DSCR Loan Requirements 2026: Ratio, Credit Score, Down Payment, Type

I've spoken to countless real estate investors who found the perfect rental property, crunched the numbers, and saw massive potential, only to be shut down by a traditional bank because their tax returns didn't show enough "personal income." It's frustrating, isn't it? As an investor myself, I know that your tax write-offs shouldn't dictate your ability to buy profitable assets.

This is exactly where a DSCR (Debt Service Coverage Ratio) loan comes into play. Simply put, a DSCR loan focuses on the property's ability to pay for itself, rather than your personal W-2 salary. However, while these loans are flexible, they aren't the "Wild West" of lending. They have a specific set of rules. In this guide, I will walk you through the exact DSCR loan requirements you need to meet in 2026 to scale your portfolio without the headache of income verification.

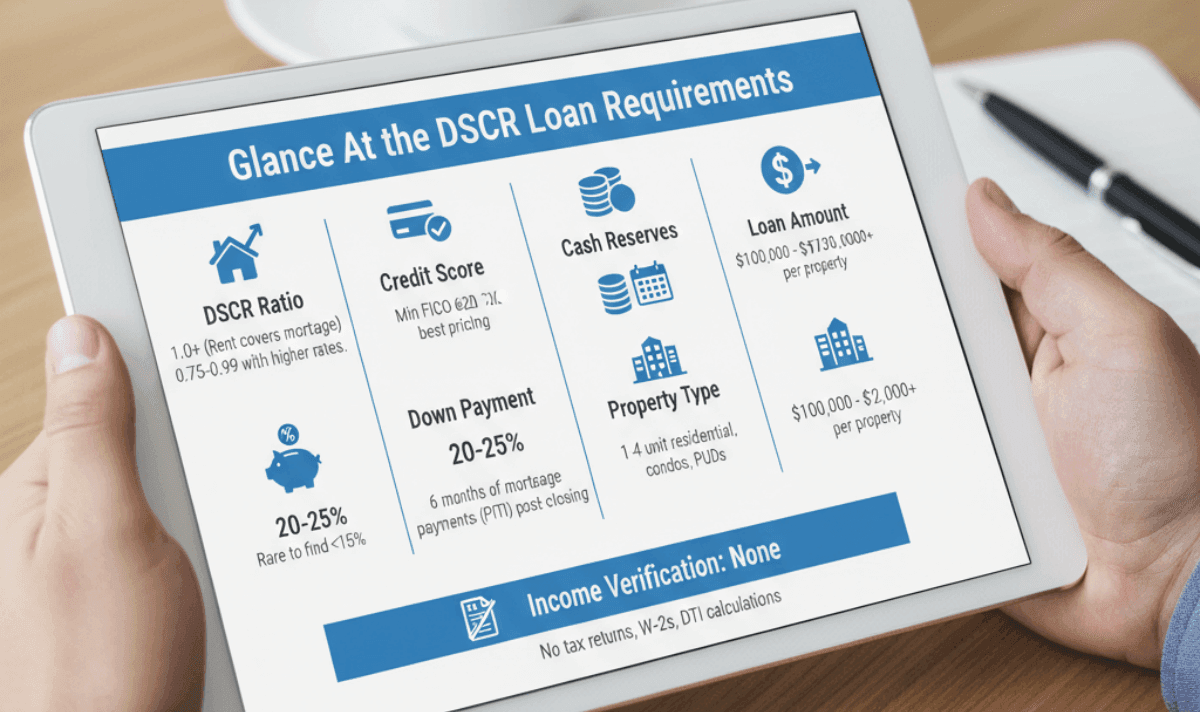

Glance At the DSCR Loan Requirements

If you are in a rush and just need the hard numbers, here is the snapshot. What are the requirements to qualify for a DSCR loan?

While every lender has slightly different "overlays", the industry standards generally look like this:

-

DSCR Ratio: Typically 1.0 or higher. This means rent covers the mortgage. Some lenders allow 0.75-0.99 with higher rates.

-

Credit Score: A minimum FICO of 620 is standard, though 700-720 gets you the best pricing.

-

Down Payment: Expect to put down 20% to 25%. It is rare to find anything lower than 15% in the current market.

-

Cash Reserves: Lenders usually want to see 6 months of mortgage payments (principal, interest, taxes, insurance) in your bank account post-closing.

