How to Buy Points on Mortgage: Is It Worth Buying Mortgage Points?

When I bought my first home, I was obsessed with one thing: getting the lowest possible interest rate. I remember staring at the rate sheet my lender slid across the desk, seeing a column for "discount points," and feeling completely lost. What are mortgage points? Simply put, they are a form of prepaid interest. You pay a fee upfront at closing, known as "buying down the rate", to lower your interest rate for the life of the loan.

It sounds like a no-brainer, right? Lower monthly payments forever? But here is the catch I learned the hard way: it's a trade-off. You are betting that you will stay in the home long enough to save more in interest than you paid upfront. If you move or refinance too soon, you lose money. In this guide, I will walk you through exactly how to buy points, the limits you need to know, and the math I use to decide if it is actually worth it.

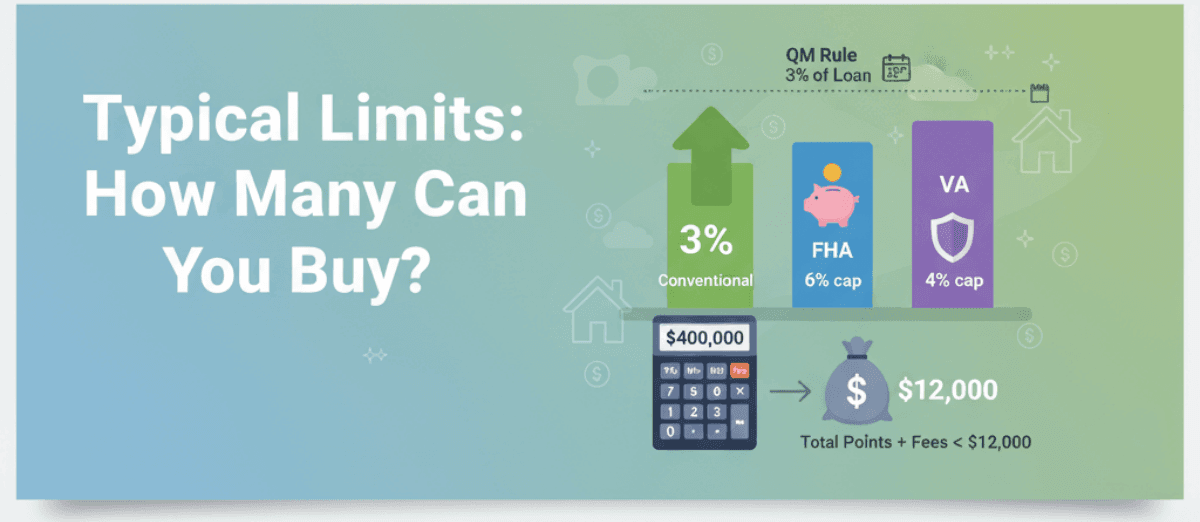

Typical Limits: How Many Can You Buy?

You might be thinking, "Great, I'll just buy enough points to get my rate down to zero!" Unfortunately, it doesn't work that way. In my experience, and according to US regulations, there are strict limits on how many points you can actually purchase.

Generally, most lenders allow you to buy between 1 to 4 points. However, the real ceiling is set by the Qualified Mortgage (QM) Rule. The Consumer Financial Protection Bureau (CFPB) caps "points and fees" at 3% of the total loan amount for loans greater than or equal to $134,841. This means if you are borrowing $400,000, your total points plus lender fees cannot exceed $12,000.

Here is a quick breakdown of limits I've seen across different loan types:

-

Conventional Loans: Usually capped by the QM 3% rule, though exceptions exist for investment properties.

-

FHA Loans: While FHA allows points, they are often limited by how much cash you have to close. Importantly, seller concessions, which can cover discount points and closing costs, are capped at 6% of the sales price.

-

VA Loans: Seller concessions beyond standard closing costs are capped at 4% of the loan amount. Customary discount points typically do not count toward this 4% limit.

