DSCR Loan Pros and Cons: Is It the Right Strategy for Your Investment?

I recently stumbled upon a discussion on Reddit that resonated deeply with me. An investor had found a solid property but was hitting a wall with traditional financing. They were asking the community: "Is the higher rate of a DSCR loan actually worth it to bypass the income check?"

I've been there. You find the perfect rental, the numbers make sense, but your debt-to-income (DTI) ratio is slightly too high, or your tax returns don't reflect your actual buying power. It's frustrating. That's where the DSCR loan comes in as a potential game-changer. But is it a magic bullet or a risky trap? In this guide, I'm going to strip away the banking jargon and walk you through the real pros and cons of DSCR loans, helping you decide if this tool belongs in your investment strategy.

Learn First: What is a DSCR Loan?

Before we weigh the good and the bad, let's clarify what this actually is. A DSCR (Debt Service Coverage Ratio) loan is a type of Non-QM (Non-Qualified Mortgage) loan that flips the script on traditional lending.

When you apply for a regular mortgage, the bank puts you under a microscope, including your salary, your tax returns, and your personal debts. With a DSCR loan, the lender primarily looks at the property, not you.

The core concept is simple: Can the property generate enough rent to pay for itself?

Lenders use a specific DSCR formula: DSCR = Net Operating Income/Total Debt Service

If the rent covers the mortgage payment (a ratio of 1.0 or higher), you are generally in the clear. It is financing based on the asset's cash flow potential rather than your personal pay stubs.

Also Read: Must-Read Guide: How to Apply for a Mortgage Loan Online?

