Must-Read Guide: How to Apply for a Mortgage Loan Online?

I still remember the first time I thought about buying a home. The excitement of browsing listings was quickly replaced by a wave of anxiety when I looked up "how to apply for a mortgage." The sheer volume of paperwork, banking jargon, and horror stories about rejected applications made me want to quit before I even started. If you feel overwhelmed, you are not alone.

But here is the good news: the days of faxing documents and driving across town to meet a banker are largely behind us. Today, applying for a mortgage online is not just possible. It is often faster, more transparent, and less stressful than the traditional route. In this guide, I will walk you through the entire digital mortgage process, from checking your credit score on your laptop to closing on your dream home, so you can navigate this journey with total confidence.

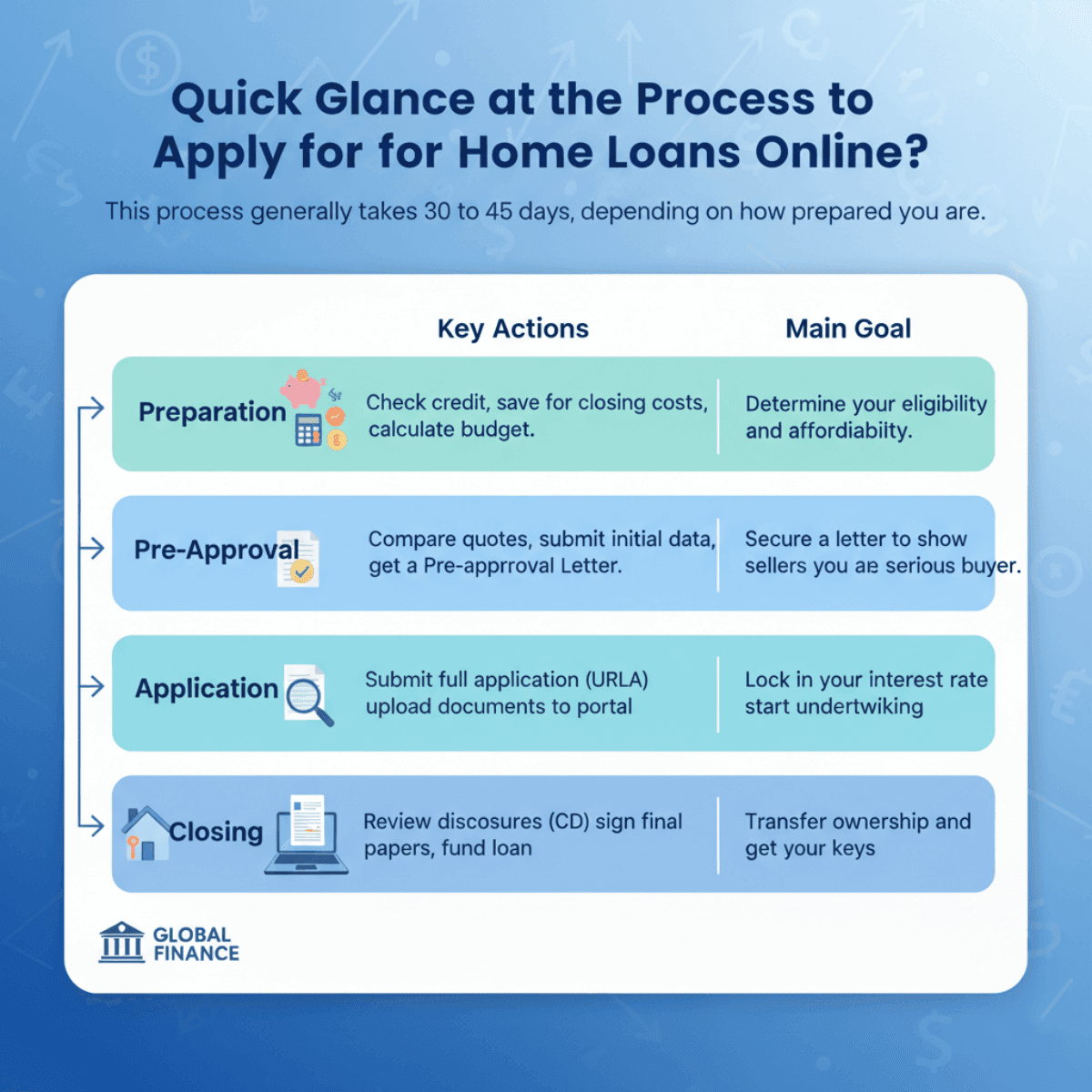

Quick Glance at the Process to Apply for Home Loans

If you want to understand the roadmap before we dive into the details, here is the high-level breakdown of what the online mortgage journey looks like. According to LendFriend, this process generally takes 45 to 60 days from preparation to closing, depending on how prepared you are.

- Preparation: Check credit, save for closing costs, calculate budget.

- Pre-Approval: Compare quotes, submit initial data, get a Pre-approval Letter.

- Application: Submit full application (URLA), upload documents to portal.

- Closing: Review disclosures (CD), sign final papers, fund the loan.