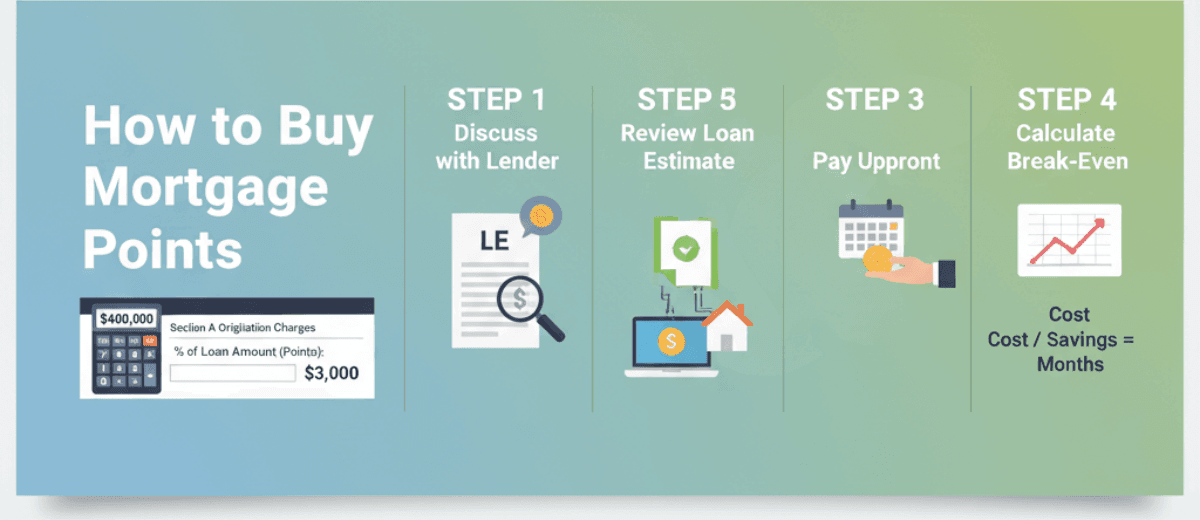

How to Buy Mortgage Points?

Buying points isn't as simple as checking a box on a website. It is a negotiation process that happens between your application and your closing date. Here is the step-by-step process I use to ensure I'm getting the right deal.

STEP 1. Discuss with Your Lender

The first step is a frank conversation. When I talk to a loan officer, I don't just ask "What is your rate?" I ask, "What is the par rate?" The par rate is the interest rate with zero points, no cost, no credit. This gives me a baseline.

Once I have the par rate, I ask to see a "rate sheet" or a side-by-side comparison. I want to know exactly how much it costs to lower the rate by 0.125%, 0.25%, or 0.50%. Typically, one point costs 1% of your loan amount and lowers your rate by about 0.25%, but this isn't a fixed law. In 2025, I've seen lenders offer different "pricing buckets" where buying 0.75 points might get you a better deal than buying 1 full point. You have to ask specifically: "If I pay $3,000 now, exactly how much does my monthly payment drop?" If they can't answer that clearly, find another lender.

STEP 2. Review Loan Estimate

After that conversation, the lender is legally required to send you a Loan Estimate (LE) within three business days. Do not just glance at the first page. I always flip immediately to Page 2.

You need to look at Section A: Origination Charges. Here, you will see a line item specifically labeled "% of Loan Amount (Points)." This is where the rubber meets the road. If you agreed to buy 1 point on a $300,000 loan, this line must show $3,000.

I always double-check this against what we discussed on the phone. Sometimes, a lender might "bake in" points to show you a lower advertised rate without explicitly telling you that you are paying for it. By checking Section A, I verify that the fee is there and that the interest rate on Page 1 matches the lower rate we agreed upon. If the numbers don't match, pause the process and ask why.

STEP 3. Pay Upfront

So, when do you actually pay? You don't write a check to the loan officer. The cost of the points is added to your total "Cash to Close."

About three days before you sign the final papers, you will receive a Closing Disclosure (CD). This replaces the Loan Estimate. I compare the CD to the LE to make sure the points cost hasn't changed. On closing day, you will wire the total funds (down payment + closing costs + points) to the title company or escrow agent.

