Full Comparison: Difference Between QM and Non-QM Mortgage

I still remember the first time I sat down to look at mortgage options. I thought I had it all figured out, good credit, decent savings, until the loan officer started throwing around terms like "QM" and "Non-QM." I felt like they were speaking a different language. If you're feeling that same confusion, you aren't alone. Most people don't realize that falling outside the "standard" box doesn't mean you can't buy a home. It just means you need a different key to open the door.

In this guide, I'm going to break down exactly what Qualified Mortgages (QM) and Non-Qualified Mortgages (Non-QM) are, how they differ, and which one actually fits your life. If you want to cut through the noise and get personalized answers, I highly recommend hopping over to Bluerate, where you can find a dedicated loan officer nearby to consult with for free.

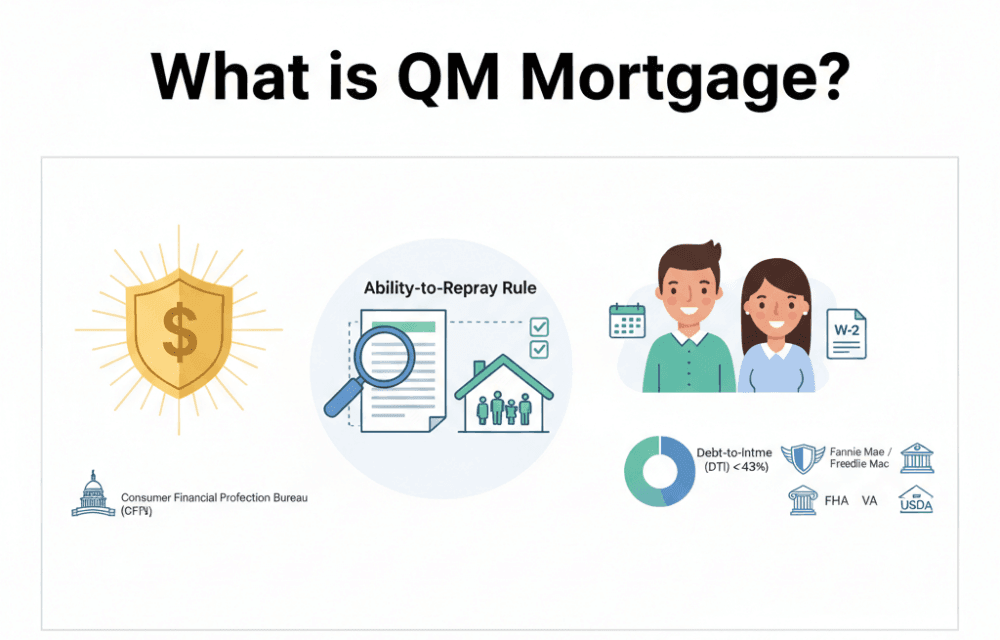

What is QM Mortgage?

A QM, or Qualified Mortgage, is essentially the "gold standard" of lending in the United States. Think of it as the safest path, designed by the Consumer Financial Protection Bureau (CFPB) to ensure you don't bite off more than you can chew. These loans are built on the "Ability-to-Repay" rule, meaning the lender has done their homework to prove you can afford the monthly payments.

QM mortgages are perfect for the "traditional" borrower. If you have a steady 9-to-5 job, receive W-2 forms at tax time, and have a debt-to-income (DTI) ratio that isn't through the roof (typically under 43%), this is your lane. These loans include the ones you hear about most often: Conventional loans backed by Fannie Mae or Freddie Mac, as well as government-backed options like FHA, VA, and USDA loans. They offer stability, lower rates, and no surprise "gotcha" terms.

