Cash-out Refinance vs HELOC: All Differences to Learn

If you are staring at your home's equity and wondering how to tap into it, you aren't alone. I remember feeling completely overwhelmed by the "alphabet soup" of financial jargon when I first looked into this. Two terms often get tossed around interchangeably: Cash-out Refinance and HELOC. While they both unlock cash from your home, they function like apples and oranges. One replaces your current loan. The other adds to it. Choosing the wrong one could cost you thousands in interest, especially in today's market. Let's break down exactly how they differ so you can make a move that actually benefits your wallet.

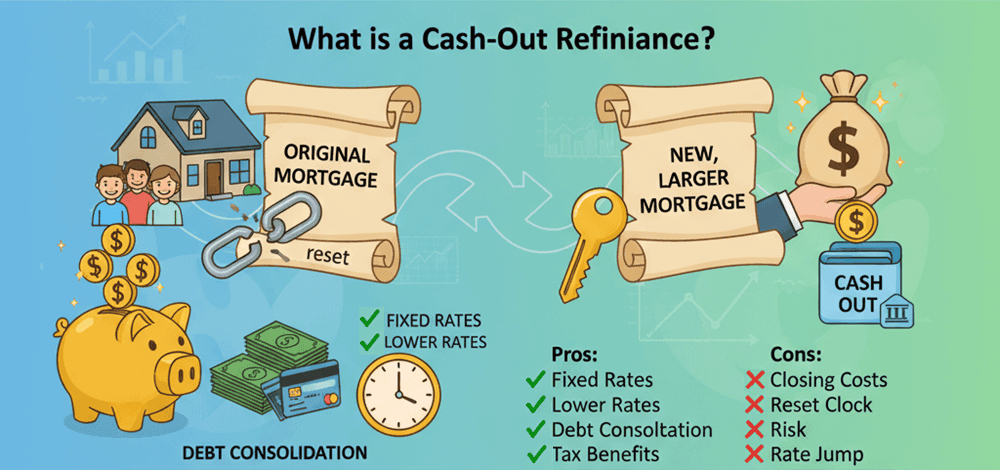

What is a Cash-Out Refinance?

Think of a cash-out refinance as hitting the "reset" button on your entire mortgage. I often explain it to homeowners this way: you aren't just taking out extra money. You are completely paying off your existing mortgage and replacing it with a new, larger one. The difference between what you owed and the new loan amount is the "cash out" that lands in your bank account as a lump sum.

This option is typically best for people who want stability. Because you are getting a brand-new primary mortgage, you usually lock in a fixed interest rate for the life of the loan (often 15 or 30 years). It is a powerful tool if current interest rates are lower than or similar to what you are currently paying. However, if you are sitting on a historic low rate like the 3% rates from a few years ago, swapping it for today's higher rates just to get some cash might not make mathematical sense.

Pros:

- Fixed Interest Rates: Your rate stays the same, making budgeting easier.

- Lower Rates: Primary mortgages generally have lower rates than HELOCs or personal loans.

- Debt Consolidation: Great for paying off high-interest credit cards.

- Tax Benefits: Interest on the cash-out portion may be tax-deductible if used for home improvements.

Cons:

- Closing Costs: You pay closing costs on the entire loan amount, not just the cash out.

- Resetting the Clock: You might extend your mortgage term back to 30 years.

- Risk: Your home is collateral. If you can't pay, you risk foreclosure.

- Rate Jump: You lose your previous low-interest rate.

