What are Mortgage Points? Everything You Need to Know Here

There is a Reddit post that perfectly captured the confusion many of us feel. A user, clearly stressed just days before closing, asked: "Can someone explain mortgage points... like I'm in 8th grade?" They were being bombarded with terms like "buy downs" and "credits" and felt pressured to make a multi-thousand-dollar decision on the spot.

If you are feeling that same pressure, take a deep breath. You are not alone. Lenders often present mortgage points as a "no-brainer" to lower your rate, but they don't always explain the math behind it. This guide cuts through the jargon to give you the transparent, 8th-grade-level explanation you deserve, helping you decide if spending extra cash now will actually save you money later.

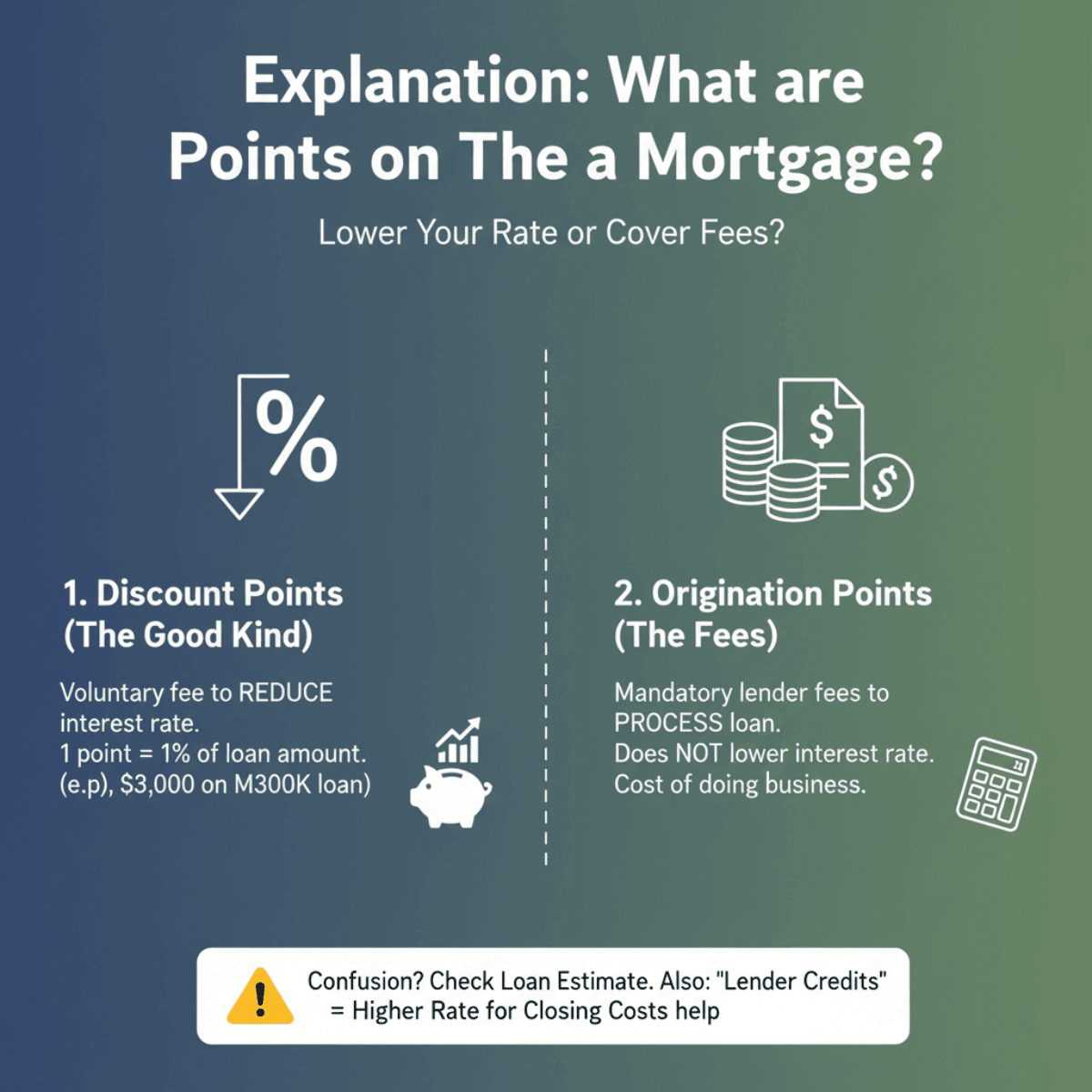

Explanation: What are Points on a Mortgage?

In the simplest terms, mortgage points are a fee you pay upfront to lower your interest rate. Think of it as prepaying some of your interest in exchange for a cheaper monthly payment.

In the industry, we call this "buying down the rate." However, it is crucial to distinguish between the two types of points you will see on your Loan Estimate, as they serve very different purposes:

-

Discount Points (The Good Kind): These are what we are focusing on today. You pay these voluntarily to reduce your interest rate. Generally, 1 point equals 1% of your loan amount. So, on a $300,000 mortgage, one point costs $3,000.

-

Origination Points (The Fees): These are fees the lender charges purely to process your loan. They do not lower your interest rate. They are simply the cost of doing business.

Why the confusion? Sometimes, lenders group these together under "Origination Charges" on your official documents (Section A of your Loan Estimate). You might also hear terms like "Lender Credits" or "Negative Points." This is the opposite scenario: you accept a higher interest rate, and in return, the lender gives you credits to cover your closing costs. This is often used by buyers who are short on cash at the closing table.

Always ask your loan officer specifically: "Are these discount points to lower my rate, or origination fees for your service?"

