Solved - How Soon Can You Refinance a Mortgage? Rules Here

I stumbled upon a thread in r/Mortgages that I see all the time. A homeowner posted: "Do I need to wait for 6 months to refinance?" They were frustrated, getting conflicting advice from friends and the internet. One person said they could do it immediately, and another swore there was a mandatory waiting period.

It's a classic confusion. The mortgage industry is filled with "rules of thumb" that get passed around as laws. But here is the truth: There isn't one single timeline for everyone.

The answer depends entirely on two things: the type of loan you currently have (FHA, VA, Conventional, etc.) and whether you want to just lower your rate or pull cash out.

As someone who has navigated these waters for years, I'm going to break down exactly how soon you can refinance, stripping away the jargon. However, keep in mind that while these are the official guidelines, every situation has unique wrinkles. Once you've read this, your best next step is always a free consultation with a local loan officer who can look at your specific numbers.

People Also Read

- Step-By-Step Guide: How to Refinance a Mortgage Loan?

- [Solved] When to Refinance Mortgage? Best Time You Cannot Miss

- Cash-out Refinance vs HELOC: All Differences to Learn

- Can You Refinance a HELOC? Reasons, Requirements, and Process

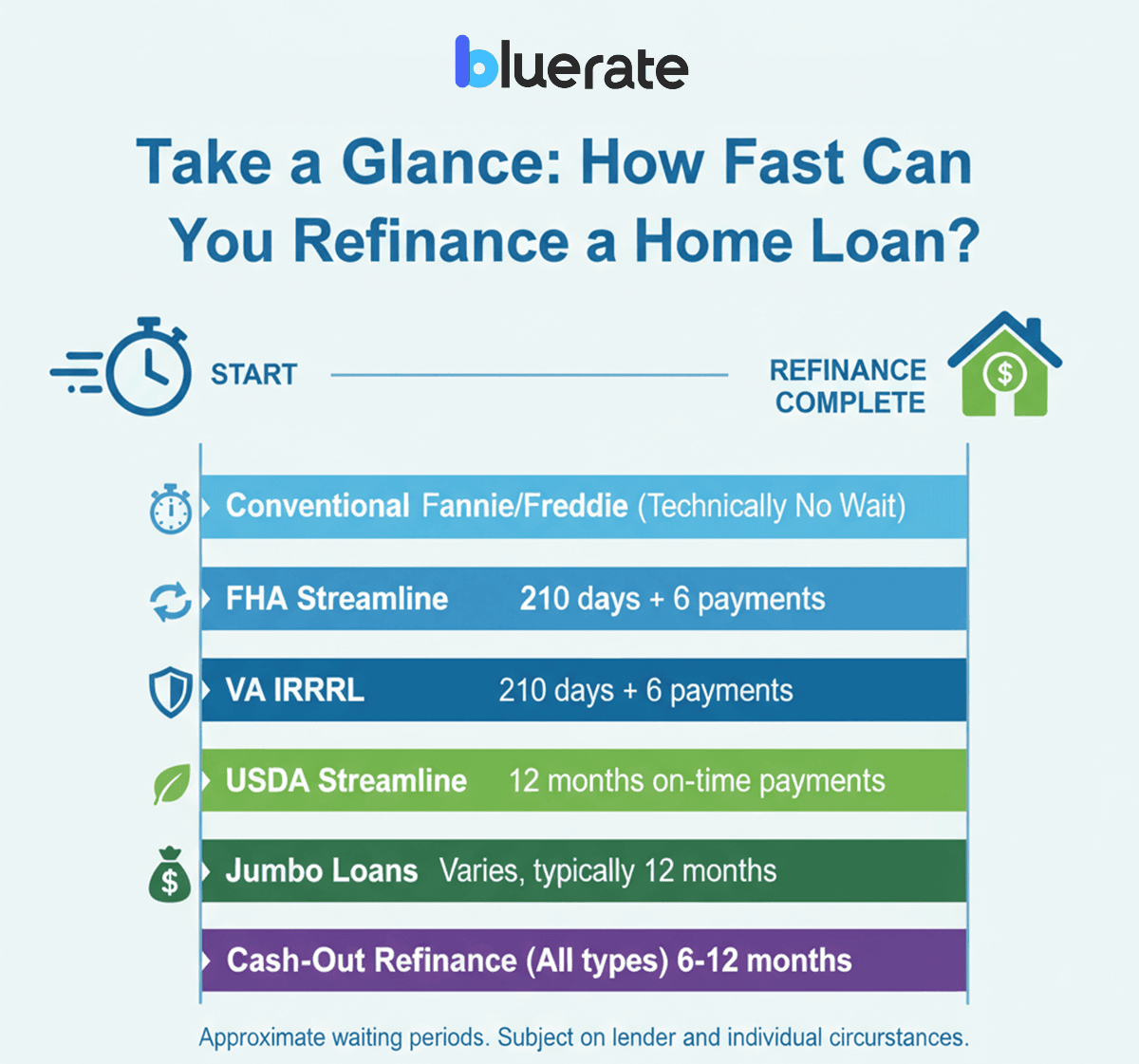

Take a Glance: How Fast Can You Refinance a Home Loan?

If you are in a rush and just need the numbers, I've put together this quick "cheat sheet."

When we talk about waiting, we use the industry term "Seasoning." This just means how long your current mortgage has been active. But be careful, there is a difference between what the official guidelines say and what a specific bank might require, which we call these "overlays".

Here is the general breakdown for Rate-and-Term refinances (just changing the rate or term, not taking cash out):

- Conventional (Fannie/Freddie): Technically no waiting period (but practically 6 months).

- FHA Streamline: 210 days from closing + 6 payments.

- VA IRRRL: 210 days from first payment + 6 payments.

- USDA Streamline: 12 months of on-time payments.

- Jumbo Loans: Varies by investor, usually 12 months.

- Cash-Out Refinance (All types): Almost strictly 6 to 12 months.

If you want to take Cash-Out, the clock is stricter. Banks want to see you handle the mortgage payments for a significant time (usually 6+ months) before they let you tap into your home equity.

Timeline: How Soon Can You Refinance an FHA Loan?

If you currently have an FHA loan, you are likely looking at the FHA Streamline Refinance. This is one of the best products on the market because it requires very little paperwork, often no appraisal and no income verification.

However, the Department of Housing and Urban Development (HUD) is very strict about the timeline to prevent "churning" (constant refinancing that eats up equity in fees).