-

Property Type: 1-4 unit residential properties, condos, and PUDs are the sweet spot.

-

Loan Amount: Generally ranges from $100,000 up to $2,000,000+ per property.

-

Income Verification: None. No tax returns, no W-2s, no DTI calculations.

DSCR Loan Requirements: DSCR Ratio

The heartbeat of this loan is the ratio itself. If you want to master these loans, you have to understand the math.

The DSCR formula is straightforward: DSCR = Net Operating Income (Monthly Rent) / Total Debt Service (PITI).

- PITI stands for Principal, Interest, Taxes, and Insurance (plus HOA fees if applicable).

So, what ratio do you actually need?

Most lenders use 1.0 as the baseline. A ratio of 1.0 means your property breaks even, the rent exactly covers the mortgage expenses. However, if you want the "prime" interest rates, you should aim for a ratio of 1.20 or 1.25. This shows the lender that the property is cash-flowing positively and is a safer bet.

I have seen lenders offer "No Ratio" or "DSCR < 1.0" loans. Yes, you can get approved even if the property loses money on paper every month, but be warned: you will pay a premium in interest rates and likely need a larger down payment (often 30%+).

The appraisal is key here. The appraiser will fill out Form 1007 (Rent Schedule). If your actual rent is lower than the market average, make sure the appraiser is using the potential Market Rent, not just what the current tenant is paying (if the lease allows).

DSCR Loan Requirements: Credit Score

There is a common misconception that because DSCR loans don't check income, they don't care about credit. That is false. In fact, because the lender isn't looking at your pay stubs, your Credit Score becomes the primary indicator of your reliability as a borrower.

The Requirements:

-

Minimum Score: Most programs start at a 620 FICO score.

-

The "Tiering" Effect: This is crucial. If you have a 640 score, you might qualify, but your Loan-to-Value (LTV) might be capped at 70% (meaning a 30% down payment). If you boost that score to 720 or 740, you unlock the maximum LTV (usually 80%) and the lowest interest rates.

Lenders look heavily at "major credit events." Even with a decent score, if you have had a bankruptcy or foreclosure in the last 3-4 years, it might be an automatic disqualification.

Before applying, check your credit report for any small errors. Paying down a high-balance credit card to boost your score by 20 points could literally save you thousands of dollars in down payment requirements or interest over the life of the loan.

DSCR Loan Requirements: Down Payment

When I transitioned from conventional financing to Non-QM (Non-Qualified Mortgage) products like DSCR, the biggest adjustment was the down payment. You typically cannot use the 3.5% or 5% down payments common with FHA or conventional owner-occupied loans.

The Standard:

You should be prepared for a 20% to 25% down payment.

-

Purchases: Usually 20% down (80% LTV) is the standard for borrowers with good credit.

-

Cash-Out Refinance: If you are pulling cash out of a property, lenders often cap the loan at 70% or 75% LTV, meaning you need more equity remaining in the home.

The lender is taking on more risk by not verifying your income. Your "skin in the game" (your equity) is their safety net. If you default, they know they can sell the property and recover their money because you have a significant equity buffer.

The good news is that sourcing requirements are often more relaxed than traditional banks. Many DSCR lenders allow Gift Funds from family members to cover part of the down payment, though they usually require you to have your own funds for the closing costs and reserves.

DSCR Loan Requirements: Property Type

Not all real estate is created equal in the eyes of a DSCR lender. These loans are specifically designed for investment properties, so you generally cannot live in the home.

Eligible Properties:

-

Single Family Residences (SFR): The easiest to finance.

-

2-4 Unit Properties: Duplexes, triplexes, and fourplexes are excellent for DSCR.

-

Condos & Townhomes: Warrantable condos are fine. Non-warrantable condos (those with high investor concentration or litigation) are harder but possible with specific lenders.

This is where I see the most interest recently. Many lenders will lend on Short-Term Rentals (STRs). Qualifying an Airbnb is different. Some lenders will accept data from AirDNA or similar analytics to project income, while conservative lenders might only accept the standard long-term market rent on the appraisal. If you are buying a vacation rental, verify specifically how the lender calculates income for STRs.

Generally, raw land, rural properties with large acreage, and mobile homes, unless they own the land and are on a permanent foundation, are difficult or impossible to finance with a standard DSCR loan.

