What is Asset-Based Loan in Mortgage? Definition and Example

There is nothing more frustrating than having a healthy bank account but being told by a lender that you can't afford a home. I've seen it happen countless times: a retiree with a robust portfolio or a self-employed entrepreneur who writes off expenses to save on taxes, only to be rejected for a standard mortgage because their "taxable income" looks too low.

This is where an Asset-Based Mortgage comes into play. Unlike commercial asset-based lending, which businesses use to borrow against inventory, in the residential world, this is a qualification method that looks at your wealth, not just your pay stub. It allows you to use your liquid assets to calculate a "phantom income," helping you qualify for a loan without needing to sell your investments or show high W-2 earnings.

What is an Asset-Based Loan in Real Estate?

In the mortgage industry, you might hear this referred to as "Asset Depletion" or "Asset Utilization." While the names sound technical, the concept is straightforward.

Instead of asking, "How much do you earn every month?", the lender asks, "How much liquid wealth do you have available to cover the payments?"

This type of loan falls under the Non-QM (Non-Qualified Mortgage) category. It is specifically designed for borrowers who don't fit the strict box of Fannie Mae or Freddie Mac guidelines.

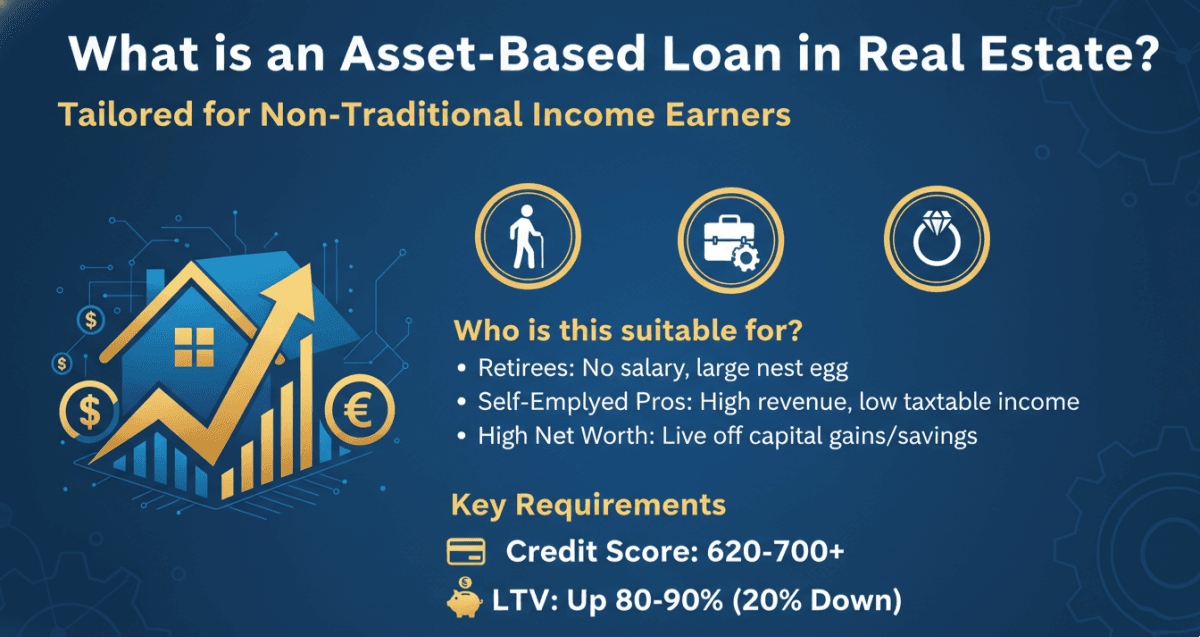

Who is an Asset-Based Loan Suitable for?

- Retirees: You have a large nest egg but no longer receive a salary.

- Self-Employed Professionals: Your business revenue is high, but your net income on tax returns is low due to deductions.

- High Net Worth Individuals (HNWIs): You live off capital gains or savings rather than a traditional paycheck.

Key Requirements of an Asset-Based Loan

U.S. lenders typically require a minimum credit score of 620-700, with many accepting 620-680 for qualified borrowers. LTV usually caps at 80% (20% minimum down payment), though some programs allow up to 90% LTV with stronger profiles. 20% down is standard.

The most critical thing to note is that you don't actually have to "deplete" or spend your assets. The lender simply uses a mathematical formula to determine if your assets could cover the loan term if needed.

