What is Break Even Point in Mortgage? Learn Here

I still remember sitting across the desk from a loan officer for the first time. I was staring at a pile of paperwork, trying to make sense of the "Loan Estimate" in front of me. He kept talking about upfront fees and lower rates, but all I could hear was the cha-ching of money leaving my bank account. Then he dropped a phrase that changed how I looked at the deal: "Don't worry, your break-even point is only 18 months."

If you are a homebuyer or a homeowner looking to refinance, you've probably heard this term thrown around, too. You might be wondering, "Why does this matter?" or "Is this just another way for the bank to sell me a loan?"

Here is the truth: Understanding the break-even point in mortgage is the single most important tool you have to avoid throwing money away. It's the difference between a smart financial move and a costly mistake. In this guide, I'll walk you through exactly what it is, why it protects your wallet, and how to calculate it yourself before you sign on the dotted line.

Definition: What is the Break-Even Point in Mortgage?

Let's strip away the banking jargon. Simply put, the mortgage break-even point is the specific moment in time when the money you save from a lower interest rate finally exceeds the money you paid to get that new loan.

Think of it as a "Cost Recovery Date." When you get a mortgage, especially during a refinance, you almost always have to pay closing costs upfront. These are fees for things like appraisals, title insurance, and origination charges. The break-even point is the finish line where you have "paid yourself back" for those upfront costs.

Here is how I like to visualize it:

-

Before the Break-Even Point: You are technically "in the hole." Even though your monthly payment is lower, you are still recovering the thousands of dollars you spent at the closing table.

-

After the Break-Even Point: This is the "freedom zone." Every month you stay in the home past this date represents actual, net-positive savings in your pocket.

In the mortgage industry, this metric is always measured in months or years. It isn't a dollar amount. It's a timeline. It answers the critical question: "How long do I need to live in this house for this loan to actually make sense?" If you plan to move before hitting that date, the loan isn't saving you money, it's costing you.