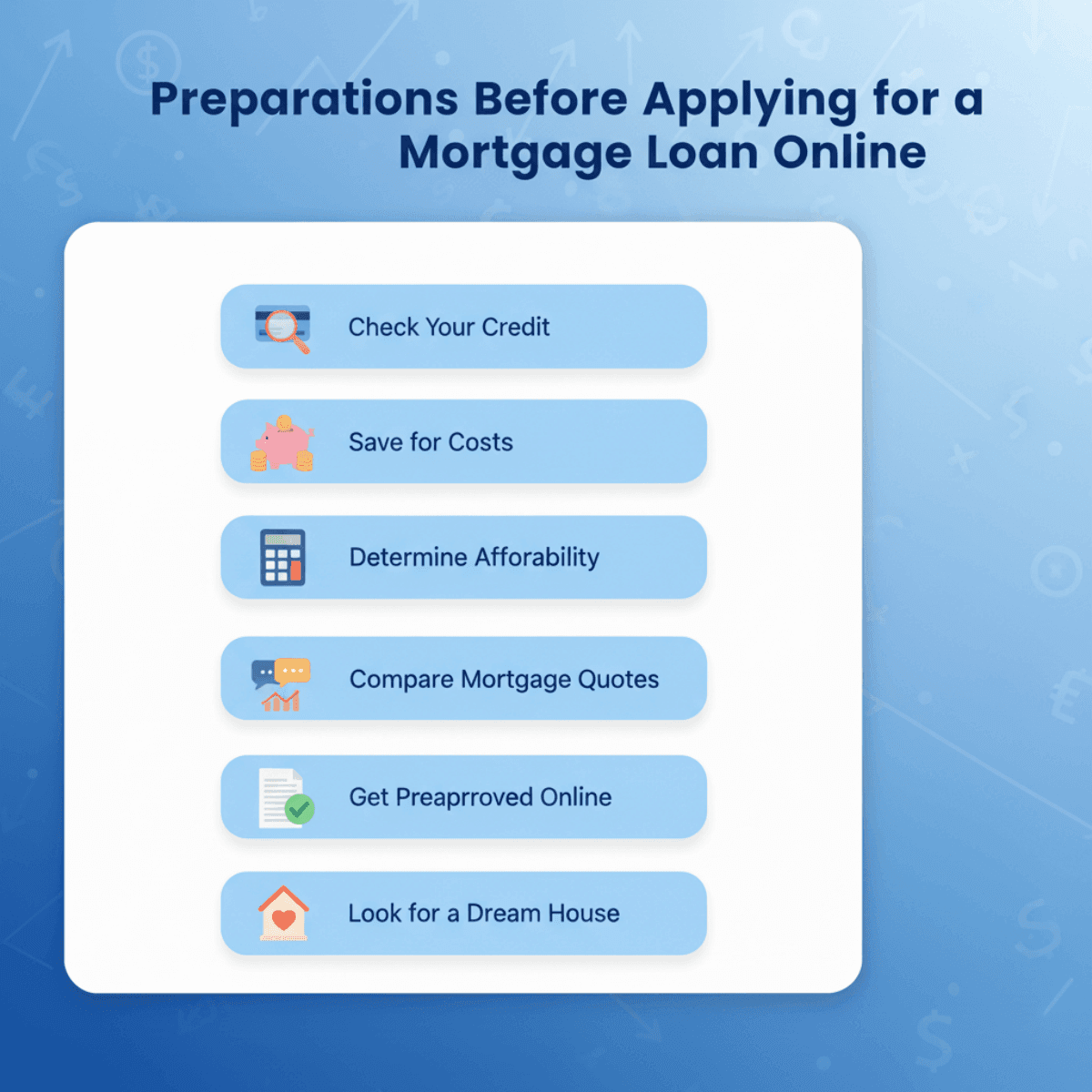

Preparations Before Applying for a Mortgage Loan Online

Before you click "Apply" on any website, you need to do some groundwork. Think of this as training before a marathon. The better your preparation, the smoother the actual race will be. Skipping these steps often leads to higher interest rates or unexpected rejections later.

Check Your Credit

Your credit score is the single most critical factor in determining your mortgage interest rate. Lenders use it to judge how risky it is to lend you money. Generally speaking, a higher score unlocks lower rates, which can save you tens of thousands of dollars over the life of a 30-year loan.

You should aim for a score of at least 620 for a conventional loan. If you are considering an FHA loan, you might get approved with a score as low as 580 for 3.5% down or 500 with 10% down. I strongly recommend checking your report at AnnualCreditReport.com at least six months before buying. Why? Because errors happen. I've seen clients lose out on great rates because of a mistake on their report that took months to fix.

Also, keep your credit utilization low (below 30%) and, this is crucial, do not open new credit cards or buy a new car once you start this process. New debt changes your profile and can derail your application instantly.

Save for Costs

Many first-time homebuyers make the mistake of focusing solely on the down payment. While saving 20% down to avoid Private Mortgage Insurance (PMI) is a great goal, there are other substantial costs you must prepare for. If you drain your bank account for the down payment, you might find yourself unable to close the deal.

You need to budget for Closing Costs, which typically range from 2% to 6% of the loan amount. On a $400,000 home, that is an extra $8,000 to $20,000 you need in cash. These costs cover appraisal fees, title insurance, attorney fees, and prepaid property taxes.

