Solved - How to Calculate Break-Even Point in Mortgage?

I still remember the knot in my stomach sitting at the closing table for my first home. The loan officer had just asked, "Do you want to buy down the rate for an extra $4,000?" It sounded great, saving $60 a month forever, but parting with that much cash upfront felt terrifying.

Whether you are a first-time homebuyer staring at a Loan Estimate or a homeowner debating a refinance email that promises "lower monthly payments," you are facing the same financial puzzle. You have to spend money to save money. But is it worth it?

The answer isn't in the interest rate itself. It's in the timeline. To make the right call, you need to calculate your mortgage break-even point, the exact moment when your upfront costs are fully paid off by your monthly savings. Let's do the math together so you can stop guessing and start planning.

When to Calculate Break-Even Point in Mortgage?

In the business world, "break-even" usually means the moment a company stops losing money and starts making a profit. In the mortgage world, it's slightly different but just as critical. Break Event Point is the specific month in the future when the money you saved on interest finally exceeds the fees you paid to get that loan.

Basically, if you sell your house or refinance again before this month hits, you've lost money. If you stay longer, you're in the green.

You need to run this calculation in three specific scenarios:

-

Refinancing: This is the most common one. You are trading your old high-interest loan for a new lower rate, but the bank charges you "closing costs" to do it.

-

Buying Mortgage Points (Discount Points): When buying a home, the lender might offer to drop your rate by 0.25% if you pay 1% of the loan amount upfront. This is a direct cash-for-savings trade.

-

Switching Loan Types: If you are moving from an Adjustable Rate Mortgage (ARM) to a Fixed-Rate loan for stability, you might pay fees. You need to know if the peace of mind is costing you too much cash.

If there are upfront fees involved to lower your monthly payment, you must calculate the break-even point.

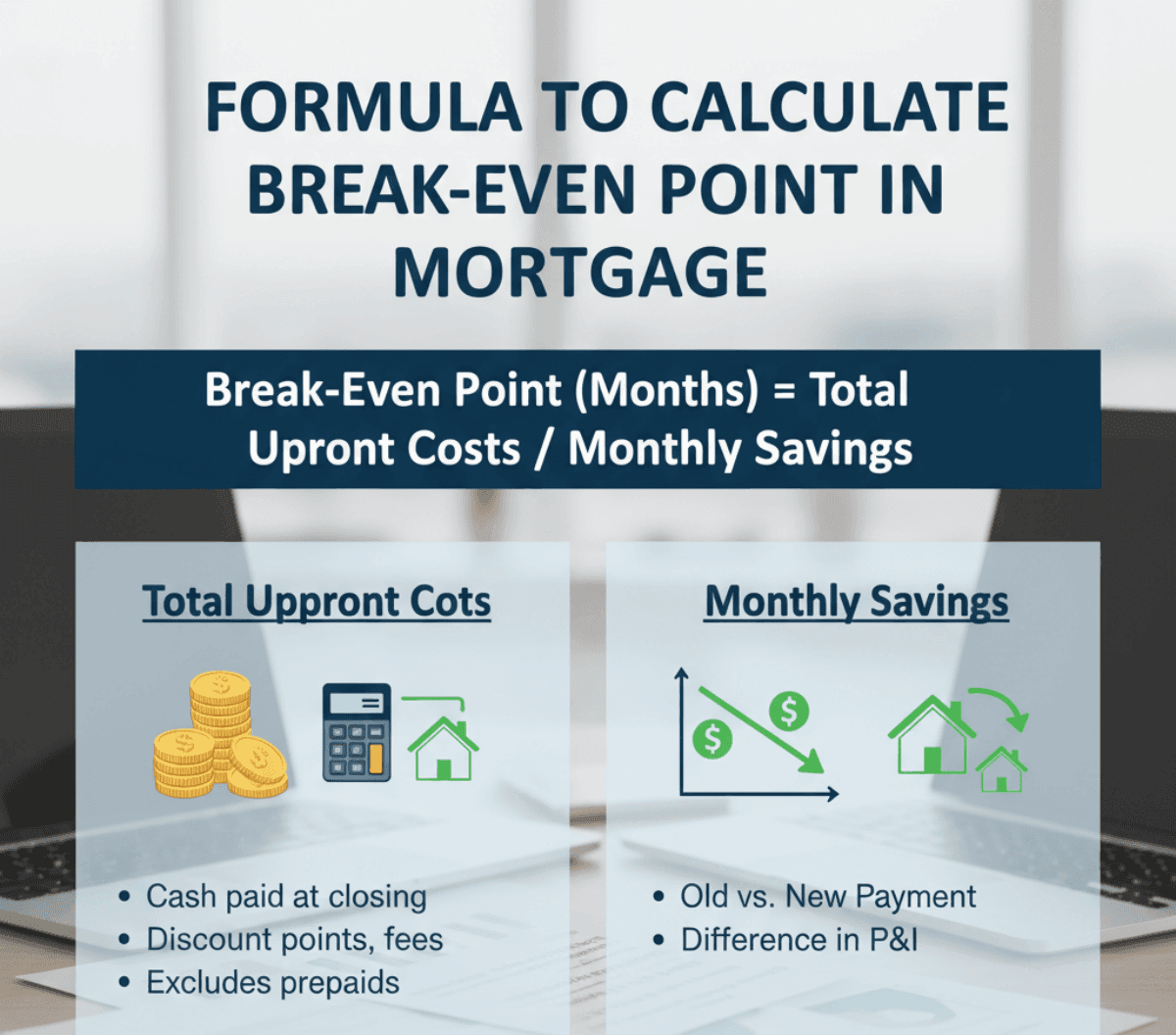

Formula to Calculate Break-Even Point in Mortgage

The math here is actually surprisingly simple, no advanced calculus required. The "break even point equation" is just a division problem.

