![[2026] What is a Mortgage? Everything You Need to Know Here](/_next/image?url=https%3A%2F%2Fdynamic-light-ab6e2536d6.media.strapiapp.com%2Fwhat_is_a_mortgage_banner_8be3ccb498.png&w=3840&q=75)

[2026] What is a Mortgage? Everything You Need to Know Here

If you are staring at home listings and feeling a mix of excitement and sheer panic, you are not alone. Buying a home is likely the biggest check you will ever write, and unless you are sitting on a mountain of cash, you are going to need financing. That's the mortgage, which is the engine that makes homeownership possible for most of us.

But here is the thing: the mortgage world is full of jargon that can make your eyes glaze over. "Amortization," "APR," "Points" that sounds like a foreign language. I wrote this guide to cut through the noise. I want to walk you through exactly what a mortgage is, how the different types, like QM vs. Non-QM, actually work, and the real-world steps to getting approved in 2026. By the end of this, you won't just be confused You'll be ready to make a move.

What is a Mortgage Loan?

In plain English, a mortgage is a loan specifically used to buy property, usually a home. But it's not like swiping a credit card or getting a personal loan for a vacation. The key difference here is collateral.

When you get a mortgage, the lender, a bank or private company, fronts the money to pay the seller for the house. You then agree to pay the lender back, plus interest, over a long timeline, usually 15 or 30 years.

Say you find a dream home for $500,000. You have saved up $100,000 for a down payment. You borrow the remaining $400,000. That $400,000 debt is your mortgage.

But there is a catch you need to take seriously. Because the loan is "secured" by your home, the house itself is the guarantee. If you stop making payments, the lender has the legal right to take the house back through foreclosure to recover their money. This is why the approval process feels so rigorous. Lenders need to be absolutely sure you can afford the monthly hit without going under. It's a tool for wealth building, but it demands respect.

