Where and How to Compare Mortgage Loan Quotes Online?

Buying a home is emotional, but financing it is purely mathematical. I've seen too many homebuyers spend months hunting for the perfect kitchen island, only to sign the first loan document shoved across the table. In today's market, where interest rates in 2026 are still keeping everyone on their toes, that mistake can cost you tens of thousands of dollars.

If you are looking to secure a mortgage, you aren't just looking for a "loan". You are looking for the most affordable path to homeownership. But with thousands of websites promising "historically low rates" while many of which are just clickbait, where do you actually find accurate data? And how do you sift through the noise?

In this guide, I'll walk you through why comparing quotes is non-negotiable, review three standard calculators I've used, and introduce a newer AI-driven marketplace that has completely changed how I look at mortgage shopping.

Why Do You Need to Compare Mortgage Quotes?

Let's be real for a second: Lenders are businesses, not charities. They operate on different margins, have different appetites for risk, and ultimately, offer different prices for the exact same product.

According to Freddie Mac research, borrowers obtaining one additional rate quote beyond the first save an average of $1,500 over the life of a typical $250,000 loan, while those getting five quotes total save about $3,000.

Here is why you need to stop at just one quote:

-

Massive Long-Term Savings: A difference of just 0.25% in your interest rate might look small on paper, but on a $500,000 loan over 30 years, that quarter-percent represents over $25,000 in extra interest payments.

-

Fee Transparency: The "Rate" isn't the whole story. Lender A might offer a lower rate but hide it behind high "origination fees" or "discount points." Comparing quotes exposes these hidden costs.

-

Negotiation Leverage: When you have a Loan Estimate from Lender A in your hand, Lender B is suddenly much more willing to wave their processing fees to win your business. You can't negotiate if you don't have leverage.

Where to Compare Mortgage Quotes Online?

The internet is flooded with tools. Most are simple calculators that give you a rough idea, while others are sophisticated platforms that connect you with real money. I've categorized them from "Basic Math" to "Advanced AI Solutions" to help you choose the right one for your stage in the buying process.

