![[Detailed Guide] How to Estimate Mortgage Refinance? Start Now](/_next/image?url=https%3A%2F%2Fdynamic-light-ab6e2536d6.media.strapiapp.com%2Festimate_mortgage_refinance_banner_a5b867067c.png&w=3840&q=75)

[Detailed Guide] How to Estimate Mortgage Refinance? Start Now

I remember sitting at my kitchen table late one night, calculator in one hand and my monthly mortgage statement in the other. I kept seeing headlines about interest rates shifting, and the thought nagged me: "Am I overpaying?" Refinancing sounded like a smart move, but I'm not the type to jump into a huge financial decision just because everyone else is doing it. I wanted to know the numbers, my numbers, before talking to a smooth-talking salesperson.

I didn't want to spend thousands on closing costs just to save twenty bucks a month. So, I dug in and learned how to estimate a mortgage refinance myself. It gave me the confidence to move forward.

If you're in the same boat, curious but cautious, this guide covers exactly how I ran the numbers. But here is a tip from my experience: my DIY math was good for a ballpark estimate, but it wasn't perfect. If you want a truly accurate picture without the headache, I'd suggest hopping on **Bluerate** to find a local loan officer. A quick, free chat with a pro in your area will always beat a generic online calculation.

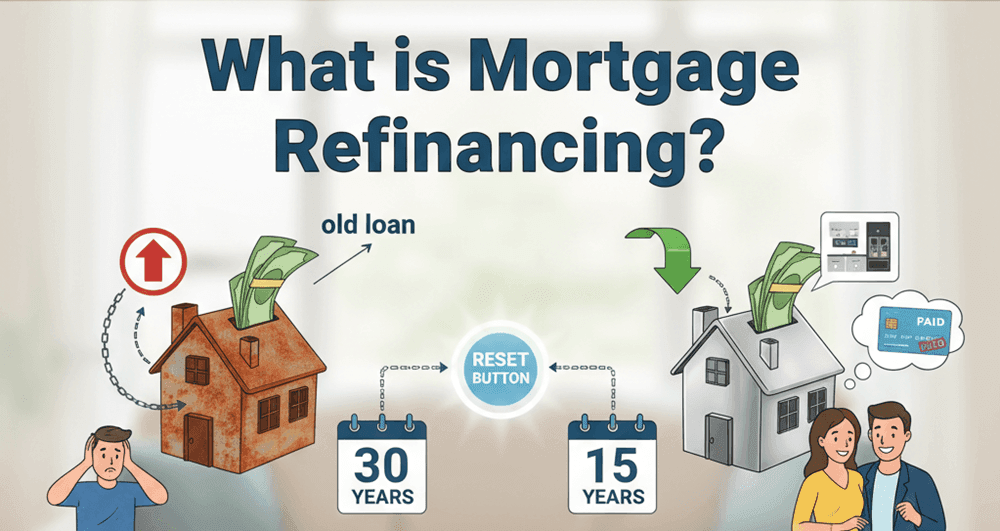

What is Mortgage Refinancing?

Let's strip away the banking jargon. Refinancing is basically taking out a new loan to pay off your old one. You're hitting the reset button.

Most people do this to snag a lower interest rate, which drops their monthly payment. Others might want to shorten their loan term, say, going from a 30-year to a 15-year mortgage to pay it off faster. Then there's the "cash-out" refi, where you tap into your home's equity to pay for a renovation or clear credit card debt.

But it's not free money. It comes with paperwork and fees. You have to ask yourself: Is the juice worth the squeeze? If you aren't planning to stay in the home for long, the cost of doing the deal might outweigh the savings.

