![[Latest 2026] Best Home Loan Refinance Companies to Choose](/_next/image?url=https%3A%2F%2Fdynamic-light-ab6e2536d6.media.strapiapp.com%2Fbest_home_loan_refinance_companies_banner_83bdfab4a9.png&w=3840&q=75)

[Latest 2026] Best Home Loan Refinance Companies to Choose

The financial landscape is finally starting to look a bit friendlier for homeowners. With mortgage rates trending downward in 2026 after the highs of previous years, the window of opportunity to refinance is creaking open. I've spoken to countless homeowners recently who are eager to lower their monthly payments or tap into their home equity, but they all hit the same wall: Overwhelm.

There are hundreds of lenders out there, promising the moon. But picking the wrong one can cost you thousands in hidden fees or result in a nightmare closing process. In this guide, I'm cutting through the noise to review the top lenders for 2026. While the big names listed below are excellent, remember that sometimes the best deal comes from a local expert who knows your specific market. I often suggest finding a nearby loan officer for a free consultation.

People Also Read

- Step-By-Step Guide: How to Refinance a Mortgage Loan?

- [Detailed Guide] How to Estimate Mortgage Refinance? Start Now

- [Solved] When to Refinance Mortgage? Best Time You Cannot Miss

- Can You Refinance a HELOC? Reasons, Requirements, and Process

- Cash-out Refinance vs HELOC: All Differences to Learn

6 Best-Rated Mortgage Refinance Companies

How did I pick this list? I didn't just look at who has the flashiest Super Bowl commercial. I evaluated these companies based on three non-negotiables: Interest Rate Competitiveness, Customer Service Satisfaction (J.D. Power scores), and Product Variety.

Whether you have perfect credit, are self-employed, or are a veteran, there is a specific lender below that fits your profile. Let's dive into the details.

CrossCountry Mortgage - Best Overall

- Website: https://crosscountrymortgage.com/

- NMLS: #3029

- Refinance Min Credit Score: 580 (FHA) / 620 (Conventional)

- Refinance Rate Lock Period: 15 - 90 Days (Customizable)

- Who is this for: Homeowners who want a tailored solution and need to close fast. If your financial situation is slightly complex, like needing to combine a refi with renovation funds, CCM is a top contender.

CrossCountry Mortgage (CCM) has rapidly become a powerhouse in the industry, and for good reason. In my experience, they strike the perfect balance between the speed of a fintech company and the product depth of a traditional bank. They are "Best Overall" because they simply have a loan for almost everyone, from standard rate-and-term refinances to complex renovation loans.

Their "FastTrack" program is legitimate. I've seen them clear files to close in under 21 days, which is crucial when you are trying to lock in a dipping rate in 2026.

Pros:

- Massive Product Menu: They offer virtually every loan type imaginable, including non-QM loans for unique income situations.

- Technology + Human: Their digital portal is smooth, but you are always assigned a dedicated loan officer, not a call center bot.

- Speed: One of the fastest closing timelines in the industry.

Cons:

- Branch Variance: Because they operate on a branch model, fees and service quality can vary slightly depending on which local office you work with.

- Rate Transparency: You usually have to speak to an officer to get a firm rate quote. They don't display live custom rates online easily.

Rocket Mortgage - Best for Customer Satisfaction

- NMLS: #3030

- Refinance Min Credit Score: 580 (FHA) / 620 (Conventional)

- Refinance Rate Lock Period: 15 - 90 Days (Ask about RateShield)

- Who is this for: The tech-savvy homeowner who wants to handle 90% of the refinance on their phone and hates playing phone tag.

You can't talk about refinancing without mentioning Rocket Mortgage. As America's largest lender, they have refined the digital mortgage process to an art form. They consistently top J.D. Power's charts for customer satisfaction because their app is incredibly intuitive. You can literally track your refinance progress like a pizza delivery.

From my perspective, Rocket is the "Amazon" of mortgages, reliable, fast, and completely digital. They are particularly strong in 2026 for their retention teams, who are aggressively offering deals to keep existing customers.

Pros:

- User Experience: The Rocket app is arguably the best in the business. Uploading documents is a breeze.

- Transparency: Their "Rocket Logic" system gives you a verified approval quickly.

- Service Retention: They service 99% of their loans, meaning you won't have your mortgage sold to a random company a month after closing.

Cons:

- Pricing: They are premium. While competitive, they aren't always the absolute cheapest option unless you pay "points" to buy down the rate.

- Less "Human": If you prefer sitting across a desk from someone, their call-center model might feel impersonal.

Navy Federal Credit Union - Best for Military Members

- Website: https://www.navyfederal.org/

- NMLS: #399807

- Refinance Min Credit Score: No strict minimum (Case-by-case, generally 600+)

- Refinance Rate Lock Period: Up to 60 Days

- Who is this for: Active duty military, veterans, and their families. If you qualify for membership, this should be your first stop.