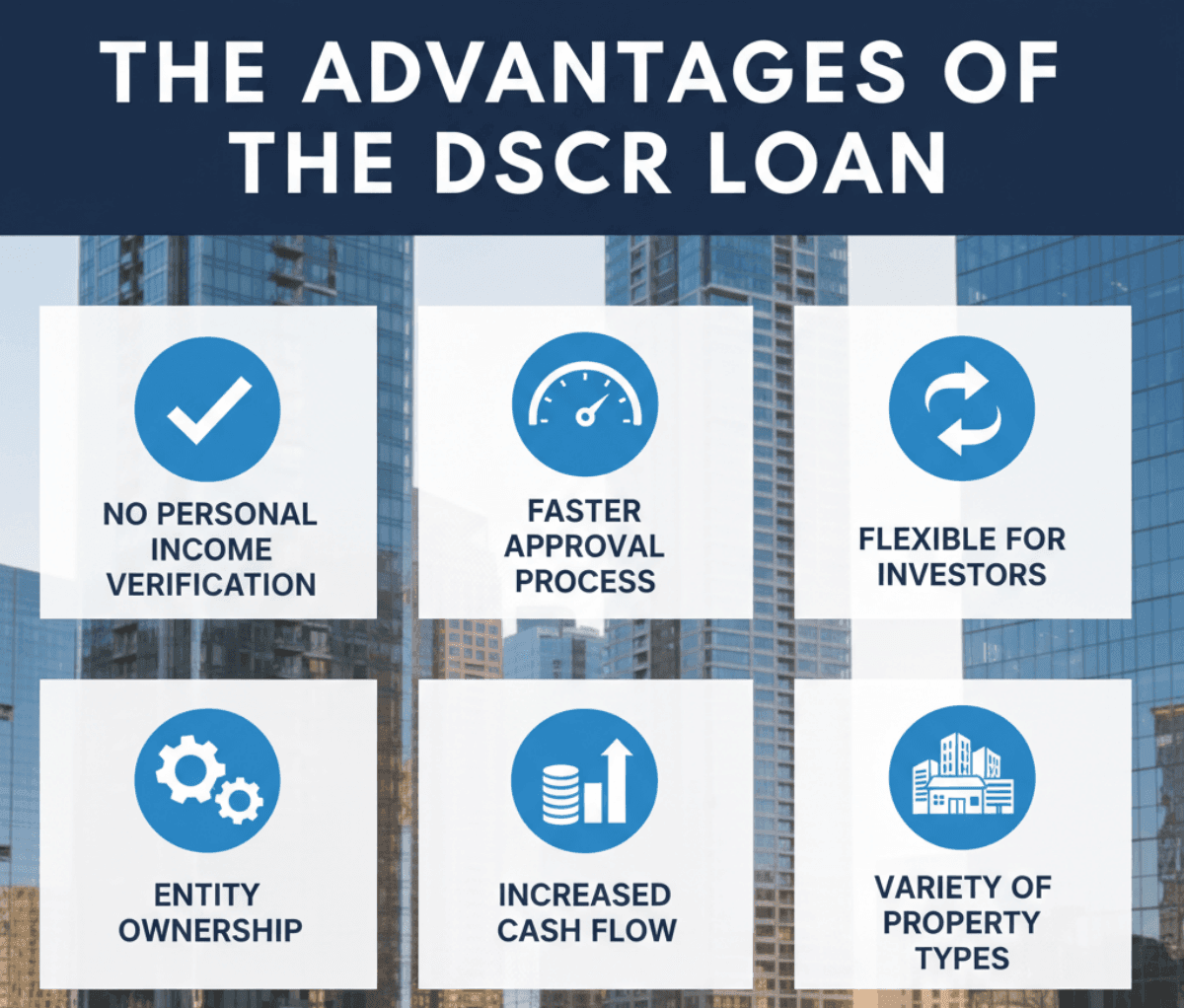

The Advantages of the DSCR Loan

Why are seasoned investors flocking to this product despite the costs? Here is why I believe it's a powerful tool for scaling a portfolio.

No Personal Income Verification

This is, without a doubt, the single biggest selling point. If you are self-employed, a freelancer, or a business owner, you know the struggle. You legally write off expenses to lower your taxable income, but that smart tax strategy makes you look "poor" to a traditional bank like Wells Fargo or Chase.

With a DSCR loan, no tax returns, W-2s, or pay stubs are required. I have seen investors who show a loss on their personal taxes still qualify for millions in real estate loans because their rental properties were profitable. This completely bypasses the dreaded DTI (Debt-to-Income) ratio hurdle. You don't have to worry about your personal car loan or credit card balances affecting your ability to buy a rental property, provided your credit score meets the minimum requirement. It separates your personal financial complexity from your business investments.

Faster Approval Process

In the current real estate market, speed is often the difference between closing a deal and losing it to an all-cash buyer. Traditional mortgages are notorious for their sluggish underwriting. You are often stuck in a loop of submitting updated bank statements and explaining large deposits for 45 to 60 days.

Because DSCR lenders skip the deep dive into your personal employment history, the underwriting process is significantly streamlined. We are talking about closing in 21 to 30 days on average. I've even seen some close in two weeks when the appraisal is ready. When I'm competing for a hot property, being able to promise a quick close gives me leverage with the seller, sometimes even allowing me to negotiate a better purchase price.

Flexible for Investors (Unlimited Loans)

Here is a limitation most new investors don't know about until they hit it: Fannie Mae and Freddie Mac cap borrowers at a maximum of 10 financed properties for second homes or investment properties (with some exceptions for high-credit borrowers up to 10 under standard guidelines). Once you hit that wall, you are cut off, no matter how perfect your credit is.

DSCR loans generally have no limit on the number of loans you can hold. This is massive if your goal is to scale from a few houses to a massive portfolio. As long as each individual property "cash flows" (meaning the rent covers the debt), lenders will keep lending to you. This scalability is why you see large portfolio holders shifting almost exclusively to DSCR financing once they graduate from their first few deals. It removes the artificial ceiling on your growth.

Entity Ownership (LLC Protection)

If you speak to any asset protection attorney, they will tell you to hold your investment properties in an LLC (Limited Liability Company), not in your personal name. This protects your personal savings if a tenant ever sues you.

With a traditional conventional loan, you usually have to close in your personal name and then awkwardly transfer the title to an LLC later (which can technically trigger a "due on sale" clause). DSCR lenders actually prefer, and sometimes require, you to close directly in the name of your LLC or corporation. This offers seamless asset protection and privacy right from the closing table. For me, this peace of mind is worth a lot. I know my personal assets are walled off from my business risks.

