DSCR Formula: How to Calculate DSCR in Real Estate?

I still remember the frustration of my first major roadblock in real estate investing. I had found a perfect rental property in Texas with solid cash flow potential, but my personal Debt-to-Income (DTI) ratio was skewed because of write-offs on my tax returns. My bank said "no."

That's when I discovered the DSCR loan, a game-changer that stopped looking at my income and started looking at the property's income.

The key to unlocking this financing is understanding the DSCR Formula. It is the specific calculation lenders use to decide if your property is a safe bet. In this guide, I'll walk you through exactly how to calculate it, what the numbers mean for your wallet, and how you can use this math to scale your portfolio without showing a single tax return.

People Also Read

- DSCR Loan Requirements 2026: Ratio, Credit Score, Down Payment, Type

- DSCR Loan Pros and Cons: Is It the Right Strategy for Your Investment?

- [2026] What is a Mortgage? Everything You Need to Know Here

- Must-Read Guide: How to Apply for a Mortgage Loan Online?

- Where and How to Compare Mortgage Loan Quotes Online?

What is DSCR (Debt Service Coverage Ratio)?

DSCR stands for Debt Service Coverage Ratio. In simple terms, it is a measurement of a property's available cash flow to pay its current debt obligations.

Think of it as a risk assessment tool. Traditional mortgages focus on you (can you afford this house?), but DSCR loans focus on the asset (can this house pay for itself?).

For lenders, this ratio is the "magic number" that determines whether a property is an asset or a liability. A healthy DSCR proves to the lender that the rental income is sufficient to cover the mortgage payments, leaving them with little to no risk. For you, the investor, understanding this ratio is critical because it dictates not just approval, but also your interest rate and down payment requirements.

How to Calculate DSCR Ratio for Mortgage?

Calculating your DSCR isn't rocket science, and you don't need a degree in finance. It really comes down to three core steps involving your income and your debts. Here is the breakdown.