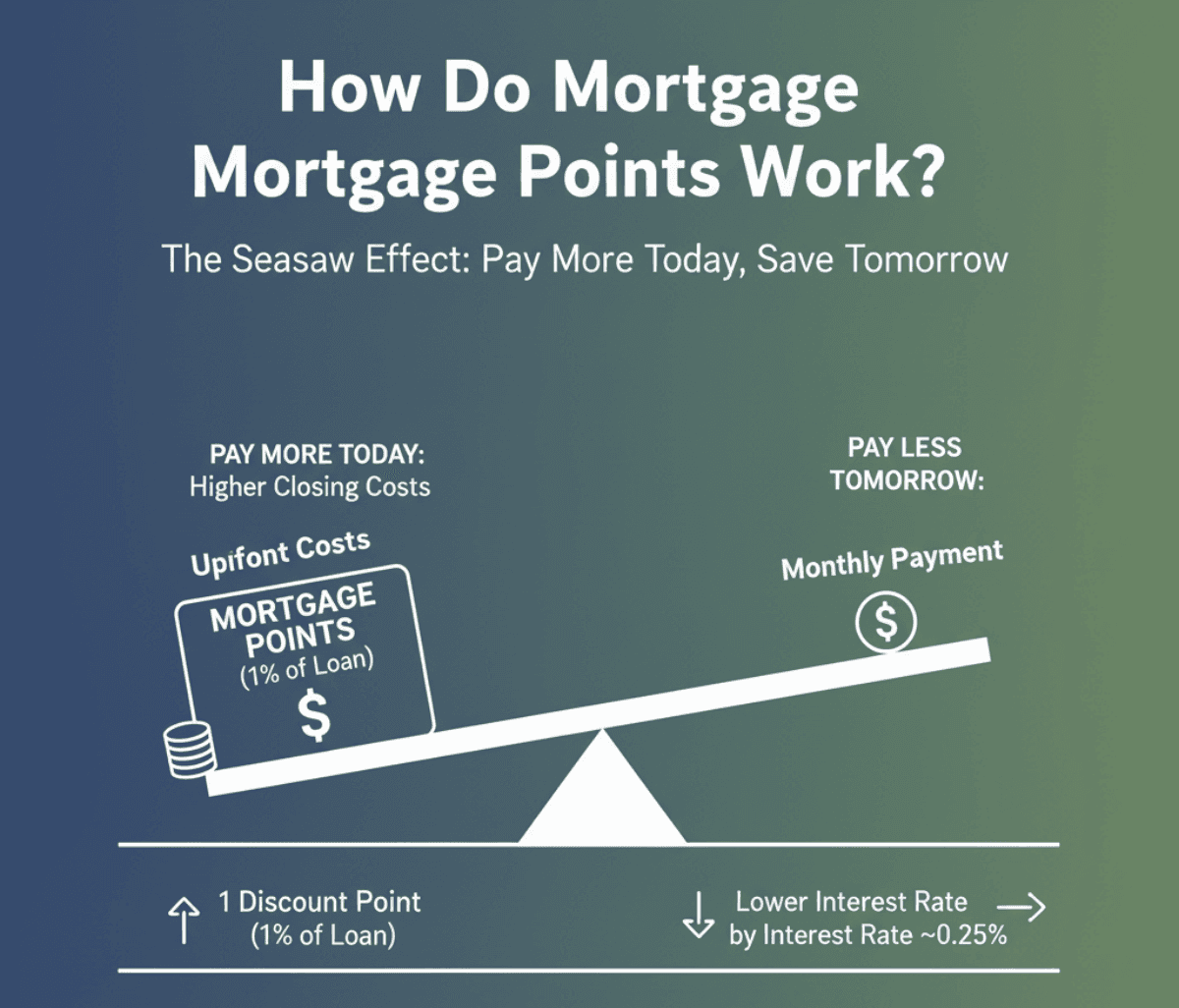

How Do Mortgage Points Work?

Imagine your mortgage is a seesaw. On one side, you have your Upfront Costs (cash you pay at closing). On the other side, you have your Monthly Payment.

Buying mortgage points is like putting a heavy weight on the "Upfront Costs" side to force the "Monthly Payment" side up in the air—making it lighter.

- You pay more today: Your closing costs go up by thousands of dollars.

- You pay less tomorrow: Your interest rate drops, lowering your monthly principal and interest payment for the entire life of the loan (usually 30 years).

Typically, buying 1 discount point (costing 1% of the loan) will lower your interest rate by 0.25%.

- Example: If market rates are 6.5%, paying 1 point might get you a rate of 6.25%.

However, this isn't magic. It's a math problem. The most critical concept you need to understand is the Break-Even Point. Since you are spending extra money upfront, you need to stay in the home (and keep the loan) long enough for the monthly savings to add up and "pay back" that initial cost. If you move or refinance before that day comes, you lose money.