Types of Assets Accepted for Qualification

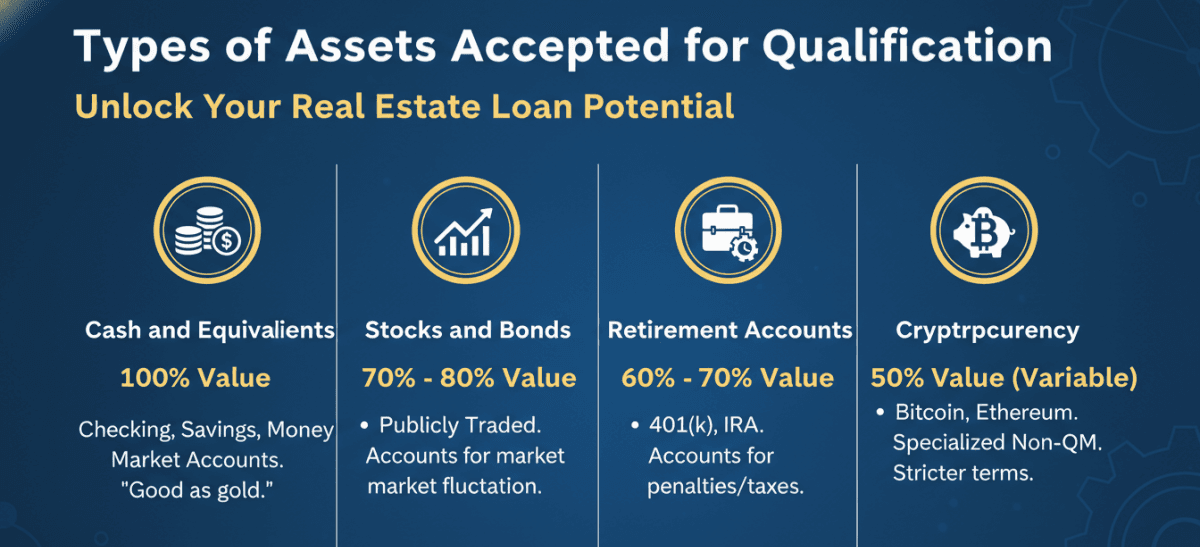

When we talk about "types" here, we are really talking about which buckets of money a lender will accept to calculate your income. Not all assets are created equal in the eyes of an underwriter.

Lenders apply a "haircut" (a percentage reduction) to certain assets to account for market volatility or withdrawal penalties. Based on current industry standards, here is the typical breakdown:

- Cash and Equivalents (100% Value): Money in checking, savings, and money market accounts is considered "good as gold." Lenders usually count 100% of these funds toward your qualification.

- Publicly Traded Stocks and Bonds (70% - 80% Value): Because the stock market fluctuates, lenders rarely count the full face value. If you have $1,000,000 in a brokerage account, they might only use $700,000 for income calculations to stay safe.

- Retirement Accounts (60% - 70% Value): For 401(k)s and IRAs, lenders must factor in early withdrawal penalties and taxes. Therefore, they usually count about 60% to 70% of the vested balance.

- Cryptocurrency: This is the new frontier. Some specialized Non-QM lenders now accept Bitcoin or Ethereum, but expect heavier haircuts (often 50%) and stricter documentation requirements compared to traditional cash.

How Does Asset-Based Loan Work?

The process might seem complex, but having guided many clients through it, I can break it down into a simple workflow. It's all about proving stability.

