Bluerate AI Agent - Meet Your New AI Mortgage Expert in 2026

If you've tried buying a home in the last year, you know the struggle. You fill out a "simple" form online, and within seconds, your phone explodes with calls from aggressive telemarketers. It's invasive, stressful, and rarely leads you to the expert you actually need.

Bluerate is here to fix this broken system. We started by building a bridge, a transparent marketplace where borrowers could find Loan Officers (LOs) without the spam. But we realized that just finding an officer wasn't enough. You need to find the right one for your specific financial DNA.

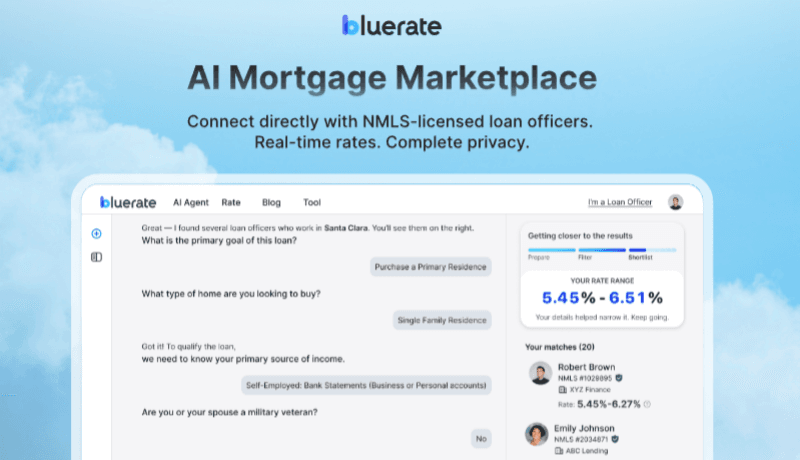

That's why I am thrilled to announce the launch of the Bluerate AI Agent. It's not just a search bar. It's an intelligent, conversational guide designed to understand your story and match you with the perfect mortgage professional and real-time rates instantly.

What is the Bluerate AI Agent?

Think of the Bluerate AI Agent as a dedicated mortgage broker who lives in your pocket, but without the sales pressure. Built by our team at Zeitro, this tool leverages advanced Large Language Models (LLMs) to transform how you navigate the mortgage landscape.

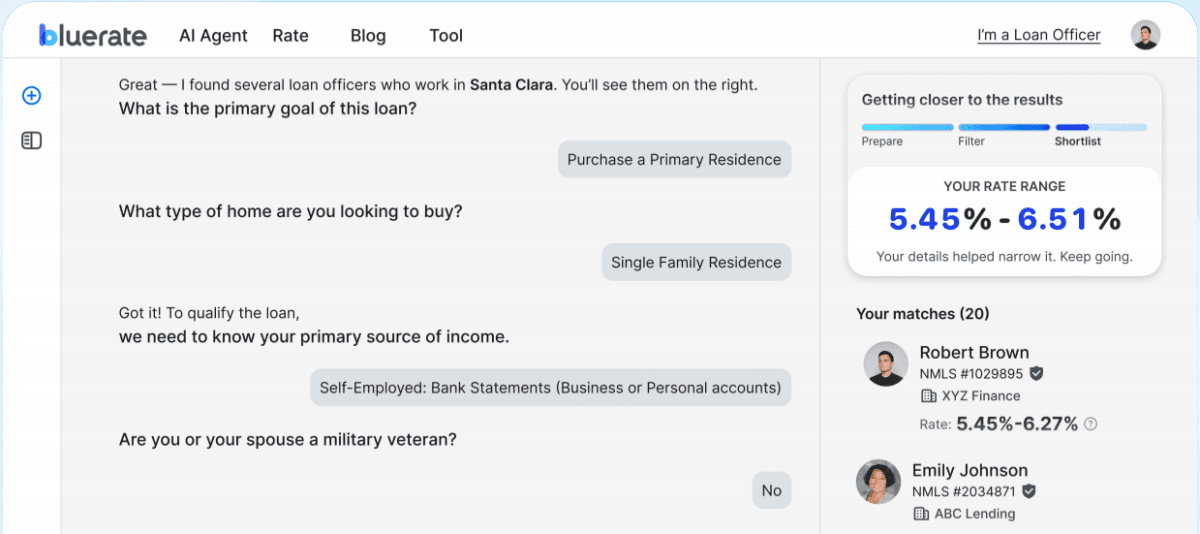

Instead of scrolling through endless lists of names or deciphering complex rate tables, you simply chat with our AI. It acts as an intelligent Loan Officer Assistant. Through a natural conversation, it analyzes your financial profile, including income, credit score, and goals, to perform a sophisticated "Prepare-Filter-Shortlist" process.

For Borrowers, it's a clarity engine. It calculates your Debt-to-Income (DTI) ratio on the fly and pre-screens you against actual lender guidelines.