To qualify for an FHA Streamline, you must meet both of these criteria:

- 210 Days: It must be at least 210 days since the closing date of your current mortgage.

- 6 Payments: You must have made 6 full monthly mortgage payments.

You cannot just prepay 6 months in advance to speed this up. You actually have to wait the time. Also, your payment history must be spotless. One late payment in the last 12 months can disqualify you.

If you are looking for an FHA Cash-Out Refinance, the rules are tighter. You typically need to have owned the home and made payments for 12 months.

Timeline: How Soon Can You Refinance a Conventional Loan?

This is where things get tricky, and where that Reddit user likely got confused.

If you check the official handbook for Fannie Mae or Freddie Mac (the entities that back most conventional loans), they state that for a Rate-and-Term refinance, there is no mandatory waiting period. Technically, you could close on a house on Monday and refinance on Tuesday if rates dropped drastically.

But here is the catch and it's a big one:

Most lenders have a clause called an EPO (Early Payoff) penalty in their contracts with investors. If you pay off your loan within 6 months, the lender loses their commission. Because of this, very few loan officers will help you refinance a conventional loan before the 6-month mark. They aren't legally forbidden from doing it, but it's bad for business, so they will tell you to wait.

For Cash-Out Refinances:

There is no loophole here. You generally must be on the title of the home for at least 6 months before you can use the appraised value to pull cash out. If you try to do it sooner, the lender will likely use the purchase price instead of the current value, which defeats the purpose if your home value has gone up.

Timeline: How Soon Can You Refinance a USDA Mortgage?

USDA loans are fantastic for rural homeowners, and they have their own version of a "Streamline" called the USDA Streamline Assist.

I find this program to be straightforward but rigid regarding the timeline. To be eligible, you must have made your mortgage payments on time for the last 12 consecutive months.

Unlike FHA or VA where you count days, USDA looks at that 12-month payment history closely.

- The Good News: Like the FHA Streamline, you usually don't need a new appraisal or credit check.

- The Factor to Watch: Even though it's a refinance, you still need to meet the USDA's household income limits. If you got a big promotion or a new job that pushes your household income above the local USDA cap, you might not qualify for this specific program and might need to switch to a Conventional loan instead.

Timeline: How Soon Can You Refinance a VA Loan?

If you are a veteran or active-duty service member, you have access to the VA IRRRL (Interest Rate Reduction Refinance Loan). The VA takes borrower protection very seriously to stop predatory lenders from convincing veterans to refinance unnecessarily.