Additionally, lenders want to see "Reserves." These are liquid assets left over after you close, usually equal to 2-6 months of mortgage payments. It proves you won't default if you have a financial emergency. Finally, ensure your funds are "seasoned", meaning the money has been in your account for at least 60 days. Large, unexplained cash deposits right before applying are a major red flag for underwriters.

Determine Affordability

It is tempting to rely on what the bank says they will lend you, but there is a big difference between what you can borrow and what you can afford. You need to calculate your Debt-to-Income (DTI) ratio. This is the percentage of your gross monthly income that goes toward paying debts.

Ideally, your "front-end DTI" (housing costs only) should stay under 28%, and your "back-end DTI" (housing + car loans + credit cards + student loans) should be under 36% (though some programs allow up to 43% or 50%).

Don't just guess these numbers. You need to see the real impact on your monthly budget. I recommend you sit down and use a calculator to see how much mortgage you can afford. It will give you a realistic price range based on your specific debts. Also, remember that interest rates fluctuate. You need to understand how mortgage rates impact affordability, so a rate hike doesn't push you out of your comfort zone.

Learn Loan Types

Not all mortgages are created equal. Finding the right loan program is just as important as finding the right house. Broadly speaking, loans fall into two categories: QM (Qualified Mortgages) and Non-QM.

QM Loans are the standard loans that meet government guidelines. These include:

- Conventional Loans: Great for borrowers with good credit (620+) and stable employment.

