![[Solved] How Many Times Can You Refinance a House?](/_next/image?url=https%3A%2F%2Fdynamic-light-ab6e2536d6.media.strapiapp.com%2Fhow_many_times_can_you_refinance_a_house_f460159aba.png&w=3840&q=75)

[Solved] How Many Times Can You Refinance a House?

I was lurking on a mortgage subreddit the other day and saw a post that really resonated with me. A homeowner was stressing out, and they had just refinanced six months ago to snag a lower rate, but then the market dipped again. They wanted to know, "Am I actually allowed to do this again? Or is the bank going to flag me as high-risk?"

It's a totally normal worry. We're trained to think that anything involving banks and six-figure debts comes with a mountain of rigid rules. You assume there's some "three strikes and you're out" policy buried in the fine print.

Let's cut to the chase: There is no legal limit to how many times you can refinance your house.

But, and this is a big "but", just because the law says you can doesn't mean your wallet says you should. While there's no legal cap, there are financial realities (and lender rules) that act as a natural brake. Refinancing isn't free, and doing it wrong can cost you more than you save. Since your home equity and credit score are unique to you, the smartest move is to stop guessing and get a pro to look at your specific numbers. A quick chat with a local loan officer is usually free, and it cuts through the confusion faster than hours of Googling.

How Often Can You Refinance Your House?

Here is the honest truth: You can refinance as often as a lender is willing to sign the check.

There is no federal law in the U.S. that says you've used up your "refinance quota" for the decade. If the numbers work, you could technically refinance every single year.

However, in the real world, lenders are the ones holding the purse strings, and they hate unnecessary risk. They operate on a rule called "Net Tangible Benefit." Basically, if you try to refinance just for the sake of it, a lender is going to say "No" unless the new loan clearly improves your situation, like dropping your rate, fixing a dangerous adjustable rate, or lowering your monthly payment significantly.

If you try to refinance three times in 18 months, banks might look at you sideways. They call this "Loan Churning," where predatory lenders flip loans just to collect fees. To stop this, most banks enforce "Seasoning Requirements", a mandatory "cooling-off" period between loans. So, while the government won't stop you, bank policies and common sense usually dictate the pace.