Increased Cash Flow (Interest-Only Options)

Now, you might be thinking, "Don't DSCR loans have higher rates? How does that help cash flow?" You are right about the rates, but many DSCR lenders offer an Interest-Only (I/O) feature.

Typically, you can choose to pay only the interest portion of the loan for the first 10 years. Because you aren't paying down the principal immediately, your monthly payment drops significantly. This creates a larger gap between your rental income and your mortgage expense, boosting your monthly cash-on-cash return. While you aren't building equity through pay-down, you are maximizing the cash currently entering your pocket. This is a strategic move for investors who prioritize immediate income over long-term debt reduction.

Variety of Property Types

Traditional lenders can be very picky about the type of property they finance. They love long-term rentals but get nervous about short-term rentals (like Airbnb or VRBO) or "non-warrantable" condos (condos that don't meet government lending standards).

DSCR loans are incredibly flexible here. Many lenders will accept projected income from AirDNA or similar data sources to qualify a short-term rental, rather than requiring a signed 12-month lease. This opens up the lucrative vacation rental market to investors who otherwise couldn't qualify based on traditional long-term rental estimates. Whether you are looking at a 2-4 unit multi-family, a condo-hotel, or a vacation home, there is likely a DSCR product that fits.

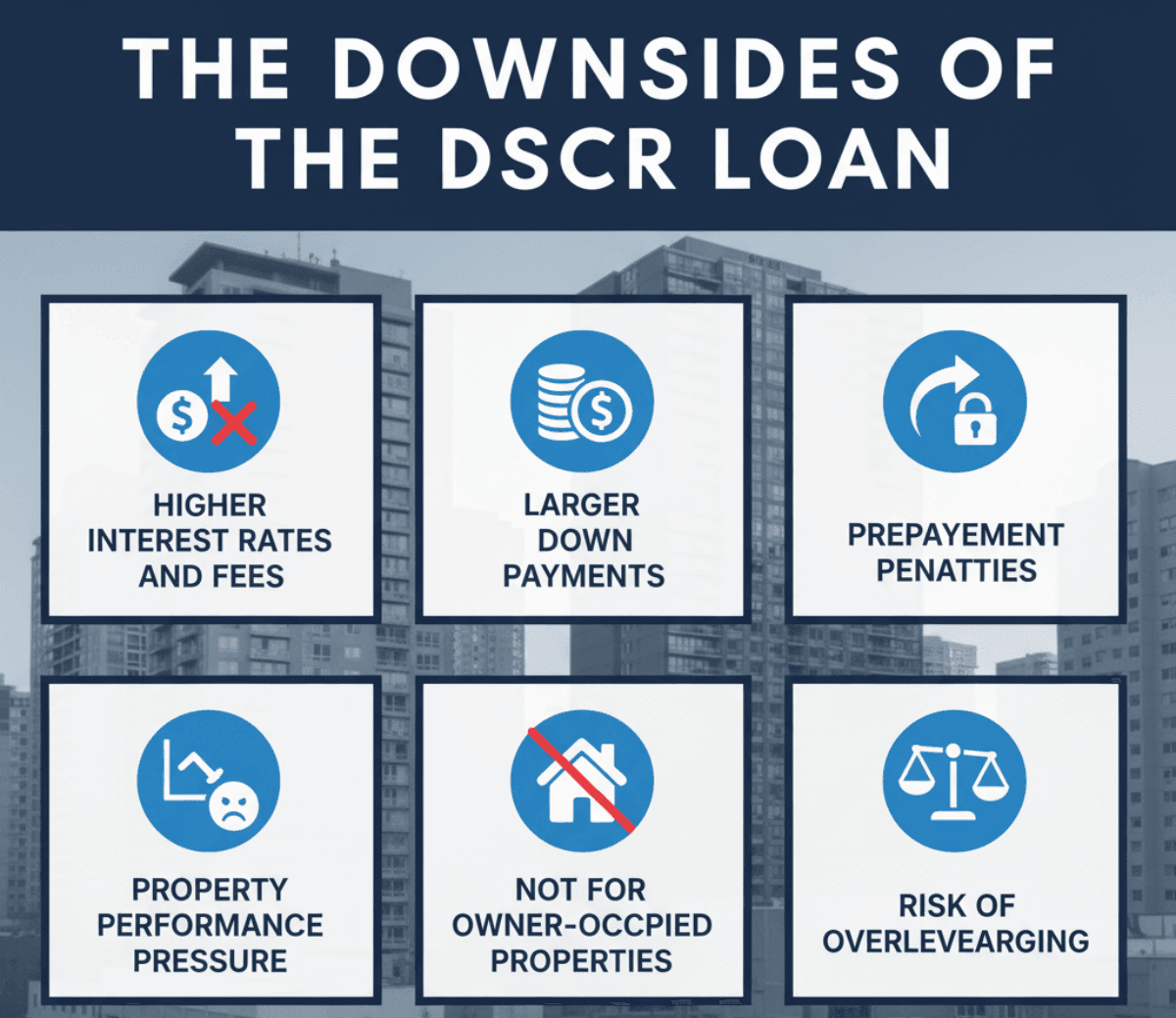

The Downsides of the DSCR Loan

Of course, if it sounds too good to be true, there's always a catch. To maintain trustworthiness, I need to be brutally honest about the risks involved.

Higher Interest Rates and Fees

You have to pay for the convenience and lack of income verification. Generally, DSCR loan interest rates are 0.50% to 2.00% higher than a conventional 30-year fixed mortgage. The lender is taking on more risk by not vetting your personal income, so they charge a premium for it.

Additionally, the fees can be steeper. You might see higher origination points (fees paid to the lender) compared to a standard bank loan. When you run your numbers, you must input this higher interest rate. A deal that looks like a home run at a 6.5% rate might barely break even at 8.5%. You need to ensure the property's income is robust enough to absorb this extra cost.

Larger Down Payments

If you are used to FHA loans with 3.5% down or conventional investment loans with 15% down, DSCR requirements might be a shock. Lenders typically require a minimum down payment of 20% to 25%.

