Solved - Can You Refinance a Home Equity Loan into a Mortgage?

I talk to homeowners every week who are staring at their bank statements with the same headache: two mortgage payments. You have your main mortgage, and then there's that second bill, your home equity loan or HELOC, chipping away at your monthly income. Maybe you used the cash for a remodel or debt consolidation a few years back, but now, managing two separate payments feels like a chore. Or worse, the interest rate on that second loan is climbing.

So, can you combine them? Can I refinance a home equity loan into a mortgage?

The short answer is yes. In the mortgage world, we usually call this a "consolidation." But just because you can doesn't mean you should. While it can simplify your life and potentially save you cash, there are upfront costs and long-term risks, especially if you're trading in a historically low rate for today's market rate. In this guide, I'll walk you through the math and the method so you can decide if it's the right move for your wallet.

Can an Equity Loan be Refinanced? Reasons Here

Yes, absolutely. You aren't stuck with that loan forever. When people ask me this, they are usually looking to do one of two things:

-

The "Roll-in" (Cash-Out Refinance): You get a brand new primary mortgage that pays off your existing first mortgage and your home equity loan. You're left with just one loan and one monthly payment.

-

The Standalone Swap: You keep your primary mortgage alone (smart if your rate is under 4%) and just refinance the home equity loan itself into a new one with better terms.

Usually, pain is the motivator. Here is what drives most people to my office:

-

Killing the Variable Rate: If you have a HELOC, your rate is likely tied to the Prime Rate. When the Fed makes moves, your payment changes. Refinancing into a fixed-rate loan stops the volatility.

-

Cash Flow Relief: By stretching the balance out over a new 30-year term, your monthly obligation often drops. It costs more in interest over the long haul, but it frees up cash now.

-

Simplifying Life: There is a real psychological benefit to having just one bill to pay.

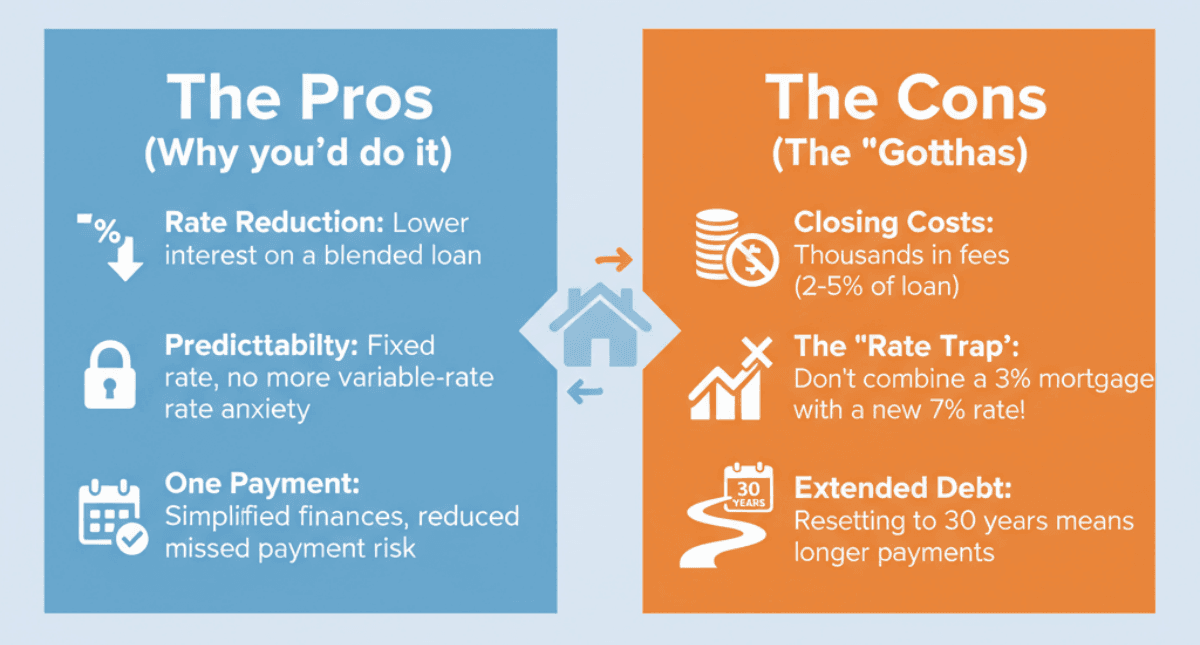

Pros and Cons of Refinancing a Home Equity Loan

Before we start filling out applications, let's look at the trade-offs. Refinancing is a powerful tool, but it's expensive.

