Can You Refinance a HELOC? Reasons, Requirements, and Process

Can you refinance a HELOC? Yes, you absolutely can. In today's economic climate, where variable rates have caused monthly payments to spike for many homeowners, this is one of the most common questions I hear. Whether you are nearing the end of your draw period and dreading the ballooning payments, or you just want to stabilize your budget, refinancing is a viable exit strategy. It isn't just about survival. It's about optimizing your debt to work for you, not against you.

However, navigating the mortgage landscape right now can feel like walking through a minefield. Rates vary wildly between lenders. That is why, before you commit to anything, I suggest you head over to Bluerate to start a free consultation with a local loan officer. They can crunch the numbers for your specific zip code and situation, saving you from making a costly mistake.

Can You Refinance a HELOC?

When people ask me if they can refinance a HELOC, they often imagine simply signing an addendum to their existing contract. In reality, the process is a bit more involved. Refinancing a HELOC technically means taking out a completely new loan to pay off the balance of your old HELOC.

Think of it as a financial reset button. You apply for a new loan, which could be another HELOC, a fixed-rate home equity loan, or even a cash-out refinance on your primary mortgage. Once approved, the funds from this new loan are used to wipe out the debt from your current line of credit. The old account is closed or paid down to zero, and you move forward with the terms, interest rate, and repayment schedule of the new loan. It requires an application, credit check, and often a new appraisal, but the long-term savings often make the legwork worth it.

Read Also: Cash-out Refinance vs HELOC: All Differences to Learn

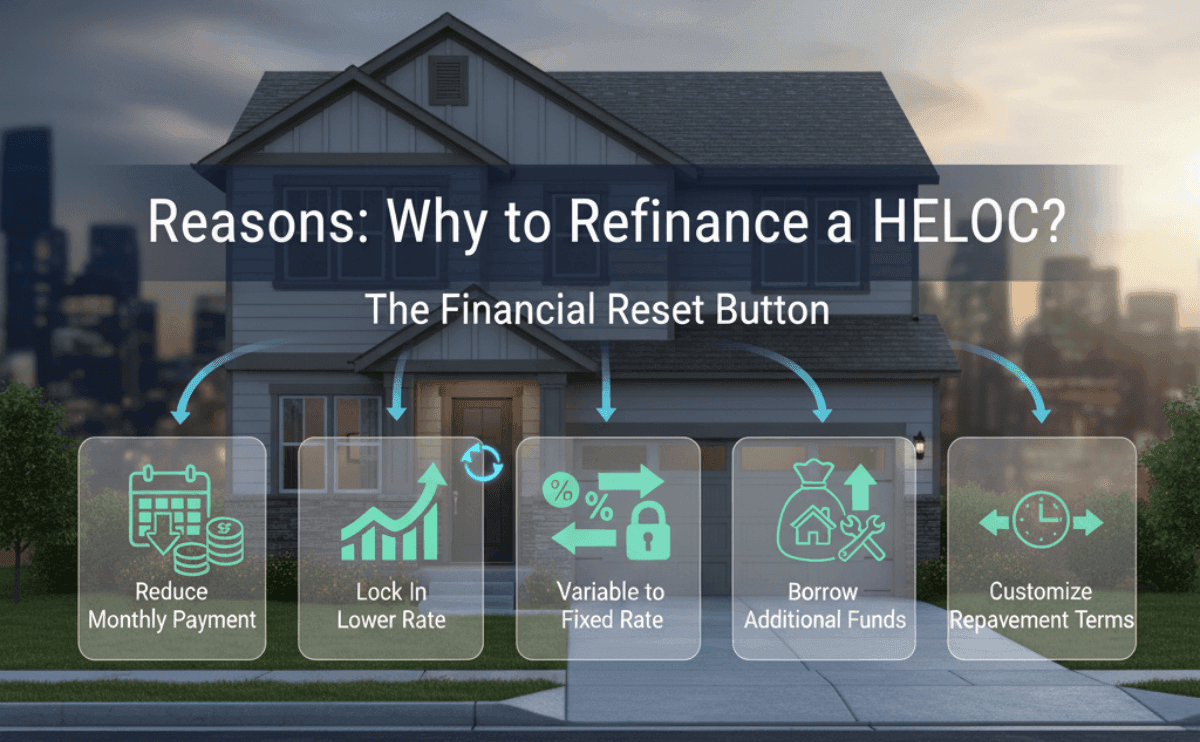

Reasons: Why to Refinance a HELOC?