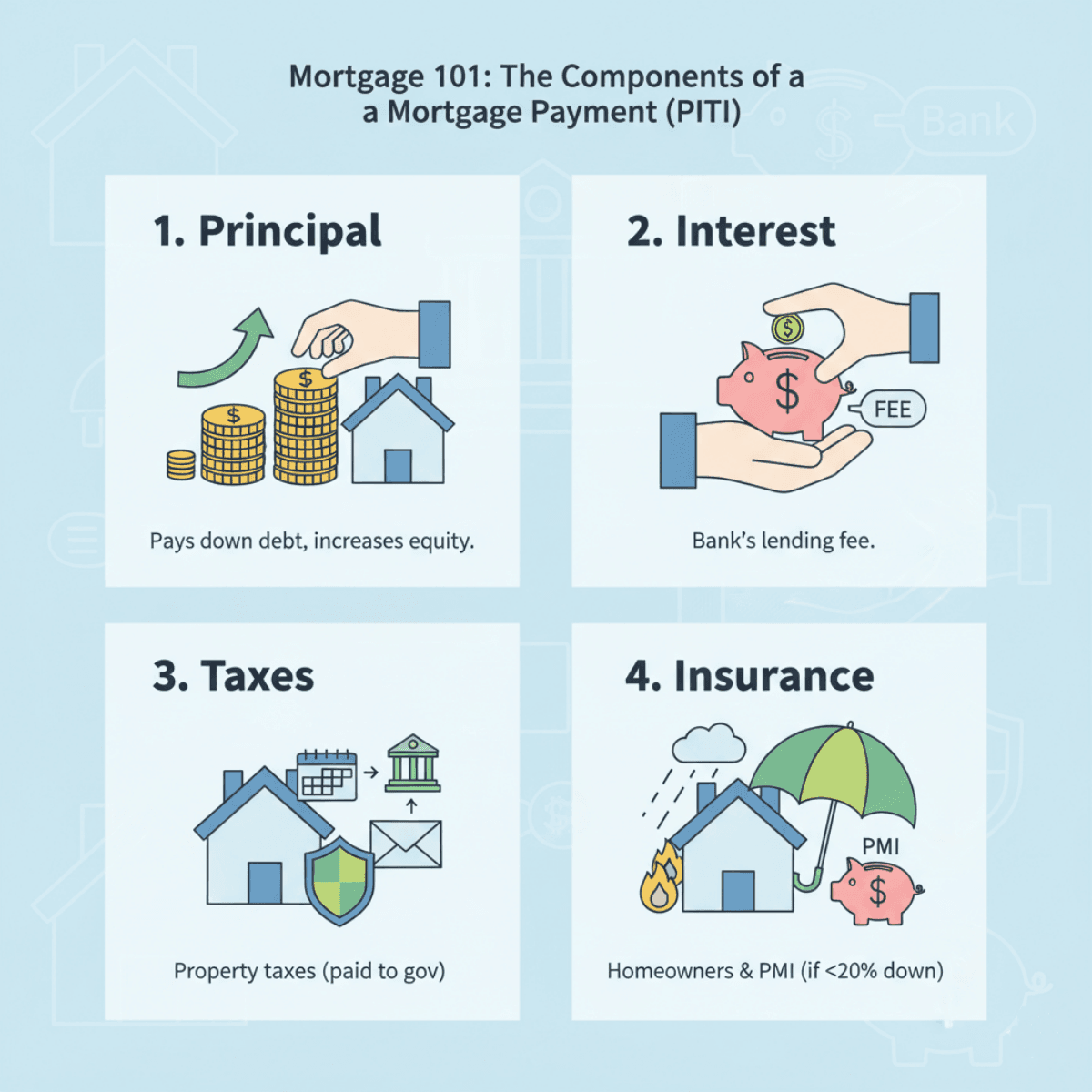

Mortgage 101: The Components of a Mortgage Payment (PITI)

Most first-time buyers make a common mistake: they look at a mortgage calculator, see a number, and think, "Great, I can afford that." But that number usually leaves out half the story. Your actual monthly bill is made up of four parts, known in the industry as P.I.T.I.

-

Principal: This is the money that actually pays down your debt. Every dollar here increases your ownership (equity) in the house.

-

Interest: This is the fee the bank charges you for lending the money.

-

Taxes: Property taxes are inevitable. Your lender usually collects a slice of this every month and pays the local government for you.

-

Insurance: You'll pay for homeowners' insurance (for fires or storms). Plus, if you put down less than 20%, you're likely paying PMI (Private Mortgage Insurance) too.

So, when budgeting, remember: the check you write covers a lot more than just the loan itself.

How Do Mortgages Work?

Think of a mortgage as a long-term relationship between you and your lender. It starts when you sign the papers at closing, but the mechanics behind it, specifically Amortization and the Lien, dictate the next few decades.

Amortization is just a fancy word for your repayment schedule. The tricky part? The math is front-loaded. In the first few years, you might be frustrated to see that nearly all your money is going toward interest, with very little chipping away at the actual loan balance. Over time, that scale tips, and you start paying off more principal.

Legally, the lender protects their interest by placing a Lien on your home. It's a public record saying, "We have a claim on this property." You own the house, you live in it, you paint the walls, but you can't sell it without paying off that lien first. Once the final penny is paid, the lien vanishes.

