Self-Employed Mortgage Guide 2026: How to Get, Requirements

I recently came across a thread on Reddit where a user asked a question that keeps so many business owners up at night: "Is it possible to get a mortgage being self employed? What do I need?"

I felt that frustration. You work twice as hard as a W-2 employee, you make good money, but because you possess a smart accountant who minimizes your tax bill, the bank thinks you're broke.

The short answer? Yes, you can absolutely get a mortgage.

However, the rules in 2026 are different for us. Standard banks might reject you, but that doesn't mean you can't buy a home. In this guide, I'm going to walk you through exactly how to qualify, the specific documents you actually need, and how to bypass the "tax return trap" using modern Non-QM options.

Can Self-Employed Get a Mortgage?

Let's cut straight to the chase: Yes, self-employed individuals can get mortgages. In fact, with the rise of the gig economy, lenders have had to adapt.

The confusion comes from a misunderstanding of how lenders view income. When you walk into a big bank like Wells Fargo or Chase, they typically try to fit you into a "Qualified Mortgage" (QM) box backed by Fannie Mae or Freddie Mac. These loans rely heavily on your Net Income (what's left after expenses) shown on your tax returns, not your Gross Income (what you actually earned).

If you wrote off $50,000 in business expenses last year, the bank sees that as $50,000 you didn't earn. But don't panic. If your tax returns don't look strong enough, there is a whole other sector of lending designed specifically for you.

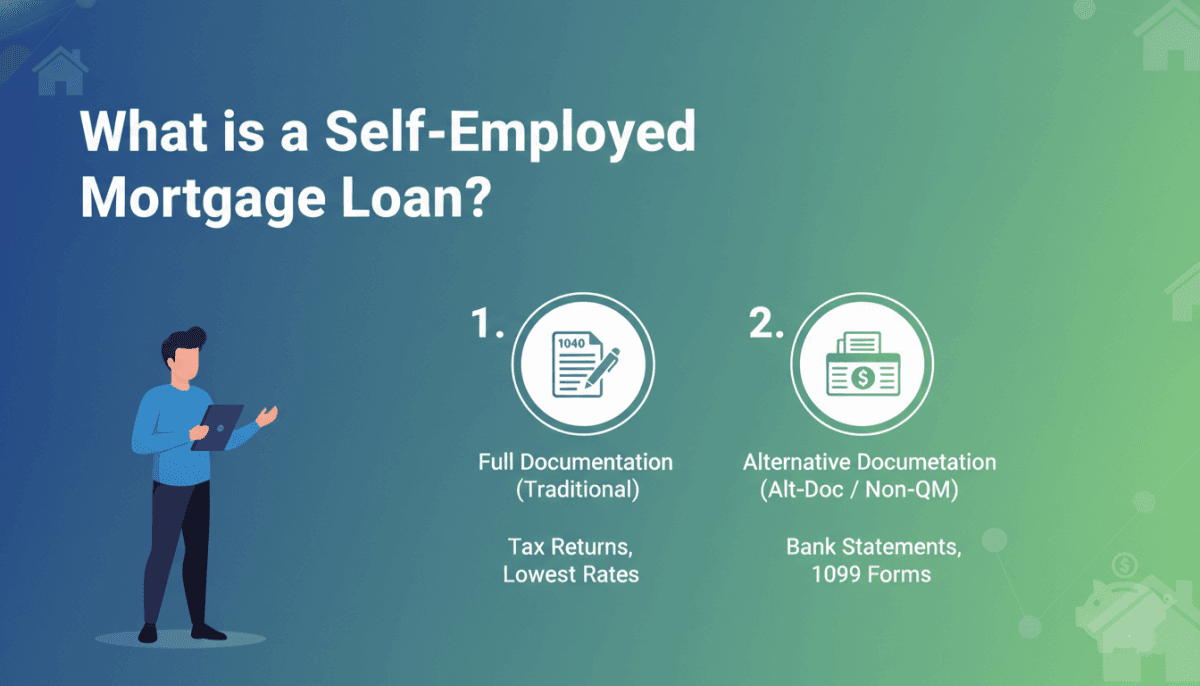

What is a Self-Employed Mortgage Loan?