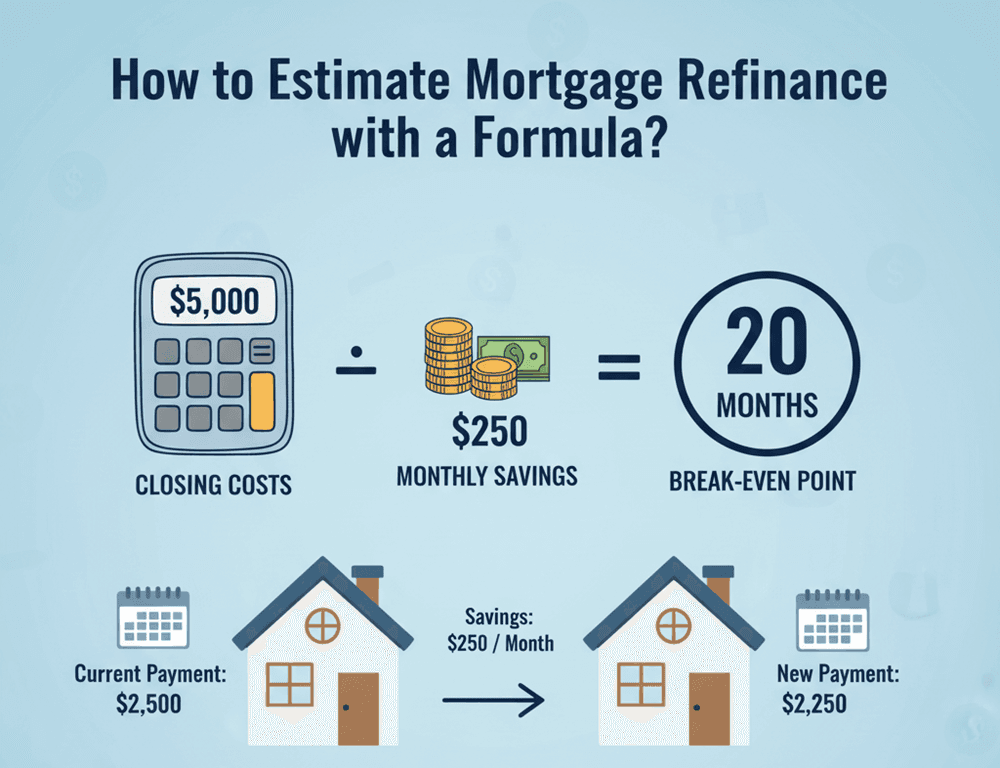

How to Estimate Mortgage Refinance with a Formula?

I like to understand the "why" behind the numbers, so I started with a simple formula. The most important thing I wanted to know was my Break-Even Point. Essentially, how many months will it take for my monthly savings to pay back the cost of the refinance?

Here is the logic I used: Total Closing Costs ÷ Monthly Savings = Months to Break Even

Let me show you how I applied this to my situation:

I got a rough quote that my closing costs (all the fees to the bank, title company, etc.) would be around $5,000. My current payment was $2,500, but the new loan would drop it to $2,250. That's a savings of $250 a month. My current payment was $2,500, but the new loan would drop it to $2,250. That's a savings of $250 a month. So, the math looked like this: $5,000 ÷ $250 = 20 Months.

This told me that for the first 20 months, I wasn't technically "saving" anything. I was just paying myself back for the closing costs. If I planned to sell the house in a year, I'd actually lose money. But since I planned to stay for another five years, it was a green light.