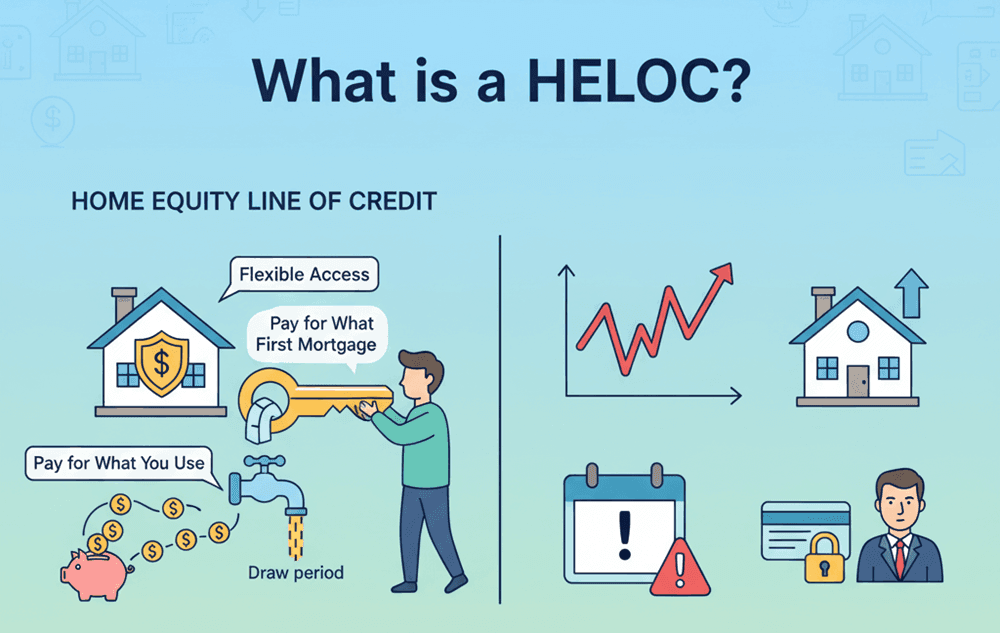

What is HELOC?

A Home Equity Line of Credit, or HELOC, functions much more like a credit card secured by your house. Instead of a lump sum, the lender approves you for a specific limit, say $50,000, and you can draw from it whenever you need during a "draw period" (usually 10 years). I find this flexibility is a lifesaver for projects where costs are unpredictable, like a kitchen renovation or paying for college tuition over several semesters.

Unlike a cash-out refinance, a HELOC is a "second mortgage." It sits on top of your existing loan, meaning you don't have to touch your current primary mortgage rate. If you have a locked-in low rate on your main house payment, a HELOC allows you to preserve that while still accessing cash. However, the trade-off is volatility. HELOCs almost always have variable interest rates tied to the Prime Rate. If the Federal Reserve raises rates, your HELOC payment goes up immediately.

See Also: [Must-Read] How Does a HELOC Work? Explore Process Here

Pros:

- Pay for What You Use: You only pay interest on the amount you actually withdraw.

- Preserve First Mortgage: You keep your existing low rate on your main home loan.

- Flexibility: Borrow and repay repeatedly during the draw period.

- Low Closing Costs: Many lenders offer HELOCs with little to no closing costs.

Cons:

- Variable Rates: Your monthly payment can fluctuate wildly with market conditions.

- Payment Shock: Once the draw period ends, you must pay back principal + interest, causing payments to spike.

- Harder to Qualify: Lenders often require higher credit scores compared to a primary mortgage.

- Collateral Risk: Like a refinance, your home is on the line if you default.

