VA IRRRL: What is VA Streamline Refinance? Everything to Learn

If you are a veteran sitting on a VA loan right now, you might be watching interest rates fluctuate and wondering if you're paying too much. I've been there. The good news is that the VA has one of the most powerful tools in the mortgage industry: the VA IRRRL (Interest Rate Reduction Refinance Loan). Most people just call it a VA Streamline Refinance.

Why is it such a big deal? Because, unlike traditional refinancing, it cuts out almost all the red tape. No piles of tax returns, usually no appraisal, and a much faster closing timeline. In this guide, I'm going to walk you through exactly what this program is, how it works, and the specific "gotchas" you need to watch out for to ensure it actually saves you money.

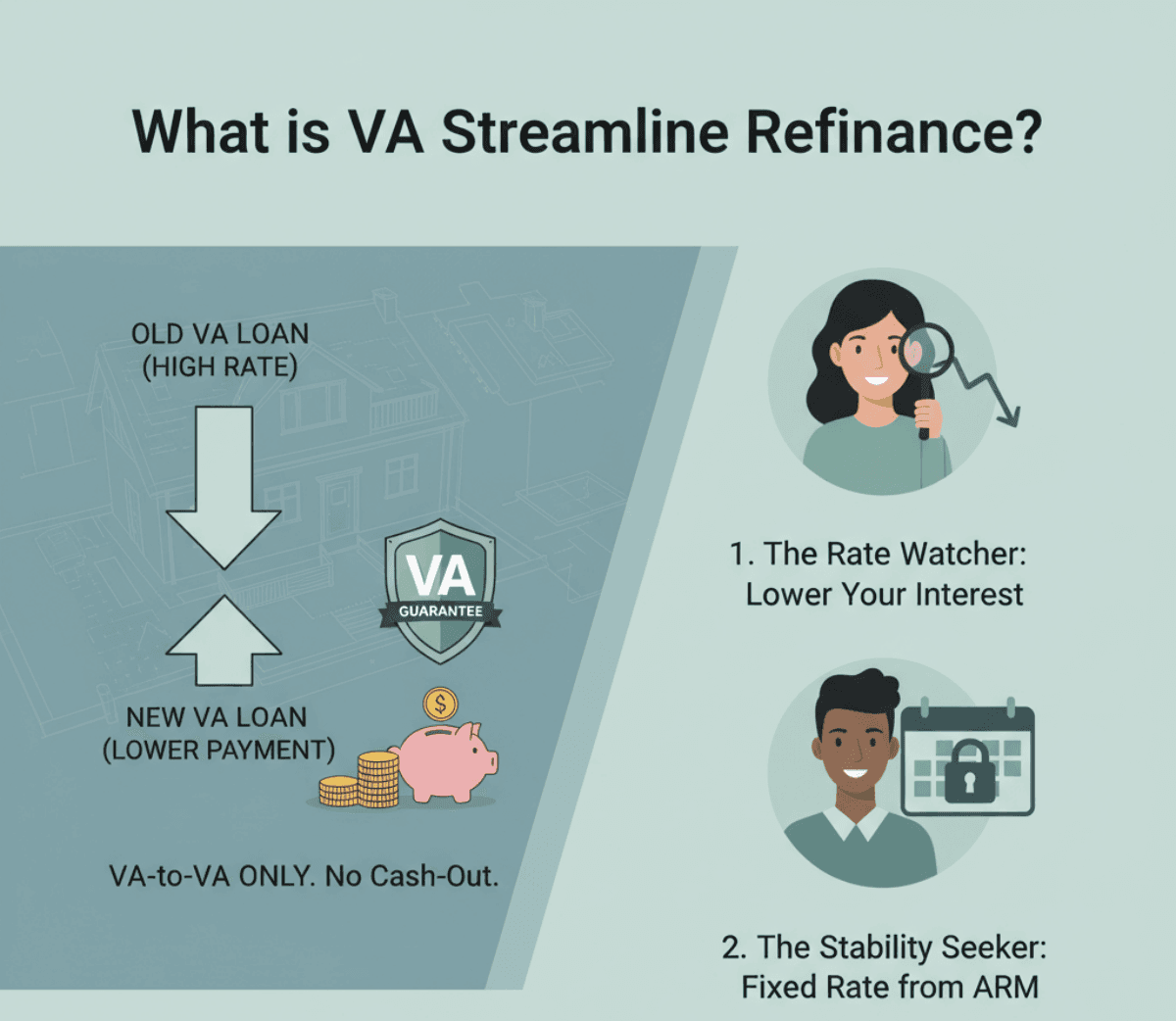

What is VA Streamline Refinance?

At its core, a VA Streamline Refinance is a "refinance-to-refinance" program designed exclusively for homeowners who already have a VA loan. You cannot use this program if you currently have an FHA or Conventional loan. It is strictly VA-to-VA.

The VA created this program with a simple history and purpose: to stabilize veterans' housing situations. When market rates drop, the government wants veterans to be able to lower their monthly payments without the friction of a full qualification process. It protects the lender (the VA guarantee remains) while helping the borrower save cash.

Who is this best for?

I typically recommend this path for two types of people:

-

The Rate Watcher: You have a high interest rate from a year or two ago, and current market rates are at least 0.5% lower.

-

The Stability Seeker: You have an Adjustable Rate Mortgage (ARM) and you want to lock in a Fixed Rate before your payments spike.

It is important to understand that this isn't a "cash-out" transaction. You aren't taking equity out of your home to buy a boat. You are simply replacing your old, expensive debt with new, cheaper debt.

How Does VA Streamline Refinance Work?

The mechanics of a VA IRRRL are surprisingly straightforward, but don't let the word "streamline" fool you into thinking it's automatic. You still have to apply for a new loan.

Here is how it works in practice: The new loan pays off your existing VA mortgage completely. The goal is to achieve what the VA calls a "Net Tangible Benefit." This is a strict government requirement. The lender must prove that refinancing puts you in a better financial position, usually by lowering your interest rate or monthly payment significantly.

Another key feature is that the closing costs can be rolled into the new loan balance. This means you can often complete a streamline refinance with zero out-of-pocket costs. While this increases your total loan amount slightly, it keeps your cash in the bank, which is a massive plus for many families.

