Mortgage Quotes: What It Is, Why You Need, and How to Get?

I remember the first time I started looking for a home. I was staring at my laptop screen, drowning in a sea of terms: Mortgage Quote, Rate Quote, Loan Estimate, Pre-approval. Honestly, they all sounded like the same thing to me. I just wanted to know: "How much is this going to cost me every month?"

If you are feeling that same confusion, you are not alone. Many first-time homebuyers mix these up, and it can cost them thousands of dollars. In this guide, I'm going to walk you through exactly what a mortgage quote is, why it is the most powerful research tool in your belt, and how to get a mortgage quote without wrecking your credit score.

People Also Read

- 10 Tips: First-Time Home Buyer Tips and Advice for You

- [Must-Read Tips] How Do I Get the Lowest Mortgage Rates?

- In-Depth Analysis: Are Mortgage Rates Expected to Go Down in 2026?

- Solved - How to Calculate Break-Even Point in Mortgage?

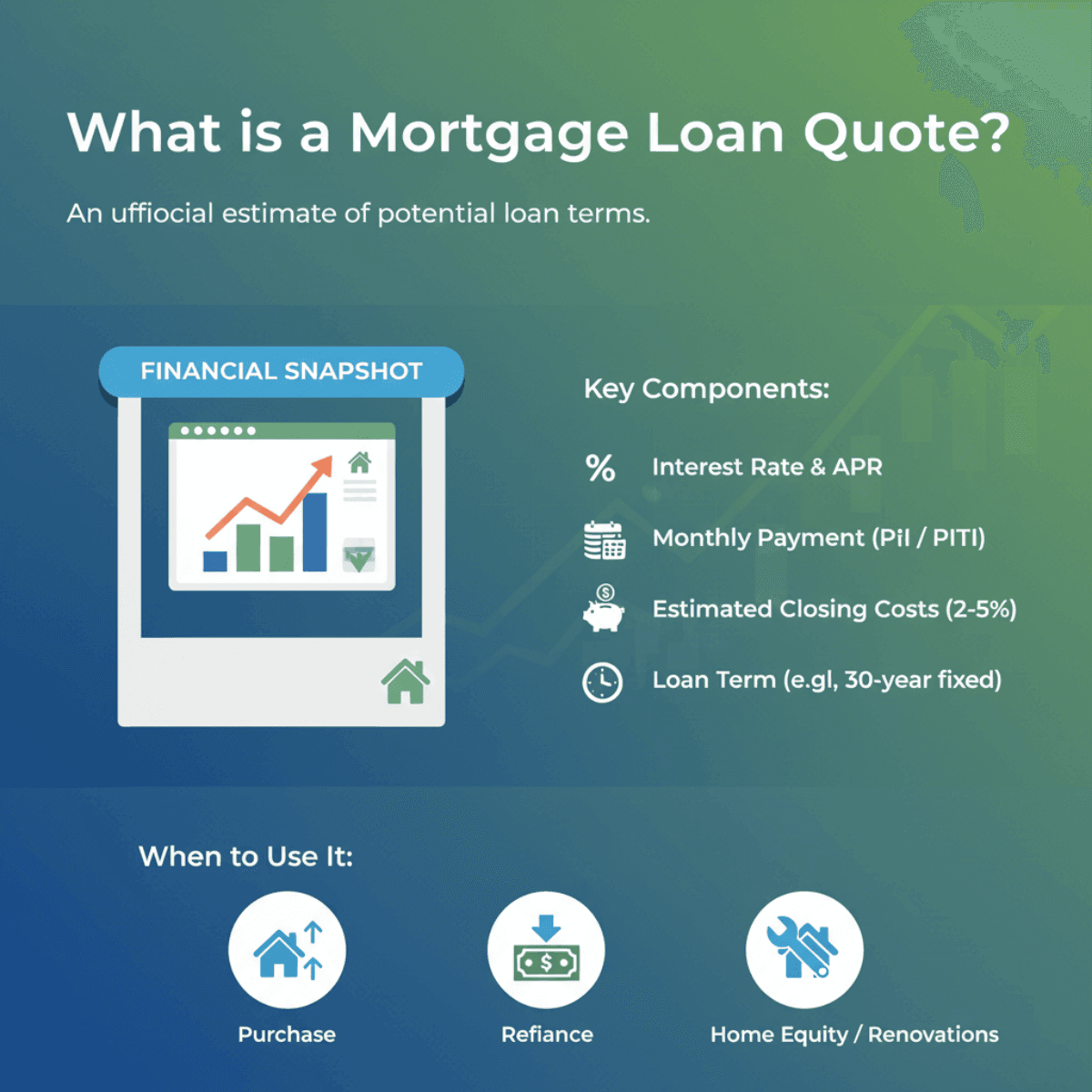

What is a Mortgage Loan Quote?

