Explained: What is a DSCR Loan? Requirements, Pros, Cons

If you are anything like me, you've probably spent late nights reading threads on Reddit, trying to make sense of the alphabet soup that is real estate finance. I see the same questions pop up constantly: "Why would a bank lend to me without seeing my pay stubs?" or "Is a DSCR loan too good to be true?"

I've been there. As investors, we often hit a wall where traditional banks simply say "no" because our tax returns don't tell the full story, or we've maxed out our debt-to-income ratio. That is where the DSCR Loan comes in. It is arguably the most powerful tool for scaling a rental portfolio in the US market today. In this guide, I'm going to cut through the jargon and explain exactly what a DSCR loan is, how the math works, and the honest pros and cons you need to know before signing the dotted line.

DSCR Loan Meaning: What Is It?

To understand the loan, we first need to understand the metric. DSCR stands for Debt Service Coverage Ratio. In the commercial finance world, this is just a fancy way of measuring cash flow. It answers one simple question: Does this asset generate enough income to pay for itself?

So, what is a DSCR Loan? A DSCR loan is a type of Non-QM (Non-Qualified Mortgage) loan used exclusively for investment properties. Unlike a conventional mortgage that dissects your personal life, your W-2s, your tax returns, your employment history, a DSCR lender doesn't care about your personal income.

Instead, the lender looks almost entirely at the property's potential. If the projected rent covers the mortgage payment, you are likely to get approved.

Who is this for?

-

Self-Employed Investors: If you write off a lot of expenses on your taxes, your net income might look too low for a conventional loan, even if you have money in the bank.

-

Serial Investors: Fannie Mae and Freddie Mac usually cap you at 10 financed properties. DSCR loans have no such limit.

-

Airbnb/VRBO Hosts: Many DSCR programs now cater specifically to Short-Term Rental (STR) income.

Key Features

-

No Personal Income Needed: I cannot stress this enough, no tax returns or pay stubs are required.

-

Property-Focused: The underwriting is based on the asset's cash flow, not your personal Debt-to-Income (DTI) ratio.

-

For Investors Only: You strictly cannot live in the property. It must be for business purposes.

-

Diverse Property Types: These loans work for single-family homes, 2-4 unit multi-family properties, and increasingly, vacation rentals.

How Does a DSCR Loan Work?

The mechanics of a DSCR loan revolve around a specific formula. When you apply, the lender acts more like a business partner analyzing a deal than a traditional bank. They use a formula to assign a "score" to your property.