VA Streamline Refinance Requirements

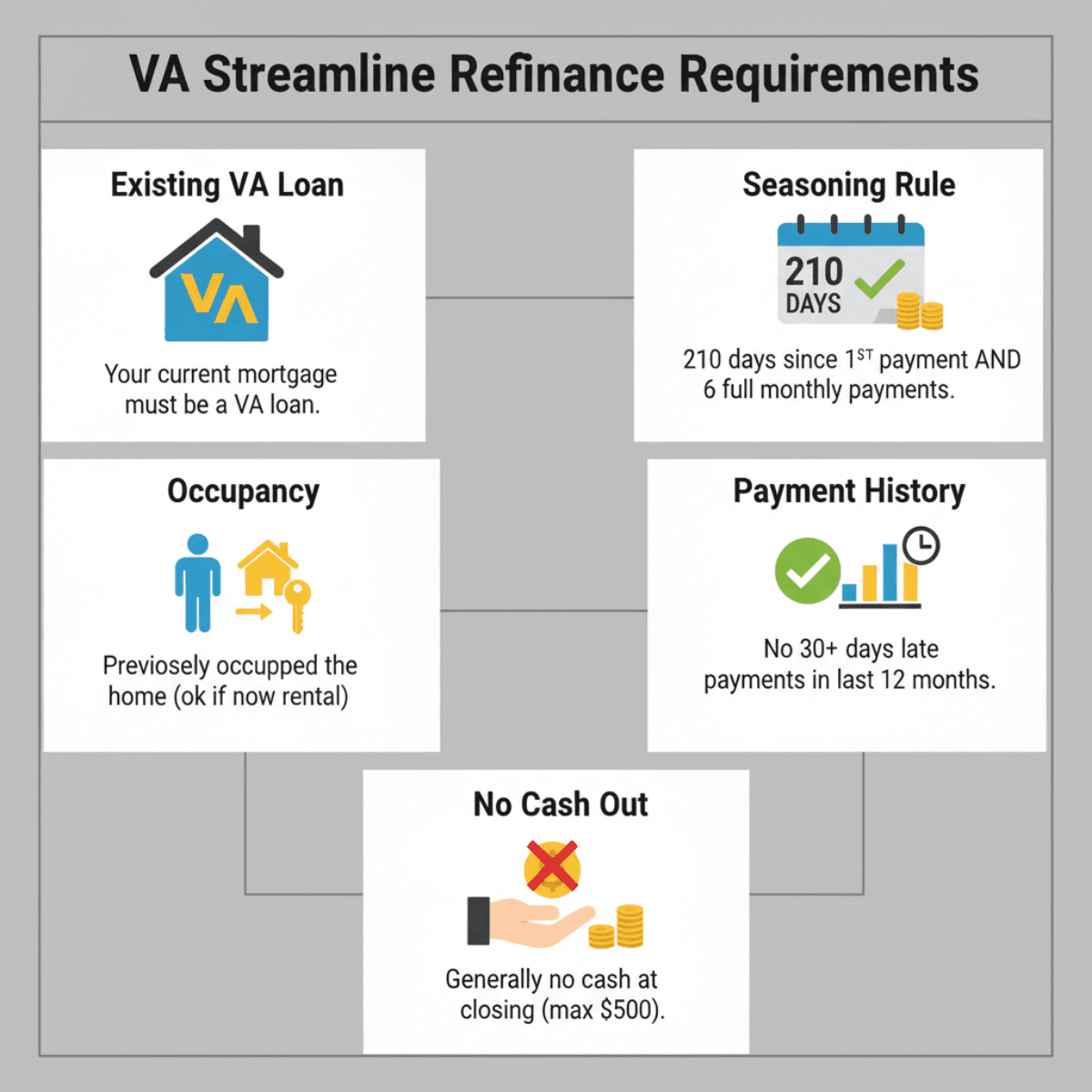

Even though this is the "easiest" loan to get, you still have to qualify. Based on official VA guidelines (VA Pamphlet 26-7), here are the non-negotiable requirements you need to meet:

-

Existing VA Loan: As mentioned, your current mortgage must be a VA loan.

-

The Seasoning Rule (Crucial): This is where many people get rejected. You cannot refinance immediately. The VA requires that 210 days have passed since your first payment date, and you must have made 6 full monthly payments. Both conditions must be met.

-

Occupancy: Unlike a new purchase where you must move in, for an IRRRL, you only need to certify that you previously occupied the home. This makes it perfect if you have been reassigned or converted the home into a rental.

-

Payment History: You generally cannot have any payments that were 30+ days late in the last 12 months.

-

No Cash Out: You generally cannot receive cash at closing (usually capped at $500 for minor computational errors).

A Note on "No Appraisal/No Income"

While the VA does not require an appraisal or income verification, lenders might. This is called a "lender overlay." If a bank demands a credit score of 640 or an appraisal, that is their rule, not the VA's. I always suggest shopping around if one lender says no.

Pros and Cons: Is a VA Streamline Refinance Worth It?

Before you sign the paperwork, you need to weigh the benefits against the costs. I'm a big fan of the IRRRL, but it isn't magic.

The Pros

-

Lower Monthly Payments: This is the main driver. A lower rate puts cash back in your pocket every month.

-

Reduced Paperwork: Skipping the income verification and appraisal saves weeks of stress and hundreds of dollars in upfront fees.

-

Energy Efficiency: You can add up to $6,000 to your loan balance specifically for energy-efficient improvements (like new windows) without a full qualification review.

The Cons

-

Closing Costs & Fees: You still have to pay title fees, origination fees, and recording fees. Even if rolled into the loan, you are paying interest on them.