- FHA Loans: Ideal for those with lower credit scores or smaller down payments.

- VA Loans: An excellent benefit for veterans with 0% down payment options.

However, the modern economy is changing. If you are a gig worker, freelancer, real estate investor, or business owner, your tax returns might not reflect your true income due to write-offs. This is where a Non-QM Loan comes in. These loans allow alternative income verification, such as using bank statements instead of W-2s.

If you are self-employed or have complex income streams, a standard bank might reject you, but a Non-QM loan might be your best solution. Understanding these options early prevents you from applying for the wrong product.

Compare Mortgage Quotes

This is the step where you can save the most money. Studies show that borrowers who compare mortgage quotes from at least three different lenders save an average of $3,000 over the life of the loan. When comparing online, pay attention to the APR (Annual Percentage Rate), not just the interest rate. The APR includes the interest rate plus lender fees and points, giving you the true cost of the loan.

Be careful with "Teaser Rates" you see in banner ads. These are often artificially low rates that require you to pay high "discount points" upfront to obtain. You need transparency.

I always advise clients to use a platform that prioritizes honesty. You can personalize your rate quotes on Bluerate to ensure you are getting real, actionable market rates without hidden surprises. We aggregate data from top lenders so you can shop with confidence, knowing the numbers are real, not just marketing fluff.

Get Preapproved Online

There is a massive difference between being "pre-qualified" and "pre-approved." A pre-qualification is just a casual estimate based on what you tell a lender. It holds very little weight. A Pre-approval, on the other hand, involves a lender verifying your credit and documents. It results in a formal letter stating exactly how much they are willing to lend you.

In a competitive market, most real estate agents won't even show you homes without a pre-approval letter. It proves you are a serious buyer with verified financing. You don't need to visit a bank branch for this anymore.

You can learn how to get pre-approved for a mortgage loan entirely online here. The process is streamlined and fast. However, keep the timeline in mind. How long is a mortgage pre-approval good for? Typically, these letters are valid for 60 to 90 days. If you haven't found a home by then, you may need to update your documents to refresh the letter.

Look for a Dream House

Once you have your pre-approval letter in hand, the fun begins: house hunting. Most buyers start their search on platforms like Zillow, Redfin, or the local MLS. While these tools are fantastic, my advice is to look beyond the photos.

Pay attention to property taxes and HOA (Homeowners Association) fees listed on the page, these are monthly costs that don't go away even after you pay off the mortgage. Also, try to visit the neighborhood at different times of the day to get a real feel for the area.

Crucially, stick to your budget. Just because you were pre-approved for $500,000 doesn't mean you should buy a $500,000 house. Use your pre-approval as a ceiling, not a target. This discipline ensures you can enjoy your new home without becoming "house poor."