Why would you go through the hassle of paperwork and underwriting all over again? Usually, it comes down to math and peace of mind. Here are the main drivers I see for refinancing a HELOC:

-

Reduce your monthly payment: If your "draw period" is ending, you are about to switch from interest-only payments to principal-plus-interest payments. This can double or triple your bill overnight. Refinancing allows you to reset the clock or extend the term to keep payments manageable.

-

Lock in a lower interest rate: If your credit score has jumped 50 points since you first applied, or if market rates dip, refinancing is the only way to capture those savings.

-

Switch from variable to fixed: This is crucial. Most HELOCs have variable rates. Refinancing into a fixed-rate loan protects you from future Federal Reserve rate hikes.

-

Borrow additional funds: If your home has appreciated in value, refinancing allows you to tap into that new equity for large expenses like renovations or college tuition.

-

Shorten or extend repayment terms: You can customize your timeline. Refinance to a shorter term to be debt-free faster, or a longer term to prioritize cash flow.

How to Refinance a HELOC?

Transitioning out of your current loan isn't a one-way street. There are several paths you can take, and the "best" one depends entirely on your financial goals. Are you looking for the lowest possible rate, or do you need stability? Let's break down the five most effective methods.

Method 1. Consult Your Current Lender for Better Terms

Before you start filling out lengthy applications with strangers, your first phone call should be to the bank or credit union that currently holds your HELOC. This is often the path of least resistance. You simply ask them if they can offer a Loan Modification or if they have a streamline refinance program for existing customers.

The primary advantage here is efficiency. Your current lender already has your payment history and property details on file. Because they want to keep your business, they might be willing to waive the appraisal requirement or offer reduced closing costs. In some cases, they might simply allow you to convert a portion of your variable-rate balance into a fixed-rate segment without opening a whole new loan account.

However, there is a downside to loyalty. Banks often reserve their most aggressive "teaser rates" for new customers to get them in the door. As an existing client, you might not be offered the absolute bottom-of-the-market rate. Additionally, if your lender's base rates are high compared to the national average, a discount might still leave you paying too much.

My advice is to get a quote from your current lender, but don't sign it immediately. Treat it as your backup plan. Then, go to Bluerate and consult with a local loan officer to see what other lenders are offering. You can use the outside offers as leverage to negotiate a better deal with your current bank.

Method 2. Refinance by Opening a New HELOC

If your current lender isn't budging, or if you want to regain the flexibility of a credit line, you can refinance by opening a new HELOC with a different institution. This essentially restarts your clock. You use the new credit line to pay off the old one, and you gain a fresh "draw period", typically another 10 years where you can make interest-only payments and borrow funds as needed.

This method is particularly attractive if you can find a lender offering a "Teaser Rate" or introductory rate. Many banks offer very low rates (sometimes below prime) for the first 6 to 12 months of a new HELOC. If you have a solid plan to pay down the debt aggressively during that cheap year, the savings can be substantial.

However, you need to be realistic about the risks. Once that teaser rate expires, the rate will adjust to the current market margin, which is almost always variable. If the Federal Reserve raises rates, your costs go up. Furthermore, switching lenders means you will likely face a new round of closing costs, including origination fees and appraisal fees. You need to calculate if the interest savings justify these upfront costs. This path is best for disciplined borrowers who need ongoing access to cash and understand how to manage variable-rate debt.

Method 3. Use a Home Equity Loan to Pay Off Your HELOC

For homeowners who are tired of losing sleep over the Federal Reserve's next move, this is often the best solution. You can refinance your variable-rate HELOC into a Home Equity Loan. Unlike a HELOC, which is a revolving line of credit (like a credit card), a home equity loan is an installment loan (like a car loan). You get a lump sum of cash, pay off the HELOC, and then make steady payments back to the new lender.

The massive "Pro" here is predictability. Home equity loans almost always come with a fixed interest rate. This means your monthly payment will be exactly the same in month 1 as it is in month 60, regardless of what happens to the economy. This stability makes budgeting incredibly simple and eliminates the risk of payment shock.

