How Much Do Mortgage Points Cost? Take a Look Here

I've sat across the desk from hundreds of homebuyers, and I can tell you that the moment we start talking about "interest rates" is usually when the stress levels spike. In today's market, where rates have hovered at levels we haven't seen in over a decade, everyone is looking for a hack to lower that monthly payment.

This is usually when a lender might slide a piece of paper across the table and say, "Well, we could get you a lower rate if you pay points."

Suddenly, you're confused. You thought you were just paying a down payment and closing costs. Now there's another fee?

If you are wondering, "How much do mortgage points actually cost, and are they worth it?" you are in the right place. I'm not just going to give you a textbook definition. I'm going to help you run the math so you don't throw thousands of dollars down the drain for a discount you might not need.

Let's break down the real cost of buying down your rate.

What are Mortgage Points?

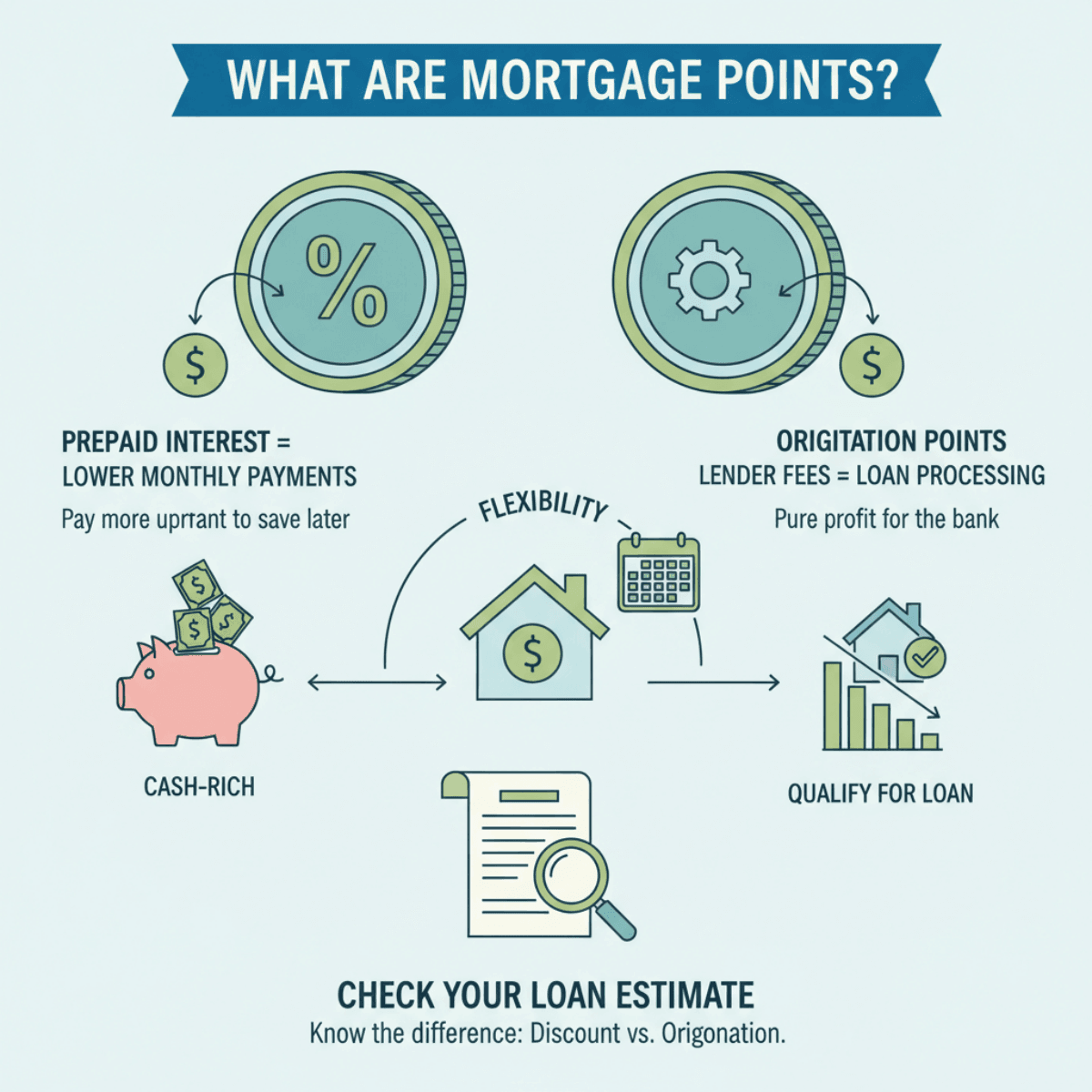

Before we talk about dollars and cents, let's clear up the jargon of what mortgage point is. In the mortgage world, you might hear these called "discount points."