When we talk about a "Self-Employed Mortgage," we aren't usually talking about a specific product name. We are talking about the method of verification.

Generally, there are two paths you can take:

-

Full Documentation (Traditional): You provide two years of tax returns (1040s, Schedule C, etc.). This is great if you show high net income on paper, as you'll get the lowest interest rates.

-

Alternative Documentation (Alt-Doc / Non-QM): This is the game-changer for most business owners. Instead of using tax returns, lenders use other ways to prove you can repay the loan, such as your bank statements or 1099 forms.

These "Non-QM" (Non-Qualified Mortgage) loans acknowledge that a business owner's tax return is designed to save on taxes, not to impress a mortgage underwriter.

Also Read: Full Comparison: Difference Between QM and Non-QM Mortgage

Types of Self-Employed Mortgage

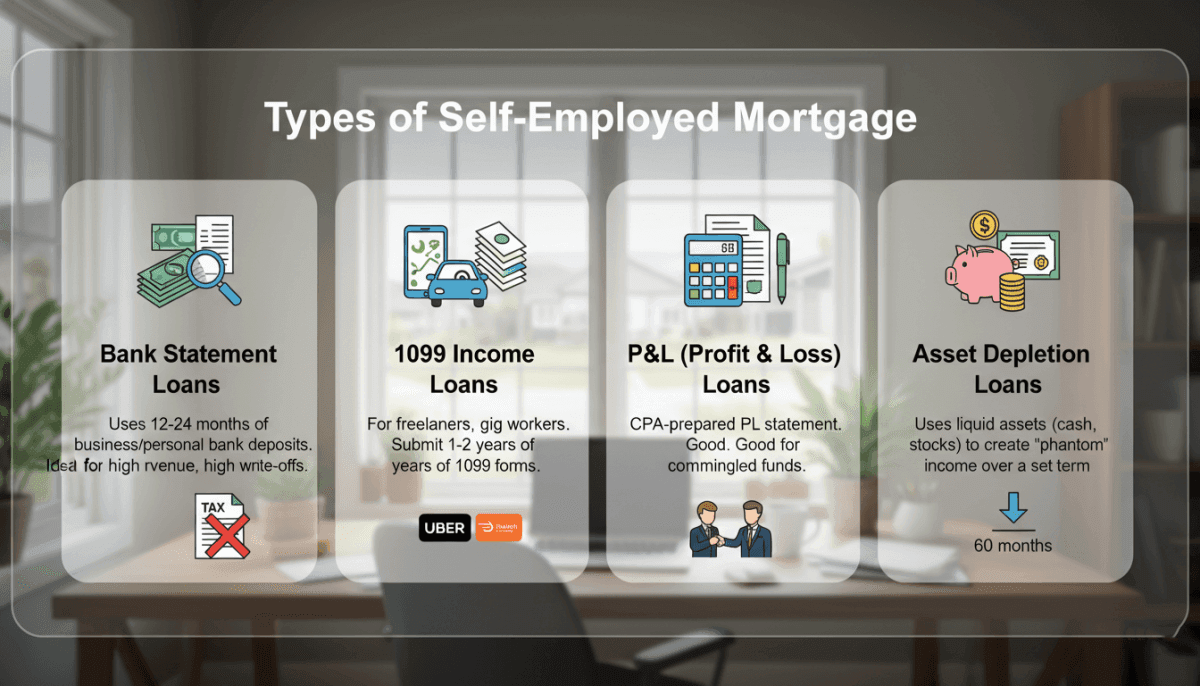

If you cannot qualify with your tax returns, you will likely look into Non-QM loans. From my experience helping clients, these are the most effective types in 2026:

-

Bank Statement Loans: This is the most popular option. The lender ignores your tax returns completely. Instead, they look at 12 to 24 months of your business or personal bank statements. They tally up your total deposits to calculate your monthly income. It's a lifesaver if you have high revenue but high write-offs.

-

1099 Income Loans: Designed specifically for freelancers, gig workers like Uber drivers or DoorDashers, and independent contractors. You simply submit your 1099 forms from the last 1-2 years.

-

P&L (Profit & Loss) Loans: If your bank statements are messy (maybe you commingle funds), a lender might accept a P&L statement prepared and signed by your CPA or tax professional.