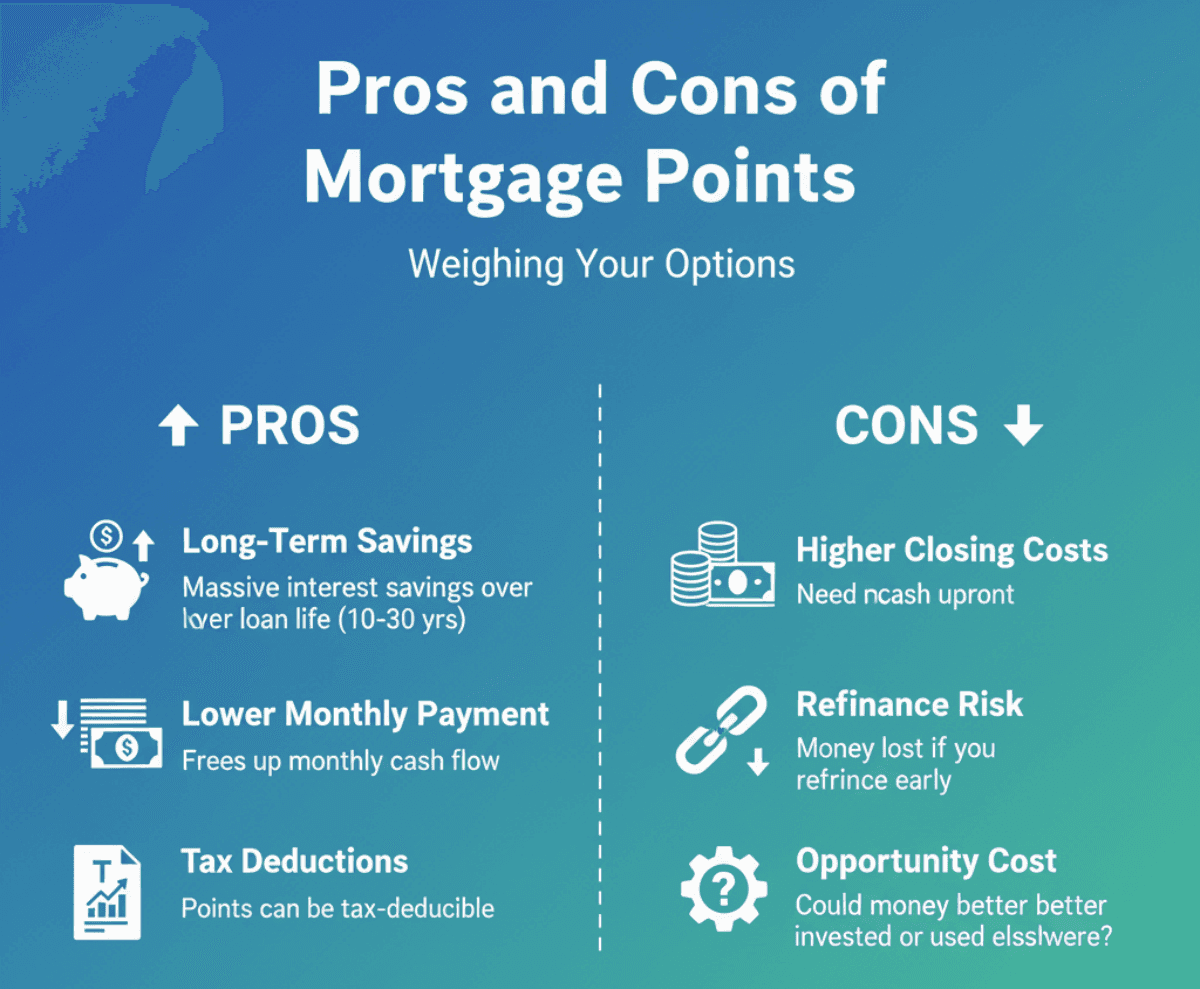

Pros and Cons of Mortgage Points

Before you write that check, you need to weigh the immediate costs against the future benefits.

Pros:

- Long-Term Savings: If you keep your mortgage for 10-30 years, the interest savings can be massive.

- Lower Monthly Payment: A lower rate frees up monthly cash flow, which can be helpful if your budget is tight.

- Tax Deductions: In many cases, discount points are tax-deductible as mortgage interest in the year you pay them.

Cons:

- Higher Closing Costs: You need more cash on hand at the closing table.

- The "Refinance Risk": This is the biggest danger. If mortgage rates drop to 5.5% next year and you refinance, the money you spent buying points on your current 6.5% loan is gone forever. You likely won't recoup that cost in just one year.

- Opportunity Cost: Could that $3,000 or $5,000 earn you a better return if invested in the stock market or used for home repairs?

Example of Using Mortgage Points

Let's look at a real-world scenario using late 2025 market data. Suppose you are buying a home with a $300,000 loan on a 30-year fixed mortgage.