Think of a mortgage quote as a "financial snapshot." It is an unofficial estimate that a lender gives you to show what your loan terms might look like if you locked them in right at that moment.

When I say "unofficial," I don't mean it's fake. I mean it isn't a binding legal contract yet. It's a conversation starter. Lenders use it to say, "Based on what you've told us about your credit and income, here is the deal we can offer."

What usually goes into a Mortgage Quote?

When you look at a quote, you should see four main components:

-

Interest Rate & APR: The rate is what you pay on the principal. The Annual Percentage Rate (APR) is usually higher because it includes the rate plus lender fees. I always tell people: watch the APR to see the true cost of the loan.

-

Monthly Payment: This typically shows Principal and Interest (P&I). Some quotes estimate escrow for taxes and insurance (PITI), but full PITI projections appear in the formal Loan Estimate after house selection. Quotes remain preliminary guesses.

-

Estimated Closing Costs: These are the fees to process the loan, usually ranging from 2% to 5% of the loan amount.

-

Loan Term: Whether it's a standard 30-year fixed or a 15-year loan, or even a 50-year loan.

When do you use a Mortgage Quote?

I use quotes for three main purposes:

-

Purchase: To see if I can actually afford that house I saw on Zillow.

-

Refinance: To check if current rates are lower than what I'm paying now.

-

Home Equity: To see how expensive it would be to cash out some equity for renovations.

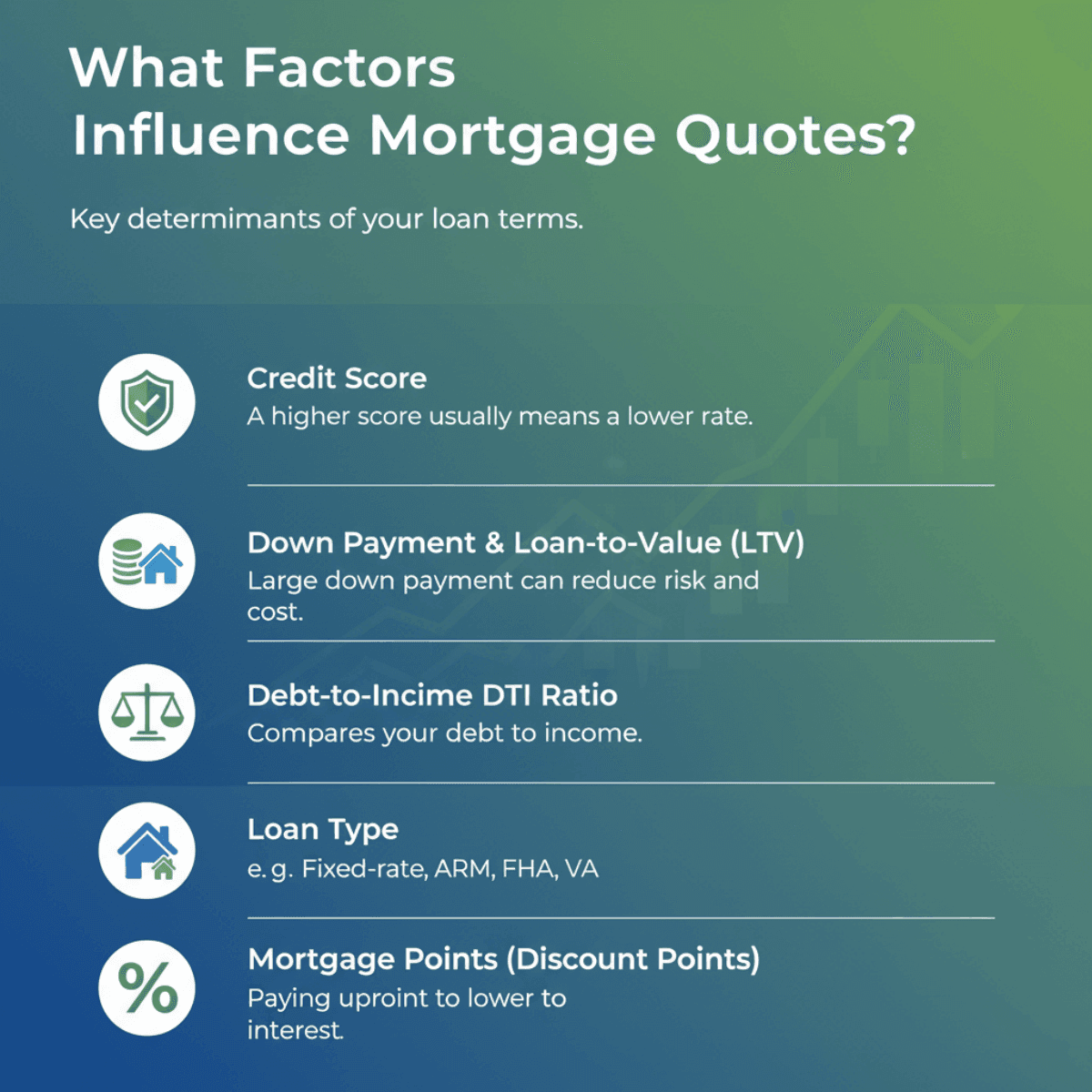

What Factors Influence Mortgage Quotes?