Pros

-

Rate Reduction: Home equity loans often have higher rates than primary mortgages. Consolidating into a primary mortgage could lower your "blended" interest rate.

-

Predictability: If you are losing sleep over a variable-rate HELOC, locking in a fixed rate solves that anxiety immediately.

-

One Payment: It sounds minor, but managing one due date instead of two reduces the chance of a missed payment and a hit to your credit score.

Cons

-

Closing Costs: This isn't free. You will likely pay 2% to 6% of the loan amount in closing costs. On a large loan, that's thousands of dollars that eats into your savings.

-

The "Rate Trap": This is the biggest risk in 2026. If your primary mortgage has a 3% rate from a few years ago, do not combine it with your equity loan if the new rate is 6% or 7%. You will likely pay significantly more interest just to simplify your bills.

-

Extended Debt: If you only had 10 years left on your mortgage, resetting to a 30-year term means you'll be paying for that house a lot longer.

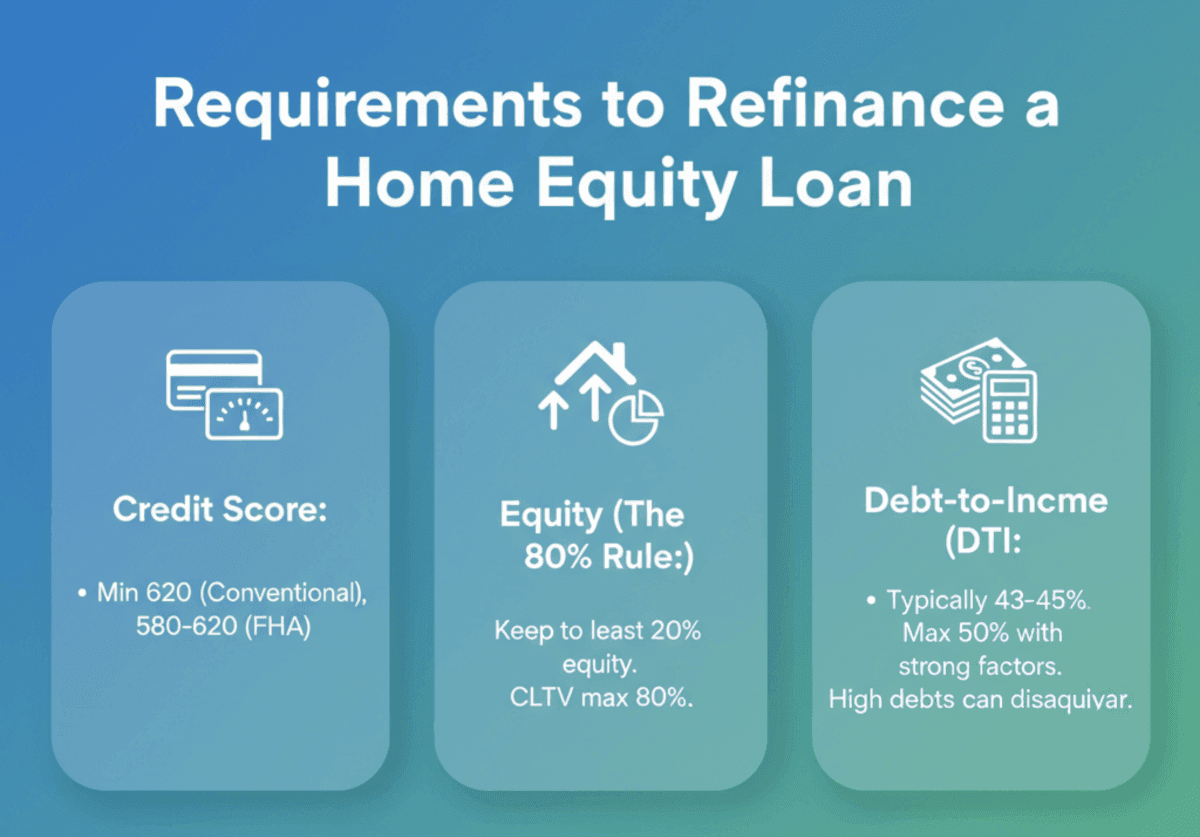

Requirements to Refinance a Home Equity Loan

Lenders view this as a brand-new loan application. They don't care that you've been paying on time for years. You have to requalify based on where you stand today.