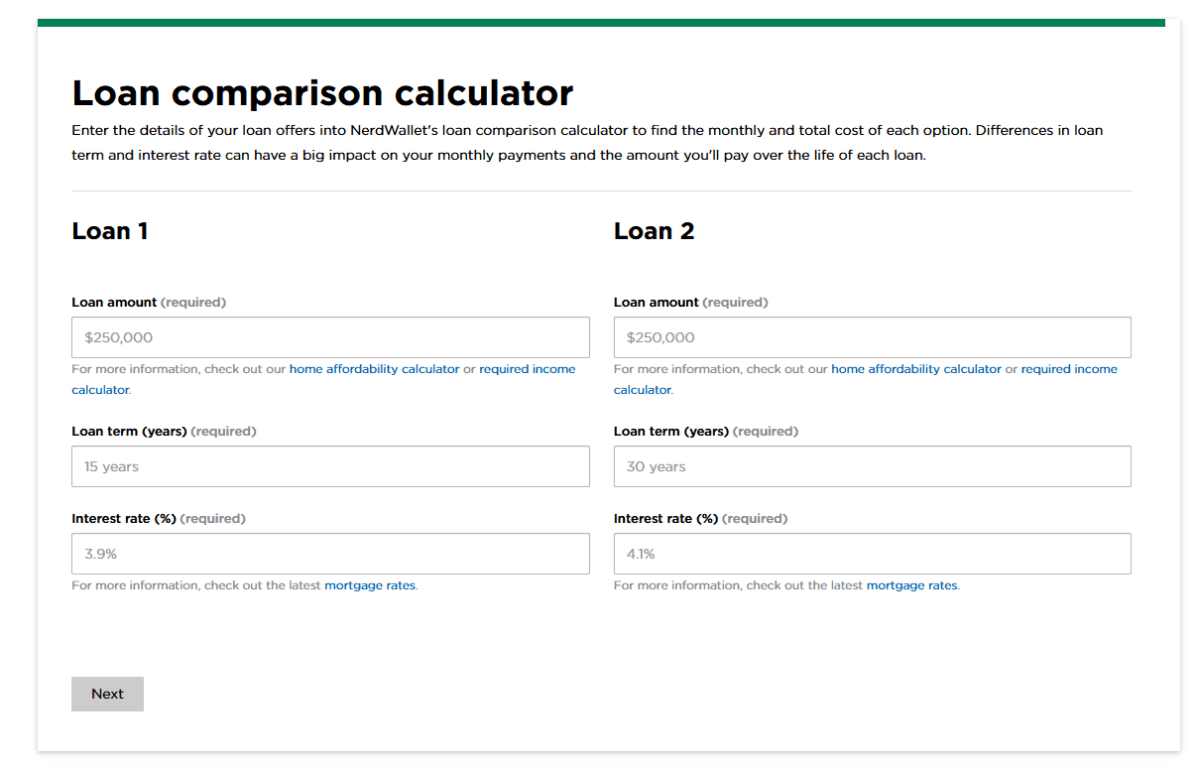

1. NerdWallet Loan Comparison Calculator

If you are in the very early stages, maybe just daydreaming about buying a house next year, the NerdWallet Loan Comparison Calculator is a solid starting point. This tool is designed for simplicity. It allows you to input three core variables: Loan Amount, Loan Term (Years), Interest Rate (%).

Once you punch these in, it instantly spits out a side-by-side comparison of two different loans, showing you the Monthly Cost and the Total Cost (interest + principal).

I like NerdWallet for its clean interface. It's fast, free, and doesn't ask for your email address. However, as an expert, I have to warn you: It is hypothetical. The tool assumes a perfect world. It doesn't know your credit score, your debt-to-income ratio, or the property taxes in your specific zip code. It's a great "back-of-the-napkin" math tool, but do not mistake these numbers for a real offer.