-

VA Funding Fee: Most borrowers pay a 0.5% funding fee on the loan amount (unless you have a service-connected disability, in which case it is waived).

-

Resetting the Term: If you have paid 5 years of a 30-year mortgage and refinance back into a new 30-year loan, you are extending your debt timeline. This might mean paying more interest over the life of the home, even with a lower rate.

How Do I Get a VA IRRRL?

If you've decided this is the right move, the process is fairly linear. Here is the step-by-step roadmap I recommend to ensure a smooth closing:

-

Check Your Eligibility: Look at your mortgage statement. Have you made 6 payments? Has it been 210 days? If yes, you are clear to proceed.

-

Shop for Lenders: Do not just accept the offer from your current mortgage servicer. Lenders set their own interest rates and fees. I have seen rates vary by 0.25% to 0.50% between lenders on the same day. Call at least three VA-approved lenders.

-

Apply and Submit COE: You will need your Certificate of Eligibility (COE). If you can't find yours, don't worry, most lenders can pull this for you instantly through the VA portal.

-

Review the Loan Estimate: Look for the "Recoupment Period." The VA requires that the costs of the loan be recouped in savings within 36 months. If it takes 5 years to break even, the loan might be denied, or it simply might be a bad deal for you.

-

Closing: Since there is often no appraisal, closing can happen in as little as 2-3 weeks. You will sign the papers, and your old loan will be paid off.

What's the Difference Between Refinance and Streamline?

It is easy to confuse a "VA Cash-Out Refinance" with a "VA Streamline Refinance," but they are fundamentally different tools.

A VA Cash-Out Refinance is a full-blown mortgage application. It requires a new appraisal, income verification, and credit checks. The primary purpose is to tap into your home's equity to pay off high-interest debt (like credit cards) or to switch a non-VA loan (like FHA) into a VA loan. You can borrow up to 100% of your home's value in some cases.

A VA Streamline (IRRRL), on the other hand, is purely about rate and term. It is faster, cheaper, and requires less documentation because the VA already guarantees your loan. You cannot pull equity out for a vacation or car purchase. If you need cash in hand, the Streamline is not the product for you.

FAQs About VA IRRRL

Q1. How often can you VA streamline refinance?

Technically, there is no limit on how many times you can use the program. However, you must meet the Seasoning Requirement (210 days and 6 payments) every single time. Additionally, each new refinance must prove a "Net Tangible Benefit," meaning the rate must drop again. You can't just refinance for the fun of it.

Q2. What is the disadvantage of streamline refinance?

The biggest downside is the 0.5% VA Funding Fee (for non-exempt veterans) and the potential to extend your debt. If you turn a loan with 20 years left back into a 30-year loan, you are paying interest for an extra 10 years. I always advise calculating the "total interest cost" before signing.

Q3. How much are closing costs on a streamline refinance?

Closing costs typically range between 1% and 3% of the loan amount. On a $300,000 loan, that's $3,000 to $9,000. However, because no appraisal or credit report fees are usually required, it is cheaper than a standard refinance. Most veterans choose to roll these costs into the loan balance.

Q4. How does streamline refinance affect my credit?

The impact is usually minimal. Some lenders do a "hard pull," which might drop your score by a few points temporarily. Others might only do a "soft pull" for qualification. Since your payment history is the main factor, it is far less invasive than a traditional mortgage application.

Conclusion: Is a VA Streamline Refinance a Good Idea?

In my professional opinion, the VA Streamline Refinance is one of the best benefits available to veterans, provided the math works.

If you can lower your interest rate by at least 0.5% and recoup your closing costs in under 36 months, it is almost always a smart financial move. It frees up monthly cash flow that you can use for savings, investments, or family needs. However, be wary of serial refinancing that keeps resetting your 30-year clock.

My final advice is don't go it alone. Reach out to a VA-specialized loan officer today on Bluerate, ask for a "Loan Estimate," and look specifically at the Breakeven Point. That number will tell you everything you need to know.