Think of mortgage points as prepaid interest. Essentially, you are paying the bank a fee upfront at the closing table in exchange for a lower interest rate for the life of your loan. It's a trade-off: you pay more today to pay less every month.

Why does this exist? Lenders offer this to give you flexibility. If you are cash-rich but income-tight, buying points can help you qualify for a loan by lowering your monthly debt obligation.

Be careful not to confuse "discount points" with "origination points." Origination points are just fees the lender charges to process the loan (pure profit for them), whereas discount points actually lower your interest rate. You should always check your Loan Estimate document to see which is which.

How Much is a Point on a Mortgage?

This is where the math comes in, but don't worry, it's straightforward.

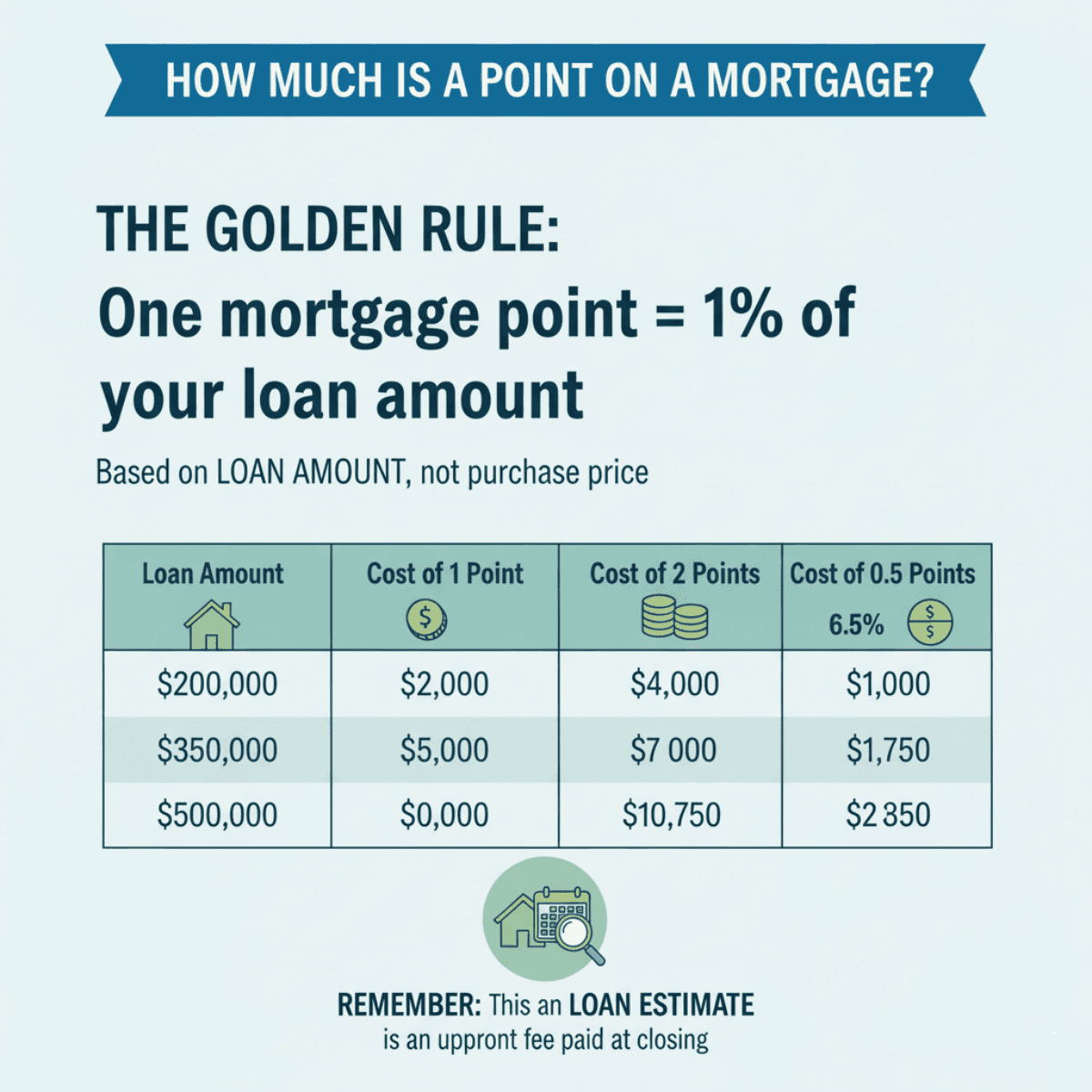

The Golden Rule: One mortgage point equals 1% of your loan amount.

Please read that again: it is based on your loan amount, not the purchase price of the house. If you are putting 20% down, you aren't paying points on that down payment portion.