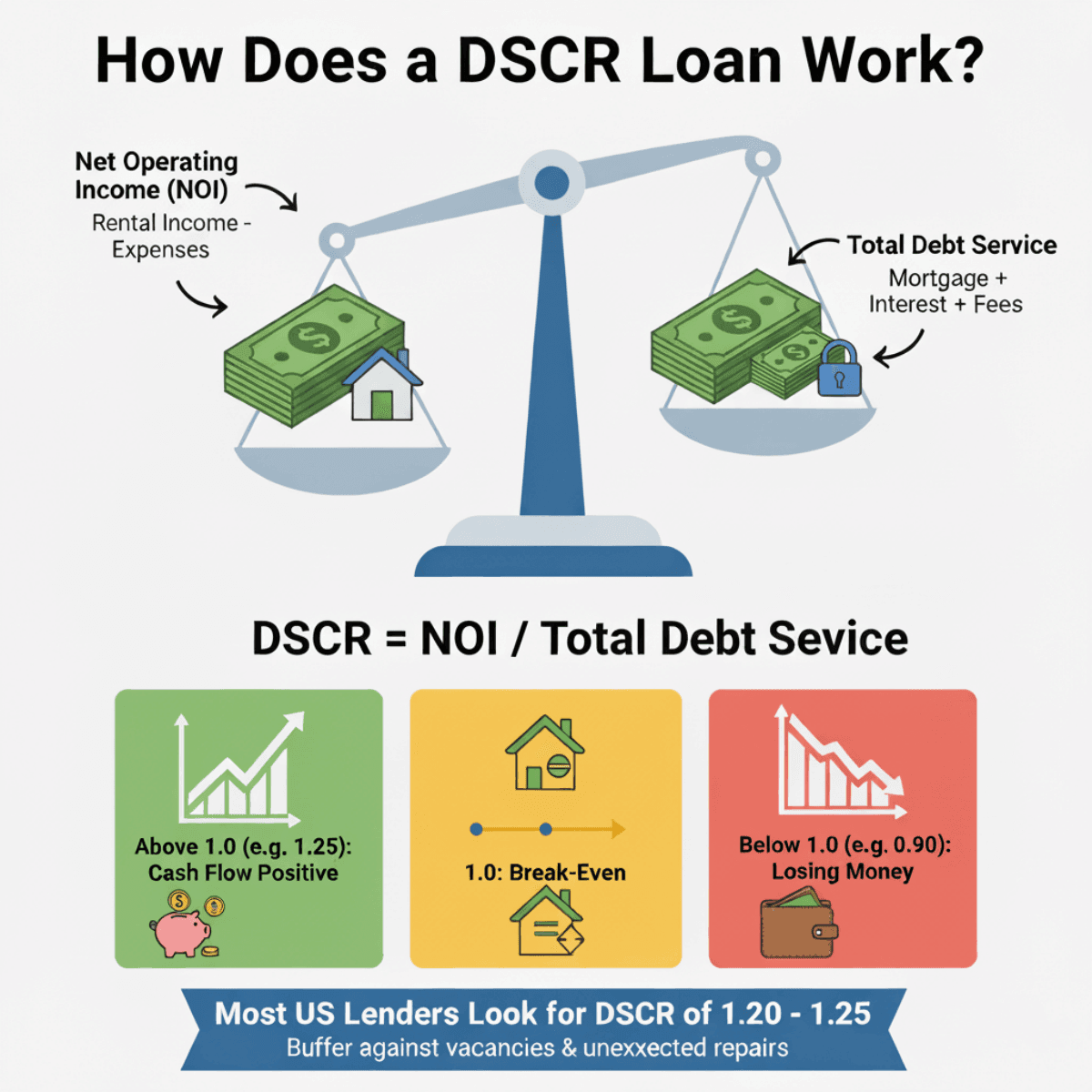

Here is the DSCR formula lenders use: DSCR = Net Operating Income (NOI) / Total Debt Service

In the context of these loans, the NOI is usually just the Gross Rental Income determined by an appraisal. The Total Debt Service is the monthly PITIA payment:

- P - Principal

- I - Interest

- T - Taxes

- I - Insurance

- A - Association Dues (HOA), if applicable

Understanding the Ratio:

-

1.0: The rent exactly covers the mortgage and expenses. This is "break-even."

-

Above 1.0 (e.g., 1.25): The property is cash flow positive.

-

Below 1.0 (e.g., 0.90): The property is losing money each month.

Most lenders in the US market look for a ratio of 1.20 to 1.25. This means for every $1.00 of debt, the property brings in $1.25 in rent. This buffer protects the lender (and you) against vacancies or unexpected repairs.

Example of DSCR Loan

Let's look at a real-world scenario to make this concrete. Imagine I am looking to buy a rental property in Florida. I found a single-family home for $350,000.

After putting down my down payment, here is what the monthly numbers look like:

- Principal & Interest + Taxes + Insurance (PITIA): $2,000 per month.

During the appraisal process, the appraiser fills out a "1007 Rent Schedule" form and estimates the market rent for this home is $2,600 per month.

My DSCR Calculation: DSCR = $2,600 (Rent) / $2,000 (Debt Cost) = 1.30

Because my ratio is 1.30, which is higher than the standard requirement of 1.20 or 1.25, I qualify easily. Even if I am a freelancer with fluctuating monthly income, the lender is confident because the house is paying the bill, not me.