Option A (Par Rate - No Points):

- Interest Rate: 6.50%

- Cost of Points: $0

- Monthly Principal & Interest: $1,896

Option B (Buying 1 Point):

- Cost of Points: $3,000 (1% of $300k)

- New Interest Rate: 6.25% (Lowered by 0.25%)

- New Monthly Principal & Interest: $1,847

The Break-Even Math:

- Monthly Savings: $1,896 - $1,847 = $49 per month

- Upfront Cost: $3,000

- Months to Break Even: $3,000 ÷ $49 = 61.2 months

Verdict: You need to live in this house and keep this specific mortgage for just over 5 years (61 months) to break even. If you sell or refinance in Year 3, buying points would be a financial mistake.

How Many Mortgage Points Can I Buy?

You might be thinking, "If buying points saves interest, why don't I buy 10 points and get a 0% rate?" Unfortunately, it doesn't work that way.

While there is no strict federal law that says "you can only buy X points," there are regulatory guardrails designed to protect you from predatory fees. Under the Qualified Mortgage (QM) Rule, the total points and fees lenders can charge are capped.

- For loans of $134,841 or more, total points and fees generally cannot exceed 3% of the loan amount.

- This means on a typical loan, you are usually limited to buying roughly 2 to 3 discount points max.

Loan Type Limits:

- Conventional Loans: Most lenders cap points around the 3% QM limit.

- VA Loans: The VA discourages excessive fees. While they don't strictly cap discount points, lenders often set their own internal caps (often around 2 points) to ensure the loan remains compliant and beneficial to the veteran.