You might be wondering, "Why did my friend get a 6.5% quote while I got a 7%?" The truth is, mortgage quotes are highly personalized. Lenders are assessing risk, and your profile determines that risk.

Here are the key levers that move your numbers:

-

Credit Score: This is the big one. In 2025, scores of 760-850 typically qualify for the best or 'prime' mortgage APRs around 7.24%, while 700-759 gets about 7.45%. Prime rates improve gradually across tiers starting from 620, per current pricing data according to theMortgageReports. If your score is lower, lenders charge a higher rate to offset the risk.

-

Down Payment & Loan-to-Value (LTV): Putting 20% down is the gold standard because it usually avoids Private Mortgage Insurance (PMI) and lowers your rate. If you only put 3% down, your LTV is 97%, which is riskier for the lender.

-

Debt-to-Income (DTI) Ratio: Lenders want to know you aren't drowning in debt. If your monthly debts (student loans, car payments, credit cards) eat up too much of your income, your rate might creep up—or you might not qualify at all.

-

Loan Type: Government-backed loans (like FHA or VA) often have lower rates than Conventional loans but come with different fee structures. Also, non-QM loans are more complicated.

-

Mortgage Points (Discount Points): This is huge right now. Basically, you pay an upfront fee (usually 1% of the loan) to "buy down" your interest rate. If you see a quote that looks suspiciously low, check if it includes points.

Why Do You Need a Mortgage Quote?

You wouldn't buy a car without asking the dealer for the price first, right? A mortgage quote is the price tag for your loan.

First, it is essential for budgeting. I've seen so many people calculate their mortgage based on the "asking price" of the home, forgetting that interest and fees can double that cost over 30 years. A quote shows you the real monthly damage.

Second, it gives you leverage. Mortgage rates aren't set in stone. If Bank A quotes you 6.8% and Bank B quotes you 6.6%, you can show Bank A the lower offer and ask them to match it. Freddie Mac research indicates that borrowers who get five quotes can save an average of about $3,000 over the life of the loan. CFPB studies highlight similar shopping benefits but cite monthly or shorter-term savings like $100 per month. That's money that should stay in your pocket, not the bank's vault.

How to Get Mortgage Quotes?

Getting a quote used to be a headache involving fax machines and endless phone tag. Thankfully, it's much easier now.

The Process:

-

Gather Info: Know your estimated credit score, your annual income, and the price of the home you are looking at.

-

Shop Around: You can go to your local bank, a credit union, or use an online marketplace.

The Smarter Way: Bluerate

Personally, I recommend using platforms like Bluerate. Instead of just giving you a generic "teaser rate" that applies to nobody, Bluerate uses AI to help personalize rates for your specific situation.

What I really like is that they allow you to connect directly with local loan officers for free. These are actual humans who know the market in your specific area, not just a call center algorithm. It simplifies the comparison process immensely.

When getting initial quotes online, most platforms use a "soft pull" on your credit, which doesn't hurt your score. Always ask if it's a soft or hard pull before agreeing!