Requirements of DSCR Loan

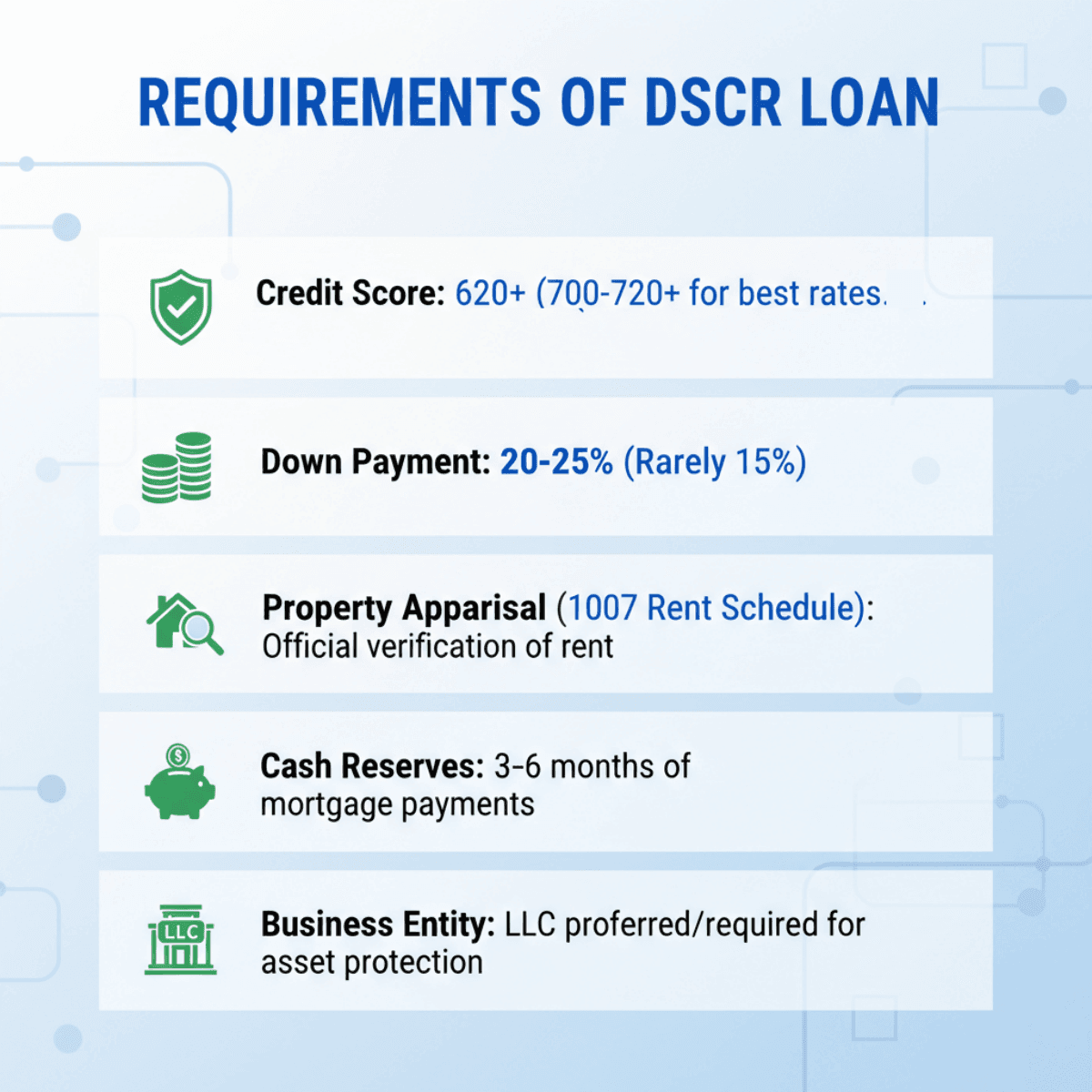

While you don't need to show income, don't mistake "no income verification" for "no requirements." These loans are not a free-for-all. Based on current market standards, here are DSCR Loan requirements you need to have in order:

-

Credit Score: Most lenders require a minimum credit score of 620. However, if you want competitive rates, you really want to be in the 700-720+ range.

-

Down Payment: Skin in the game is mandatory. Expect to put down 20% to 25%. There are rare programs that allow 15%, but the interest rates are usually punitive.

-

Property Appraisal (1007 Rent Schedule): You cannot just say "I think it will rent for $3,000." An official appraiser must verify the fair market rent using a form called the 1007 Rent Schedule.