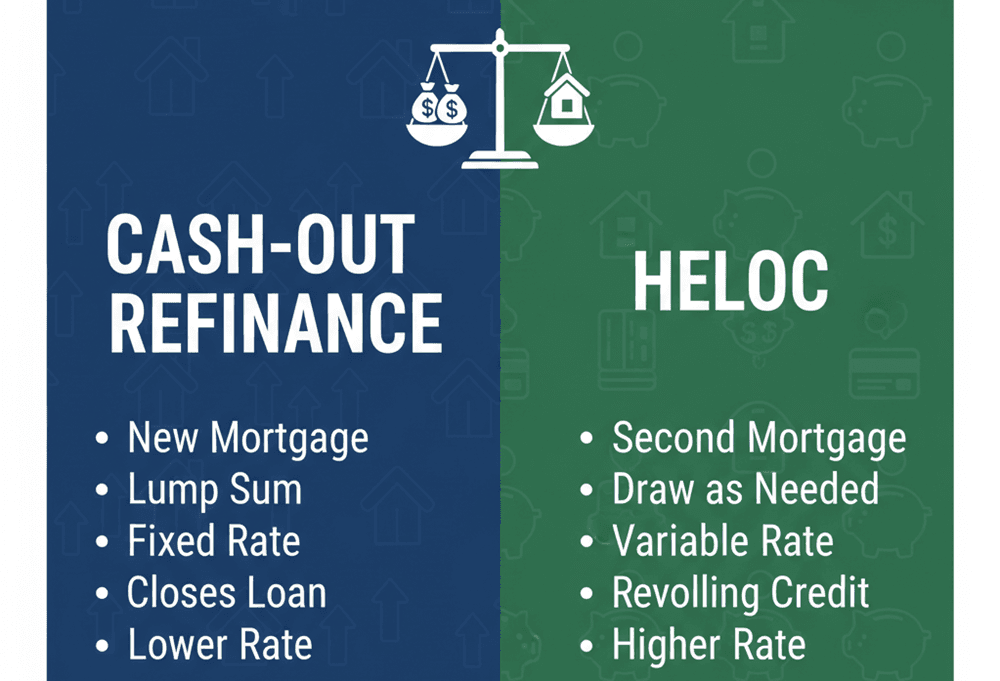

What are Difference Between Cash Out Refinance and HELOC?

Now, let's compare HELOC vs refinance in these 9 aspects.

Loan Structure

The fundamental difference lies in how the debt is structured against your property. A cash-out refinance is a replacement loan. It pays off your existing mortgage entirely and takes the "first lien" position. You end up with just one loan and one monthly payment.

In contrast, a HELOC is a subordinate loan, often called a "second lien." It does not replace your primary mortgage. It sits behind it. This means you will have two separate bills to pay each month: your original mortgage payment and your HELOC payment. I tell clients to think of a cash-out refi as remodeling the whole house, while a HELOC is like building an addition. It's a separate structure attached to the main one.

Funds Access

How you get your money is a major lifestyle consideration. With a cash-out refinance, you receive a single lump sum at the closing table. Once that money is dispensed, that's it. If you need more later, you have to refinance again. This is ideal for fixed costs, like paying off a specific credit card balance or buying an investment property.

A HELOC works like a revolving checkbook. You are given a credit limit, and you can draw $500 today for a repair and $10,000 next month for a tuition bill. You can also pay it down and borrow it again, just like a credit card. This "draw as you go" method is perfect for ongoing renovation projects where bills come in stages.

Interest Rate

This is often the deciding factor for my clients. Cash-out refinances typically offer fixed interest rates. Because it is a primary mortgage, the rate is usually lower than other debt products, and it stays the same for 30 years. This provides peace of mind and predictability.

HELOCs, on the other hand, almost always come with variable interest rates. The rate is tied to an index like the Prime Rate plus a margin. If the economy shifts and the Fed hikes rates, your HELOC interest rate will climb overnight. While some lenders now offer "fixed-rate options" within a HELOC, the standard product is variable, which introduces uncertainty into your monthly budget.

Monthly Payments

With a cash-out refinance, your payment is straightforward: it is an amortized installment covering both principal and interest. It remains consistent (excluding tax/insurance changes) for the life of the loan. You start paying down the balance immediately.

HELOC payments are more complex. During the initial "draw period" (usually 10 years), you are often allowed to make interest-only payments. This keeps bills low initially. However, once the "repayment period" hits (usually the next 20 years), you must pay principal plus interest. This can lead to "payment shock," where your monthly bill effectively doubles or triples overnight because you are finally required to pay back the borrowed money.

Equity

Both loans require you to have "skin in the game," known as equity. Lenders generally won't let you borrow 100% of your home's value. For both cash-out refinances and HELOCs, the standard limit is usually 80% to 85% Loan-to-Value (LTV).

This means if your home is worth $400,000, lenders typically want you to keep 20% ($80,000) untouched. You can only borrow against the remaining amount. However, VA loans are a notable exception for cash-out refinances, sometimes allowing qualified veterans to tap into up to 100% of their equity. Generally, HELOC lenders can be slightly stricter on equity requirements because they are in the riskier "second" position if you default.