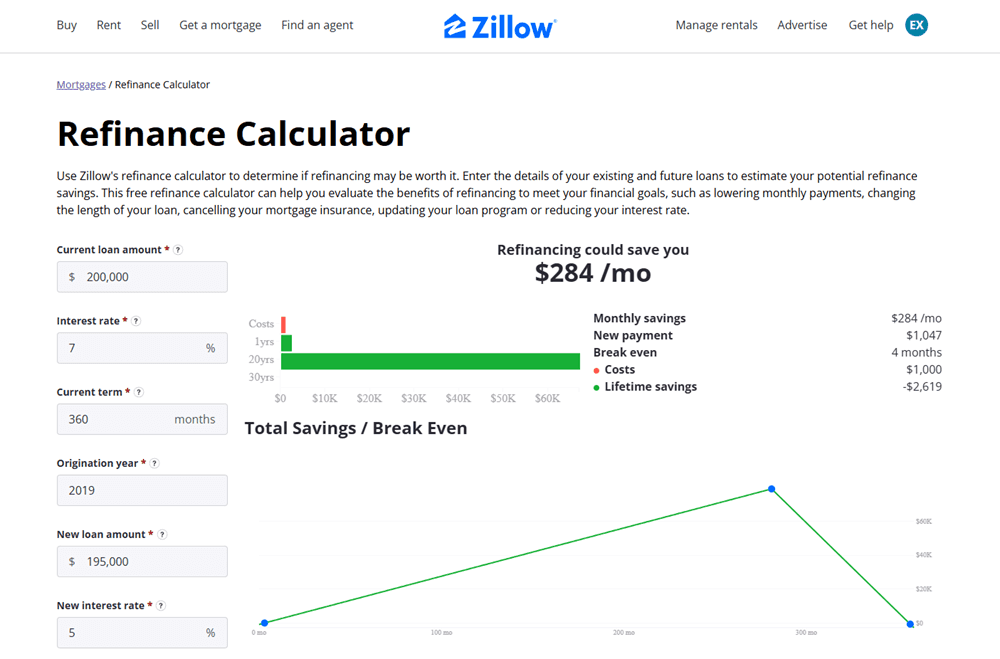

How to Estimate Home Refinance with an Online Calculator?

If you don't want to mess with manual math, there are plenty of tools out there. I played around with estimators from Bankrate, NerdWallet, and Zillow. They are great for speed, and you can run five different scenarios while drinking your morning coffee.

However, they have a flaw: they are generic. They guess on things like property taxes and insurance unless you correct them.

Here is how I used the Zillow Refinance Calculator to get a decent estimate:

STEP 1. Open this online free refinance calculator on your browser.

STEP 2. Enter details including: Current loan amount, Interest rate, Current term, Origination year, New loan amount, New interest rate, New term, Refinance fees.

STEP 3. The refinance calculator will automatically do the math in real time. You can see monthly savings, new payment, break-even terms, etc.