DSCR Loan Requirements: Documentation

One of the most refreshing aspects of the DSCR process is the "Lite Doc" nature of the paperwork. If you are used to submitting 200 pages of tax returns, you will find this process surprisingly light.

What You DO NOT Need:

-

No personal or business tax returns.

-

No W-2 forms.

-

No pay stubs.

-

No employment verification calls to your boss.

What You DO Need:

-

Application (1003): The standard mortgage application.

-

Credit Report: The lender will pull this.

-

1007 Rent Schedule: The appraiser fills this out to determine the property's market income.

-

Lease Agreements: If the property is currently rented, you'll provide the current lease.

-

Asset Documentation: Usually 2 months of bank statements.

-

Entity Documents: Many investors buy in an LLC for protection. You will need your Articles of Organization and Operating Agreement.

Lenders want to see that you won't go broke if the property sits vacant for a month. You typically need to show liquid cash reserves equal to 3 to 6 months of mortgage payments. Stocks and retirement accounts can often count toward this requirement (sometimes at a discounted value, like 70% of the vested balance).

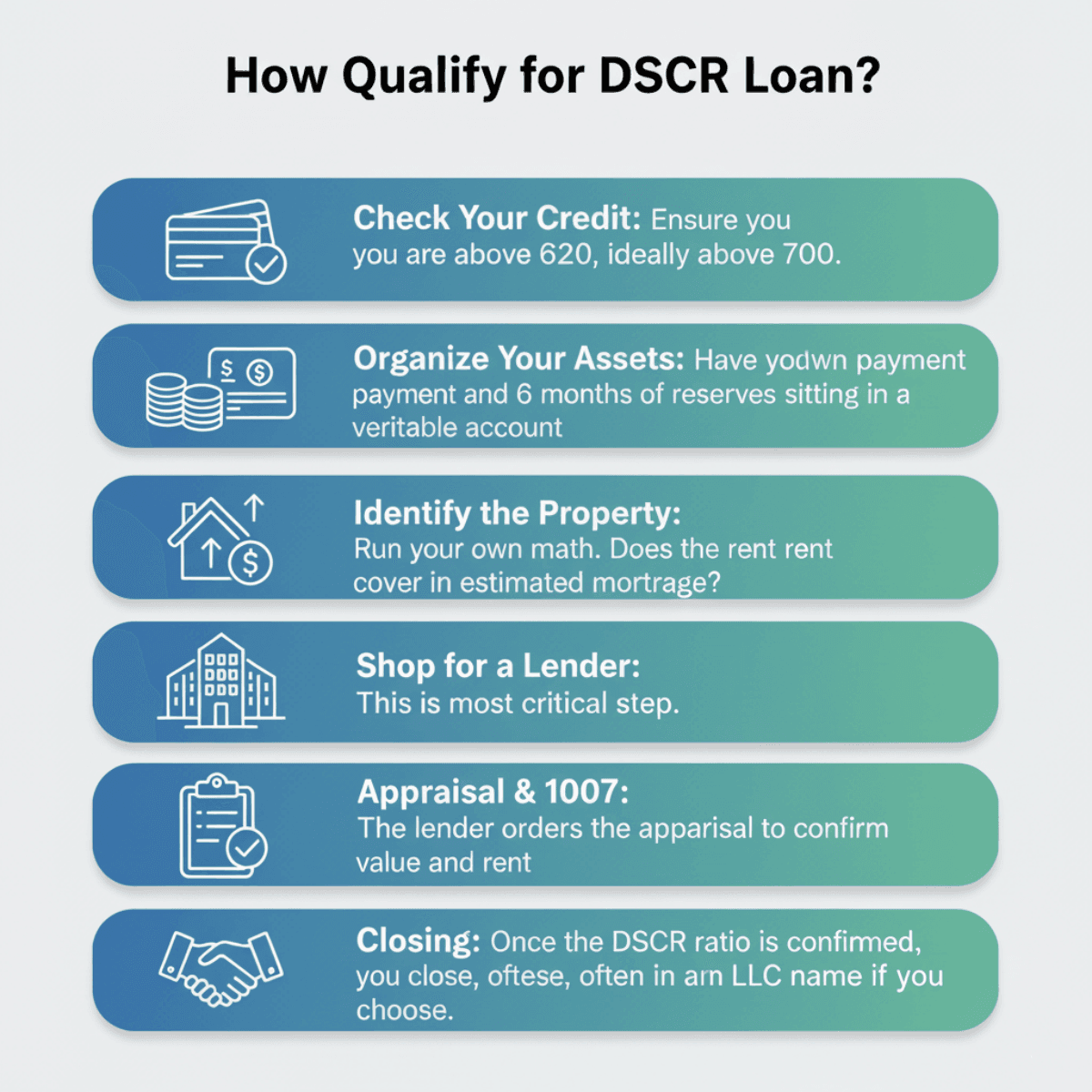

How to Qualify for a DSCR Loan?