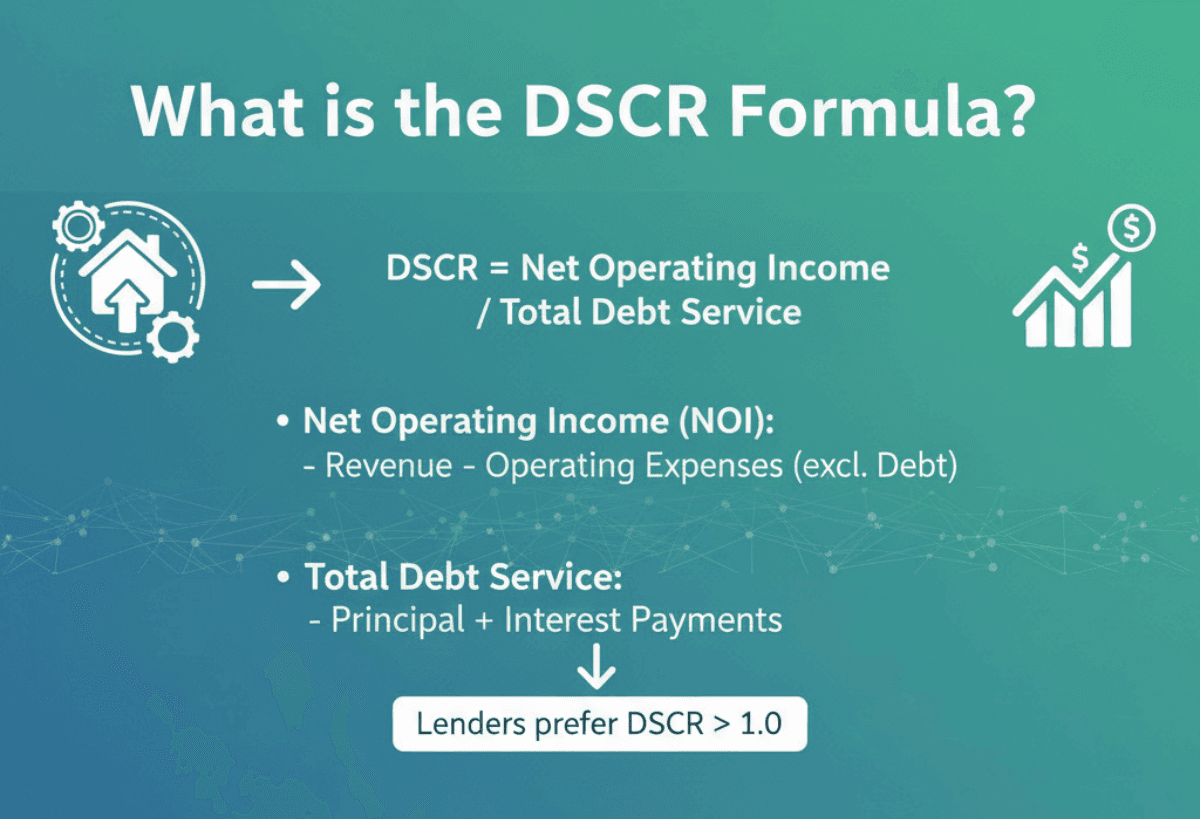

What is the DSCR Formula?

The fundamental formula used by real estate investors and lenders is:

DSCR = Net Operating Income (NOI) / Total Annual Debt Service

- Net Operating Income (NOI): This is the revenue the property generates after operating expenses.

- Total Debt Service: This is the total cost of the loan payments (Principal and Interest) plus other mandatory costs associated with the debt.

While the academic formula uses "NOI," most residential non-QM lenders simplify this for single-family rentals. They often use Gross Rental Income divided by PITIA (Principal, Interest, Taxes, Insurance, Association dues).