Because the lender relies solely on the property's equity and income for security, they want you to have "skin in the game." This high entry barrier means you need more upfront capital. For a $400,000 property, you are looking at coming up with $80,000 to $100,000 in cash, plus closing costs. This can significantly drag down your "Cash-on-Cash Return" (CoC) simply because the denominator (your investment) is so much larger.

Prepayment Penalties

This is the "gotcha" that catches many rookies off guard. Most DSCR loans come with a Prepayment Penalty (PPP). This means if you sell the property or refinance the loan within the first few years (usually 3 to 5 years), you have to pay a hefty fine.

A common structure is "3-2-1," meaning a penalty of 3% of the loan balance in year one, 2% in year two, and 1% in year three. If you are a "fix and flip" investor or plan to refinance as soon as rates drop next year, this loan might be a terrible choice. You are essentially locked into the loan unless you are willing to burn thousands of dollars to get out of it. Always ask your lender to explain the PPP terms clearly.

Property Performance Pressure

With a DSCR loan, the property is the income source. If the market turns, rent prices drop, or your vacancy rate spikes, you are still on the hook for that mortgage payment.

Unlike a personal income loan where your salary can subsidize a vacant rental unit, a DSCR loan assumes the property pays for itself. If your DSCR ratio drops below 1.0 due to market conditions, you might find it very difficult to refinance that property later. You are placing a massive bet on the performance of that specific real estate market. Thorough market research and conservative rent estimates are not just optional. They are survival requirements.

Not for Owner-Occupied Properties

This is a hard red line. DSCR loans are strictly business-purpose loans. You absolutely cannot live in the property. It is illegal to use a DSCR loan for a primary residence or even a second home that you occupy for the majority of the year.

Lenders are exempt from certain consumer protection laws (like the Dodd-Frank Act) because they are lending to a business entity for investment. If you move into the property, you could be committing mortgage fraud. If your goal is "House Hacking" (living in one unit and renting the others), a DSCR loan is generally off the table unless you strictly occupy none of the financed units (though rules on this are tight).