Here is the reality of what you need to get approved:

-

Credit Score: While 620 is the minimum credit score for most conventional loans, some lenders accept lower scores with higher rates. FHA cash-out refinances typically require at least 580-620 depending on the lender.

-

Equity (The 80% Rule): You can't drain the house dry. Lenders use a metric called CLTV (Combined Loan-to-Value). Typically, they want you to keep at least 20% equity in the home. If your home is worth $500k, your total new loan usually can't exceed $400k.

-

Debt-to-Income (DTI): Conventional refinance lenders typically cap DTI at 43-45%, but approvals up to 50% are possible with automated underwriting systems or strong compensating factors. If you have huge car payments or credit card bills, it might disqualify you from refinancing the house.

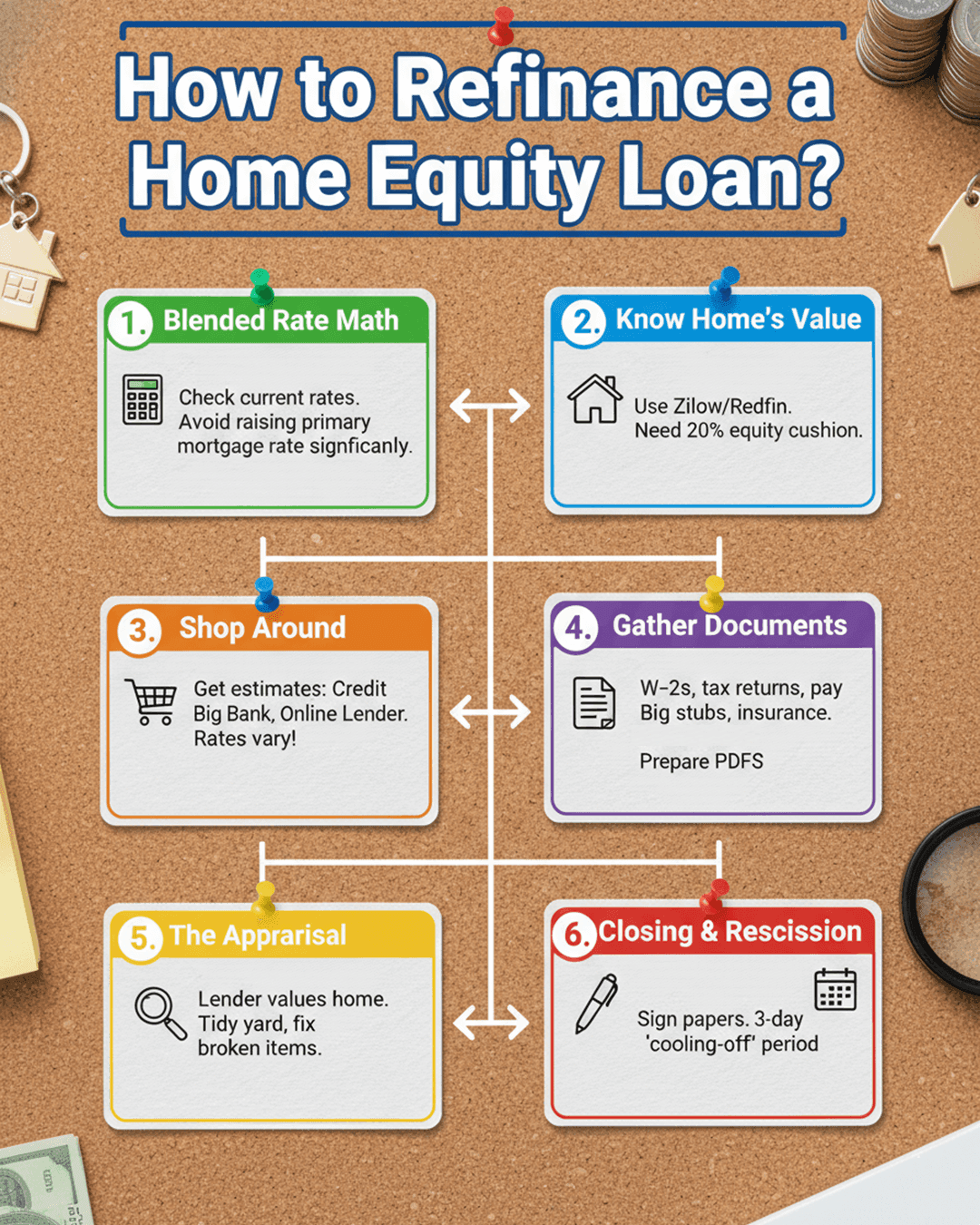

How to Refinance a Home Equity Loan?

If the pros outweigh the cons for you, here is the playbook for getting it done.

-

Do the "Blended Rate" Math: Check your current rates. If refinancing raises the rate on your primary mortgage significantly, stop. It's likely not worth it.

-

Know Your Home's Value: Check a few sites like Zillow or Redfin to get a ballpark number. If you don't have that 20% equity cushion I mentioned earlier, you might be wasting your time.

-

Shop Like You Mean It: Loyalty to your current bank is expensive. Get Loan Estimates from three sources: a local credit union, a big bank, and a direct online lender. I've seen rates vary by 0.5% on the same day for the same borrower.

-

Gather the Docs: You know the drill: W-2s, tax returns, pay stubs, and insurance declarations. Have them ready as PDFs to speed things up.

-

The Appraisal: The lender will send someone to value your home. A quick tip: Tidy up the yard and fix any obvious broken things (like a cracked window) before they arrive.

-

Closing & Rescission: You'll sign the papers. Since this is your primary home, federal law gives you a 3-day "cooling-off" period (Right of Rescission) to back out if you get cold feet.

What to Consider Before You Refinance a Home Equity Loan?

I always tell my clients: "Don't spend a dollar to save a dime." Before you sign, look at two specific things:

The Break-Even Point

Take your total closing costs (let's say $4,000). Divide that by how much you save per month (let's say $100).

- $4,000 / $100 = 40 months.

