Self-Employed Mortgage Requirements 2026: What to Prepare?

I still remember the sinking feeling when I first applied for a mortgage as a freelancer. I had money in the bank, but on paper, my tax returns made it look like I barely scraped by. If you are reading this in 2026, you likely share that anxiety. You want to buy a home, but you're worried your 1099 income or business deductions will disqualify you.

The good news? It is entirely possible to get approved, but the rules are different for us than for W-2 employees. Since mortgage guidelines and state regulations shift constantly, preparation is your best defense. While this guide covers the essentials, I highly recommend finding a local loan officer to navigate your specific state's policies for the most accurate assessment.

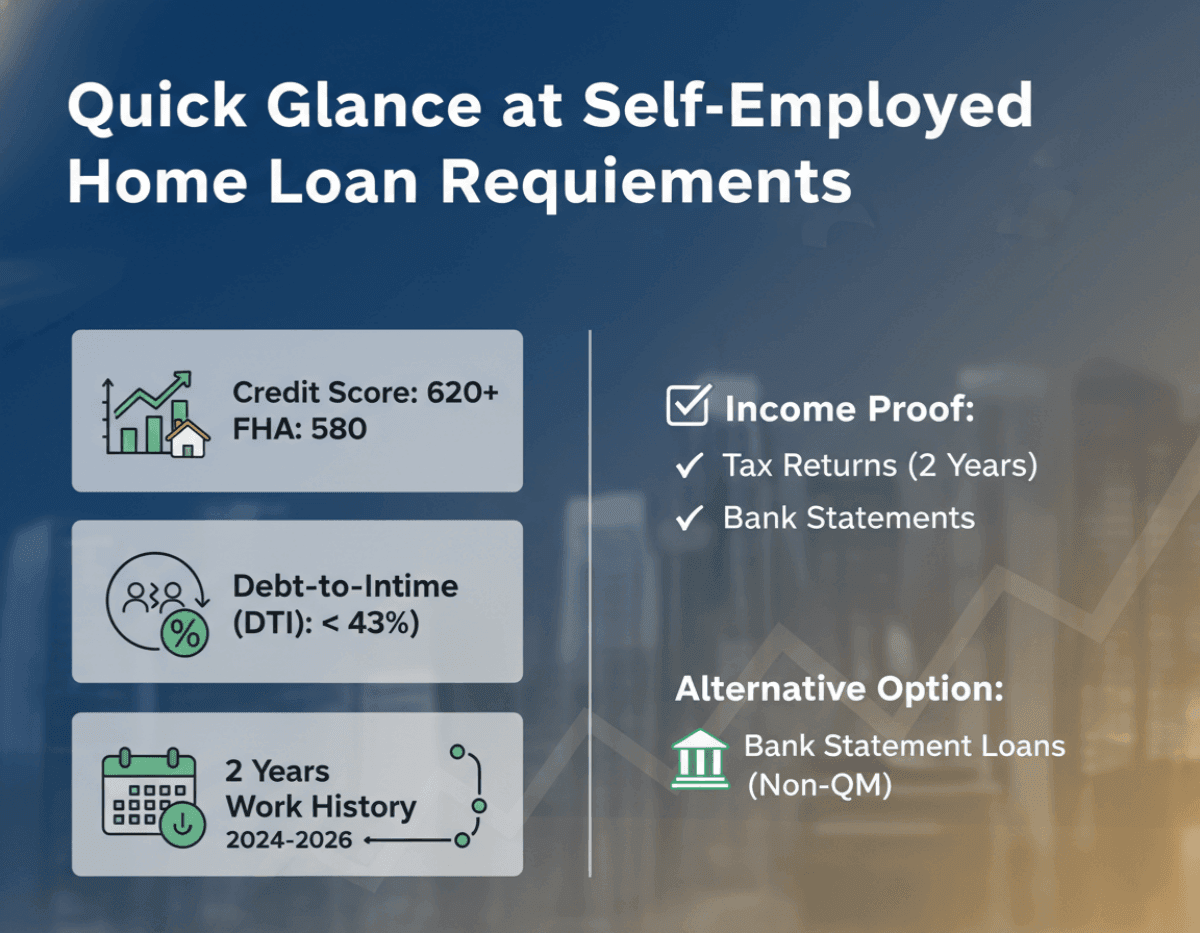

Quick Glance at Self-Employed Home Loan Requirements

If you are in a rush, here is the "cheat sheet" for 2026. These are the baseline benchmarks most underwriters will look for before diving into your file. This section is designed to give you a quick "Yes/No" self-assessment.

