Timeline to Know: How Long Does It Take to Refinance a House?

I was recently reading a thread on the Bay Area Real Estate subreddit, and one homeowner's frustration really struck a chord with me. They described their refinancing process as falling into a "black hole", weeks of silence, expiring rate locks, and pure anxiety. It's a feeling I know all too well. When you are looking to lower your monthly payments or pull out cash, uncertainty is the enemy.

So, how long does it actually take? While the process involves many moving parts, understanding the timeline is your best defense against stress. However, from my experience in the industry, the biggest variable isn't just interest rates. It's the human element. The speed of your refinance depends heavily on the efficiency of your team. This is why I often recommend starting with a platform like Bluerate, which connects you for free with top-rated local loan officers who prioritize speed and communication, rather than just treating you like a number.

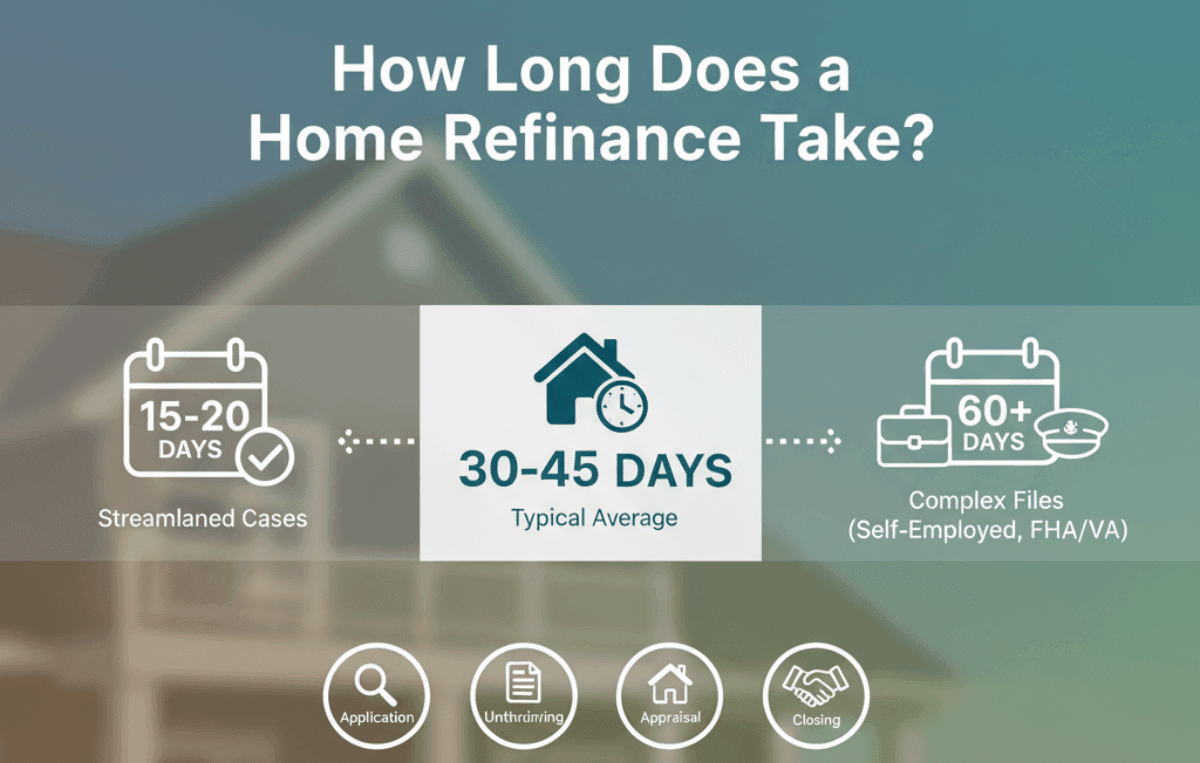

How Long Does a Home Refinance Take?

If you want the short answer, it typically takes 30 to 45 days to refinance a house in the current market.

However, that's just a statistical average. I've seen streamlined cases with appraisal waivers close in as little as 15 to 20 days. Conversely, complex files involving self-employment income or government-backed loans (like FHA or VA) can easily stretch past the 60-day mark. The timeline isn't a straight line. It's a series of checkpoints. In the following sections, I will break down exactly where those days go, so you can track your progress and know when to push your lender for updates.