- It will take you over three years just to break even. If you plan to sell the house in two years, don't refinance. You are literally throwing money away.

Prepayment Penalties

Dig up the paperwork for your current home equity loan. Some lenders charge a nasty fee if you pay off the loan early (usually within the first 3 years). Make sure that the fee doesn't wipe out your savings.

FAQs About Refinancing a Home Equity Loan

Q1. Can you refinance a home equity loan for a lower interest rate?

Yes, but it depends on the market and your credit. If your credit score has jumped 50 points since you took out the loan, you're a prime candidate for a lower rate.

Q2. Can you refinance a home equity loan with bad credit?

It's tough. Conventional lenders are strict. FHA cash-out refinances generally require a minimum credit score of 580, though some lenders set overlays at 600-620. Scores in the 500s are unlikely to qualify even for FHA. It's more forgiving on credit scores but comes with Mortgage Insurance Premium (MIP) costs that stick around.

Q3. Can you refinance a home equity loan and your mortgage at the same time?

Yes, that is exactly what a "Cash-Out Refinance" does. It bundles everything into one new loan.

Q4. How often can you refinance a home equity loan?

Legally? As often as you want. Practically? Most lenders want a "seasoning" period of 6 to 12 months between loans. Plus, paying closing costs every year is a bad financial strategy.

Q5. What is better to do, a refinance or a home equity loan?

If you have a low rate on your primary mortgage (e.g., under 4%), get a separate home equity loan. Don't touch the primary! If your primary rate is high, combining them via a refinance usually makes more sense.

Q6. Why is taking equity out of your home a bad idea?

It turns unsecured debt (or smaller debt) into a risk against your shelter. If you can't make the payments, you don't just get a bad credit score, and you lose your house.

Conclusion

Refinancing a home equity loan into a mortgage isn't just a paperwork shuffle. It's a strategic financial move. It can save you from the volatility of variable rates and simplify your monthly budget. However, you have to watch out for closing costs and the danger of resetting your loan term.

My final piece of advice? Online calculators are great for estimates, but they don't know your full story. Before you commit, sit down with a licensed loan officer. Let them run the numbers for your specific situation so you can make a decision based on facts, not just a hunch.