![[Guide] 50 Year Mortgage: What Is It? Who Offers? How to Get?](/_next/image?url=https%3A%2F%2Fdynamic-light-ab6e2536d6.media.strapiapp.com%2F50_year_mortgage_banner_f300e8fffd.png&w=3840&q=75)

[Guide] 50 Year Mortgage: What Is It? Who Offers? How to Get?

If you've been scrolling through Truth Social or watching the news lately, you've likely seen the buzz surrounding President Trump's latest proposal to tackle the housing affordability crisis: the 50-year mortgage. With home prices hovering near record highs and interest rates refusing to drop back to 2020 levels, this "game changer", as described by FHFA Director Bill Pulte, is being pitched as the silver bullet for first-time buyers.

But as someone who has crunched mortgage numbers for years, I know that if something sounds too good to be true, it usually is. Is this loan a lifeline for your wallet, or a debt trap for your future? In this guide, I'll walk you through exactly what a 50-year mortgage is, the math behind it, and whether you should actually consider one.

What is a 50 Year Mortgage?

At its core, a 50-year mortgage is exactly what it sounds like: a home loan where the repayment schedule (amortization) is stretched over five decades instead of the standard 30 years.

Historically, these loans were extremely rare in the United States. They were mostly found in the "Non-QM" (Non-Qualified Mortgage) market, a niche sector for borrowers who don't fit the standard mold, or used as a distress tool for "loan modifications" to prevent foreclosure. However, the conversation shifted dramatically in late 2025.

President Trump and his administration have proposed making these ultra-long-term loans a standard option backed by government-sponsored entities like Fannie Mae and Freddie Mac. The logic is simple: by spreading the payments out over an extra 20 years, your monthly bill drops, theoretically helping you qualify for a home you otherwise couldn't afford.

Currently, this product targets two main groups:

- First-time homebuyers priced out of the market by high monthly payments.

- Real Estate Investors looking to maximize cash flow by minimizing monthly obligations.

Can you refinance into one? Yes. In fact, most people encountering 50-year terms today aren't buying new homes. They are struggling homeowners renegotiating their terms to avoid default. However, the new proposal aims to make this a mainstream purchase product.

It is important to note that as of late 2025, standard "Qualified Mortgage" laws still favor the 30-year fixed loan. For the 50-year mortgage to become as common as the 30-year, Congress and the CFPB (Consumer Financial Protection Bureau) would need to adjust regulations to protect lenders from the higher risk of default that comes with such a long commitment. Until then, these remain somewhat of a "specialty" product.

Pros and Cons of 50 Year Mortgage

When I look at financial products, I always tell my clients: "There is no free lunch." The 50-year mortgage trades short-term relief for long-term cost. Here is the reality of the trade-off.

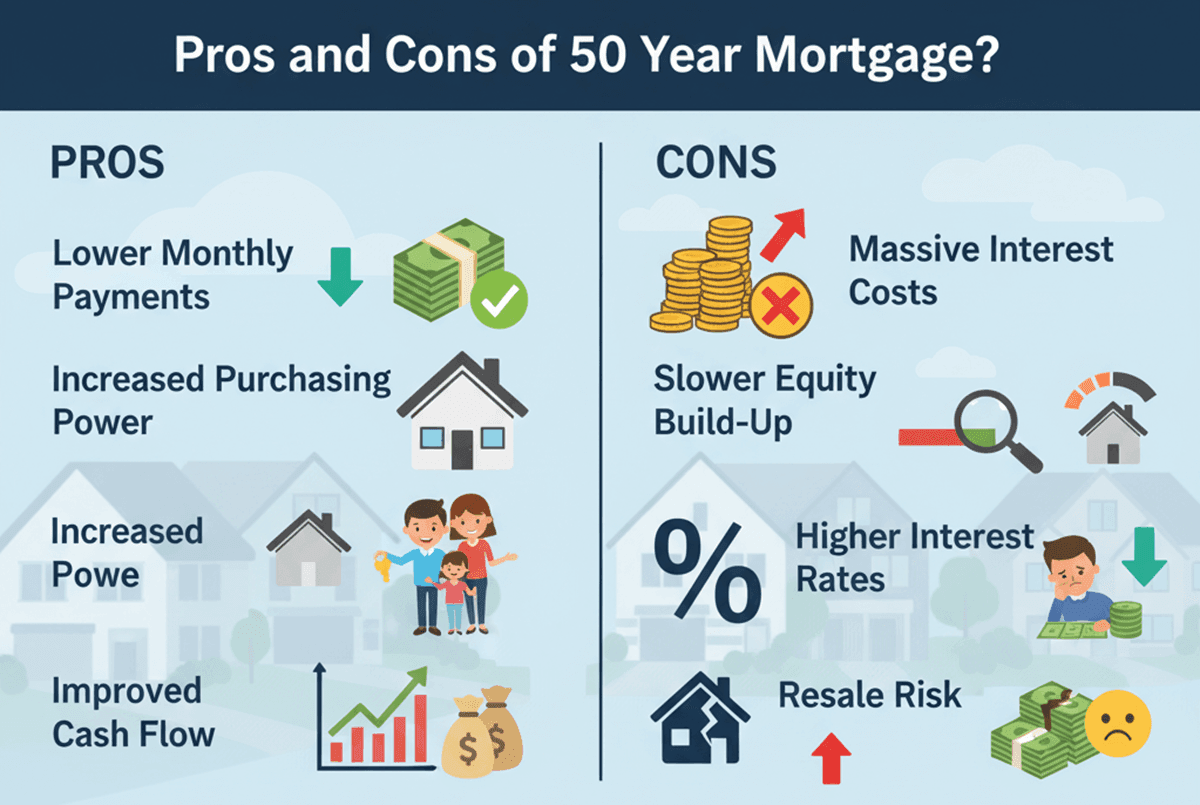

Pros

-

Lower Monthly Payments: This is the headline benefit. By stretching the principal repayment, your monthly obligation decreases. For a family on a tight budget, saving 200-300 a month could be the difference between approving a loan or being rejected.

-

Increased Purchasing Power (Theoretically): A lower monthly payment improves your Debt-to-Income (DTI) ratio. On paper, this allows you to qualify for a more expensive house than you could with a 30-year loan.

-

Improved Cash Flow for Investors: If you are buying a rental property, a 50-year loan lowers your fixed costs, potentially turning a negative cash-flow property into a positive one.

Cons

-

Massive Interest Costs: This is the wealth killer. I cannot stress this enough, and you will likely pay double the interest compared to a 30-year loan. Because the term is so long, the bank collects interest from you for an extra 20 years.

-

Slower Equity Build-Up: With a 30-year loan, you start making a dent in the principal after about 10 years. With a 50-year loan, you are essentially "renting from the bank" for the first 20+ years. Your payments are almost entirely interest, meaning if you try to sell the house in 5 or 10 years, you will likely have built almost zero equity (or even be underwater if prices dip).

-

Higher Interest Rates: Lenders aren't stupid. Lending money for 50 years is risky. To compensate for that risk, 50-year mortgages typically come with an interest rate that is 0.25% to 0.75% higher than a standard 30-year fixed loan, which eats away at some of the monthly savings.

-

Resale Risk: If you need to sell in a down market, you have no "cushion" of equity to pay for agent fees and closing costs.

Who Offers a 50 Year Mortgage?

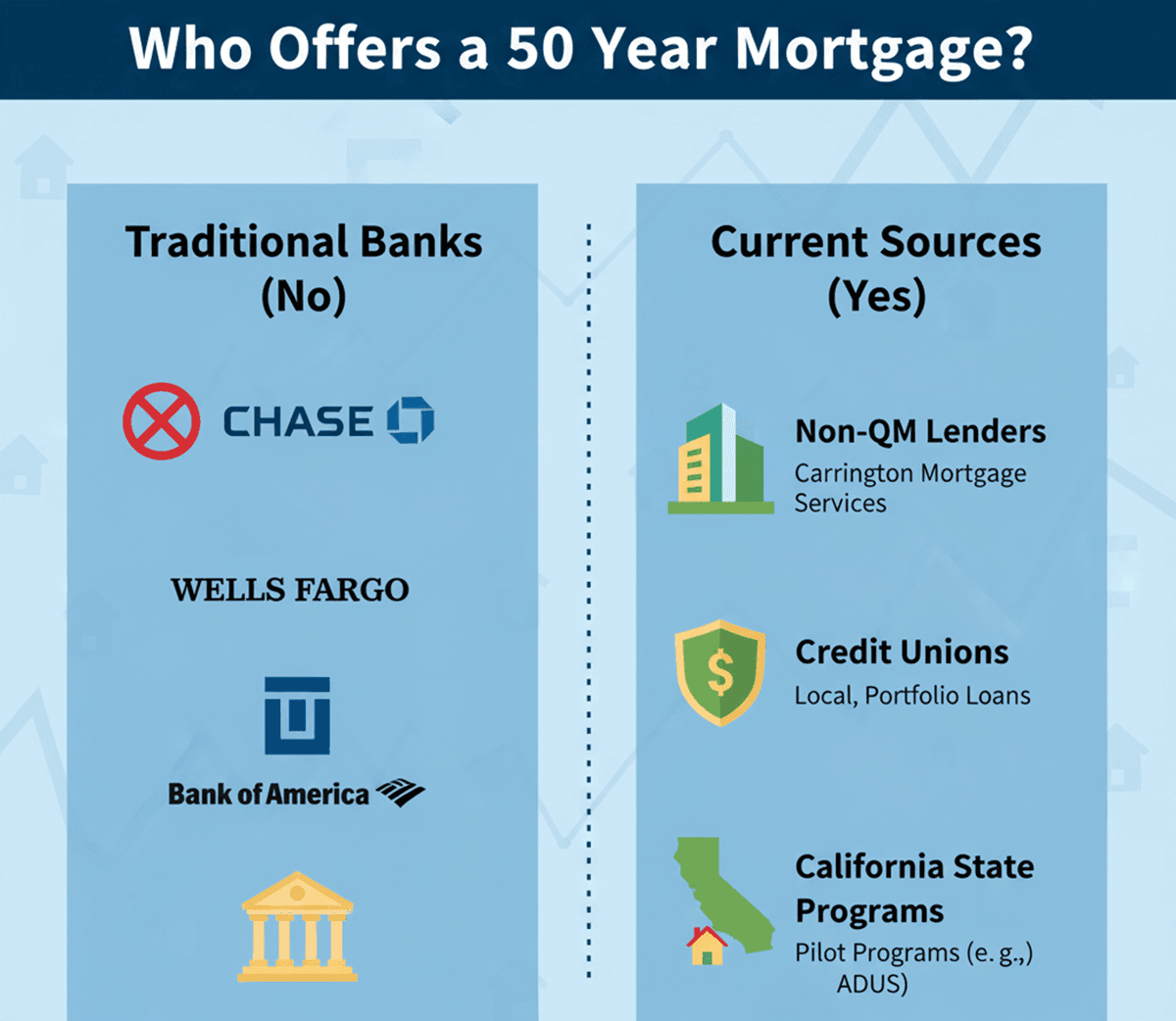

Despite the White House's push, you cannot simply walk into a Chase, Wells Fargo, or Bank of America branch today and ask for a 50-year purchase loan. The big banks are conservative and generally stick to "Qualified Mortgages" that they can easily sell to Fannie Mae.

Currently, your best bet to find these loans is through:

-

Non-QM Lenders: Specialized mortgage companies like Carrington Mortgage Services or other niche lenders that cater to investors and self-employed borrowers.

-

Credit Unions: Some local credit unions offer portfolio loans (loans they keep on their own books) and have more flexibility to offer extended terms.

-

California State Programs: In high-cost areas like California, there have been pilot programs (like for ADUs) offering extended terms, though these are highly specific.

If you want to get more info, you can get in touch with non-QM loan officers on Bluerate for a free consultation.

Can You Get a 50 Year Mortgage?

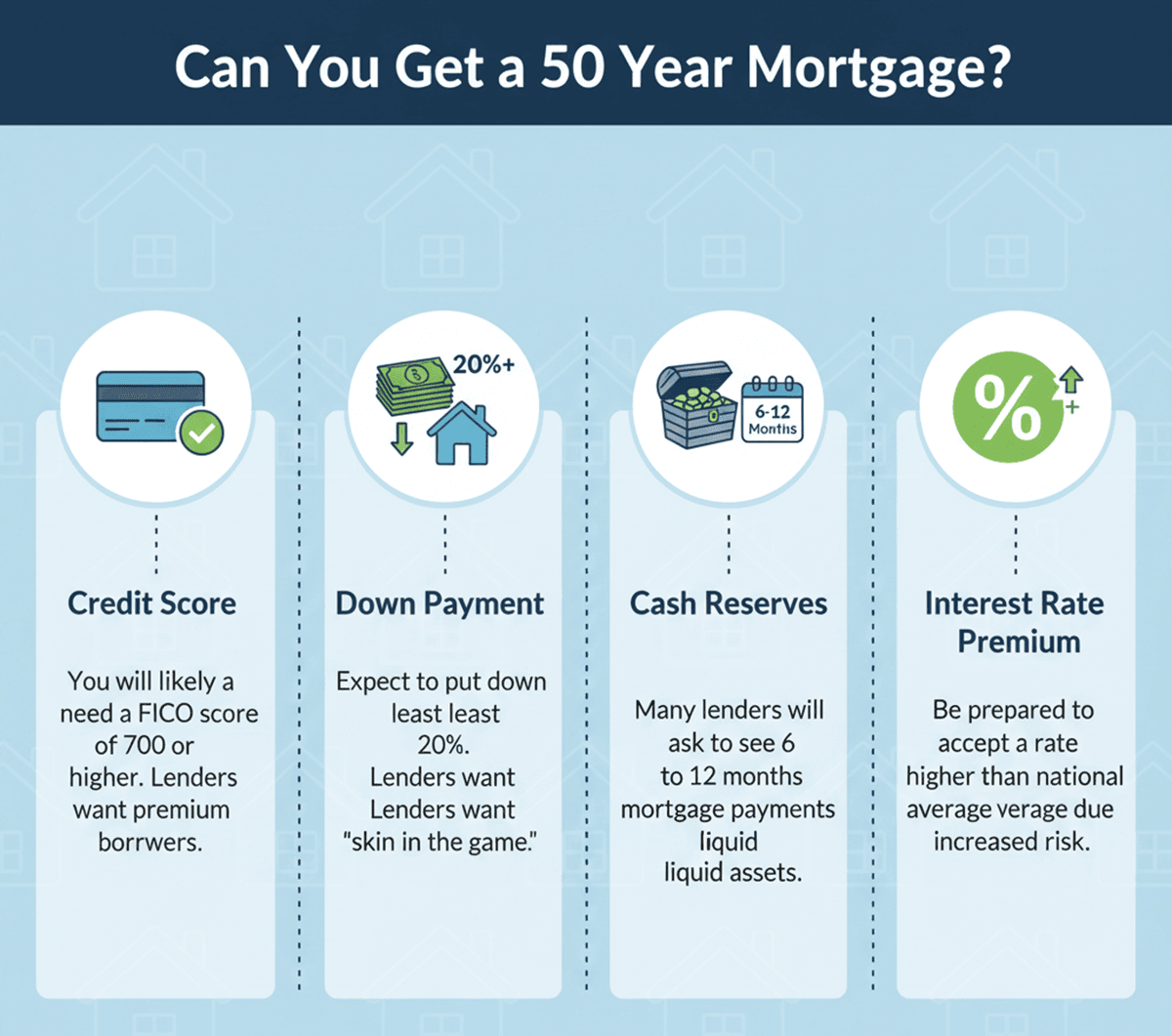

Just because these loans exist doesn't mean they are easy to get. In fact, because they are considered "Non-QM" (non-standard), lenders often impose stricter requirements than they do for a regular 30-year FHA or Conventional loan. They need to ensure you are financially stable enough to maintain payments for half a century.

Typical Qualification Requirements:

-

Credit Score: You will likely need a FICO score of 700 or higher. Standard government loans might accept 580, but 50-year lenders want premium borrowers.

-

Down Payment: Expect to put down at least 20%. Lenders want you to have "skin in the game" since the loan itself builds equity so slowly.

-

Cash Reserves: Many lenders will ask to see 6 to 12 months of mortgage payments sitting in your bank account (liquid assets) to prove you can weather a financial storm.

-

Interest Rate Premium: Be prepared to accept a rate higher than the national average.

If you are already a homeowner facing foreclosure, your current servicer might offer you a 40-year or 50-year modification to lower your payments. In this distress scenario, you don't "apply" in the traditional sense. You negotiate based on hardship.

Also Read: [Must-Read Tips] How Do I Get the Lowest Mortgage Rates?

30 Year Mortgage vs 50 Year Mortgage

Let's stop talking theory and look at the cold, hard math. This is where the "affordability" argument often falls apart. Indeed, mortgage rates impact affordability.

Let's assume you are buying a home and need a $400,000 loan.

- Scenario A (Standard): 30-Year Fixed at 6.5%.

- Scenario B (Extended): 50-Year Fixed at 6.75% (Remember, longer terms usually carry higher rates).

The Monthly Payment:

- 30-Year: ~$2,528 / month (Principal & Interest)

- 50-Year: ~$2,335 / month

- The "Savings": You save roughly $193 per month.

The Total Interest Cost:

- 30-Year Total Interest: ~$510,000

- 50-Year Total Interest: ~$1,001,000

The Verdict:

To save less than $200 a month, the price of a few family dinners, you are agreeing to pay the bank an extra $491,000 in interest over the life of the loan. That is nearly half a million dollars of your wealth transferred to the lender. Furthermore, after 10 years of payments:

- On the 30-year loan, you would owe roughly $338,000.

- On the 50-year loan, you would still owe roughly $382,000.

You have barely scratched the surface of the debt. This highlights why many financial experts call the 50-year mortgage a "wealth trap."

FAQs About a 50 Year Mortgage

Q1. Are 50-year mortgages available right now?

Yes, but they are niche. While President Trump has proposed expanding them, currently they are primarily available through specialized Non-QM lenders or specific credit unions. They are not yet a standard option at major banks for general homebuyers.

Q2. Would a 50-year mortgage help me qualify for a larger loan?

Technically, yes. Because your monthly required payment is lower, your Debt-to-Income (DTI) ratio improves, which allows you to borrow more on paper. However, many lenders offset this by requiring higher credit scores or larger down payments, which might disqualify you anyway.

Q3. Why don't banks offer 50-year mortgages?

Risk. Fifty years is a long time. There is a higher chance that the borrower will die, default, or the property will depreciate significantly before the loan is paid off. Additionally, banks rely on selling loans to investors (Fannie Mae/Freddie Mac). Until the government fully backs these 50-year loans as a standard product, banks don't want to get stuck holding them.

Q4. How much will a 50-year mortgage cost?

In terms of purchase price, it costs the same. But in terms of financing, it is incredibly expensive. As shown in my calculation above, you could end up paying 2 to 3 times the original loan amount in interest alone. It is arguably one of the most expensive ways to buy real estate.

Conclusion

The 50-year mortgage is a controversial topic for a reason. While the Trump administration and Director Pulte frame it as a necessary innovation to solve the affordability crisis, the numbers paint a more complex picture.

Yes, it lowers your monthly payment, potentially allowing you to get your foot in the door of a home you otherwise couldn't buy. But the cost of that entry is staggering. By opting for a 50-year term, you are severely handicapping your ability to build wealth and equity. You are trading a slightly cheaper today for a much more expensive tomorrow.

My advice? If you are an investor utilizing specific cash-flow strategies, this might be a useful tool. But for the average family looking to build generational wealth, I strongly recommend sticking to a 30-year fixed loan, or even a 15-year if you can swing it. Don't let the allure of a lower monthly payment blind you to the massive long-term debt.