Top Picks: Best Asset-Based Mortgage Lenders in 2026

I've sat across from countless clients who share the same frustration: they are undeniably wealthy, yet "paper poor" in the eyes of traditional banks. You might have millions sitting in brokerage accounts, a robust cryptocurrency portfolio, or substantial retirement savings, but because you don't have a standard W-2 pay stub, Fannie Mae says "no." It is an incredibly isolating experience to have the means to buy a home cash-outright but still want to leverage a mortgage for financial planning.

Fortunately, the mortgage landscape in 2026 has evolved. You don't need a new job. You need an Asset-Based Mortgage, which is often called an asset depletion loan. These loans allow lenders to "virtualize" your liquid assets into a monthly income stream to qualify you. Below, I've curated the top lenders who actually understand high-net-worth borrowers and have moved beyond outdated income verification models.

Top Rated Asset-Based Mortgage Lenders Reviewed

I didn't simply pick these names out of a hat. The lenders listed below were selected based on specific, rigorous criteria: the flexibility of their asset calculations (how much "haircut" they give your stocks), their interest rate competitiveness in the current 2026 market, and their track record for closing complex non-QM loans.

While some of these lenders have headquarters in specific states, most offer nationwide coverage. Here is my breakdown of the best asset-based mortgage lenders to help you secure that dream home without the W-2 hassle.

1. North American Savings Bank (NASB)

Best for: Retirees and High-Net-Worth Individuals using IRA/401(k) assets.

States Available: Nationwide (all 50 states).

North American Savings Bank (NASB) stands out because it is a federally chartered bank, not just a fintech company. In my experience, this gives them a level of stability and process that many borrowers appreciate. They are a "Portfolio Lender," meaning they originate loans to keep on their own books rather than selling them to government agencies.

This allows them to make their own rules. Their asset depletion program is particularly robust for retirees. Unlike some lenders who ignore retirement accounts until you reach age 59½ for penalty-free access, NASB has specific formulas, such as hypothetical depletion over 360 months, to utilize eligible IRA and 401(k) balances effectively for qualification without requiring early withdrawals.

Pros

- Flexibility with Retirement Accounts: They are known for distinctively favorable calculations on IRA and 401(k) distributions compared to standard guidelines.

- Direct Lender Status: Since they hold the paper, decision-making is often faster and less bureaucratic than big box banks.

- High Customer Satisfaction: They consistently hold high ratings on platforms like Google Reviews and the BBB, which is rare in the mortgage industry.

- Competitive Rates: As a bank, their cost of funds is lower, often resulting in slightly better rates than pure non-QM hedge funds.

Cons

- Credit Score Requirements: They may require a slightly higher credit score (often 660-680+) compared to aggressive hard money lenders.

- Conservative LTV: You might not get the absolute highest Loan-to-Value ratio here. Expect to put down at least 20-25%.

- Strict Documentation: Even though they don't need income, they are thorough on asset verification trails.

2. Griffin Funding

Best for: Self-Employed borrowers and those needing speed/tech-driven process.

States Available: Nationwide (licensed in 49 states + D.C., excluding NY; including CA, FL, TX, WA).

If you need speed and a modern, tech-forward approach, Griffin Funding is a heavy hitter. They have carved out a massive niche in the "Non-QM" space. While they are famous for their VA loans, their Asset-Based and Bank Statement loans are top-tier.

What I appreciate about Griffin is their "Asset Depletion" logic: they can take your total liquid assets and divide them by a set term (often 60 to 84 months) to create a qualifying monthly income. This is a game-changer for gig economy workers or business owners who write off all their expenses.

Pros

- Low Credit Tolerance: They can often work with credit scores as low as 600-620, which is incredibly forgiving.

- High Loan Amounts: They are comfortable lending up to $3 million or more for luxury properties.

- Interest-Only Options: They offer Interest-Only (IO) features for up to 10 years, which helps keep monthly payments low for cash-flow management.

- Diverse Asset Acceptance: They are generally more open to counting different types of liquidity compared to traditional banks.

Cons

- Higher Fees: You might see higher origination fees or "points" compared to a standard conventional loan.

- Rate Premium: Their interest rates reflect the higher risk and flexibility, so expect a premium over the market average.

- Prepayment Penalties: Be sure to check for prepayment penalties on their investment property products.

3. New American Funding

Best for: Borrowers needing "Manual Underwriting" and personalized support.

States Available: Nationwide (licensed in all 50 states + D.C.)

New American Funding is a massive name in the industry, but they operate with the heart of a specialized lender. Their superpower is Manual Underwriting. In an age where algorithms automatically deny applications, New American Funding still uses human underwriters who look at the "whole story."

If your asset portfolio is complex, perhaps a mix of trust income, royalties, and liquid cash, their team is better equipped than most to untangle that web and find a way to say "yes." They offer a specific "Non-QM" suite that includes asset-based qualification.

Pros

- Human Touch: Real underwriters review complex files, reducing the chance of an algorithmic rejection.

- Flexible Terms: They offer a wide variety of loan terms, including 40-year mortgages in some programs to lower payments.

- Bilingual Support: They are an industry leader in serving diverse communities with excellent Spanish-language support.

- Broad Product Line: If asset depletion isn't the perfect fit, they can seamlessly switch you to a Bank Statement loan.

Cons

- Volume Delays: Because they are so large, turn times can sometimes be slower during peak market seasons.

- Verification Rigor: Their manual underwriting process, while helpful, can feel intrusive as they ask for explanations on many deposits.

- Rates: Competitive, but typically higher for their non-standard products compared to their conventional loans.

4. CrossCountry Mortgage

Best for: Complex scenarios requiring a local presence and face-to-face service.

States Available: Nationwide with thousands of local branches.

CrossCountry Mortgage has grown aggressively to become one of the largest retail lenders in the U.S. Their strength lies in its massive network of brick-and-mortar branches. For an asset-based loan, which requires explaining where your money is, sitting down with a Loan Officer locally can be invaluable.

They offer a proprietary suite of Non-QM products, often referred to as "Signature" or "Select" lines, which includes an Asset Qualifier product. This program allows you to qualify solely based on your liquid assets without disclosing employment information.

Pros

- Local Expertise: Having a local loan officer means they understand the specific housing market and property taxes in your area.

- Asset Qualifier Simplicity: Their program is straightforward, typically, if your liquid assets equal the loan amount plus 60 months of reserves/debt service, you qualify.

- Speed: Known for very fast closing times once the file is in underwriting.

- Flexibility: They accept a wide range of assets, including 100% of checking/savings/CDs and typically 80-90% of publicly traded stocks/bonds (with haircuts for volatility).

Cons

- Inconsistent Experience: Because they operate on a branch model, the service quality can vary heavily depending on which Loan Officer you get.

- Rate Transparency: It can be hard to get a clear rate quote online without speaking to a sales rep first.

- Fees: Watch out for "Admin fees" or "Underwriting fees" which can vary by branch.

5. Angel Oak Home Loans

Best for: The "Pure" Asset Qualifier experience and Flexible Guidelines.

States Available: Licensed in approx. 45 states (Check specific availability).

It is impossible to talk about asset-based lending without mentioning Angel Oak. They are effectively the pioneers of the modern Non-QM market. Please note, I am recommending Angel Oak Home Loans (their retail arm for consumers), not their wholesale division.

Their flagship product is the "Asset Qualifier Home Loan." This is arguably the most streamlined product on the market. Unlike others that calculate a "monthly income," Angel Oak often just looks at your total liquidity. If your liquid assets meet their formula, typically the loan amount divided by 240 months (20 years) to impute income, plus 6-12 months of reserves for PITIA and debt service, you qualify. No employment section on the application is even required.

Pros

- True "No Income" Loan: You literally do not list employment or income on the 1003 loan application.

- Forgiving on Credit Events: They have shorter waiting periods for bankruptcy, foreclosure, or short sales than standard banks (sometimes just 2 years).

- High Limits: They lend up to $3 million, making them ideal for luxury markets like California or Florida.

- 100% Gift Funds: In some programs, they allow gift funds to cover the down payment, which is rare.

Cons

- Post-Closing Liquidity: They want to see that you still have money left over after buying the house. You can't drain your accounts to zero.

- Rates: You are paying for the convenience of not showing income. Rates will be higher than a Full-Doc loan.

- Down Payment: Expect a minimum down payment of 20% to 30%, depending on your credit score.

