Home Refinance Meaning: What Does Refinance Mean?

I was scrolling through Reddit recently and saw a user ask, "What is refinancing?" It hit home. We toss these financial terms around, but honestly, it can feel like a foreign language. I remember when I bought my first place, I was just happy to get the keys. I didn't want to think about the mortgage again for thirty years. But then rates dropped, and everyone kept asking, "Have you refinanced yet?" I felt lost.

Think of this article as your jargon-free guide. We'll break down exactly what refinancing means, why you might do it, and the hidden costs no one mentions. And if you decide it's the right move, you don't have to do it alone. You can use platforms like Bluerate to shop around and connect directly with a refinance loan officer who can crunch the numbers for you.

Definition: What is Home Refinance?

At its core, home refinance is simply the process of trading in your old mortgage for a new one. You aren't taking out a second mortgage on top of your current one. You are completely paying off your existing loan with a brand-new loan.

Why would you do this? Because the new loan comes with different terms. Maybe the interest rate is lower, the monthly payment is cheaper, or the duration of the loan is shorter.

Imagine you bought a car with a loan at 7% interest. Two years later, you find a bank offering 5%. You take a new loan at 5% to pay off the 7% loan. You still have the same car, but your payments are now structured differently. Home refinancing works exactly the same way. It is a financial "do-over" that allows homeowners to adjust their debt to fit their current life situation.

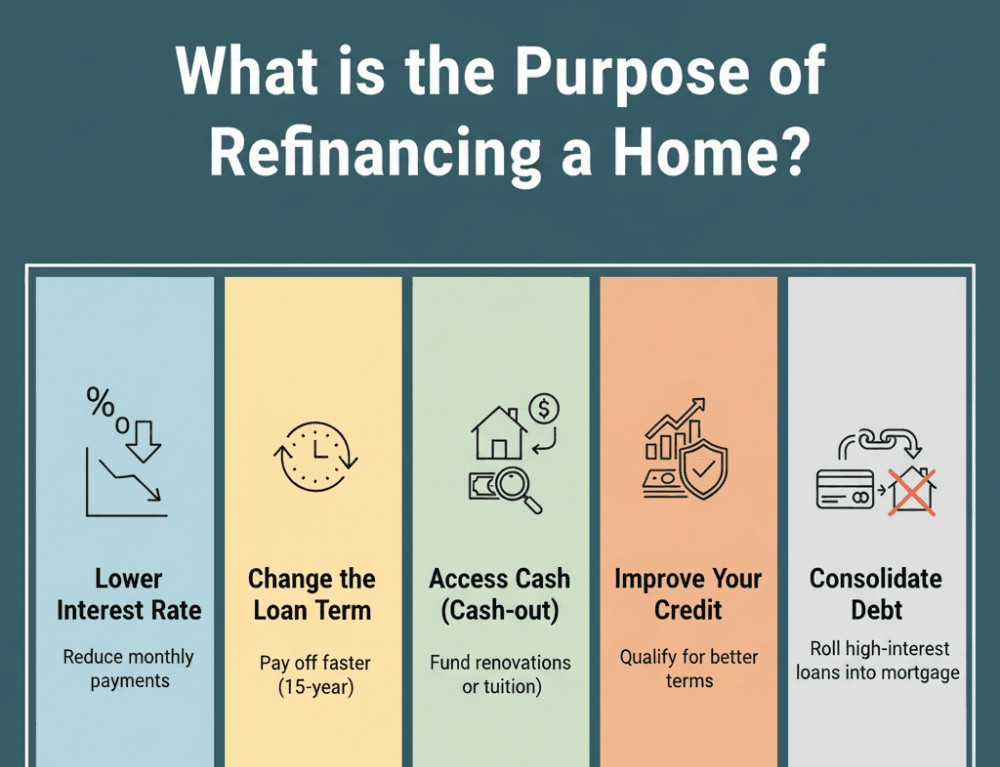

What is the Purpose of Refinancing a Home?