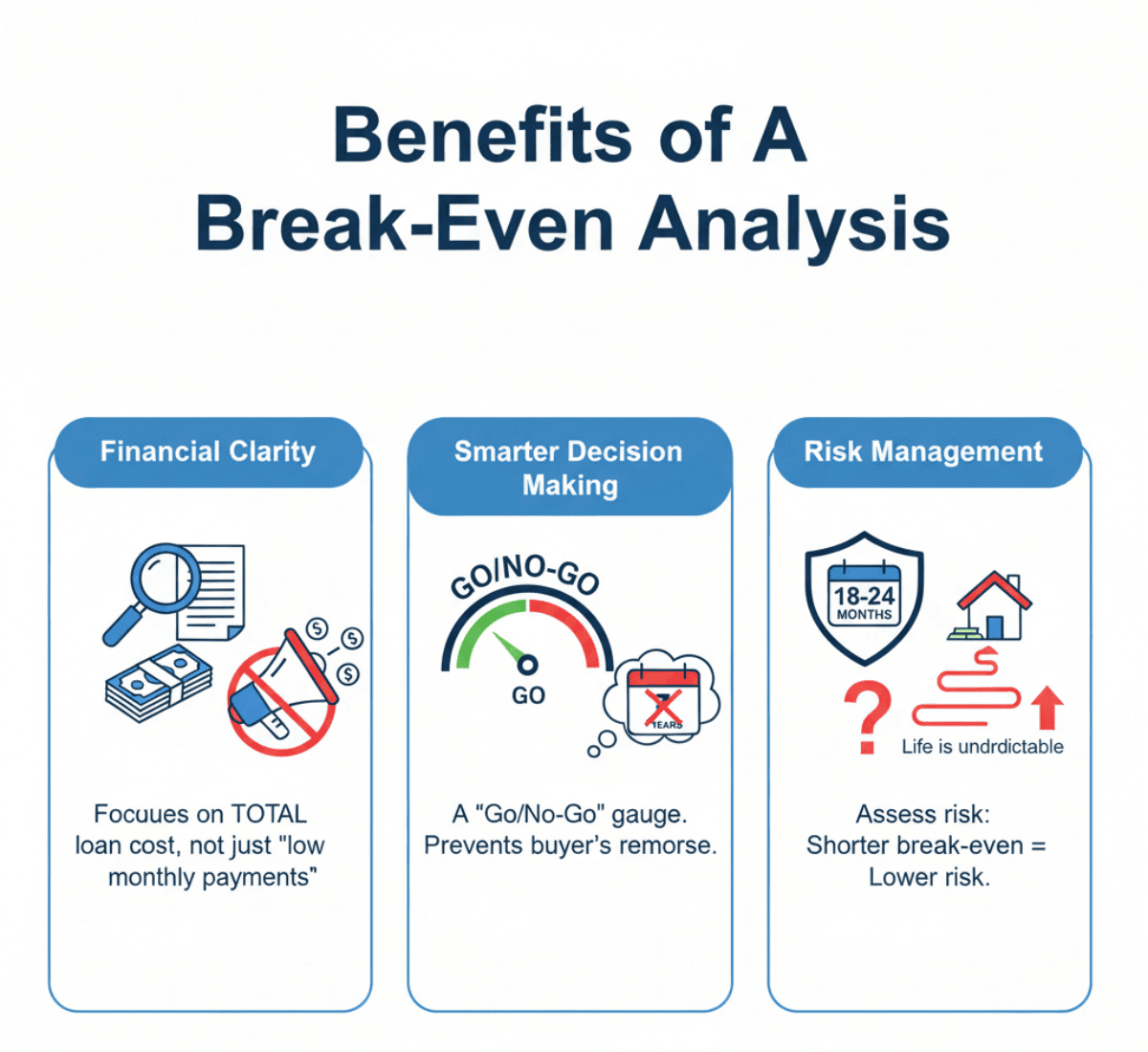

Benefits of A Break-Even Analysis

Why should you bother doing this math? I've seen too many friends get excited about a slightly lower interest rate, only to spend thousands in fees that they will never recoup because they moved two years later. A proper break-even analysis offers three massive benefits:

-

Financial Clarity: Marketing flyers love to shout about "low monthly payments," but they rarely mention the $6,000 or $8,000 in closing costs hidden in the fine print. This analysis forces you to look at the total cost of the loan, not just the monthly sticker price. It cuts through the marketing noise.

-

Smarter Decision Making: It acts as a "Go/No-Go" gauge for your loan. If your calculation shows it will take 7 years to break even, but you plan to upgrade to a bigger house in 5 years, the math gives you a clear "No." It prevents buyer's remorse.

-

Risk Management: Life is unpredictable. Jobs change, and families grow. By knowing your break-even point, you can assess your risk. A shorter break-even, like 18 to 24 months, is low risk because it's easier to predict your life two years out than ten years out.