Here is a breakdown of how the costs scale with different loan sizes:

What do you get for that cost? Generally speaking, paying 1 point will lower your interest rate by 0.25% (e.g., dropping from 7.0% to 6.75%).

However, this isn't a law written in stone. Lenders have their own pricing sheets that change daily. Sometimes, 1 point might get you a 0.375% reduction. Other times, the market is so volatile that 1 point only buys you 0.125%.

You don't have to buy a whole point. I often structure loans where a client buys 0.375 points or 1.125 points to hit a specific "sweet spot" in pricing. It's highly customizable. You may find a loan officer to help you with that.

Is It a Good Idea to Buy Points on a Mortgage?

The honest answer? It depends entirely on how long you keep the mortgage.

I often tell my clients: "Don't buy mortgage points if you're dating the house. Only buy mortgage points if you're marrying the mortgage."

When it's a "Yes"

Buying points is a smart financial move if this is your "forever home" and you plan to stay put for 10, 15, or 30 years without refinancing. If you pay $4,000 upfront to save $100 a month, and you stay in the loan for 10 years, you've saved significantly more than you spent.

When it's a "No"

If you plan to sell the house in three years, or if you think interest rates will drop next year (allowing you to refinance), buying points is a waste of money.

Imagine paying $5,000 today to lower your rate, only to sell the house in two years. You might have only "saved" $2,000 in monthly payments during that time. You just lost $3,000. In high-rate environments, many people avoid points because they hope to refinance as soon as rates dip.

Considerations Before You Buy Mortgage Points

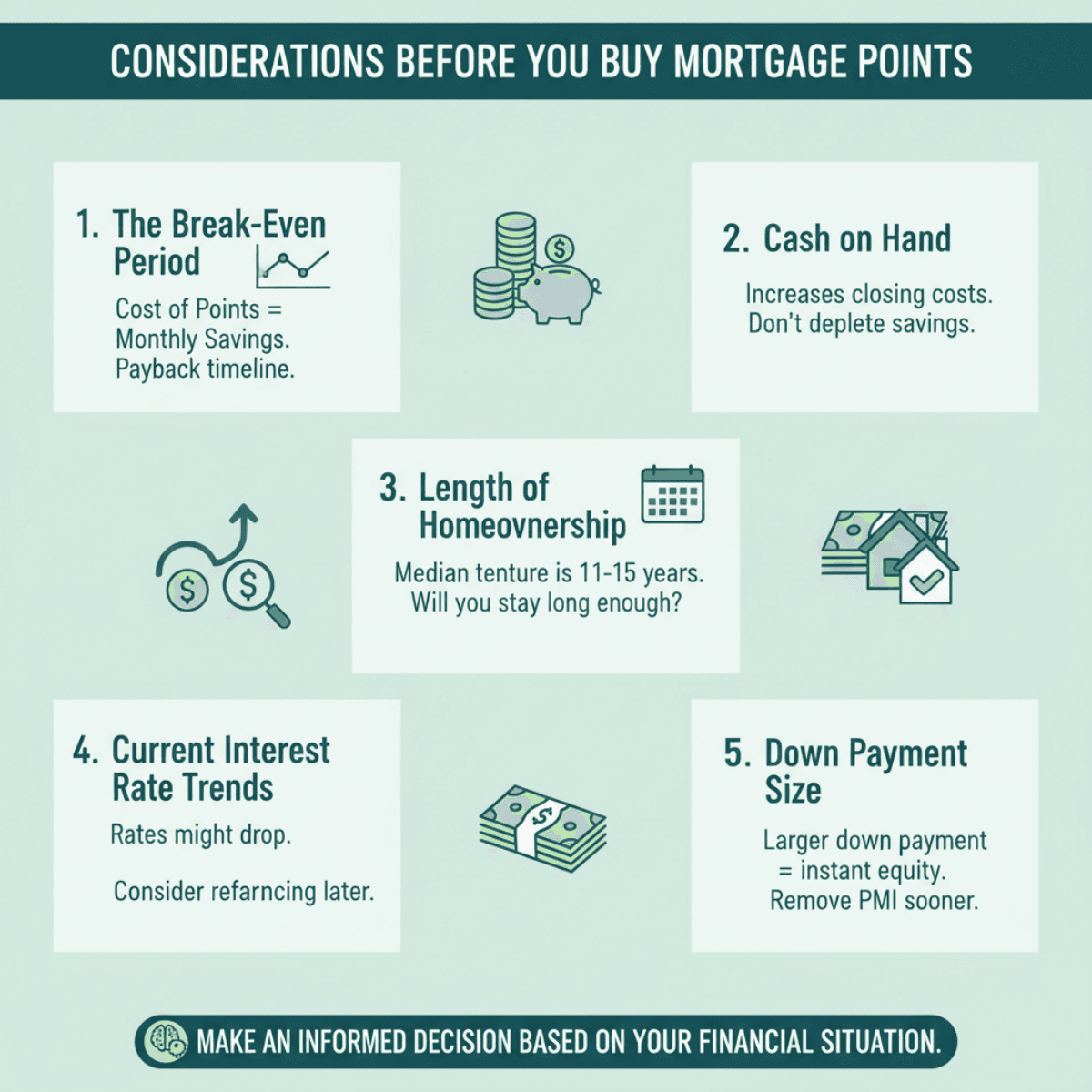

Deciding to pay for points is a strategic gamble. Before you wire that extra cash to the title company, here are five factors you must weigh carefully.