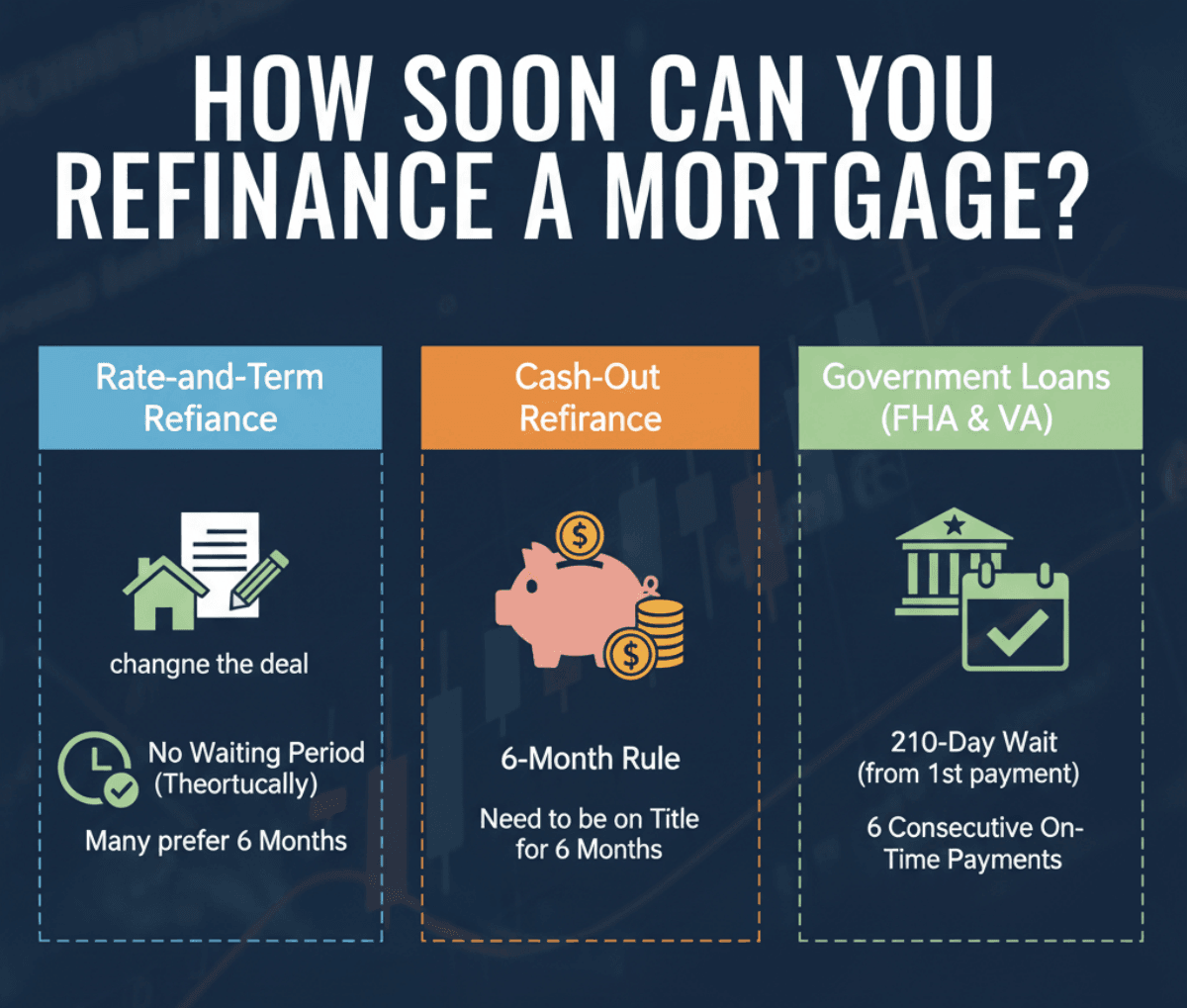

How Soon Can You Refinance a Mortgage?

The answer to "how soon" isn't a single number, and it depends entirely on what you're trying to do. Are you just lowering your rate, or are you trying to pull cash out for a renovation?

Here is the "napkin math" on waiting periods:

Rate-and-Term Refinance (Just changing the deal):

This is the easiest path. If you aren't taking cash out, some lenders have zero waiting period. You could theoretically sign the papers a month after your last closing. That said, many lenders prefer to see at least 6 months of payment history just to be safe.

Cash-Out Refinance (Taking money out):

If you want to tap into your home's equity, the rules have tightened up. Most conventional lenders stick to the 6-month rule. You generally need to be on the title for at least six months before you can treat your house like a piggy bank.

Government Loans (FHA & VA):

These guys have strict federal guidelines. For an FHA Streamline or VA IRRRL, you are typically looking at a 210-day wait from your first payment, plus you need to have made 6 consecutive on-time payments. No skipping allowed.

If you're scratching your head about which bucket your mortgage falls into, check out this breakdown on how soon can you refinance a mortgage for the nitty-gritty details.

