Full Explanation: How Does a Cash Out Refinance Work?

In my years working in the mortgage industry, I've fielded countless calls from homeowners asking, "How do I get the money out of my house?" While many people know the term Cash Out Refinance, I often find a significant gap in understanding how the mechanics actually work. A common misconception is that it works like an ATM withdrawal or a Home Equity Line of Credit (HELOC).

The reality is quite different. You aren't just "taking cash out". You are executing a complete financial reset. In this guide, I'm going to pull back the curtain and explain exactly what happens behind the scenes, from the moment you apply to the moment the wire transfer finally hits your bank account, so you can decide if leveraging your 2026 home equity is the right move for you.

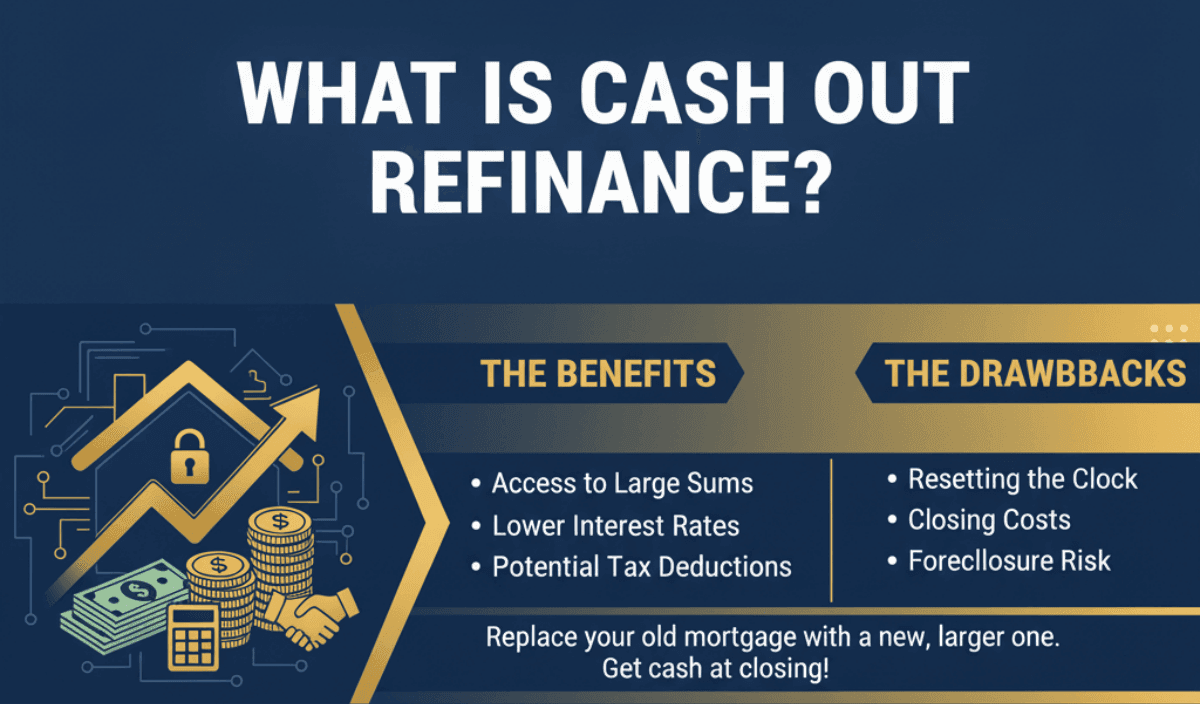

What is Cash Out Refinance?

Simply put, a cash-out refinance is a mortgage transaction where you pay off your existing home loan by taking out a new, larger mortgage. You aren't adding a second loan on top of your current one. You are completely replacing the old one. The difference between the new loan amount and your old loan balance is then paid to you in tax-free cash at closing.

The Benefits

-

Access to Large Sums: It allows you to tap into significant equity, which is often hundreds of thousands of dollars at once.

-

Lower Interest Rates: Even in fluctuating markets, mortgage rates are typically much lower than high-interest credit cards (often 20%+) or unsecured personal loans.