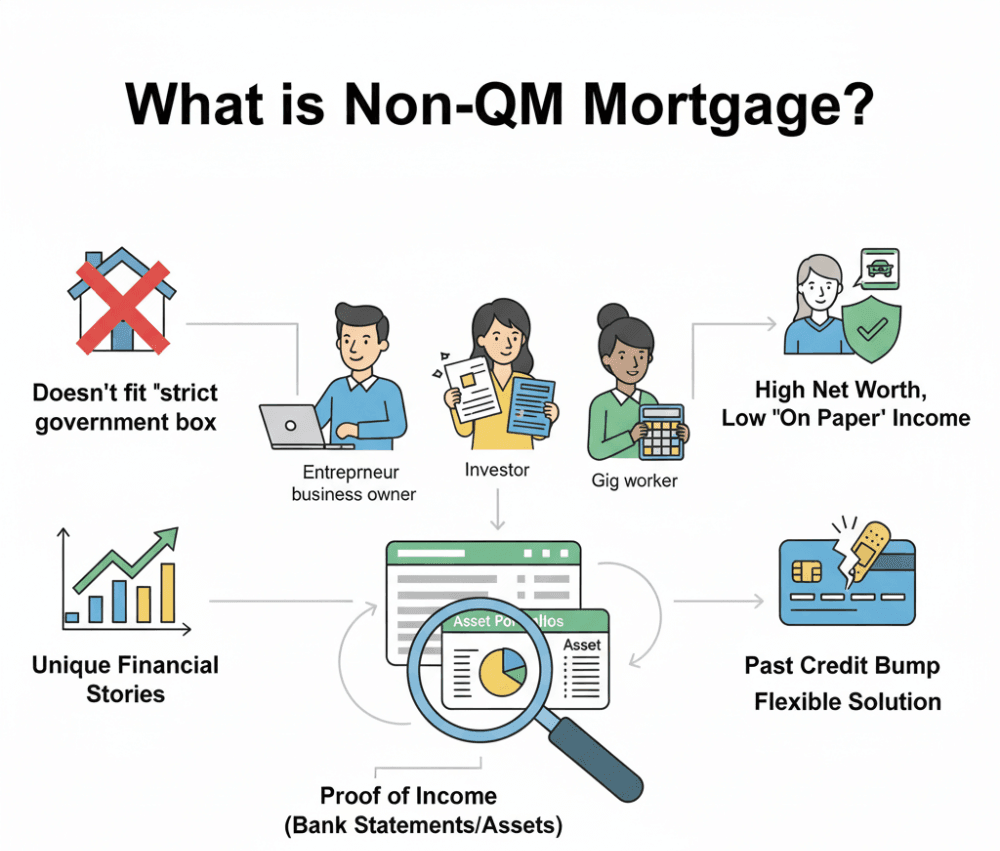

What is Non-QM Mortgage?

Now, let's talk about the Non-QM Mortgage. A common misconception I hear is that "Non-QM" means "bad loan" or "subprime," like the ones that caused the 2008 crash. That is simply not true anymore. A Non-QM loan is just a mortgage that doesn't fit the strict government box we just talked about. It stands for "Non-Qualified Mortgage," and it's designed for people with unique financial stories.

Who is this for? It's for the entrepreneurs, the self-employed business owners who write off expenses to lower their taxes, real estate investors, or gig workers with fluctuating income. Instead of using tax returns, lenders might use bank statements or asset portfolios to prove you can pay. If you have a high net worth but low "on paper" income, or if you've had a credit bump in the past couple of years, Non-QM is often the flexible solution that keeps your homeownership dream alive.