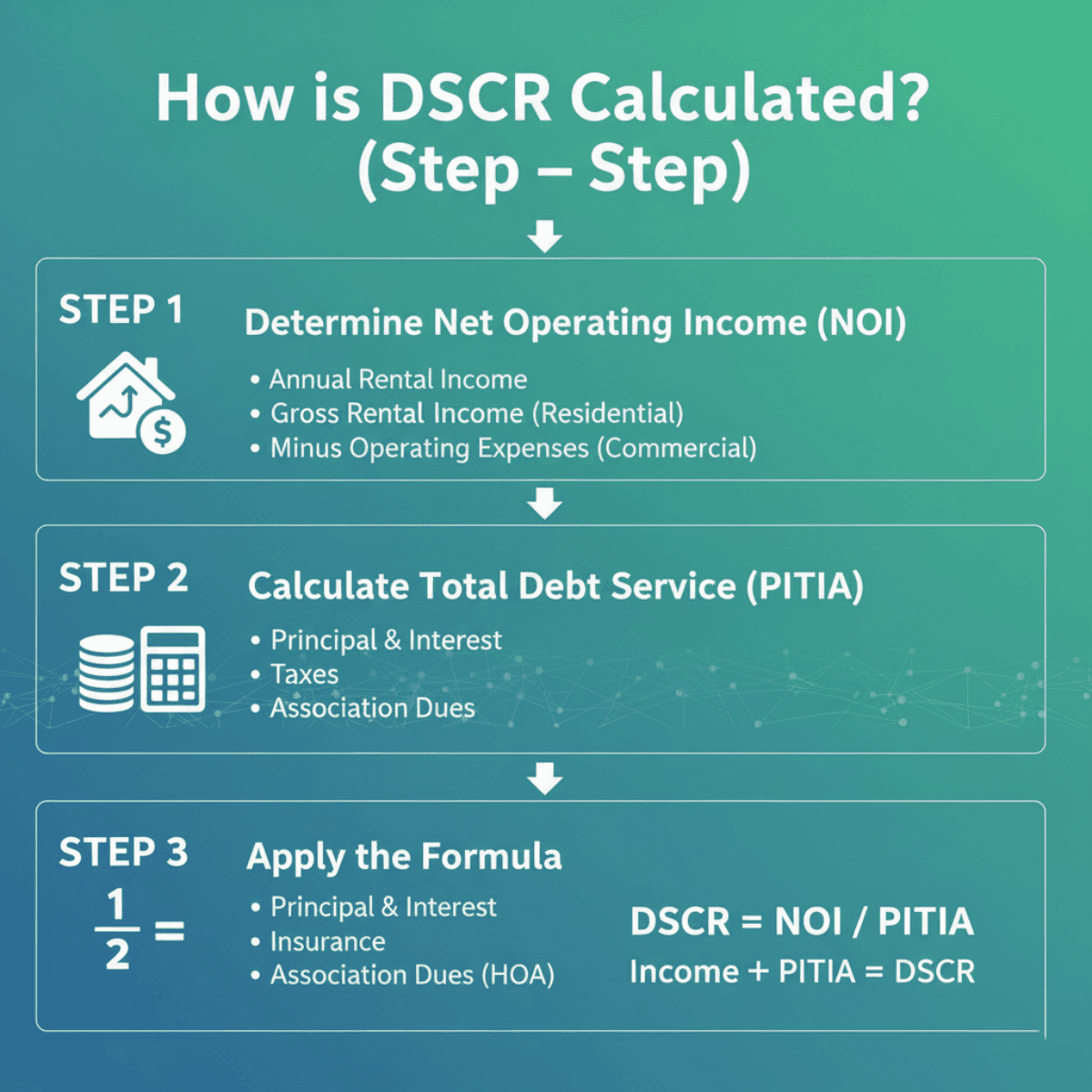

How is DSCR Calculated? (Step-by-Step)

To get the number that a lender will actually see, follow these three steps carefully:

1. Determine Net Operating Income (NOI)

First, calculate your annual rental income. Be honest here. Lenders will typically use the lower of your actual lease agreement or the market rent determined by an appraisal, specifically Form 1007 Rent Schedule.

For commercial properties, you deduct operating expenses, like repairs and management fees, to get NOI. However, for residential DSCR loans, lenders typically just take the Gross Rental Income and handle the expenses in the next step.

2. Calculate Total Debt Service

Next, sum up all the costs associated with the loan and property ownership. This usually includes:

- Principal & Interest (The mortgage payment)

- Taxes (Property taxes)

- Insurance (Homeowners insurance)

- Association Dues (HOA fees, if applicable)

This total is often referred to as PITIA.

3. Apply the Formula

Finally, divide the result from Step 1 by the result from Step 2.

- Calculation: Income ÷ PITIA = DSCR.

Example of Calculating DSCR

Let's look at a real-world scenario. Imagine I am buying a rental property in Florida.

- Rental Income: The appraiser confirms the market rent is $3,000 per month.

- Expenses (PITIA):

- Mortgage (Principal + Interest): $1,800

- Property Taxes: $400

- Insurance: $150

- HOA Fees: $50

- Total Debt Service: $2,400 per month.

Now, I plug these into the formula: DSCR = $3,000 / $2,400 = 1.25

The DSCR is 1.25. This means the property generates 25% more income than it costs to own. This is a "cash flow positive" property that most lenders would be happy to finance.