-

Asset Depletion Loans: Got a lot of cash in the bank or stocks but no steady monthly income? This loan uses your total liquid assets and divides them by a set term, like 60 months, to create a "phantom" monthly income for qualification.

Also Read: Best Mortgage Loans for Self-Employed: Which to Pick in 2026?

Pros and Cons of Self-Employed Mortgage Loans

Before you dive in, you need to weigh the trade-offs. Non-QM loans are powerful tools, but they come with a price.

Pros:

-

High Approval Rate: You can get approved even if your tax returns show a loss.

-

Tax Efficiency: You don't have to amend your taxes and pay the IRS thousands of dollars just to qualify for a house. You keep your write-offs.

-

Flexibility: These lenders understand business structures better than big box banks.

Cons:

-

Higher Interest Rates: Expect to pay rates that are 0.5% to 1.5% higher than a standard fixed-rate mortgage. Lenders view you as "higher risk" because there is no government backing.

-

Larger Down Payment: Be prepared to put down at least 10%. If your credit score is under 680, they might ask for 15-20%.

-

Prepayment Penalties: Prepayment penalties on some Non-QM loans, which are often 3-5 years, e.g., six months' interest, apply mainly to business-purpose or investment loans, but many primary residence self-employed mortgages do not include them. You should always confirm with the lender.

What are Self-Employed Mortgage Requirements?

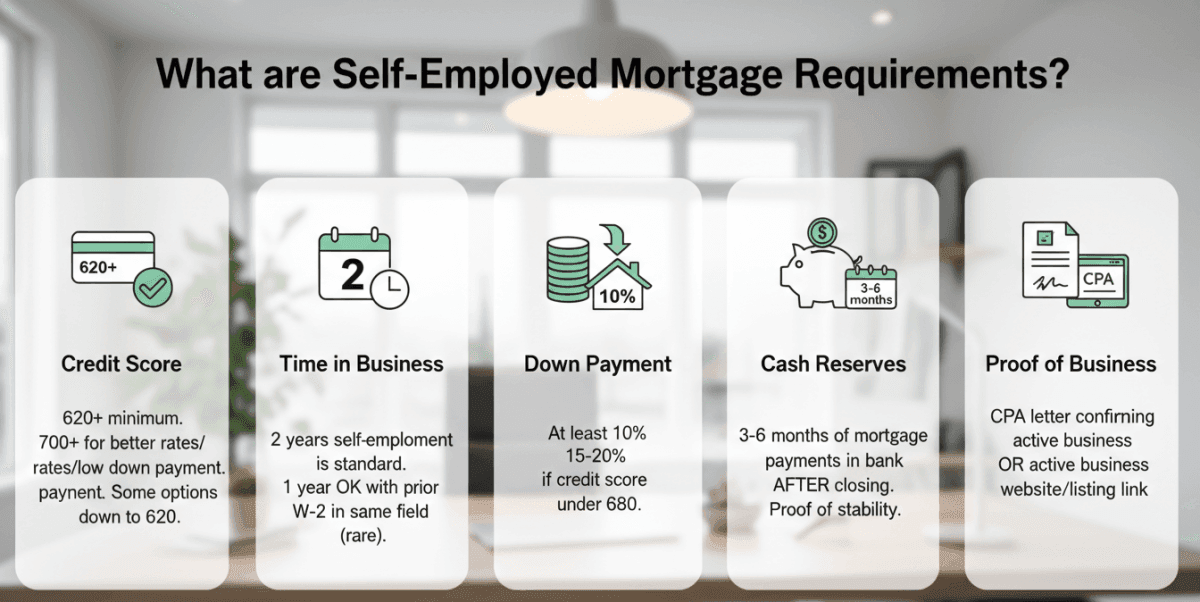

While every lender has their own "overlay" (internal rules), here is what you generally need to prepare for in 2026. If you can check these boxes, you are in good shape.

-

Credit Score: Most lenders look for a score of 620 or higher. Bank statement loans generally require a minimum credit score of 620-640, with 700+ preferred for better rates or lower down payments, but low-down-payment options exist at scores as low as 620, depending on the lender.

