Raymond James Mortgage Reviews: Is It Any Good? Check Here

Considering Raymond James Mortgage for your home financing needs? Whether you're a borrower who os evaluating loan options or an employee who is researching the company's reputation, it's important to grasp the idea of Raymond James Mortgage. This review summarizes what Raymond James Bank's mortgage division offers, highlights its strengths and weaknesses found in public records and consumer reviews, and complaints. You might as well read on if you want a concise but evidence-based take.

People Also Read

- Better Mortgage Reviews: Pros, Cons, and Everything to Know

- AmeriSave Mortgage Reviews 2025: Pros & Cons, Loan Options, Rating

- CrossCountry Mortgage Reviews 2026: Benefits, Drawbacks, and FAQs

- Comprehensive 21st Mortgage Reviews: What, Pros & Cons, FAQs

- Freedom Mortgage Reviews 2026: Complaints, Pros, Cons, and More

- True Carrington Mortgage Reviews in 2026: Lifesaver or Nightmare?

Learn About What Raymond James Mortgage is

Raymond James Mortgage is the mortgage-lending arm of Raymond James Bank (a subsidiary of Raymond James Financial, Inc.), offering residential mortgage products for purchases and refinances, including conventional fixed-rate loans, ARMs, FHA and VA loans, jumbo loans, interest-only structures, and a pledged-securities mortgage for clients with margin-eligible investment accounts. Raymond James Financial traces its roots to 1962. Raymond James Bank operates as a federally chartered bank and provides banking, securities-based lending, and mortgage services to clients across the United States. The Bank's mortgage center states its mortgage products are "available in all 50 states" and that its mortgage programs "have no minimum loan amount or relationship size requirements to apply."

Advantages and Disadvantages of Raymond James Mortgage

Also, let's learn the pros and cons of Raymond James Mortgage to help you make a choice.

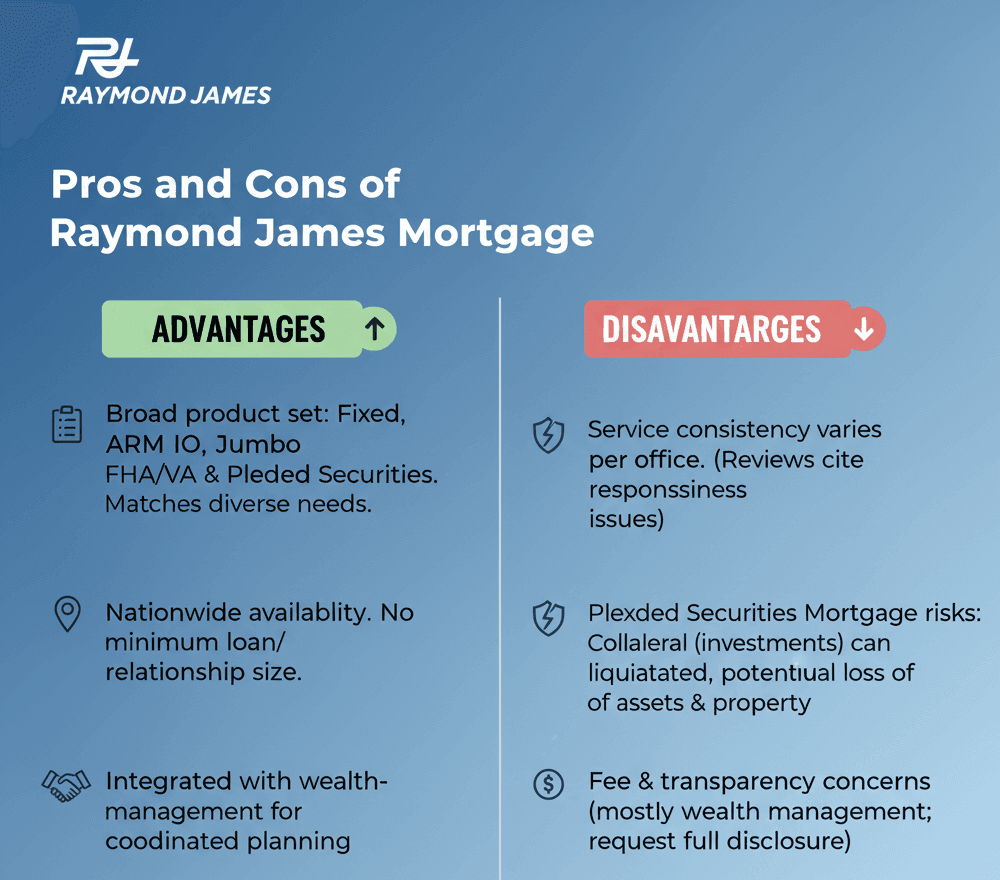

Advantages

- Broad product set that includes conventional fixed-rate loans, multiple ARM terms, interest-only structures, jumbo loan options, FHA/VA participation, and a unique pledged-securities mortgage for clients who hold margin-eligible assets. This breadth helps match loan options to a range of borrower needs.