Here is the standard formula you need: Break-Even Point (Months) = Total Upfront Costs / Monthly Savings

Let's break down the variables:

-

Total Upfront Costs: This is the cash you pay at closing to get the new loan or rate. It includes discount points, origination fees, appraisal fees, and other closing costs. Do not include "prepaids" like property taxes or insurance, as you'd pay those anyway.

-

Monthly Savings: This is the difference between your old mortgage payment (Principal & Interest) and your new proposed payment.

Using this break even point equation gives you a single number: Months. If the answer is 30, it means it will take you 30 months (2.5 years) to earn back your investment. If you plan to move in 2 years, the deal is a bad one.

How Do You Calculate Break-Even Point?

Knowing the formula is one thing, but seeing it in action with real numbers is where it clicks. Below, I've broken down the two most common real-world examples for you.

Break-Even Point Example 1: Refinance

Let's say you bought a home a couple of years ago when rates were higher, perhaps around 7.5%. Now, in 2026, you see refinance rates averaging around 6.6%. You want to lower your monthly bill, but the lender is charging you closing costs.

The Scenario:

-

Current Loan: $350,000 balance at 7.5% interest.

-

New Offer: $350,000 balance at 6.5% interest.

-

Closing Costs: The lender charges $5,000 in total fees (origination, title, etc.) to process the refinance.

The Calculation:

-

Current Monthly P&I: $2,447

-

New Monthly P&I: $2,212

-

Monthly Savings: $235 ($2,447 - $2,212)

-

Total Upfront Cost: $5,000

-

Break-Even Math: $5,000 ÷ $235

-

Result: 21.2 Months

It will take you roughly 21 months (under 2 years) to recoup that $5,000 fee.

Is this good? Yes. Most financial experts agree that a break-even under 30 months is excellent. If you plan to live in this house for 5 or 10 years, you will save thousands of dollars over the long haul.

Break-Even Point Example 2: Mortgage Points

This is the dilemma I faced. You are buying a new home for $400,000. The standard rate is 6.5%, but the lender says: If you pay 1 Point ($4,000), I'll lower your rate to 6.25%.

The Scenario:

-

Loan Amount: $400,000.

-

Standard Rate (Option A): 6.5% with $0 points cost.

-

Discounted Rate (Option B): 6.25% with $4,000 cost (1 point).

The Calculation:

Option A (Standard)

-

Interest Rate: 6.5%

-

Monthly P&I: $2,528

-

Monthly Savings: $0

-

Upfront Cost: $0

-

Break-Even Math: N/A

-

Result: N/A

Option B (With Points)

-

Interest Rate: 6.25%

-

Monthly P&I: $2,463

-

Monthly Savings: $65

-

Upfront Cost: $4,000

-

Break-Even Math: $4,000 ÷ $65

-

Result: 61.5 Months

Your break-even point is roughly 61.5 months, or just over 5 years.

Is this good? It's risky. 5 years is a long time. If you get a job transfer or need to upsize in year 4, you actually lose money by buying that point. Plus, you have to consider opportunity cost: Could that $4,000 have earned more interest sitting in a High-Yield Savings Account? In this case, I would likely skip the mortgage points.

FAQs About Calculating Break-Even Point

Here are the specific questions I often hear from homebuyers when they start crunching these numbers.

Q1. How to calculate break-even point in Excel?

You don't need a fancy calculator. Excel or Google Sheets works perfectly. Set up three cells:

-

Cell A1: Enter your Total Closing Costs (e.g., 5000).

-

Cell B1: Enter your Monthly Savings amount (e.g., 200).

-

Cell C1: Enter this formula: =A1/B1.

To see it in years, use =(A1/B1)/12. This gives you the instant answer for your decision-making.

Q2. Is a 3-year break-even point good for a mortgage?

Generally, yes. A break-even point of 30 months (2.5 years) or less is considered a "slam dunk." A timeline between 30 and 48 months (2.5 to 4 years) is standard and usually acceptable. Once you creep past 60 months (5 years), the risk increases significantly because life is unpredictable, you might move or refinance again before you ever see the savings.

Q3. Does the break-even calculation include principal reduction?

The simple formula above only calculates cash flow (interest savings). However, a lower interest rate also means you pay down your principal balance slightly faster. A "True Break-Even" calculation includes this equity build-up, which might shorten your break-even timeline by a few months. But for a quick "yes or no" decision, the simple cash-flow formula is safer and more conservative.

Q4. Can I roll the closing costs into the loan?

Yes, this is called a "no-closing-cost refinance." However, the costs don't disappear. They are added to your loan balance.

This increases your total debt and your monthly payment, which reduces your monthly savings. While you pay zero cash upfront, your break-even calculation changes because your savings are smaller. You still need to calculate if the slightly lower payment justifies the higher loan balance.

Conclusion

Calculating your mortgage break-even horizon is the single best way to remove emotion from your housing decisions. It turns a stressful "guessing game" into a simple math problem.

Remember, time is the only variable that matters. The greatest interest rate in the world is useless if you pay $5,000 to get it, but move out in 18 months.

My final advice:

-

Get a Loan Estimate from your lender.

-

Find the "Origination Charges" and "Points" in Section A.

-

Use the formula: Cost ÷ Monthly Savings.

-

Ask yourself: "Will I definitely live here longer than that number?"

If the answer is a confident yes, sign the papers. If you're unsure, keep your cash in your pocket. Don't let the promise of a lower rate blind you to the reality of the upfront cost.