-

Potential Tax Deductions: If you use the funds for capital home improvements, the interest on that extra cash may be tax-deductible. Please always verify with a CPA, as IRS rules are specific.

The Drawbacks

-

Resetting the Clock: You are starting a new 30-year (or 15-year) term. If you were 10 years into your current mortgage, you're back to year one.

-

Closing Costs: This isn't free. You will pay appraisal fees, origination fees, and title insurance, typically costing 2% to 6% of the loan amount.

-

Foreclosure Risk: Because your home is the collateral, if you can't make the payments on this larger loan, you risk losing your house.

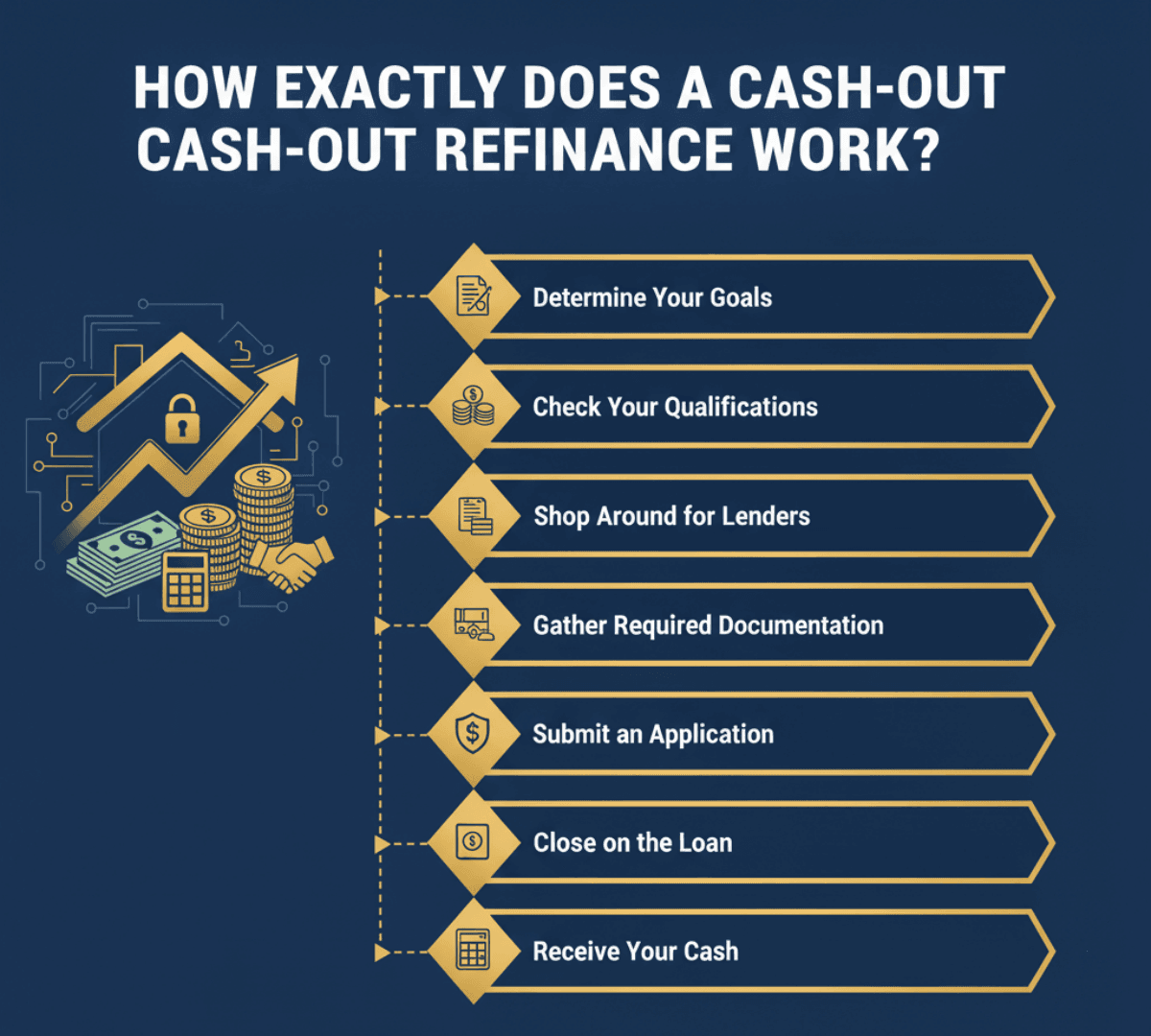

How Exactly Does a Cash-Out Refinance Work?