- Nationwide availability and no stated minimum loan amount or relationship-size requirement to apply, useful for borrowers who don't meet large-account minimums.

- Integration with wealth-management services for clients who want banking and advisory coordination. Many high-net-worth clients value the option to coordinate mortgage strategy with a broader wealth plan.

Disadvantages

- Service consistency varies: third-party reviews and complaint records show variability in customer service responsiveness and advisor consistency across offices.

- Pledged Securities Mortgages carry special risks: collateral is an investment account that may drop in value. Raymond James' disclosures warn that pledged assets can be liquidated, potentially without prior notice, to preserve collateral levels, and borrowers can lose both pledged securities and the property in default scenarios. Borrowers should consider the market risk and margin-call exposure carefully.

- Fee & transparency concerns reported by some customers: reviewers sometimes cite advisory/wrap fees and surprise costs. These are mostly related to wealth management accounts rather than the mortgage product itself.

Real Complaints on Raymond James Mortgage

Public records and news coverage show two relevant angles:

- Customer complaints filed on consumer review platforms and BBB profiles

- Regulatory enforcement findings involving parts of the Raymond James organization

Below, I summarize both and provide representative complaint text where public pages permit.

Regulatory Summary

In 2024, according to ThinkAdvisor, FINRA alleged that parts of Raymond James failed to timely report certain customer complaints and had supervisory deficiencies tied to mutual fund transactions and automated surveillance configuration. The firm agreed to a settlement that totaled nearly $2 million related to these supervisory/reporting failures. These findings do not describe mortgage underwriting practices specifically, but are relevant to firm governance and compliance culture.

BBB Complaints

BBB has several complaints about Raymond James. Here are some real voices to hear:

- ****** ****** made a 25k investment i asked him if he purchased gold? Or what. No response. He then took out 40k in another investment. This is a conservative account not a risky investment. He then took 200k and invested in very speculative gold stock with no communications whatsoever. I had fired ****** just day before and he was not authoruzed to do any further purchases. HE WAS INFORMED THAT I WAS MOVING MY ACCOUNT AND MOVIBG IT IN ITS ENTIRITY. Yet he proceeded to s**** me out of 250k of money without my permission or approval. HE NEEDS TO BE CRIMINALLY CHARGED. I ENTEND TO DO JUST THAT.

- In 2020 *************************** died and I was appointed the executor. She had funds with Raymond James which were designated to be placed in the trust of *********************. Will, Court Documents were provided as well as lawyers speaking to each other. Raymond James instead used her SSN to open a new account for an estate. When requested to fix their error they have refused to abide by the will stating they need more money and lawyers. They refuse to respond to phone calls or emails. They than opened an account for the trust of ********************* but refuse to put the money in there after saying they would. I have gotten no response since September aside from a letter saying they are working. They have said the only option is to withdraw all IRAs and pay double taxes on them rather than doing the legal transfer they were told to do upon her death. I am requesting assistance in getting them to move the money to the *** provided so that I can transfer it to the new institution it was supposed to go to 1 year ago. The new place will not accept it because Raymond James has failed to abide by a will.

- $250,000 of our money was invested through ************* private banking into *******. $10,000 instantly disappeared in fees/commissions. We gave instructions to them take the funds out of ******* and to deposit the funds into our bank account but instead they put the money into another investment firm Raymond James without our authorization and then sent us client relationship paperwork to sign. We told them we did not want the money reinvested into Raymond James and told them to put the money back into our bank account. They then took it out of Raymond James but never gave it back. The money is now not in any accounts and numerous requests for the funds to be returned have gone unanswered. I see that this is just one of many similar complaints about these banks/firms. Instead of investment firms they should be called divestment firms.