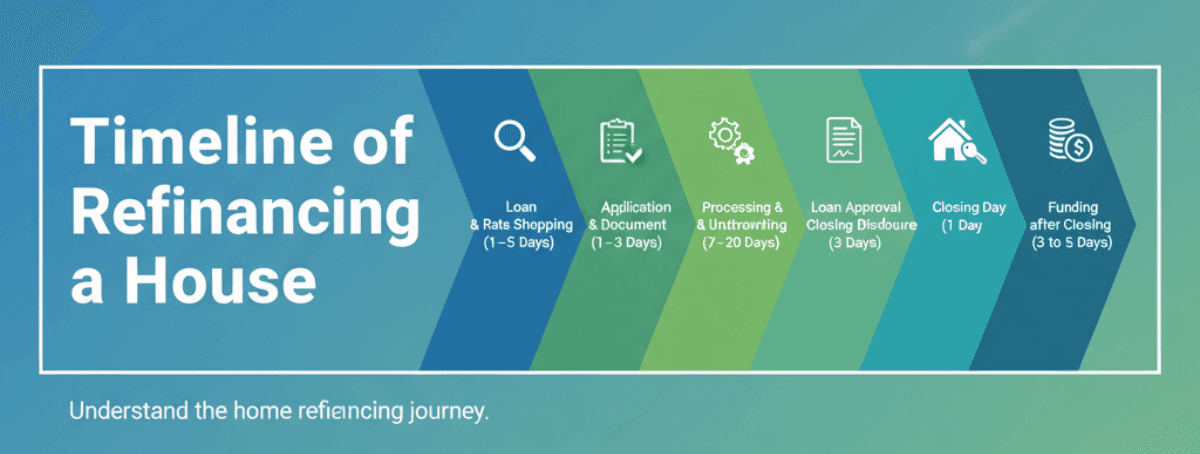

Timeline of Refinancing a House

To learn the time will be spent in every step, let's dive into the following.

1. Pre-Approval & Rate Shopping (1–5 Days)

This is the research phase. You aren't just looking for a low interest rate. You are looking for the right partner. During these first few days, you should contact multiple lenders to compare Loan Estimates. Don't just look at the big percentage number. Look at the APR and the "Origination Charges" in Section A of the estimate. This process can take a few days because you are waiting for loan officers to run your credit and get back to you with firm numbers. A pro tip: Using a matching service like Bluerate can significantly cut down this legwork by instantly putting you in touch with competitive local officers.

2. Loan Application & Document Submission (1–3 Days)

Once you've chosen your lender and locked your rate, the clock starts ticking. You will formally submit your application and, more importantly, your documents. This usually takes 1 to 3 days, depending entirely on how organized you are. You'll need to upload pay stubs, W-2s, tax returns, and bank statements. From my experience, incomplete documentation is the silent killer of timelines. If the lender asks for "all pages" of a bank statement, do not leave out the blank pages. Submit everything immediately. The faster you get these in, the sooner your file moves to the queue that actually matters: Underwriting.

3. Processing & Underwriting (7–20 Days)

This is the "Quiet Period" that frustrates most homeowners. For about one to three weeks, your file sits with the processor and the underwriter. The processor verifies your data, and the underwriter assesses the risk. Crucially, this is also when third-party services happen, such as the Home Appraisal and Title Search. You have zero control over the appraiser's schedule, which can cause delays in busy markets. During this time, your only job is to watch your email like a hawk. If the underwriter issues a "condition" (a request for more info), reply within hours, not days.

4. Loan Approval & Closing Disclosure (3 Days)

Hearing the words "Clear to Close" (CTC) is the best feeling in this process. However, you can't sign immediately. Federal law (the TRID rule) mandates a 3-day waiting period after you receive your Closing Disclosure (CD). You must acknowledge receipt of this document, which outlines your final terms, interest rate, and cash-to-close amount. This waiting period is non-negotiable, and it's a consumer protection measure designed to give you time to compare the final numbers against your initial Loan Estimate. Use this time to verify every single fee.

5. Closing Day (1 Day)

Finally, you reach the finish line. Closing typically takes about an hour or two. Depending on your state and lender, this might happen at a title company's office, a lawyer's office, or, more commonly now, a mobile notary can come to your house or coffee shop. You will sign a stack of documents about an inch thick. Make sure you bring two forms of valid ID and, if you are bringing cash to the table, a cashier's check or proof of wire transfer. Once the ink is dry, you're done... almost.

6. Funding after Closing (3 to 5 Days)

Here is a detail that often catches homeowners off guard: if you are refinancing your primary residence, you don't get the money the day you sign. Federal law grants you a Right of Rescission, which is a three-business-day "cooling-off" period where you can cancel the loan if you change your mind. The lender cannot release funds until this period expires. If you sign on a Monday, the rescission period is Tuesday, Wednesday, and Thursday. The loan funds are due on Friday. If you are doing a "Cash-Out" refinance, plan your spending accordingly, and you won't see that cash instantly.