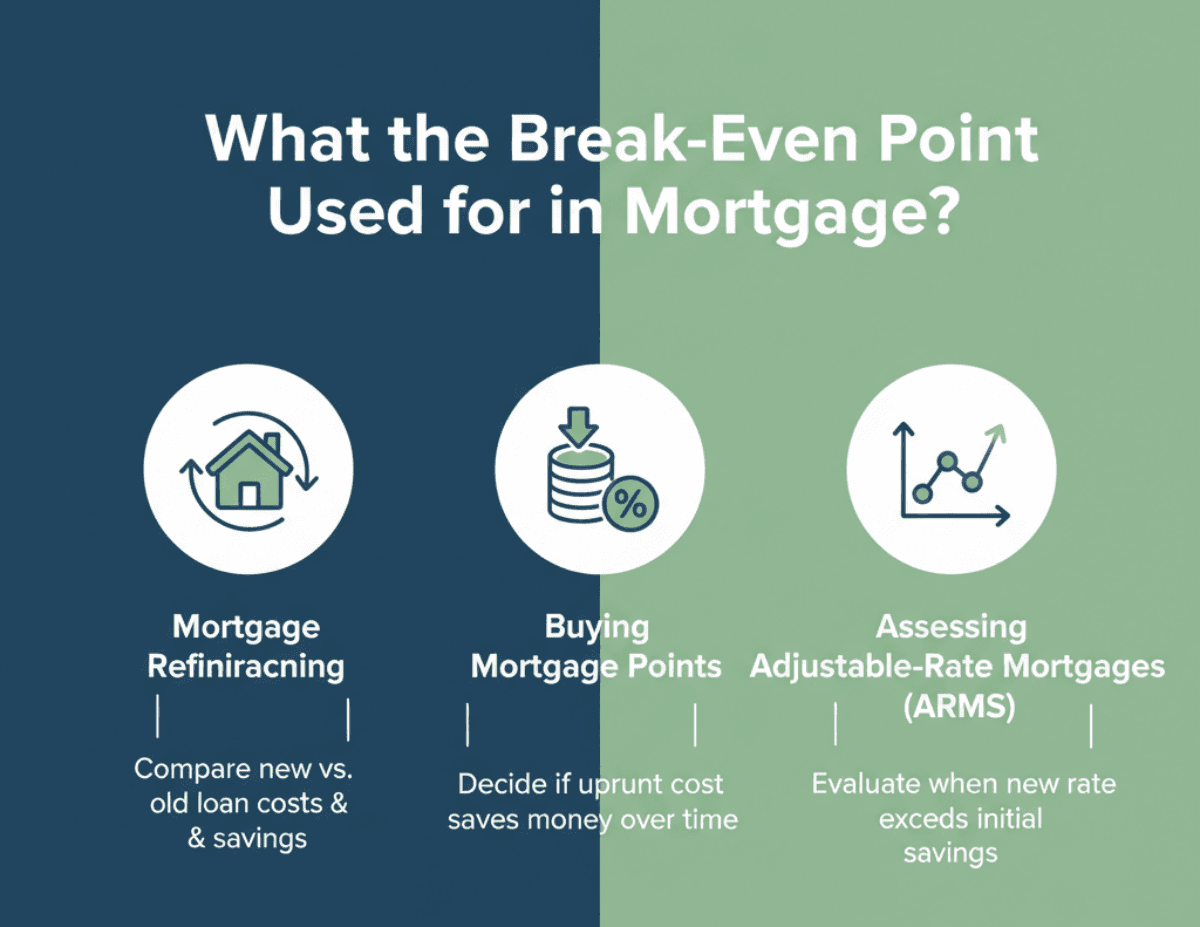

What is the Break-Even Point Used for in Mortgage?

In my experience as a financial writer and homeowner, the break-even point isn't just a theoretical concept. It is a practical tool used in three specific scenarios. If you are in any of these situations, you need to run these numbers.

Mortgage Refinancing (The Most Common Use)

This is the big one. When interest rates drop, lenders will flood your mailbox with refinance offers. They will promise to drop your payment by $150 a month. But if they charge you $5,000 in closing costs to do it, you need the break-even point to see if that trade-off is worth it.

I usually advise people that if the break-even point is longer than 3-4 years, they need to be extremely confident they are staying in that "forever home." If it's over 5 years, the refinance is rarely worth the hassle unless it significantly improves your cash flow.

Buying "Discount Points"

When you are buying a home, your lender might ask, "Do you want to pay mortgage points to lower your rate?" This means paying an extra fee upfront (usually 1% of the loan amount per point) to get a lower interest rate for the life of the loan.

Many buyers pay for points but sell the house five years later. They paid extra upfront for long-term savings they never stuck around to enjoy. The break-even calculation tells you exactly how long you must own the home to justify buying those points.

Assessing Adjustable-Rate Mortgages (ARMs)

If you are switching from an ARM to a fixed-rate mortgage to lock in stability, the math changes slightly. Here, you are paying costs to buy "peace of mind." While the financial break-even is still important, you might accept a longer break-even period just to sleep better at night knowing your rate won't skyrocket next year.

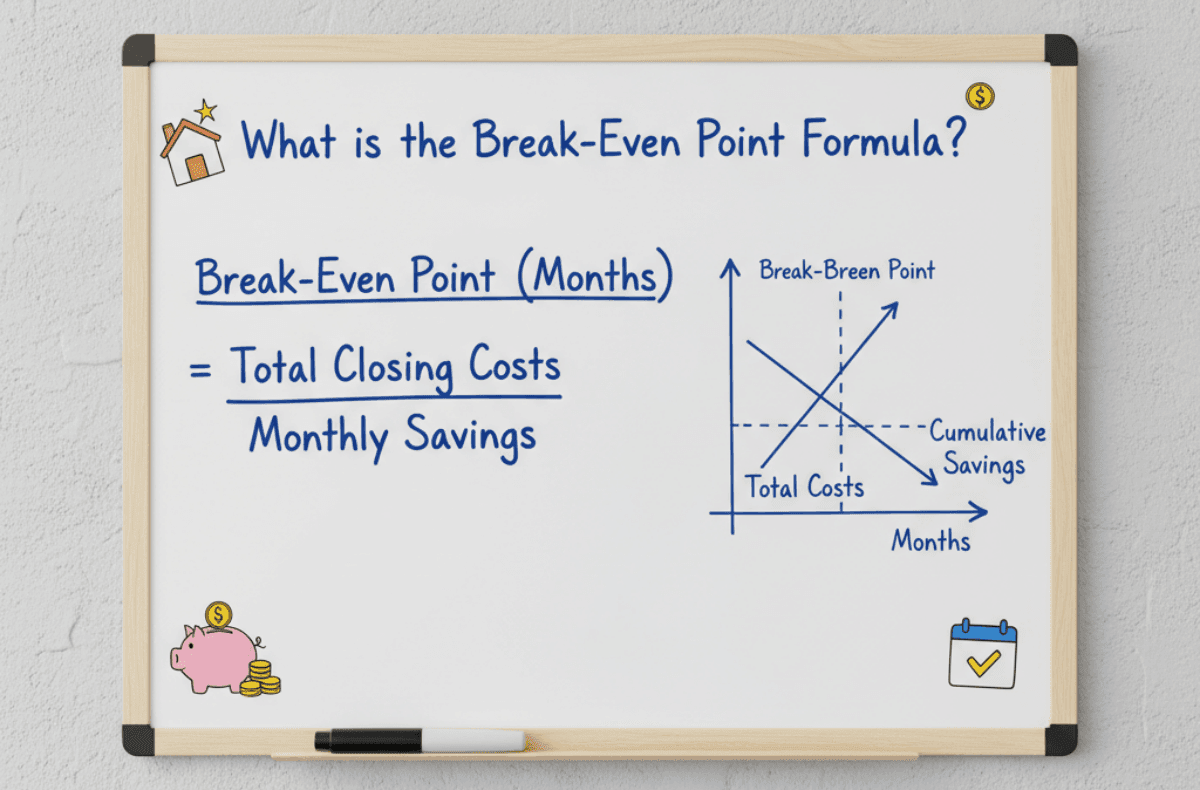

What is the Break-Even Point Formula?

The math here is surprisingly simple. You don't need a fancy financial calculator or an advanced degree to figure this out. I use this basic equation every time I review a Loan Estimate:

Break-Even Point (Months) = Total Closing Costs / Monthly Savings

Let's break down the variables so you don't make a mistake:

-

Total Closing Costs: This is the Cost to Refinance. You can find this on your official "Loan Estimate" document under "Closing Cost Details" (Section J). Do not include "Prepaids" or "Escrow" funds (like property taxes and insurance) in this number. Those are costs you would pay regardless of whether you refinance. Only count the fees for the loan itself (origination, title, appraisal).

-

Monthly Savings: This is the difference between your old principal and interest payment and your new one. Again, exclude taxes and insurance. Property taxes change because of your local government, not your lender. If you include them, your calculation will be wrong.

How To Calculate the Breakeven Point?

Let's walk through a real-world example. Imagine I bought my home a few years ago when rates were higher, and now I want to refinance to save some cash.

Here is my scenario:

-

Current Mortgage Payment (Principal & Interest): $2,600

-

New Proposed Mortgage Payment: $2,350

-

Monthly Savings: $250 ($2,600 - $2,350)

Next, I look at the fees. The lender is charging me for the application, the appraisal, the title search, and a small origination fee.

- Total Closing Costs: $6,000

Now, I apply the formula:

$6,000 (Closing Costs) / $250 (Monthly Savings) = 24 Months

What does this result tell me? This result of 24 months means that for the first two years after refinancing, I am not actually "saving" money. I am simply reimbursing myself for the $6,000 I spent to get the loan.

-

If I sell the house in Month 12: I have actually lost money on this deal.

-

If I sell the house in Month 24: I have broken even. I haven't gained or lost anything (except the time spent on paperwork).

-

If I stay for 5 years (60 months): Now we are talking. For the remaining 36 months after the break-even point, that $250 savings is pure profit. That's $9,000 in real savings (250 x 36).

In the US market, closing costs typically range between 2% and 6% of your loan amount. If your calculated break-even point is under 30 months, it is generally considered a "slam dunk" deal. If it is between 30 and 48 months, it's decent, but you need to be sure about your future plans. Anything over 60 months is risky territory.

Conclusion

Understanding the Break-Even Point in Mortgage is about more than just doing fifth-grade math. It is about protecting your future flexibility. It serves as a reality check against the exciting promises of lower rates.

Before you sign any mortgage documents, I encourage you to sit down, ignore the sales pitch, and look strictly at the numbers. Ask yourself the hard question: "Will I definitely be living in this house three or four years from now?" If the answer is "maybe" or "no," a refinance with high closing costs might be a bad investment, even if the interest rate looks amazing.

Remember, the goal of a mortgage isn't just to get the lowest rate possible. It's to build wealth. And you can't build wealth if you are constantly resetting your break-even clock every few years. Run the numbers, trust the math, and make the decision that fits your life, not just the lender's sales quota.