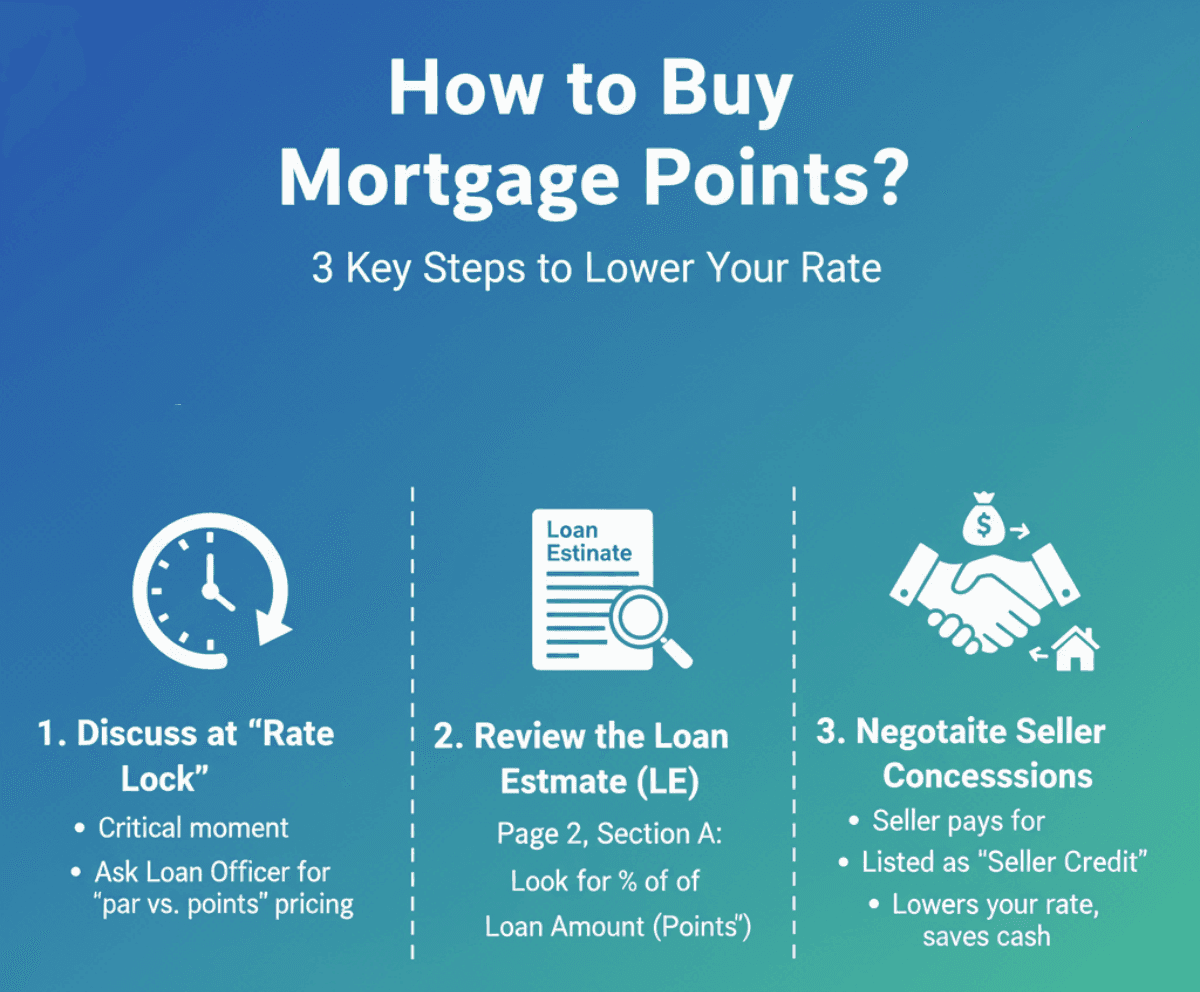

How to Buy Mortgage Points?

Buying mortgage points isn't something you do at the grocery store. It happens during the mortgage underwriting process. Here is how to execute it:

-

Discuss at "Rate Lock": The most critical moment is when you lock your interest rate. Ask your Loan Officer specifically to show you a pricing sheet with "par rates" (no points) versus options with 1 or 2 points.

-

Review the Loan Estimate (LE): Look at Page 2, Section A ("Origination Charges"). You should see a line item labeled clearly as "% of Loan Amount (Points)." If this section is blank, you aren't buying points.

-

Negotiate Seller Concessions: This is a pro tip. If you are tight on cash, you can ask the seller to pay for your points. In your purchase contract, this is listed as a "Seller Credit." You use their money to buy down your rate, permanently lowering your monthly payment without draining your own bank account.

FAQs About What is a Point for Mortgage

Q1. How much is 1 point worth in a mortgage?**

One point is consistently worth 1% of your total loan amount. If you borrow $100,000, one point costs $1,000. It typically lowers your interest rate by 0.25%.

Q2. How much would 3 points cost for a $250,000 loan?**

It would cost $7,500. You calculate this by multiplying the loan amount ($250,000) by 0.03 (3%). This is a significant upfront cash requirement.

Q3. How many points are normal for a mortgage?**

