Step-By-Step Guide: How to Refinance a Mortgage Loan?

I came across a Reddit post named "starting_the_refi_process" that hit close to home. They sounded completely lost, asking if anyone could explain refinancing like they were five years old. I get it. The first time I looked into refinancing my own place, I felt like I was trying to read a different language.

Between the acronyms and the banks asking for paperwork I didn't even know I had, it's enough to make you want to quit. But here's the thing: it's actually manageable if you break it down. While I've laid out every single step below based on my own experience, I'll let you in on a secret: the easiest way to start isn't by Googling alone. It's grabbing a free consultation with a decent loan officer. They can look at your specific numbers in five minutes and tell you if it's even worth the hassle.

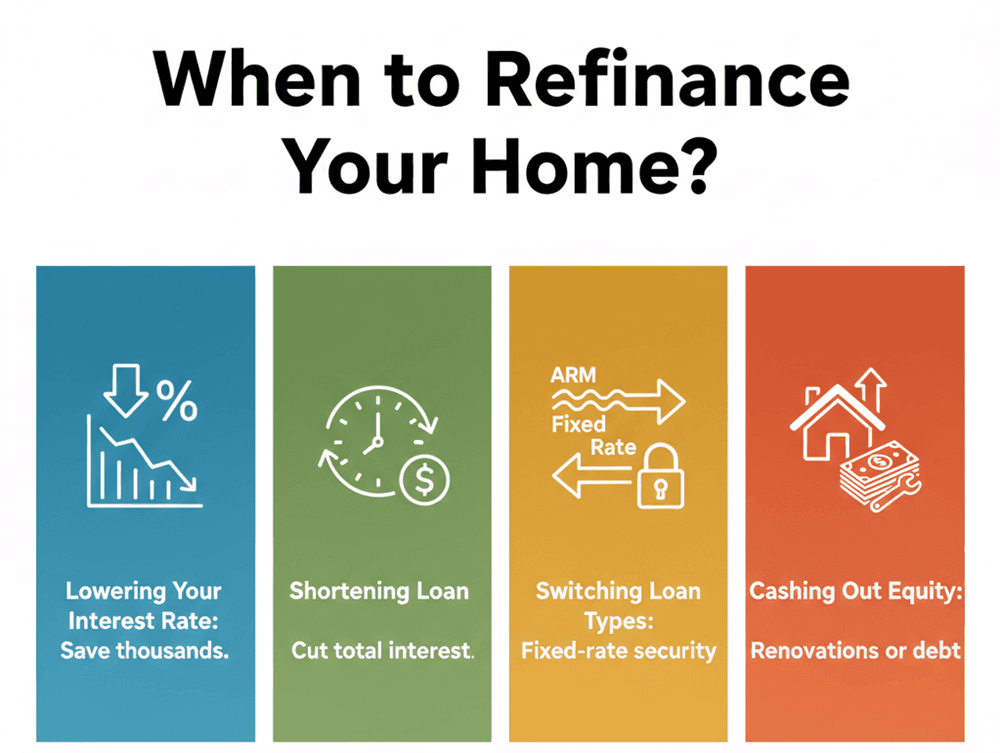

When to Refinance Your Home?

Before we talk about how, let's talk about why. Refinancing costs money, closing costs are no joke, so you need a solid reason to do it. I operate by the "Break-Even" rule. Basically, how many months will it take for the monthly savings to pay off the cost of the new loan? If you plan to move before that date, don't do it.

Here is when I'd seriously consider pulling the trigger:

-

Rates dropped: If current rates are 0.75% to 1% lower than yours, the math usually works out.

-

You want to pay it off faster: I have friends who switched from a 30-year to a 15-year term. Their monthly bill went up slightly, but they slashed massive amounts of interest.

-

Dump the ARM: If you have an Adjustable-Rate Mortgage and rates are creeping up, locking in a fixed rate lets you sleep better at night.

-

You need cash: Houses earn money just sitting there. You can do a "cash-out" refi to pull that equity out for renovations or to kill high-interest credit card debt.

How to Refinance a Mortgage with a Different Lender?

There is a weird myth out there that you have to stay with your current bank. Let me be clear: You don't owe them anything. In fact, switching lenders is often where the best deals are. The process is exactly the same whether you stay or go. The only difference? If you switch, your new lender just wires money to pay off the old one. That's it. If your current bank offers you a sweet loyalty discount, great, take it. But in my experience, loyalty doesn't pay bills. Shop around and go with whoever gives you the cheapest money.