-

Cash Reserves: Lenders want to see that you have a safety net. You will typically need to show you have 3 to 6 months of mortgage payments liquid in your bank account after closing.

-

Business Entity: While not always mandatory, most lenders prefer (or require) you to close in the name of an LLC. This is actually a benefit for you, offering better asset protection.

Pros and Cons of DSCR Loan

Every financial tool has trade-offs. I've used DSCR loans to great success, but they aren't perfect for every deal. Here is an honest breakdown of DSCR loan Pros & Cons.

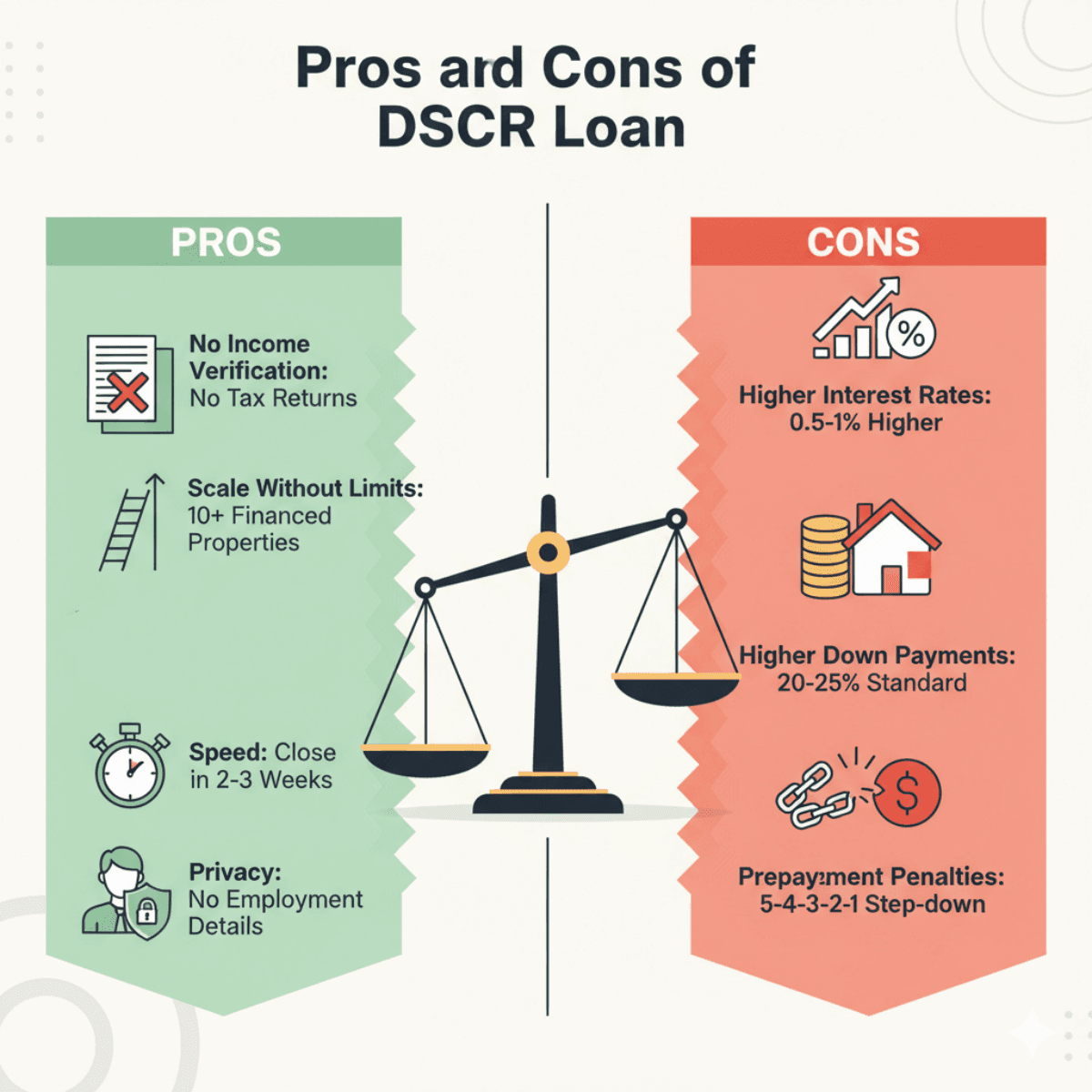

Pros:

-

No Income Verification: This is the big one. No W-2s, no tax returns, no hassle.