Qualifying for a DSCR loan is less about "proving you are rich" and more about "proving the deal works." Here is the typical workflow I recommend to get from concept to closing:

-

Check Your Credit: Ensure you are above 620, ideally above 700.

-

Organize Your Assets: Have your down payment and 6 months of reserves sitting in a verifiable account.

-

Identify the Property: Run your own math. Does the rent cover the estimated mortgage?

-

Shop for a Lender: This is the most critical step.

-

Appraisal & 1007: The lender orders the appraisal to confirm value and rent.

-

Closing: Once the DSCR ratio is confirmed, you close, often in an LLC name if you choose.

Because DSCR loans are "Non-QM" products, there is no government-set interest rate. One lender might offer you 7.5% with 2 points, while another offers 8.5% with 0 points. The spread can be massive.

I highly recommend using Bluerate to navigate this. It's an AI-powered marketplace that lets you compare rate quotes from multiple specialized loan officers for free. Instead of calling ten different banks and repeating your story, Bluerate helps you find the loan officer who specifically wants your type of deal, ensuring you don't overpay on interest or fees.

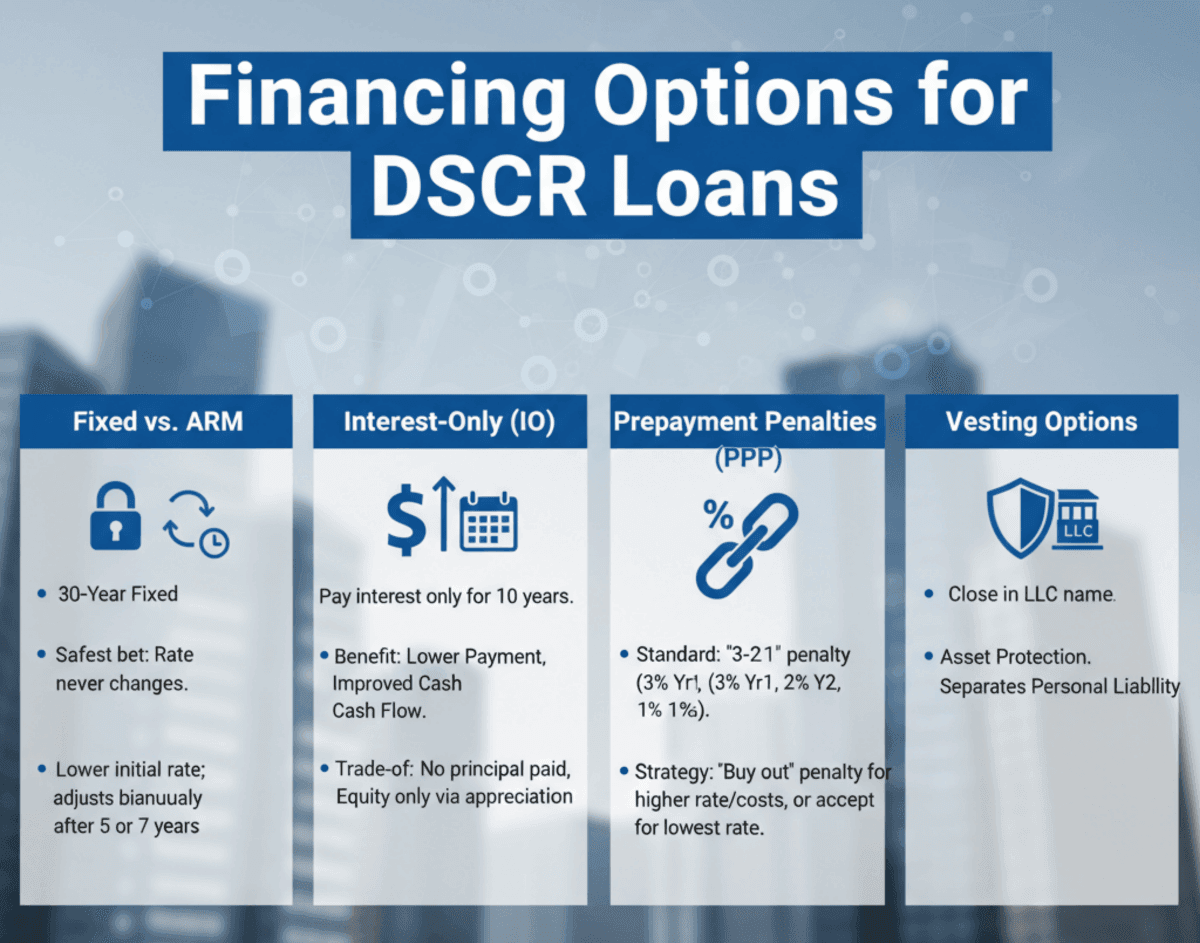

Financing Options for DSCR Loans

When structuring your loan, you have more options than the standard "30-year fixed." Understanding these can significantly impact your cash flow.

Fixed vs. ARM (Adjustable Rate Mortgage)

-

30-Year Fixed: The safest bet. Your rate never changes.

-

5/6 or 7/6 ARM: The rate is fixed for 5 or 7 years, then adjusts every 6 months. These often come with a slightly lower initial interest rate. If you plan to sell the property in 5 years, an ARM might save you money.

Interest-Only (IO)

This is a favorite among sophisticated investors. In an Interest-Only DSCR loan, you pay only the interest for the first 10 years.

-

The Benefit: Your monthly payment is significantly lower, which drastically improves your Cash Flow.

-

The Trade-off: You aren't paying down any principal, so you aren't building equity through payments, only through market appreciation.

Prepayment Penalties (PPP)

Most DSCR loans come with a Prepayment Penalty. This sounds scary, but it's a tool.

-

Standard Structure: A "3-2-1" penalty means you pay a 3% fee if you sell/refinance in year 1, 2% in year 2, and 1% in year 3.

-