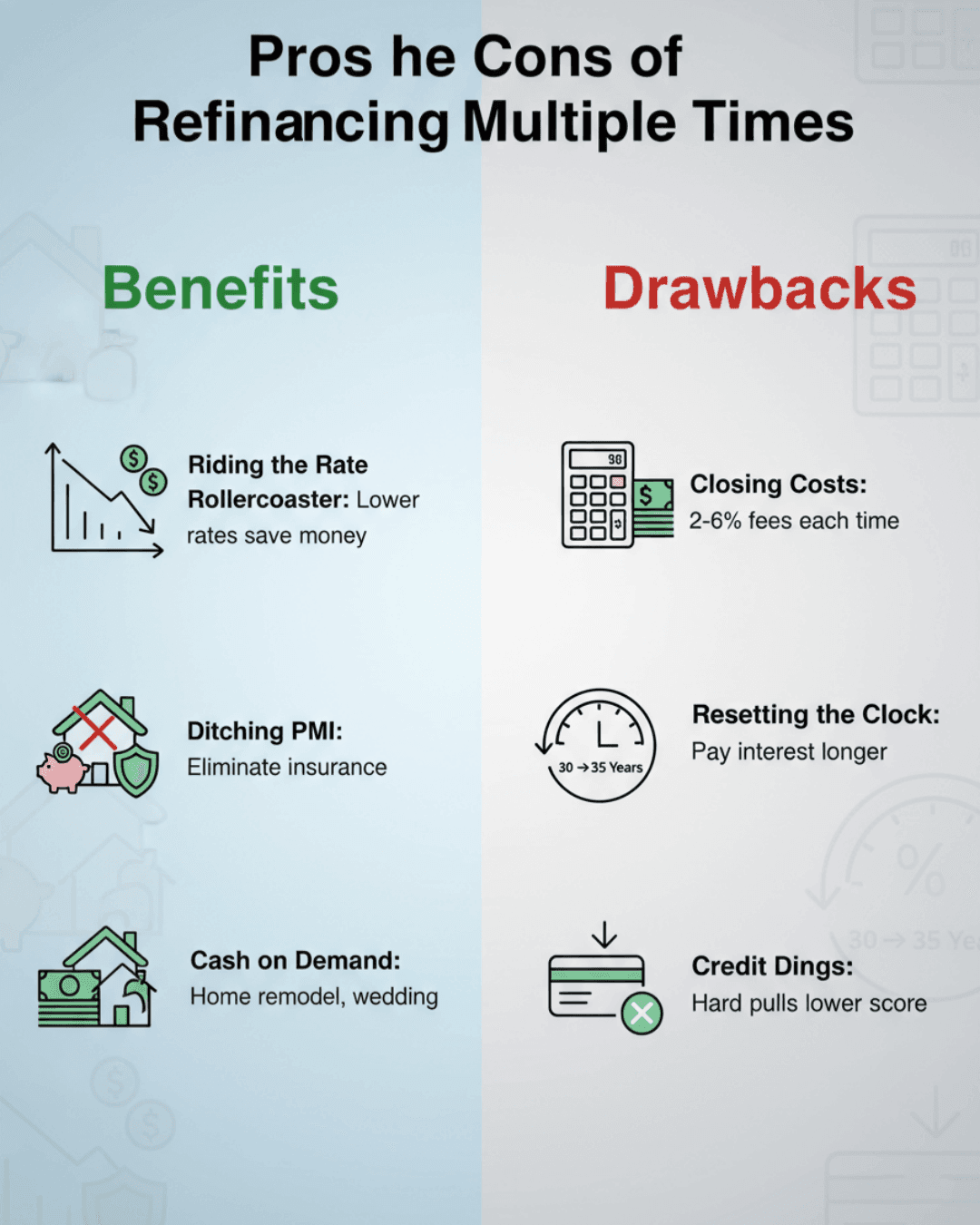

Pros and Cons of Refinancing Multiple Times

I've seen people save a fortune by refinancing twice in three years, and I've seen others burn money because they ignored the fees. It's a tool, not a magic trick.

Benefits:

Riding the Rate Rollercoaster: If rates crash, you win. Refinancing multiple times lets you chase the market down, potentially saving hundreds a month.

Ditching PMI: You might refinance once to get a better rate, and then again a year later because your home value shot up, finally letting you kill that expensive Private Mortgage Insurance.

Cash on Demand: It gives you access to big chunks of cash for life events, like a wedding or a kitchen remodel.

Drawbacks:

Closing Costs: This is the silent killer. Every time you refinance, you are paying 2% to 6% of the loan amount in fees. On a $400k home, that's serious money. Do that three times, and you've stripped a ton of equity out of your house.

Resetting the Clock: People forget this one. If you pay a 30-year mortgage for 5 years and then refinance into a new 30-year loan, you just turned your 30-year debt into a 35-year debt. You're paying interest for longer.

Credit Dings: Each application is a "Hard Pull." One is fine. Five in a year? That's going to drag your credit score down.