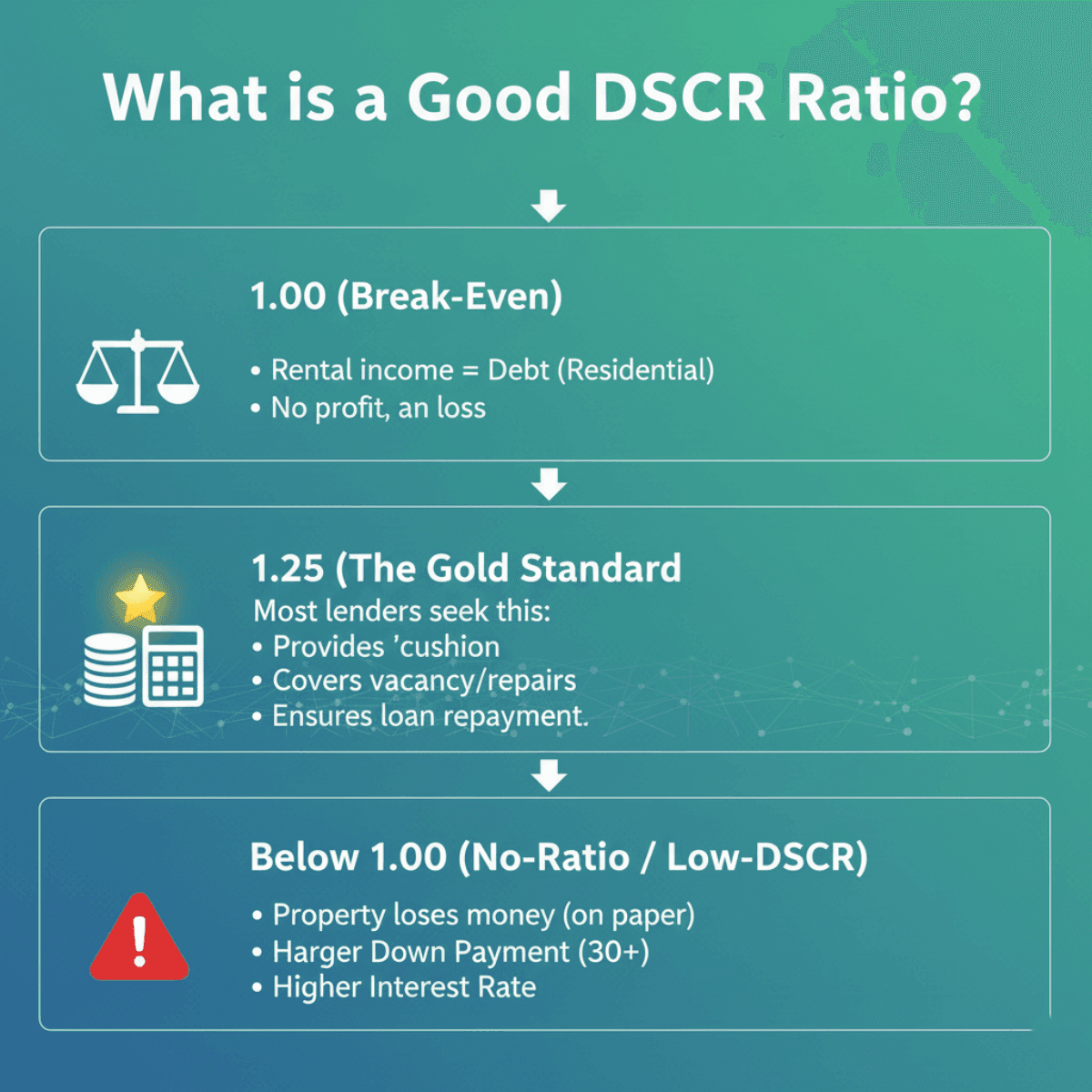

What is a Good DSCR Ratio?

You might be wondering, "What number am I aiming for?"

- 1.00 (Break-Even): A ratio of 1.0 means your rental income exactly covers your debt. You aren't losing money, but you aren't making a profit either.

- 1.25 (The Gold Standard): Most lenders look for a ratio of 1.20 to 1.25. This provides a "cushion," ensuring that even if the property sits vacant for a month or needs repairs, the loan can still be paid.

- Below 1.00 (No-Ratio / Low-DSCR): Can you get a loan with a 0.8 DSCR? Yes, but it will cost you. These are often called "No-Ratio" loans. Because the property loses money on paper, lenders view this as higher risk. To compensate, they typically require a larger down payment (often 30%+) and charge a higher interest rate.

Keep in mind that as interest rates rise, your "Debt Service" (denominator) gets larger. This lowers your DSCR. A property that qualified easily two years ago might struggle to hit a 1.25 ratio today solely due to higher rates.

FAQs About Calculating DSCR

Q1. Are all DSCR loans 20% down?

Not necessarily. While 20% to 25% is the industry standard for a healthy DSCR (above 1.25), requirements vary based on risk. If your DSCR is strong (e.g., >1.5), some aggressive lenders might allow 15% down. Conversely, if your DSCR is below 1.0, expect to put down 30% to 35% to offset the lender's risk.

Q2. How do I calculate DSCR in Excel?

It is very simple to set up. In cell A1, put your Monthly Rent, in B1 put your Monthly PITIA. In C1, use this formula: =A1/B1

If you want to be precise with annual figures, use: =(Monthly Rent * 12) / (Monthly PITIA * 12)

Q3. What does 1.25 DSCR mean?

A 1.25 DSCR means the property generates $1.25 of income for every $1.00 of debt. It indicates a healthy, positive cash flow property with a 25% margin of safety for operating expenses. This is the benchmark most lenders want to see for the best interest rates.

Q4. What's the difference between DSCR and Debt-to-Income Ratio?

The main difference is who is being measured.

- DTI (Debt-to-Income): Measures YOU. It compares your personal monthly debts (car loans, credit cards, current mortgage) to your personal income.

- DSCR: Measures the PROPERTY. It ignores your personal debts and income entirely, looking only at the rental's ability to pay for itself.

Conclusion

Mastering the DSCR formula is the secret weapon for real estate investors who want to scale beyond the limitations of personal income. It shifts the focus from your W2 to your asset's potential, allowing you to build a portfolio based on the profitability of your deals, not your tax returns.

However, keep in mind that every lender calculates expenses slightly differently. Some may include management fees in the debt service, while others won't.

Calculating your DSCR is just the first step. To see if your property qualifies for the best rates, it's best to speak with an expert. You can consult with a professional non-QM loan officer at Bluerate for free to get a precise analysis of your investment scenario.