-

The Break-Even Period: This is the most critical metric. You calculate this by dividing the Cost of Points by the Monthly Savings.

- Example: Cost is $4,000. Monthly savings is $80.

- $4,000 ÷ $80 = 50 months.

- You need to keep this loan for 4 years and 2 months just to make your money back. If you move before then, you lose money.

-

Cash on Hand: Buying points increases your closing costs ("cash to close"). Do you have enough liquidity? Don't deplete your emergency fund just to save $40 a month. Once that money is paid to the lender, you can't get it back for a rainy day.

-

Length of Homeownership: According to recent data from the National Association of Realtors, the median time homeowners stayed in their home before selling was 11 years last year—a record high—and buyers now expect a median tenure of 15 years in their new home.

-

Current Interest Rate Trends: Look at the broader economic landscape. If financial experts and the Federal Reserve are signaling that rates will drop in the next 12-24 months, paying heavy points now might be unwise. You'd be better off taking the slightly higher rate now and refinancing for free or low cost when the market improves.

-

Down Payment Size: Sometimes, using that extra $3,000 to increase your down payment is better than buying points. A larger down payment builds instant equity and might help you remove PMI (Private Mortgage Insurance) sooner, which could save you more money than a slightly lower interest rate.

FAQs About the Cost of Mortgage Points

I hear these questions almost every day. Here are the quick, direct answers to help you navigate the details.

Q1. How much does 1 point affect a mortgage payment?

Typically, purchasing 1 point lowers your interest rate by 0.25%.

Let's use real numbers: On a $400,000 loan with a 30-year fixed term:

- At 7.0%, principal and interest are roughly $2,661.

- At 6.75% (paying 1 point), it drops to $2,594.

- The Result: You save about $67 per month. You would need to determine if the upfront cost (approx. $4,000) justifies that $67 monthly savings.

Q2. How much is 2 points of interest?

Buying 2 points costs 2% of your loan amount. For a $300,000 mortgage, that is a hefty $6,000 upfront fee.

Generally, buying 2 points might lower your rate by roughly 0.50% to 0.75% depending on the lender's scale. While the monthly savings are larger, the "break-even horizon" often gets longer because the upfront cost is so high. This is usually only recommended for people who are absolutely certain they will never move or refinance.

Q3. Is it better to buy down rate or pay points?

These terms are often used interchangeably, but there is a nuance. "Paying points" usually refers to a permanent rate buydown for the life of the loan.

However, there is also a "Temporary Buydown" (like a 2-1 Buydown), where the seller pays to lower your rate for just the first two years.

In a high-interest market, temporary buydowns (paid for by the seller) are often better than permanent points because they cost less and protect you if you plan to refinance soon.

Q4. Are mortgage points tax-deductible?

Yes, in most cases. According to the IRS (Topic No. 504), mortgage interest points are generally deductible as itemized deductions on Schedule A.

However, there are caps. Under current tax law (TCJA, extended through 2025), you can deduct interest on up to the first $750,000 of acquisition debt ($375,000 if married filing separately) for mortgages taken out after December 15, 2017. Discount points are generally deductible if they meet IRS criteria like being for your principal residence and paid from your funds.

Also, the points must be defined as interest (not service fees) and you must have paid them directly.

Q5. How much would 3 points cost for a $250,000 loan?

The math is simple: $250,000 × 0.03 = $7,500

That is a significant amount of cash to bring to closing. You would likely need to see a very steep drop in the interest rate (usually close to 1%) to make this investment worth it. Most borrowers rarely buy 3 points unless a builder or seller is covering the cost for them.

Conclusion

Mortgage points are not a scam, but they aren't a magic bullet either. They are simply a financial tool—a lever you can pull to adjust your loan structure.

The cost is simple to calculate (1% of the loan per point), but the value is harder to predict. It ultimately comes down to your timeline. If you have the cash and the long-term commitment to the property, points can save you tens of thousands of dollars over the decades. If you are looking for flexibility, keep your cash in your pocket.

Don't just guess. Ask your loan officer to provide a "Break-Even Analysis" report. Seeing the numbers on paper makes the decision much easier.