-

Credit Score: Generally 620+ for Conventional loans. 580+ for FHA loans.

-

Debt-to-Income (DTI): Ideally below 43%, though up to 50% is possible with strong cash reserves.

-

Work History: A standard of 2 years of self-employment history in the same industry.

-

Income Proof: Two years of personal and business tax returns (1040s, Schedule C, or K-1s).

-

Alternative Option: If your tax returns show low income, ask about Bank Statement Loans (Non-QM), where lenders look at deposits rather than taxable income.

Self-Employed Home Loan Requirements 2026

While agencies like Fannie Mae and Freddie Mac set the standard rules, every lender interprets risk differently. In 2026, lenders are scrutinizing the stability of your income more than ever. Below are the specific pillars you need to build your application on with self-employed home loans.

Income Verification (Tax Returns vs. Alternative Methods)

This is where 90% of self-employed confusion happens. Lenders do not look at your Gross Revenue (what you invoiced). They look at your Net Income (what you paid taxes on). If you wrote off everything to save on taxes, your "qualifying income" might be too low.

However, here is an insider detail often missed: Add-backs. Experienced loan officers know that some deductions are "paper losses," not real cash outflows. We can often "add back" expenses like Depreciation, Depletion, and sometimes Business Use of Home to your income total. This instantly boosts your borrowing power.

If your net income on tax returns is still too low, do not panic. You may qualify for a Bank Statement Loan. In this scenario, the lender ignores tax returns and calculates income based on the average deposits into your business bank account over 12-24 months.

Stable Cash Flow

Lenders are obsessed with trends. They want to see that your business is stable or growing. They will compare your 2024 tax return against your 2025 return.

-

Increasing Income: If 2025 was better than 2024, they typically average the two years.

-

Declining Income: This is a red flag. If your income dropped in 2025, the underwriter might use the lower amount or reject the loan if the drop is severe.

You need to be prepared to write a "Letter of Explanation" if there was a dip in income due to a one-time event (like taking parental leave or a supply chain issue) to prove the business is still healthy.

Credit Score

For self-employed borrowers, your credit score acts as a trust signal. Because our income fluctuates, lenders view us as "higher risk." A strong credit score helps offset that perceived risk.

-

Conventional Loans: Typically require a FICO score of 620 or higher.

-

FHA Loans: Allow scores as low as 580 or higher for 3.5% down payment. Scores of 500-579 qualify with 10% down payment, though many lenders require 580+.

Note that mortgage lenders use a specific FICO model (usually FICO 2, 4, and 5), which might differ from the free credit score you see on your banking app. I always suggest aiming 20 points higher than the minimum requirement to be safe.

Debt-to-Income (DTI) Ratio

Your DTI is the percentage of your monthly gross income that goes toward paying debts (credit cards, student loans, and the new mortgage). The "magic number" is usually 43% or lower.

Here is a crucial tip for business owners: Business Debt Exclusion. Business-paid debts like car loans can sometimes be excluded from personal DTI if proven with 12 months of business bank statements showing consistent payments, but this applies mainly to housing-related or fully business-deducted debts. Personal credit card debts paid by business may not qualify as easily and depend on lender policy. This can significantly increase the home price you qualify for.

Business Proof & Work History

The "Two-Year Rule" is the industry standard. Lenders want to see that you have successfully managed your business for at least two full tax years.

-

Documentation: You will need a current Business License or a letter from your CPA verifying the business has been active for two years.