You don't always have to pay this with your money. In the current market, I often advise buyers to negotiate a "Seller Concession." You can ask the seller to give you a credit (e.g., $5,000) at closing, and you can specifically use that money to buy down your interest rate. It's a brilliant way to get a lower monthly payment without draining your own savings.

STEP 4. Calculate Break-Even

This is the most critical section of this entire article. Please do not buy points without doing this math. The Break-Even Point is the month when your accumulated savings finally exceed the upfront cost.

Here is the formula I use: Cost of Points ÷ Monthly Payment Savings = Months to Break Even.

Let's look at a real-world example I calculated recently:

-

Loan Amount: $400,000 (30-year fixed)

-

Par Rate (6.5%): Principal and interest payment is approximately $2,528.

-

Buy 1 Point ($4,000 upfront): Rate drops to 6.25%.

-

New Payment: Approximately $2,463.

-

Monthly Savings: About $65.

Now, the math: $4,000 (Cost) ÷ $65 (Savings) = 61.5 Months.

This means it will take me over 5 years just to earn back that $4,000. If I sell the house in year 4, I actually lose money by buying points. If I refinance in year 3 because rates dropped, I also threw that money away. You must ask yourself: "Will I absolutely be in this specific mortgage for longer than the break-even period?"

STEP 5. Consider Alternatives

Before I commit thousands of dollars to points, I always look at where else that cash could go. Sometimes, buying points is the "expensive" way to save money.

First, I look at the Down Payment. If I have an extra $5,000, would putting it toward the down payment lower my Private Mortgage Insurance (PMI) or get me a better tier of interest rate automatically? Sometimes reaching 20% equity is far more valuable than a 0.25% rate cut.

Second, I think about Liquidity. Once you pay for points, that money is gone. It's trapped in the house. If you keep that $4,000 in a high-yield savings account as an emergency fund, you have security. If the furnace breaks next winter, you'll be glad you have the cash rather than a slightly lower mortgage payment.

Finally, consider Investing. If the market returns 8% and your mortgage savings is effectively a 6% return, you might be better off investing the difference. It's all about opportunity cost.

When to Buy Mortgage Points?

Based on my experience and current market analysis, here is when I give the "green light" to buy points:

-

You found your "Forever Home": If you are absolutely certain you will live in this house for 10+ years and never refinance, points are a guaranteed return on investment.

-

Seller is paying: If the seller offers $10,000 in concessions to close the deal, use that "free money" to buy down the rate. It lowers your payment at zero cost to you.

-

You need to qualify: Sometimes, your Debt-to-Income (DTI) ratio is just barely too high. Buying points to lower the rate (and thus the monthly payment) can sometimes be the magic trick that gets your loan approved.

-

You are in a high tax bracket: Mortgage discount points are generally tax-deductible (if you itemize). If you need a tax shield this year, prepaying interest via points can be a savvy tax move.