Buying between 0 and 1 point is the most common range. Buying more than 2 points is rare unless there is a specific seller-paid promotion (like a builder buydown) because the upfront cost becomes prohibitively expensive.

Q4. Are mortgage points worth it long-term?**

Yes, but only strictly long-term. If you stay in your home past the break-even point (usually 5-7 years) and never refinance, you will save thousands in interest over the 30-year term.

Q5. Is 1 point worth refinancing?**

Generally, no. When you refinance, you are already paying new closing costs. Adding points increases the time it takes to recoup those costs. Unless the rate drop is massive (e.g., 1% or more) and you plan to stay forever, avoid points on refinances.

Conclusion: Is It a Good Idea to Buy Points on a Mortgage?

So, is buying mortgage points a smart move? It depends entirely on your timeline.

We are currently in a rate environment where future refinancing is a real possibility. This makes buying points riskier than usual. Use this simple decision tree:

- Do not buy points if: You think you might move in the next 5 years, or if you believe interest rates will drop significantly (allowing you to refinance soon). The risk of "wasted money" is too high.

- Consider buying points if: This is your "forever home," you have plenty of cash reserves, and you want the absolute lowest monthly payment possible for the next 20+ years.

My final advice is that you don't just trust the lender's pitch. Use an online "Break-Even Calculator" with your specific numbers. If the break-even period is longer than 5 years, keep your cash in your pocket.