-

Time in Business: The gold standard is 2 years of self-employment history. Some aggressive Non-QM lenders will accept 1 year if you have previous W-2 experience in the same field, but this is rare.

-

Down Payment: Be prepared to put down at least 10%. If your credit score is under 680, they might ask for 15-20%.

-

Cash Reserves: This is often overlooked. Lenders want to see that after you pay your down payment and closing costs, you still have 3 to 6 months of mortgage payments left in the bank. This proves your business can survive a slow month.

-

Proof of Business: You may need a CPA letter stating you are still in business, or a link to your active business website/listing.

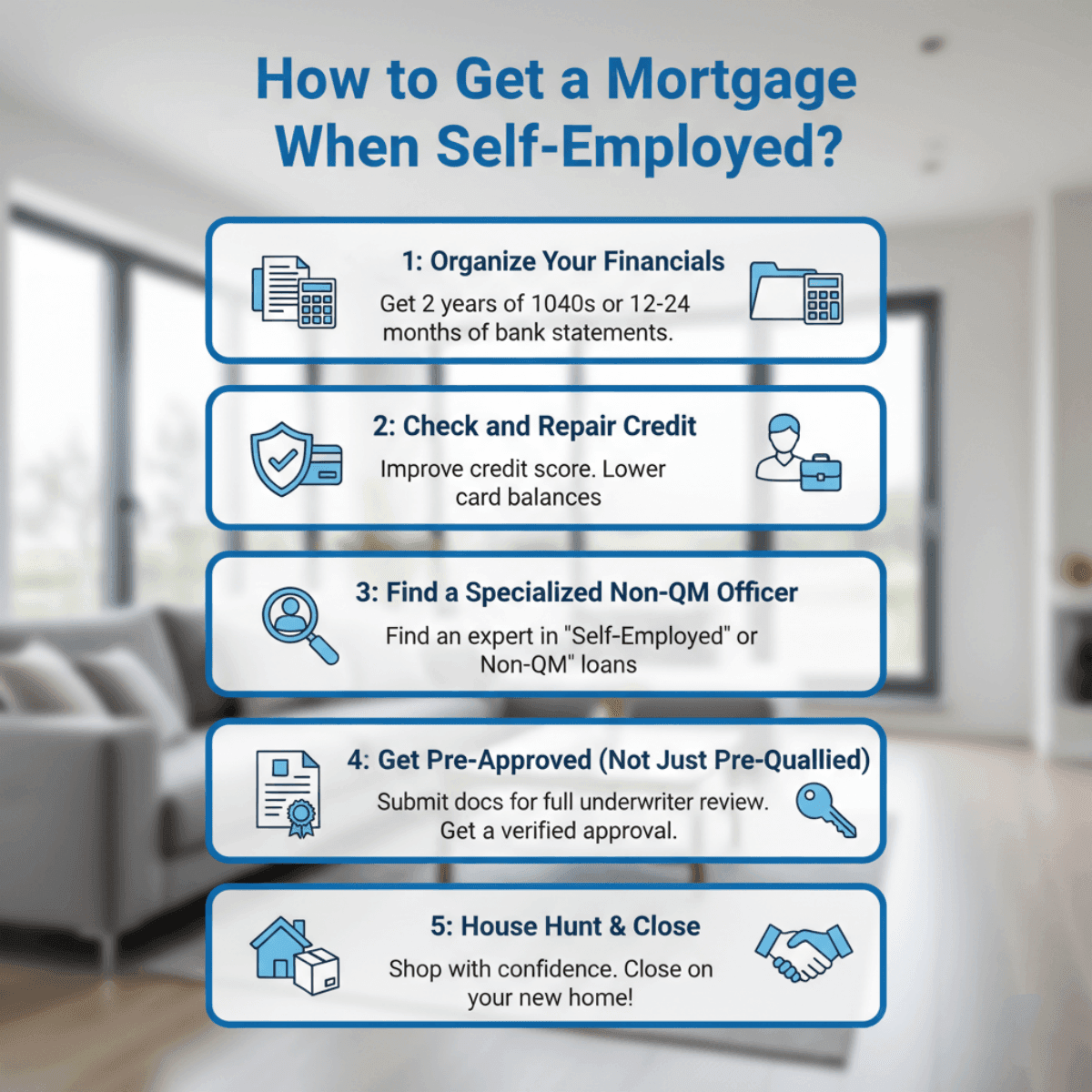

How to Get a Mortgage When Self-Employed?