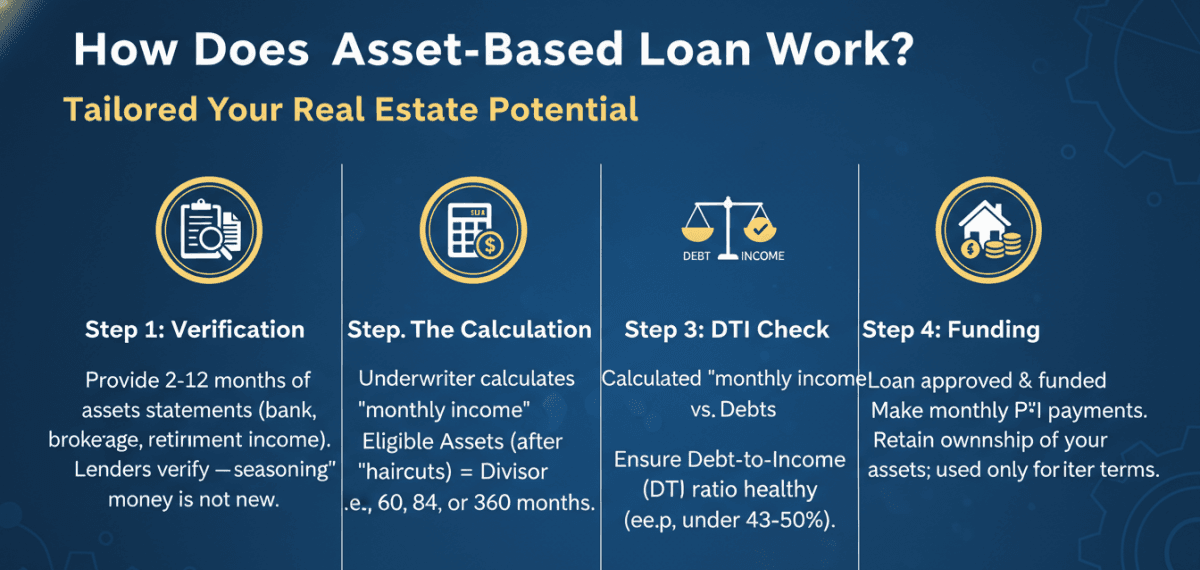

Step 1: Verification

First, you provide statements for all your accounts. Unlike a standard loan, where we look at 2 months of statements, for asset utilization, lenders typically require 2-12 months of asset statements to verify seasoning, with 2 months common for standard verification and longer (up to 12) for self-employed or irregular deposits. They want to ensure the money is "seasoned" (it has been there for a while) and didn't just appear yesterday.

Step 2: The Calculation

The underwriter takes your "Eligible Assets" after applying the haircuts mentioned above and divides that number by a specific term.

Some lenders divide by 60 months, while others use 84 months or the full loan term (360 months). A smaller divisor results in higher calculated income.

Step 3: DTI Check

The result of that calculation is your "monthly income." The lender then checks this against your debts to ensure your Debt-to-Income (DTI) ratio is healthy, which is usually under 43-50%.

Step 4: Funding

Once approved, the mortgage functions just like any other. You make monthly payments of principal and interest. You retain full ownership of your stocks and savings. They are simply used to qualify you.

Pros and Cons of Asset-Based Loans

Before you jump in, it is vital to weigh the benefits against the costs. This solution is a powerful tool, but it is not for everyone.

The Benefits:

- No Income Documentation: You can skip the headache of providing tax returns or P&L statements.

- High Buying Power: If you have significant savings, you can qualify for luxury properties that your tax returns wouldn't support.

- Investment Freedom: You don't need to liquidate your portfolio to buy the house in cash. You can keep your money invested in the market while leveraging a mortgage.

The Drawbacks:

- Higher Interest Rates: Because these are Non-QM loans, they carry slightly higher risk for the lender. Expect rates to be 0.5% to 1.5% higher than a standard Conventional loan.

- Larger Down Payment: While some conventional loans allow 3% down, asset-based loans typically require 20% down or more.

- Reserve Requirements: Lenders often want to see that after the down payment and closing costs, you still have 6 to 12 months of mortgage payments left in the bank.

Example of an Asset-Based Loan

Let's look at a real-world scenario to make the math sticky.

Meet Sarah, a retired graphic designer. She wants to buy a home in California for $1,000,000.

- She has no monthly pension.

- She has a stock portfolio worth $3,000,000.

Here is how the lender calculates her income:

-

Determine Eligible Assets: The lender counts 70% of her stock portfolio.

- $3,000,000 x 0.70 = $2,100,000.

-

Calculate Monthly Income: The lender uses an 84-month calculation term.

- $2,100,000 ÷ 84 = $25,000 per month.

Now, on paper, Sarah earns $25,000 a month.

Assuming her new mortgage payment, taxes, and insurance total $7,000/month, her DTI is roughly 28%. This is well within the safe zone, and she gets approved for the loan easily, despite having zero employment income.

Asset-Based Loans vs Traditional Loans

How does this stack up against the "Traditional" route, like a 30-year fixed Conventional loan?

Also Read: Difference Between QM and Non-QM Mortgage

Income Verification:

- Traditional: Focuses on history. Lenders demand W-2s and tax returns to prove you earned money in the past two years.

- Asset-Based: Focuses on solvency. Lenders look at your balance sheet to prove you have the money right now.

Speed and Complexity:

- Traditional: Can get bogged down if you have complex tax write-offs or declining income years.

- Asset-Based: Often faster for self-employed borrowers because there is no need to analyze complex tax schedules. However, verifying large asset transfers can trigger a lot of paperwork.

Cost:

- Traditional: Offers the lowest market rates.

- Asset-Based: You pay a premium (higher rate) for the flexibility of not showing income documents.

Conclusion

Asset-Based mortgages are a game-changer for people who are "asset rich but income poor." They bridge the gap between your true financial health and the rigid requirements of traditional banking, allowing you to leverage your wealth without liquidating it.

However, because guidelines for these loans vary wildly between lenders, especially regarding how they calculate income from your stocks or crypto. It is crucial to work with a specialist who understands the Non-QM landscape.

If you want to dive deeper into Asset-Based Loans or check your eligibility, you can find experienced Loan Officers near you at Bluerate for a free consultation.