Why go through the paperwork again? Usually, it comes down to saving money or solving a financial problem. Here are the most common reasons homeowners refinance:

-

Lower interest rate: This is the classic reason. If market rates drop below what you are currently paying, refinancing can lower your monthly bill. For example, dropping your rate by just 1% can save thousands of dollars over the life of the loan.

-

Change the loan term: You might want to pay off your house faster. Switching from a 30-year to a 15-year mortgage increases your monthly payment, but you'll be debt-free a decade and a half sooner. Conversely, extending the term can lower monthly payments if cash flow is tight.

-

Access cash (Cash-out refinance): If your home has increased in value, you can tap into that equity. You take a bigger loan than you owe and pocket the difference in cash to pay for renovations or tuition.

-

Improve your credit: If your credit score has improved significantly since you bought your home, you might qualify for a better loan program today than you did years ago.

-

Consolidate debt: With credit card interest rates hovering around 23.99% in late 2025, many people refinance to roll that high-interest debt into their mortgage, which typically has a much lower rate.

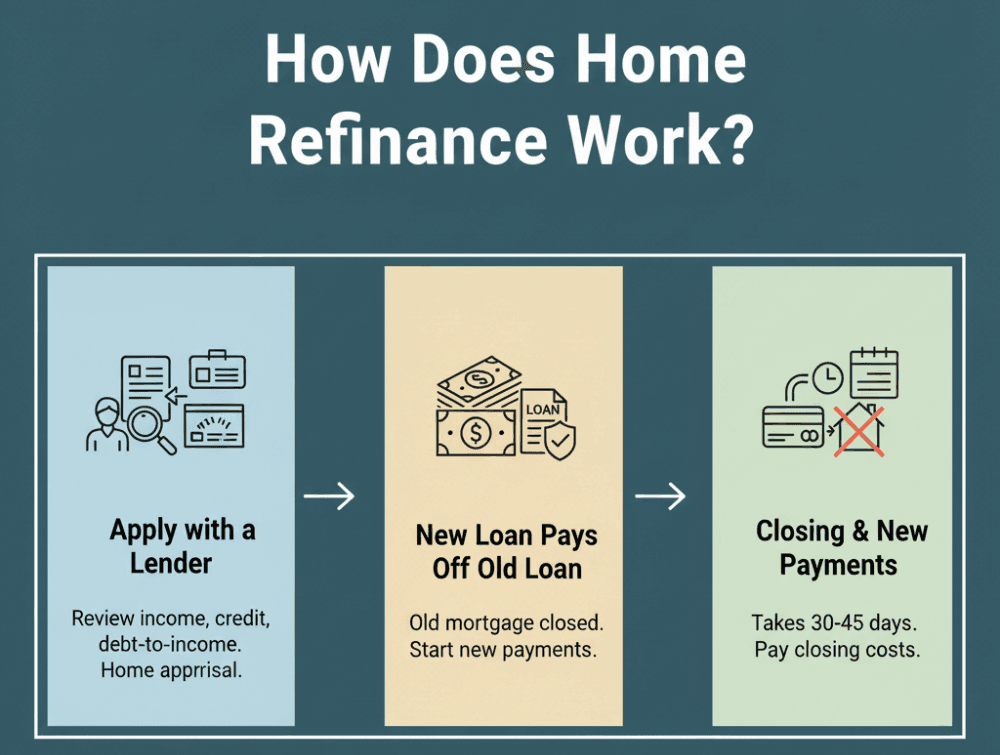

How Does Home Refinance Work?

Refinancing works almost exactly like applying for your original mortgage, but with less stress because you already own the home.

First, you apply with a lender. They will review your income, credit score, and debt-to-income ratio to ensure you can afford the new loan. In most cases, they will order a new appraisal to see what your home is currently worth.

Once approved, the new lender uses the funds from your new loan to pay off your old lender entirely. Your old mortgage account is closed, and you start making payments to the new lender.

It is important to note that this process isn't instant. It usually takes 30 to 45 days from application to closing. Also, because it is a new loan, you will have to pay "closing costs" again, which we will discuss later.

What are the Types of Mortgage Refinance?