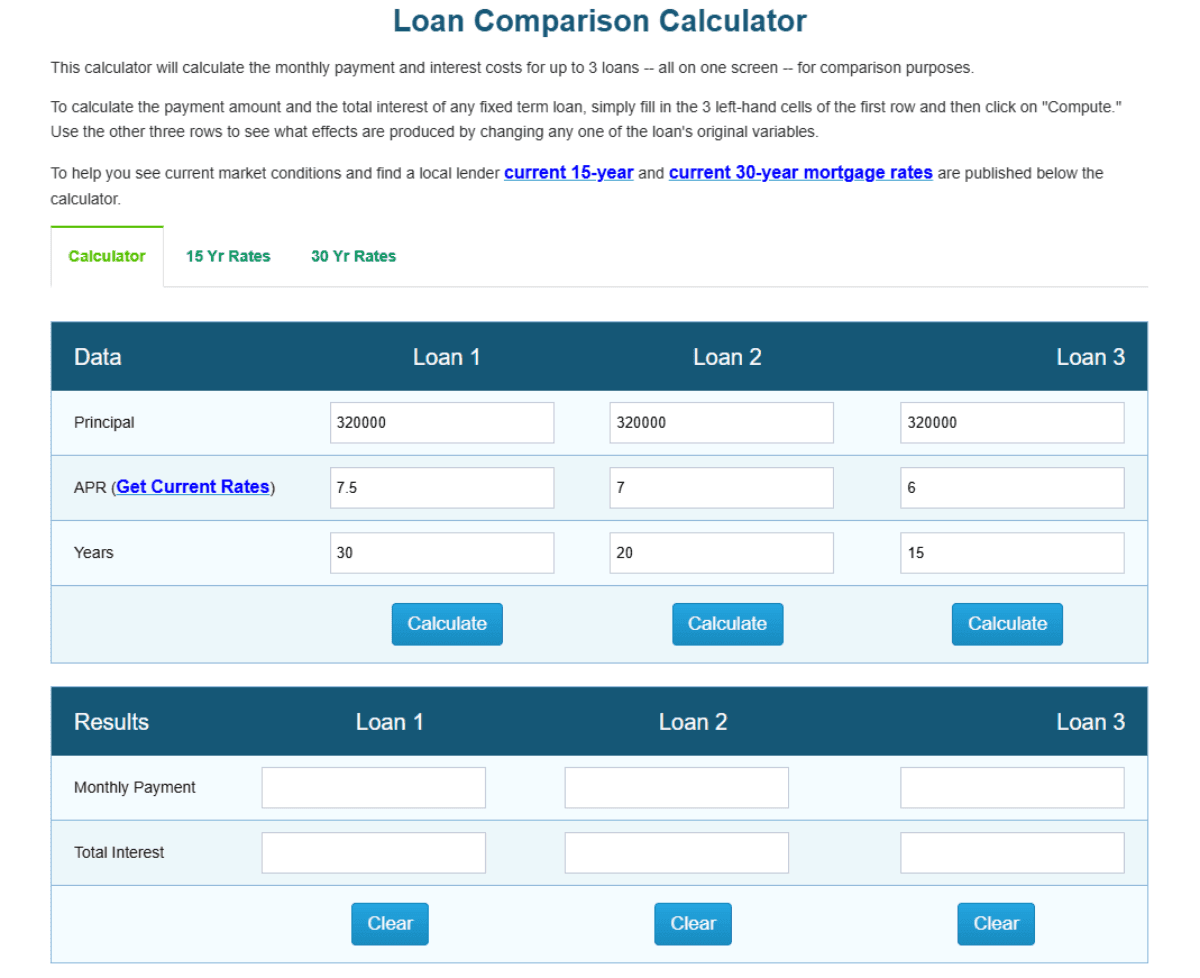

2. Mortgage Loan Comparison Calculator

Next up is the Mortgage Loan Comparison Calculator from MortgageCalculator.org. This one feels a bit more "old school" in its design, but it offers a bit more utility if you are trying to decide between loan types. Like NerdWallet, you input the Principal, APR, and Loan Term (Years). The output gives you the Monthly Payment and Total Interest.

The biggest advantage here is the ability to compare three loans at once. This is particularly useful if you are debating between a 30-year fixed, a 15-year fixed, and maybe a 5/1 ARM. It also attempts to pull in "Current Local Thirty Year Mortgage Rates," which adds a layer of reality to the math.

Again, the data is generic. While it shows local averages, it doesn't account for your financial picture. If you have a 680 credit score, the "average" rate displayed might be completely unattainable for you, leading to false expectations.

3. CrossCountry Mortgage Comparison Calculator

Moving slightly up the ladder, we have a tool provided directly by a lender: the CrossCountry Mortgage Comparison Calculator. This tool goes a step deeper. In addition to Loan Amount, Term, and Interest Rate, it asks for the Origination Fee. This is critical because it forces you to think about the cost of getting the loan, not just the monthly payment. It then generates: Closing Costs, Loan Amount, Monthly Payment.

I particularly appreciate the bar chart visualization. For visual learners, seeing a tall blue bar representing "Total Interest" next to the "Principal" bar can be a sobering reality check about the cost of borrowing.

While better than the basic calculators, it still has a blind spot. It doesn't factor in your Credit Score, Points, Income, or Liabilities. Without these, the "Closing Cost" figure is just a wild guess. It's a helpful educational tool, but it's not a quote.