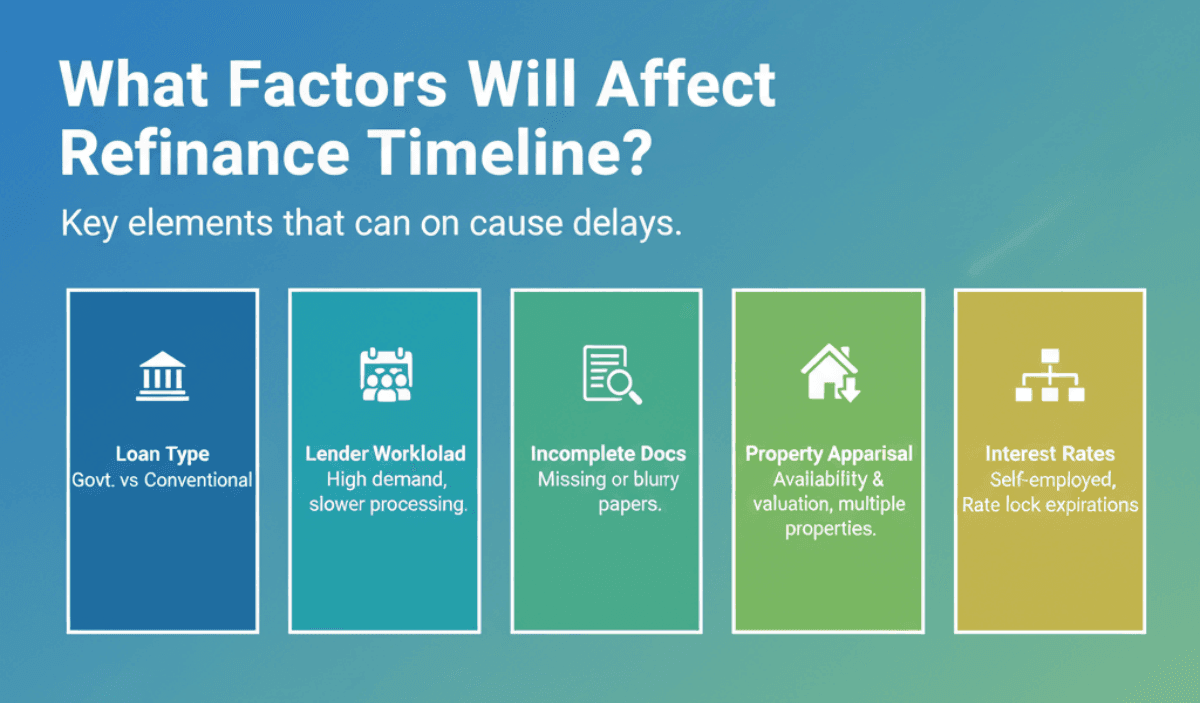

What Factors Will Affect Refinance Timeline?

While the 30-45 day average is a good benchmark, several variables can either grease the wheels or throw a wrench in the gears. Understanding these factors helps you manage your expectations.

-

Loan Type: Government-backed loans (FHA, VA, USDA) often require more stringent appraisals and deeper underwriting reviews compared to conventional loans, potentially adding a week to the timeline.

-

Lender Workload: This is simple supply and demand. When interest rates drop significantly, everyone rushes to refinance. Lenders get backlogged, and turn times for underwriting can double.

-

Incomplete Documentation: I cannot stress this enough, and sending a blurry photo of a pay stub instead of a proper PDF scan causes delays. If the underwriter has to ask twice, you go to the back of the line.

-

Property Appraisal: In rural areas or extremely busy markets, simply finding an available appraiser can take two weeks. Furthermore, if the value comes in low, the rebuttal process stops everything cold.

-

Loan Complexity: If you are a W-2 employee, it's straightforward. If you are self-employed, own multiple rental properties, or have complex tax structures, the underwriter needs more time to calculate your qualifying income.

-

Interest Rates: Rate lock expirations create natural deadlines. If your lock is expiring, lenders will often rush your file, but if you let it expire, renegotiating can restart parts of the process.

-

Credit or Debt Issues: If you take out a new car loan or charge up a credit card during the refinance process, the lender will see it. This changes your Debt-to-Income (DTI) ratio and triggers a re-underwrite, causing significant delays.