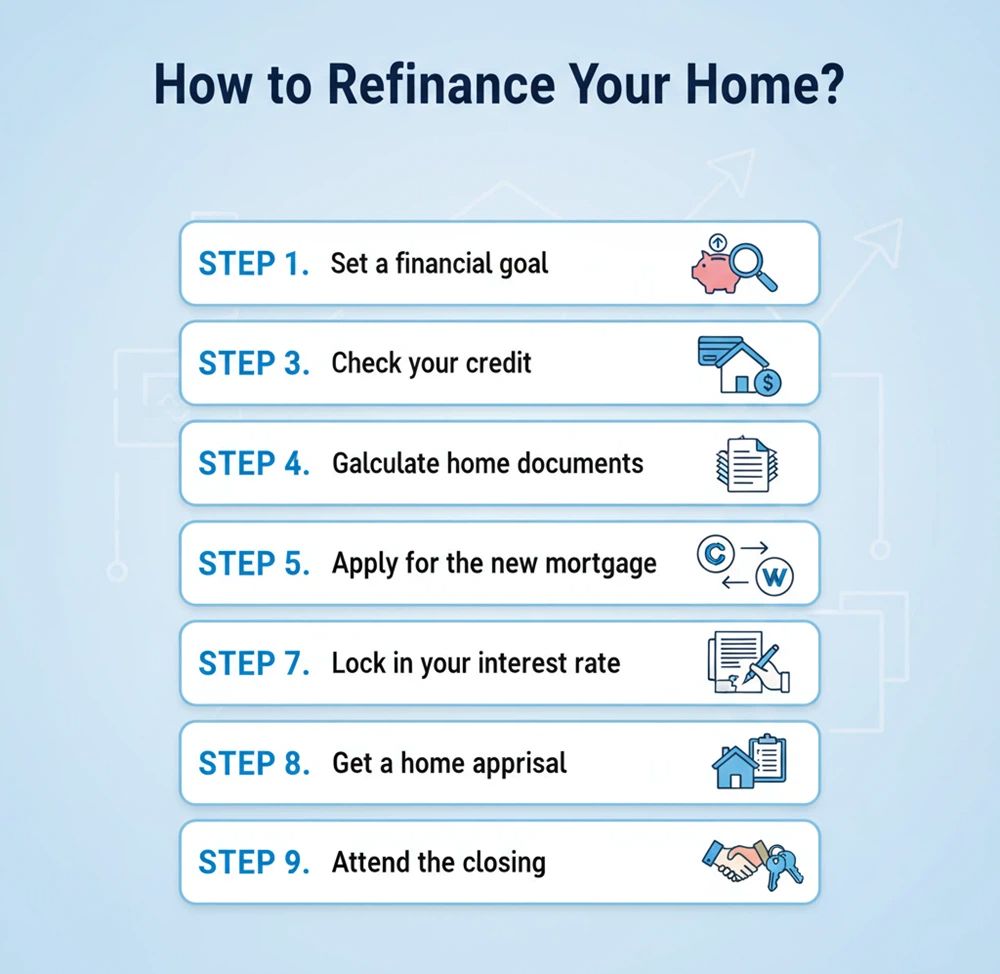

STEP 1. Set a Financial Goal

You need to know what "winning" looks like for you. I remember talking to my buddy, Mark. He just wanted the "lowest mortgage rate" possible. But when we dug deeper, his real stress was monthly cash flow because his wife had just quit her job. We realized that extending his term back to 30 years, even at a slightly higher rate than a 15-year loan, was actually the smarter move for his survival right now.

Don't just chase a number. Ask yourself: Do I need to lower my monthly payment to breathe easier? Do I want to be mortgage-free by the time the kids go to college? Or do I need $30k cash to fix the roof? Your goal dictates which loan product you pick. If you don't have a target, you'll likely end up with the wrong loan.

STEP 2. Check Your Credit

Your credit score is basically the gatekeeper to your savings. Before I even called a bank, I pulled my own report. Lenders typically want to see a FICO score of 620 or higher for a standard conventional loan. But here's the kicker: 620 gets you in the door. It doesn't get you the VIP treatment.

To get those rock-bottom rates you see in advertisements, you usually need a score closer to 760. If you check your score and it's sitting at 680, and you have some credit card debt you can pay down, do that first. Waiting a few months to bump your score up by 20 points could shave a quarter of a percentage point off your rate. Over 30 years, that tiny difference is enough to buy a new car. Don't skip this check.

STEP 3. Calculate Home Equity

Equity is just a fancy word for "how much of the house you actually own." To figure this out, take what your house is worth today (check Zillow or Redfin for a rough estimate) and subtract what you still owe on your mortgage.

Why does this matter? Because of the magic number: 20%. If you have less than 20% equity (meaning your Loan-to-Value ratio is over 80%), lenders will likely slap you with Private Mortgage Insurance (PMI). I hate PMI, it's money you pay to protect the bank, not you. Also, if you're hoping to take cash out, most lenders won't let you touch that last 20% of equity. Knowing your equity position upfront saves you from the disappointment of getting denied later.

STEP 4. Gather Your Documents

Refinancing is basically a giant scavenger hunt for paperwork. If you want this to go fast, have everything ready before you apply. Nothing slows down a loan like an underwriter waiting three days for you to find a tax return from 2023.

I recommend making a digital folder on your desktop with:

-

Pay stubs: The last 30 days.

-

W-2s: The last two years.

-

Tax Returns: Two years of full federal returns (especially if you have side hustles).

-

Bank Statements: Two months of all your accounts (checking, savings, 401k).

-

Current Mortgage Statement: Your latest bill.

Trust me, handing this over in one neat package makes your loan officer love you, and it speeds up the approval process significantly.