If you have served, Navy Federal is almost unbeatable. As the world's largest credit union, they operate not for profit, but for their members. This translates directly into interest rates that commercial banks often cannot match.

For 2026, their VA Interest Rate Reduction Refinance Loan (IRRRL) program is the gold standard. I've seen them waive origination fees that other lenders charge, saving veterans thousands of dollars upfront. They also offer "rate match" guarantees, which shows their confidence in their pricing.

Pros:

- Lowest Rates: Consistently lower APRs than national averages.

- Low Fees: Capped origination fees and often no PMI required on certain conventional products.

- Servicing: They service their own loans, offering a lifetime relationship.

Cons:

- Exclusivity: You must be active duty, retired military, or a direct family member to join.

- Slower Process: Due to high demand, their closing times can be slower (45-60 days) compared to Rocket or CCM.

New American Funding - Best for Low Costs/Rates

- Website: https://www.newamericanfunding.com/

- NMLS: #6606

- Refinance Min Credit Score: 580 (Flexible Manual Underwriting)

- Refinance Rate Lock Period: 45 Days

- Who is this for: Self-employed entrepreneurs, freelancers, or anyone whose tax returns don't tell the full story of their financial health.

New American Funding (NAF) has carved out a niche by being incredibly flexible. While many banks rely solely on automated algorithms to approve you, NAF specializes in Manual Underwriting. This means a human being looks at your file to make a common-sense decision.

This approach often allows them to offer lower costs to people who might look "risky" to a computer but are actually financially solid. Their "I CAN" mortgage product is particularly useful for customizing your loan term, like refinancing to a 22-year term instead of resetting to 30.

Pros:

- Flexibility: Excellent for Self-Employed borrowers or gig-economy workers.

- Manual Underwriting: They can approve loans that others deny.

- Custom Terms: Pick the exact number of years for your new loan to stay on track for payoff.

Cons:

- Rate Variance: While fees are low, if your credit is lower, the interest rate itself might be adjusted higher to compensate for risk.

- Geographic Limits: Not available in all US territories (though available in most states).

U.S. Bank - Best for Existing Customers

- Website: https://www.usbank.com/index.html

- NMLS: #402761

- Refinance Min Credit Score: 620+

- Refinance Rate Lock Period: 30 - 60 Days

- Who is this for: Current U.S. Bank customers or conservative borrowers who prefer the stability and face-to-face option of a traditional brick-and-mortar bank.

Sometimes, sticking with what you know pays off. U.S. Bank is a traditional giant, but it is aggressive about keeping its banking clients. If you already have a checking account or mortgage with them, you qualify for "Relationship Pricing."

In 2026, I expect big banks to use these discounts heavily to compete with fintechs. This could mean a 0.125% to 0.25% discount on your rate or a reduction in closing costs just for being a loyal customer.

Pros:

- Loyalty Discounts: Significant savings for existing customers.

- Full Integration: See your mortgage right next to your checking account in one app.

- Stability: A "Too Big to Fail" institution offers peace of mind.

Cons:

- Stricter Guidelines: They are a conservative bank. They strictly adhere to the 620+ credit box.

- Slower: The bureaucracy of a big bank means things move a bit slower than non-bank lenders.

Carrington Mortgage Services - Best for Low Credit Score

- Website: https://www.carringtonmortgage.com/

- NMLS: #2600

- Refinance Min Credit Score: 500 (FHA) / 550 (VA)

- Refinance Rate Lock Period: 30 - 45 Days

- Who is this for: Homeowners with a credit score below 600 or significant marks on their credit report who need to refinance to save their home or consolidate debt.

Life happens. Bankruptcy, foreclosure, or missed payments can tank a credit score, but that shouldn't lock you out of refinancing forever. Carrington Mortgage Services specializes in the "underserved" market.

While most lenders cut off FHA refinances at a 580 score, Carrington is willing to go down to 500 with a 10% equity position. They are experts at navigating difficult credit histories and helping homeowners get back on track.

Pros:

- Accessibility: They accept credit scores that almost no one else will touch.

- Second Chances: Willing to work with borrowers post-bankruptcy or foreclosure sooner than others.

- FHA/VA Expertise: Highly specialized in government-backed loan troubleshooting.

Cons:

- Cost: You will pay for the risk. Expect higher interest rates and fees compared to prime lenders.

- Service: Customer reviews can be mixed, largely due to the stressful nature of subprime lending.