The "Con" is that you lose flexibility. Once you pay down the principal on a home equity loan, you cannot re-borrow that money. If an emergency pops up, you'd need to apply for a new loan. Additionally, the starting interest rate on a fixed home equity loan is often slightly higher than the initial rate of a variable HELOC because you are paying a premium for that stability. This method is ideal for those who are done borrowing and are now solely focused on paying off their debt in a structured, safe way.

Method 4. Use a Cash-Out Refinance on Your First Mortgage to Pay Off Your HELOC

This approach involves heavy lifting, but it can simplify your financial life. A cash-out refinance replaces your current primary mortgage with a new, larger mortgage. You use the extra cash to pay off your HELOC completely. The result? You are left with just one loan and one monthly payment.

The main benefit is consolidation. Managing one bill is easier than balancing two. Also, interest rates on primary mortgages are generally lower than rates on standalone home equity products. By rolling the HELOC debt into your primary mortgage, you might lower the average interest rate you are paying on that specific debt chunk.

However, there is a massive warning label attached to this method. You must look at your current primary mortgage rate. If you locked in a historically low rate like 2.5% or 3% a few years ago, giving that up to refinance into today's rates, which might be 6% or 7% is usually a terrible financial move. You would be raising the interest cost on your entire home debt just to eliminate the HELOC. This method only makes sense if your current primary mortgage rate is already high, or if the blended rate of the new loan saves you money overall. Refinance closing costs on a full mortgage refinance are also significantly higher, 2% to 6% of the loan amount, compared to HELOCs.

Method 5. Pay Off Your HELOC With a Personal Loan

Sometimes, the best way to handle a HELOC is to get away from real estate loans entirely. If your HELOC balance is relatively small, say, under $30,000, you might consider refinancing it with an unsecured personal loan.

The biggest advantage here is that a personal loan is unsecured. This means your home is no longer collateral. If you run into a financial catastrophe and default on a personal loan, your credit score will tank, but the bank cannot foreclose on your house. This provides a layer of security for your family. Speed is another factor. Personal loans can often be funded in a matter of days, with zero appraisal requirements and minimal paperwork.

The trade-off is the cost. Because there is no collateral securing the deal, lenders charge higher interest rates on personal loans than on home equity products. You will also face a shorter repayment term, typically 3 to 7 years. While this gets you out of debt faster, it creates a much higher monthly payment compared to a 20-year HELOC term. This method is strictly for those who want a "clean break" from secured debt and have the monthly cash flow to support aggressive repayment.