-

Scale Without Limits: You won't hit the "10 financed properties" wall that exists with conventional financing.

-

Speed: Because the underwriting is lighter (no need to analyze your entire financial history), these loans can often close faster, sometimes in as little as 2-3 weeks.

-

Privacy: Since you don't divulge your employment details, it offers a layer of privacy that conventional loans don't.

Cons:

-

Higher Interest Rates: You pay for the convenience. Rates are typically 0.5% to 1% higher than a standard conventional investment loan.

-

Higher Down Payments: You generally cannot buy a property with 5% or 10% down here. 20-25% is the standard.

-

Prepayment Penalties: This is a crucial detail. Most DSCR loans come with a "Step-down" prepayment penalty (e.g., 5-4-3-2-1). If you sell or refinance in the first few years, you could owe thousands in fees. Always check this clause.

How to Get a DSCR Loan?

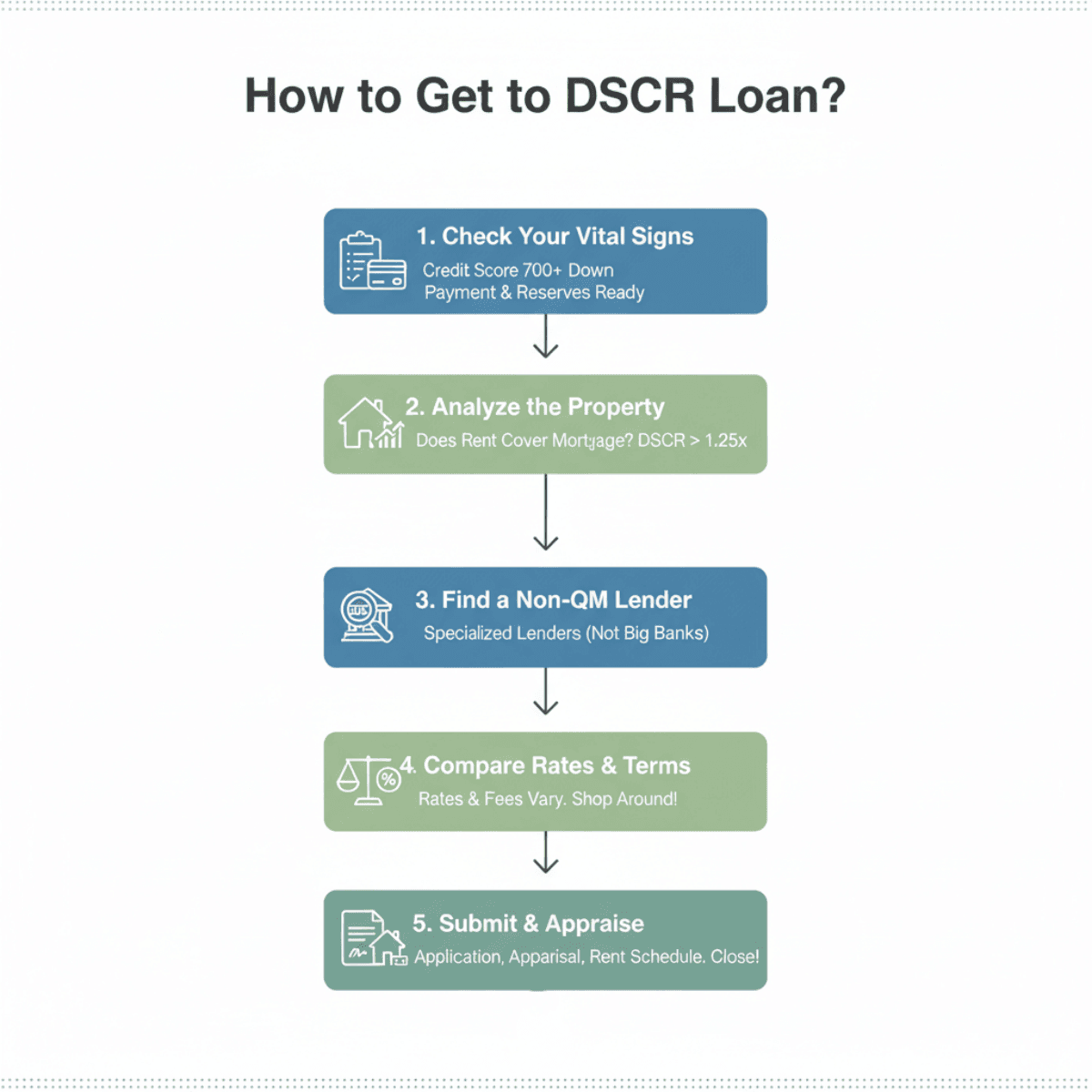

If the math makes sense for your strategy, here is the roadmap to apply for a DSCR Loan:

-

Check Your Vital Signs: Ensure your credit score is accurate (aim for 700+) and you have your down payment plus reserves ready in a liquid account.

-

Analyze the Property: Before you even talk to a lender, run the numbers yourself. Does the expected rent cover the mortgage by at least 1.25x?

-

Find a Non-QM Lender: You cannot walk into a Chase or Wells Fargo for this. You need a specialized Non-QM lender.

-

Compare Rates and Terms: This is the most critical step. Because these loans aren't government-regulated in the same way conventional loans are, rates and fees vary wildly between lenders. Don't just settle for the first broker you speak to. I recommend using a comparison tool like Bluerate. It allows you to compare loan officers and rates for free. Seeing the options side-by-side can save you 0.5% or more on your rate, which adds up to thousands over the life of the loan.

-

Submit and Appraise: Once you pick a lender, submit your application. The main hurdle will be the appraisal and the rent schedule. Once those come back positive, you are on the home stretch to closing.

FAQs About DSCR Loan

Q1. What is the downside to a DSCR loan?