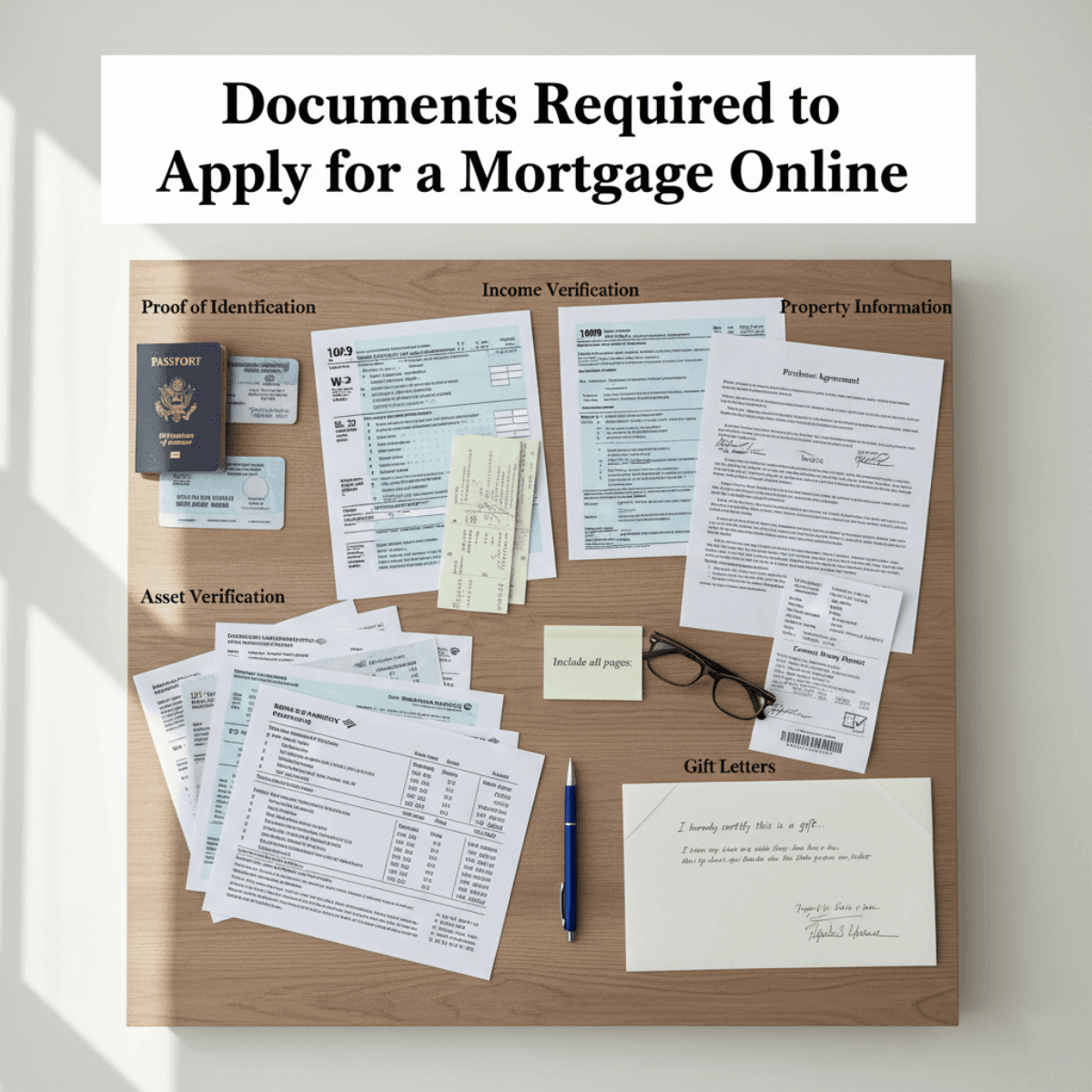

Documents Required to Apply for a Mortgage Online

Even though the process is online, the documentation requirement is strict. Lenders must verify every aspect of your financial life to comply with federal regulations. Having clear, digital copies (PDFs are best) of the following ready will speed up your application significantly:

- Proof of Identification: A valid government-issued photo ID (Driver's License, Passport) and your Social Security Number.

- Income Verification:

- W-2 Employees: Pay stubs for the last 30 days and W-2 forms for the last 2 years.

- Self-Employed: 1099 forms and full tax returns (1040s) for the last 2 years.

- Asset Verification: Bank statements for all accounts (checking, savings, investment) for the last 2 to 3 months. Note: Ensure all pages are included, even blank ones.

- Property Information: The signed Purchase Agreement and proof of your earnest money deposit.

- Gift Letters: If a relative is helping with the down payment, you will need a signed letter stating the money is a gift, not a loan.