Closing Costs

This is where the cash-out refinance often hurts the most. Because you are taking out a massive new mortgage, you have to pay standard closing costs, origination fees, appraisals, title insurance, etc. The cost of refinancing typically runs 2% to 6% of the total loan amount. On a $300,000 loan, that's $6,000 to $16,000 upfront.

Conversely, HELOCs are known for having very low or zero closing costs. Since it is a smaller, secondary loan, banks often waive many fees to attract customers. You might just pay a small appraisal fee or an annual maintenance fee (often $50-100). If you only need a small amount of cash, the high closing costs of a refi usually make it a bad deal.

Loan Term

A cash-out refinance resets your timeline. If you have been paying your 30-year mortgage for 10 years, you only have 20 years left. If you do a cash-out refi into a new 30-year term, you are starting over from year one. This lowers monthly payments but significantly increases the total interest paid over time.

A HELOC has a segmented timeline, typically a 30-year total term split into two phases: a 10-year draw period and a 20-year repayment period. It does not change the timeline of your primary mortgage. Your main house loan will still be paid off on its original schedule, assuming you keep making payments.

Borrowing Limits

For a cash-out refinance, borrowing limits are largely dictated by conforming loan limits set by the FHFA (Federal Housing Finance Agency). In 2024-2025, for most areas, this is upwards of $766,550. If you need more, you enter "Jumbo loan" territory, which has stricter rules.

HELOCs are "portfolio loans," meaning the bank keeps them on their own books rather than selling them to investors. Therefore, the bank decides the limit. Some local credit unions might cap HELOCs at $100,000, while major banks might go up to $500,000 or more, provided you have the equity. Your borrowing power is strictly capped by that 80-85% combined loan-to-value ratio we discussed earlier.

Requirements

Getting approved for these loans isn't automatic. For a cash-out refinance, lenders are generally looking for a credit score of at least 620. They will scrutinize your income and employment history rigorously because they are taking on the entire risk of your home loan. They also typically require your Debt-to-Income (DTI) ratio to be under 43% to 50%.

HELOCs can actually be harder to qualify for. Because the lender is in the "second position" (meaning if you go bankrupt, the first mortgage gets paid before them), they are more risk-averse. Many lenders require a credit score of 680, 700, or even higher for a HELOC. They also strictly enforce DTI limits. While the paperwork might feel lighter than a full refinance, the credit standards are often tighter. If your credit score has taken a dip recently, a cash-out refi might paradoxically be easier to get than a HELOC.