The main downsides are the cost and the commitment. You will pay a higher interest rate and a larger down payment compared to conventional loans. Additionally, most DSCR loans come with prepayment penalties, locking you into the loan for 3 to 5 years unless you're willing to pay a hefty fee to exit early.

Q2. Is it hard to qualify for a DSCR loan?

Generally, no. It is actually easier than a conventional loan if you have the cash. Because lenders don't scrutinize your personal debt-to-income ratio or employment history, the process is much more straightforward. If the property cash flows and you have the down payment, you will likely qualify.

Q3. Are DSCR loans 30-year fixed?

Yes, the most common format is a 30-year fixed-rate mortgage. However, many lenders also offer Interest-Only options (e.g., 10 years interest-only, followed by 20 years fully amortized), which can be great for maximizing monthly cash flow in the short term.

Q4. Do DSCR loans require 20% down?

Yes, typically. 20% to 25% is the industry standard. While some aggressive lenders might advertise 15% down programs, they are rare, require excellent credit, and come with significantly higher interest rates.

Q5. Do DSCR loans have closing costs?

Yes, absolutely. Like any real estate transaction, you will have closing costs. These include title insurance, recording fees, appraisal fees, and lender underwriting fees ("points"). Expect closing costs to run between 2% to 5% of the loan amount.

Q6. Why is DSCR negative?

If a DSCR is "negative" (below 1.0), it means the property's rental income is less than the mortgage payment, you have negative cash flow. Some lenders still offer "No Ratio" or "DSCR < 1.0" loans for properties in high-appreciation areas, but they require much higher down payments and interest rates to offset the risk.

Conclusion

The DSCR loan is a game-changer for real estate investors. It shifts the focus from your personal paycheck to the asset's performance, allowing you to scale your portfolio based on how good your deals are, not how your tax returns look.

However, it is not a decision to take lightly. The higher rates and prepayment penalties mean you need to buy right. If you are ready to explore this option, don't fly blind. Use a resource like Bluerate to shop around. Comparing terms from different loan officers is the best way to ensure your investment remains profitable for years to come.