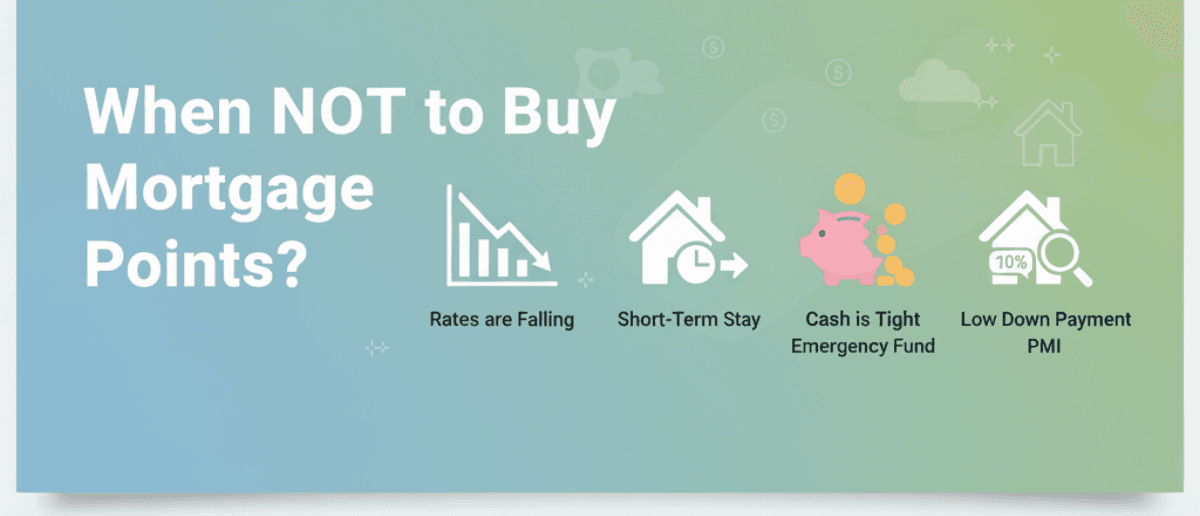

When Not to Buy Mortgage Points?

Conversely, here are the situations where I strongly advise against it:

-

Rates are falling: In 2025, many economists predict rates might trend downward. If rates drop 1% next year and you refinance, the points you bought today become worthless instantly.

-

Short-term stay: If this is a "starter home" or you might relocate for work in 3-5 years, you likely won't reach the break-even point.

-

Cash is tight: Never deplete your emergency fund to buy points. House ownership is expensive. You will need that cash for repairs and maintenance.

-

Low down payment: If you are putting 3.5% down, you are already paying for mortgage insurance. I usually recommend keeping cash on hand rather than chasing a marginally lower rate.

FAQs About Buying Points on Mortgage

Q1. Are mortgage points tax-deductible?

Yes, in most cases. According to the IRS (Publication 936), discount points are considered prepaid interest. If you buy a primary home, you can typically deduct the full amount in the year you pay them, provided you itemize deductions on Schedule A. However, verify with a CPA, as deductibility follows mortgage interest limits ($750,000 debt cap for post-2017 loans) and requires itemizing.

Q2. Are mortgage points the same as origination points?

No, and this confuses many people. Discount Points are optional fees you pay to lower your rate. Origination Points are mandatory fees charged by the lender to process your loan. Origination points do not lower your interest rate. They are just a cost of doing business.

Q3. How many points can you buy on a mortgage?

While you technically can buy as many as the lender allows, the 3% QM Rule acts as a practical cap. For most borrowers, buying more than 2 to 3 points becomes prohibitively expensive and triggers regulatory red flags for the lender.

Q4. Should you buy mortgage points if rates are rising?

This is actually a strategic "Yes." If rates are trending up, locking in a lower rate permanently via points can protect you from inflation. It creates a fixed, affordable payment while the rest of the market gets more expensive.

Q5. Do mortgage points affect ARM?

Yes, but be careful. Buying points on an Adjustable-Rate Mortgage (ARM) usually only lowers the interest rate for the initial fixed period (e.g., the first 5 or 7 years). Once the rate starts floating, that discount might disappear. The break-even math on ARMs is much riskier.

Q6. Is it smart to pay points on a mortgage?

It is smart only if the math works. It is not an emotional decision. it is a calculation of "Time vs. Cost." If you stay past the break-even date, it is a smart investment. If you leave early, it is a bad expense.

Conclusion

Buying mortgage points is one of the few levers you can pull to control your financial destiny in a real estate transaction. It allows you to trade upfront cash for long-term monthly savings. However, it is not a "one-size-fits-all" solution.

In the current housing market, where rate volatility is real, I urge you to be cautious. Do not just blindly accept a lower rate. Run the break-even calculation. If it takes 6 years to earn your money back, ask yourself if you really commit to that timeline.

Before you sign the Loan Estimate, sit down with your loan officer. Ask them to show you the "Total Cost of Loan" with and without points over 5 and 10 years. Seeing those hard numbers is the only way to answer the question: Is it worth it?