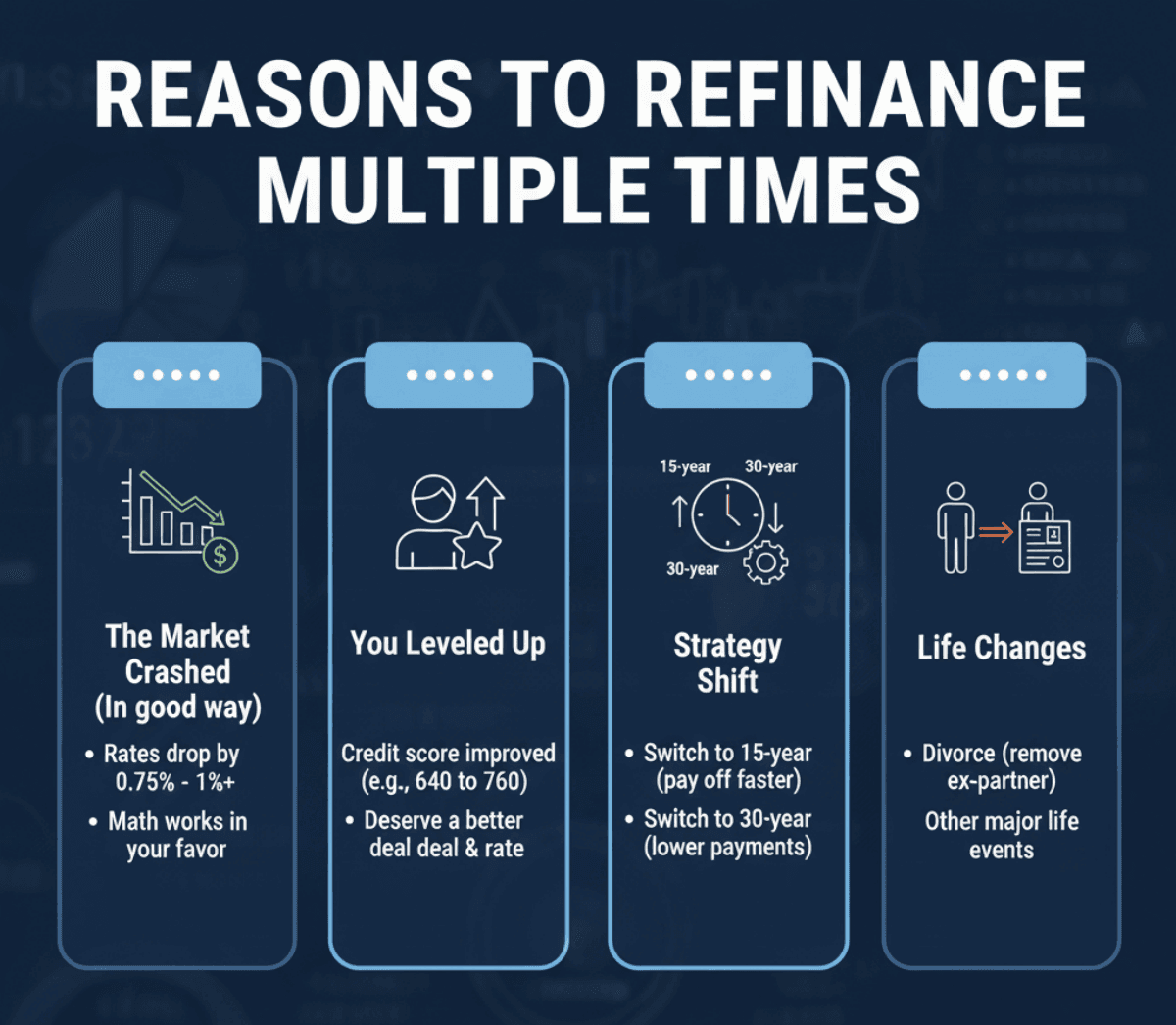

Reasons to Refinance Multiple Times

Why would anyone put themselves through the paperwork headache more than once? Because life happens fast, and the market moves even faster.