Risk of Overleveraging

Because these loans are so easy to get, no DTI checks, unlimited number of loans, there is a psychological risk of getting carried away. I call it "easy money syndrome."

Just because a lender will give you a loan doesn't mean you should take it. Investors can quickly accumulate too much debt, expanding their portfolio faster than they can manage it. If you have 10 properties all highly leveraged at high interest rates, a slight economic downturn or a dip in rental demand could topple your entire portfolio. It requires a high level of financial discipline to stop yourself from over-borrowing just because the option is there.

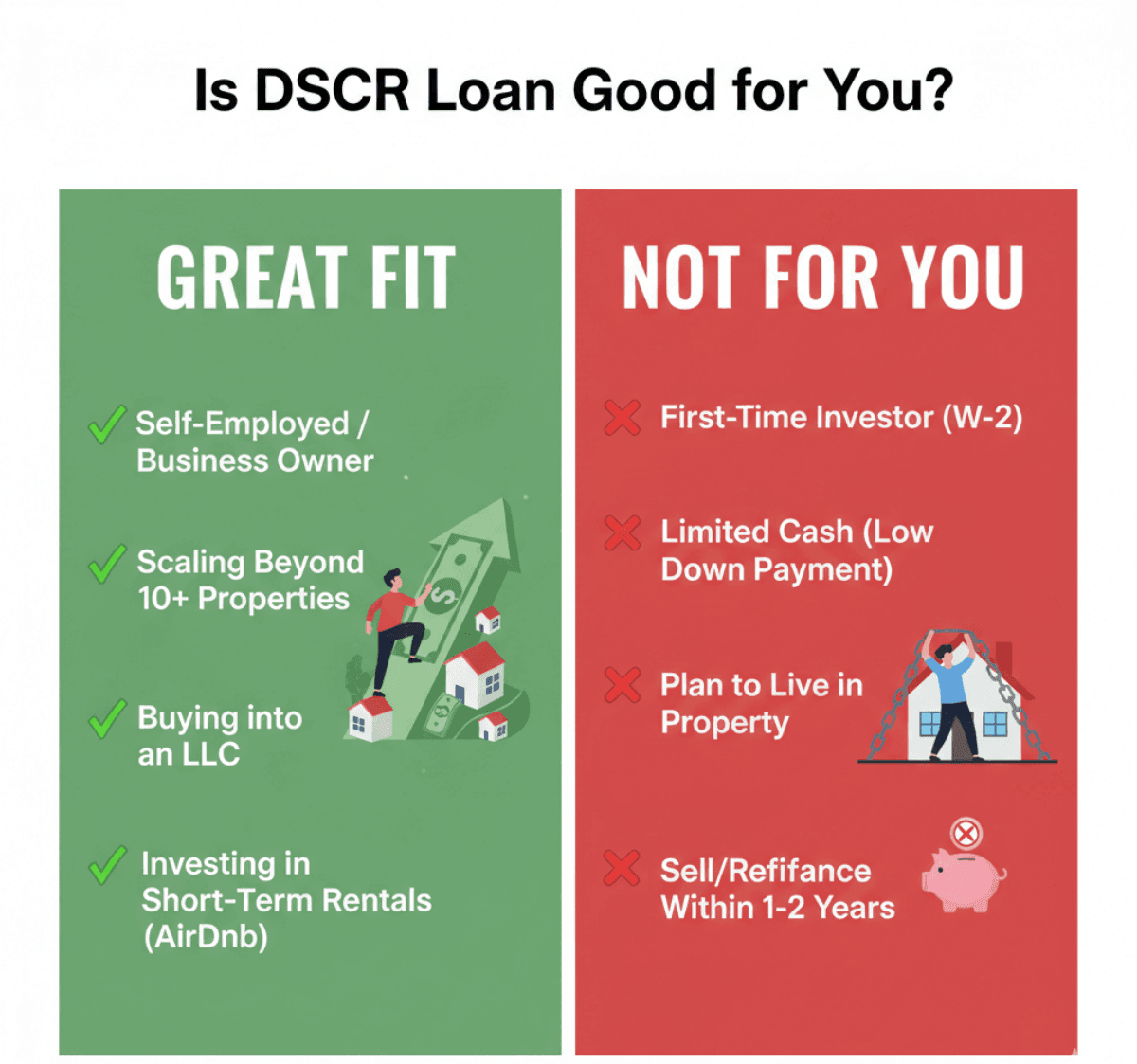

Is DSCR Loan Good for You?