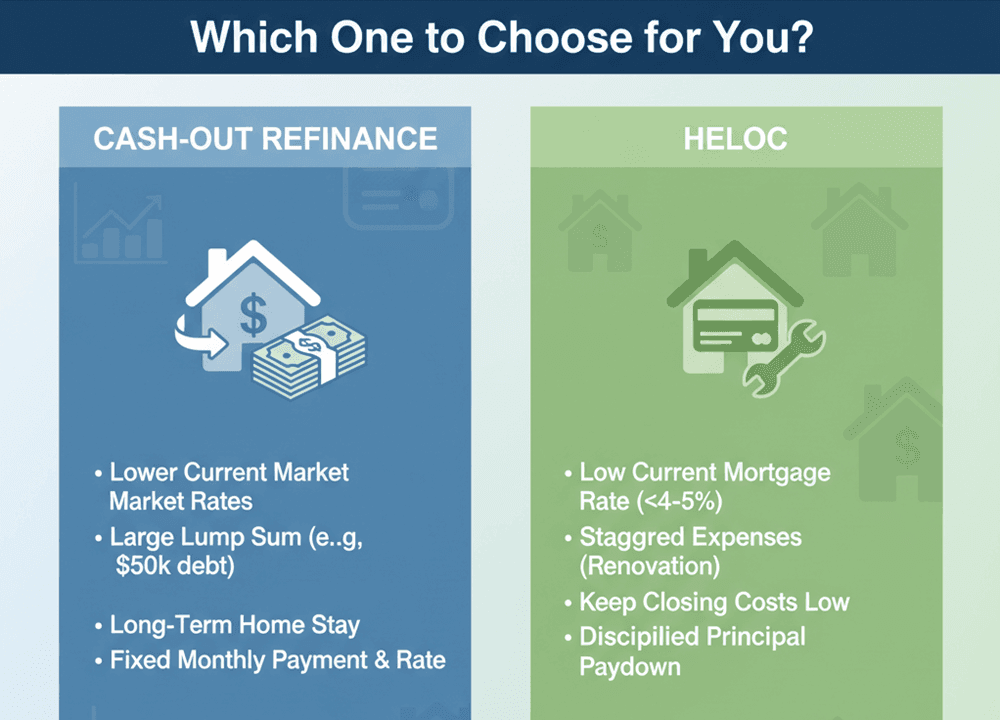

Which One to Choose for You?

So, which path should you take? It comes down to your current mortgage rate and how you plan to use the money.

Choose a Cash-Out Refinance if:

- Current market rates are lower than your existing mortgage rate.

- You need a large lump sum for a major, one-time expense (like consolidating $50k in credit card debt).

- You plan to stay in the home for a long time to spread out the closing costs.

- You want the stability of a fixed monthly payment and interest rate.

Choose a HELOC if:

- You have a low interest rate on your current mortgage (e.g., under 4-5%). Do not give that up!

- You need money for staggered expenses, like a renovation that will take months to complete.

- You want to keep closing costs to a minimum.

- You are disciplined enough to pay down the principal early to avoid payment shock later.

If you are still scratching your head, or if you've decided but don't know which lender offers the best terms for your specific credit profile, don't guess. I highly recommend checking out Bluerate. It's a transparent marketplace where you can find local, knowledgeable loan officers who can run the numbers for your specific scenario.

FAQs About HELOC vs Refinance

Q1. Can you refinance a HELOC?

Yes, absolutely. You can refinance a HELOC into a new HELOC with better terms, or you can roll your HELOC balance into a standard mortgage using a cash-out refinance. People often do this to lock in a fixed rate on their variable HELOC debt.

Q2. What is better, a HELOC or cash-out refinance?

Neither is inherently "better". It depends on your current interest rate. If your current mortgage rate is 3% and market rates are 7%, a HELOC is better because it preserves your low primary rate. If market rates drop below your current rate, a cash-out refinance is better.

Q3. What is the downside of a cash-out refinance?

The biggest downsides are the high closing costs (2-5% of the loan) and the risk of resetting your loan term. You might end up paying significantly more interest over the long haul just to access a small amount of cash today.

Q4. Is a HELOC a trap?

It can be if you aren't careful. The "trap" is the variable interest rate and the interest-only draw period. Borrowers often get used to tiny payments, and when the repayment period hits (and rates have risen), the monthly bill can become unaffordable, leading to default.

Q5. Can I pull equity out of my house without refinancing?

Yes. A HELOC or a Home Equity Loan (which is a fixed-rate second mortgage) allows you to tap into equity without touching or refinancing your primary mortgage.

Q6. Is it smart to use HELOC to pay off a mortgage?

This is a strategy known as "velocity banking," but it is risky for the average person. While mathematically possible, it requires strict discipline and a stable income. If rates rise or your income drops, using a variable-rate HELOC to pay off a fixed-rate mortgage can backfire spectacularly.

Conclusion

Navigating the choice between a Cash-out Refinance and a HELOC boils down to one golden rule: protect your interest rate. If you are holding onto a historic low rate, a HELOC is likely your best friend, allowing you to access cash without blowing up your primary loan. If rates have dropped or you need a stable, lump-sum solution, a cash-out refinance offers the predictability you might need.

Remember, your home is your most valuable asset, and these decisions have long-term impacts. Don't rely on guesswork. If you want to compare real rates from local experts without the hassle, head over to Bluerate. Searching for a trusted loan officer there can help you navigate these waters safely and ensure you get the best deal for your financial future.