Key Features: Why Choose Bluerate AI?

Why is this better than a traditional search bar? Let's look at the capabilities.

Master of Expert-Level Knowledge

A human Loan Officer might memorize the basics, but our AI Agent has access to the comprehensive rulebooks for Conventional, FHA, VA, USDA, and even complex Non-QM products. This means when we tell you you're a good fit for a loan, it's not a guess. It's a data-backed assessment that saves you from the heartbreak of a late-stage rejection.

Precision Matching: Find the Right Human

Most "marketplaces" are actually lead-selling machines. They sell your contact info to whoever pays the most. We do the opposite. Our AI uses a proprietary Match Score to pair you with Loan Officers based strictly on competence and fit.

If you are a veteran looking for a VA loan in Texas, the AI filters out generalists and shortlists top-rated specialists in your zip code. It evaluates the LO's past performance, license status, and specific expertise. You don't get a random salesperson. You get a curated list of professionals who have already succeeded with cases just like yours.

Built for Every Scenario

The "standard" 30-year fixed mortgage isn't for everyone, especially in today's gig economy. If you are self-employed, an investor, or a foreign national, traditional bank algorithms often fail you. This is where Bluerate AI shines.

We have trained the Agent to handle complex scenarios like DSCR (Debt Service Coverage Ratio) loans for investors. The AI asks the right questions to uncover these niche opportunities, connecting you with Non-QM experts who understand that your tax return doesn't always reflect your true ability to repay.

Your 24/7 Personal Mortgage Assistant

Buying a home doesn't happen strictly between 9 AM and 5 PM. You might have a burning question at midnight: "How much down payment do I actually need?" or "What happens to my rate if my credit score drops 10 points?" With Bluerate AI, you get instant, judgment-free answers anytime.

You don't have to worry about feeling "uneducated" or wasting a professional's time with basic questions. The AI handles the education and the math, letting you explore scenarios at your own pace so you are fully confident before you ever speak to a human.

Enterprise-Grade Security & Privacy

In an industry notorious for selling consumer data, we take a radical stance: Privacy First. We are proud to be SOC 2 Type II certified. This isn't just a badge. It means an independent auditor has tested our security controls over a sustained period, which is typically 6-12 months, and verified that we protect your data with bank-level rigor.

Unlike other sites, we never sell your data. You can explore rates and get matched anonymously. Your contact information is only shared when you decide to hit the "Contact" button. This ensures a completely spam-free experience, keeping your phone quiet until you're ready to talk.

100% Free Access

You might expect a tool this powerful to sit behind a paywall, but we believe transparency should be free. Whether you are a first-time homebuyer testing the waters or a seasoned Real Estate Agent needing a quick qualification tool, Bluerate is completely free to use.

There are no subscription fees, no hidden costs, and no credit card required to start a chat. Our mission is to democratize access to professional mortgage advice, giving you the same data the pros use without the price tag.

Who Is the Bluerate AI Agent Built For?

We designed this Agent to address the specific pain points of four key groups in the current market:

-

First-Time Homebuyers: The process is intimidating. You have questions you're afraid to ask. Our AI removes that barrier, answering "silly" questions without judgment and helping you understand if a 620 credit score is enough to buy.

-

Self-Employed & Gig Workers: If you run an LLC or work on 1099 income, big banks often view you as "risky." Our AI understands how to present your income profile and instantly connects you with Non-QM experts who specialize in self-employed borrowers, ensuring you don't get rejected for the wrong reasons.

-

Refinance Seekers: With rates fluctuating, it's hard to know when to pull the trigger. The AI can crunch the numbers on a "Cash-Out" refinance or a HELOC, helping you decide if a 0.75% rate drop is worth the closing costs based on your specific loan balance.

How to Use Bluerate AI Agent?

Getting started is incredibly simple. We've removed all the friction:

- Start the Chat: Simply head to our homepage and click the "Chat with AI" button.

-

The Basics: The Agent will ask for your location first. Real estate is local, and so are the experts.

-

Interactive Q&A: Answer a few questions about your goals (buying vs. refi) and finances. The AI adapts to your answers, only asking what's necessary.

-

Get Results: Within moments, view your personalized Rate Quotes and a shortlist of recommended Loan Officers. You can check their profiles and, when you're ready, message them directly through the platform.

Final Word

The era of blind mortgage shopping is over. With Bluerate, you aren't just getting a list of lenders. You're getting a technology-backed strategy to secure the best financing for your home. We have combined the speed of AI with the trust of NMLS-verified professionals to create a marketplace that actually works for you.

Don't let financing uncertainty slow down your home-buying journey. I invite you to try the Bluerate AI Agent today. It's free, it's private, and it might just save you thousands on your mortgage.

Start Your Chat Now -- Find your perfect rate and Loan Officer in minutes.