![[Solved] How Much Does it Cost to Refinance a Mortgage?](/_next/image?url=https%3A%2F%2Fdynamic-light-ab6e2536d6.media.strapiapp.com%2Fhow_much_does_it_cost_to_refinance_a_mortgage_22ad066241.png&w=3840&q=75)

[Solved] How Much Does it Cost to Refinance a Mortgage?

I was scrolling through Reddit the other day and stumbled upon a post by a user asking, "On average, what is the cost of refinancing?" I immediately felt for them. The sticker shock when you see that Loan Estimate can be overwhelming. You go in expecting to save money on your monthly payment, only to be hit with a massive upfront bill.

Generally, you aren't just paying a single "refinance fee". You're paying for a collection of services. While national averages exist, your specific costs are never fixed in stone. To avoid the guessing game, I highly recommend visiting Bluerate. There, you can directly contact experienced loan officers who can give you an accurate, itemized quote based on your specific financial situation, rather than relying on generic calculators.

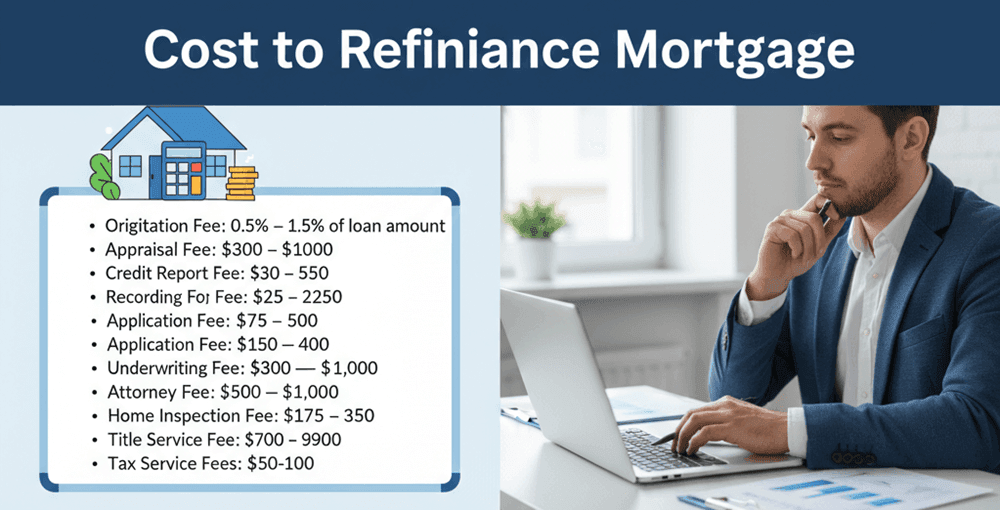

Cost to Refinance Mortgage

Let's get straight to the numbers. According to data from Freddie Mac and major lenders like Bankrate, you should expect to pay between 2% and 6% of your total loan amount to refinance.

For example, if you are refinancing a mortgage balance of $300,000, your closing costs could range anywhere from $6,000 to $18,000. That is a wide gap, right? This is why knowing exactly what you are paying for is crucial.

Here is a breakdown of the typical fees you will encounter on your Closing Disclosure:

- Origination Fee: 0.5% -- 1.5% of the loan amount

- Appraisal Fee: $300 -- $1,000

- Credit Report Fee: $30 -- $50

- Recording Fee: $25 -- $250

- Application Fee: $75 -- $500

- Survey Fee: $150 -- $400

- Underwriting Fee: $300 -- $900

- Attorney Fee: $500 -- $1,000

- Home Inspection Fee: $175 -- $350

- Title Service Fee: $700 -- $900

- Tax Service Fees: $50 -- $100

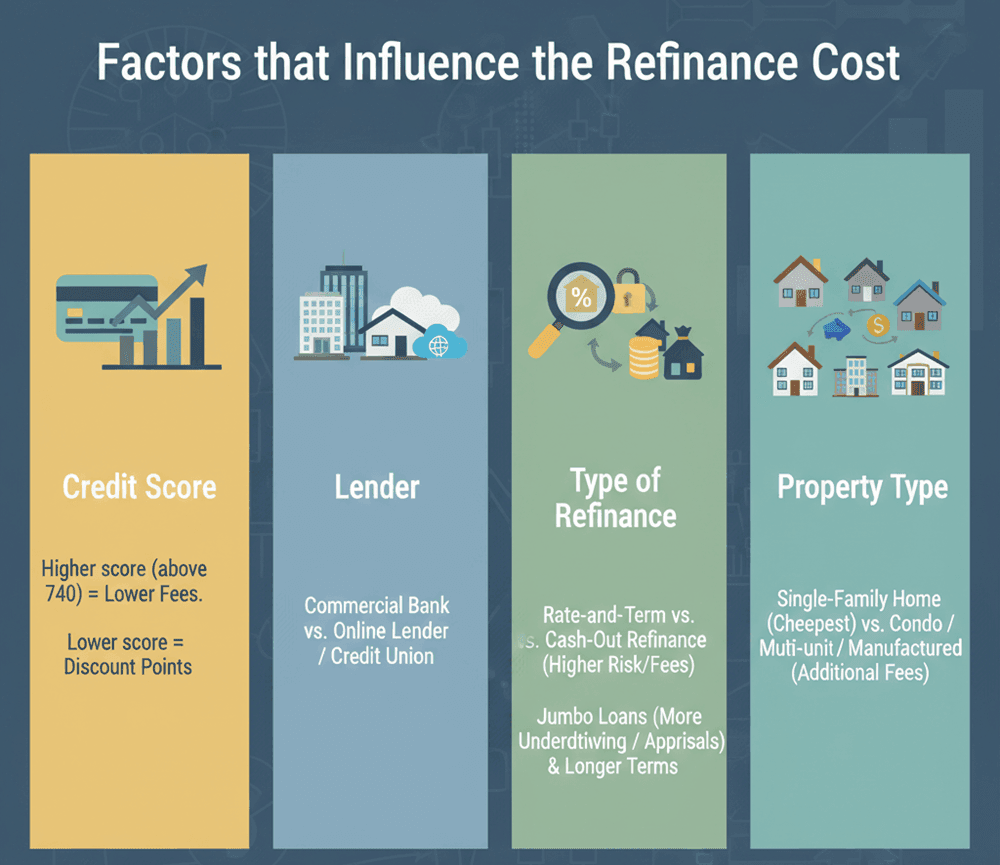

Factors that Influence the Refinance Cost

You might wonder why your neighbor paid significantly less to refinance than you did. The truth is, to esitmate refinance are highly individualized. Once we move past the standard government recording fees, the rest depends heavily on your risk profile and choices.

Here are the five main factors that will swing the price up or down:

-

Credit Score: This is the big one. Borrowers with a credit score above 740 usually qualify for the lowest origination fees. If your score is lower, lenders may charge "discount points" to offset the risk, driving up your closing costs.

-

Lender: Different institutions have different overheads. A big commercial bank might have higher fixed fees compared to an online lender or a credit union.

-

Type of Refinance: Are you just changing your rate (Rate-and-Term), or are you pulling cash out (Cash-Out Refinance)? Cash-out refinances are viewed as riskier, so they almost always come with higher interest rates or fees.

-

Loan Size and Term: Jumbo loans (loans that exceed conforming limits) often require more extensive underwriting and sometimes even two appraisals, increasing the cost.

-

Property Type: A standard single-family home is the cheapest to process. If you are refinancing a condo, a multi-unit investment property, or a manufactured home, expect additional inspection and certification fees.

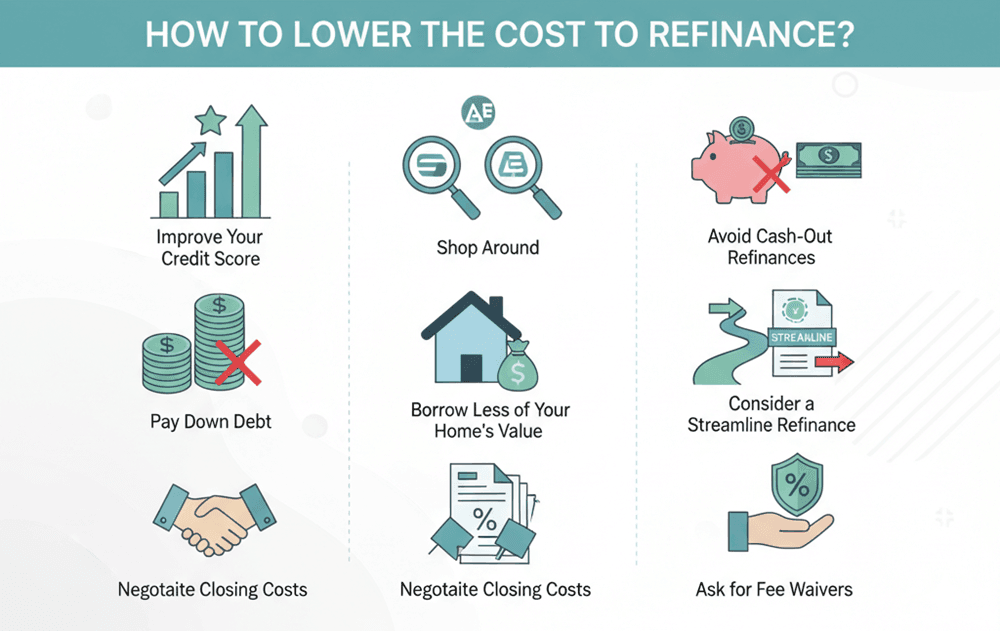

How to Lower the Cost to Refinance?

If that 2-6% range sounds painful, don't worry. There are actionable ways to trim the fat off these expenses. I've been through this process myself, and a little preparation goes a long way. Then, you can start to refinance your home.

Here are eight strategies to keep more money in your pocket:

-

Improve Your Credit Score

Before you even apply, check your credit report. If you can boost your score by paying down a high-balance credit card or fixing an error, you could move into a better pricing tier. A mere 20-point increase can sometimes save you thousands in points.

-

Pay Down Debt

Lenders look at your Debt-to-Income (DTI) ratio. If you lower your existing debt, you become a "safer" bet, which can eliminate certain risk-based adjustments to your fees.

-

Shop Around (The Smart Way)

Never settle for the first quote. This is where Bluerate shines. Unlike other sites that sell your data as a "lead" to random call centers, Bluerate lets you browse and directly contact specific loan officers. You can quickly compare quotes from different professionals to see who offers the most competitive closing costs without the hassle of being spammed.

-

Borrow Less of Your Home's Value

If you have cash on hand, consider paying down your principal so you are borrowing less than 80% of the home's value. This ensures you won't have to pay for private mortgage insurance (PMI), significantly lowering your long-term costs.

-

Avoid Cash-Out Refinances

If your primary goal is to lower your monthly payment, stick to a "rate-and-term" refinance. Taking cash out signals higher risk to the lender and triggers higher fees.

-

Consider a Streamline Refinance

If you currently have an FHA or VA loan, ask about a "Streamline" refinance. These programs often waive the need for a new appraisal and require much less documentation, making them cheaper and faster.

-

Negotiate Closing Costs

Yes, you can negotiate! Items like the origination fee are often flexible. If you have a quote from one lender, show it to another and ask if they can beat it.

-

Ask for Fee Waivers

If you are refinancing with your current lender, ask them to waive the application or processing fee. They might agree just to keep your business.

Can I Refinance a Mortgage with No Closing Costs?

You will often see ads screaming "No Closing Cost Refinance!" It sounds like a dream, but let's be real: there is no such thing as a free lunch. The services, appraisers, title companies, attorneys, still need to get paid.

"No closing cost" usually means one of three things:

-

Roll the Closing Costs Into the Loan: The lender adds the $5,000 (or whatever the amount is) to your total principal balance. You don't pay cash today, but you will pay interest on that extra $5,000 for the next 30 years.

-

Higher Interest Rate: The lender gives you "lender credits" to cover the closing costs. In exchange, you agree to a slightly higher interest rate than the market par rate. This works well if you don't plan to stay in the home for a long time.

-

No Lender Costs: Sometimes, a lender might waive their specific origination or application fees as a promotion. However, you will still be responsible for third-party fees like title insurance and taxes.

When is It Worth It to Refinance?

Refinancing isn't always the right move just because rates dropped slightly. You need to calculate your "break-even point." This is the time it takes for your monthly savings to pay back the closing costs.

Refinancing is typically worth it if:

-

You can lower your rate by 0.50% to 1%: This usually generates enough savings to recoup costs within 24 months.

-

You plan to stay in the home: If you are moving in two years, you probably won't recover the $5,000+ you spent on closing costs.

-

You can shorten your term: Switching from a 30-year to a 15-year mortgage might raise your monthly payment slightly, but will save you massive amounts in interest over the life of the loan.

-

You can eliminate Mortgage Insurance: If your home value has gone up and you now have 20% equity, refinancing out of an FHA loan to remove MIP is a smart financial move.

FAQs About Cost to Refinance Mortgage

Q1. What are the fees when refinancing?

The most common fees include the origination fee (lender prep), appraisal fee (property valuation), title insurance (legal protection), credit report fee, and government recording fees. Expect these to total 2-6% of the loan.

Q2. What is the 80/20 rule in refinancing?

The 80/20 rule refers to the Loan-to-Value (LTV) ratio. If you possess at least 20% equity in your home (meaning you only borrow 80% or less of its value), you typically avoid paying Private Mortgage Insurance (PMI), which significantly reduces your monthly costs.

Q3. What disqualifies you from refinancing?

You might be disqualified if your credit score has dropped significantly, your Debt-to-Income (DTI) ratio is too high (usually above 43-50%), or if you have "negative equity" (you owe more than the home is worth).

Final Word: Is Refinancing Worth the Cost?

Refinancing is a math problem, not a guessing game. It is worth the cost only if your monthly savings are significant enough to pay back those closing fees within a reasonable time frame, usually under 30 months. If you plan to move soon, it's likely money down the drain.

Don't rely on back-of-the-napkin math. To get a clear picture, I suggest heading over to Bluerate. You can find a verified loan officer who can look at your unique credit and equity situation. They will help you calculate your exact break-even point so you can decide with confidence.