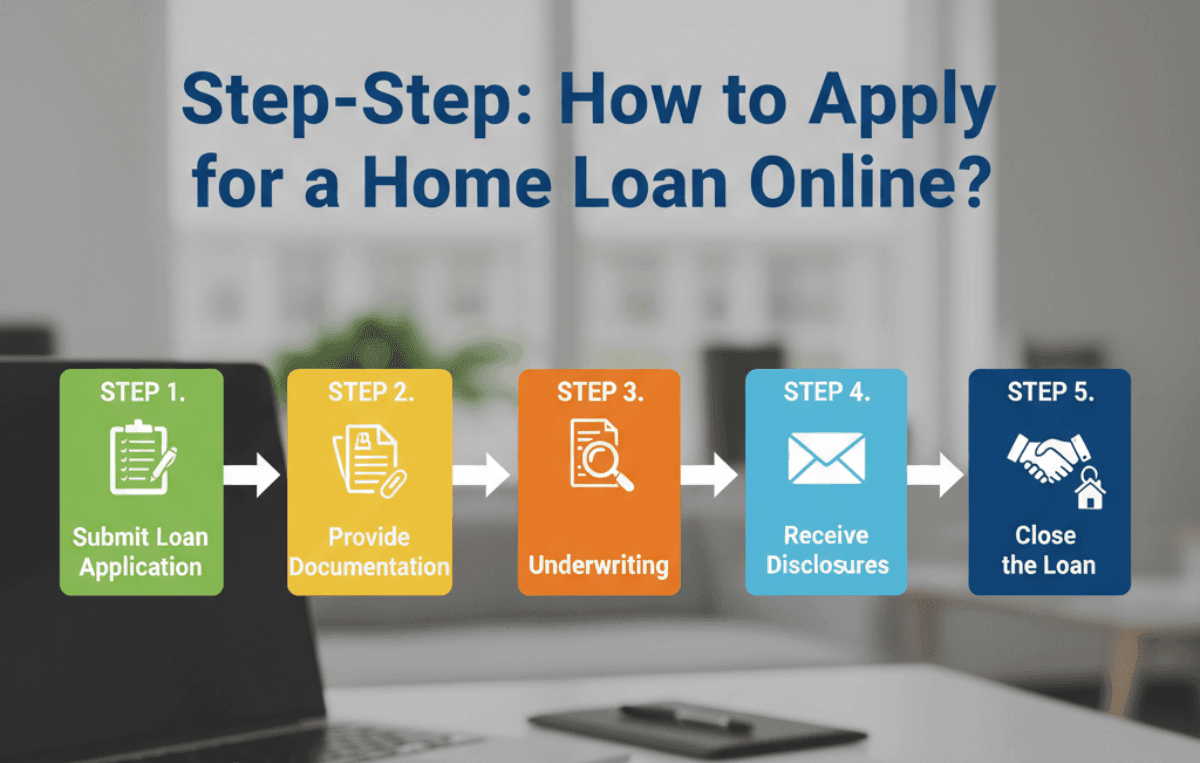

Step-by-Step: How to Apply for a Home Loan Online?

You have prepared your finances, found the house, and have your documents ready. Now, let's look at the actual execution phase. This is the technical part of the journey where your "Pre-approval" turns into a funded loan.

STEP 1. Submit Loan Application

Once your offer on a house is accepted, you need to officially apply. This involves filling out the Uniform Residential Loan Application (URLA), also known as Form 1003. Unlike the pre-approval which was general, this application is tied to the specific property address you want to buy.

You will submit this through the lender's online portal. It asks for detailed information about the property, your finances, and the type of loan you want. It is vital to understand the difference between mortgage prequalification and approval at this stage. you are now moving into the formal approval territory where the lender is legally obligated to process your file.

STEP 2. Provide Documentation

After submitting the application, your loan officer or processor will open a secure portal for you to upload the documents we listed earlier. Modern portals are very user-friendly, and some even allow you to link your bank accounts directly to import statements securely, saving you from downloading PDFs.

Speed is key here. If the lender asks for an updated pay stub, upload it the same day. Delays in providing documents are the #1 reason for missed closing dates. Be responsive and check your email daily.

STEP 3. Underwriting

This is the "black box" phase for many buyers. The Underwriter is the person whose job is to assess the risk of lending to you. They verify that everything you claimed matches your documents and that the property value matches the purchase price (via an appraisal).

