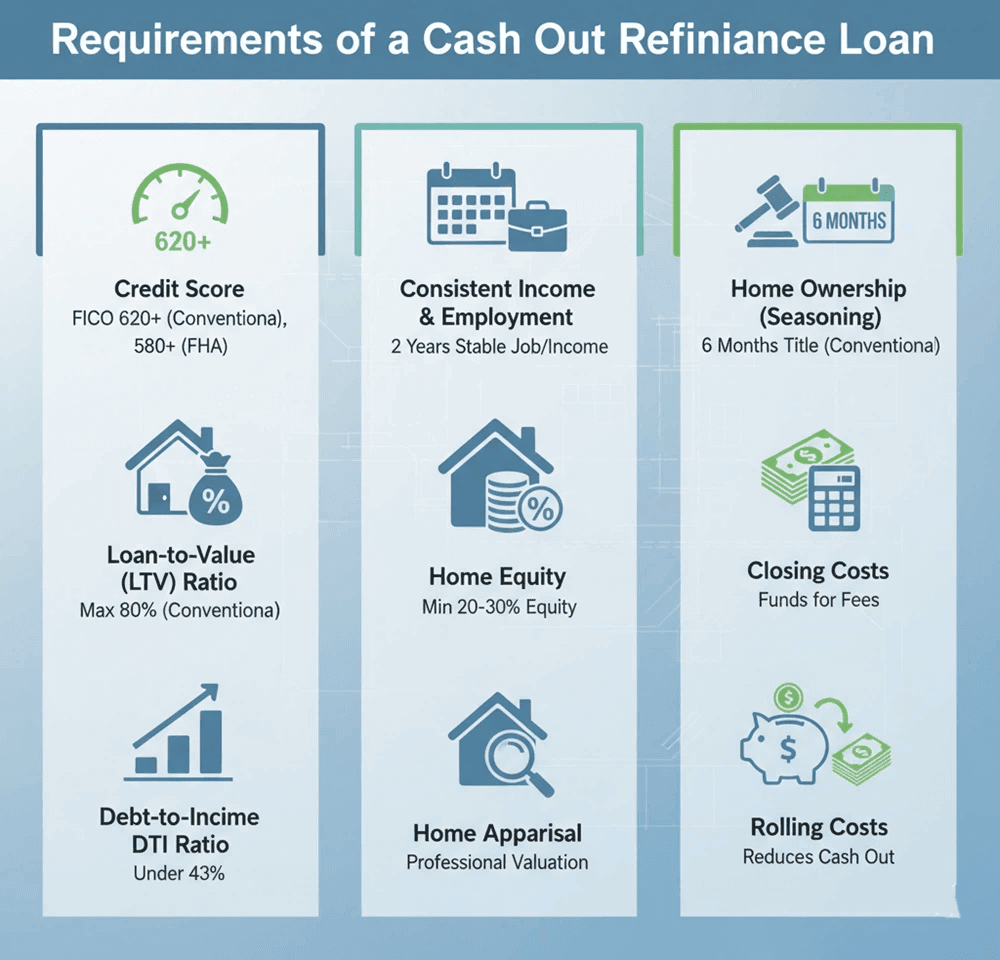

Requirements of a Cash Out Refinance Loan

Getting approved isn't automatic. Lenders want to ensure I can handle the bigger loan. Here are the nine key hurdles I need to clear:

-

Credit Score: Generally, I need a FICO score of 620 or higher for a conventional loan. If I'm going the FHA route, some lenders will go down to 580, but 620 is the safe zone for better pricing.

-

Loan-to-Value (LTV) Ratio: This is the golden rule. For conventional loans, I usually cannot borrow more than 80% of my home's value. If my home is worth $100k, my new loan can't exceed $80k. (Veterans are the exception, often allowed up to 100%).

-

Debt-to-Income (DTI) Ratio: Lenders look at my total monthly debts divided by my gross monthly income. They typically want this under 43%, though I've seen exceptions up to 50% with strong cash reserves.

-

Consistent Income and Employment: I need to prove stable employment, usually with two years of W-2s or tax returns. Self-employed? I'll need two years of steady profit on my Schedule C.

-

Home Equity: I must have "skin in the game." If I don't have at least 20-30% equity currently, there usually isn't enough room to take cash out and still satisfy the lender's buffer.

-

Home Appraisal: I can't just guess what my house is worth. The lender orders a professional appraisal (which I pay for) to validate the value. If it comes in low, the deal might die.

-

Home Ownership (Seasoning): I can't buy a house and refinance it the next day. Conventional loans typically require me to be on the title for 6 months. FHA requires I've lived there for 12 months.

-

Closing Costs: I need to verify I have the funds to cover these, or enough equity to roll them into the loan.

-

Rolling Costs: If I choose to roll the closing costs into the loan, it reduces the actual cash I receive in my hand. I need to account for this "shrinkage" in my math.

Is a Cash-out Refinance Ever a Good Idea?

This is the million-dollar question. In my experience, a cash-out refinance is a good idea when the math objectively improves your financial health. The best use case is high-interest debt consolidation. If I am drowning in $30,000 of credit card debt at 22% interest, swapping that for a 6-7% mortgage rate can save me hundreds monthly.