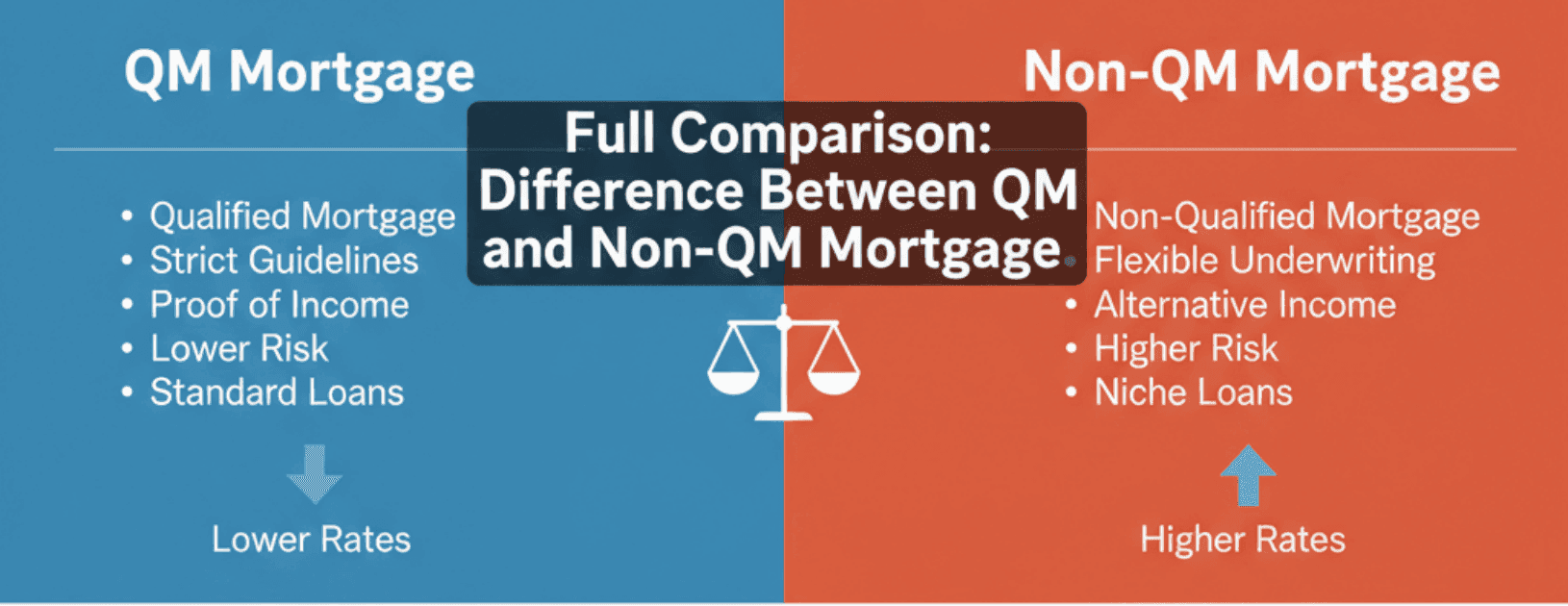

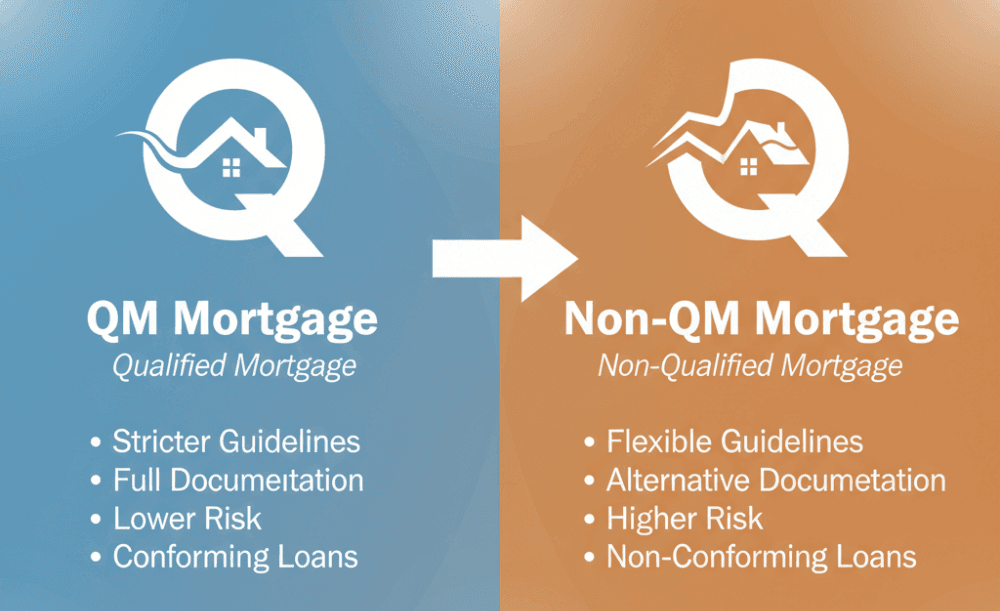

Difference Between QM and Non-QM Mortgage

Now that we have the definitions sorted, let's get into the nitty-gritty. I'm going to compare these two side-by-side so you can see exactly where they differ.

Standards

The biggest difference here lies in who sets the rules.

-

For QM loans, the standards are rigid and set federally by the CFPB. They are designed to be "safe." This means the loan cannot have risky features like negative amortization, where your loan balance goes up even if you pay, or interest-only periods. The rules are black and white to protect the borrower from predatory lending.

-

For Non-QM loans, the standards are set by the individual lender or the private investor buying the loan. Because they aren't bound by the government's strict "cookie-cutter" definitions, they can rewrite the rulebook. This allows for "make-sense" underwriting. While they still must ensure you can repay the loan, they have the freedom to look at your financial picture more creatively than a standard government algorithm would allow.

Loan Types

When you apply for a QM mortgage, you are looking at the familiar names. These are the standard products offered by almost every bank in America.

-

Conventional Loans: These are sold to Fannie Mae or Freddie Mac.

-

Government Loans: FHA (great for lower credit), VA (for veterans), and USDA (for rural areas).

Non-QM mortgages open up a different menu of options:

-

Bank Statement Loans: perfect for business owners who don't show much profit on tax returns.

-

DSCR (Debt Service Coverage Ratio): for investors who want to qualify based on the property's rental income, not their personal income.

-

Asset Depletion: for retirees or wealthy individuals who want to use their liquid cash to qualify.

-

Jumbo Loans: while some are QM, many jumbo loans (exceeding county loan limits) fall into Non-QM if they have flexible terms.

Loan Features