Because of this, the seasoning requirements are actually Federal Law, not just guidelines.

You cannot close on a VA refinance until:

- 210 days have passed since your first payment due date.

- AND you have made 6 full monthly payments.

Note the emphasis on "AND." If you make 6 payments but only 180 days have passed, you have to wait.

Recoupment Rule

There is another layer here. The VA requires that the refinance provides a "Net Tangible Benefit." This usually means the new loan must have a lower interest rate, and the costs of the refinance must be recouped (paid back by your monthly savings) within 36 months. If the math doesn't show you saving money quickly enough, the VA won't insure the new loan.

Timeline: How Soon Can You Refinance a Jumbo Loan?

Jumbo loans (mortgages that exceed the conforming loan limits, usually for luxury properties) are a different beast. Because these loans aren't backed by government agencies like Fannie Mae or the FHA, the rules are set entirely by the private investors or banks holding the money.

This means there is no universal rule. However, from my experience working with Jumbo investors, they are conservative.

- Standard Practice: Most Jumbo lenders require 12 months of seasoning (title ownership and payments) before allowing a refinance.

- Strict Scrutiny: Because the loan amounts are high, they will scrutinize your credit and income again heavily.

If you have a Jumbo loan and rates have dropped, don't rely on Google. Call your current loan servicer or a local portfolio lender. They are the only ones who can tell you their specific internal policy.