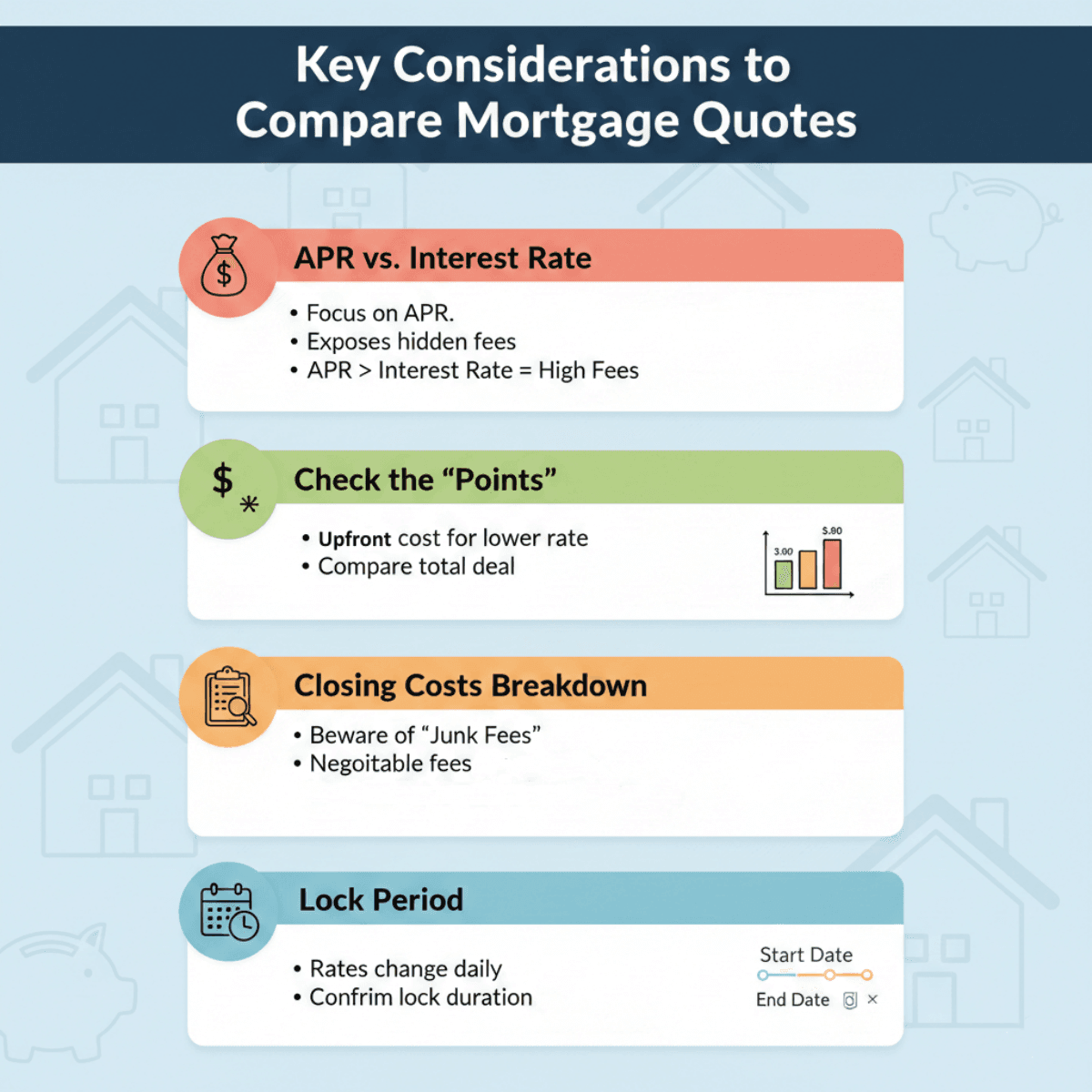

Key Considerations to Compare Mortgage Quotes

Once you have 3 or 4 quotes in front of you, it can look like a mess of numbers. Here is how I analyze them to find the winner:

-

Look at the APR, not just the Interest Rate: I can't stress this enough. A lender might show you a flashy low interest rate but hide massive "origination fees" in the fine print. The APR exposes this. If the APR is significantly higher than the interest rate, those fees are high.

-

Check the "Points": Did Lender A quote you 6.5% with $0 in points, while Lender B quoted 6.25% but wants you to pay $4,000 upfront? Lender A might actually be the better deal if you don't have the extra cash to close.

-

Closing Costs Breakdown: Look for "Junk Fees." Things like "Application Fee," "Underwriting Fee," or "Processing Fee" vary wildly between lenders. These are often negotiable.

-

Lock Period: Rates change daily. Ask the lender: "Is this rate locked? If so, for how long?" A 30-day lock is standard, but if your closing is 60 days out, that quote might expire.

Mortgage Quote vs Pre-Approval

This is the most common mix-up I hear from first-time buyers. They get a mortgage quote online and think they are ready to make an offer on a house. They are not.

Mortgage Quote:

-

What it is: Informal research.

-

Verification: None. The lender takes your word for your income and credit.

-

Purpose: To compare costs and budget.

-

Seller Perception: Sellers won't accept this. It proves nothing about your ability to close the deal.

Pre-Approval:

-

What it is: A conditional commitment to lend.

-

Verification: The lender has actually checked your pay stubs, W-2s, and bank assets, and done a hard credit pull.

-

Purpose: To buy a home.

-

Seller Perception: Essential. It tells the seller, "I have the money, and a bank has vetted me."

Think of a Mortgage Quote as browsing the menu to see what you can afford. Pre-approval is putting your credit card on the table to order the meal.

Conclusion

Navigating the mortgage world can feel intimidating, but understanding Mortgage Quotes is your first step toward financial confidence. Remember, these quotes are tools for you to use, not just numbers the bank throws at you. They help you budget, compare, and ultimately save thousands of dollars.

Don't settle for the first offer you see. I highly recommend starting your search on Bluerate to get personalized, transparent comparisons and connect with pros who can guide you. The extra hour you spend comparing quotes today could pay for your future kitchen renovation tomorrow.