Now, let's wrap up the process with 7 steps and see how a cash-out refinance exacly work.

Step 1: Determine Your Goals and Calculate Potential Cash-Out

Everything starts with the math. First, be clear on why you need the money. Lenders generally cap cash-out refinances at 80% Loan-to-Value (LTV) for conventional loans. This means you must keep at least 20% equity in the property to protect the lender's risk.

The Insider Formula: (Current Home Value × 0.80) -- Current Mortgage Balance = Potential Cash Available.

If you have a VA loan, you might be eligible to go up to 90-100% LTV in some cases (depending on lender overlays and residual income requirements), which is a massive advantage for veterans. However, conventional loans cap at 80% LTV, and even VA cash-out refinances often require 10% equity to avoid higher rates or fees, according to VA Lender's Handbook.

Step 2: Check Your Qualifications

Before you fill out a single form, I recommend doing a self-audit. Cash-out loans carry higher risk for banks, so the requirements are stricter than a standard "rate and term" refinance.

-

Credit Score: Most lenders look for a minimum score of 620. However, to avoid extra fees and get a decent rate, you ideally want to be above 740.

-

Debt-to-Income (DTI): Your total monthly debt payments (including the new mortgage) generally cannot exceed 43% of your gross monthly income.

-

Seasoning Requirements: This is a detail often missed. For Fannie Mae/Freddie Mac cash-out refinances, the borrower must have owned the home for at least 6 months (12 months if the prior loan was a cash-out refinance). FHA requires 12 months of on-time payments. If you bought the house six months ago with a purchase mortgage, you may qualify based on the Fannie Mae Selling Guide.

Step 3: Shop Around for Lenders

Don't just auto-renew with your current bank. I always advise clients to get quotes from 3 to 5 different lenders. When you receive their offers, ask for the Loan Estimate (LE). This is a standardized government form that makes comparison easy.

Don't just look at the Interest Rate. Look at the APR (Annual Percentage Rate). The APR includes the interest rate plus the lender fees and closing costs. A lender might show you a low rate but hide massive fees in the fine print, the APR exposes that trick.

To compare rates from different lenders, you may consult nearby loan officers on Bluerate for free.

Also, don't miss: [Latest 2026] Best Home Loan Refinance Companies to Choose

Step 4: Gather Required Documentation

Once you pick a lender, you need to prove you can afford the loan. Underwriting standards in 2025 are rigorous. You will need to provide a "paper trail" for your financial life.

Be prepared to submit:

-

Income: Pay stubs for the last 30 days.

-

Tax History: W-2s and federal tax returns for the past two years.

-

Assets: Bank statements for the last two months. Pro tip: If you have large, unexplained deposits in your bank account, the underwriter will ask for a letter explaining where that money came from.

-

Insurance: Your current homeowners' insurance declarations page.

Step 5: Submit an Application and Get a Home Appraisal

This is the pivotal moment. Your lender will order a professional home appraisal to determine the fair market value of your property. If the appraiser says your home is worth less than you thought, your LTV ratio changes, and your cash-out amount could be cut, or the loan denied entirely.

Also, the appraiser checks for health and safety issues. If your roof is leaking or there are exposed wires, the lender may require you to fix these issues ("Subject to Repairs") before they will release any funds.

Step 6: Close on the Loan

If you pass underwriting, you're cleared to close. At least three business days before your signing date, you will receive a Closing Disclosure (CD).

Compare this CD against the Loan Estimate you got in Step 3. The numbers should be almost identical. If fees have mysteriously jumped, ask questions immediately.

At the closing table, you will sign a stack of documents. Regarding costs: You rarely pay closing costs out of pocket. Instead, they are usually "rolled into" the loan balance, meaning they are deducted from your final cash payout.