Getting approved requires more strategy than a regular loan. Here is the step-by-step process I recommend to ensure you don't get denied at the last minute.

Step 1: Organize Your Financials

Decide your path early. If you are using tax returns, get your last two years of 1040s ready. If you are going the Non-QM route, download the last 12-24 months of PDF bank statements (all pages, even the blank ones).

Step 2: Check and Repair Credit

Since interest rates are higher for us, a better credit score can save you hundreds per month. Pay down credit card balances to lower your utilization before applying.

Step 3: Find a Specialized Non-QM Loan Officer

This is the most critical step. Do not walk into your local checking account bank branch. The tellers there often don't know how to structure these loans. You need a loan officer who specializes in "Self-Employed" or "Non-QM" products.

It's recommended to use a mortgage marketplace like Bluerate. They allow you to search specifically for loan officers who handle Non-QM loans. You can compare different officers, ask them about their experience with bank statement loans, and get quotes without running around town. It saves a ton of time and helps you avoid rookies.

Step 4: Get Pre-Approved (Not Just Pre-Qualified)

Submit your docs to your chosen officer. Ask for a full underwriter review. A "Pre-Qualification" letter is worthless for self-employed buyers. You need a verified approval to make an offer that sellers will trust.

Step 5: House Hunt & Close

Once you have that solid approval, you can shop with confidence.

How to Improve Mortgage Chances as Self-Employed?

If you are planning to buy in the next 6-12 months, you can take action now to make your application bulletproof.

-

Separate Business and Personal Expenses: This is the #1 mistake I see. If you pay for groceries out of your business account, or business software out of your personal account, it creates a nightmare for underwriters. Stop doing this immediately. Keep two distinct accounts.

-

Boost Your Credit Score: As mentioned, Non-QM rates are tiered by credit score. Moving from a 680 to a 720 could drop your interest rate by 0.5%.

-

Minimize Deductions (If going Traditional): If you are determined to get a conventional Fannie Mae loan, talk to your CPA about claiming fewer write-offs this year to show a higher net income. It means paying more taxes, but it makes qualifying easier.

-

Save for a Larger Down Payment: Money talks. If your income documentation is a bit "grey," offering a 25% down payment can often get an underwriter to overlook other minor issues.

FAQs About Self-Employed Home Loans

Q1. Is it hard to get a mortgage being self-employed?

It is not necessarily "harder," just different. It requires more paperwork. If you try to apply like a W-2 employee, you will fail. But if you use the right program, like a Bank Statement Loan, the difficulty is about the same as a regular loan.

Q2. Can I get approved for a mortgage if I am self-employed?

Absolutely. Millions of business owners own homes. The key is proving your ability to repay. As long as you have cash flow (deposits) or assets, there is a lender willing to work with you.

Q3. What are the risks of self-employed mortgages?

The main risk is the interest rate. Because you aren't backed by the government, rates can be higher. Also, ensure you understand the terms and avoid loans with "Balloon Payments" unless you have a solid plan to pay them off.

Q4. How to calculate self-employed income for mortgage loans?

For Traditional Loans, lenders usually average the "Net Profit" from Schedule C over two years.

For Bank Statement Loans, they take your total eligible deposits for 12 months, multiply by an "Expense Factor" (usually assuming 50% expenses, though this varies by industry), and divide by 12 to get your monthly income.

Conclusion

Being your own boss shouldn't disqualify you from owning a home. While the process involves more scrutiny than it does for a salaried employee, the "Self-Employed Mortgage" market in 2026 is robust and full of options.

Don't let a rejection from a big bank discourage you. They simply weren't looking at the right data. The secret to success is working with a loan officer who understands the nuances of 1099 income and bank statement verification.

If you aren't sure where to start, I highly recommend visiting Bluerate. It's an excellent resource to find and chat with experienced non-QM loan officers for free. Buying a home is a big step. Make sure you have an expert in your corner who knows how to fight for your approval.