I worked with a client who refinanced in 2020 because rates hit rock bottom. Then, in 2022, they refinanced again, not for the rate, but to get cash out for a business opportunity. It made sense both times for completely different reasons.

Here are the solid reasons to go back to the well:

The Market Crashed (In a good way): If rates drop by 0.75% or 1% since your last sign-off, the math usually works out in your favor.

You Leveled Up: Maybe when you bought your place, your credit was "meh" (say, 640) and you got a 7% rate. Now? You're at 760. You deserve a better deal.

Strategy Shift: You might switch from a 30-year to a 15-year loan to burn the mortgage down faster. Or, conversely, switch back to a 30-year to lower payments during a tight year.

Life Changes: Divorce is a common one. You often have to refinance to get an ex-partner's name off the legal documents.

If you're trying to time the market, take a look at this guide on when to refinance mortgage to spot the right signals.

Considerations Before You Refinance Multiple Times

Before you sign another stack of loan documents, put the calculator to work. Don't get distracted by the "monthly savings", look at the total cost.

Here is the one number that matters: The Break-Even Point.

It works like this: Divide your total closing costs by your monthly savings.

Scenario: Refinancing costs you $4,000 upfront, but saves you $200 a month.

The Math: $4,000 ÷ $200 = 20 months.

The Verdict: If you plan to move or refinance again in less than 20 months, don't do it. You are losing money.

Also, check your equity. Lenders usually want you to keep at least 20% equity in the home. If property values in your neighborhood have dipped, you might not have enough ownership stake to make the deal work without triggering insurance penalties.

Is It Bad to Refinance Your Home Multiple Times?

No, it's not "bad." It's just math.

It only becomes "bad" if you treat your house like an ATM machine. We call this "Serial Cash-Out Refinancing." If you are constantly refinancing to pay for vacations, new cars, or credit card bills, you are dangerously depleting your wealth. You risk ending up "underwater", owing more than the house is worth, if the market corrects.

But if you are refinancing to cut interest costs, shorten your term, or invest in something that grows? That's just smart financial management.

FAQs About How Often Can You Refinance Your House

Q1. How many times can you refinance your home in a year?

Technically? As many as you want. Practically? Maybe twice. Lenders usually enforce a 6-month "seasoning" period for cash-out deals. Rate-and-term swaps can happen faster, but unless rates are crashing daily, it rarely makes sense to do it that often.

Q2. How soon after refinancing can you do it again?

For a simple rate-and-term switch, some lenders are cool with it immediately, though waiting 6 months is standard to avoid penalties. For cash-out, expect a hard 6-month wait from your last closing date.

Q3. What is the 80/20 rule in refinancing?

This is the "sweet spot." You generally want to keep your loan at 80% of the home's value (leaving you 20% equity). Dip below that 20% equity line, and you'll likely get hit with Private Mortgage Insurance (PMI), which eats up your savings.

Q4. What is the 6 month refinance rule?

In industry speak, this is "Title Seasoning." Fannie Mae and Freddie Mac basically say you need to be the legal owner on the title for at least 6 months before you can pull cash out.

Q5. Can I refinance twice in one year?

Yes, as long as there is a "Net Tangible Benefit" (you're actually saving money or improving your loan) and you can afford the closing costs. Just be ready for the underwriter to ask a few extra questions.

Q6. Do refinancing hurt your credit?

Short term? A little. You'll see a dip of 5-10 points due to the "hard inquiry." But if you pay your new mortgage on time, your score usually bounces back in a few months.

Conclusion

So, can you refinance your house three, four, or five times? Absolutely. There are no "refinance police" coming to stop you. The only limit is whether the numbers make sense for your bank account.

The golden rule is your Break-Even Point. If you stay in the home long enough to recoup those closing costs, refinance away. If not, you're just donating fees to the bank.

Here's the thing: generic internet advice can only get you so far. Your zip code, your credit history, and your specific home value change the math completely.

I always tell people: don't guess with a six-figure asset. Use Bluerate to find a local loan officer. A local pro knows the neighborhood values better than a national call center, and they can run a custom break-even analysis for you. Best of all? It's usually free to chat. Here are recommended loan officers: