Best Mortgage Loans for Self-Employed: Which to Pick in 2026?

If you are like me, you probably love tax season for the write-offs but dread it when it comes time to buy a house. It's the classic self-employed paradox: we work hard to lower our taxable income to pay Uncle Sam less, but that same "low income" on paper makes us look risky to traditional banks.

Back in the day, if your tax returns didn't show a massive profit, you were out of luck. But navigating the housing market in 2026 is different. The lending landscape has evolved significantly to accommodate the gig economy and business owners. Whether you are a freelancer, a contractor, or run an S-Corp, you don't necessarily need a perfect W-2 to buy a home anymore.

In this guide, I'm going to break down exactly which self-employed mortgage loans are best for self-employed borrowers this year, distinguishing between the "Standard" routes and the "Creative" solutions, so you can decide which path fits your financial profile.

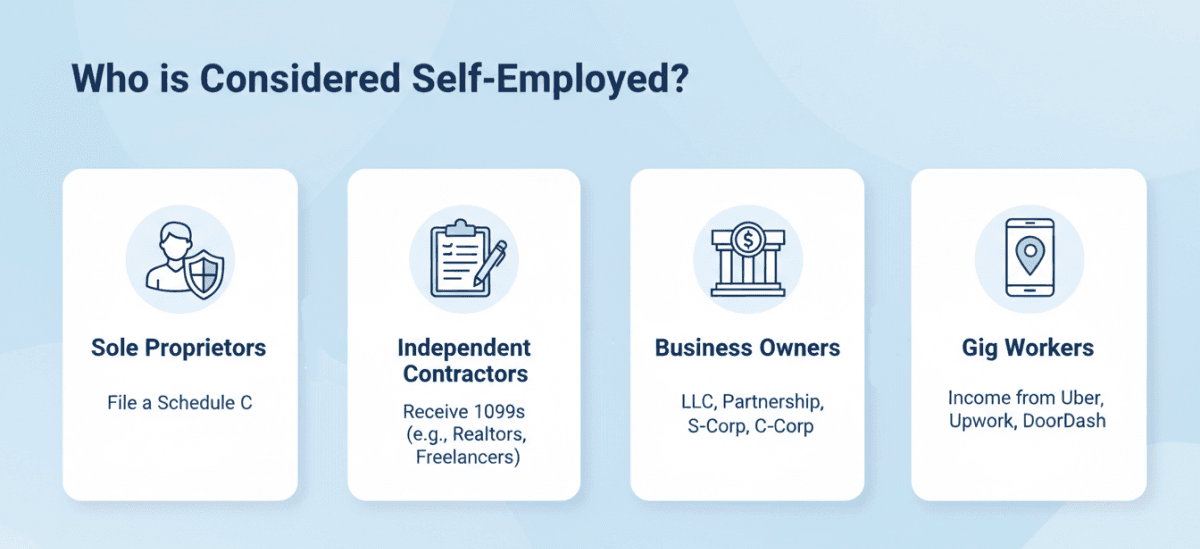

Who is Considered Self-Employed?

Before we dive into the loans, let's clarify if the banks actually view you as "self-employed." It's not just about owning a big company. In the eyes of major lenders like Fannie Mae, you are considered self-employed if you have a 25% or greater ownership interest in a business from which income is derived. Receiving 1099 income or lacking an employer guarantee also typically triggers self-employment documentation requirements.

If you check any of these boxes, this guide is for you:

- Sole Proprietors: You file a Schedule C with your personal tax returns.

- Independent Contractors: You receive 1099 forms instead of W-2s (e.g., realtors, freelance designers).

- Business Owners: You are part of an LLC, Partnership, S-Corp, or C-Corp.

- Gig Workers: Your income fluctuates based on platforms like Uber, Upwork, or DoorDash.

Understanding this status is crucial because it dictates the documentation trail you'll need to provide.

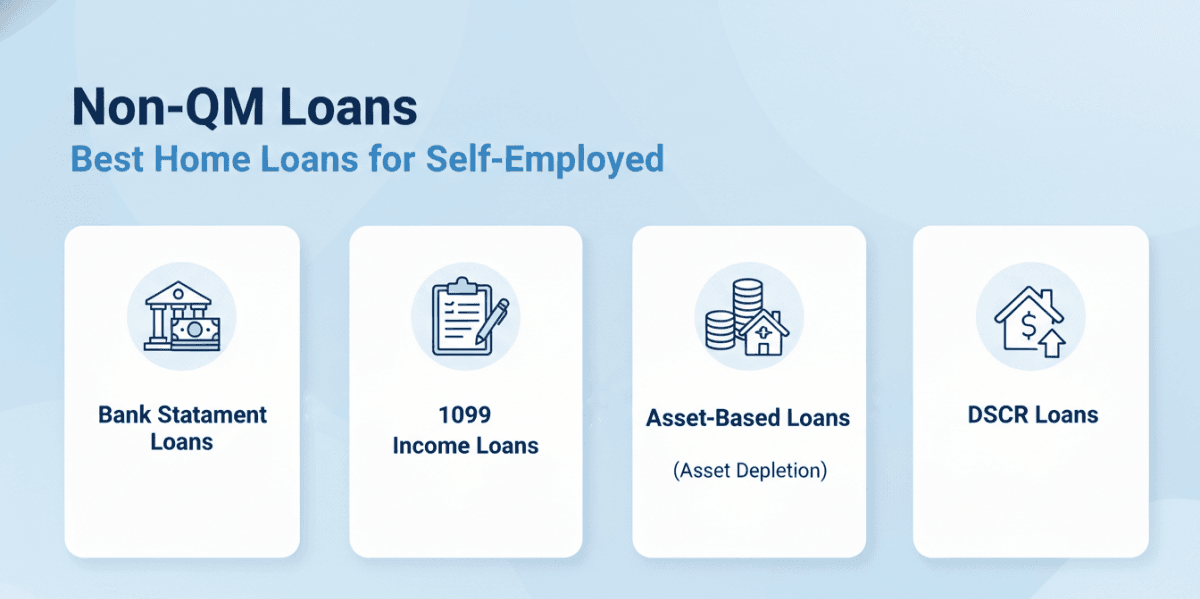

Non-QM Loans - Best Home Loans for Self-Employed

This is where things get interesting. Non-QM (Non-Qualified Mortgage) loans are my favorite recommendation for business owners who have strong cash flow but heavy tax deductions. These lenders don't care about your taxable net income. They care about your ability to pay.

Here are the top Non-QM options dominating the market in 2026.

Also Read: Non-QM Loan Requirements: Everything to Know At First

Bank Statement Loans

Best for: Business owners with high revenue but low "net income" on tax returns.

Min. Credit Score: Typically 600 - 660.

Min. Down Payment: 10% - 20%.

This is arguably the most popular alternative for self-employed buyers. Instead of looking at your tax returns and all those write-offs that lower your income, the lender looks at 12 to 24 months of your personal or business bank statements.

They calculate your income based on the average monthly deposits. For example, if you deposit $10,000 a month into your business account, they might count 50% to 100% of that as qualifying income, depending on your expense factor. It's a game-changer because it reflects your real cash flow, not just what you reported to the IRS. Just note that interest rates are usually 0.5% to 1% higher than standard loans, but the flexibility is worth it.

1099 Income Loans

Best for: 1099 contractors like real estate agents, consultants, and gig workers.

Min. Credit Score: Typically 660+.

Min. Down Payment: 10% - 20%.

If you are a freelancer or contractor who receives 1099 forms, this loan is specifically designed for you. Similar to bank statement loans, lenders ignore your tax returns entirely. Instead, they look at the "Gross Income" listed on your 1099 forms from the last 1 or 2 years.

They will apply a standard expense factor, often assuming your expenses are around 10% to 25%, to determine your net qualifying income. This is fantastic because Schedule C tax returns often show a much lower number after you've deducted home office expenses, mileage, and meals. This program allows you to qualify for a much larger loan amount.

Asset-Based Loans (Asset Depletion)

Best for: High net-worth individuals (HNWI) or retirees with large savings but low monthly income.

Min. Credit Score: Typically 700+.

Min. Down Payment: 20% - 30%.

I often suggest this to people who are "asset rich but cash poor." Maybe you sold a business or have a massive stock portfolio, but you don't have a steady monthly paycheck. With an Asset-Based Mortgage or Asset Depletion Loan, the lender takes your total liquid assets like cash, stocks, retirement accounts, and divides them by a set term, usually 60 or 84 months.

The resulting number is used as your "monthly income" for qualification. You don't actually have to liquidate your stocks or spend the cash. You just need to prove the money is there. It's a smart way to leverage your wealth without touching your investments.

DSCR Loans

Best for: Real Estate Investors buying rental properties (Not for primary residence).

Min. Credit Score: Typically 620 - 640.

Min. Down Payment: 20% - 25%.

Note: A DSCR loan cannot be used for the home you want to live in, but it is vital for self-employed investors building a portfolio. DSCR stands for Debt Service Coverage Ratio.

The lender doesn't care about your personal income, your tax returns, or your job history. They only care about one thing: Will the rental income cover the mortgage payment? If the rent is $2,500 and the mortgage is $2,000, the ratio is 1.25, and you are likely approved. This is the easiest loan to get paperwork-wise, making it a powerful tool for scaling a rental business in 2026.

Also Read:

- DSCR Loan Requirements 2026: Ratio, Credit Score, Down Payment, Type

- DSCR Loan Pros and Cons: Is It the Right Strategy for Your Investment?

- DSCR Formula: How to Calculate DSCR in Real Estate?

- Best DSCR Lenders Near Me 2026: Highlights, Pros & Cons

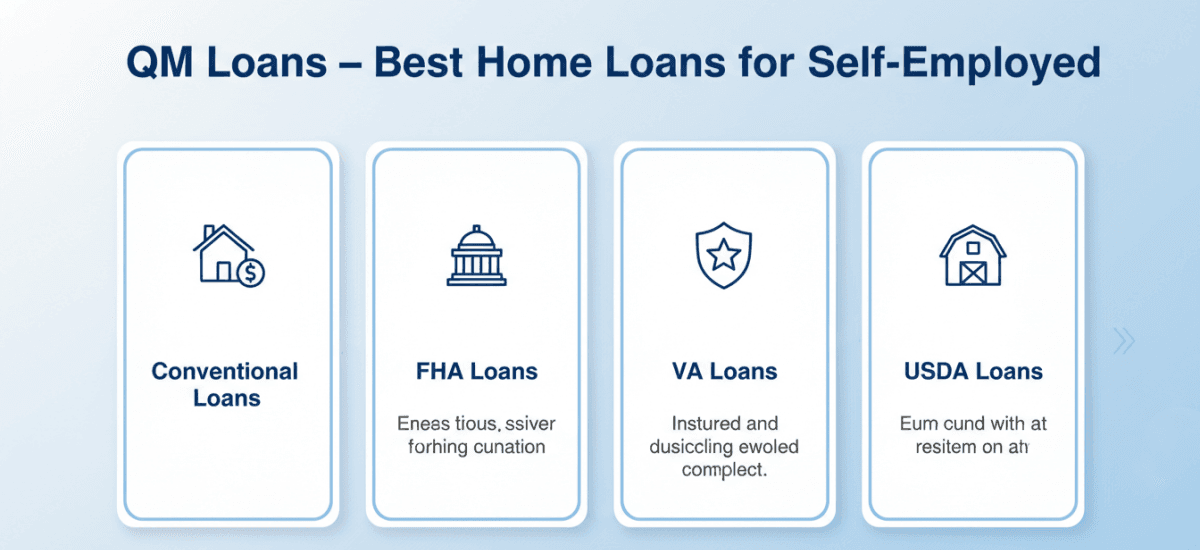

QM Loans - Best Home Loans for Self-Employed

QM (Qualified Mortgage) loans are the "Standard" loans, Conventional, FHA, and VA. While they are stricter with documentation, they offer the lowest interest rates and safest terms. If your tax returns look healthy, start here.

Also Read: Full Comparison: Difference Between QM and Non-QM Mortgage

Conventional Loans

Best for: Borrowers with strong credit (620+) and 2 years of consistent tax returns.

Min. Credit Score: 620.

Min. Down Payment: 3% (First-time buyers) or 5%.

Backed by Fannie Mae or Freddie Mac, these are the gold standard. To qualify, you usually need to provide two years of personal and business tax returns. The lender will average your net income from those two years.

However, there is a hidden gem for us: If the business has been in existence for five years or more with 25%+ borrower ownership throughout, and automated underwriting approves, lenders like Fannie Mae may require only one year of personal tax returns (business returns may still be needed). Declining income trends remain a red flag. Just remember, declining income from one year to the next is a major red flag for conventional underwriters.

FHA Loans

Best for: Borrowers with lower credit scores or higher Debt-to-Income (DTI) ratios.

Min. Credit Score: 580 (with 3.5% down) or 500 (with 10% down).

Min. Down Payment: 3.5%.

If your credit score has taken a hit or you have a lot of existing debt, an FHA loan is a forgiving option backed by the government. While they still require two years of tax returns, FHA guidelines permit total DTI ratios up to 56.9% or higher with strong compensating factors, making them more flexible than conventional loans (max ~50%).

The trade-off is that you have to pay Mortgage Insurance Premiums (MIP) for the life of the loan if you put down less than 10%. But for many self-employed folks just starting to stabilize their income, FHA provides a necessary foot in the door.

VA Loans

Best for: Self-employed Veterans, active-duty military, and eligible surviving spouses.

Min. Credit Score: None officially (Lenders often look for 580 - 620).

Min. Down Payment: 0%.

If you served and are now running your own business, this is hands down the best loan available. Zero down payment and no monthly mortgage insurance.

The catch for self-employed vets is the same as conventional: you need two years of tax returns to prove stability. However, VA loans prioritize residual income (post-debt/expenses amount for family living) over DTI ratios alone, which serves as a secondary guideline.

USDA Loans

Best for: Low-to-moderate income borrowers looking to buy in designated rural areas.

Min. Credit Score: Typically 640.

Min. Down Payment: 0%.

USDA loans are geographically restricted, and you must buy in a qualified "rural" area (which actually covers 97% of the US land mass). They offer 0% down payment, which is incredible.

However, they have strict income limits. If your business was too successful in 2025, you might actually make too much money to qualify. This is ideal for freelancers living in smaller towns who have modest, steady income and want to avoid a down payment.

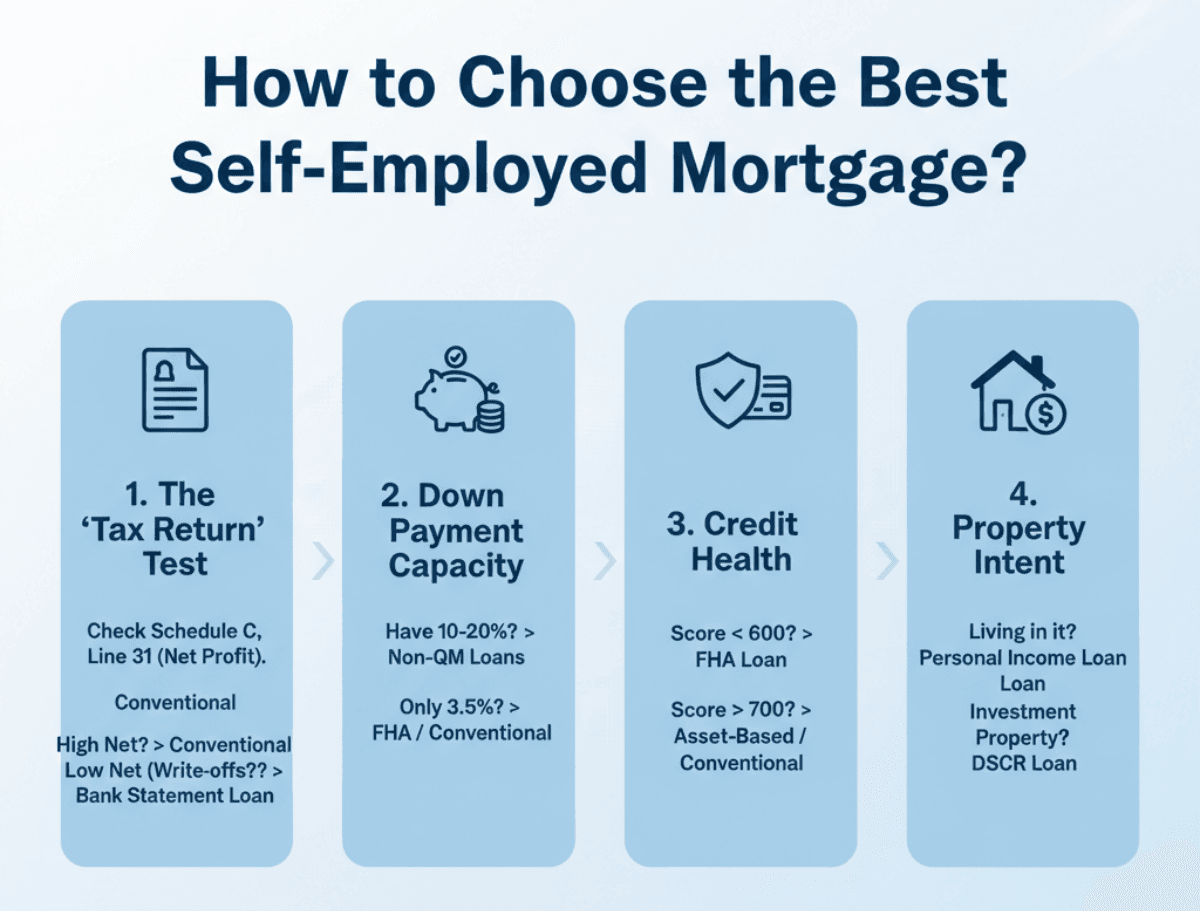

How to Choose the Best Self-Employed Mortgage?

With so many acronyms, how do you actually pick? In my experience, it comes down to a simple decision tree based on your paperwork.

Here are the key factors to consider:

-

The "Tax Return" Test: Look at line 31 of your Schedule C (Net Profit). Is it high enough to support a mortgage? If yes, go Conventional for the best rates. If no (because you wrote everything off), go Bank Statement Loan.

-

Down Payment Capacity: Non-QM loans usually require at least 10-20% down. If you only have 3.5% saved up, you are likely restricted to FHA or Conventional paths.

-

Credit Health: If your score is under 600, FHA is your safest harbor. If you are above 700, the world of Asset-Based and Conventional opens up.

-

Property Intent: Are you living there? If not, stop looking at personal income loans and switch immediately to DSCR for investment properties.

How to Get a Mortgage When Self-Employed?

Getting approved requires a bit more strategy than your W-2 friends. You can't just walk into a bank branch and hope for the best. Here is my battle-tested plan:

-

Separate Your Finances: If you are still buying groceries out of your business checking account, stop. Lenders need to see a clean separation between business expenses and personal money.

-

Lower Your DTI: Pay off credit cards before applying. Lenders calculate your Debt-to-Income ratio carefully. Eliminating monthly payments boosts your borrowing power.

-

Prepare the "Add-Backs": Work with a CPA. Lenders can "add back" certain non-cash deductions like Depreciation or Business use of home to your income, making you look wealthier on the application.

-

Find a Specialist: This is crucial. Big box banks often say "no" to self-employed borrowers simply because they don't want to do the complex manual underwriting. You need a Loan Officer who specializes in Non-QM or self-employed advocacy.

I used to spend hours calling different brokers, asking if they offered bank statement loans. It was exhausting. Now, there are smarter ways to search. I recommend checking out Bluerate to find help. It's an AI-driven platform that matches you with local loan officers who specifically understand self-employed profiles. You can get a free consultation without the cold-calling headache.

FAQs About Best Mortgage Loans for Self-Employed

Q1. Can I get a mortgage with only 1 year of self-employment?

Yes. While 2 years is the standard, you can qualify with 1 year of tax returns on a Conventional loan if you have a previous 2-year work history in the same line of work (e.g., you went from an employed plumber to a self-employed plumber).

Q2. Which mortgage lender is best for self-employed?

There isn't one single "best" bank, but generally, Mortgage Brokers are better than big commercial banks like Chase or Wells Fargo for us. Brokers have access to wholesale Non-QM lenders who specialize in Bank Statement loans. Using a tool like Bluerate can help you locate these specialized brokers quickly.

Q3. How to get approved for a mortgage when self-employed?

Focus on "Net Income," not "Gross Revenue." Organize your P&L (Profit and Loss) statement, ensure your business license is active, and if your tax returns are weak, be prepared to provide 12 months of bank statements for an alternative loan type.

Q4. What do I need to show for a self-employed mortgage?

For traditional loans: 2 years of 1040 tax returns, Schedule C, 1099s, and a year-to-date P&L statement.

For Non-QM loans: 12-24 months of business/personal bank statements or a CPA letter verifying your business ownership and expense ratio.

Also Read: Self-Employed Mortgage Requirements: What to Prepare?

Q5. How does self-employed income work for a mortgage?

Lenders look at the average of your last two years of net income. However, they can "add back" non-cash expenses. For example, if your net income is $50,000 but you claimed $10,000 in depreciation, the lender may count your income as $60,000.

Q6. How to provide proof of income when you are self-employed?

If you can't use tax returns, your Bank Statements become your proof of income. Lenders will sum up your total deposits for the year, subtract a standard expense factor (e.g., 50%), and use the remaining amount to calculate your monthly income.

Conclusion: Which Loan is Best for Self-Employed?

Buying a home when you work for yourself isn't impossible. It just requires picking the right tool for the job.

If you have excellent records and show a good profit on your taxes, stick to Conventional loans, because they are cheaper. But if you are like most business owners and maximize your deductions, don't be afraid to use a Bank Statement Loan. Yes, the rate is slightly higher, but it allows you to buy a home without owing the IRS thousands of dollars in extra taxes just to "look good" on paper.

The market in 2026 is full of options, but they are complex. Don't try to navigate this alone. I highly recommend connecting with a pro who knows the ins and outs of these programs. You can start by getting a free consultation with a nearby loan officer via Bluerate to see exactly how much you can qualify for today.