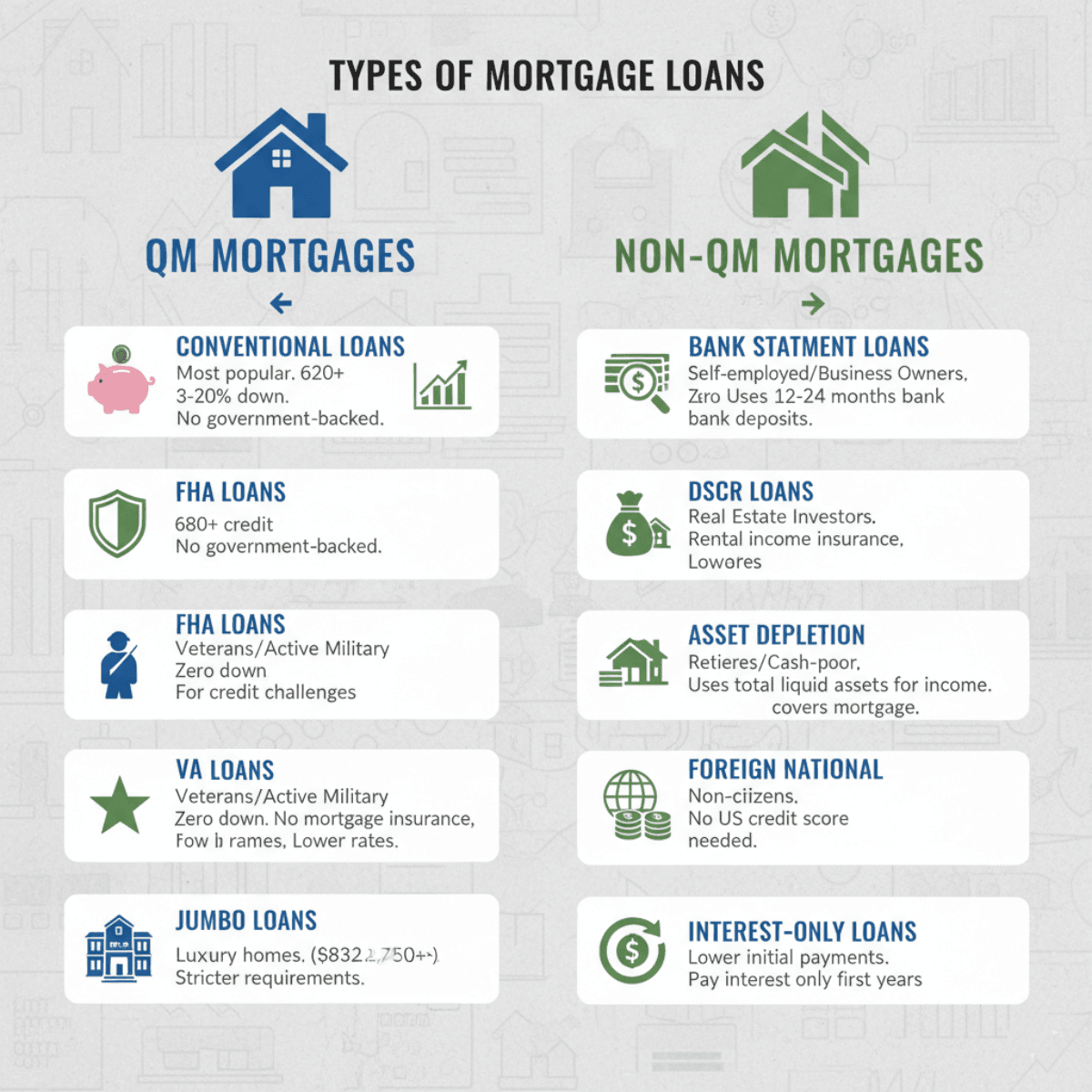

Types of Mortgage Loans

Not all loans are created equal. Depending on your job and financial life, you'll generally choose between two paths: Qualified Mortgages (QM) for standard borrowers, and Non-QM for those with more complex finances. You'll also decide between a Fixed-Rate (safe, predictable) and an Adjustable-Rate (riskier, but potentially lower initial rate).

QM Mortgages

Qualified Mortgages, or QM, are what most people picture when they think of a home loan. These are the "vanilla" options that conform to strict government standards to ensure you aren't taking on a loan you can't afford. If you have a 9-to-5 job with W-2s and a decent credit score, this is likely where you'll start.

-

Conventional Loans: The most popular route. These aren't government-backed, so lenders like to see credit scores above 620. First-timers can sometimes get in with just 3% down, though putting down 20% is the best way to avoid extra insurance costs.

-

FHA Loans: Government-backed for borrowers with credit challenges. Minimum credit score of 580 qualifies for 3.5% down payment (500-579 requires 10%). FHA MIP lasts the loan term if the down payment <10%. It drops after 11 years if 10% or more.

-

VA Loans: If you are a veteran or active military, this is the gold standard. Zero down payment, no mortgage insurance, and often lower rates. It's one of the best benefits available for service members.

-

Jumbo Loans: For luxury homes exceeding 2026 conforming limits—$832,750 baseline in most U.S. areas, up to $1,249,125 in high-cost regions like parts of California. Stricter credit and larger down payments are required. Expect stricter requirements, higher credit scores, and larger down payments to be the norm here.

Non-QM Mortgages

Here is where the market has really evolved. A few years ago, if you were self-employed or an investor with a complicated tax return, you were often out of luck. Enter Non-QM (Non-Qualified Mortgage) loans. These aren't "bad" loans. They just use common sense instead of rigid government checkboxes to verify you can pay.

-

Bank Statement Loans: I see this save deals all the time. If you run a business, your tax write-offs might make your income look low on paper. These loans ignore the tax return and look at your actual bank deposits over 12-24 months to calculate income.

-

DSCR Loans: A favorite for real estate investors. The lender doesn't care about your personal salary. They simply ask: "Does the rental income from this property cover the mortgage payment?" If yes, you're likely approved.

-

Asset Depletion: This is for the "house rich, cash poor" crowd, or retirees. Lenders use your total liquid assets (stocks, savings) to calculate a theoretical monthly income.

-

Foreign National Loans: Designed for non-citizens who want to buy US property but don't have a US credit score.