If you like predictability, QM loans are your best friend. They typically come in 30-year or 15-year fixed terms. You know exactly what you're paying every month, and the loan is fully amortized, meaning you are paying off both principal and interest from day one. You won't find balloon payments, or a huge lump sum due at the end here.

Non-QM loans offer features that can be powerful financial tools if used correctly. For example, I've seen real estate investors utilize Interest-Only options to keep their monthly cash flow high for the first 10 years. Non-QM can also offer 40-year terms to lower monthly payments. While these features add flexibility, they require you to be more disciplined with your finances since you aren't always paying down the loan balance immediately.

Borrower Profile

The QM borrower is what I call the "document-ready" applicant. You are likely a W-2 employee with a verifiable two-year work history. Your income is consistent, your tax returns show exactly what you make, and your financial life fits neatly onto a standard application form. You are looking for the lowest possible rate and long-term security.

The Non-QM borrower is often an "outlier" with a more complex story. You might be a successful freelancer, a doctor with student loans that skew your debt ratio, or a house flipper. I've met business owners making $300k a year who couldn't get a QM loan because their tax write-offs made their income look like $40k. For them, Non-QM was the only bridge to buying a home. It's also for those recovering from a bankruptcy or foreclosure who have re-established cash flow but haven't waited the mandatory 4-7 years for a standard loan.

Loan Requirements

This is where the rubber meets the road.

For QM loans, the requirements are strict:

-

Credit Score: Usually 620+, though FHA can go to 580.

-

DTI: Strictly capped. Generally, your debt payments can't exceed 43% of your income, though some modern rules allow up to 50% with strong factors.

-

Documentation: You must provide tax returns (1040s), W-2s, and pay stubs. No exceptions.

For Non-QM loans, the requirements of non-QM mortgage shift:

-

Credit Score: flexible. I've seen programs accept scores down to 500-580, though you'll need a larger down payment (often 20-30%) to offset that risk.