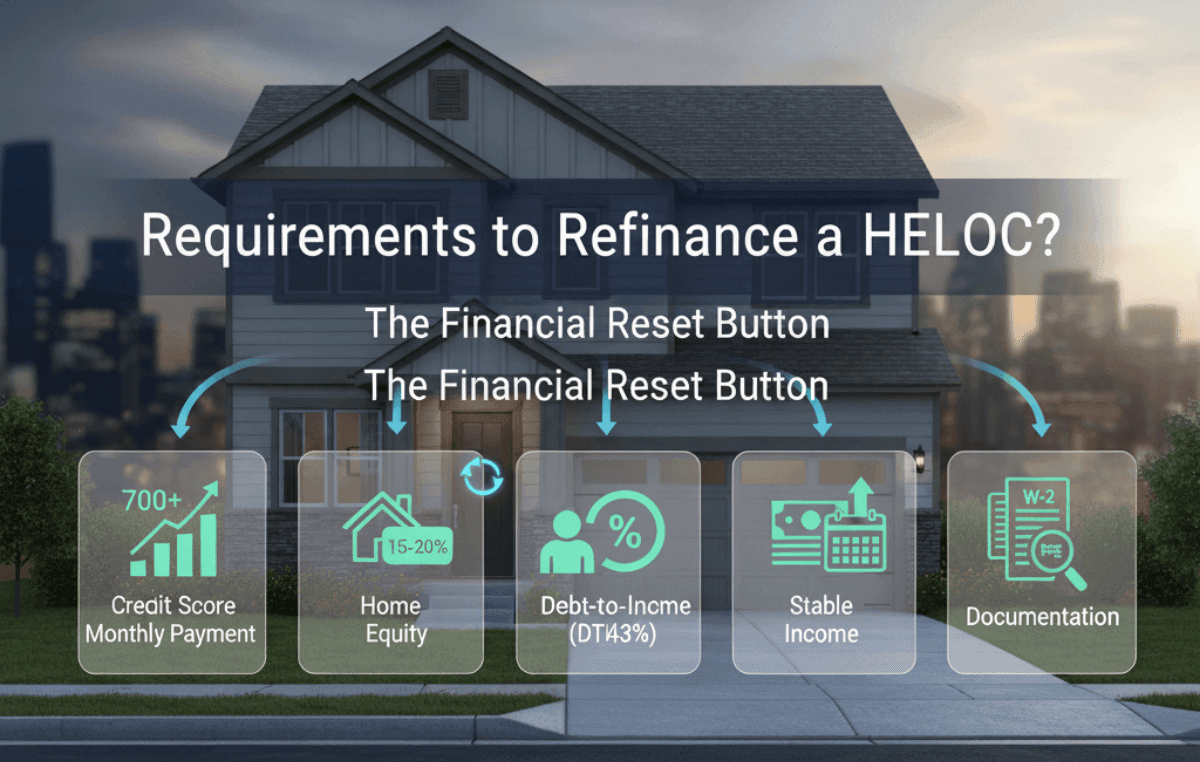

Requirements to Refinance a HELOC

Lenders aren't handing out money as easily as they did a few years ago. To get approved for a refinance, you need to prove you are a safe bet. Here is what underwriters are looking for:

-

Credit Score: While you might find lenders willing to work with a 620 score, the terms won't be pretty. To refinance into a rate that actually saves you money, you generally need a score of 700 to 720+. The higher the score, the lower the margin the bank adds to the Prime Rate.

-

Home Equity: You cannot borrow 100% of your home's value. Lenders look at the Combined Loan-to-Value (CLTV) ratio. Typically, you need to retain about 15% to 20% equity in the property. This means if your home is worth $400,000, your primary mortgage plus the new HELOC cannot exceed roughly $320,000 to $340,000.

-

Debt-to-Income (DTI): This measures your ability to pay. Lenders want to see that your total monthly debt payments (including the new loan) do not exceed 43% of your gross monthly income. Some lenders may stretch this to 50% if you have significant savings, but 43% is the standard safe zone.

-

Documentation: Prepare to be audited. You will need to provide W-2s for the last two years, recent pay stubs (usually 30 days' worth), tax returns, and your most recent mortgage statement to prove you are current on payments.

How to Qualify to Refinance a HELOC?

If you are worried your application might not pass, don't just apply blindly and hope for the best. Take these actionable steps to "dress up" your financial profile before the lender sees it:

-

Check Your Credit Report Early: Pull your report at least 3 months in advance. If there are errors, dispute them. If your utilization is high, pay down credit card balances. A 20-point bump can save you thousands in interest.

-

Know Your True Equity: Don't rely on a guess. Check recent sales of comparable homes in your neighborhood. If you are on the borderline of the 80% or 85% CLTV limit, you might need to bring cash to closing to make the deal work.

-

Calculate Your DTI: Be proactive. If you have a small car loan with a $400 monthly payment and only $2,000 left on the balance, pay it off before applying. This immediately improves your DTI ratio and boosts your borrowing power.

-

Shop Around: I cannot stress this enough. Refinancing rates are not fixed by the government. They are set by individual banks. One bank might offer you Prime + 0.5%, while another offers Prime + 1.5%. Always compare at least three quotes.

Conclusion

Refinancing a HELOC isn't just a paperwork exercise. It's a strategic move to protect your home and your wallet from volatile markets. Whether you choose to lock in a fixed rate with a Home Equity Loan or consolidate debt via a cash-out refinance, the goal is to put yourself in a stronger financial position.

However, remember that the "lowest mortgage rate" isn't always the "best loan" if the closing costs are sky-high or the terms don't fit your timeline. Real estate finance is nuanced, and online calculators can only tell you so much.

Don't leave this to guesswork. I highly recommend visiting Bluerate to consult with a local loan officer for free. They can help you navigate the specific equity requirements in your area, compare offers from multiple lenders, and ensure the new loan actually achieves your financial goals. A 15-minute conversation could be the difference between a stressful payment and a manageable one.