-

The Exception: If you have been self-employed for only one year but worked in the exact same field as a W-2 employee for the previous two years, some loan programs might make an exception. However, transitioning from a dentist to a freelance graphic designer within a year would likely not qualify.

Cash Reserves

"Reserves" refer to the liquid cash you have left over after paying the down payment and closing costs. While a W-2 employee might not need any reserves, self-employed borrowers are often asked to show 2 to 6 months of mortgage payments (PITI) in the bank. This proves to the lender that if your business has a slow month, you can still pay the mortgage. Retirement accounts (like IRAs or SEP-IRAs) can usually count toward this requirement.

How to Get Approved for a Self-Employed Home Loan?

Getting approved isn't about luck. It's about organization. Here is the workflow I recommend:

-

Gather Documents Early: Do not wait until you find a house. Have your last two years of 1040s, Schedule Cs, 1099s, and K-1s (if applicable) ready as PDFs.

-

Check Your Credit: Pull your official reports months in advance to fix any errors.

-

Get a "Full" Pre-Approval: Avoid simple pre-qualifications. Ask an underwriter to review your tax returns before you make an offer. This is vital for self-employed buyers to ensure your income is calculated correctly.

-

Shop for the Right Lender: Not all banks understand Schedule C income. You need a lender who specializes in self-employed mortgages.

Also Read: Best Mortgage Lenders for Self-Employed: Top-Rated Picks

Tips to Get Approved for Self-Employed Mortgage

If you are planning to buy a home in the next 12 to 24 months, you need to start strategizing now. Here are five actionable tips to improve your odds:

-

Minimize Deductions (The Hard Truth): This is painful, but effective. For the two years prior to buying a home, consider writing off fewer expenses. Yes, you will pay more in taxes, but you will show a higher Net Income, which directly increases your loan qualification amount.

-

Keep Business and Personal Finances Separate: Never pay personal bills from your business account, and vice versa. "Commingling funds" is a nightmare for underwriters and can cause your loan to be denied because they cannot distinguish business assets from personal assets.

-

Boost Your Credit Score: Pay down credit card balances to below 30% utilization. A higher score can sometimes help you get a waiver on certain income documentation requirements.

-

Save for a Larger Down Payment: Offering 20% or more down reduces the lender's risk. If your application is borderline, a large down payment is often the deciding factor that gets you an approval.

-

Consider a Co-Borrower: If your self-employed income just isn't quite there, adding a spouse or family member with a steady W-2 income to the loan can average out the risk and boost your DTI profile.

FAQs About Self-Employed Home Loan Requirements

Q1. Who is eligible for a self-employed home loan?

Generally, anyone who owns 25% or more of a business is considered self-employed. This includes freelancers, independent contractors (1099 workers), and small business owners.

Q2. How to calculate self-employed income for mortgage loans?

Lenders typically use this formula: (Year 1 Net Income + Year 2 Net Income) / 24 months. Remember, they add back non-cash deductions like depreciation. If your latest year shows a decline, they may only use the lower amount.

Q3. What are 1099 home loan requirements?

For 1099 workers, requirements are similar to other business owners. However, if you lack tax return income, you might look into Non-QM loans where lenders use 12-24 months of bank statements to calculate cash flow instead of tax returns.

Also Read:

Q4. Can I get a mortgage when self-employed less than 1 year?

It is very difficult. Most lenders require a minimum of one year of self-employment tax returns. The only common exception is if you have a long history in the same line of work and strong cash reserves, but this varies by lender.

Conclusion

Buying a home when you are your own boss is more complex, but it is far from impossible. I have seen countless freelancers and business owners successfully close on their dream homes by understanding the rules of the game. The key is to focus on your Net Income, organize your paperwork early, and maintain a clean separation between your business and personal finances.

However, because every business structure (Sole Prop, LLC, S-Corp) impacts your application differently, general internet advice can only take you so far. I strongly recommend you visit Bluerate.ai to connect with a nearby loan officer. They can look at your specific tax returns and give you a real, personalized assessment without the guesswork.