-

DTI: Much higher limits. Some lenders allow up to 50% or even 55% DTI. For DSCR investor loans, your personal DTI often doesn't matter at all.

-

Documentation: This is the game-changer. You might only need 12 to 24 months of business bank statements. If the deposits show healthy cash flow, that counts as income. Or, they might just look at your liquid assets. The "Ability to Repay" is proven through liquid cash rather than taxable income.

Underwriting

When you submit a QM file, it usually goes through an Automated Underwriting System (AUS), like Fannie Mae's "Desktop Underwriter." It's an algorithm. It looks at your data points and gives a "Approve/Eligible" or "Refer/Ineligible" result. It's fast, but it doesn't have feelings or the ability to understand nuance.

Non-QM underwriting is almost always Manual Underwriting. A human underwriter sits down and looks at your file. They read your letter of explanation. They look at your business model. They ask, "Does this make sense?" This human element is why Non-QM takes a bit more effort but has a higher success rate for complex borrowers. It's subjective, meaning a good loan officer can fight for your case, something you can't do with a computer algorithm.

Interest Rates/Fees

There is a trade-off for flexibility. QM loans consistently offer the lowest interest rates in the market because they are government-backed and considered "safe." Additionally, the government caps the "Points and Fees" a lender can charge (usually at 3% of the loan amount), protecting you from high closing costs.

Non-QM loans carry higher rates, typically 0.5% to 3% higher than standard QM loans. Why? Because the lender is taking on more risk without a government safety net. You will also likely see higher loan origination fees. Think of it as paying a premium for the privilege of bypassing standard documentation. For many, this extra cost is worth it to secure the property now, with the plan to refinance into a QM loan later once their tax returns look "cleaner."

Lender Protections

This part is technical but important. QM loans provide lenders with "Safe Harbor." This is a legal shield. If a borrower defaults and tries to sue the lender claiming, "You shouldn't have lent me this money, I couldn't afford it," the lender is protected because they followed the federal QM checklist.

Non-QM loans usually fall under "Rebuttable Presumption" or have no protection at all. This means if you default, you could technically sue the lender, and they would have to prove in court that they did their due diligence. Because the non-QM lender takes on this legal risk and because they can't sell these loans to Fannie Mae, they are harder to find and more expensive. They keep these loans on their own books or sell them to private hedge funds.

FAQs About QM and Non-QM Mortgage

Q1. What are the Pros and Cons of non-QM loans?

The biggest pro is access. You can get approved based on real cash flow, not complex tax returns, and you can buy property even with recent credit events. The cons are the costs: you will pay a higher interest rate and usually need a larger down payment (often 10-20% minimum) compared to the 3-5% down on standard loans.

Q2. What is the credit score for non-QM loans?

While QM loans usually require a 620 score, Non-QM offers more grace. Many lenders have programs for scores as low as 580, and some specialized programs even go down to 500. However, remember: the lower your score, the higher your interest rate and down payment requirement will be.

Q3. What is non-QM vs conventional loan?

Think of a conventional loan as a specific type of QM loan. It's the standard, government-sponsored loan (Fannie/Freddie) for borrowers with good credit. A Non-QM loan is the alternative category. So, all conventional loans are QM, but not all QM loans are conventional (some are FHA/VA). Non-QM is in a completely separate bucket for alternative documentation.

Conclusion

Navigating the mortgage world can feel like walking through a maze, but understanding the difference between QM and Non-QM is your compass. If you have a standard job and clean credit, sticking to QM is your best bet for the lowest mortgage rates. But if you are self-employed, an investor, or have a complex financial history, Non-QM isn't just an alternative. It's a powerful opportunity to build wealth when the bank says "no."

Don't let the paperwork scare you away from your dream home. If you want to see which rates and programs match your specific scenario without the headache, I suggest visiting Bluerate. You can connect with experienced loan officers who specialize in both QM and Non-QM options, ensuring you get a free consultation that actually makes sense for you.