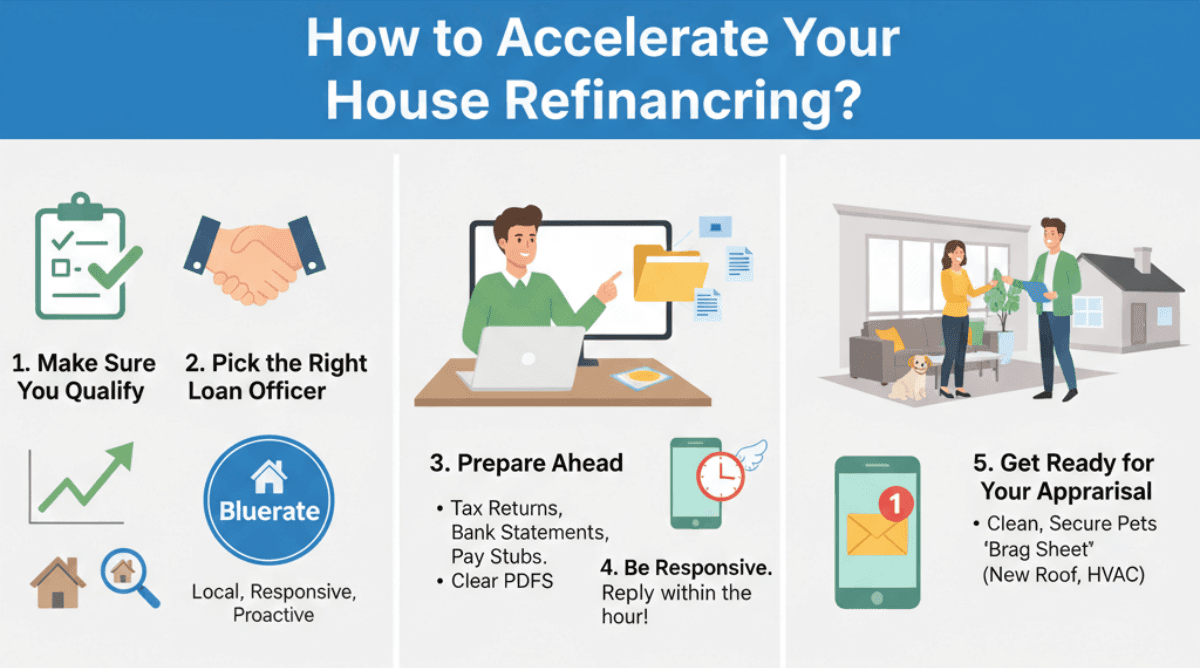

How to Accelerate Your House Refinancing?

You are not a passive observer in this process. You can actively drive the timeline. Here are five ways to ensure you close on the faster side of the average.

-

Make Sure You Qualify: Before you even apply, check your credit score and do a rough calculation of your home equity. Applying for a loan you clearly don't qualify for wastes everyone's time.

-

Pick the Right Loan Officer: This is the game-changer. You need a loan officer who is local, responsive, and proactive. This is why I recommend Bluerate. Their platform specializes in matching you with professionals who know the local market conditions and have a track record of closing on time. A good LO anticipates problems before they happen.

-

Prepare Ahead: Create a digital folder on your computer before you apply. Have your last two years of tax returns, two months of bank statements, and 30 days of pay stubs saved as clear PDFs.

-

Be Responsive: Treat lender emails like urgent work tasks. If they ask for a letter of explanation regarding a large deposit, write it and send it back within the hour.

-

Get Ready for Your Appraisal: Treat the appraisal like a home showing. Clean the house, secure your pets, and prepare a "brag sheet" of recent improvements (new roof, HVAC, remodeling) to hand to the appraiser. This helps ensure the value comes in right the first time.

FAQs About Timeline of Refinancing a House

Q1. What is the fastest you can refinance a house?

In perfect conditions, usually involving an appraisal waiver and a highly efficient digital lender, it is possible to close in 15 to 20 days. However, this is the exception, not the rule.

Q2. Is it hard to refinance a home?

It is generally less stressful than buying a home because you aren't moving. It is primarily a paperwork exercise. If your income is stable and you have equity, it isn't "hard," just administrative.

Q3. What disqualifies you from refinancing?

The most common disqualifiers are a Loan-to-Value (LTV) ratio that is too high (meaning you don't have enough equity), a low credit score (typically under 620 for conventional loans), or a Debt-to-Income (DTI) ratio exceeding 45-50%.

Q4. What is the timeline for refinancing a home loan?

To summarize: You should plan for a 30 to 45-day cycle. This covers 1 week for prep/application, 2-3 weeks for underwriting and appraisal, and 1 week for closing and funding.

Conclusion

Refinancing your home is a financial marathon, not a sprint, but the prize at the finish line, lower monthly payments or access to cash, is worth the effort. While the standard timeline sits between 30 and 45 days, remember that you have the power to influence this. By being organized, responding quickly, and understanding the "why" behind the waiting periods, you can navigate the process with confidence.

Most importantly, don't underestimate the value of the team you choose. A slow lender can cost you a rate lock. If you want to ensure you are working with efficient, vetted professionals in your area, connect with a loan officer through Bluerate today. It's the smartest first step to getting your refinance closed faster and stress-free.