The Strategy: You can often "buy out" the penalty (have no penalty) by paying a higher interest rate or higher closing costs. Conversely, if you plan to hold the property long-term, accepting a 5-year penalty can get you the lowest possible interest rate.

Vesting Options

Unlike conventional loans, DSCR lenders are very comfortable letting you close in the name of an LLC (Limited Liability Company). This provides asset protection and separates your personal liability from the property.

FAQs About DSCR Loan Requirements

Q1. Do DSCR loans require 20% down?

Yes, typically. While you might hear rumors of 15% down programs, they are extremely rare and usually come with very high interest rates. Plan for 20% to 25% to be safe and to secure a profitable interest rate.

Q2. Can You Use Equity for the DSCR Down Payment?

Yes. Many investors use a Cash-Out Refinance on an existing rental property or their primary residence or a HELOC to generate the cash needed for the down payment on a new DSCR purchase.

Q3. Is it hard to get a DSCR loan?

No, it is generally easier than a conventional loan. While the down payment is higher, the underwriting process is much faster and less intrusive because the lender does not analyze your personal debt-to-income ratio or employment history.

Q4. What are the downsides of a DSCR loan?

The main downsides are higher interest rates, which are typically 1% to 2% higher than conventional loans and Prepayment Penalties. You are paying for the speed and flexibility of not having to prove personal income. Also Read: DSCR Loan Pros and Cons: Is It the Right Strategy for Your Investment?

Q5. How long can you do a DSCR loan?

Standard terms are 30 years, but 40-year terms (often with an interest-only period) are becoming increasingly popular to help lower monthly payments and improve the DSCR ratio.

Conclusion

DSCR loans have completely changed the landscape for real estate investors. They remove the friction of personal income verification and allow you to scale your portfolio based on the quality of your assets, not your tax returns. If you have the down payment and a property that cash flows, you are already 90% of the way there.

However, the "make or break" factor is often the financing terms. Since rates and fees vary so wildly in this sector, do not settle for the first quote you get. I strongly suggest checking out Bluerate to compare offers. Finding the right loan officer can mean the difference between a property that just breaks even and one that generates significant monthly profit. Good luck with your investment!