It is very common to receive a "Conditional Approval." Do not panic! This just means the underwriter needs a few more things to sign off, perhaps a letter explaining a large deposit or clarification on a past address. Provide these quickly (Letters of Explanation or LOEs) to move to the final stage.

STEP 4. Receive Disclosures

Once the underwriter issues a "Clear to Close," you are almost there. You will receive a document called the Closing Disclosure (CD).

Legally, you must receive the CD at least 3 business days before you sign the final papers. This is known as the "3-Day Rule." Use this time to compare the CD against your initial Loan Estimate. Check the interest rate, monthly payment, and cash to close. If there are discrepancies, ask your loan officer immediately.

STEP 5. Close the Loan

Closing day! You will sign a stack of documents (either digitally or with a notary/attorney). You will also need to send your "Cash to Close" (down payment + closing costs). This is usually done via Wire Transfer or a Cashier's Check, personal checks are rarely accepted.

Once the lender reviews the signed package and sends the funds ("Funding"), and the county records the deed ("Recording"), the house is officially yours. Congratulations, you are a homeowner!

FAQs About Applying for a Mortgage Loan

I often get asked the same questions by first-time buyers. Here are the answers to some common concerns.

Q1. What is the 3 7 3 rule for a mortgage?

The 3-7-3 rule refers to waiting periods mandated by federal law (TRID) to protect you.

- 3 Days: You must receive a Loan Estimate within 3 business days of applying.

- 7 Days: Closing cannot occur sooner than 7 business days after the Loan Estimate is received and at least 3 business days after the Closing Disclosure.

- 3 Days: You must receive the Closing Disclosure at least 3 business days before closing.

Q2. What is the easiest mortgage loan to get approved for?

Generally, FHA Loans are considered the easiest to qualify for. They are backed by the government, allowing for credit scores as low as 580 and higher Debt-to-Income ratios than conventional loans. They are designed specifically to help first-time buyers or those with less-than-perfect credit.

Q3. Is it safe to apply for a mortgage online?

Yes, it is extremely safe, provided you use a reputable lender. Online lenders use bank-level encryption to protect your data. In fact, applying online reduces the risk of physical documents getting lost or mishandled. Always check for "https" in the URL and read reviews before submitting personal info.

Q4. What are my options if I have bad credit or irregular income?

If traditional banks say "no," you still have options. Non-QM (Non-Qualified Mortgage) lenders specialize in these situations. For example, if you are self-employed, you can use bank statements to prove income instead of tax returns. If your credit is poor, there are specific loan products that focus more on the property's value or your cash reserves rather than just your FICO score.

Q5. How much mortgage can I get with $70,000 salary?

With a $70,000 annual salary (approx. $5,833/month), lenders typically cap your housing payment at around $1,633/month. Depending on current interest rates (e.g., ~6.5 - 7%) and property taxes, this usually translates to a loan amount between $200,000 and $240,000. However, if you have no other debts, you might qualify for slightly more.

Q6. How much is a $300,000 mortgage payment for 30 years?

At a 7% interest rate on a 30-year fixed loan, the Principal and Interest payment is approximately $1,996 per month. However, you must add Property Taxes (approx. $300/mo), Homeowners Insurance (approx. $100/mo), and possibly PMI. So, your total monthly check would likely be closer to $2,400 - $2,500.

Conclusion

Applying for a mortgage loan online doesn't have to be a scary process. By breaking it down into these manageable steps, from checking your credit to submitting your digital application, you gain control over one of the biggest financial decisions of your life. The digital tools available today empower you to shop faster, compare smarter, and close sooner.

Remember, the lowest rate on a banner ad isn't always the best deal for you. You need a partner who offers transparency and expertise. I highly recommend visiting Bluerate not just to view rates, but to compare real mortgage quotes tailored to your scenario. Unlike generic aggregators, Bluerate connects you with experienced loan officers who can guide you through the underwriting maze and handle your loan origination from start to finish.

Don't leave your dream home to chance. Start comparing quotes today and take the first real step toward holding those keys in your hand.