Mortgage Options Raymond James Offers

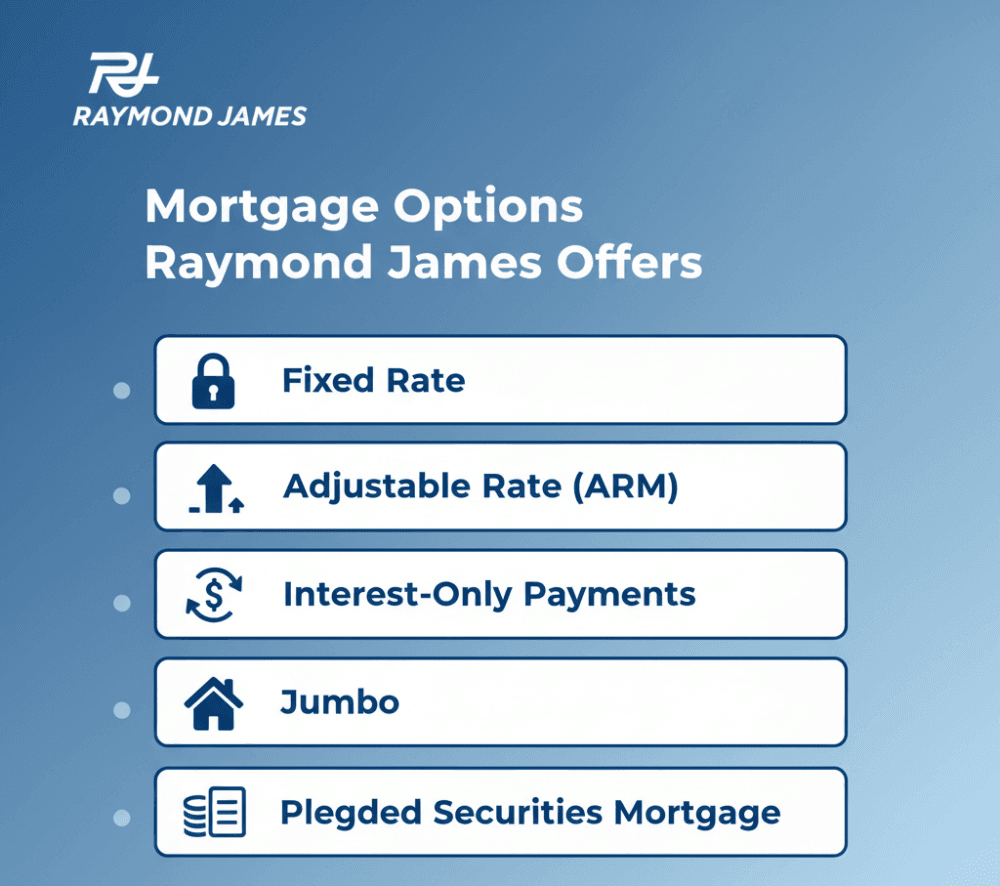

Raymond James Bank lists five headline mortgage product families on its mortgage page. Let's see what they are.

- Fixed Rate Mortgages: A mortgage with an interest rate that stays the same for the life of the loan. Raymond James lists typical 15- and 30-year fixed terms. Good for borrowers who want predictable monthly payments and plan to hold the home long-term.

- Adjustable Rate Mortgages (ARM): A loan that starts with a fixed rate for an initial term, which is commonly 5, 7, 10, or 15 years, then adjusts periodically. Raymond James explicitly offers 5/1, 7/1, 10/1 and a 15/1 ARM structure. ARMs can offer lower initial rates but carry interest-rate risk at the adjustment dates. Borrowers who plan to sell or refinance before the adjustment may benefit.

- Interest-Only Payments: A loan where, for an initial term, such as 5, 7, or 10 years, borrowers pay only interest but not principal, followed by principal and interest. It is often amortized over the remaining term. This lowers early monthly payments but does not reduce principal during the interest-only period, increasing future payment risk or balloon exposure. Raymond James offers interest-only options with initial interest-only fixed periods. Evaluate cash-flow timing and exit strategy carefully.

- Jumbo Mortgages: Loans that exceed conforming loan limits set by the federal agencies like Fannie Mae/Freddie Mac. Raymond James provides both fixed and adjustable jumbo options for higher-value purchases. Borrowers will face different underwriting (larger down payment, higher credit standards) and pricing than conforming loans.

- Pledged Securities Mortgage (PSM): A mortgage collateralized in part by margin-eligible securities held in a Raymond James investment account, plus the property. It can allow borrowing up to a high percentage, which sometimes up to 100% of purchase price in certain structures, without liquidating investments.

What People Say About Raymond James Mortgage?

Better to listen to what people are saying about Raymond James Mortgage. Let's see Raymond James Mortgage reviews on YELP and Trustpilot.

Yelp (2.5/5.0)

Yelp brand pages and local office pages show mixed experiences. The brand-level Yelp aggregation lists an average rating around 2.5/5 (sample size varies by location). Complaints on Yelp generally focus on customer service responsiveness, perceived high fees (usually connected to advisory/wrap accounts rather than mortgage principal/interest), and inconsistent advisor experiences. Positive reviews single out individual advisors who provided highly responsive, personalized service. Representative Yelp excerpts appear publicly on branch pages.

- I was an executive assistant at Raymond James for five years until I had an aneurysm rupture I loved ever aspect of my career at Raymond James and made some life long memories while I was there. I miss my work friends from there the most and I miss working for Andy Zolper the most.

- I have been a client for years. Recently , the stock market boomed but not my account. I have had two different advisors at Bangor locale and each person mismanaged my accounts. The first advisor deposited $$ into another investor's account.... in a separate incident year(s) later, the second advisor stated dates and bank account where money would be deposited (specified the date/time savings would be there) - that money never made it into the account (even waited an extra 24hrs). I find the Bangor locale to be high-end, not focused on the average person- and an attitude that goes with it. Communication with either advisor always seemed scripted and mainstream advice any investing firm would suggest as "sound advice".

- They're awful with the payouts. Im supposed to have auto deposit to my savings on the 1st of ea month. I understand weekends and holidays have to be delayed but the months where the 1st falls on a weekday and no holiday its continously late, doesnt arrive until the 2nd or 3rd. Its only a day or two, but when I'm counting on that money and my bills are late a day or two its a big deal to ME. It just seems very shoddy. I dont understand why this happens. It should be automated, i almost feel like instead, it's so guy in his boxers working in his garage, manually transferring my money. Get it together

Trustpilot (2.0/5.0)

Trustpilot aggregate scores for raymondjames.com are generally low, around 2.0/5. Trustpilot reviewers frequently complain about perceived poor customer service, lack of transparency in fee structures, and dissatisfaction with advisor support on matters like annuity distributions or account transfers. Positive Trustpilot reviews praise dedicated, competent advisors on a case-by-case basis.

- My Financial Advisor, Brianna Beski, Co. Springs Office, goes above and beyond, ensuring that she stays in touch reviews my portfolio and helps me make good decisions for my upcoming retirement. She takes ample time to explain things to me. She provides amazing educational workshops from Trust to Divorce. She reviewed my trust and answered all my questions. She even helped direct me on how to apply for my SSI widow benefits. She is absolutely the best Financial advisor I have worked with and I highly recommend her.

- Too much driven fees advisors...all they ever talked is fees upon fees, without setting up a plan on how to make good return on investment. search for libbey jane bean on google, if you need a professional broker/investment advisor, she will only charge you when you make return on investment.

- Totally dishonest company. Repeatedly asking for countless additional fees. No transparency. Promising instant payout after one final payment - only to keep coming up with another hidden payment. I lost a fortune to this scam company. Must be avoided at all cost!

FAQs About Raymond James Mortgage Reviews

More answers will be given to help you get rid of any questions. Let's go on reading.

Q1. Are Raymond James fees high?

For wealth/advisory accounts, some clients report wrap or advisory fees in the 1–2% range and additional account maintenance charges. These are industry-typical for full-service wealth managers and vary by account type. For mortgage products, Raymond James Bank promotes competitive mortgage pricing, but mortgage costs (rates, origination fees, third-party fees) depend on the program selected and the borrower's credit.

Q2. What is Raymond James' reputation?

Raymond James is a large, established firm founded in 1962 with a substantial advisor force and integrated banking services. It enjoys strong brand recognition for wealth management, but public reviews and recent regulatory actions show that customer service and transparency complaints exist, and the firm faced a FINRA enforcement action in 2024 related to complaint reporting and supervisory deficiencies.

Q3. What bank is associated with Raymond James?

Raymond James Bank is the affiliated bank for Raymond James Financial and is the entity that issues Raymond James-branded mortgage products (Raymond James Bank, NMLS ID 405712). The Bank is a member FDIC institution and lists mortgage products on its site.

Q4. What's special about Raymond James?

The firm's differentiators include its integrated wealth-management + banking model, a pledged securities mortgage product for sophisticated investors, and a national mortgage offering with no stated minimum loan or relationship-size requirement. Its reputation for personalized advisor service is cited often by satisfied clients, but the quality of experience appears to vary significantly by individual advisor and branch.

Q5. Who is better, Raymond James or Edward Jones?

"Better" depends on client needs. Raymond James is larger in wealth management, offers integrated banking and mortgage products and has a strong institutional & private client offering, Edward Jones is known for a neighborhood-branch advisor model with a different fee and service posture. Compare fee structures, local advisor reputation, and product fit, for example, if you require pledged-securities lending, Raymond James offers that specialized product. For a borrower focused strictly on mortgage rates and mortgage servicing, compare local pricing and loan terms from multiple lenders, don't rely on brand alone.

Conclusion

Raymond James Bank offers a full suite of mortgage products (fixed, ARM, interest-only, jumbo, pledged-securities mortgages) with nationwide availability and no stated minimum loan or relationship size to apply. Those features make it a viable option for a wide range of borrowers, including clients who want to integrate a mortgage strategy with wealth management. However, public reviews and a notable 2024 FINRA resolution show variability in customer experience and some firmwide supervisory weaknesses. Complaints are most commonly about communication, perceived fee transparency, and account handling. For prospective borrowers: get written fee disclosures and a Loan Estimate, confirm servicing contact paths, and compare rate/fee quotes from at least two other lenders before committing.