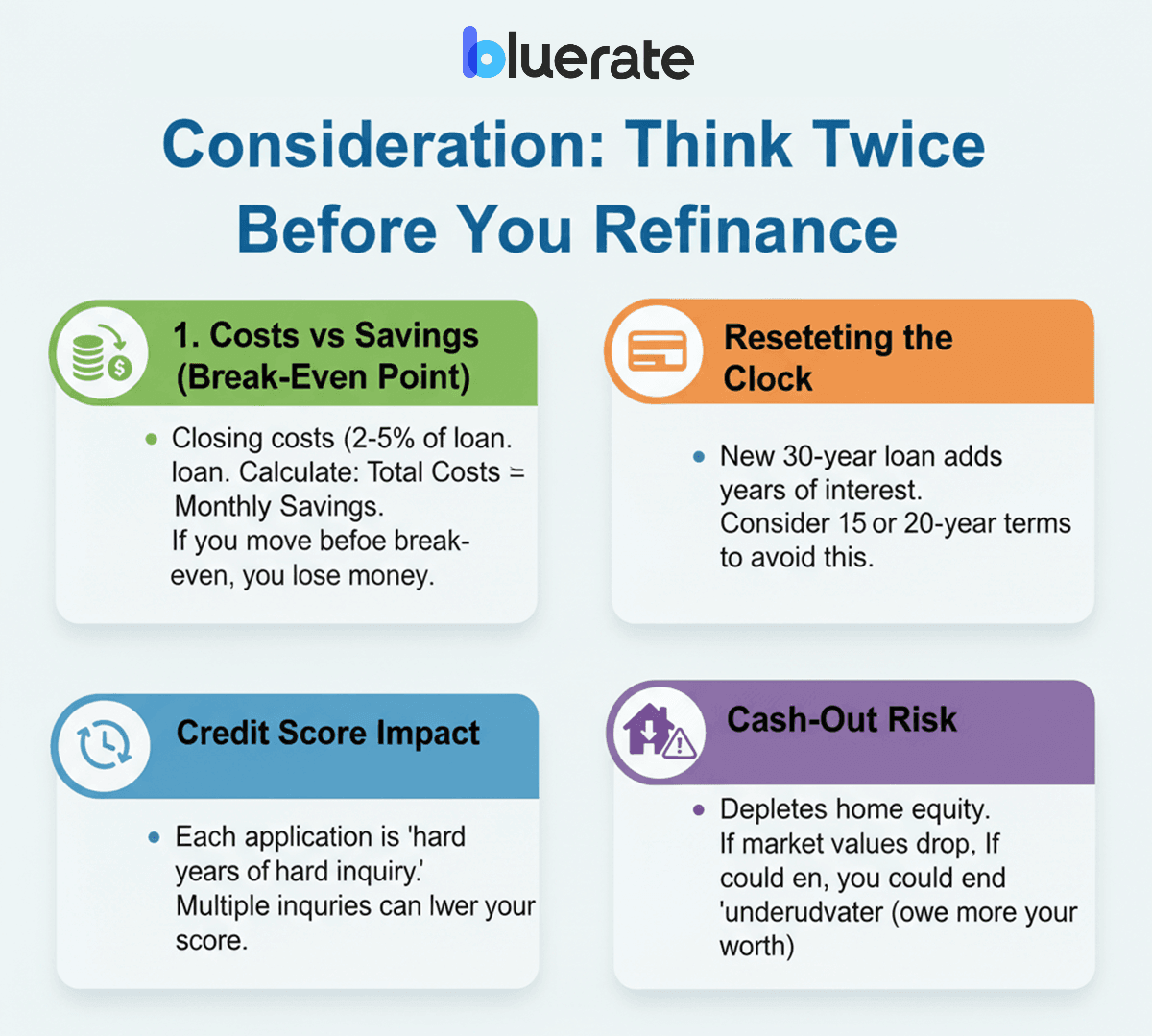

Consideration: Think Twice Before You Refinance

Just because you can refinance doesn't mean you should. I've seen homeowners rush into a refinance to save $50 a month, only to realize later they actually lost money.

Here are the critical factors I tell my clients to consider beyond just the timeline:

1. The "Seasoning" of Costs vs. Savings

Refinancing isn't free. Closing costs typically run 2% to 5% of the loan amount. You need to calculate your Break-Even Point.

- Formula: Total Closing Costs ÷ Monthly Savings = Months to Break Even.

- If it takes 48 months to break even, but you plan to move in 3 years, you are throwing money away.

2. Resetting the Clock

If you have been paying your 30-year mortgage for 5 years, you have 25 years left. If you refinance into a new 30-year loan, you are resetting the clock back to 30. You might lower your monthly payment, but you are adding 5 extra years of interest payments. Consider refinancing into a 20-year or 15-year term to avoid this.

3. Credit Score Impact

Every refinance application involves a hard inquiry on your credit. While one inquiry isn't a disaster, multiple applications over a long period can drag your score down.

4. Cash-Out Risk

If you are doing a cash-out refinance, remember that you are depleting the equity in your home. If housing markets shift and values drop, you could end up "underwater" (owing more than the home is worth).

Frequently Asked Questions

Q1. How long do you have to wait before you can refinance a mortgage?

Generally, you should expect to wait 6 months. While some Conventional loans technically allow it sooner, finding a lender is difficult due to penalty clauses. Government loans (FHA/VA) strictly require a 210-day wait plus 6 payments.

Q2. How long does it take to refinance a house with cash-out?

How long does it take to refinance a house? Industry-standard for Cash-Out is 6 months of being on the title. Some lenders differ, but 6 months is the safe bet to use the home's current appraised value rather than the purchase price. FHA cash-out requires 12 months.

Q3. What is the 2% rule for refinancing?

This is an old rule stating you should only refinance if rates drop by 2%. It is outdated. Today, with larger loan balances, a drop of even 0.75% to 1% can save you significant money. Focus on the Break-Even point, not just the rate.

Q4. Do you need 20% equity to refinance?

No. For a Rate-and-Term refinance, you can often refinance with less than 20% equity, though you will likely have to pay Private Mortgage Insurance (PMI). For a Cash-Out refinance, however, most lenders strictly require you to keep at least 20% equity in the home.

Q5. Can refinancing hurt your credit?

Temporarily, yes. A hard inquiry usually drops your score by a few points. Also, closing your old loan and opening a new one reduces the "average age" of your credit accounts. However, on-time payments on the new loan will boost your score back up over time.

Q6. How quickly can I refinance after buying a home?

If you are doing a standard Conventional refinance, you can technically do it immediately if you find a willing lender. But practically, you should plan on waiting 6 months to avoid complications with your lender's guidelines.

Q7. What is the 6-month refinance rule?

This usually refers to Title Seasoning. Lenders want to see you have owned the home for 6 months before they trust the current market value for a refinance. If you refinance before 6 months, they will likely use the lower of the purchase price or appraised value.

Conclusion

Navigating mortgage timelines can feel like trying to solve a puzzle where the pieces keep changing shape. But if there is one "golden rule" to take away from this, it is the 6-month mark. For most homeowners, whether you have an FHA, VA, or Conventional loan, waiting six months puts you in the safe zone to refinance without hitting regulatory walls or lender penalties.

Remember, refinancing is a tool to improve your financial health, not just a reaction to a news headline about interest rates.

If you are close to that 6-month window or have a unique situation (like a sudden improvement in credit score), don't guess. Reach out to a local, licensed Loan Officer. They can run the specific numbers for your scenario, usually for free, and tell you exactly when you are eligible to pull the trigger.