So, should you pull the trigger? Here is my verdict based on different investor profiles.

A DSCR loan is likely a GREAT fit if:

- You are Self-Employed or a business owner with complex tax returns.

- You are looking to scale beyond 4-10 properties and have hit conventional loan limits.

- You are buying a property into an LLC for asset protection.

- You are investing in Short-Term Rentals (Airbnb) and need credit for projected income.

A DSCR loan is likely NOT for you if:

- You are a first-time investor with a solid W-2 job and low debt (stick to conventional for lower rates).

- You have limited cash and need a low down payment (under 20%).

- You plan to live in the property (house hacking).

- You plan to sell or refinance within 1-2 years (due to prepayment penalties).

What are the requirements of a DSCR Loan?

If you've decided to proceed, get your paperwork ready. While lighter than a bank loan, DSCR requirements are still specific:

- Credit Score: Typically requires a minimum FICO of 620 to 660, varying by lender. However, a score of 700+ will get you significantly better interest rates.

- DSCR Ratio: Most lenders look for a ratio of 1.0 to 1.25. This means Gross Rent must equal or exceed the PITIA (Principal, Interest, Taxes, Insurance, HOA). Note: Some lenders allow < 1.0 ratios, but expect much higher rates and larger down payments.

- Appraisal & 1007 Form: The appraiser must complete a Rent Schedule (Form 1007). This document officially determines the fair market rent the lender uses for their calculations.

- Down Payment: Expect to put down 20% to 25%.

- Cash Reserves: Lenders usually want to see that you have 3 to 6 months of mortgage payments saved in liquid cash, just in case of vacancies.

FAQs About DSCR Loan Pros and Cons

Q1. Can I live in a home bought with a DSCR loan?

No. I cannot stress this enough. DSCR loans are for investment properties only. Occupying the home violates the loan terms and federal lending regulations regarding business-purpose loans.

Q2. How much are closing costs on a DSCR loan?

Closing costs typically range from 3% to 5% of the loan amount. This includes appraisal fees, title insurance, and lender origination fees. Because these are specialized loans, lender fees can be slightly higher than standard conventional mortgages.

Q3. What is the minimum down payment for a DSCR loan?

According to OffMarket, the industry standard is 20-25%, though some lenders offer as low as 15% for excellent credit. Plan for 20-25% to be safe.

Q4. How is DSCR Calculated?

The formula is: Monthly Gross Rental Income / Monthly PITIA Debt.

PITIA = Principal + Interest + Taxes + Insurance + HOA dues.

For example, if Rent is $2,500 and your total housing cost is $2,000, your DSCR is 1.25. This is a healthy ratio.

Q5. How to find a DSCR loan officer near me?

Big banks like Chase or Wells Fargo generally do not offer these loans. You need a specialized Non-QM lender or mortgage broker.

To save time, I recommend using a comparison platform. You can find experienced DSCR loan officers on Bluerate who specialize in your specific state. It's free to contact them and allows you to compare rates from different providers.

Conclusion

To wrap this up, the DSCR loan is neither inherently "good" nor "bad", it is simply a specialized tool. It trades a higher interest rate and larger down payment for speed, flexibility, and freedom from income verification.

For the right investor, especially the self-employed or those in growth mode, it opens doors that are otherwise locked. However, it demands that you do the math carefully. Ensure your rental income can support the higher debt service. Don't just buy a property because you can get a loan. Buy it because the numbers make sense.

If you are ready to explore this option, I highly suggest getting quotes from multiple lenders to see who offers the best terms for your scenario. You can start by checking rates and officers at Bluerate.ai. Make the numbers work for you, not the other way around.