Step 7: Receive Your Cash

You've signed the papers, so you get the check immediately, right? No. If this is your primary residence, federal law (TILA) mandates a 3-day Right of Rescission. This is a "cooling-off" period that allows you to cancel the loan without penalty if you change your mind.

Because of this rule, the lender legally cannot release the funds until the fourth business day. So, if you close on a Tuesday, don't expect the wire transfer to hit your account until roughly Saturday or the following Monday. Plan your expenses accordingly!

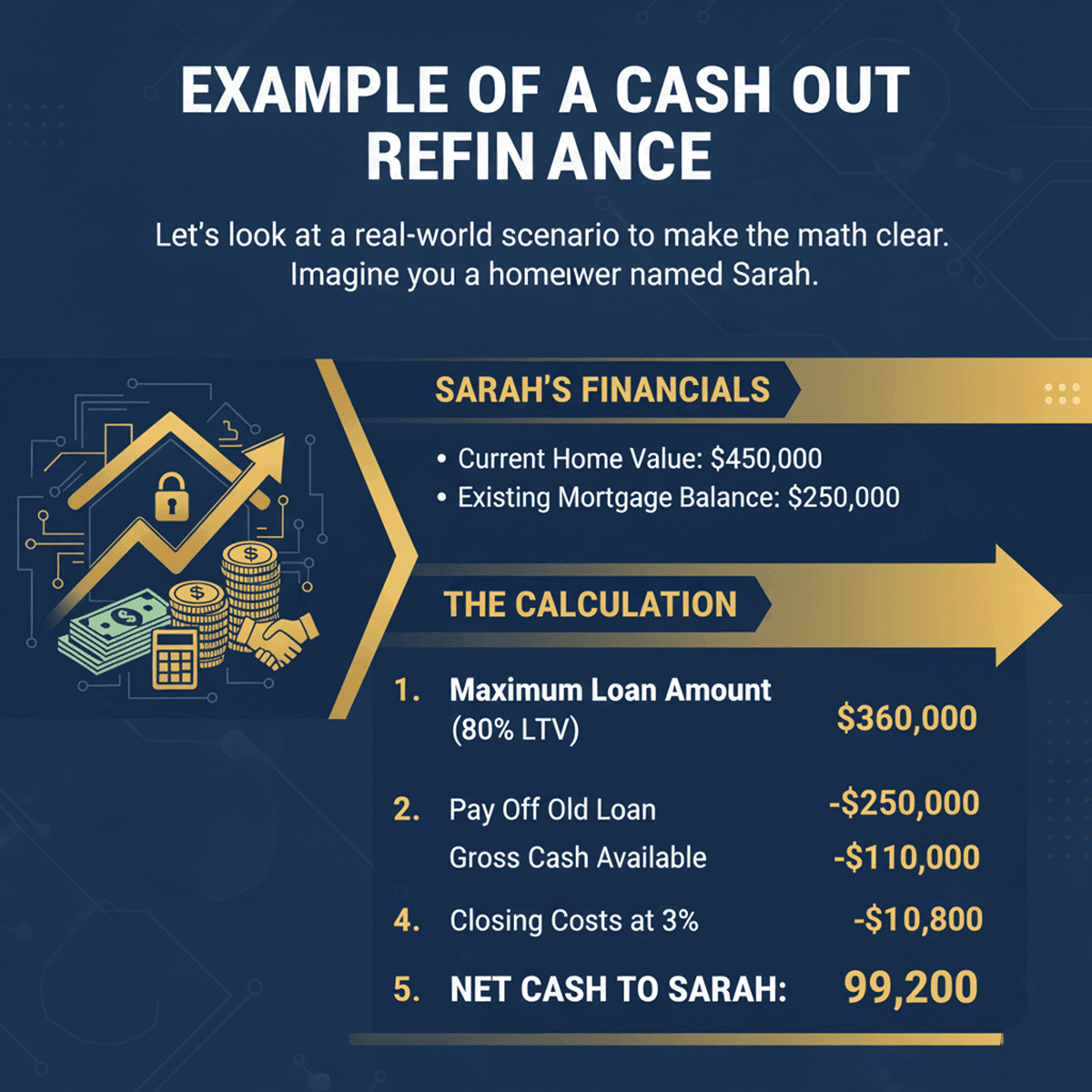

Example of a Cash Out Refinance

Let's look at a real-world scenario to make the math clear. Imagine you are a homeowner named Sarah.