There isn't just one way to refinance. Depending on your goal, whether it's saving cash or paying off the house sooner, there is a specific loan type for you.

Rate-and-term refinance

This is the most common "vanilla" option. You are simply changing the interest rate or the term (length) of your loan without taking any cash out. For example, if you have 25 years left on a 30-year mortgage at 7%, you might refinance into a new 15-year loan at 5.5%. Your goal here is purely financial efficiency, paying less interest or finishing the loan faster.

Cash-out refinance

This allows you to turn your home's equity into liquid cash. You take out a new mortgage for more than you currently owe. The new loan pays off the old one, and the difference is wired to your bank account. For instance, if you owe $200,000 but your home is worth $400,000, you might refinance for $250,000. You get the $50,000 difference (minus closing costs) to use for home improvements or other expenses.

Cash-in refinance

This is the opposite of a cash-out. Here, you bring a lump sum of money to the closing table to pay down your loan balance. Why would you do this? Usually, to get your Loan-to-Value (LTV) ratio below 80%. Doing this can eliminate private mortgage insurance (PMI) or qualify you for a significantly lower interest rate because the loan is less risky for the lender.

No-closing-cost refinance

"No-closing-cost" is a bit of a marketing trick. Lenders don't work for free. In this scenario, the lender pays your upfront closing costs (like appraisal and title fees), but in exchange, they charge you a slightly higher interest rate or roll the costs into your total loan balance. It saves you money today but costs you more in the long run.

Short refinance

A short refinance is not something you typically choose. It is a relief option for distressed borrowers. If you are underwater (owe more than the home is worth) and facing foreclosure, the lender may agree to refinance the mortgage for a lower amount than what is owed, forgiving the difference. This usually hurts your credit but saves you from losing your home.

Reverse mortgage

Designed for homeowners aged 62 and older, a reverse mortgage allows you to convert part of your home equity into cash without selling the home. You don't make monthly mortgage payments. Instead, the lender pays you. The loan balance grows over time and is typically repaid when you move out, sell the home, or pass away.

Debt consolidation refinance

This is a specific type of cash-out refinance where the goal is strictly to pay off high-interest debt. If you have $30,000 in credit card debt at 24% interest, rolling that into a mortgage at 6% or 7% can save you hundreds of dollars a month. It shifts unsecured, expensive debt into secured, cheaper debt.

Streamline refinance

If you have an FHA or VA loan, you might qualify for a streamline refinance. As the name suggests, it cuts out a lot of the red tape. These loans often require no home appraisal and very little income verification. The catch is that you must already have a government-backed loan to use this program, and it must provide a "net tangible benefit," like a lower payment.

Pros and Cons of Home Refinance

Before you sign on the dotted line, you need to weigh the good against the bad. Refinancing is a powerful tool, but it isn't free.

What are the Advantages of Refinancing a Home Loan?

Refinancing can transform your financial picture if done at the right time. Here are the main benefits:

-

Lower interest rate: This is the biggest money-saver. Reducing your rate not only lowers your monthly bill but also reduces the total amount of interest you pay the bank over the decades.

-

Lower monthly payments: By securing a lower rate or extending your loan term (e.g., restarting a fresh 30-year term), you can significantly drop your required monthly payment. This frees up cash flow for groceries, savings, or other bills.

-

Shorter loan term: If you are making more money now than when you first bought, you can refinance into a 15-year mortgage. You will own your home free and clear much faster.

-

Longer loan term: If you are struggling with cash flow, extending your term can reduce the pressure. It costs more in the long run, but helps you survive specifically tight months.

-

Eliminate PMI: If your home value has gone up and you now have 20% equity, refinancing can remove Private Mortgage Insurance. Since PMI does nothing for you (it protects the lender), getting rid of it is pure savings.

-

Borrow money: A cash-out refinance is often the cheapest way to borrow large sums of money compared to personal loans or credit cards.

What are the Disadvantages of Refinancing a Home Loan?

It's important to look at the math, not just the monthly payment. Here are the downsides:

-

Closing costs: Refinancing isn't cheap. In 2024 and 2025, average closing costs of refinancing typically range between 2% and 6% of the loan amount. On a $300,000 loan, that's $6,000 to $18,000 you have to pay upfront or roll into the loan. You need to calculate your "break-even point" to see if it's worth it.