-

Interest-Only Loans: These allow you to pay only the interest for the first few years. It keeps payments low initially, which is great for cash flow, but you won't be building equity until the principal payments kick in later.

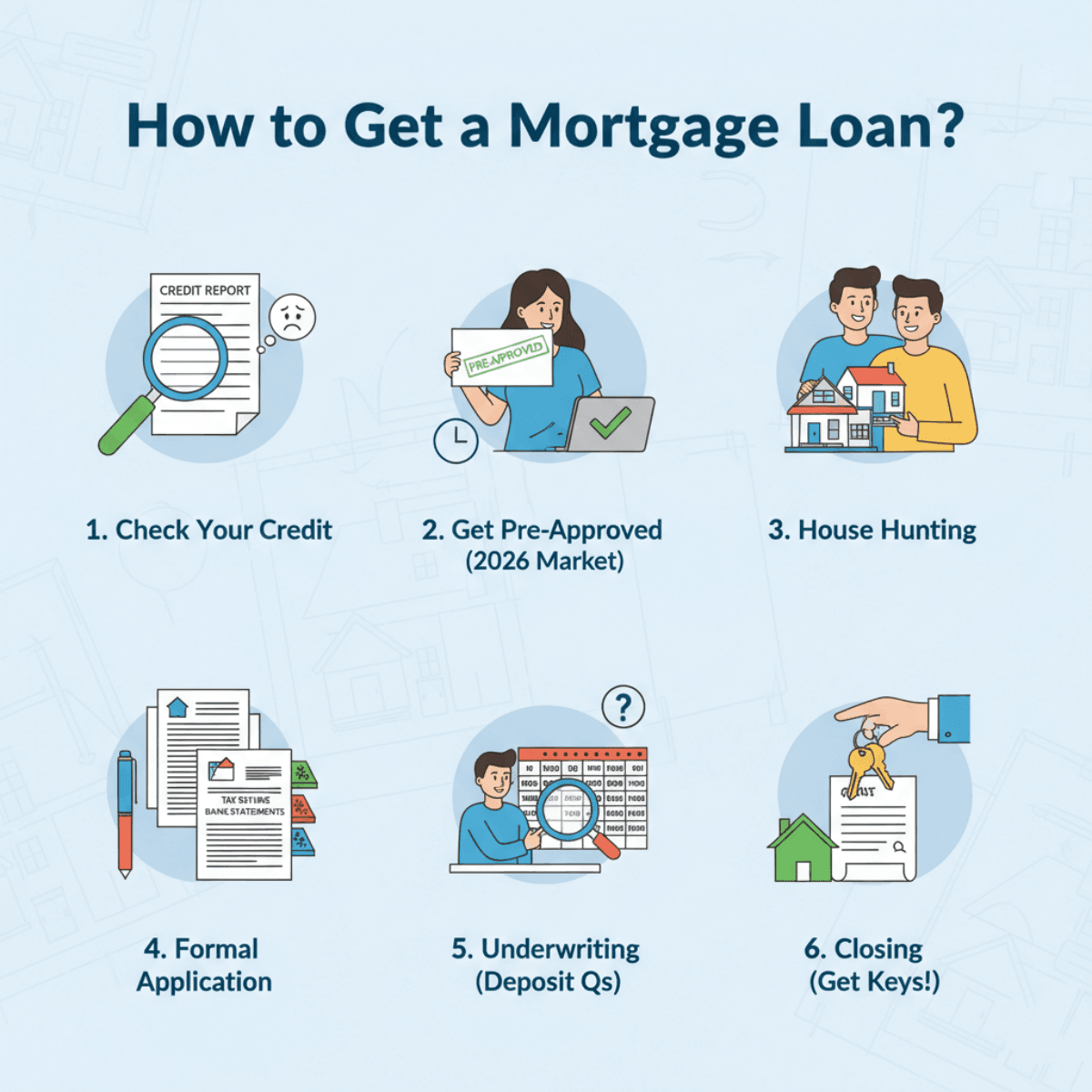

How to Get a Mortgage Loan?

Don't just walk into an open house without a plan. The mortgage application is a series of specific steps:

-

Check Your Credit: Pull your own report first. You don't want any nasty surprises when the bank checks it.

-

Get Pre-Approved: Do not skip this. A pre-approval letter proves to sellers you have the money. In a competitive 2026 market, offers without this go straight to the trash.

-

House Hunting: Now you can shop with confidence, knowing exactly what you can afford.

-

Formal Application: Once an offer is accepted, you submit your full financial file, pay stubs, tax returns, the works.