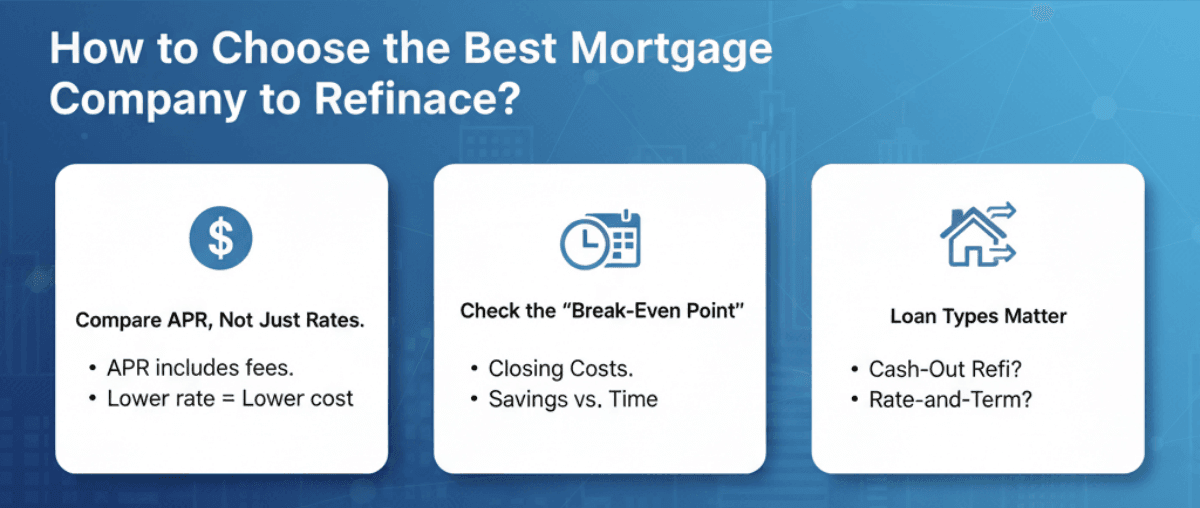

How to Choose the Best Mortgage Company to Refinance?

Listing companies is easy, but choosing one is personal. Here is my actionable advice on how to shop in 2026:

-

Compare APR, Not Just Rates: The advertised "Interest Rate" is vanity. The APR (Annual Percentage Rate) is sanity. The APR includes the lender fees. If Lender A has a lower rate but a much higher APR than Lender B, Lender A is charging you high upfront fees to get that rate.

-

Check the "Break-Even Point": Ask specifically about "Closing Costs." If refinancing saves you $200 a month but costs $6,000 to close, it will take you 30 months (2.5 years) to break even. If you plan to move in 2 years, don't refinance.

-

Loan Types Matter: Ensure the lender offers what you need. Need cash out for a remodel? Look for "Cash-Out Refi." Just want a lower rate? Look for "Rate-and-Term."

-

Customer Service Test: Call them. If it takes 20 minutes to get a human on the phone before you give them money, imagine how hard it will be after they have your business.

FAQs About Best Home Loan Refinance Companies

Q1. Can I refinance with no closing costs?

Here is the truth: There is no such thing as a free lunch. A "no-closing-cost" refinance simply means the lender gives you a "Lender Credit" to cover the fees, but in exchange, they charge you a higher interest rate. This is a good strategy if you don't have cash on hand or plan to sell the house in the near future (3-5 years).

Q2. What is the best home loan refinance companies in California?

There is no single "best" company because rates change by zip code and credit profile. California also has high property values, often requiring "Jumbo Loans" which niche lenders handle better.

I strongly recommend comparing multiple quotes. Don't just rely on national ads. I suggest using Bluerate to find local loan officers in CA. You can customize your rate needs and get a free consultation with a pro who knows the local market. Here are recommended loan officers:

Q3. What is the 80/20 rule in refinancing?

This refers to the Loan-to-Value (LTV) ratio. If you refinance and your new loan amount is more than 80% of your home's current value, lenders will typically require you to pay Private Mortgage Insurance (PMI). To get the best deal and avoid this extra monthly fee, aim to keep your loan amount at or below 80% of your home's value.

Q4. How soon can you refinance a mortgage?

Legally, there's often no waiting period for a "Rate-and-Term" refinance, though some lenders verify your employment again. However, for a Cash-Out Refinance, most lenders require a "seasoning period" of 6 months from the time you closed on your original mortgage.

Q5. How many times can you refinance a house?

Technically, there is no limit. You can refinance as many times as you want, provided you qualify and there is a "Net Tangible Benefit" (financial advantage) to doing so. However, be careful, resetting your 30-year clock every few years means you are paying mostly interest and building very little principal.

Q6. How long does it take to refinance a house?

In 2026, the average timeline is 30 to 45 days.

- Simple Streamline (FHA/VA): Can be as fast as 15-20 days.

- Cash-Out / Complex Income: Can take 45-60 days.

- Speed depends heavily on how quickly you upload your documents!

Conclusion

Refinancing in 2026 could be one of the smartest financial moves you make, potentially freeing up cash flow or shaving years off your mortgage. Whether you choose a digital giant like Rocket Mortgage or a specialized lender like New American Funding, the key is doing the math to ensure the savings are real.

One final word of advice: Online rates are often just "teasers." To get a true picture of what you qualify for, you need a custom quote. Don't be afraid to shop around. I highly encourage you to utilize tools like Bluerate to connect with local loan officers who can guide you through the nuances of your local market. It's free to look, and it could save you a fortune.