STEP 5. Compare Lenders

This is the most annoying but most profitable part of the process. You have to shop around. When I refinanced, the first offer I got seemed fine, but I checked two other places and found a rate 0.25% lower with fewer fees. That was basically free money.

However, calling five different banks, repeating your social security number, and listening to their sales pitch is exhausting. I really hate playing phone tag. This is where I suggest using a tool like Bluerate. Instead of doing all the legwork yourself, you can use their platform to connect with a loan officer for a free consultation. It cuts out the noise. You get a professional who can look at multiple options for you, answering your questions directly without the sales fluff. It's a much faster way to see what the market really offers.

STEP 6. Apply for the New Mortgage

Once you've picked your winner, it's time to make it official. You'll fill out the Uniform Residential Loan Application. It asks for everything: your income, your debts, and details about the house. Since you did the prep work in Step 4, this should be easy.

Within three business days of applying, the lender must send you a Loan Estimate. This is the holy grail document. It shows your interest rate, your monthly payment, and exactly how much cash you need to close. Read this thing while drinking your morning coffee. Check the spelling of your name. Check the loan amount. If the numbers look different than what the loan officer promised on the phone, call them immediately. This is your chance to catch mistakes.

STEP 7. Lock in Your Interest Rate

Mortgage rates move like the stock market, they change every day. I've seen people try to "time the market," waiting for rates to drop another tiny bit, only to watch them spike overnight. Don't gamble with your house.

Once you are happy with the numbers on your Loan Estimate, tell your lender to "lock it." A rate lock guarantees that your rate won't change for a set period (usually 30-45 days) while the paperwork gets processed. It protects you. If rates skyrocket next week, you're safe. If rates crash? Ask your lender if they have a "float down" option, but honestly, the peace of mind of a locked rate is worth more than betting on a 0.1% drop.

STEP 8. Get a Home Appraisal

Now the bank needs to verify your house is actually worth the money they are lending you. They will hire an independent appraiser to come visit. You usually pay for this, expect a bill for around $500 to $800.

I always treat appraisal day like I'm trying to sell the house again. I tidy up the yard, declutter the living room, and make sure the dog is out of the way. I also write down a list of upgrades I've done (like "New HVAC in 2025" or "Remodeled Master Bath") and hand it to the appraiser. It helps them justify a higher value. If the appraisal comes in too low, it can mess up your loan-to-value ratio, so you want that number as high as possible.

STEP 9. Attend the Closing

You're at the finish line. Three days before the final signing, you'll get a Closing Disclosure. It should match your Loan Estimate closely. If there are new, random fees, ask about them.

"Closing" is usually just you sitting in an office (or sometimes at your own kitchen table with a notary) signing your name about a hundred times. You'll also pay your refinance closing costs. These usually run 2% to 6% of the loan amount. So on a $300k loan, you might bring a cashier's check for $6,000 to $18,000, unless you rolled those costs into the loan balance.

Fun fact: If you are refinancing your primary home, federal law gives you a 3-day "Right of Rescission." That means you can change your mind and cancel the whole thing within three days of signing. It's a nice safety net.

FAQs About Refinancing a Mortgage

Q1. How much to refinance a mortgage?

It's not cheap. Expect to pay between 2% and 6% of your total loan amount. For most people, that lands somewhere between $5,000 and $10,000. This covers things like the appraisal, title search, and lender fees. You can consider estimating your refinance in advance.

Q2. How long does it take to refinance a mortgage?

Patience is key here. On average, it takes about 30 to 45 days from the moment you apply to the moment you close. If the market is crazy busy or your finances are complicated (like if you're self-employed), it could drag on to 60 days.

Q3. How much equity do you need to refinance?

The standard requirement is 20% equity if you want the best deal and want to avoid paying extra insurance (PMI). However, there are programs out there (like FHA or VA loans) that let you refinance with much less, sometimes with barely any equity at all.

Q4. What is the rule of thumb for when to refinance?

Old school advice says to refinance if you can drop your rate by 1%. But honestly, calculate your break-even point. If the savings cover the closing costs in under 24 months, it's usually a smart move, even if the rate drop is smaller.

Q5. Are there any restrictions on refinancing?

Yes. The big one is "seasoning." Most lenders make you wait 6 to 12 months after buying your home or closing your last mortgage before you can refinance again. Also, you generally can't refinance if the home is currently listed for sale.

Q6. What disqualifies you from refinancing?

If your credit score has tanked (under 620), you're underwater (you owe more than the home is worth), or your Debt-to-Income ratio is too high (usually over 43%), you'll likely get denied. Lenders need to know you can afford the new payment.

Conclusion

Refinancing isn't just about getting a lower interest rate. It's about taking control of your biggest monthly expense. It can free up cash, shorten your debt sentence, or help you tackle other financial goals. Yes, the paperwork is boring, and the process takes a month or two, but the feeling of saving hundreds of dollars every single month is absolutely worth it.

If you're feeling overwhelmed by the math or just want to see if today's rates are worth your time, don't guess. Head over to Bluerate. You can connect directly with a loan officer for a free consultation. They can run the numbers for you, compare rates, and give you a straight answer without you having to spend hours researching on your own. It's the smartest first step you can take.