It is also smart for home improvements. Adding a new kitchen or bedroom increases the property value, effectively putting that equity back into the house, and the interest might be tax-deductible.

However, it is a bad idea to use this money for depreciating assets like a luxury car, a vacation, or speculative investments. Never bet your house on something that loses value. Also, if I plan to move in the next 3-5 years, the closing costs usually take too long to recoup, making it a losing financial move.

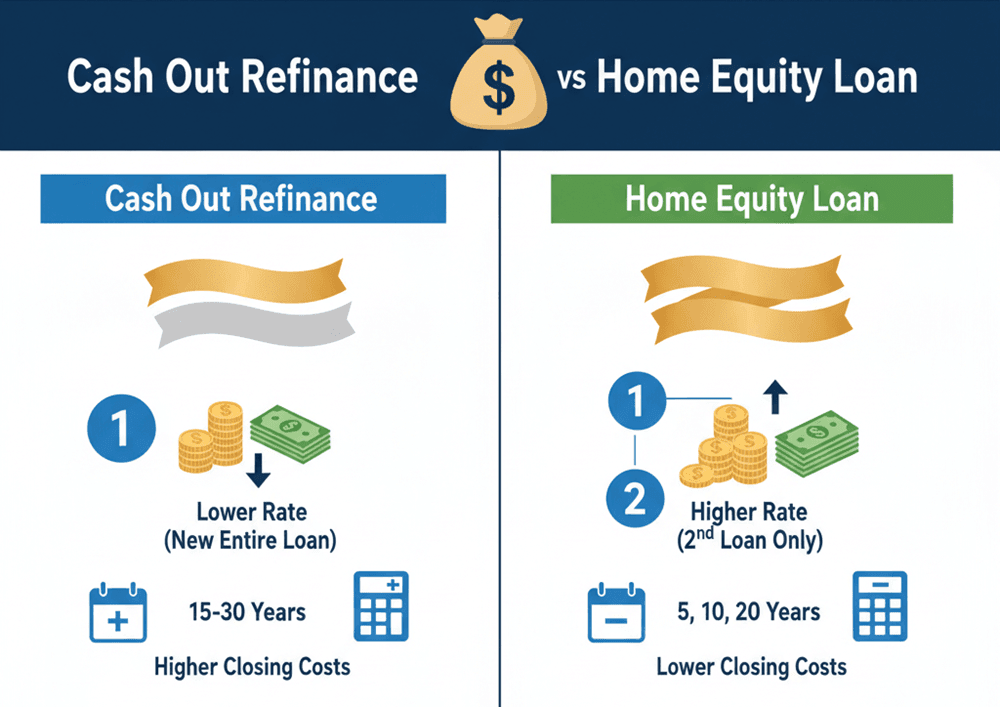

Cash Out Refinance vs Home Equity Loan

Many people confuse these two, but they are structurally different. Here is how I distinguish them:

-

Structure: A Cash Out Refinance replaces my entire existing mortgage. A Home Equity Loan is a second mortgage that sits on top of my original one.

-

Monthly Payment: With a cash-out, I have just one monthly bill. With a Home Equity Loan, I have two separate mortgage payments to manage every month.

-

Interest Rate: Cash-out refis typically have lower rates than Home Equity Loans. However, the new rate applies to my entire loan balance. If I currently have a historic 3% rate, a cash-out refi would force me to trade that for today's higher rate on the whole debt, usually a bad move.

-

Fund Access: Both provide a lump sum of cash at closing. (Unlike a HELOC, which is a revolving line of credit).

-

Closing Costs: Cash-out refis generally have higher closing costs because they are calculated on the full loan amount. Home Equity Loans often have lower or waived closing costs.

-

Loan Term: Cash-out refis usually reset to 15 or 30 years. Home Equity Loans can have shorter terms, like 5, 10, or 20 years, allowing me to pay off that specific chunk of debt faster.

FAQs About a Cash Out Refinance Mortgage

Q1. How much does it cost to cash-out refinance?

The costs to refinance are typically between 2% and 6% of the total loan amount. For a $300,000 loan, that is $6,000 to $18,000. This includes lender origination fees, appraisal fees, title insurance, and credit report charges. You usually don't pay this out of pocket. it's subtracted from your equity proceeds.

Q2. What is the negative to a cash-out refinance?

The biggest negative is risk exposure. You are securing unsecured debt (like credit cards) with your home. If you lose your job and can't pay your Visa bill, your credit score drops. If you can't pay your new mortgage, you face foreclosure. Additionally, you reset the amortization schedule, meaning you'll pay mostly interest again for the first few years of the new loan.

Conclusion

A cash-out refinance is a power tool, it can build an addition to your home or wipe out crushing debt, but it can also strip your wealth if used carelessly. The math has to make sense for your specific situation. Don't rely on general rules of thumb.

If you are thinking about unlocking your equity, don't guess. I highly recommend visiting Bluerate to find a local, experienced loan officer. They can look at your specific credit profile and property value to tell you exactly how much cash you can get, for free.