Key Factors to Consider When Choosing the Best Asset-Based Mortgage Lender

Choosing a lender isn't just about who has the prettiest website. When you are applying for an asset depletion loan, the "devil is in the details." Here are the technical factors you need to scrutinize before signing:

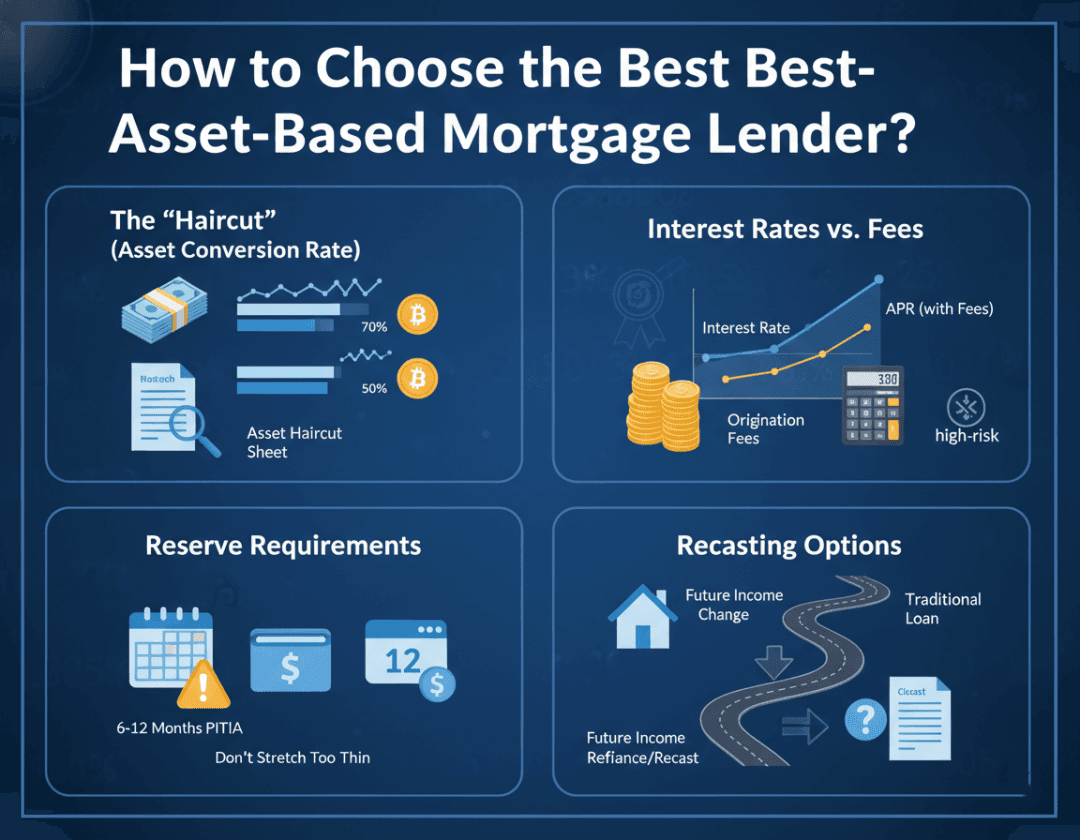

-

The "Haircut" (Asset Conversion Rate): This is the most critical factor. Lenders don't count all money equally. Cash in a checking account is usually counted at 100%. However, stocks and bonds might only be counted at 70% to 80% of their face value to account for market volatility. If you hold cryptocurrency, some lenders count it at 50%, while others (like some conservative banks) won't count it at all. Ask for their "Asset Haircut Sheet" upfront.

-

Interest Rates vs. Fees: Asset-based loans are considered higher risk. Expect interest rates to be 0.5% to 2% higher than a standard 30-year fixed conventional mortgage. Additionally, check the Origination Fees. Some lenders charge significantly higher points upfront to give you a "lower" rate. Always look at the APR, not just the interest rate.

-

Reserve Requirements: It is not enough to just have the down payment. Most of these lenders require 6 to 12 months of mortgage payments (PITIA) sitting in your account after you close on the house. Ensure you aren't stretching yourself too thin.

-

Recasting Options: Ask if the lender allows "Recasting." If your income situation changes in the future (e.g., you start showing high income on tax returns), can you refinance or recast the loan into a traditional lower-rate product easily?

Conclusion

Being asset-rich should be a ticket to financial freedom, not a barrier to homeownership. The "W-2 world" was built for the 20th century, but lenders like Angel Oak Home Loans, Griffin Funding, and NASB have adapted to the reality of 2026. Whether you are a retired executive or a crypto investor, an Asset-Based Mortgage is often the smartest lever you can pull to buy a home without liquidating your portfolio and triggering a massive tax event.

My final piece of advice? Don't settle for the first "Yes." Get a Loan Estimate (LE) from at least three of the lenders listed above. Compare the APR and the cash-to-close requirements side-by-side.

Disclaimer: I am a financial writer, not a licensed mortgage broker. Lending guidelines change daily. Please consult with a qualified mortgage professional to discuss your specific financial situation.