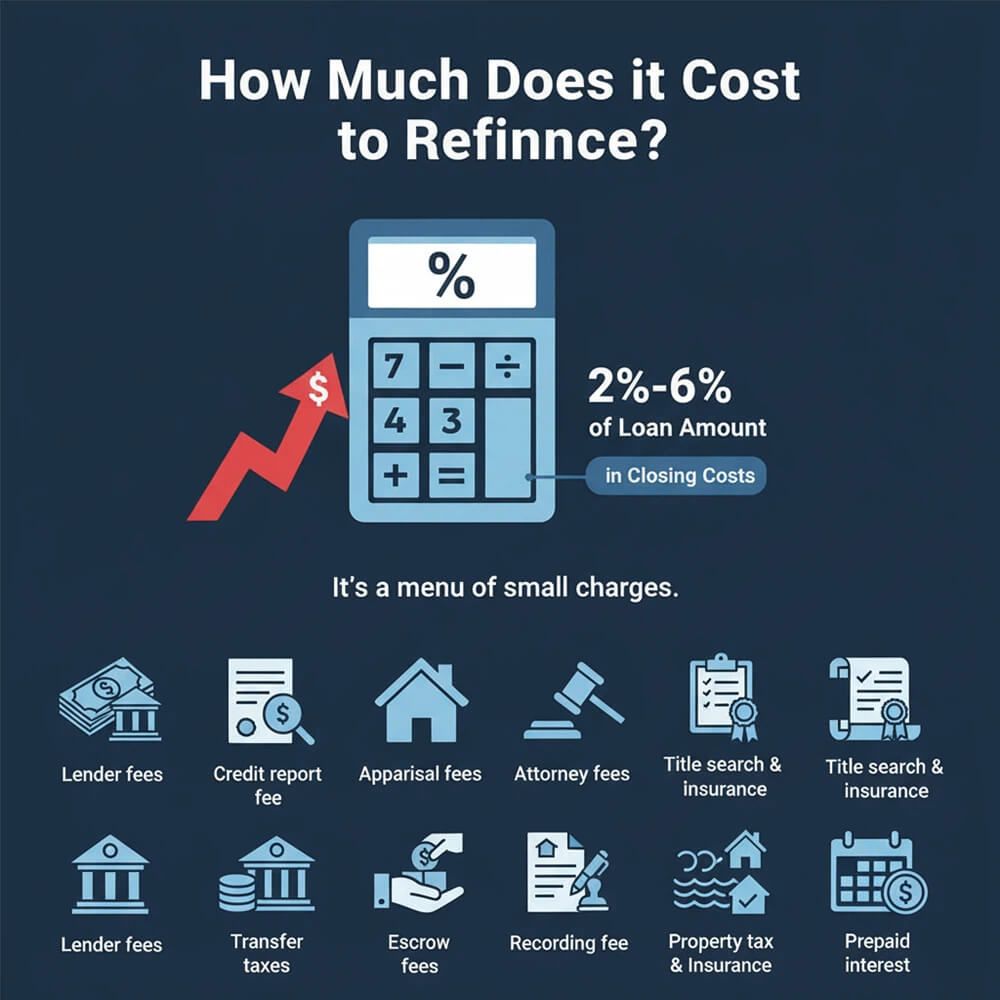

How Much Does it Cost to Refinance?

This is the part that usually shocks people. Refinancing isn't cheap. From what I've seen in the U.S. market, you need to be ready to pay between 2% and 6% of your total loan amount in refinance closing costs.

It's not just one fee. It's a whole menu of small charges. Here is what you should look out for:

- Lender fees: The bank's cut for processing the loan.

- Credit report fee: Usually under $50, but you pay for them to check your score.

- Appraisal fees: Someone has to come out and prove your house is worth the money.

- Title search & insurance: This ensures no one else has a legal claim to your property.

- Attorney fees: Depending on your state, you might need a lawyer to oversee the signing.

- Transfer taxes: A tax charged by the local government when debt changes hands.

- Escrow fees: The cost for the neutral third party handling the funds.

- Flood certification: To check if you are in a flood zone (yes, even if you live on a hill, they often check).

- Recording fee: The county charges this to file the new deed.

- Property tax & Insurance: You might have to prepay these for the upcoming months.

- Prepaid interest: The interest due from the day you close until the end of that month.

FAQs About Estimating Mortgage Refinance

Q1. What is the 2% rule for refinancing?

This is an old-school rule of thumb. It says you should only refinance if you can drop your interest rate by at least 2% (like going from 8% to 6%). Honestly? In today's economy, this rule is a bit outdated. On a large loan, even a 0.75% or 1% drop can save you thousands over time. Focus on the break-even point, not just the percentage drop.

Q2. What is the 80/20 rule in refinancing?

This is all about equity. Lenders love it when you own at least 20% of your home (meaning your loan is only 80% of the home's value). If you have less than 20% equity, they usually make you pay Private Mortgage Insurance (PMI). That extra cost can eat up your potential savings, so it's a key number to watch.

Q3. How much does it cost to refinance a $500,000 house?

Let's do the napkin math based on the 2-6% range.

- On the low end (2%), you are looking at $10,000.

- On the high end (6%), it could be $30,000.

Most people land somewhere in the middle, likely around $12k to $15k, depending on where you live and your lender.

Final Word

Estimating these numbers yourself is a smart way to keep your expectations in check. It stops you from getting swept up in marketing hype. By using the break-even formula and double-checking with online tools, I felt much more prepared.

But remember, my calculations were just estimates. Online tools don't know your credit history nuances or the exact tax laws in your state.

If the numbers look like they work for you, the next step is to get a "hard" quote. I'd recommend going to Bluerate to find a local loan officer. Let them run the official numbers for free. It's better to know the exact price tag before you sign anything.

People Also Read

- Must-Read: How Long is a Mortgage Preapproval Good for?

- Mortgage Prequalification vs Preapproval: All Differences in 2026

- How to Calculate Early Payoff of Mortgage? Formula and Penalty

- How to Pay off Mortgage Faster? Pros, Cons, and 7 Ways for You

- What is the Lowest Mortgage Rate Today? Get Best Quote Today!