-

Increased total interest: If you have been paying your mortgage for 10 years and then refinance into a new 30-year loan, you are resetting the clock. You might lower your monthly payment, but you will be paying interest for a total of 40 years instead of 30.

-

Higher monthly payments: If you switch to a shorter term (like 15 years) to save on interest, your monthly bill will jump up. You need to be 100% sure your budget can handle that hike.

-

Reduced home equity: With a cash-out refinance, you are literally lowering the percentage of the home you own. If housing prices drop, you could end up "underwater" (owing more than the house is worth).

-

Process and time: It takes time to gather pay stubs, tax returns, and bank statements. It's a hassle.

-

Temporary credit score impact: Lenders will do a "hard pull" on your credit, which can drop your score by a few points temporarily.

-

Risk of a lower appraisal: If the appraiser says your home is worth less than you thought, you might not qualify for the loan, but you might still be out the money for the appraisal fee.

-

Risk of borrowing too much: If you use a cash-out refinance to pay off credit cards but don't fix your spending habits, you might run up the credit cards again, and now you have a bigger mortgage and new credit card debt.

How to Refinance Your Mortgage?

Ready to move forward? The process is fairly standardized, but who you work with matters. Also, it's recommended to estimate your home finance before you make up your mind for a new loan. To learn more details, you can check here: Step-By-Step Guide: How to Refinance a Mortgage Loan?

STEP 1. Check your credit: Ensure your score is in good shape to get the best rates.

STEP 2. Estimate your equity: You generally need at least 20% equity to get the best terms and avoid PMI.

STEP 3. Shop around: This is the most critical step. Don't just take the first offer from your current bank. Rates vary wildly between lenders.

STEP 4. Apply and lock your rate: Submit your documents. Once you see a rate you like, "lock" it so it doesn't change before you close.

STEP 5. Close the loan: Sign the paperwork and pay your closing costs.

This is where Bluerate shines. Instead of calling five different banks and repeating your story, you can use Bluerate to easily compare options. They connect you directly with experienced refinance loan officers who know the local market. It's a smarter way to shop around and ensure you aren't leaving money on the table.

FAQs About Refinancing a Home

Q1. Does refinancing mean you pay more?

It depends on how you look at it. You might pay less per month, but pay more in total interest over the long run if you extend your loan term (e.g., turning a 20-year balance back into a 30-year loan). However, if you refinance to a lower rate and keep the same term, you will pay less.

Q2. Do you get money when you refinance?

Only if you do a cash-out refinance. In a standard "rate-and-term" refinance, you don't receive any cash. The transaction is just paperwork, moving debt from one lender to another. With a cash-out, the difference between your old loan and the new loan is paid to you.

Q3. Does refinancing mean starting over?

Yes, in terms of the timeline. You are taking out a brand-new loan. If you have paid off 5 years of a 30-year mortgage and refinance into a new 30-year loan, you restart the clock at year zero. However, you can choose to refinance into a shorter term (like 20 or 15 years) to avoid this "starting over" feeling.

Q4. Is it better to refinance or pay extra?

This is a math question. If your current interest rate is high (e.g., 7-8%), refinancing to a lower rate is usually better. If your rate is already low (e.g., 3-4%), refinancing probably doesn't make sense. In that case, making extra principal payments will save you money without the hassle and closing costs of refinancing.

Conclusion: Is refinancing a good or bad idea?

Is refinancing a smart move? The honest answer is: it depends on the math.

Refinancing is a fantastic idea if you can lower your interest rate by at least 0.75% to 1%, or if you need to escape a high-interest debt trap. It's a bad idea if you are planning to move in the next few years, as you won't have enough time to recoup the closing costs through your monthly savings.

Don't guess with your biggest financial asset. Take a moment to check Bluerate to see what real rates look like for your specific situation. A quick conversation with a loan officer can clarify whether you'll save $50 or $50,000. It's worth the check.