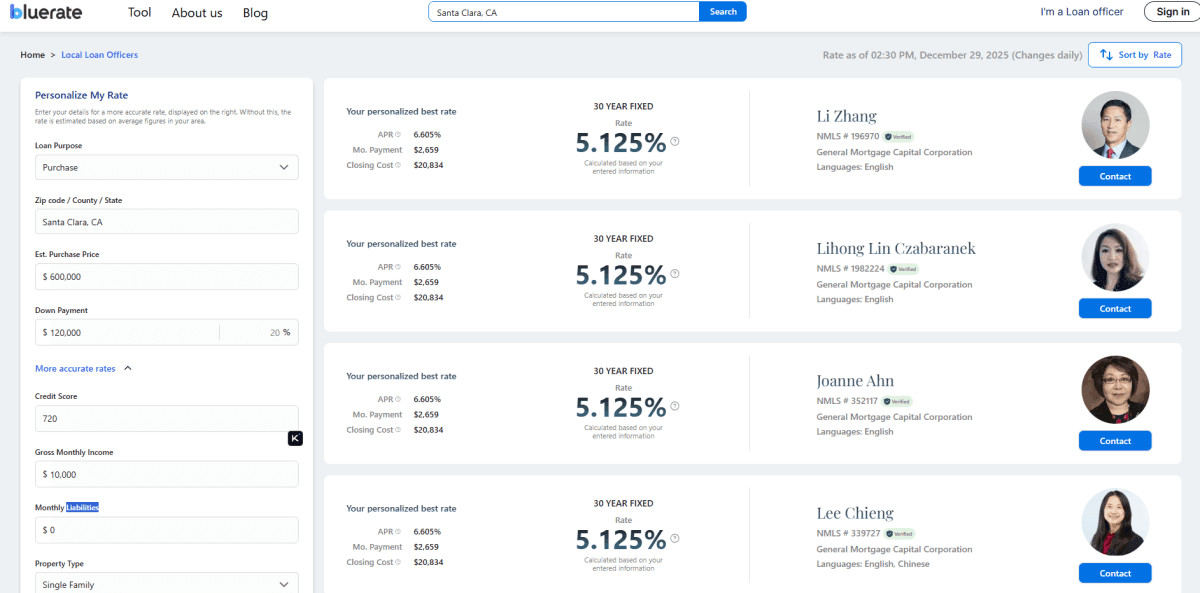

4. Bluerate - Personalize Your Rate

Now, let's talk about a tool that actually bridges the gap between "estimating" and "shopping." Bluerate isn't just a calculator. It's an AI-powered mortgage marketplace.

Unlike the previous tools where you just punch in a hypothetical rate, Bluerate works backwards from your actual profile to find real products. When I tested their "Personalize Your Rate" feature, the difference was night and day.

How it works:

The system asks for specifics that actually matter to underwriters:

-

Goal: (Buy, Refinance, or Cash-out)

-

Usage: (Primary residence, Secondary, or Investment)

-

Property Type: (Single-family, Condo, Multi-family, etc.)

-

Financials: Est. Purchase Price, Down Payment, Income, Liabilities, and Credit Score.

Once you input this, the AI doesn't just do math. It scans the market. It returned specific Loan Programs with accurate APR, Monthly Payments, and Closing Costs.

Why Bluerate stands out in the market?

-

Real Rates, No "Teaser" Nonsense: The biggest frustration in this industry is clicking a "5.5%" ad only to find out that rate costs $10,000 in points. Bluerate displays real, executable rates. What you see is what you can actually get.

-

Direct Access to Local Experts: Most websites sell your info as a "lead" to a random call center. Bluerate lets you choose. You can see a list of local loan officers, compare their offers, and contact them directly for free. You are in control, not the algorithm.

-

Comprehensive Lender Network: They tap into pricing from nearly 30 mainstream lenders simultaneously. It's like having 30 browser tabs open at once, but updated in real-time.

-

Streamlined Tech (FNM 3.4 & LOS): For the tech-savvy, this is huge. You can pre-qualify online and the system automatically generates your 1003 loan application form. Because it connects directly to the Loan Origination System (LOS), you can export data in the industry-standard FNM 3.4 format. This minimizes manual errors and speeds up the closing process by up to 20%.

-

Instant Credit Insights: It runs an instant credit check to give accurate pre-approval results. Usually a Soft Pull for the initial look, which protects your score.