-

Current Home Value: $450,000

-

Existing Mortgage Balance: $250,000

-

Goal: Renovate the kitchen and pay off a car loan.

The Calculation:

-

Maximum Loan Amount (80% LTV): $450,000 × 0.80 = $360,000

-

Pay Off Old Loan: The first $250,000 goes to pay off the old mortgage.

-

Gross Cash Available: $360,000 - $250,000 = $110,000

-

Closing Costs: Estimated at 3% ($10,800).

-

Net Cash to Sarah: $110,000 - $10,800 = $99,200

Sarah now has a new mortgage of $360,000, and $99,200 is wired to her bank account to use as she pleases.

Common Use for the Cash

Technically, once the money is in your account, it's yours to spend. Lenders don't monitor your transactions. However, not all uses are created equal.

Smart Uses:

-

Home Improvements: Upgrading kitchens, baths, or adding square footage. This increases your home's value, essentially putting the equity back into the asset.

-

High-Interest Debt Consolidation: Paying off credit cards with 25% APR using a mortgage with much lower rates can save you hundreds per month.

Risky Uses:

-

Vacations or Luxury Cars: Using a 30-year loan to pay for a trip that lasts a week is financially dangerous. You end up paying interest on that vacation for decades.

-

Investing in Volatile Assets: I've seen clients use equity to buy risky stocks. If the market crashes, you still owe the mortgage debt.

Note on Taxes:

According to IRS Publication 936, interest is deductible on acquisition indebtedness (to buy/build/improve) or home equity indebtedness (up to prior limits, now consolidated). Lenders don't track spending, but tracing rules apply if audited. Using cash-out for debt consolidation typically doesn't qualify that portion unless traced to home improvements. Consult a CPA, as TCJA changes phased out non-qualified home equity deductions post-2017.

FAQs About the Process of Cash-Out Refinance

Q1. What are the disadvantages of a cash-out refinance?

The biggest risks are foreclosure (since your home is collateral), closing costs (2%-5% of the loan), and restarting your amortization schedule, meaning you pay interest for a longer period compared to your original loan.

Q2. What is the rule for cash-out refinance?

The "Golden Rule" is the 80% LTV limit. You generally must retain 20% equity in your property. You also typically need a credit score of 620+ and a Debt-to-Income ratio under 43%.

Q3. How much money do you get from a cash-out refinance?

You receive the difference between your new loan amount (capped at 80% of home value) and your existing mortgage balance, minus closing costs.

Q4. What is better, a home equity loan or cash-out refinance?

If your current mortgage interest rate is very low (e.g., under 4%), keep it! Use a Home Equity Loan (a second mortgage) instead. Only use a Cash-Out Refinance if current rates are comparable to or lower than your existing rate.

Q5. Does a cash-out refi hurt my credit?

Temporarily, yes. The application triggers a "hard inquiry," dropping your score by a few points. However, if you use the cash to pay off maxed-out credit cards, your score often bounces back higher due to lower utilization.

Q6. How much are closing costs on a cash-out refinance?

Expect to pay between 2% and 6% of the total loan amount. On a $300,000 loan, that's between $6,000 and $15,000.

Q7. Do you need an appraisal for a cash-out refinance?

Yes. Lenders almost always require a full appraisal to verify the home's current market value and ensure they aren't lending more than 80% of its worth.

Q8. How long does it take to refinance a house with cash-out?

The average timeline is 30 to 45 days from application to funding, though this can vary based on how busy appraisers are in your area.

Conclusion

A cash-out refinance is a powerful tool that can unlock the wealth you've built in your home, but it's not "free money." It's a strategic financial move that replaces your current debt with new debt.

Before you sign on the dotted line, calculate your break-even point and ensure the long-term cost of the loan justifies the immediate cash you receive. If you are unsure, I highly recommend consulting with a licensed mortgage professional who can look at your specific financial picture. In today's market, knowledge is your best asset.