-

Underwriting: An underwriter will comb through your finances. They might ask weird questions about a $50 deposit. Just answer them. It's part of the game.

-

Closing: You sign a stack of papers, wire the closing costs, and get the keys.

Key Considerations of a Mortgage Loan

When you are comparing loan estimates, don't just look at the bottom line monthly payment. You need to look under the hood.

-

Interest Rate vs. APR: This is the biggest confusing point. The interest rate is what you pay on the balance. The APR includes that rate plus all the fees and points the lender is charging you. Always compare APRs to see which loan is actually cheaper.

-

Loan Term: Do you go for 15, 30, or even 50 years? A 30-year loan gives you a lower monthly payment, which is safer for your budget. A 15-year loan forces higher payments, but you will save a fortune in interest and own the home much faster.

-

Down Payment: While 20% is the ideal target to avoid insurance costs, don't drain your emergency fund just to hit that number. Leaving yourself cash-poor is a recipe for stress.

-

Closing Costs: These are the "hidden" fees, appraisals, title insurance, etc. They usually run 2-5% of the purchase price. Make sure you have cash set aside for this, separate from your down payment.

Glossary in a Mortgage

Here are 10 terms you'll hear thrown around. Think of this as your cheat sheet:

-

Amortization: The timeline of paying off your loan, split into principal and interest.

-

Appraisal: A required report where a pro estimates the home's fair market value.

-

Closing Costs: One-time fees paid at the finish line (title, recording fees, etc.).

-

DTI (Debt-to-Income): A ratio comparing your monthly debt payments to your gross income.

-

Down Payment: The initial chunk of cash you pay. The mortgage covers the rest.

-

Equity: The part of the house you actually own (Value minus Loan Balance).

-

Escrow: A holding account used to pay your taxes and insurance automatically.

-

LTV (Loan-to-Value): The percentage of the home's price that is borrowed.

-

PMI: Insurance that protects the lender (not you) if you have a low down payment.

-

Pre-approval: A lender's written confirmation of how much they are willing to lend you.

Tips for Getting a Mortgage Loan

I've seen perfectly good loan applications fall apart days before closing because of avoidable mistakes. Here is how to keep your application bulletproof:

-

Don't Buy Big Ticket Items: This is the golden rule. Do not buy a new car, furniture, or put a vacation on your credit card while buying a house. It changes your debt ratios and can kill the deal instantly.

-

Stability is Key: Lenders hate unpredictability. Don't quit your job to start a freelance career in the middle of escrow. If you get a promotion, that's fine, but tell your loan officer immediately.

-

Paper Trail Everything: If your grandma gives you $10,000 for the down payment, you can't just deposit the cash. You need a "Gift Letter." Lenders have to trace every dollar to ensure it's not a secret loan.

-

Shop Around: Rates vary. Calling just one bank is like checking only one airline for a flight. Compare estimates.

-

Be Fast: When the bank asks for a document, send it same-day. Delays usually happen on the borrower's end, not the bank's.

Also Read: 10 Tips: First-Time Home Buyer Tips and Advice for You

FAQs About What is a Mortgage

Q1. What is a mortgage for dummies?

Think of it as a huge IOU specifically for a house. You borrow money from a bank to buy the home, and you pay it back in monthly installments over many years. If you stop paying, the bank takes the house back.

Q2. What is a simple definition of a mortgage?

A mortgage is a legal loan agreement where real estate is used as collateral. It allows you to buy a property without paying the full cash price upfront, securing the loan with the property itself.

Q3. How much is a mortgage on a $300,000 house?

For 20% down ($60,000), $240,000 loan at 6.5% over 30 years, principal and interest is approximately $1,517/month. Total PITI varies by location but often $1,900-$2,200 including taxes and insurance.

Q4. Is it better to pay mortgage monthly or biweekly?

Biweekly is usually smarter. By paying half your monthly amount every two weeks, you end up making one extra full payment per year (26 half-payments). This slashes years off your loan term and saves thousands in interest.

Conclusion

Understanding what a mortgage is changes the game. It stops being a scary financial burden and starts looking like what it really is: a tool to help you secure your future. Whether you fit the standard box for a QM loan or need the flexibility of a Non-QM solution, the money is out there if you know where to look.

My advice? Don't let the paperwork intimidate you. Start by getting your documents in order and talking to a pro who can look at your specific numbers. The market in 2026 is moving fast, and being prepared is your best advantage.

Ready to see what you qualify for? Freely contact a loan officer near you today to start your pre-approval journey.