-

Privacy & Security (SOC 2 Type II): This is my favorite part. In an era of data breaches, Bluerate is SOC 2 Type II certified. This means they use enterprise-grade security. More importantly, they do not sell your data. You won't get 50 spam calls five minutes after clicking "submit." That peace of mind alone is worth the visit.

If you are serious about buying a home and want to know exactly what you qualify for, not just a guess, Bluerate is the superior tool.

How to Compare Mortgage Quotes?

So, you've used a tool like Bluerate, and you have three different quotes in front of you. How do you pick the winner? It's not always the one with the lowest monthly payment. Here is my checklist for comparing offers:

-

APR vs. Interest Rate: The Interest Rate is what you pay on the balance. The APR (Annual Percentage Rate) includes the interest rate plus lender fees and mortgage insurance. Always compare APRs. It's the true cost of the loan.

-

Closing Costs Breakdown: Look at Section A and B of your Loan Estimate. These are the "Lender Fees." A lender might offer a low rate but charge a massive "Underwriting Fee" to make up for it.

-

Discount Points: Check if you are paying for that low rate. "Points" are upfront fees paid to lower the interest rate. Calculate the Breakeven Point: If paying $4,000 in points saves you $50 a month, it will take you 80 months (over 6 years) to break even. If you plan to move in 5 years, don't pay the points.

-

Loan Term Impact: A 15-year loan has higher monthly payments but drastically lower total interest. Make sure you are comparing apples to apples (e.g., don't compare a 30-year quote to a 15-year quote without noting the difference).

-

Prepayment Penalties: Ask explicitly: "Is there a fee if I pay this loan off early?" You want the answer to be "No."

-

Rate Lock Period: In a volatile market, when you lock matters. Does the quote include a 30-day, 45-day, or 60-day lock? A cheaper quote with a 15-day lock is useless if you can't close that fast.

FAQs About Comparing Mortgage Quotes

Q1. What is a mortgage quote?

A mortgage quote is a preliminary estimate provided by a lender that outlines the terms of a loan you may qualify for. It typically includes the interest rate, APR, monthly payment, and estimated closing costs based on the financial information you provide.

Q2. Is a mortgage quote the same as a pre-approval?

No. A quote is an estimate (often unverified). A Pre-approval is a conditional commitment from a lender to loan you a specific amount, issued after they have verified your income, assets, and credit history.

Q3. Who provides a mortgage quote?

Quotes can come from various sources: direct lenders (banks, credit unions), mortgage brokers (who shop multiple banks for you), and online marketplaces like Bluerate that aggregate offers from multiple sources.

Q4. Does getting a mortgage quote affect my credit score?

It depends. Most modern comparison tools (like Bluerate) use a "Soft Pull" to get a mortgage quote which does not impact your credit score. However, when you apply for a formal pre-approval or the final loan, the lender will do a "Hard Pull," which may temporarily lower your score by a few points.

Q5. Are mortgage quotes guaranteed?

Generally, no. Interest rates change daily, sometimes hourly, based on the bond market. A quote is only a snapshot in time. The rate is not guaranteed until you formally "Lock" the rate with the lender.

Q6. How long is a mortgage quote valid?

Without a rate lock, a quote might effectively expire the same day. However, official Loan Estimates (LE) provided after an application are usually valid for 10 business days regarding the estimated closing costs.

Conclusion

Comparing mortgage quotes isn't just about finding the lowest number. It's about finding the right financial partner and understanding the true cost of your home. While tools like NerdWallet and MortgageCalculator.org are great for quick, back-of-the-napkin math, they lack the personalization required for a real financial decision.

For a process that is secure, accurate, and tailored to your unique financial life, I highly recommend using Bluerate. It combines the speed of AI with the reliability of direct lender connections, all without sacrificing your privacy to spam callers.

Don't leave money on the table. Take control of your home buying journey, compare smart, and lock in the best rate possible.